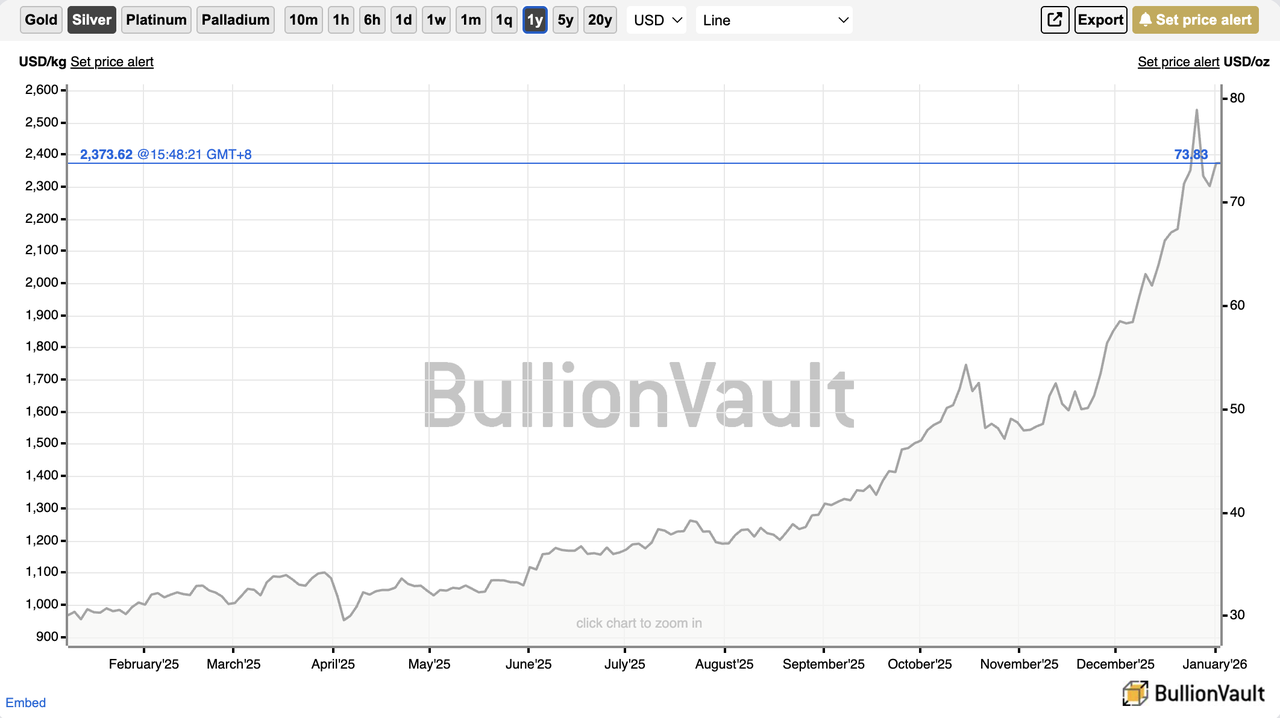

As 2026 gets underway, silver markets are capturing global attention with an extraordinary run that has defied traditional expectations. According to Reuters, after a stunning surge in 2025, with spot prices climbing more than 140% year on year and touching record levels above $80 per ounce, silver has emerged as one of the strongest-performing major assets globally. By end-2025, the estimated total market capitalization of above-ground silver had climbed to over $4 trillion, placing it ahead of companies such as

Apple, with around $4.0 trillion and

Alphabet, valued around $3.8 trillion, and positioning silver among the world’s most valuable traded assets.

Silver Price Hit Record highs in 2025 | Source: Bullion Vault

This environment has driven renewed interest in tokenized precious metals, including both

silver-backed and gold-backed crypto assets, as investors look for more flexible ways to access commodity exposure. Silver-backed crypto is a blockchain-based digital asset that derives its value from physical silver reserves, offering on-chain exposure to silver prices alongside 24/7 crypto-native liquidity. As interest in tokenized commodities grows, silver-backed tokens are emerging as a practical bridge between traditional precious metal markets and decentralized finance.

