In 2024–2025, ETFSwap (ETFS) became one of the most talked-about “TradFi meets DeFi” projects. It promised a decentralized way to trade

tokenized exchange-traded funds (ETFs), stake tokens for high yields, and use

AI tools to filter and track ETF opportunities. Marketing campaigns and presale articles pushed bold predictions of 5,000x–25,000% returns and even a $100 billion market cap.

The reality looks very different today. ETFSwap trades around $0.00031 per ETFS, giving it only a few hundred thousand dollars in market value, far below the presale price of $0.00854 and well off past spikes near $0.05–$0.47. That translates into an on-paper ROI of roughly 0.04x versus the initial token sale price.

At the same time, ETFSwap has passed a 95% security audit score from Cyberscope and completed team

KYC checks with SolidProof, but also carries low trust scores on some scam-review sites and negative community reports.

This guide explains what ETFSwap is, how it works, its tokenomics, and the main risks you should know before using or investing in ETFSwap.

What Is ETFSwap (ETFS) Investment Platform for Tokenized ETFs?

ETFSwap is a decentralized investment platform built on the

Ethereum blockchain that lets you trade tokenized ETFs instead of only cryptocurrencies. It aims to bring traditional exchange-traded funds on-chain by converting them into ERC-20 tokens that you can buy, sell, or stake inside a DeFi environment.

In simple terms, ETFSwap wants to be a

DEX focused on ETFs. You connect a

Web3 wallet like

MetaMask, swap crypto like

ETH or

stablecoins into tokenized ETFs, and manage these positions directly on-chain. The platform also markets AI-powered tools, such as ETF screeners, filters, and trackers, to help you scan ETF markets, filter by performance or risk profile, and monitor holdings in real time.

The ecosystem is powered by ETFS, the platform’s native ERC-20 token. ETFS is used for fees, staking, governance, and access to premium ETF products. ETFSwap’s roadmap includes plans to launch its

own ETF product and expand into spot

Bitcoin ETF management, positioning itself as a bridge between traditional ETFs and on-chain DeFi rails.

Key Features of ETFSwap (ETFS)

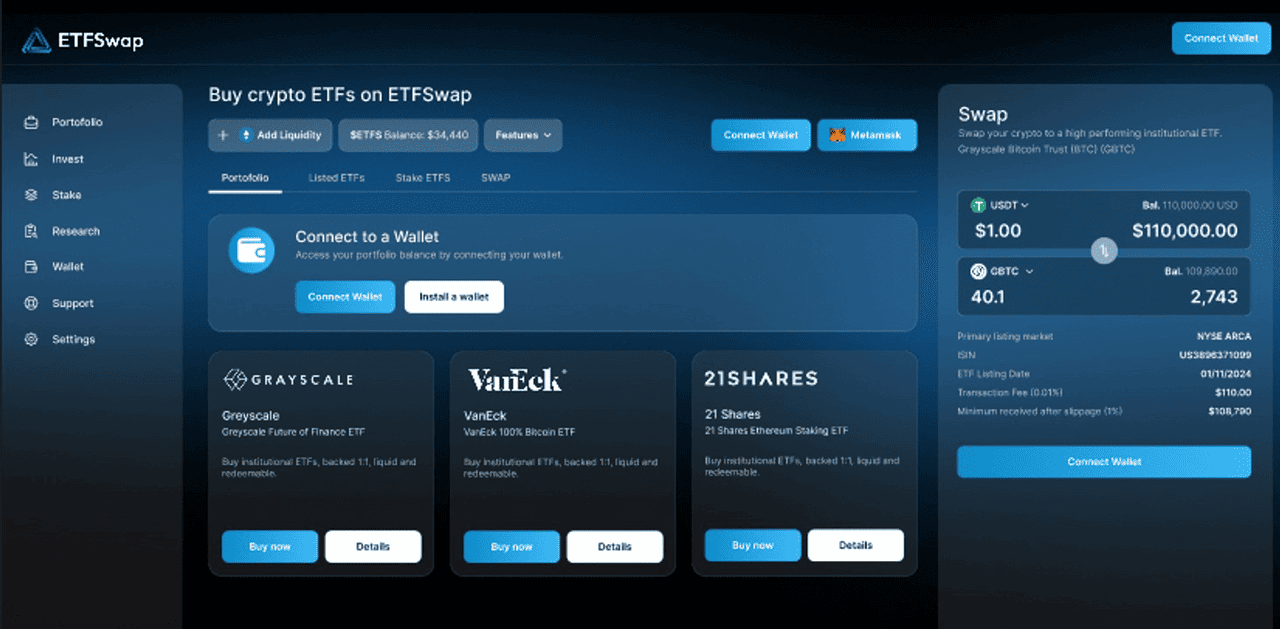

An overview of ETFSwap | Source: ETFSwap docs

Here’s a quick overview of ETFSwap’s main value propositions:

1. Tokenized ETF Trading: Swap cryptocurrencies directly into tokenized ETFs that track traditional assets such as stocks, commodities, or spot Bitcoin ETFs.

