Launched on October 28, 2025, the Canary HBAR ETF puts

Hedera on U.S. stock screens with a true spot product. It delivers direct HBAR exposure through a regular brokerage account, no wallet or exchange required. Below we unpack how the ETF works, how creation and redemption keep shares near NAV, and what fees to expect.

We also contrast it with

Bitcoin and

Ethereum ETFs, spotlight Hedera’s core tech, and explain why HBAR rose about 17% percent in October 2025 on ETF momentum and growing

USDC activity on the chain.

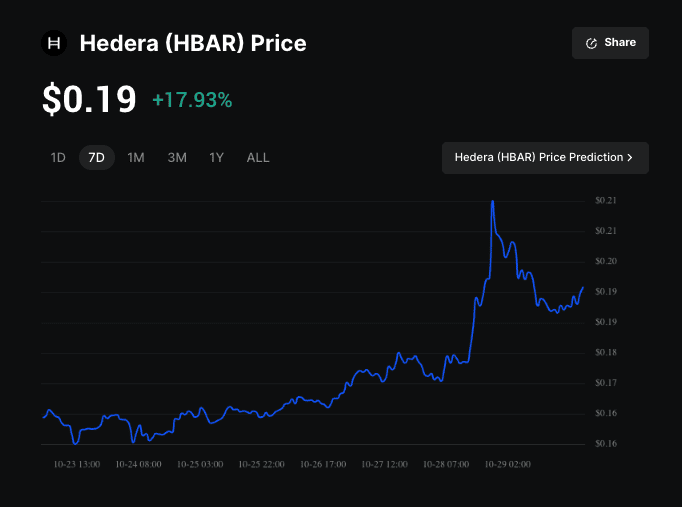

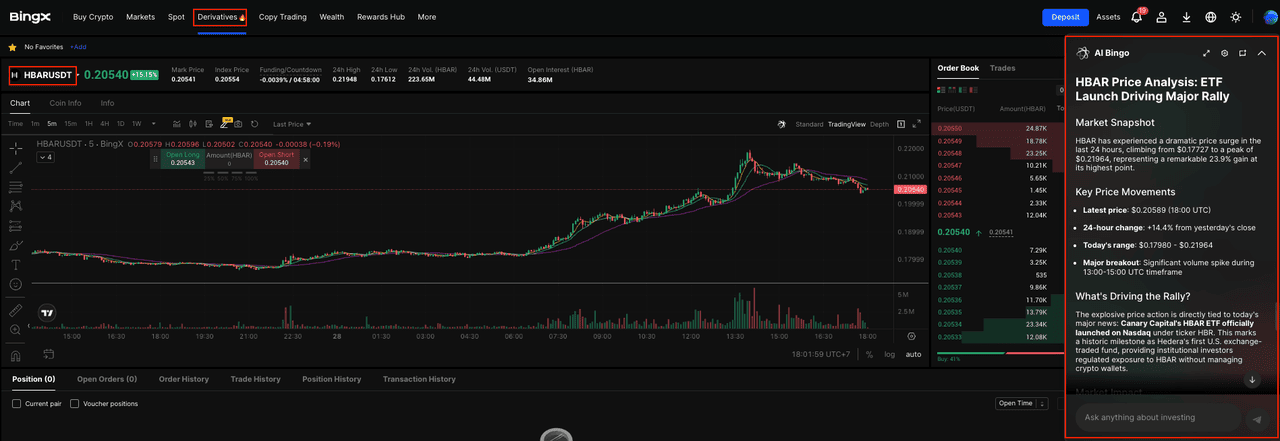

Hedera (HBAR) Price Chart 7 Days | Source:

