Chainlink (LINK) is back in focus as U.S. spot LINK ETF access to the asset continues to expand. On January 6, 2026,

Bitwise Asset Management received approval to list its spot Chainlink ETF under the ticker CLNK on NYSE Arca, with trading expected to begin this week. The approval places LINK among a small group of crypto assets beyond

Bitcoin and

Ethereum with multiple spot ETF products available to U.S. investors.

This development follows the launch of the Grayscale Chainlink ETF (GLNK) on December 2, 2025, also listed on NYSE Arca. According to SoSoValue, GLNK recorded $37 million in first-day inflows, reflecting early institutional demand for regulated LINK exposure and reinforcing Chainlink’s positioning as a core piece of blockchain infrastructure rather than a purely speculative asset.

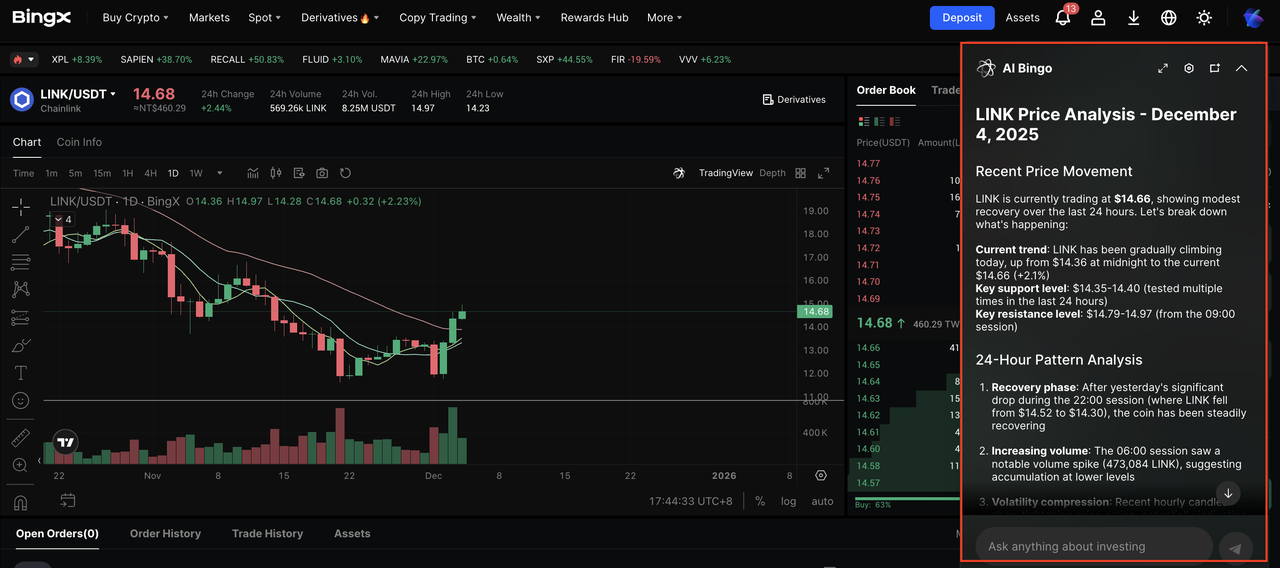

LINK price surged over 11% over the past week | Source: BingX

LINK Price

LINK has gained more than 11% over the past week, trading around $13.8 to $14.0, alongside rising spot volume and derivatives activity. As institutional products extend beyond

Bitcoin and

Ethereum, LINK is increasingly viewed as exposure to oracle networks, data verification, and on-chain finance infrastructure. This article explains what Chainlink is, how spot LINK ETFs such as GLNK and CLNK work, and the alternative option of buying and holding LINK directly on BingX to maintain full flexibility and on-chain utility.

What Is Chainlink and How Does It Work?