In this article, we explore the top silver-backed crypto tokens to watch in 2026, examining how each project connects physical silver holdings with blockchain infrastructure and what differentiates them in the evolving tokenized precious metals market.

What Is a Silver-Backed Crypto Token and How Does a Tokenized Silver Token Work?

Silver-backed crypto tokens are blockchain-based digital assets designed to represent ownership or economic exposure to physical silver held in secure, professionally managed vaults. Each token is typically backed by a defined amount of real-world silver, such as allocated bullion stored under custody, with the token’s value closely tracking the spot price of silver. Depending on the issuer’s design, holders may trade the token on crypto markets or redeem it for physical silver or cash equivalents.

Tokenized silver works by linking physical silver reserves to

on-chain tokens issued on a blockchain network. When tokens are minted, a corresponding amount of silver is acquired and placed under custody, creating a direct backing relationship between the digital token and the underlying metal. Compared with traditional silver investments that involve storage, insurance, and limited trading hours, silver-backed crypto tokens can be transferred, traded, or held through crypto wallets and exchanges on a 24/7 basis, offering greater flexibility while remaining anchored to real-world assets.

How Tokenized Silver Tokens Work

1. Physical silver acquisition: The issuer sources investment-grade silver, such as LBMA-certified bars, and stores it in regulated vaults operated by established custodians, typically located in major precious metals hubs.

2. Token minting on blockchain: Once the silver is secured, an equivalent number of digital tokens is minted via smart contracts on a blockchain network, most commonly

Ethereum, creating a transparent on-chain record of supply.

3. Reserve backing and verification: Tokens in circulation are designed to be fully backed by physical silver on a 1:1 basis by weight. Issuers publish regular attestations or third-party audits to verify that token supply matches the silver held in custody.

4. Redemption and supply adjustment: Depending on the project, tokens may be redeemable for physical silver, often subject to minimum thresholds, or used purely for price exposure. Redeemed tokens are burned or removed from circulation to maintain full reserve backing.

This structure combines silver’s role as both an industrial metal and a store of value with blockchain-native advantages such as fractional ownership, continuous global liquidity, and efficient transfers. By reducing the logistical complexity of traditional bullion ownership, tokenized silver enables broader participation in silver markets through standard crypto wallets and exchanges.

What Are the Top Tokenized Silver Cryptos to Watch in 2026?

Silver-backed crypto tokens are an emerging segment of real-world asset tokenization, offering on-chain exposure to physical silver. Following silver’s 140% price surge in 2025, interest in tokenized silver has increased as investors look for alternatives to traditional bullion and ETFs.

While still smaller than

gold-backed crypto, the tokenized silver market has grown to over $270 million in total market capitalization, supported by silver’s renewed role as both a precious metal and a key industrial input.

The following are the top 3 silver-backed crypto tokens currently active in the market.

