Bitcoin mining in 2026 looks nothing like it did a decade ago. After the

2024 Bitcoin halving, block rewards were cut to 3.125 BTC, network difficulty hit all-time highs, and mining has become a capital-intensive, energy-driven business.

Yet mining hasn’t disappeared. Instead, it has split into three clear paths:

• Solo mining for those chasing full block rewards

This guide explains how each method for mining Bitcoin works, what returns realistically look like in 2026, and which option fits different types of BTC miners, from beginners to advanced operators.

What Is Bitcoin Mining and Why Is It Important in 2026?

Bitcoin mining is the process of securing the Bitcoin network and issuing new BTC by validating transactions through

proof-of-work (PoW). Miners use specialized hardware (ASICs) to compete in solving cryptographic puzzles. The first miner to solve a block earns the block reward of 3.125 BTC in 2026 plus transaction fees.

Why Bitcoin Mining Is Harder in 2026 Than Ever Before

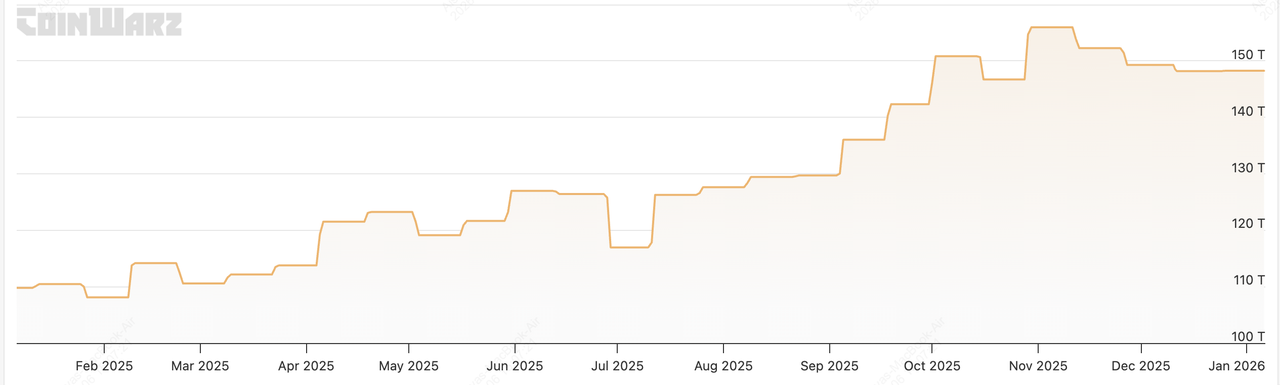

Bitcoin mining difficulty over the past one year | Source: CoinWarz

Bitcoin mining remains critical for four measurable reasons, starting with network security enforced by difficulty adjustment. As of block 931,120 in January 2026, Bitcoin’s mining difficulty stands at 148.26 trillion (T), reflecting the amount of computational work required to mine each block under the SHA-256 algorithm. With an average block time of 10.12 minutes, the network is operating very close to its 10-minute target, demonstrating how mining difficulty dynamically stabilizes block production despite fluctuations in hashrate.

Third, difficulty trends reflect miner economics and capital discipline. In January 2025, difficulty was around 109 trillion, compared with 148.26 trillion in January 2026, representing a year-over-year increase of roughly 35%. This sharp annual rise indicates sustained capital investment and efficiency upgrades across the mining sector, even as post-halving margins tighten. The resulting feedback loop between Bitcoin price, energy costs, and difficulty ensures that only the most efficient operations remain competitive, reinforcing Bitcoin’s evolution into an efficiency-driven energy network rather than a speculative free-for-all.

1. Network Security at Record Levels: In 2026, Bitcoin’s total hashrate consistently hovers around 900–950 EH/s, the highest in history. Higher hashrate makes the network exponentially harder to attack, reinforcing Bitcoin’s status as the most secure public blockchain.

