In 2026, gold has firmly re-established itself as a primary global store of value as investors respond to intensifying geopolitical risk, trade-war fears, persistent inflation, and weakening confidence in fiat currencies. Spot gold prices surged past $4,900 per ounce in January 2026, marking multiple all-time highs within weeks. Analysts now widely view $5,000 per ounce as the next psychological milestone, with some long-term forecasts extending significantly higher.

This rally follows a historic 2025, during which gold gained more than 60%, supported by central-bank accumulation, falling real interest rates, ETF inflows, and geopolitical flashpoints. By January 2026, gold already notched a record 11% gain year-to-date, reinforcing its role as a hedge against currency debasement, political uncertainty, and systemic risk. As prices climbed above $4,900 in January 2026, the estimated value of all above-ground gold exceeded $33 trillion, underscoring

gold’s scale as a global monetary asset.

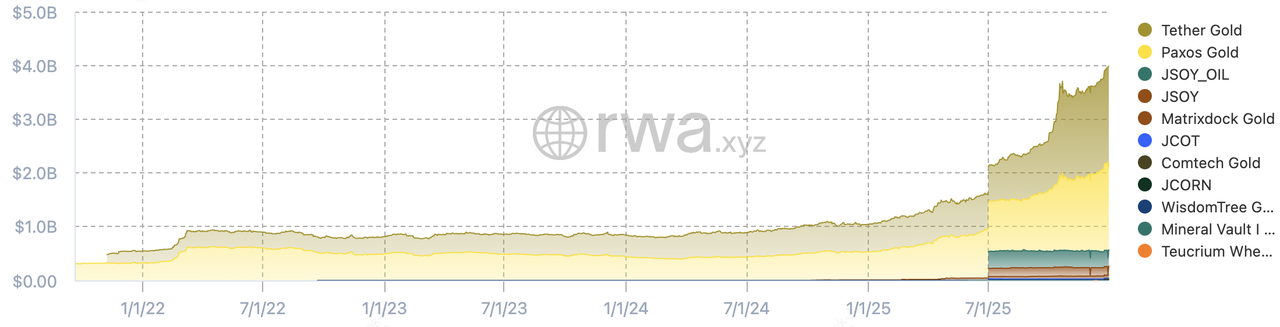

The rapid growth of

tokenized gold highlights a broader shift toward blockchain-based ownership of real-world assets. As of January 2026, the tokenized gold market is nearing a $5 billion market capitalization, with the wider tokenized commodities market accounting for over $4.7 billion in monthly on-chain transaction volume and more than 188,000 active holders worldwide. Monthly active wallet activity continues to rise, reflecting increasing demand for gold exposure that is liquid, programmable, and globally accessible. This growth underscores how tokenized gold is evolving from a niche product into a core digital asset class, bridging traditional stores of value with modern financial infrastructure.

Total value of tokenized commodities on-chain | Source: RWA.xyz

Pax Gold (PAXG) is one of the largest and most established tokenized gold products in the market, along with

Tether's XAUT. As of 2025, PAXG has a market capitalization of approximately $1.9 billion, with over 387,000 tokens in circulation, each representing one troy ounce of physical gold stored in professional vaults. Its structure allows investors to gain exposure to gold with the speed, transparency, and programmability of blockchain technology.

What Is Pax Gold (PAXG) Tokenized Gold Crypto and How Does It Work?

Pax Gold (PAXG) is a

gold-backed cryptocurrency that represents direct ownership of physical gold on the blockchain. Each PAXG token is backed 1:1 by one fine troy ounce of LBMA-accredited gold, securely stored in professional vaults operated by approved custodians such as Brink’s. PAXG is issued by Paxos Trust Company, a New York–chartered trust company regulated by the New York State Department of Financial Services (NYDFS).

Unlike synthetic gold tokens or derivatives, PAXG gives holders legal ownership of physical bullion, not just price exposure. Each token is linked to a specific gold bar, and users can verify the bar’s serial number, weight, and purity through Paxos’s

on-chain lookup tools. This design combines the scarcity and trust of physical gold with the speed, transparency, and portability of blockchain-based assets.