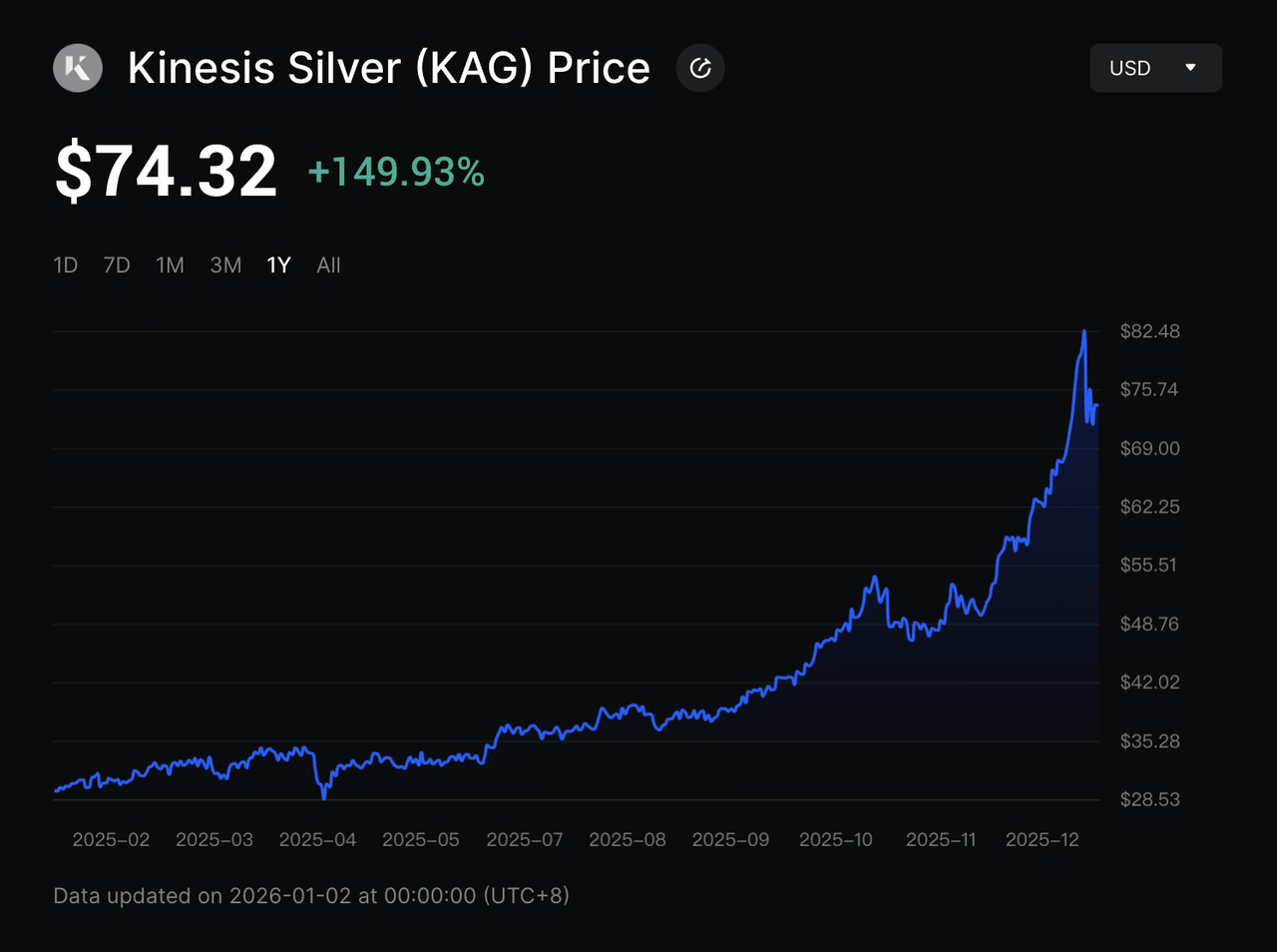

1. Kinesis Silver (KAG)

Issuer: Kinesis AG (via the Kinesis Monetary System)