2. Controlled Monetary Issuance: Mining is the only way new BTC enters circulation. With roughly 450 BTC issued per day after the 2024 halving, Bitcoin’s annual supply growth is now below 1%, lower than most fiat currencies and even gold. Mining enforces Bitcoin’s fixed supply cap of 21 million BTC.

3. Economic Incentives and Fee Markets: As block subsidies decline over time, transaction fees have become a larger share of miner revenue. During periods of high on-chain activity in 2024–2025, fees occasionally exceeded 20–30% of total block rewards, highlighting mining’s role in sustaining Bitcoin’s long-term security model.

4. Energy and Infrastructure Alignment: In 2026, an estimated 50%+ of global Bitcoin mining is powered by renewable or stranded energy sources like hydro, flare gas, wind, and solar. This has shifted mining from a purely speculative activity into an energy-arbitrage and grid-balancing industry, especially in regions with surplus power.

Bitcoin mining is no longer just about earning BTC. In 2026, it functions as the security backbone of a trillion-dollar asset network, a monetary enforcement mechanism for Bitcoin’s scarcity, and a growing energy-optimization industry.

Understanding how BTC mining works, and choosing the right way to participate, matters more than ever as rewards shrink, competition intensifies, and efficiency becomes the deciding factor. Mining today is no longer about “having more machines.” It’s about efficiency, power cost, and risk management.

What Is Solo Bitcoin Mining and How Does It Work??

Solo Bitcoin mining is the most independent way to mine BTC. It means running your own full Bitcoin node and operating mining hardware that competes directly against the entire global Bitcoin network to discover new blocks.

If your miner finds a valid block, you keep 100% of the reward. There are no pool fees, no reward sharing, and no intermediaries. In 2026, that reward consists of the 3.125 BTC block subsidy plus all transaction fees included in the block.

How Solo Bitcoin Mining Works: Step by Step

1. Run a full Bitcoin node: You download and maintain the full Bitcoin blockchain of over 600 GB in 2026, independently verifying transactions and blocks without relying on third parties.

2. Connect ASIC miners directly to your node: Your ASICs, such as Antminer or WhatsMiner models, attempt to solve cryptographic puzzles by hashing block headers billions of times per second.

3. Compete against the global network: Your hashrate competes with the entire Bitcoin network, which averages 900–950 EH/s in 2026.

4. Find a block and claim the full reward: If your miner finds a valid block before anyone else, you earn 3.125 BTC block subsidy and 100% of transaction fees, which can add 5–30%+ to rewards during high network congestion.

There is no smoothing of income. Every outcome is binary: all or nothing.

Realistic Solo Mining Odds in 2026

Solo mining is best described as a probabilistic hashrate lottery. Your chances depend entirely on how much of the network’s total hashrate you control. Here’s what the math looks like in real terms:

• 1 PH/s (1,000 TH/s): On average, you may find one block every 6–8 years.

• 2–3 PH/s: Block discovery improves, but still averages one block every 3–4 years.

• Industrial scale (50+ PH/s): Capable of finding multiple blocks per year, but only with large capital investment, professional hosting or data-center infrastructure, and electricity costs typically below $0.05 per kWh.

Because of this extreme variance, solo mining block wins by small operators still make headlines in 2026. They are statistically rare but not impossible.

Pros of Solo Bitcoin Mining

• Full ownership of rewards: You keep every satoshi earned, no pool fees or revenue sharing.

• Maximum decentralization: Solo miners strengthen Bitcoin’s censorship resistance and reduce pool dominance.

• Complete operational control: You choose hardware, software, upgrade cycles, and fee strategies.

• No counterparty risk: No reliance on pool operators or third-party payout systems.

Cons of Solo Bitcoin Mining

• Extremely unpredictable income: You can mine for months or years without earning anything.

• High capital requirements: Competitive solo setups require multiple ASICs, power infrastructure, cooling, and redundancy.