PAXG is a regulated, gold-backed digital asset issued by Paxos Trust Company, a New York–chartered trust company overseen by the New York State Department of Financial Services (NYDFS). Each PAXG token represents direct ownership of one fine troy ounce of LBMA-accredited gold stored in secure vaults operated by approved custodians such as Brink’s.

How PAXG Gold Token Works: Tokenization, Custody, and Verification

PAXG has no fixed maximum supply. Tokens are minted when gold is added and burned when gold is redeemed, ensuring the circulating supply always matches the gold held in custody.

Pax Gold (PAXG) uses a regulated mint-and-burn model to keep a strict 1:1 backing with physical gold at all times. Here’s how it works:

1. Gold Custody: LBMA-accredited gold bars are deposited into secure, regulated vaults operated by custodians approved by Paxos Trust Company.

2. Token Minting: For every 1 troy ounce of gold deposited, 1 PAXG token is minted on Ethereum.

3. On-Chain Verification: Each PAXG token is linked to a specific gold bar. Holders can verify the bar’s serial number, weight, and purity using Paxos’ public audit and lookup tools.

4. Trading or Redemption: PAXG can be traded 24/7 on supported exchanges like BingX or redeemed for physical gold through Paxos, subject to minimums and fees.

What Are the Top 5 Benefits of Pax Gold (PAXG)?

PAXG is widely used by institutions, funds, and individuals as a digitally native safe-haven asset, offering inflation hedging and capital preservation while eliminating the storage, insurance, and settlement frictions of physical gold. Pax Gold (PAXG) offers a regulated, on-chain way to own physical gold. Here are the five most important benefits, explained clearly and backed by data:

1. Regulated and Audited Gold Ownership: PAXG is issued by Paxos Trust Company, a New York–chartered entity regulated by the NYDFS. Gold reserves are subject to regular third-party audits, providing institutional-grade oversight rarely available in crypto-native assets.

2. 100% Physical Gold Backing (1:1): Each PAXG token represents one fine troy ounce of LBMA-accredited gold, fully allocated and stored in professional vaults. Tokens are minted and burned only when physical gold enters or leaves custody, keeping supply tightly aligned with reserves.

3. High Liquidity and Market Depth: As of January 2026, PAXG has a market cap of $1.9 billion and 24-hour trading volume exceeding $600 million, making it one of the most liquid tokenized gold assets. This liquidity allows efficient entry and exit without relying on traditional bullion markets.

4. Fractional and Programmable Gold Exposure: PAXG enables fractional ownership, allowing investors to buy or transfer small portions of gold instead of full bars. Tokens can also be integrated into wallets, exchanges, and DeFi systems, unlocking use cases like collateralization, instant settlement, and portfolio rebalancing.

5. 24/7 Global Accessibility: Unlike physical gold or ETFs, PAXG can be transferred globally, 24/7, without banks, brokers, or market-hour restrictions. This makes it especially attractive for investors seeking gold exposure with real-time liquidity and borderless access.

How Does PAX Gold (PAXG) Differ From Physical Gold?

Pax Gold (PAXG) differs from physical gold primarily in how it is owned, traded, and stored. PAXG represents digital ownership of allocated, LBMA-accredited gold held in professional vaults, with each token linked to a specific gold bar that can be verified on-chain. On the other hand, physical gold requires direct possession or third-party storage, which introduces logistical challenges around security, transport, and insurance.

In terms of usability, PAXG is tradable 24/7 with near-instant settlement and can be divided into very small fractions, making precise position sizing easy. Physical gold trades only during dealer hours, settles slowly, and is typically sold in fixed bar or coin sizes. While physical gold offers self-custody, PAXG prioritizes liquidity, transparency, and capital efficiency, making it better suited for investors seeking flexible, digital gold exposure.

What Is the Difference Between PAXG and XAUT Gold Cryptos?