2. On-Chain, 24/7 ETF Access: Trade ETF exposures around the clock, not just during stock-market hours.

3. AI-Assisted Research: Use ETF screeners, filters, and trackers to help analyze ETF markets and build strategies.

4. Deflationary ETFS Tokenomics:

• 1% buy tax is burned to reduce supply.

• 5% sell tax funds reward pools and liquidity incentives for holders and LPs.

5. Staking and Liquidity Rewards: Stake ETFS or provide liquidity to pools to earn yield, paid in ETFS and/or other tokens.

6. Security Audits and KYC: ETFSwap’s smart contracts have a 95% security score from Cyberscope, with no critical vulnerabilities reported in multiple iterations, and the team has undergone KYC checks with SolidProof.

These features are designed to make ETFSwap feel like a hybrid between a brokerage ETF platform and a DeFi yield protocol.

How Does ETFSwap Tokenized ETF Platform Work?

ETFSwap combines tokenization, a DEX/AMM trading engine, and DeFi rewards:

1. Tokenization of ETFs

Traditional ETF units, such as equity, commodity, bond, or

Bitcoin ETFs, are represented as ERC-20 tokens on Ethereum. These “tokenized ETFs” can then be traded like any other on-chain asset, enabling 24/7 access, fractional ownership, and global reach without relying on a stockbroker.

In ETFSwap’s model, authorized participants or platform partners deposit underlying assets into liquidity structures, and the protocol issues corresponding tokenized ETF units that track those assets.

2. Decentralized Exchange and AMM

ETFSwap operates using a decentralized exchange (DEX) model powered by an

automated market maker (AMM), where prices adjust automatically based on the token ratios in liquidity pools rather than traditional order books. You simply connect your wallet, select a pool such as ETH/tokenized ETF, and complete the swap in one transaction, while liquidity providers supply assets to these pools and earn fees or ETFS rewards. This design ensures continuous, permissionless liquidity and supports both small and large trades without relying on centralized market makers.

3. Staking and Yield Generation

The ETFS token underpins a staking program where holders lock their tokens in smart contracts to earn passive rewards sourced from the platform’s 5% sell-tax pool. These rewards are distributed periodically to stakers, and while some promotional materials cite potential yields of around 36% APY or higher when paired with ETF-based products, actual returns depend on trading volume, emissions, and market conditions. The model aims to create a “trade-to-earn” cycle in which trading activity generates tax revenue, and long-term participants benefit from the resulting yield.

4. AI-Powered ETF Tools

ETFSwap highlights its AI-powered research suite as a core feature, offering tools like an ETF Screener and Filter to sort ETFs by metrics such as sector, performance, and volatility, along with an ETF Tracker for monitoring live prices, charts, and portfolio composition. These tools aim to bring institutional-grade ETF analysis into a DeFi environment, though users should still verify insights and data independently to ensure accuracy and make informed decisions.

Why Has ETFSwap Attracted So Much Attention?

ETFSwap sits at the intersection of hot narratives like tokenized ETFs, AI tools, DeFi yields and heavy marketing, which explains why ETFSwap has generated buzz:

1. ETF + DeFi Narrative: The tokenization of real-world assets and ETFs is a strong narrative, especially after Spot Bitcoin ETFs from issuers like BlackRock showed massive inflows. ETFSwap positions itself as a pure-play “ETF DEX”, which naturally attracts speculative interest.

2. Aggressive Return Forecasts: Promotional content and influencer posts have floated return targets like 80x, 5,000x, 12,000%, or even 25,000% gains tied to presale or beta launches. These numbers are marketing projections, not guarantees, and have not played out so far given the current sub-presale price.

3. Presale Scale and Hype: ETFSwap reportedly raised $7–8 million during its presale rounds, selling tens of millions of ETFS tokens between April 4 and May 7, 2024, at prices from $0.00854 up to $0.05769 in later bonus stages.

What Is ETFS Token Used For in the ETFSwap Ecosystem?

Within the ETFSwap ecosystem, the ETFS token serves several roles:

• Staking token: ETFS holders can stake their tokens to earn a share of up to 20% of ETFSwap’s daily platform earnings.

• Reward distribution: Staking rewards are split 60% in ETFS and 40% through buy-and-burn mechanisms that permanently remove tokens from circulation.

