Over the years, crypto has moved beyond the margins of global finance and into the core of mainstream markets, crossing a $4 trillion market cap at its peak in H2 2025. By early 2026,

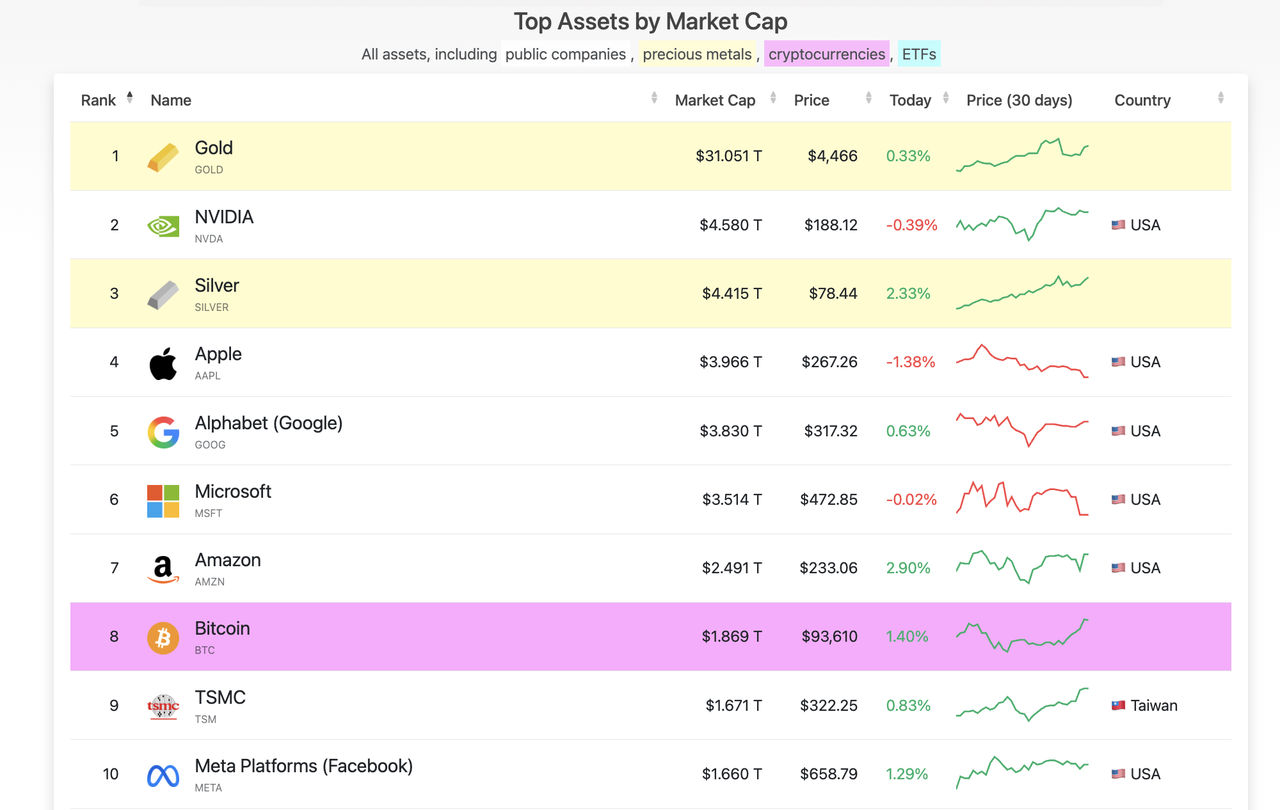

Bitcoin has secured a place among the world’s top 10 largest assets by market capitalization, ranking alongside

gold and major

U.S. technology companies. This shift reflects growing institutional adoption and the normalization of crypto as a long-term asset class rather than a speculative trend.

Bitcoin has secured a place in the top 10 largest assets by market cap | Source: CompaniesMarketCap

The momentum behind Bitcoin has also lifted the broader crypto ecosystem. As adoption expands through

ETFs, custody solutions,

corporate treasury, and balance sheets, crypto-related public companies are increasingly benefiting from this structural growth. Exchanges, brokerages, stablecoin issuers, and Bitcoin-focused firms have become critical infrastructure connecting traditional markets with digital assets.

