As global markets enter 2026, tokenized commodities are rapidly gaining traction as on-chain alternatives to traditional safe-haven assets. In 2025, gold prices surged roughly 66%, reaching record highs above $4,500 per ounce, while silver exploded by over 150%, outpacing most asset classes amid tightening supply and rising industrial demand. These extraordinary gains have propelled

tokenized gold and silver markets past $4 billion in total capitalization, spurred by 24/7 blockchain trading and increased institutional participation.

Gold and silver gains in 2025 | Source: TradingView

Looking ahead to 2026, major financial institutions and market analysts remain bullish but nuanced in their outlooks. Gold is projected to rise toward $4,900 per ounce by December 2026, underpinned by ongoing central bank purchases, geopolitical uncertainty, and anticipated monetary easing. Meanwhile, silver forecasts vary widely, with some models suggesting continued upside as industrial demand and structural deficits persist, though volatility risks remain higher than for gold. This dynamic environment reinforces the growing role of tokenized metals in diversified portfolios, combining the historical reliability of precious metals with the accessibility and liquidity of blockchain-based markets.

Should you choose tokenized gold or tokenized silver?

This guide compares gold and silver tokens across performance, risk, liquidity, and use cases to help you decide which asset fits your investment strategy.

What Are Tokenized Gold and Silver Cryptos and How Do They Work?

Tokenized gold and silver are digital representations of physical precious metals that exist on blockchain networks. Each token is backed 1:1 by real, audited bullion stored in professional vaults, meaning every on-chain unit corresponds to a specific amount of physical gold or silver, typically one troy ounce or one gram. This structure allows investors to gain direct exposure to precious metals without handling physical bars, while still retaining verifiable ownership through on-chain records and independent audits.

Unlike traditional gold or silver ETFs or paper certificates, tokenized metals can be traded 24/7, transferred instantly across borders, and held in

self-custody wallets. Ownership is recorded on public blockchains such as

Ethereum,

Polygon, or

Avalanche, ensuring transparency and traceability. As of January 2026, tokenized commodities collectively exceed $4 billion in market value, with gold accounting for the majority and silver gaining momentum due to rising industrial demand.

Popular Tokenized Gold Assets

Tether Gold (XAUT) and Pax Gold (PAXG) dominate the tokenized gold market, together accounting for over 90% of total gold-backed crypto value.

Tether Gold represents one troy ounce of LBMA-certified gold stored in Swiss vaults and is the most liquid gold token, widely used for hedging, trading, and on-chain collateral due to its deep liquidity and 24/7 availability.

Pax Gold, issued by Paxos Trust Company under NYDFS oversight, also represents one troy ounce of physical gold held in LBMA-approved vaults and is favored by institutions for its strong regulatory framework, audited reserves, and compliance-focused structure.

Popular Tokenized Silver Assets

Kinesis Silver (KAG), Silver Token (XAGX), and

Gram Silver (GRAMS) are among the most widely used

silver-backed cryptocurrencies, each serving different investor needs. KAG is the largest by market value, with each token backed by one ounce of fully allocated silver and enhanced by a yield-sharing model that distributes a portion of transaction fees to holders, making it attractive for long-term investors.

XAGX focuses on liquidity and trading efficiency, offering one-to-one silver backing across multiple blockchains for active traders seeking short- to medium-term exposure. GRAMS, by contrast, represents one gram of silver per token, enabling low-cost entry and micro-investing for users who want fractional exposure to physical silver without committing significant capital.