• Operational complexity: Running a node, managing uptime, and handling network issues require technical expertise.

• Cash-flow stress: Electricity and hosting bills continue regardless of mining success.

Who solo mining is for in 2026: Large-scale miners with ultra-cheap electricity, strong capital reserves, and high risk tolerance.

What Is Pool Mining and Why Do Most Bitcoin Miners Use It?

Pool mining is the most common way to mine Bitcoin in 2026. Instead of competing alone against the entire network, miners combine their hash power and share block rewards proportionally based on contribution.

The core purpose of a mining pool like AntPool or ViaBTC is simple: reduce income volatility. Bitcoin still produces one block roughly every 10 minutes, but for individual miners, especially small ones, the odds of finding a block alone are extremely low. Pools transform mining from a high-variance lottery into a predictable, measurable revenue stream.

How Bitcoin Mining Pools Work: Step by Step

1. Miners contribute hash power or “shares”: Each miner connects their ASICs to a pool server and submits “shares,” which are proofs of partial work. Shares don’t create blocks by themselves, but they measure how much work each miner contributes.

2. The pool aggregates hash power: By combining thousands of miners, pools control a significant portion of the network’s total hashrate. In 2026, the largest pools individually control 15–30% of global hash power, allowing them to find blocks regularly.

3. The pool finds blocks frequently: Because of this scale, pools may discover multiple blocks per day, dramatically reducing reward variance compared to solo mining.

4. Rewards are distributed according to a payout model: Common payout methods include:

• PPS (Pay-Per-Share): Fixed payout per share, regardless of whether the pool finds a block.

• FPPS (Full Pay-Per-Share): PPS plus a share of transaction fees.

• PPLNS (Pay-Per-Last-N-Shares): Rewards distributed based on recent contribution, with higher variance but lower fees.

Each model balances risk, fees, and payout stability differently.

Typical Pool Mining Economics in 2026

In 2026, mining pool economics are designed to prioritize stability and cash-flow predictability. Most major Bitcoin mining pools charge fees of around 1–2.5%, in exchange for smoothing out reward variance and handling block discovery and payouts. Payouts are typically issued daily or near-daily, allowing miners to regularly realize income instead of waiting months or years for a solo block reward.

Because rewards are distributed across many blocks, income variance is significantly lower than solo mining, making returns more consistent and easier to forecast. Many pools also set low minimum payout thresholds, often as little as 0.001 BTC, enabling even small or single-ASIC miners to receive frequent payouts. Together, these mechanics make pool mining revenue predictable enough to reliably cover electricity, hosting, and maintenance costs, which is critical for sustaining mining operations over the long term.

Why Pool Mining Dominates Bitcoin Mining in 2026

By 2026, over 95% of individual miners participate in mining pools. This dominance is driven by practical economics rather than ideology:

• Predictable income: Regular payouts make it easier to manage cash flow and operating expenses.

• Clear ROI calculations: Miners can estimate daily or monthly returns using hashrate, fees, and power costs.

• Viability for small setups: Even miners with a single ASIC can earn consistent rewards.

• Operational simplicity: Pools handle block construction, transaction selection, and payout accounting.

In short, pool mining makes Bitcoin mining accessible beyond industrial-scale operators.

Pros of Pool Mining

• Consistent cash flow: Regular payouts reduce financial stress and planning uncertainty.

• Lower variance risk: Earnings are smoothed across many blocks instead of relying on rare solo wins.

• Simpler setup and monitoring: Most pools offer dashboards, APIs, and automatic payouts.

• Compatible with home and hosted mining: Works equally well for residential miners and data-center-hosted ASICs.

Cons of Pool Mining

• Pool fees reduce total yield: Fees slightly lower returns compared to theoretical solo success.

• Centralization concerns: Large pools controlling significant hashrate raise governance and censorship questions.

• Dependence on pool reliability: Downtime, misconfiguration, or policy changes can affect payouts.