Against this backdrop, companies such as Coinbase, Strategy (formerly MicroStrategy), Robinhood, and Circle stand out as key crypto stocks to watch in 2026, offering investors multiple ways to gain exposure to the continued integration of crypto into the global financial system.

Crypto Stocks Market Performance in 2025 and Outlook for 2026

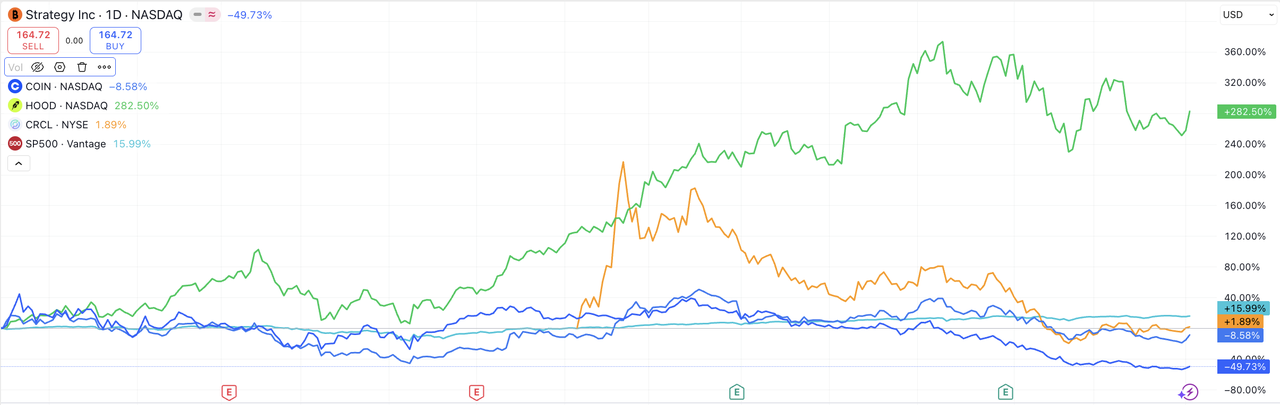

By the end of 2025, crypto-related stocks had established themselves as a distinct equity category, though performance varied widely across companies.

Robinhood (HOOD) stood out, finishing the year up roughly 185–190%, while

Coinbase (COIN) ended 2025 down around 11% year-over-year despite peaking above $400 during Bitcoin’s mid-year rally.

Strategy (MSTR) closely tracked Bitcoin’s cycle, reaching highs above $450 before retracing, while

Circle (CRCL), following its 2025 IPO, stabilized with a market capitalization of approximately $19.6 billion entering 2026.

Source: TradingView

What Are the Key Drivers Shaping Crypto Stocks in 2026?

The growth in crypto stocks was driven not only by Bitcoin’s rise to macro-asset status, but also by the maturation of stablecoins, the expansion of real-world asset tokenization, and tangible progress in regulatory frameworks. As a result, crypto stocks entered 2026 with stronger fundamentals, clearer valuation narratives, and increasing relevance within global financial markets.

2. Stablecoins became core financial infrastructure: By late 2025, the

stablecoin market surpassed $280–300 billion in total capitalization. Stablecoins increasingly functioned as settlement infrastructure for trading, payments, and tokenized assets, strengthening the outlook for regulated issuers and compliance-focused crypto companies.

3. Selective but outsized equity performance: Crypto stocks outperformed during key phases of the cycle rather than uniformly. Robinhood more than doubled, Coinbase benefited from ETF-related flows and

S&P 500 inclusion, Strategy amplified Bitcoin’s upside through its treasury strategy, and Circle rallied strongly post-IPO as stablecoin adoption accelerated.

4. Regulatory clarity improved investor confidence: Progress around spot

Bitcoin ETFs, clearer stablecoin frameworks, and legislative momentum such as the

GENIUS Act reduced policy uncertainty. Heading into 2026, investors increasingly viewed crypto stocks as regulated financial and infrastructure plays rather than pure high-beta token proxies.