PAX Gold (PAXG) and Tether Gold (XAUT) both provide 1:1 exposure to physical gold on the blockchain, but they differ mainly in regulatory approach and market positioning. PAXG is issued by Paxos Trust Company and operates under NYDFS oversight, with regular third-party audits and clear regulatory disclosures. This structure makes PAXG especially attractive to institutions and investors who prioritize compliance, transparency, and verifiable custody of underlying gold.

Tether Gold (XAUT), issued by Tether, follows a more crypto-native, offshore model, emphasizing liquidity and broad exchange integration. As of January 2026, XAUT has a larger market cap of $2.49 billion, while PAXG shows higher daily trading volume at $473 million vs. XAUT's $307 million, reflecting different usage patterns. In practice, PAXG suits investors seeking regulated, institutional-grade gold exposure, while XAUT appeals to those prioritizing scale, accessibility, and seamless integration within the wider crypto ecosystem.

How to Buy Pax Gold (PAXG) on BingX

BingX offers a simple and secure way to gain exposure to PAX Gold (PAXG), whether you’re looking to hold gold long term or actively trade price movements. With deep liquidity, low fees, and integrated

BingX AI tools, BingX enables both beginners and experienced traders to access tokenized gold efficiently.

Buy, Sell, or HODL PAXG on the Spot Market

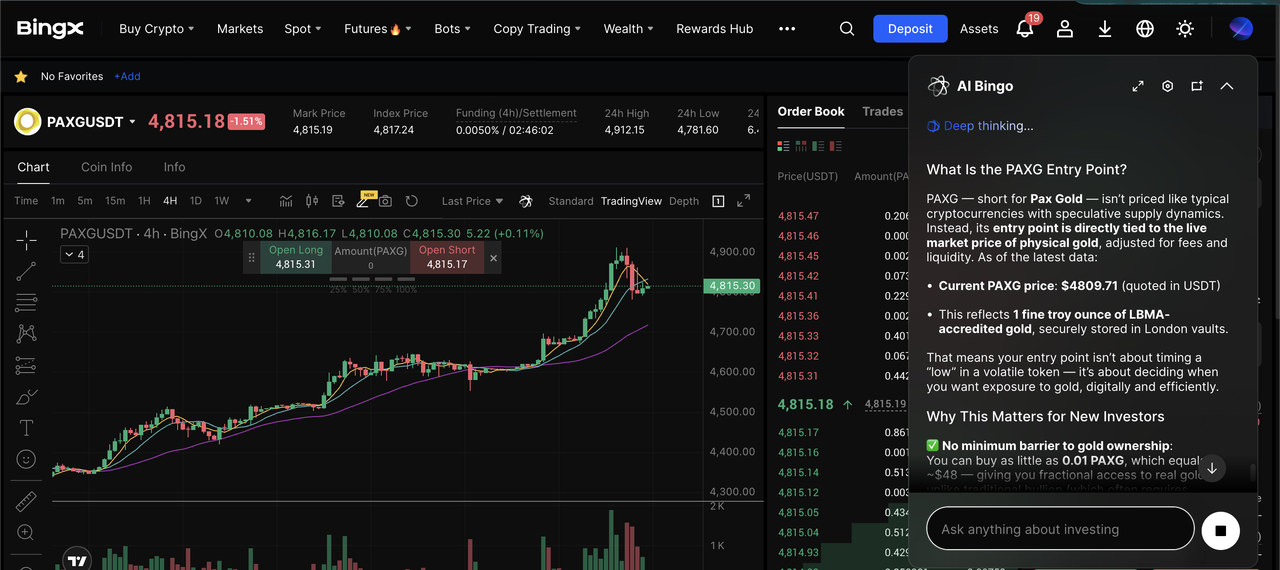

PAXG/USDT trading pair on the spot market powered by BingX AI insights

Spot trading is ideal for users who want to own PAXG directly and benefit from long-term gold price appreciation.

1. Access the Spot Market: Log in to BingX and navigate to the

PAXG/USDT trading pair.