Despite these drawbacks, the trade-off is usually acceptable for most miners.

Who pool mining is for in 2026: Most home miners, small operators, and anyone prioritizing stability over lottery-style rewards.

What Is Cloud Mining and How Does It Work?

Cloud mining allows users to gain exposure to Bitcoin mining without owning or operating physical hardware. Instead of purchasing ASICs, setting up power infrastructure, or managing cooling and maintenance, you rent Bitcoin hashrate from a third-party provider through a fixed-term contract.

In this model, the provider owns and operates the mining equipment, typically in large data centers located in regions with low electricity costs, while users receive a share of the mined Bitcoin after operational expenses and platform fees are deducted.

How Cloud Mining Works (Step by Step)

1. Purchase a mining contract: You buy a contract specifying:

• Hashrate (commonly 50–500 TH/s for retail users)

• Contract duration (usually 6–36 months)

2. Provider mines on your behalf: The cloud-mining operator runs ASIC miners in their facilities, handling:

• Hardware procurement and upgrades

• Electricity and cooling

• Network connectivity and uptime

3. Receive BTC payouts net of costs: Your earnings are paid in Bitcoin after deducting electricity costs (often the largest expense), maintenance and hosting fees, and platform margin or management fee. Payouts are typically credited daily or weekly, depending on the provider’s policy.

Realistic Cloud Mining Returns in 2026

In real-world market conditions, reputable cloud-mining contracts typically generate around 5–10% APR in BTC terms, rather than the exaggerated returns often advertised online. These returns are highly sensitive to external variables: a rising Bitcoin price can improve profitability by increasing the value of mined BTC, while increasing network difficulty reduces the amount of Bitcoin mined per terahash over time.

At the same time, electricity cost assumptions play a critical role; higher power and cooling expenses can quickly compress or even eliminate margins, especially after difficulty adjustments. As a result, cloud mining returns fluctuate with market conditions and should be viewed as variable, not guaranteed, income.

Because

Bitcoin mining economics are fixed and transparent, any platform advertising guaranteed daily profits, fixed high yields, or triple-digit returns is almost certainly misrepresenting risk. These claims are incompatible with how Bitcoin’s proof-of-work system actually functions.

Pros of Cloud Mining

• No hardware ownership: No ASIC purchases, noise, heat, or hardware depreciation.

• No technical setup: Beginners can participate without managing nodes or firmware.

• Defined exposure: Fixed hashrate and contract duration make capital allocation clear.

• Passive BTC income: Appeals to users seeking hands-off exposure to mining rewards.

Cons of Cloud Mining

• Counterparty risk: You rely entirely on the provider’s honesty, solvency, and uptime.

• Scam-heavy sector: Cloud mining has historically attracted Ponzi schemes and fake dashboards.

• Low liquidity: Contracts are typically locked; early exits are rare or heavily penalized.

• Opaque fee structures: Electricity and maintenance costs can significantly reduce net returns.

Who cloud mining is for in 2026: Users who want hands-off BTC exposure and understand the risks of counterparty trust.

Cloud Mining vs. Pool Mining vs. Solo Mining: A 2026 Comparison

| Feature |

Solo Mining |

Pool Mining |

Cloud Mining |

| Reward size |

Large, rare |

Small, frequent |

Contract-based |

| Income stability |

Very low |

High |

Medium |

| Setup complexity |

Very high |

Medium |

Low |

| Capital required |

Very high |

Medium |

Low–Medium |

| Control |

Full |

Shared |

None |

| Best for |

Large operators |

Most miners |

Passive users |

At a practical level, solo mining offers the largest rewards but comes with extremely low income stability and very high capital requirements, making it viable only for large operators. Pool mining trades jackpot-style payouts for frequent, predictable income, which is why it has become the default choice for most miners in 2026. Cloud mining, meanwhile, removes hardware and setup complexity entirely, offering contract-based exposure that appeals to passive users; though returns depend heavily on fees, electricity assumptions, and provider reliability.