What Are Tokenized Crypto Stocks and How Do They Work?

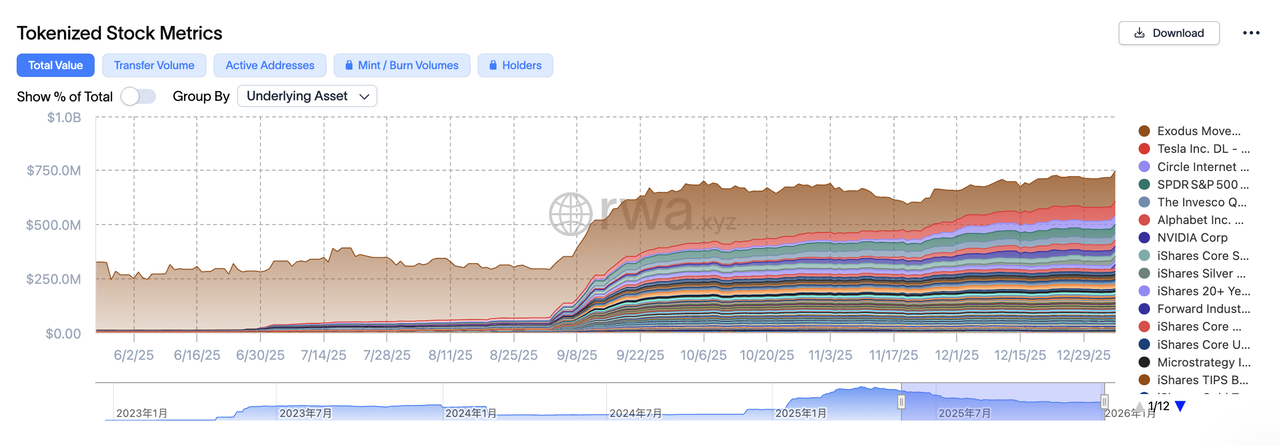

While equity performance across crypto-related stocks was uneven in 2025, on-chain adoption of their tokenized versions accelerated rapidly. According to RWA.xyz, tokenized exposure grew by +122% for Coinbase, +270% for Strategy, +1,800% for Robinhood, and +2,400% for Circle between July and December 2025, positioning tokenized stocks as one of the fastest-growing real-world asset (RWA) segments heading into 2026.

Source: RWA.xyz

Crypto tokenized stocks are blockchain-based representations of publicly listed equities that track the economic performance of traditional shares. Instead of purchasing stocks through a brokerage account, investors gain exposure via on-chain tokens that mirror price movements of the underlying company. These tokens do not represent direct share ownership and typically do not provide dividends or shareholder rights.

How crypto tokenized stocks work in practice:

• Provide economic exposure to public equities without owning shares

• Traded and held on crypto-native platforms

• Typically settled in stablecoins

• Available 24/7, without traditional market-hour constraints

• Integrated into on-chain portfolios alongside cryptocurrencies

By operating entirely within crypto infrastructure, tokenized stocks offer global accessibility, continuous trading, and seamless portfolio integration, making them a practical bridge between traditional equities and blockchain-based finance as RWA adoption continues to expand.

Top Crypto-Related Companies Stocks to Watch in 2026

1. Coinbase (COIN)

Source: Google Finance

Market Cap ~ $63.8 B (As of January 6, 2026)

Coinbase (COIN) remains one of the most important infrastructure companies in the crypto ecosystem. In 2025, Coinbase ended the year down approximately 11% year-over-year, but this headline figure masks strong intra-year momentum. The stock surged to a peak above $400 in July 2025, driven by Bitcoin’s all-time high, ETF-related trading activity, and Coinbase’s inclusion in the S&P 500.

As of January 6, 2026, Coinbase’s market capitalization stands at approximately $63.8 billion, reflecting its role as a core exchange, custody provider, and institutional gateway to crypto markets.