Backing: 1 KAG = 1 troy ounce of fully allocated physical silver

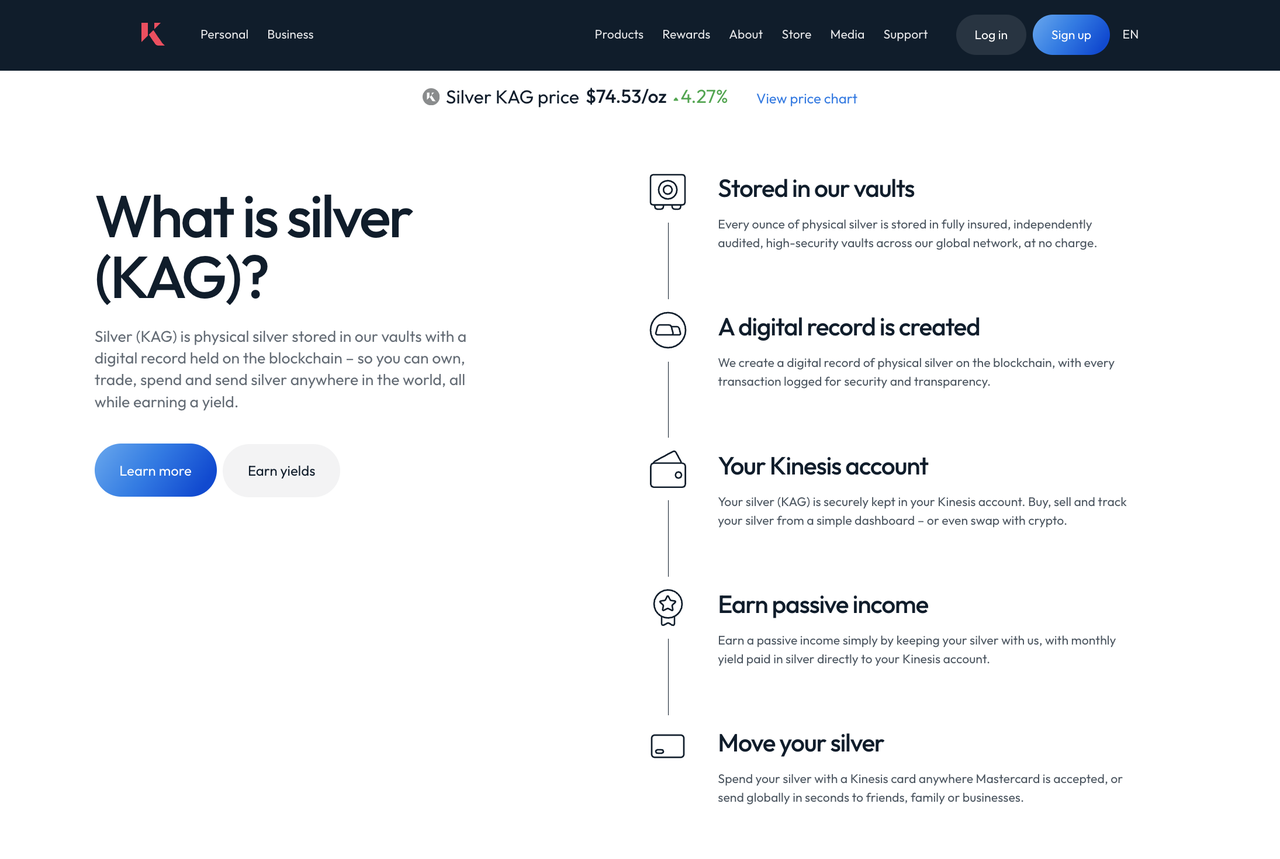

Kinesis Silver (KAG) is a silver-backed digital asset issued within the Kinesis Monetary System, a precious-metals-based financial platform developed by Kinesis AG in partnership with the Allocated Bullion Exchange (ABX). Each KAG token represents one ounce of fully allocated silver stored in insured vaults across a global network spanning six continents. All bars are serialized and reconciled against on-chain supply to maintain full reserve backing.

KAG is currently the largest silver-backed crypto token in the market, accounting for the majority of adoption and on-chain activity within the tokenized silver category. A defining feature of KAG is its yield mechanism: unlike most silver-backed tokens, KAG holders can earn a monthly yield paid in KAG, sourced from a share of transaction fees generated across the Kinesis ecosystem rather than leverage or lending.

Physical redemption is supported, with delivery starting from 200 ounces via localized vaulting hubs. This positions KAG as one of the few silver-backed tokens designed for both long-term silver ownership and transactional use within a broader monetary system.