How Profitable Is Bitcoin Mining in 2026?

Bitcoin mining profitability in 2026 is governed by three measurable variables that apply across all mining models: electricity cost, ASIC efficiency (joules per terahash), and mining method, which determines how risk and reward are distributed over time. Electricity remains the dominant factor, miners paying above $0.08 per kWh are often operating on thin or negative margins, while those below $0.05–$0.06 per kWh retain a structural advantage. ASIC efficiency also matters more than ever, as newer-generation machines can produce significantly more hash power per unit of energy, directly improving breakeven economics.

The mining method you choose determines how those underlying economics translate into real income. Solo mining exposes miners to extreme variance, where even efficient setups can go years without earning a block reward. Cloud mining compresses variance, but margins are quickly eroded by electricity charges, maintenance costs, and provider fees, leaving limited upside in most market conditions. Pool mining, by contrast, uses reward sharing to smooth out income, turning Bitcoin mining into a cash-flow model rather than a probabilistic gamble.

For most individuals in 2026, pool mining offers the best risk-adjusted outcome. Pool fees of 1–2.5% are far cheaper than the opportunity cost and uncertainty of solo mining, and far more transparent than many cloud-mining contracts. This is why pool mining consistently emerges as the most practical choice in side-by-side comparisons of cloud mining vs. pool mining vs. solo mining, it balances efficiency, predictability, and sustainability in a post-halving environment.

Which Bitcoin Mining Method Should You Choose in 2026?

Choosing the right Bitcoin mining method in 2026 depends on how much capital you can deploy, how stable you want your income to be, and how much operational risk you’re willing to take in a post-halving, high-difficulty environment.

Choose Solo Mining if:

• You have ultra-cheap electricity

• You operate at industrial scale

• You accept long zero-income periods

Choose Mining Pools if:

• You want predictable BTC income

• You mine at home or via hosting

• You value stability over jackpots

Choose Cloud Mining if:

• You want zero hardware involvement

• You accept counterparty risk

• You treat it as high-risk passive exposure

An Alternative to Bitcoin Mining: How to Trade BTC on BingX

If mining economics or operational risk don’t fit your profile in 2026,

BingX AI-powered trading tools offer a more flexible way to gain Bitcoin exposure, without complex hardware, electricity costs, or long-term infrastructure commitments.