Alternative: Coinbase Tokenized Stock (COINX, COINON)

For on-chain crypto users,

COINX and

COINON bring Coinbase shares directly onto blockchain rails, allowing investors to gain economic exposure to one of the most important crypto infrastructure companies without relying on traditional brokerage accounts.

Coinbase’s tokenized stock is often used alongside spot crypto and stablecoins, reflecting its role as a core bridge between traditional finance and on-chain markets.

According to RWA.xyz, tokenized exposure to Coinbase grew from approximately $4.39 million in early July 2025 to $9.76 million by December 31, 2025, representing an on-chain growth rate of roughly +122% over six months. This steady expansion highlights increasing comfort among crypto-native investors with holding exchange-related equities directly on-chain.

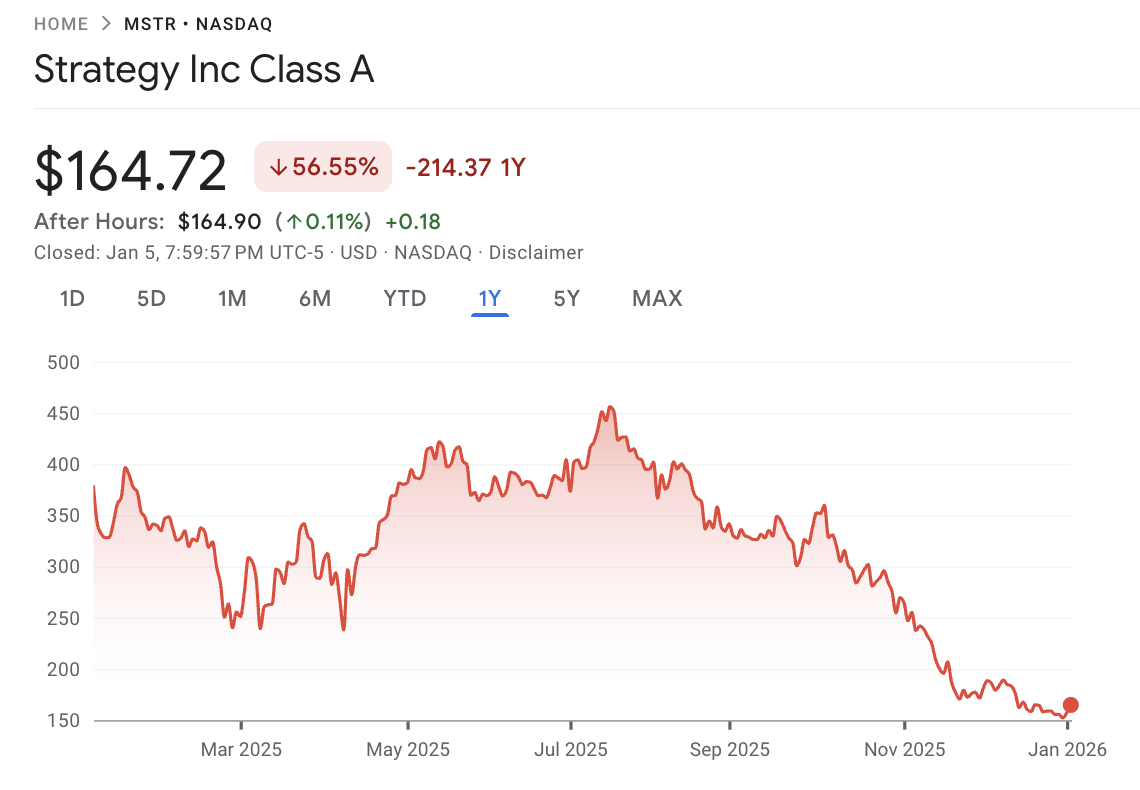

2. Strategy (Formerly MicroStrategy) (MSTR)

Source: Google Finance

Market Cap ~ $45–47 B (As of January 6, 2026)

Strategy, formerly MicroStrategy, represents one of the most direct equity exposures to Bitcoin in public markets. While the stock finished 2025 lower after Bitcoin retraced from its peak, Strategy reached highs above $450 earlier in the year, closely tracking Bitcoin’s rally. As of early January 2026, the company’s market capitalization is approximately $45–47 billion, underscoring its continued relevance as a Bitcoin-centric corporate treasury play.