Chainlink is a decentralized oracle network that serves as a crucial bridge between blockchains and external data sources. While blockchains excel at secure transaction execution, they cannot natively access off-chain information such as market prices, compliance data, or institutional payment systems. This limitation restricts the functionality of smart contracts. Chainlink solves this by using a decentralized network of independent node operators to deliver secure, verified, and tamper-resistant data on-chain.

Originally launched as a price oracle for

DeFi, Chainlink has expanded into a comprehensive infrastructure platform powering banking, capital markets, asset management, payments,

stablecoins, and

real-world asset tokenization. Its open standards and composable services now form a foundational layer for advanced blockchain applications.

Key Chainlink Services Explained

• Oracle Services: Chainlink’s oracle network retrieves and verifies real-world data for blockchains, solving the “oracle problem” and enabling smart contracts to use accurate external information. It delivers high-throughput price feeds, on-chain Proof of Reserve for collateral verification, and verifiable randomness and automation for DeFi,

gaming, and enterprise applications.

• Cross-Chain Interoperability Protocol (CCIP): CCIP provides secure cross-chain messaging and token transfers, reducing fragmentation and enabling applications to operate across multiple networks. It supports standardized token movement, rapid integrations with new chains, and enterprise use cases demonstrated through pilots with traditional financial systems including Swift.

• Real-World Asset (RWA) Infrastructure: Chainlink supplies the data and interoperability layer for tokenized real-world assets, linking off-chain valuations and audit information directly to on-chain representations. CCIP enables cross-chain asset movement, while continuous updates maintain consistent and auditable records. Leading institutions such as Euroclear, Clearstream, BNY Mellon, Citi, ANZ, and JPMorgan have tested or adopted these tools.

What Is the Spot LINK ETF and How Does It Work?

A LINK ETF is a regulated investment product that provides price exposure to Chainlink (LINK) through a traditional stock exchange. Instead of buying and custodying LINK directly on a crypto platform, investors purchase ETF shares that track LINK’s spot price, allowing them to gain exposure through standard brokerage accounts and regulated market infrastructure.

In the U.S. market, two spot LINK ETFs now define this category:

2. Bitwise Chainlink ETF (CLNK): Approved on January 6, 2026, CLNK is issued by Bitwise Asset Management and is set to trade on NYSE Arca. The approval expands regulated access to LINK and introduces a second spot ETF issuer offering direct price exposure to Chainlink.

Structurally, spot LINK ETFs custody LINK and issue shares that mirror its price movements. This format removes the need to manage wallets, private keys, or on-chain transactions, making LINK exposure easier to integrate into traditional portfolios while remaining closely tied to the asset’s spot market performance.

Grayscale Launches the First Spot Chainlink ETF (GLNK) on NYSE Arca on Dec. 2, 2025

Grayscale Investments launched the first United States spot Chainlink ETF, GLNK, on NYSE Arca on December 2, 2025, converting its long-running Chainlink Trust into an exchange-traded product. The conversion followed an amended S-1 filing submitted on November 12, 2025, confirming that GLNK is registered under the Securities Act of 1933.

As with other single-asset spot crypto ETFs, including Bitcoin, Ethereum, and

Solana, GLNK operates under the 1933 Act framework, which governs products backed directly by an underlying asset. This contrasts with the 1940 Act structure used by certain newer crypto ETFs, such as the REX-Osprey Dogecoin ETF and select 21Shares index products. According to SoSoValue, GLNK recorded $37 million in first-day inflows, ranking among the strongest debuts for spot altcoin ETFs and introducing Chainlink to a broader institutional and retail investor base through a regulated, exchange-listed format.