Spot Trading BTC on BingX

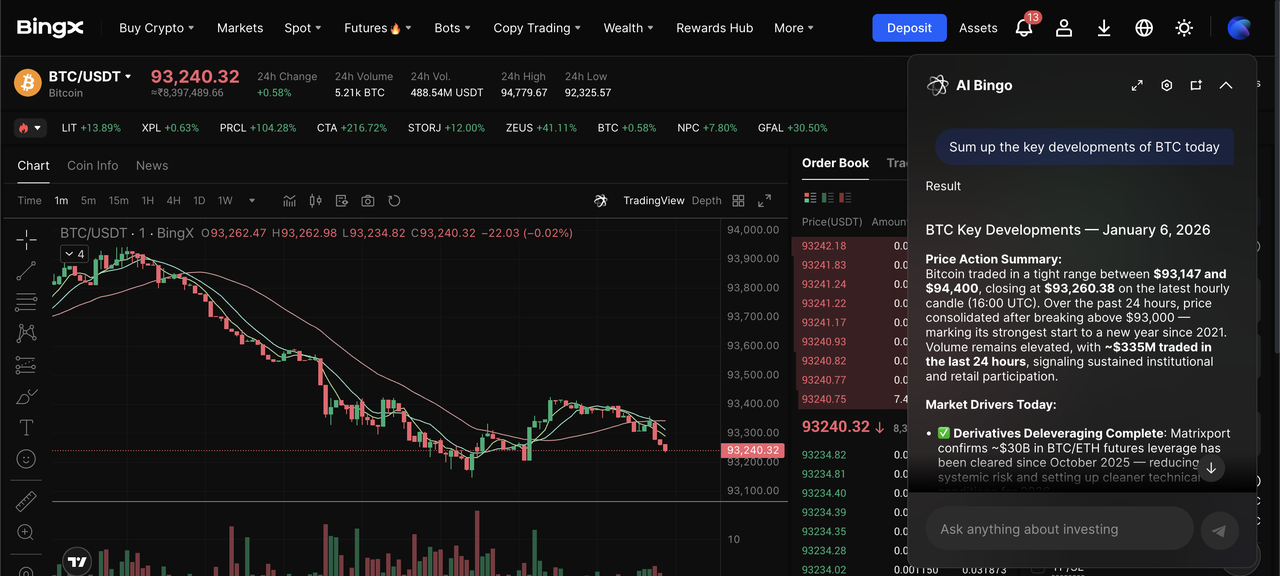

BTC/USDT trading pair on the spot market powered by BingX AI insights

Spot trading allows you to

buy and sell Bitcoin directly at market prices, making it suitable for long-term holders and active traders alike. You own the BTC outright, can withdraw it at any time, and benefit fully from price appreciation, without dealing with mining difficulty, hashrate competition, or operating expenses.

Trade BTC Futures on BingX

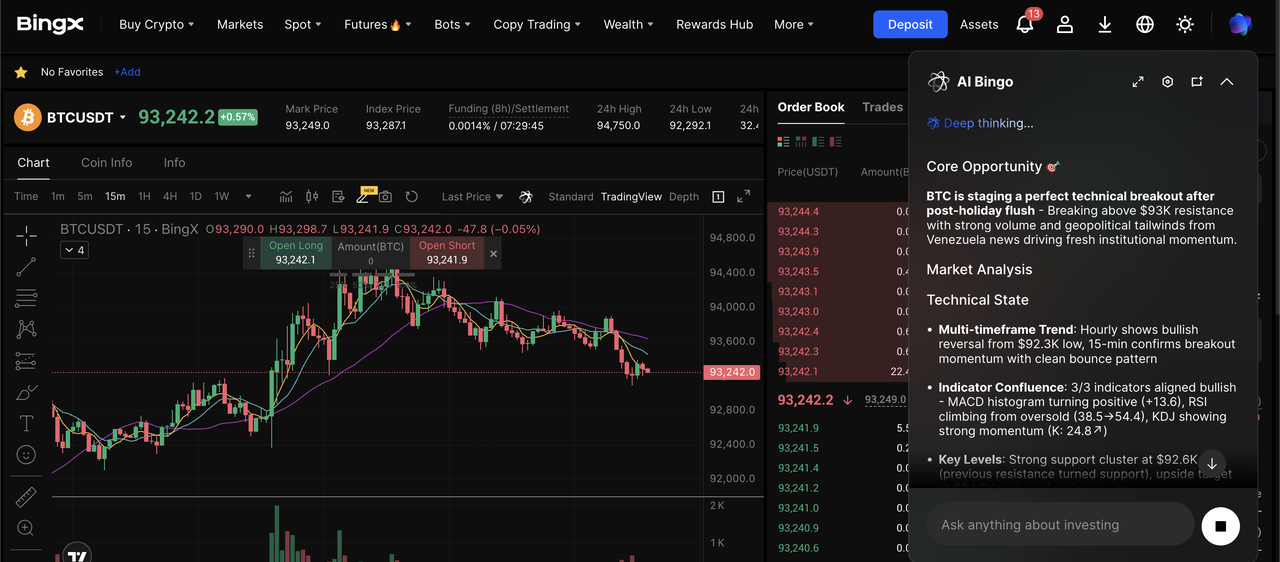

BTC/USDT perpetual contract on the futures market powered by BingX AI

BTC futures on BingX let you go long or short Bitcoin using leverage, enabling you to profit from both rising and falling markets.