Alternative: Strategy Tokenized Stock (MSTRX, MSTRON)

Tokenized versions

MSTRX and

MSTRON reflect on-chain demand for Strategy, a company widely viewed as an equity proxy for Bitcoin exposure. For many crypto users,

Strategy’s tokenized stock functions as a way to express long-term Bitcoin conviction through corporate equity rather than holding BTC alone.

RWA.xyz data shows that tokenized exposure to Strategy increased from approximately $3.35 million in July 2025 to $12.35 million by December 31, 2025, translating to an on-chain growth rate of about +270% over six months. This growth underscores sustained interest in Bitcoin-aligned equities within tokenized markets.

3. Robinhood (HOOD)

Source: Google Finance

Market Cap ~ $103.6 B (As of January 6, 2026)

Robinhood was one of the strongest-performing crypto-adjacent equities in 2025. The stock ended the year up approximately 185–190%, supported by renewed retail participation across crypto, equities, and derivatives. Shares peaked above $150 in November 2025 as trading activity accelerated. As of January 2026, Robinhood’s market capitalization is approximately $103.6 billion, positioning it as one of the largest publicly traded platforms bridging traditional markets and crypto.

Alternative: Robinhood Tokenized Stock (HOODX, HOODON)

HOODX and

HOODON represent tokenized access to Robinhood, a company positioned at the intersection of retail trading, equities, and crypto.

Robinhood’s tokenized stock has increasingly been used by on-chain investors seeking exposure to retail-driven market activity while remaining fully embedded in crypto-native environments.

According to RWA.xyz, tokenized exposure to Robinhood expanded from approximately $0.24 million in early July 2025 to $4.61 million by year-end, marking an on-chain growth rate of roughly +1,800% over six months. The sharp increase reflects accelerating adoption following broader availability of tokenized equity formats.

4. Circle (CRCL)

Source: Google Finance

Market Cap ~ $19.6 B (As of January 6, 2026)

Circle, the issuer of

USDC, represents the stablecoin and payments infrastructure layer of the crypto economy. After

Circle IPO in 2025, Circle experienced significant early volatility, including a rapid surge above $250, before stabilizing toward year-end. As of January 6, 2026, Circle’s market capitalization is approximately $19.6 billion, reflecting growing recognition of stablecoins as core financial infrastructure.

Alternative: Circle Tokenized Stock (CRCLX, CRCLON)

Tokenized stocks

CRCLX and

CRCLON provide on-chain exposure to Circle, the company behind USDC and a key player in stablecoin and payments infrastructure. Unlike exchange or brokerage equities,

Circle’s tokenized stock is often associated with longer-term themes such as settlement, compliance-ready finance, and global payments.

RWA.xyz data shows that Circle’s tokenized equity exposure grew from approximately $1.48 million in July 2025 to $37.85 million by December 31, 2025, representing an on-chain growth rate of over +2,400%. This expansion largely reflects structural onboarding following Circle’s IPO and broader tokenization rollout, highlighting strong on-chain interest in stablecoin infrastructure as a foundational financial layer.

How to Invest in Crypto Stocks: A Step-by-Step Guide

Investors today have multiple ways to gain exposure to crypto-related public companies, ranging from traditional equity ownership to crypto-native trading instruments. Each approach offers a different balance between ownership rights, accessibility, and flexibility, making it important to choose the method that aligns with your investment goals and experience level.

1. Buy Crypto Stocks on a Brokerage Platform

Purchasing crypto-related stocks through a traditional brokerage is the most established method and closely resembles how investors buy conventional equities. This route is typically favored by those seeking long-term exposure, direct ownership of shares, and participation in corporate governance where applicable. Crypto stocks such as Coinbase, Strategy, Robinhood, and Circle are all listed on U.S. exchanges and can be accessed through mainstream brokerage platforms.