• Revenue-based buybacks: A portion of daily platform revenue is used to repurchase ETFS on the open market, with 25% of the bought tokens burned and 75% redistributed to stakers.

• Liquidity provider utility: Holders can supply liquidity, e.g., ETFS/ETH pairs, and earn interest paid in assets like ETH.

• Airdrops and releases: Ongoing

airdrops and scheduled monthly token releases add additional earning opportunities for active participants.

• Deflationary design: Combined mechanisms, such as burns, revenue sharing, and staking, aim to reduce circulating supply and enhance long-term token utility within the ETFSwap ecosystem.

Outside ETFSwap, ETFS currently trades on a small number of decentralized and centralized venues, with modest daily volumes and no major exchange listings as of November 2025.

What Is ETFSwap Tokenomics: Supply, Allocation, and Taxes?

ETFS token distribution | Source: ETFSwap docs

ETFS is an ERC-20 token with a maximum supply of 1,000,000,000 tokens. Public tokenomics from the presale phase outlines the following allocation:

• Presale: 400,000,000

• Ecosystem Development: 240,000,000

• Liquidity and Listings Reserves: 120,000,000

• Team Allocation: 60,000,000 (locked for five years)

• Marketing, MM and KOL Incentives: 60,000,000

• Cashback Reserve: 50,000,000

• Partners and Advisors: 30,000,000

• Community Rewards: 40,000,000

• Vesting Model: 30% released at launch, followed by 14% monthly for five months

ETFS Buy/Sell Tax and Deflation

ETFS uses a two-part tax model:

• 1% Buy Tax → Burn: Every buy transaction sends 1% of ETFS to a burn wallet, gradually reducing total supply over time.

• 5% Sell Tax → Rewards Pool: Every sell transaction charges 5%; these tokens go to a pool used for staking rewards, liquidity incentives, and cashback programs.

This design aims to reward long-term holders and offset selling pressure, but it also means every trade is taxed, which can be expensive for active traders.

Is ETFSwap Legit or a Scam Project?

This is one of the most common questions around ETFSwap, and the answer is mixed.

Pros of ETFSwap

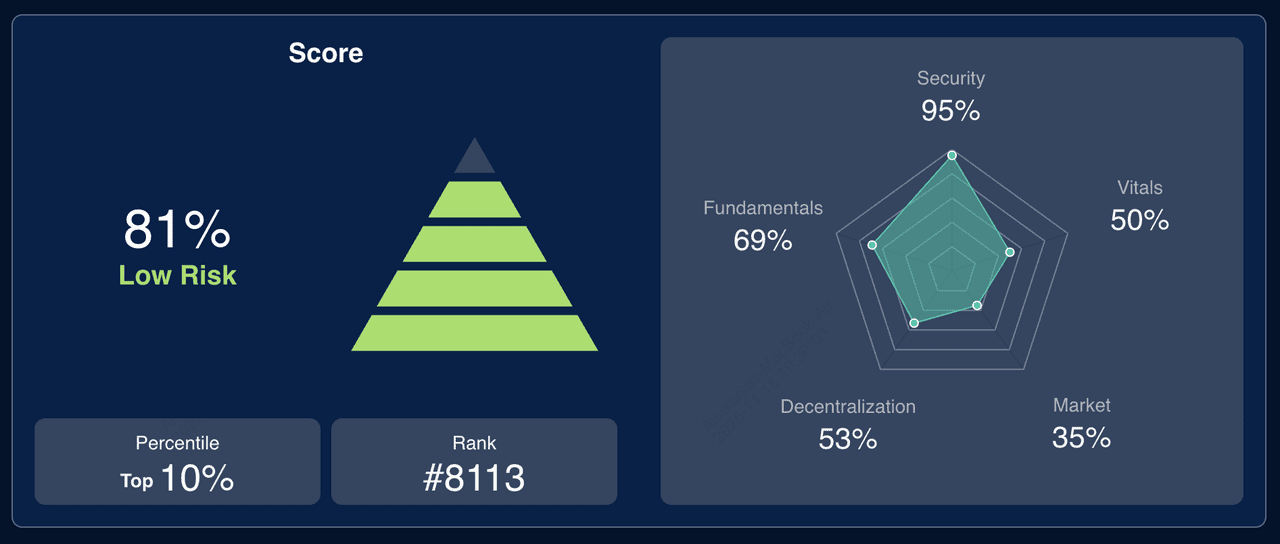

Cyberscope's security score for ETFSwap | Source: Cyberscope

• Security audits: Cyberscope gives ETFSwap a 95% security score with no critical or medium smart-contract issues reported across several audit iterations.