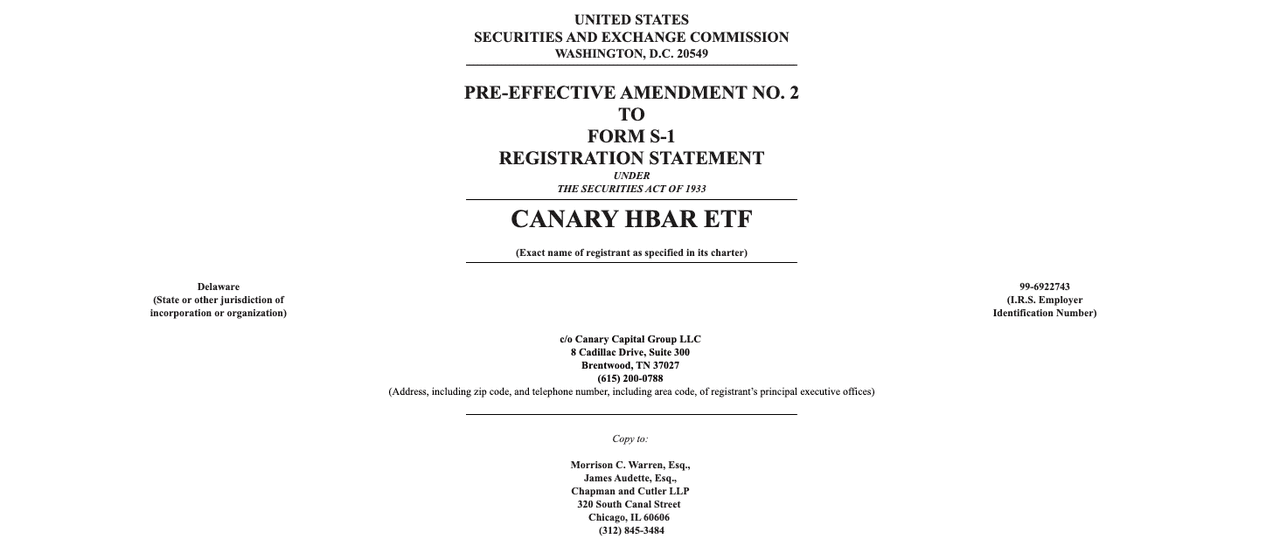

BingXWhat Is the Canary HBAR ETF and How Does It Work?

Launched on October 28, 2025, the Canary HBAR ETF is an exchange-traded fund that provides direct spot exposure to Hedera’s native asset,

HBAR, through your regular brokerage account. You don't need a wallet or a crypto exchange. You can buy and sell ETF shares during normal market hours. The fund aims to track the HBAR price minus the management fee and your trading costs.

Behind the scenes, the fund holds real HBAR with a qualified custodian, typically in cold storage. Large market makers, also called authorized participants, create and redeem ETF shares in blocks using HBAR or cash. This process helps keep the share price close to the fund’s net asset value, which is calculated from a transparent reference rate that pulls HBAR prices from multiple liquid venues. Because crypto trades 24/7 while the ETF trades only when the stock exchange is open, short-term gaps can appear, including premiums, discounts, and wider spreads during volatile periods.

Official HBAR ETF registration statement from the SEC

How Does a Hedera (HBAR) ETF Differ From Bitcoin and Ethereum ETFs?

• Market Depth and Liquidity: Bitcoin and

Ethereum have deeper spot and derivatives markets, which usually means tighter spreads and larger creation redemption activity. HBAR liquidity is smaller, so the ETF can see wider spreads and more pronounced premiums or discounts at times.

• Staking Treatment: Bitcoin has no staking. Ethereum supports

staking but U.S. spot ETH ETFs currently do not stake. Hedera supports staking, but a spot HBAR ETF typically will not stake either, so any on-chain yield is not captured for shareholders.

• Hedging Tools:

BTC and

ETH have established regulated futures markets that market makers use for hedging. HBAR futures liquidity is comparatively limited, which can affect market-making costs and spreads.

• Benchmark Construction: All three use independent reference rates, but the venue mix and weighting differ by asset, which can influence tracking behavior.

• Network Specific Risks: Hedera’s technology (hashgraph consensus, governance council model, fee design) presents a distinct risk and adoption profile compared to Bitcoin’s

proof of work and Ethereum’s smart contract dominance, and this can translate into different volatility and fund flows for the ETF.