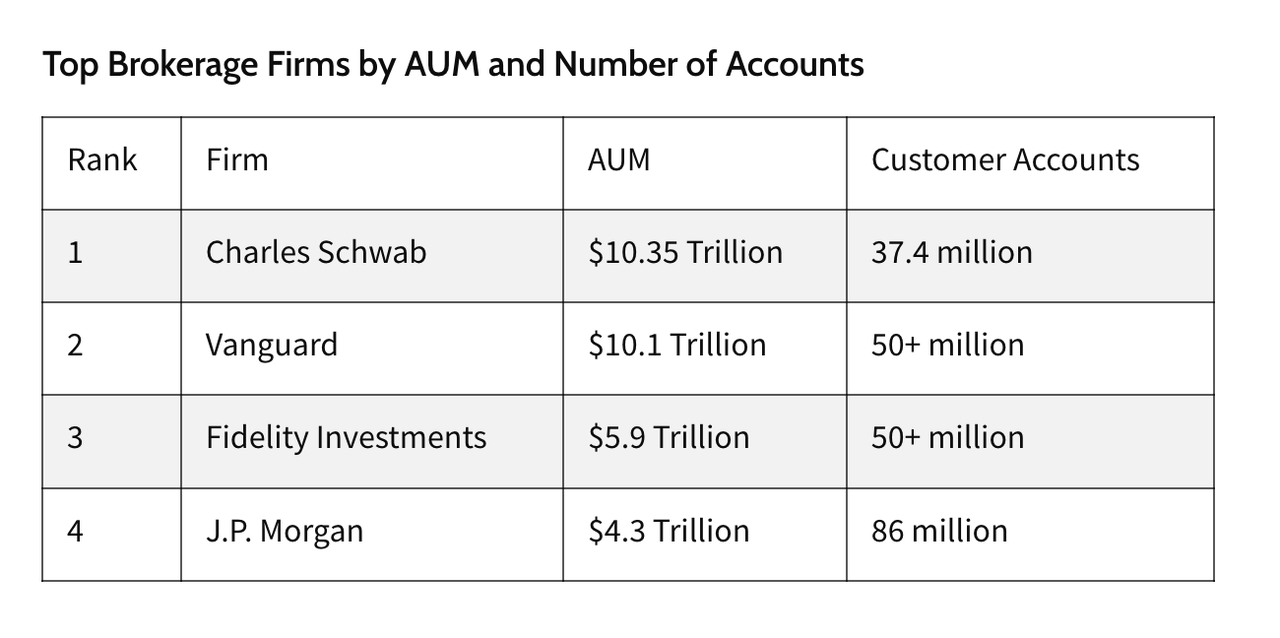

Source: Investopedia

Step 1: Open an account with a regulated brokerage such as Fidelity, Charles Schwab, Robinhood, eToro, or Webull.

Step 2: Complete identity verification, fund your account, and submit any required tax documentation.

Step 3: Search for the stock ticker and purchase full or fractional shares based on your budget.

Step 4: Take into account taxes, currency conversion costs, and any cross-border investment rules.

2. Buy Tokenized Crypto Stocks on BingX

Tokenized crypto stocks provide a blockchain-based way to access equity exposure without relying on a traditional brokerage account. These assets are designed to track the economic performance of publicly listed companies while being traded and held within crypto-native platforms.

For investors already active in crypto markets, BingX tokenized stocks allow equity exposure to be managed alongside digital assets using stablecoins, supported by

BingX AI that help users monitor market trends, volatility, and price dynamics within a single trading interface.

Step 2: Deposit USDT into your Spot wallet using a supported network.