2. Analyze the Market: Use BingX AI to view real-time trend analysis, support and resistance levels, and momentum indicators to help identify optimal entry points.

3. Place Your Order: Choose a

Market Order for instant execution or a Limit Order to buy at your preferred price. Once filled, your PAXG will appear in your spot wallet.

This approach is ideal for investors seeking long-term exposure to gold without the need for physical storage or complex custody arrangements.

Long or Short PAXG with Leverage on the Futures Market

PAXG/USDT perpetual contract on the futures market powered by BingX AI

For more active traders, BingX also offers PAXG/USDT perpetual futures, allowing you to profit from both rising and falling gold prices.

2. Analyze Market Conditions: Activate BingX AI tools to review trend direction, volatility levels, and momentum indicators.

4. Monitor and Adjust: Track your position in real time, manage

funding rates, and adjust risk controls as market conditions change.

In addition to trading PAXG perpetual futures, you can also

trade gold futures with crypto directly on the BingX platform.

Futures trading allows experienced traders to capitalize on short-term price movements, but it also carries higher risk due to leverage. Proper risk management is essential.

Why Trade PAXG Tokens on BingX?

BingX offers deep liquidity and tight spreads for efficient PAXG trading, supported by AI-powered tools that help identify trends and optimize entry and exit points. With both spot and futures markets available on one platform, traders can easily switch between long-term exposure and short-term strategies, all while benefiting from 24/7 global market access and reliable execution.

Is It Safe to Buy Pax Gold (PAXG)?

PAX Gold (PAXG) is widely considered one of the safer ways to gain digital exposure to gold, as it is issued by Paxos Trust Company, a regulated entity overseen by the New York State Department of Financial Services (NYDFS). Each token is backed 1:1 by physical gold stored in LBMA-approved vaults, with regular third-party audits and on-chain verification tools that allow holders to confirm backing. These safeguards make PAXG one of the most transparent and institutionally trusted gold-backed tokens available.

Top 5 Risks and Considerations Before Investing in Pax Gold (PAXG)

1. Issuer and Custody Risk: PAXG depends on Paxos Trust Company to securely custody physical gold, manage minting and burning, and honor redemptions. Any operational, legal, or compliance issue at the issuer level could impact access to or redemption of the underlying gold.

2. Regulatory and Jurisdictional Risk: Although PAXG is issued by an NYDFS-regulated entity, future changes in crypto, commodities, or cross-border regulations could restrict trading, custody, or availability in certain countries or on specific exchanges.

3. Blockchain and Smart Contract Risk: PAXG is an ERC-20 token on Ethereum, exposing holders to risks such as smart-contract vulnerabilities, wallet compromises, network congestion, and high transaction fees during periods of heavy on-chain activity.

4. Physical Redemption Limitations: Redeeming PAXG for physical gold is possible but subject to minimum redemption amounts, fees, and processing timelines. This makes PAXG less practical for investors who intend to frequently convert tokens into physical bullion.

5. Gold Price and Market Volatility: PAXG closely tracks spot gold prices, meaning its value can fluctuate with macroeconomic factors such as interest-rate expectations, currency movements, and geopolitical events. While gold is a defensive asset, it can still experience sharp corrections.

Conclusion: Should You Buy Pax Gold (PAXG) in 2026?

Pax Gold (PAXG) offers a regulated, transparent way to gain exposure to physical gold through the convenience of blockchain technology. Backed 1:1 by allocated gold and issued by a regulated trust company, PAXG appeals to investors seeking stability, auditability, and long-term value preservation in an increasingly digital financial landscape. Its structure makes it particularly suitable for those who want gold exposure without the logistical challenges of physical storage.

That said, PAXG is not risk-free. Its value remains tied to gold price movements, and investors are still exposed to regulatory, custody, and blockchain-related risks. As with any investment, PAXG should be considered within the context of broader portfolio diversification and risk tolerance. For investors looking to balance stability with accessibility, PAXG can serve as a practical digital alternative to holding physical gold, but it should complement, not replace, a well-diversified strategy.

Related Reading