2. Silver Token (XAGX)

Issuer: XAGX Silver Token (community-driven project)

Backing: Value indexed to silver price (silver-pegged design)

Silver Token (XAGX), also known as XAGX Silver Token, is a silver-pegged crypto asset designed to track the price of silver on-chain. The project positions XAGX as a digital representation of silver value rather than a traditional regulated bullion token, with supply dynamics governed by smart contracts deployed on the

Avalanche C-Chain.

Unlike fully allocated vault-backed models, XAGX focuses on price exposure and on-chain liquidity rather than physical redemption at scale. The token is primarily used for trading, hedging, and speculative exposure to silver prices within crypto markets. While its structure differs from custodial bullion-backed tokens, XAGX reflects one end of the silver tokenization spectrum, emphasizing decentralization and accessibility over direct metal delivery.

3. Silver (GRAMS)

Issuer: Token Teknoloji Anonim Şirketi (Turkey-based issuer)

Backing: 1 GRAMS = 1 gram of physical silver

Silver (Grams), commonly referred to as GRAMS, is a gram-denominated silver-backed crypto token issued by Token Teknoloji Anonim Şirketi, a company registered in Turkey. The project is generally regarded as originating from Turkey based on its issuer and primary market focus, although its on-chain infrastructure and token circulation are not limited to a single jurisdiction.

Each GRAMS token represents one gram of physical silver, a structure designed to lower the entry barrier for retail users compared to ounce-based silver tokens. The project emphasizes accessibility and small-unit denomination rather than large-scale bullion settlement. While GRAMS operates at a smaller scale than Kinesis Silver, it illustrates how tokenized silver can be localized and adapted for markets where fractional precious metal ownership is more practical.

What Are the Use Cases for Silver-Backed Tokens?

Silver-backed tokens extend beyond passive holding and slot into multiple workflows:

1. Hedging Against Volatility

A lower beta pocket inside the crypto stack that helps you de-risk without leaving on-chain markets. Traders rotate from high-volatility pairs into KAG, XAGX, or GRAMS during drawdowns, then rotate back when risk appetite returns. This can smooth PnL and reduce liquidation risk on leveraged positions.

2. DeFi Integration

Where supported, metal-backed tokens can be posted as collateral to borrow stables or to structure delta-neutral strategies, so you keep silver exposure while unlocking liquidity. KAG additionally pays a monthly, debt-free

yield to holders on its native platform. Providing liquidity in silver pairs can earn fees, but it introduces impermanent loss, so position sizing and fee math matter.

3. Cross-Border Transfers and Spending

Settlement in minutes, 24/7, with transparent on-chain proofs. Wallet-to-wallet transfers make remittances simpler than shipping bars or wires. With KAG’s virtual card you can spend metal-backed value at the point of sale, while XAGX and GRAMS move easily between EVM wallets for quick peer payments.

Emerging experiments include real-world asset (

RWA) indices that bundle multiple metals, multi-chain issuance to improve routing between

Avalanche and

Polygon, and richer

proof-of-reserves dashboards to strengthen the link between the circulating supply and vaulted metal.

Tokenized Silver ETF vs. Silver-Backed Crypto Tokens: Which One Should You Choose in 2026?

Another popular way to gain exposure to tokenized silver is through tokenized silver ETFs. While both tokenized silver ETFs and silver-backed crypto tokens offer digital access to silver prices, they are built on different structures and serve distinct investment use cases.

Tokenized silver ETFs, such as those issued by platforms like

Ondo Finance, are on-chain representations of traditional silver ETFs. These tokens track the net asset value (NAV) of an underlying silver trust and provide ETF-style price exposure via blockchain infrastructure. They offer 24/7 trading and faster settlement but do not grant ownership of physical silver or redemption rights to bullion, leaving investors exposed primarily to price movements and issuer-related risks.