Futures trading is commonly used for short-term trading, hedging existing BTC exposure, or expressing macro views, but it also carries higher risk due to leverage and should be managed carefully.

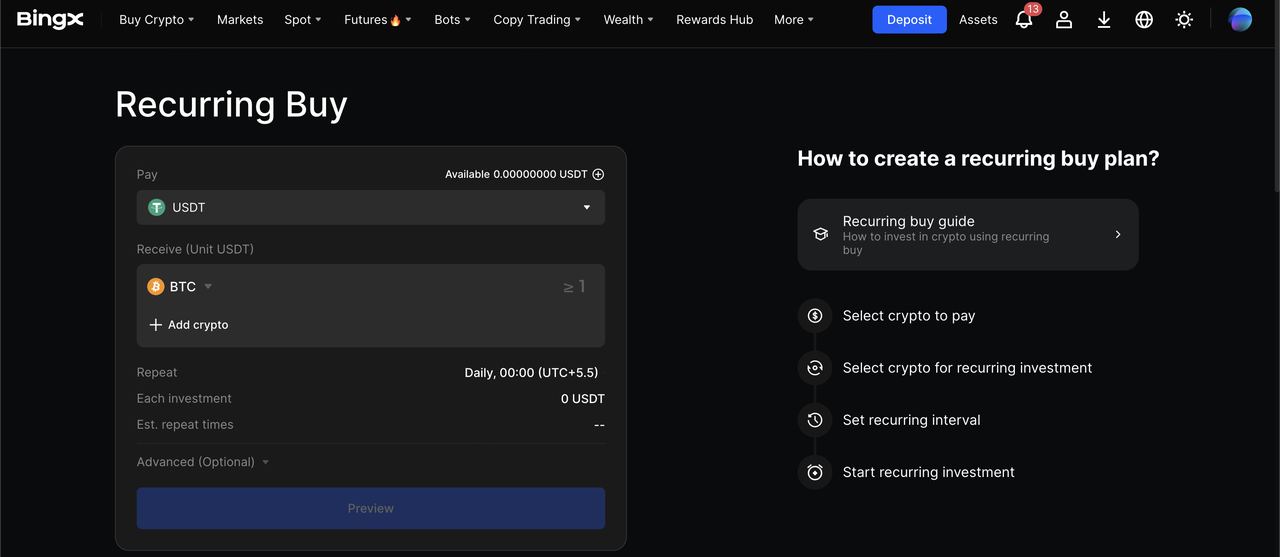

DCA Bitcoin with BingX Recurring Buy

DCA Bitcoin (BTC) on BingX Recurring Buy

BingX Recurring Buy enables you to automatically invest in Bitcoin at regular intervals, helping reduce the impact of market volatility through dollar-cost averaging (DCA). This strategy is best suited for users who want steady BTC accumulation over time without actively timing the market.

Together, these options provide practical alternatives to Bitcoin mining, allowing you to choose between ownership, active trading, or systematic accumulation, depending on your goals and risk tolerance.

Final Verdict: What’s the Best Way to Mine Bitcoin in 2026?

For most users, mining pools represent the most practical and sustainable way to mine Bitcoin in 2026, as they reduce income volatility and turn mining from a low-probability lottery into a more measurable, cash-flow-oriented activity. Solo mining remains a niche strategy suited mainly to large operators with significant capital, ultra-low electricity costs, and the ability to tolerate long periods without rewards, while cloud mining sits in between, offering accessibility at the cost of higher counterparty risk and thinner margins.

It’s important to note that no mining method guarantees profits. Returns remain highly sensitive to Bitcoin’s price, network difficulty, electricity costs, and operational efficiency, and unfavorable changes in any of these factors can quickly erode margins. In this context, Bitcoin mining in 2026 should be approached not as a passive yield product, but as an efficiency-driven energy and

risk-management business where careful planning and realistic expectations are essential.

Related Reading