Gold enters 2026 after one of the strongest rallies in its modern history. In 2025, gold prices surged more than 60%, repeatedly setting all-time highs as central banks accumulated record amounts of bullion, real interest rates declined, and geopolitical risks intensified across major economies.

As a result, gold is increasingly viewed not as a short-term trade, but as a strategic hedge and portfolio stabilizer. For crypto-native investors, the challenge is no longer whether to hold gold, but how to gain exposure efficiently without physical storage, traditional brokers, or limited market hours. BingX solves this by offering crypto-native access to gold, making gold investing simpler and more accessible for beginners in 2026.

What Is Gold and Why Is It Considered an Attractive Safe-Haven Asset?

Gold (ticker: XAU) is a precious metal with a long-standing role as a non-sovereign store of value. Unlike fiat currencies, gold cannot be printed or diluted by monetary policy, and its global supply grows slowly, historically around 1–2% per year, driven mainly by mining output. This built-in scarcity underpins gold’s ability to preserve purchasing power over long periods.

Gold is one of the most attractive safe-haven assets for global investors because it has consistently acted as a hedge against inflation, currency depreciation, and systemic risk. Since the end of the Bretton Woods system in 1971, gold has delivered around 7–8% annualized returns over the long term, while maintaining low correlation with stocks and bonds, making it effective for diversification. In periods of falling real interest rates, elevated debt, or geopolitical stress, demand for gold typically rises, reinforcing its role as a portfolio stabilizer rather than a speculative asset.

Why Invest in Gold in 2026?

Gold remains a compelling investment in 2026 as global macro risks stay elevated despite slowing inflation in some regions. Public and private debt levels across major economies remain near record highs, while real interest rates are still volatile, conditions that historically support gold demand. In 2025, gold rose more than 60%, driven largely by record central bank buying, with official-sector purchases exceeding 1,000 tonnes for the third consecutive year, signaling strong institutional confidence in gold as a reserve asset.

Looking ahead,

gold’s appeal in 2026 lies less in short-term price surges and more in risk protection and portfolio resilience. Institutional forecasts by JP Morgan and Goldman Sachs broadly cluster in the $4,500–$5,000 per ounce range, reflecting expectations of continued diversification flows, geopolitical uncertainty, and potential monetary easing cycles. For investors, gold offers a way to reduce portfolio volatility, hedge against currency debasement, and maintain exposure to a scarce, globally liquid asset at a time when traditional assets remain sensitive to policy shifts and macro shocks.

How Can You Invest in Gold on BingX?

Gold price surged over 60% in 2025 | Source: GoldPrice

Investing in gold on BingX does not require buying or storing physical gold bars or coins. Instead, BingX lets you gain exposure to gold prices through digital, crypto-settled products that closely track the value of real, physical gold held in professional vaults or referenced by global gold benchmarks.

On BingX, beginners can invest in gold in two clear ways, depending on their risk tolerance and experience level.