Market Snapshot: Gold vs. Silver Tokens in 2025

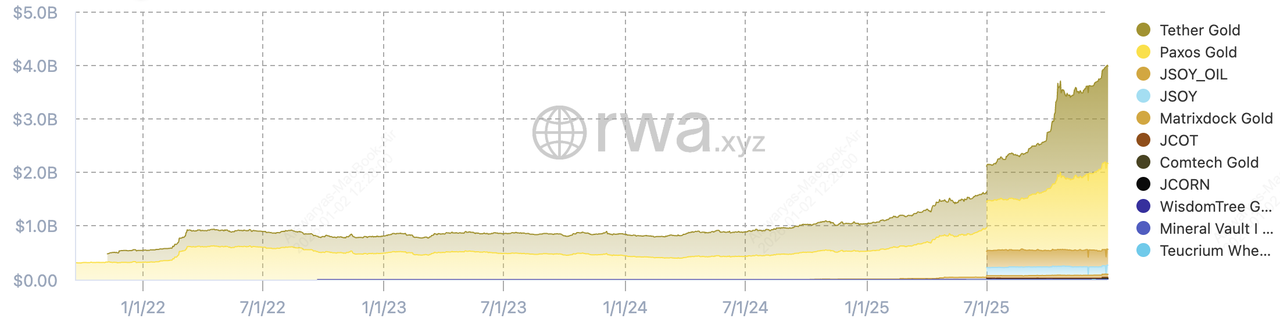

Total value of tokenized commodities, including gold and silver | Source: RWA.xyz

In 2025, tokenized gold remained the dominant asset by market capitalization, with the sector exceeding $4.4 billion, driven by sustained inflows into products like Tether Gold (XAUT) and Pax Gold (PAXG). Gold’s strength reflects its role as a macro hedge amid easing monetary policy, geopolitical uncertainty, and continued central bank accumulation. Spot gold prices surged past $4,500 per ounce in December 2025, reinforcing gold’s position as the primary store of value within the tokenized commodities market.

In contrast, tokenized silver has delivered stronger relative growth, albeit from a smaller base. The silver token market crossed $270 million, supported by rising industrial demand from solar, EVs, and electronics, alongside persistent supply deficits. Silver prices climbed nearly 170% in 2025, outperforming gold on a percentage basis. While gold dominates in scale and stability, silver’s higher volatility and tightening supply have made it the faster-growing segment for investors seeking upside within the tokenized commodities space.

As we enter 2026, gold remains the dominant asset by market value, but silver has recently outperformed in percentage terms as industrial demand surged and supply tightened.

Key Differences Between Tokenized Gold and Tokenized Silver for Investors

Tokenized gold and tokenized silver both provide on-chain exposure to precious metals, but they differ significantly in behavior, use cases, and risk-return profiles. Understanding these differences can help investors tailor their portfolios based on goals such as capital preservation, growth potential, or hedging against macroeconomic uncertainty.

1. Market Size and Liquidity: Tokenized Gold's $4B vs. $274M Tokenized Silver M-Caps

Tokenized gold assets like Tether Gold (XAUT) and Pax Gold (PAXG) together account for more than 90% of the total gold-backed crypto market, with combined market caps over $3.9B, providing deep liquidity and tight spreads for trading and hedging. Silver-backed tokens such as KAG, XAGX, and GRAMS collectively hold a significantly lower market cap of around $274 million for tokenized silver alone, which may lead to wider bid-ask spreads and lower depth in certain markets.

2. Volatility and Price Sensitivity: Gold's 72% Gains vs. Silver's 167% Rise in 2025

Historically, gold prices have shown lower volatility as a store of value and are comparatively stable. In 2025, gold delivered approximately 72% returns, reflecting its reliance on macro hedging flows rather than industrial demand spikes. Silver’s dual role as both a monetary and industrial metal drove an outsized gain of over 167% in 2025 on some exchanges, making silver tokens more susceptible to demand shocks, supply deficits, and macroeconomic shifts.

3. Fundamental Demand Drivers: Safe-Haven Gold vs. Industrial Tailwinds for Silver

Gold primarily attracts capital for inflation hedging, geopolitical protection, and portfolio insurance, traits that make tokenized gold attractive for conservative or institutional investors. Silver benefits from structural industrial demand, particularly from solar, EVs, and electronics sectors, which growth forecasts indicate will persist in 2026. This demand can amplify price movements beyond macro factors alone.

4. Use Cases in Crypto Portfolios: Hedging Gold, Diversifying Portfolios with Silver

Investors often use gold tokens as digital hedges against currency weakening or crypto volatility, thanks to their stability and deep liquidity. Silver tokens may act as a tactical allocation for periods of strong industrial demand or speculative positioning, potentially boosting risk-adjusted returns within diversified crypto portfolios.

5. Liquidity Events and Trading Patterns: Gold's Consistency, Silver's Volatile Spikes

Gold markets show consistent institutional interest. Gold token volumes and transfer activity remain robust, supported by ETFs and longtime investor trust in gold as a reserve asset. On the other hand, silver trading surges with macro/industrial catalysts. Silver trading volume spikes more sharply during periods of policy easing or industrial demand upticks, reflecting higher sensitivity to economic data and real-world supply constraints.