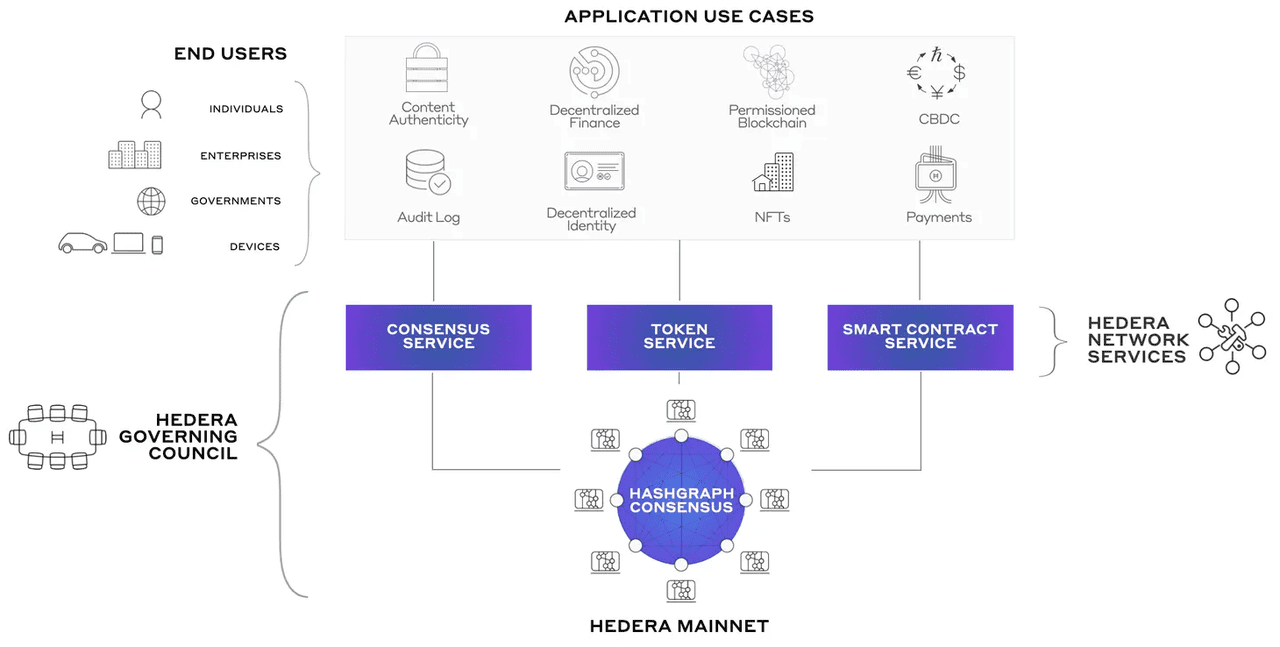

What Is Hedera (HBAR) and How Does It Work?