By contrast, silver-backed crypto tokens are tied directly to physical silver held in custody, with token supply linked to underlying metal reserves. Depending on the project, holders may be able to redeem tokens for physical silver or use them within crypto-native systems, making them function more like digital bullion.

In short, tokenized silver ETFs act as on-chain extensions of traditional ETFs, while silver-backed crypto tokens emphasize metal-linked ownership. The choice depends on whether an investor prefers ETF-style exposure or a closer connection to physical silver.

| Feature |

Tokenized Silver ETF (e.g., SLVON) |

Silver-Backed Crypto Tokens |

| Market size |

~$20M on-chain value |

~$275M total category |

| Exposure |

Silver ETF price |

Physical silver |

| Ownership |

Economic exposure only |

Metal-linked exposure |

| Physical redemption |

Not available |

Sometimes available |

| Issuer type |

Regulated TradFi issuer |

Crypto-native bullion issuer |

| Custody |

ETF custodians |

Allocated vault storage |

| Denomination |

ETF units |

Ounces or grams |

| Trading hours |

24/7 |

24/7 |

| Settlement |

On-chain |

On-chain |

How to Buy and Trade Tokenized Silver on BingX

While the tokenized silver market is gaining attention, it remains relatively small and early-stage compared to gold-backed crypto assets such as

PAXG or

XAUT, which have already achieved broader adoption and deeper liquidity. As a result, exchanges like BingX typically require silver-backed tokens to undergo additional evaluation and listing processes before they become available for spot trading.

That said, investors can still gain exposure to silver-related assets on BingX through alternative products. These include

Ondo’s tokenized iShares Silver Trust ETF (SLVON) on the spot market, as well as silver price–linked perpetual futures (SILVER) for more active trading strategies. Together, these options provide accessible ways to participate in silver’s price movements while the broader tokenized silver ecosystem continues to develop.

1. Buy Ondo Tokenized Silver ETF (SLVON) on BingX

Ondo’s iShares Silver Trust Tokenized ETF (SLVON) is available for spot trading on BingX via the SLVON/USDT pair. This allows investors to access silver ETF price exposure with 24/7 liquidity using crypto rails.

BingX offers deep liquidity, fast execution, and built-in

BingX AI insights that help users monitor price movements and manage risk efficiently within a streamlined trading interface.

Step 2: Fund your account: Deposit USDT via bank transfer, crypto deposit, or P2P trading if supported in your region.

Step 4: Place your trade: Use a

market order for immediate execution or a limit order to set your preferred entry price.

Step 5: Manage or store your SLVON: Hold SLVON on BingX for active trading, or withdraw it to a compatible wallet for self-custody.

This option is best suited for investors seeking ETF-style silver exposure with continuous market access and on-chain settlement.