• Team KYC: Third-party write-ups note that the team completed KYC verification via SolidProof, which is better than fully anonymous teams.

• Clear tokenomics: Token allocation, taxes, and presale phases are documented across multiple independent sources.

Potential Cons and Red Flags of the ETFSwap Project

ETFS price declined steeply after launch | Source: GeckoTerminal

• Low trust scores on scam-review platforms:

- Scam Detector gives etfswap.com a 37.6/100 trust score, labeling it as questionable and controversial.

- Scamadviser is more neutral with 61/100, but still classifies the site as medium-to-low risk.

• Community reports: Some users on forums like Reddit explicitly describe ETFSwap as a scam or complain about loss of funds, while others are more neutral or positive.

• Steep price decline: ETFS traded as high as around $0.05–$0.47 shortly after launch, but now trades near $0.00031, well below every presale round – a classic pattern for heavily marketed tokens that fail to sustain demand.

• Concentrated holdings: Some analyses note that a small number of wallets control a large portion of supply, amplifying the risk of sudden dumps.

Because of these conflicting signals, you should treat ETFSwap as a very high-risk, speculative DeFi project, not as a “safe” ETF gateway.

Key Risks to Consider Before Using ETFSwap

If you are researching ETFSwap, keep these risks in mind:

1. Speculative Token and Extreme Volatility: ETFS is a small-cap token with limited liquidity and a history of sharp price swings. Marketing promises of multi-thousand-percent returns are speculative and have not materialized so far.

2. Regulatory Uncertainty Around Tokenized ETFs: ETFSwap deals with tokenized ETF exposures, an area that regulators are still figuring out. Depending on your jurisdiction, these products could be treated as securities or face compliance challenges, especially if the platform offers products tied to regulated ETFs without clear licensing.

3. Smart-Contract and Platform Risk: Even with audits, smart contracts can still contain bugs or suffer from integration issues. Any exploit in liquidity pools, staking contracts, or oracles could lead to permanent loss of funds.

4. Taxed Trading and Low Liquidity: The 1% buy and 5% sell tax make ETFS costly for active traders and can discourage market-making. Combined with relatively low daily volume, this can lead to wide slippage and difficulty exiting large positions.

5. Centralization and Governance Risk: Concentrated token holdings and a relatively small community mean on-chain governance can be dominated by a few large wallets, affecting decisions around fees, emissions, or even future token contracts.

6. Reputational and Scam Risk: The combination of aggressive marketing, extremely bullish predictions, low trust scores, and negative user reports means you should approach ETFSwap with extra caution, especially if you see unauthorized “guaranteed return” pitches or unsolicited messages.

Final Thoughts

ETFSwap (ETFS) aims to bring ETF-style investing into DeFi through tokenized ETFs, AI tools, and yield opportunities on Ethereum. Its design aligns with broader trends in asset tokenization and crypto-based ETF infrastructure, offering 24/7 access and on-chain transparency for ETF-like exposures.

At the same time, ETFSwap remains a high-risk, speculative project. The ETFS token trades well below presale levels, trust scores and community reviews are mixed, holdings appear concentrated, and regulation around tokenized ETFs is still evolving. If you choose to get involved, treat ETFSwap as experimental DeFi exposure, size positions carefully, and only commit capital you can afford to lose.

Related Reading

FAQs on ETFSwap (ETFS)

1. Where can I buy ETFSwap (ETFS)?

You can buy ETFS tokens on decentralized exchanges like

Uniswap by connecting a Web3 wallet and swapping ETH or stablecoins for ETFS.

2. When did ETFSwap launch?

ETFSwap conducted its token presale from April 4 to May 7, 2024, raising over $7-8 million, and the ETFS token went live shortly after with its first public listing on Uniswap in H2 2024.

3. Is ETFSwap a good investment?

ETFSwap is highly speculative. While it offers innovative ETF tokenization features, its token price, trust ratings, and market traction remain uncertain, so caution is essential.

4. How do I buy ETFSwap (ETFS)?

To buy ETFS, connect your MetaMask or another Web3 wallet to Uniswap, select the ETFS token contract, and swap ETH or a supported stablecoin for ETFS.

5. Is ETFSwap safe to use?

While ETFSwap has undergone smart-contract audits, no DeFi platform is risk-free; users should conduct their own research, verify contract addresses, and use small test transactions.

6. What happened to the ETFSwap price after launch?

ETFS fell sharply after launch, dropping from presale prices of $0.00854–$0.05769 to trading near $0.0003–$0.0005, reflecting a decline of over 90–99%. This drawdown was driven by low liquidity, concentrated token holdings, and sustained sell pressure from early presale buyers exiting their positions.