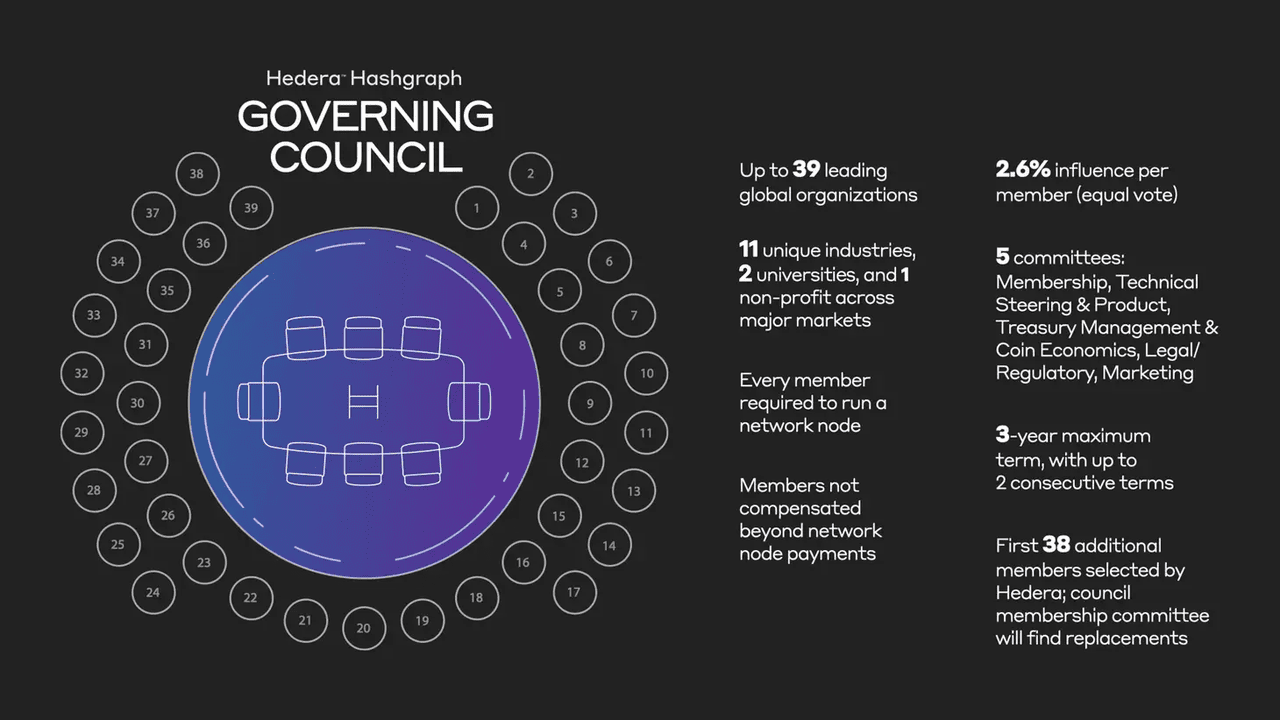

Hedera is a public, open-source

proof-of-stake network that uses hashgraph consensus instead of a traditional blockchain. Hashgraph is a directed acyclic graph that reaches agreement through virtual voting and a gossip protocol, which lets the network order transactions quickly and finalize them without producing blocks. The protocol targets asynchronous Byzantine fault tolerance so honest nodes can agree even if some act maliciously.

On performance, Hedera reports about 10,000 transactions per second in a single shard, with finality in roughly 3 to 5 seconds. Reported energy use is about 0.003 Wh per transaction. That mix of throughput, speed, and low cost fits real-time use cases like micropayments and event logging.

Developers pay fees in HBAR for core services: transferring HBAR, minting fungible and

non-fungible tokens, calling

smart contracts, and writing data. The design keeps bandwidth consumption low to sustain fees while maintaining security and stability. The stack includes a token service for native issuance, an

EVM-compatible smart contract service, a file service, and a consensus service for timestamping and fair ordering. Governance comes from a rotating Governing Council of global organizations that vote on upgrades and oversee treasury management.

Why Did Hedera (HBAR) Surge 17% in October 2025?

ETFs and on-chain traction pushed HBAR back into focus. Here’s what moved it:

1. A new U.S. Hedera ETF unlocked fresh liquidity

The new HBAR ETF from Canary Capital offers direct spot exposure to HBAR and has clearly been a catalyst for the recent price surge.

2. Risk-on rotation into altcoins

With broader crypto sentiment turning up, capital rotated out of Bitcoin into selected

altcoins. HBAR benefited from that shift as momentum traders chased leaders.