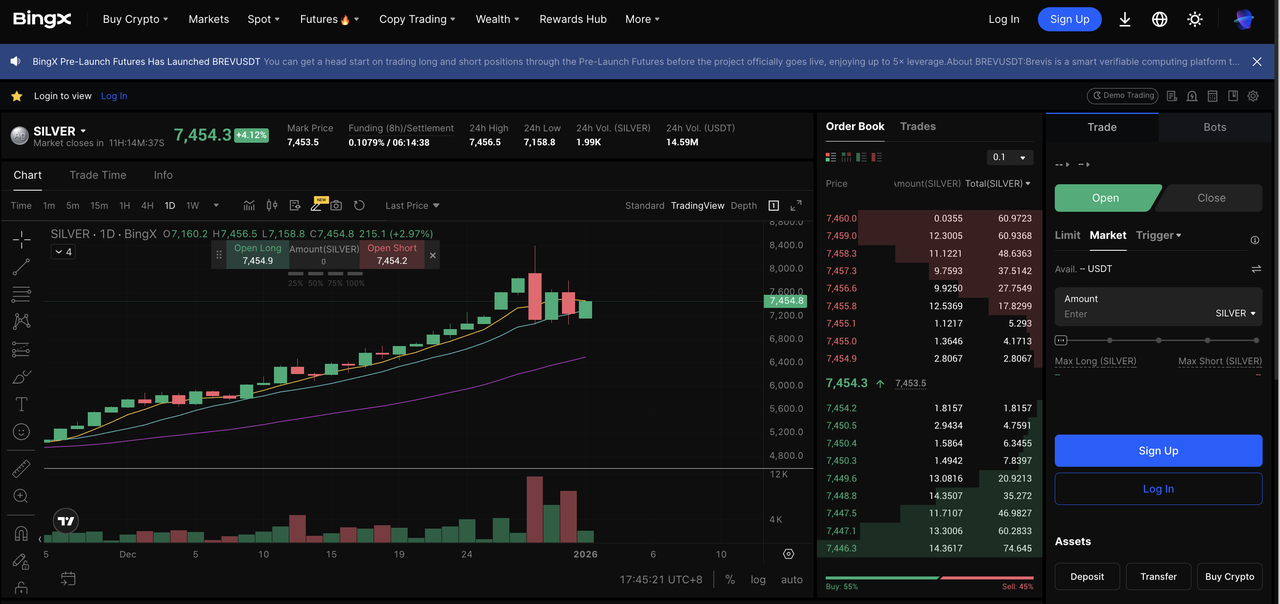

2. Trade Silver Price-Linked Futures (SILVER) on BingX

For more advanced or short-term strategies, BingX offers silver price-linked perpetual futures (SILVER), which track silver price movements without requiring ownership of physical silver, ETFs, or tokenized assets.

Step 1: Access the Futures market: Log in to BingX, enable futures trading, and fund your futures wallet with USDT.

Step 3: Choose direction and leverage: Go long or short on silver prices and select your leverage and margin settings.

Silver futures allow traders to go long or short, use leverage to amplify exposure, and trade silver without holding any underlying asset. These products are designed for active trading and hedging and carry higher risk due to leverage and liquidation mechanics.

Final Thoughts

Tokenized silver is still an emerging segment within the broader real-world asset market, especially when compared to more established gold-backed crypto products. However, rising silver prices, strong industrial demand, and growing interest in on-chain commodities are steadily bringing silver back into focus.

For investors, there is no single “best” way to gain silver exposure. Tokenized silver ETFs like SLVON offer a familiar, ETF-style approach with 24/7 on-chain access, while silver price-linked futures provide flexibility for short-term trading and hedging. As the tokenized silver ecosystem continues to evolve, these products serve as practical entry points while the broader market matures.

Ultimately, choosing between these options depends on your investment horizon, risk tolerance, and how closely you want your exposure tied to physical silver. As tokenization expands across commodities, silver is likely to play a growing role alongside gold in the next phase of on-chain real-world assets.

Related Reading

FAQs on Tokenized Silver Products

1. What is tokenized silver?

Tokenized silver is a blockchain-based way to gain exposure to silver prices, either through tokenized silver ETFs or silver-backed crypto tokens linked to real-world assets.

2. What is the difference between tokenized silver ETFs and silver-backed crypto?

Tokenized silver ETFs track the price of traditional silver ETFs on-chain, while silver-backed crypto tokens are tied to physical silver held in custody and may offer redemption options.

3. Is tokenized silver backed by real silver?

Some silver-backed crypto tokens are backed by physical silver, while tokenized silver ETFs provide price exposure only and do not grant ownership of physical metal.

4. Where can I buy tokenized silver?

You can buy and trade silver-related tokenized products on platforms like BingX, including Ondo’s tokenized iShares Silver Trust ETF (SLVON) and silver price–linked futures.

5. Is tokenized silver a good investment?

Tokenized silver may appeal to investors seeking digital exposure to silver prices. Tokenized ETFs are generally better for long-term exposure, while silver futures are suited for short-term trading and hedging.