6. Risk Profile: Conservative Gold vs. Aggressive Silver Investors

• Conservative to Moderate for Gold: Tokenized gold is suitable for investors seeking lower drawdowns and reliable hedges within volatile markets.

• Moderate to Aggressive for Silver: Tokenized silver carries higher upside potential but also greater downside risk in corrections, making it more appropriate for investors with higher risk tolerance or tactical allocation strategies.

While both tokenized gold and silver offer valuable exposure to real-world assets on blockchain, they serve different portfolio roles. Gold tokens excel as stable stores of value and hedges, whereas silver tokens deliver higher growth potential driven by industrial demand and market dynamics, but with increased volatility and liquidity risk. Choosing between them should align with your investment time horizon, risk tolerance, and broader diversification strategy.

2026 Outlook: Gold's $5,000 vs. Silver's $200 Upside Target

Gold enters 2026 as the “stability anchor,” while silver looks like the “higher-beta trade.” After outsized 2025 gains, multiple forecasters expect early-2026 consolidation via profit-taking and digestion before the next directional move, especially if rate cuts continue and real yields stay compressed. Heraeus projects gold in a wide $3,750–$5,000/oz range for 2026, reflecting a firm macro bid, including central bank demand, de-dollarization narrative, and policy uncertainty, but also acknowledging pullback risk after a sharp run-up.

Silver’s 2026 setup is more explosive, but also more fragile. In percentage terms, several analysts expect silver to outperform gold again, because it has a dual engine:

1. the same “monetary metal” tailwinds as gold during easing cycles, and

2. industrial demand tied to solar, EVs, electronics, and defense.

However, silver’s volatility is not theoretical: late-2025 showed how quickly price can reverse when leverage gets squeezed, e.g., CME margin hikes contributed to forced liquidations after silver hit record highs, a reminder that silver often moves “fast in both directions.” Heraeus’ 2026 range for silver of $43–$62/oz also signals “choppier, higher-risk” conditions versus gold, even if the broader macro trend remains supportive.

What Does This Mean for Tokenized Commodity Investors in 2026?

• If you want a defensive hedge: Gold’s outlook is more about preserving purchasing power and cushioning portfolio drawdowns during macro stress like central bank interest rates, geopolitics, currency risk.

• If you want upside with higher variance: Silver is more likely to deliver larger swings, benefiting from easing cycles and industrial tightness, but prone to sharp pullbacks when liquidity thins or margin requirements rise.

Why Investors Choose Tokenized Gold in 2026

Tokenized gold has become a cornerstone asset for investors seeking stability, liquidity, and inflation protection, combining the reliability of physical gold with the efficiency and accessibility of blockchain-based markets.

1. Stability and Wealth Preservation: Gold-backed tokens closely track physical gold, which has historically protected purchasing power during inflationary and geopolitical stress. In 2025, spot gold surged above $4,500 per ounce, driven by central bank accumulation, currency debasement concerns, and declining real interest rates. This stability makes tokenized gold a preferred hedge during macroeconomic uncertainty.

2. Institutional-Grade Infrastructure: Leading tokenized gold assets such as PAXG and XAUT are backed by LBMA-accredited bullion, stored in insured vaults and supported by regular third-party attestations. PAXG alone operates under NYDFS regulation, while XAUT maintains full metal allocation with on-chain verification, making both suitable for institutional and high-net-worth investors seeking transparency and compliance.

3. Lower Volatility Profile: Gold exhibits significantly lower volatility than silver or major cryptocurrencies. In 2025, gold’s annualized volatility remained roughly 40–50% lower than silver and far below that of Bitcoin, reinforcing its role as a portfolio stabilizer rather than a speculative asset.

4. Deep Liquidity and Market Depth: Tokenized gold dominates the

real-world asset (RWA) sector, accounting for over 90% of total tokenized precious metals market value. With combined market capitalization exceeding $4 billion, assets like XAUT and PAXG offer deep liquidity, tight spreads, and reliable price discovery across centralized and

on-chain markets.

Tokenized gold is best suited for: Long-term investors, institutions, and risk-averse portfolios seeking capital preservation, inflation hedging, and consistent exposure to a globally recognized store of value.