3. Visible stablecoin usage on the Hedera ecosystem

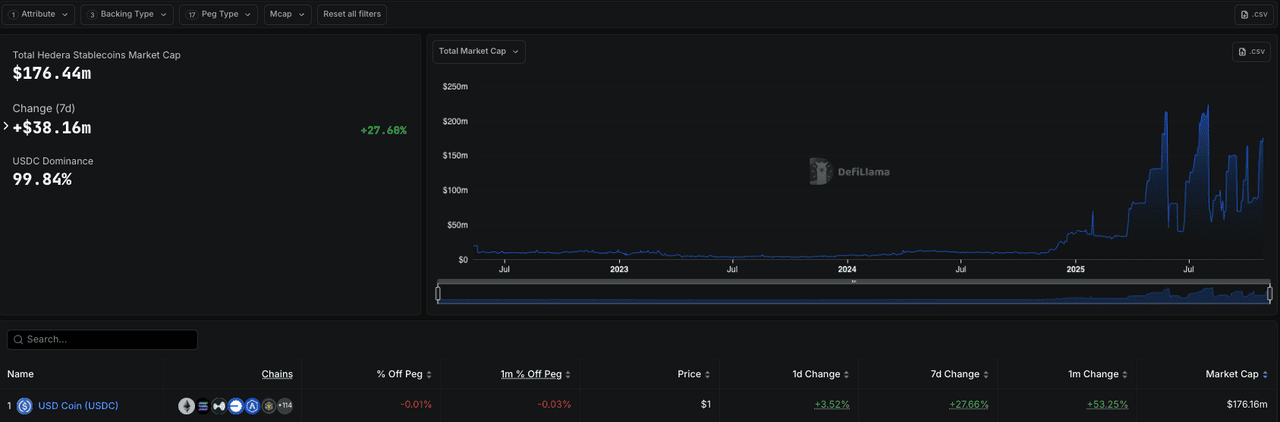

According to DefiLlama, the market cap of

USDC on Hedera is now approximately $176 million. This increase in market cap is a clear indication of rising liquidity and genuine network demand, in addition to the trading narrative.

Total Hedera Stablecoins Market Cap | Source:

DefiLlama

Together, ETF exposure, market rotation and tangible stablecoin traction created favorable conditions for a significant rally, while maintaining elevated volatility around ETF headlines.

What Is the HBAR Token Utility?

• Users and developers: Pay predictable fees in HBAR for transfers, token mints (fungible and NFTs), smart contract calls, and data writes. Benefit from finality in about 3 to 5 seconds and design targets of around 10,000 TPS.

• dApp and token issuers: Use the Token Service for native issuance and management without custom contracts, and deploy Solidity on the EVM-compatible Smart Contract Service. Settle all activity with fees denominated in USD and paid in HBAR.

• Enterprises and data pipelines: Tap the Consensus Service for timestamping and fair ordering of events, and the File Service for small data and references. Anchor auditing, supply chain, and identity flows on the chain with costs paid in HBAR.

• Node operators and delegators: Stake HBAR to secure the network. Stake weight influences consensus, and rewards are shared between operators and delegators from defined allocations and transaction fees.

HBAR Tokenomics and Allocation

HBAR has a fixed total supply of 50 billion, with 42,475,229,929 in circulation. The remainder is managed under treasury policies, guided by a Treasury Management Report that defines classifications, allocations, and release schedules focused on allocated and unallocated balances, ecosystem growth, and staking incentives.

Staking rewards come from treasury designations and transaction fees, including a 250 million HBAR top up; about 5.4 billion HBAR is staked, and up to 13% of total supply qualifies for the full annual reward rate.

How to Trade Hedera (HBAR) on BingX

Whether you are building a long-term HBAR position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token. With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

HBAR/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit HBAR or USDT and verify the correct network before trading.

Always conduct your own research (

DYOR). Diversify your portfolio and never invest more than you can afford to lose.

How to Trade HBAR Perpetual Futures

HBAR/USDT perpetual contract on BingX futures powered by AI BingX

Futures, especially perpetual futures, let you trade HBAR price movements with leverage; you don’t necessarily need to hold the underlying HBAR. You can go long (betting price will rise) or short (betting price will fall). BingX offers a

HBAR-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate HBAR-USDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk (if losses push margin below maintenance).

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Should You Invest in a Hedera (HBAR) ETF?

A Hedera ETF could offer a simple, regulated way to gain exposure to Hedera’s ecosystem without managing wallets, private keys, or on-chain transactions. For investors who prefer traditional brokerage accounts, familiar custody structures, and portfolio diversification through regulated financial products, an ETF may be a convenient entry point once available in their region.

For users who prefer direct crypto ownership, an alternative is to buy Hedera (HBAR) on crypto exchanges such as BingX, where you can trade HBAR directly, store it in your own wallet, or use it within the Hedera ecosystem. This provides full control over your holdings, real-time trading, and access to the network’s applications and staking opportunities.

Related Reading