Below is an overview of Grayscale’s current ETF lineup, products in the filing stage, and trusts that have not yet entered the ETF pipeline:

• Live Grayscale Crypto ETFs: Bitcoin ETF (GBTC, Jan. 2024),

Ethereum ETF (ETHE, Jul. 2024),

Solana ETF (GSOL, Oct. 2025),

XRP ETF (GXRP, Nov. 2025), Dogecoin ETF (GDOGE, Oct. 2025), Chainlink ETF (GLNK, Dec. 2, 2025), Crypto Sectors Index ETF (GCSX, 2025)

• Filed but Not Yet Launched: Polygon Trust ETF (

POL),

Aave Trust ETF (AAVE), Chainlink Covered Call ETF, Web3 Infrastructure Index ETF, Smart Contract Platforms ETF, and proposed Litecoin, Bitcoin Cash, and Ethereum Classic ETFs

Bitwise Gains Approval to List a Spot Chainlink ETF (CLNK) on NYSE Arca on Jan. 6, 2026

Bitwise Asset Management received approval on January 6, 2026 to list its spot Chainlink ETF under the ticker CLNK on NYSE Arca, according to filings with the U.S. Securities and Exchange Commission. The ETF is expected to launch later this week.

Bitwise disclosed that its investment manager will seed the product with $2.5 million, equivalent to 100,000 shares at $25. The ETF carries a 0.34% management fee, with a full fee waiver extended for the first three months on up to $500 million in assets under management. Coinbase Custody will serve as the custodian for LINK holdings, while BNY Mellon will act as cash custodian.

The Bitwise filing also notes LINK staking as a secondary investment objective, though no implementation details have been announced. If staking is enabled in the future, Attestant Ltd is listed as the preferred staking agent. The approval positions CLNK as the second U.S.-listed spot Chainlink ETF, expanding regulated access to LINK beyond a single issuer.

Grayscale Chainlink Trust ETF (GLNK) vs. Bitwise Chainlink ETF (CLNK): What’s the Difference?

The approval of a second U.S. spot Chainlink ETF gives investors two regulated vehicles for LINK exposure on traditional exchanges. While GLNK and CLNK both track Chainlink’s spot price and trade on NYSE Arca, they differ in origin, fee structure, and launch design. Grayscale’s product represents the conversion of an existing trust into an ETF, while Bitwise’s offering is a newly structured spot ETF built specifically for exchange trading.

| Feature |

Grayscale Chainlink Trust ETF (GLNK) |

Bitwise Chainlink ETF (CLNK) |

| Issuer |

Grayscale Investments |

Bitwise Asset Management |

| Exchange |

NYSE Arca |

NYSE Arca |

| Status & Timing |

Live since Dec. 2, 2025 |

Approved Jan. 6, 2026, launch pending |

| Product Origin |

Converted from Grayscale Chainlink Trust |

Newly launched spot ETF |

| Regulatory Framework |

Securities Act of 1933 |

Securities Act of 1933 |

| Fees & Waivers |

0.35% fee, waived for first 3 months |

0.34% fee, waived for first 3 months up to $500M AUM |

| Custody Setup |

Coinbase Custody |

Coinbase Custody (cash custodian: BNY Mellon) |

| Initial Capital |

Not disclosed |

$2.5M seed (100,000 shares at $25) |

| Early Market Response |

$37M first-day inflows |

Not yet trading |

How to Invest in the Spot Chainlink (LINK) ETF: A Step-by-Step Guide

U.S. investors can access spot Chainlink ETFs in the same way they buy stocks or traditional ETFs. Both GLNK (live) and CLNK (approved, launching shortly) are listed on NYSE Arca, making them available through most major U.S. brokerage platforms.

Step 1: Choose a U.S. brokerage that supports NYSE Arca Brokerages such as Fidelity Investments, Charles Schwab, TD Ameritrade, Robinhood, and eToro (U.S.) provide access to NYSE Arca–listed ETFs.

Step 2: Search for the Spot LINK ETF ticker Enter GLNK to access the Grayscale Chainlink Trust ETF. Once trading begins, CLNK can also be searched to access the Bitwise Chainlink ETF. Always confirm the exchange listing and product name before placing a trade.

Step 3: Decide your position size Review the current ETF price, check your broker’s trading fees if applicable, and determine how much LINK exposure fits your overall portfolio allocation.

Step 4: Place your order Investors can place a market order for immediate execution or a limit order to buy at a specific price, just as with other ETFs.