Why Silver Tokens Are Gaining Momentum in 2026

While gold dominates in stability, silver-backed tokens are gaining traction due to higher upside potential and industrial demand.

1. Strong Industrial Demand: Silver is a critical input for solar panels, electric vehicles, semiconductors, and advanced electronics. In 2025, industrial use accounted for over 55% of total silver demand, with solar installations alone consuming more than 20% of global supply. As clean-energy deployment accelerates, demand growth is outpacing new mine supply, tightening the market structurally.

2. Persistent Supply Deficits Are Supporting Prices: Global silver markets have recorded multiple consecutive annual deficits, with demand exceeding supply by more than 100 million ounces in 2024–2025. Unlike gold, most silver is mined as a byproduct of copper, zinc, and lead, limiting supply responsiveness even when prices rise. This structural imbalance has been a key driver behind silver’s over 150% price increase in 2025.

3. Higher Volatility Creates Greater Upside Potential: Silver historically exhibits higher beta than gold. While gold acts as a stabilizer, silver tends to outperform during reflationary cycles and periods of monetary easing. In 2025, silver outpaced gold by more than 2× in percentage gains, reinforcing its role as a higher-risk, higher-reward metal during expansionary phases.

4. Growing On-Chain Utility and Adoption: Tokenized silver assets such as KAG, XAGX, and GRAMS are increasingly used beyond passive holding. They are being integrated into DeFi protocols for collateralization, yield strategies, and cross-border settlements. Monthly on-chain volumes for silver-backed tokens have expanded alongside rising investor participation, signaling growing utility beyond simple price exposure.

Tokenized silver is best suited for: Active traders, higher-risk portfolios, and investors seeking upside exposure.

Tokenized Gold or Silver On-Chain: Which Is Better for Portfolio Diversification?

The choice between gold and silver tokens ultimately depends on risk tolerance and portfolio objectives. Gold-backed tokens remain the preferred hedge for capital preservation, supported by lower volatility and strong institutional demand. In 2025, gold prices rose over 70% in 2025, while maintaining significantly lower drawdowns than silver. Central bank purchases, which exceeded 1,000 tonnes annually, continue to underpin gold’s role as a reserve asset. For investors prioritizing stability, downside protection, and long-term wealth preservation, tokenized gold provides a more predictable risk profile.

Silver tokens, by contrast, offer higher growth potential but with increased volatility. Silver prices surged more than 150% in 2025, driven by structural supply deficits and accelerating industrial demand from solar, EVs, and electronics. However, silver’s sharper price swings, often double the volatility of gold, make it better suited for tactical positioning rather than capital preservation. Investors with higher risk tolerance may favor silver tokens for their upside during commodity bull cycles, while conservative portfolios may prefer gold for stability and consistency.

Gold + Silver in Your Portfolio: A Balanced Strategy

Many investors combine both gold and silver tokens, using gold for stability and silver for upside, creating a more resilient and diversified on-chain commodity portfolio.

How to Trade Tokenized Gold and Silver Assets on BingX

BingX offers multiple ways to gain exposure to tokenized gold and silver, catering to both long-term investors and active traders. Whether you want to hold physical-backed assets, trade short-term price movements, or hedge macro risk, BingX provides flexible tools powered by deep liquidity and

BingX AI-driven insights.