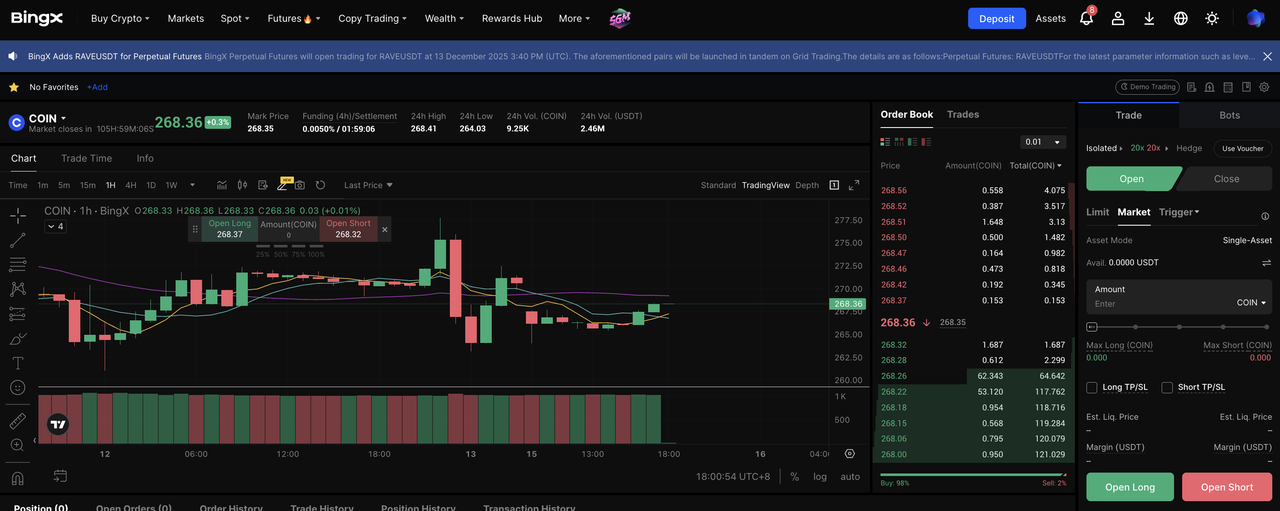

3. Trade Crypto Stock Price-Linked Futures on BingX

Stock price-linked futures are derivative contracts that allow traders to gain exposure to the price movements of crypto-related stocks without holding shares or tokenized assets. These instruments are commonly used for short-term trading, hedging, or tactical positioning, and they support both upward and downward market views. Because futures involve leverage, they are generally better suited for experienced traders who actively manage risk.

Step 3: Choose a long or short position and set leverage according to your risk tolerance.

Step 4: Monitor margin levels, liquidation prices, and market movements in real time.

Risks and Considerations Before Investing in Crypto Tokenized Stocks

While crypto tokenized stocks expand access to equity exposure, they also introduce distinct risks that differ from traditional stock ownership. Understanding these factors is essential before investing.

1. No direct share ownership: Tokenized stocks usually provide economic exposure only and do not include shareholder rights such as voting or dividends.

2. Issuer and structural risk: These assets depend on issuing frameworks, custodians, and counterparties to maintain accurate tracking of the underlying stock.

3. Liquidity differences: On-chain liquidity may vary from traditional markets, leading to wider spreads or lower depth during certain periods.

4. Regulatory uncertainty: Tokenized equities operate at the intersection of securities and crypto regulation, which continues to evolve across jurisdictions.

5. Crypto market volatility: Because tokenized stocks trade within crypto environments, broader market swings can amplify short-term price movements.

Taken together, crypto tokenized stocks are best viewed as a complementary investment format, rather than a replacement for traditional equity ownership. Investors should assess their risk tolerance, investment horizon, and understanding of tokenized structures before allocating capital.

Final Thoughts

Crypto-related stocks and their tokenized counterparts reflect how deeply digital assets have become embedded in global financial markets. By 2026, companies such as Coinbase, Strategy, Robinhood, and Circle are no longer viewed solely as proxies for token prices, but as infrastructure plays spanning exchanges, payments, brokerage services, and on-chain finance.

At the same time, the rapid growth of tokenized stocks highlights a structural shift in how investors access equity exposure. While tokenized stocks do not replace traditional share ownership, they offer a complementary, crypto-native way to participate in public markets with greater flexibility and global reach.

As real-world asset tokenization continues to mature, crypto tokenized stocks are likely to play an expanding role alongside traditional equities, providing investors with more ways to express conviction across both on-chain and off-chain financial systems.

Related Reading