Step 5: Monitor holdings and tax treatment After execution, the ETF appears in your brokerage portfolio. In the U.S., gains from selling LINK ETFs are generally subject to capital gains tax, while any distributions follow standard ETF tax rules. Investors holding ETFs in IRAs or other tax-advantaged accounts may benefit from deferred or reduced taxation, depending on account structure.

Alternative: How to Buy and Trade Chainlink (LINK) on BingX

Buying LINK directly is the better choice for investors who want full access to Chainlink’s on-chain ecosystem. Unlike the ETF, holding the token allows users to participate in staking, future protocol upgrades, and 24/7 market activity. On BingX, LINK can be purchased through spot trading pairs with a simple, secure interface, giving users the flexibility to hold assets on the exchange or withdraw them to a personal wallet for on-chain use.

Direct ownership also avoids ETF management fees and tracks real-time market prices without NAV deviations, though it requires users to manage their own wallet security and withdrawals if they choose self-custody.

Step 2: Activate BingX AI Click the AI icon on the chart to access

BingX AI for real-time insights, including key price levels, trend signals, and market structure analysis.

Step 3: Choose Spot or Futures Use Spot if you want to accumulate LINK as a long-term holding. Use Futures if you want to trade short- or long-term price swings with the ability to go long or short.

Step 4: Place Your Order Select a market order for instant execution or a

limit order to set your preferred entry price. If trading Futures, configure leverage,

stop-loss, and take-profit levels before confirming the trade.

Step 5: Manage Your Position Spot purchases appear directly in your BingX wallet. Futures positions can be monitored and adjusted within the trading interface as the market evolves.

Spot LINK ETF vs. Holding LINK Directly: Which Is Better for Chainlink Investors?

Spot LINK ETFs such as GLNK and CLNK offer a familiar way for U.S. investors to gain LINK price exposure through traditional brokerage accounts, without dealing with wallets or on-chain mechanics. This approach fits well within existing portfolio structures, retirement accounts, and standard compliance frameworks.

Holding LINK directly, however, remains the preferred option for investors who want full participation in the crypto ecosystem. Direct ownership allows access to staking, governance, and DeFi applications, along with continuous 24/7 trading that ETFs cannot provide. On BingX, users can buy LINK via spot markets, hold it on the platform, or withdraw it to a personal wallet for full on-chain control.

Both approaches serve different needs. ETFs emphasize simplicity and regulatory familiarity, while direct ownership prioritizes flexibility, utility, and real-time market access.

| Category |

Spot LINK ETF (GLNK / CLNK) |

Holding LINK Directly |

| Investor Profile |

U.S. investors using traditional brokerages |

Global crypto users seeking full on-chain access |

| Access Method |

Buy through NYSE Arca via stock brokers |

Buy on crypto exchanges such as BingX |

| Utility |

Price exposure only |

Full access to staking, governance, and DeFi |

| Trading Hours |

U.S. stock market hours only |

24/7 global crypto markets |

| Fees |

Ongoing management fees apply |

No management fee, only trading and network fees |

| Custody |

Brokerage custody, no private keys |

User-controlled custody if self-stored |

| Tax Treatment |

Eligible for IRAs and U.S. tax-advantaged accounts |

Treated as crypto property, no IRA access via exchanges |

| Price Tracking |

May show minor deviations from spot LINK |

Tracks real-time spot LINK price |

| Complexity |

Very simple, familiar structure |

Requires comfort with wallets and on-chain tools |

Risks and Considerations Before Investing in the Spot LINK ETF

Before investing in a spot LINK ETF such as GLNK or CLNK, it is important to recognize that these products inherit many of the same risks as the underlying Chainlink (LINK) itself. While ETFs provide regulated, brokerage-friendly access, they do not remove price volatility, market risk, or broader regulatory uncertainty. Investors should consider the following factors carefully.