1. Buy, Sell, or Hold Gold and Silver Tokens on BingX Spot

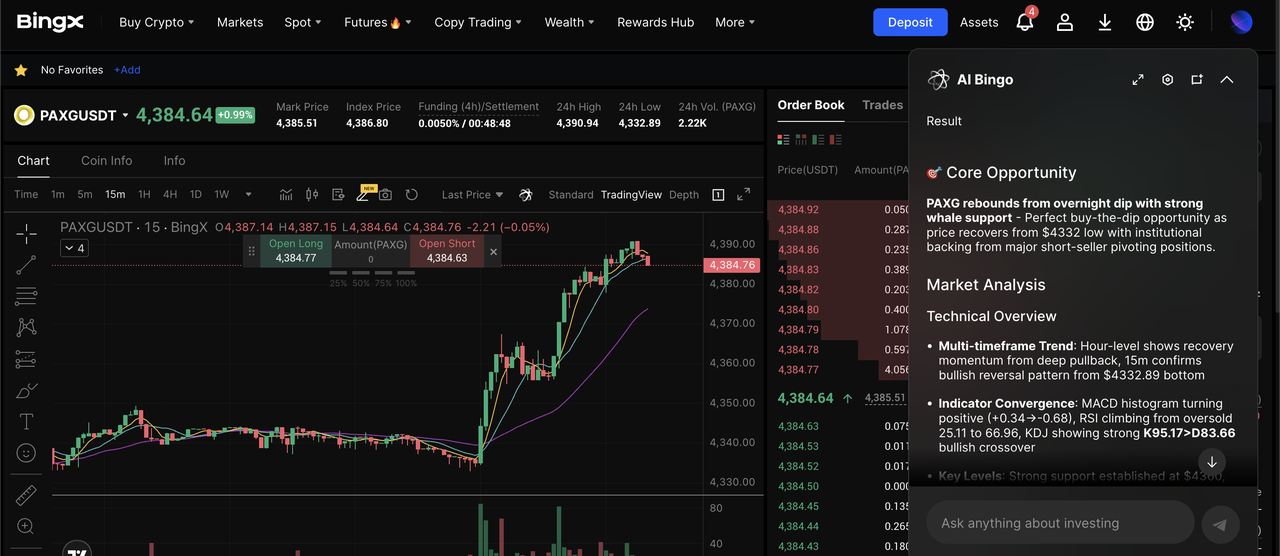

XAUT/USDT trading pair on the spot market powered by BingX AI insights

BingX allows users to trade leading tokenized precious metals such as Tether Gold (XAUT) and Pax Gold (PAXG) directly on the spot market. These tokens are backed 1:1 by physical gold and can be bought, sold, or held just like any other crypto asset. Spot trading is ideal for investors seeking long-term exposure to gold or silver without leverage, enabling them to hedge against inflation, preserve value, or diversify portfolios using real-world assets.

3. Hold the assets long term to hedge against inflation or diversify your portfolio with physically backed commodities.

2. Long or Short Tokenized Gold and Silver on BingX Futures

PAXG/USDT perpetual contract on the futures market powered by BingX AI

For traders seeking higher capital efficiency, BingX offers perpetual futures contracts on tokenized gold and silver. These instruments allow users to go long or short, enabling profit opportunities in both rising and falling markets.

2. Choose your position direction: Long (if you expect prices to rise) or Short (if you expect prices to fall).

3. Select margin mode (Cross or Isolated) and set your leverage based on risk tolerance.

4. Pick an order type (Market for instant execution or Limit for a specific entry price) and enter position size.

6. Confirm the order, then monitor PnL (profit and loss),

funding rates, and liquidation price in real time and adjust your risk controls as needed.

Futures trading supports adjustable leverage, real-time risk controls, and advanced order types, making it suitable for active traders looking to hedge portfolios or capitalize on short-term price movements driven by macroeconomic data, interest rate decisions, or commodity supply shocks.

3. Trade Gold and Silver Futures on BingX

Trade silver futures with crypto on BingX

1. Head to the futures market on BingX and search for

Gold futures or Silver futures among the assets.

2. Go long or short to profit from both rising and falling gold/silver prices.

3. Use adjustable leverage to tailor risk exposure based on market conditions.

4. Access real-time pricing, deep liquidity, and advanced order types for efficient execution.

5. Monitor funding rates, liquidation levels, and market trends directly within the BingX trading interface.

Should You Choose Tokenized Gold or Silver in 2026 for Portfolio Diversification?

There is no universal answer, as gold and silver serve different roles within a diversified portfolio. Tokenized gold tends to suit investors seeking stability, capital preservation, and lower volatility, supported by strong institutional demand and long-term monetary hedging characteristics. In contrast, tokenized silver offers higher growth potential, driven by industrial demand and supply constraints, but comes with greater price volatility and cyclical risk.

For most investors, a balanced allocation to both assets can provide optimal diversification, gold offering downside protection and silver providing upside exposure during economic expansion. As tokenization continues to modernize access to real-world assets, both metals now trade with greater liquidity and transparency than ever before. However, investors should remain mindful that commodity prices can fluctuate sharply, and tokenized assets still carry market, liquidity, and issuer-related risks.

Related Reading