1. Market Volatility: LINK remains a volatile crypto asset. Spot LINK ETFs directly reflect LINK’s price movements and can experience sharp swings during both bullish and bearish market conditions.

2. Price Tracking and Liquidity Dynamics: Although spot ETFs are designed to track LINK closely, ETF shares may trade at small premiums or discounts to spot prices due to bid-ask spreads, market liquidity, or trading session constraints.

3. No On-Chain Functionality: Spot LINK ETFs provide financial exposure only. Investors cannot stake LINK, participate in governance, or use the token within the Chainlink ecosystem through an ETF structure.

4. Fees and Trading Hours: Both GLNK and CLNK charge management fees and trade only during U.S. stock market hours. By contrast, LINK traded directly on crypto markets is available 24/7 without ongoing management fees.

5. Regulatory and Tax Considerations: Crypto ETFs operate within evolving U.S. regulatory frameworks, and future policy changes may affect trading, disclosures, or tax treatment. Capital gains taxes generally apply when ETF shares are sold, and investors should consider how ETFs fit within their broader tax strategy.

Overall, spot LINK ETFs are designed for investors seeking regulated, simplified exposure through traditional markets, while accepting the structural trade-offs that come with an ETF wrapper.

Final Thoughts

The launch of GLNK marked Chainlink’s entry into the U.S. spot ETF market, providing a regulated, exchange-listed vehicle for investors who prefer traditional brokerage access and familiar ETF structures. The subsequent approval of CLNK further reinforces institutional interest in LINK and positions Chainlink among a small group of crypto assets beyond Bitcoin and Ethereum to support multiple U.S.-listed spot ETFs.

Spot LINK ETFs offer a streamlined way to gain price exposure within regulated markets, making them well suited for investors prioritizing simplicity, portfolio integration, and brokerage custody. At the same time, holding LINK directly remains central for participants who value on-chain utility, staking participation, and continuous access to global crypto markets. Platforms such as BingX continue to serve this segment by enabling spot trading and optional self-custody.

As Chainlink’s role in oracle networks, data verification, and cross-chain infrastructure continues to expand, both ETF-based exposure and direct ownership represent established and complementary ways for investors to engage with LINK’s long-term development.

Related Reading

Frequently Asked Questions (FAQ) on Spot LINK ETFs

1. What spot LINK ETFs are available at the moment?

As of January 2026, there are two U.S. spot Chainlink ETFs:

• GLNK by Grayscale Investments, which is live and trading

• CLNK by Bitwise Asset Management, which has received approval and is expected to begin trading shortly

2. When is the first spot Chainlink ETF launch date?

The first U.S. spot Chainlink ETF, GLNK, launched on December 2, 2025, marking Chainlink’s entry into regulated, exchange-listed ETF products.

3. Where do spot LINK ETFs trade?

Both GLNK and CLNK are listed on NYSE Arca, a primary venue for crypto-related ETFs in the United States.

4. Where can I buy the spot LINK ETF?

Spot LINK ETFs can be purchased through U.S. brokerages that support NYSE Arca, including Fidelity, Charles Schwab, TD Ameritrade, Robinhood, and eToro US.

For investors who prefer direct token ownership instead of an ETF, LINK can be bought via spot trading on BingX, with the option to hold on the platform or transfer to a personal wallet.

5. What is a Spot Chainlink ETF or Spot LINK ETF?

A LINK ETF is a regulated investment fund that holds Chainlink (LINK) and tracks its spot market price. It allows investors to gain LINK exposure through traditional brokerage accounts without using crypto exchanges or managing private wallets.

6. Will LINK’s price surge because of the ETF launches?

Spot LINK ETFs may attract new capital by lowering access barriers for traditional investors, and recent ETF-related flows suggest growing institutional interest in Chainlink’s role in data infrastructure and cross-chain systems. However, LINK’s price will still be influenced by broader crypto market conditions, liquidity cycles, and overall risk sentiment. ETF launches can support positive momentum, but sustained price appreciation is not guaranteed.