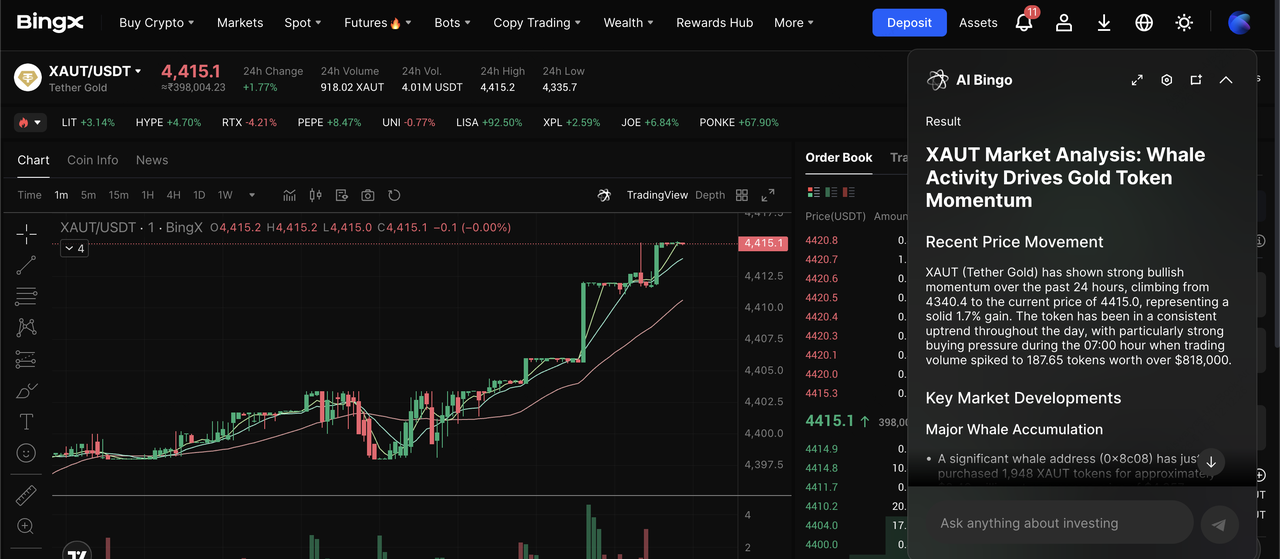

1. You can buy

tokenized gold on the spot market, where assets like

XAUT or PAXG represent gold-backed tokens and behave like

digital gold, unleveraged, easy to hold, and suitable for long-term diversification.

2. More advanced users can

trade gold-linked futures, which allow you to go long or short on gold prices using leverage, but come with higher risk and require active risk management.

Both approaches allow you to benefit from gold’s price movements without handling physical storage, insurance, or traditional commodity brokers, making gold investing more accessible for crypto-native users in 2026.

Why Invest in Gold on BingX vs. Traditional Brokers?

1. 24/7 trading, unlike stock-market ETFs

3. Crypto-native access using

USDT4.

BingX AI tools for trend analysis and risk signals

5. Ability to diversify beyond crypto without leaving the crypto ecosystem

Trade Tokenized Gold on the BingX Spot Market: Best for Beginners

For beginners, spot trading tokenized gold on BingX offers a straightforward way to invest in gold prices using USDT, without leverage, margin requirements, or the complexities of physical gold ownership.

What Is Tokenized Gold?

Tokenized gold represents ownership of physical gold stored in professional, audited vaults, issued as blockchain-based tokens. Each token is typically backed 1:1 by physical gold, meaning its price closely tracks global gold prices.

How to Buy, Sell, or Hold Tokenized Gold on BingX: Step-by-Step Guide

XAUT/USDT trading pair on the spot market powered by BingX AI's insights

1. Create and verify your BingX account

5. Choose an order type:

• Limit order to buy at a specific price

6. Confirm your order and hold tokenized gold in your BingX account

Why Spot Tokenized Gold Is Beginner-Friendly

Spot tokenized gold is beginner-friendly because it removes many of the risks and operational hurdles associated with traditional gold investing. Since spot purchases are unleveraged, there is no liquidation risk, and investors are not exposed to margin calls or forced exits.

Tokenized gold eliminates concerns around physical storage, insurance, and purity, while offering 24/7 trading access, unlike gold ETFs that are limited to stock-market hours. With the ability to invest in small fractional amounts, beginners can start with low capital and gradually build exposure, making spot tokenized gold well suited for first-time investors, long-term holders, and crypto users seeking portfolio diversification through gold.

Trade Gold Futures on BingX: For Active Traders

Trading gold futures on BingX allows experienced traders to take leveraged long or short positions on gold prices, but requires disciplined risk management due to higher volatility and liquidation risk.

What Are Gold Futures on BingX?

Gold futures on BingX are crypto-settled perpetual contracts that track gold prices. Instead of owning gold, you trade price movements, allowing you to go:

• Long (profit if gold rises)

• Short (profit if gold falls)

These contracts use USDT as collateral and do not require traditional commodity brokers.

How to Trade Gold Futures on BingX: Step-by-Step Guide

Gold perpetual futures contract on BingX futures market

1. Transfer USDT to your Futures Wallet

4. Choose position type:

• Long if bullish on gold

• Short if bearish or hedging

5. Set leverage carefully (beginners: 2x–5x max)

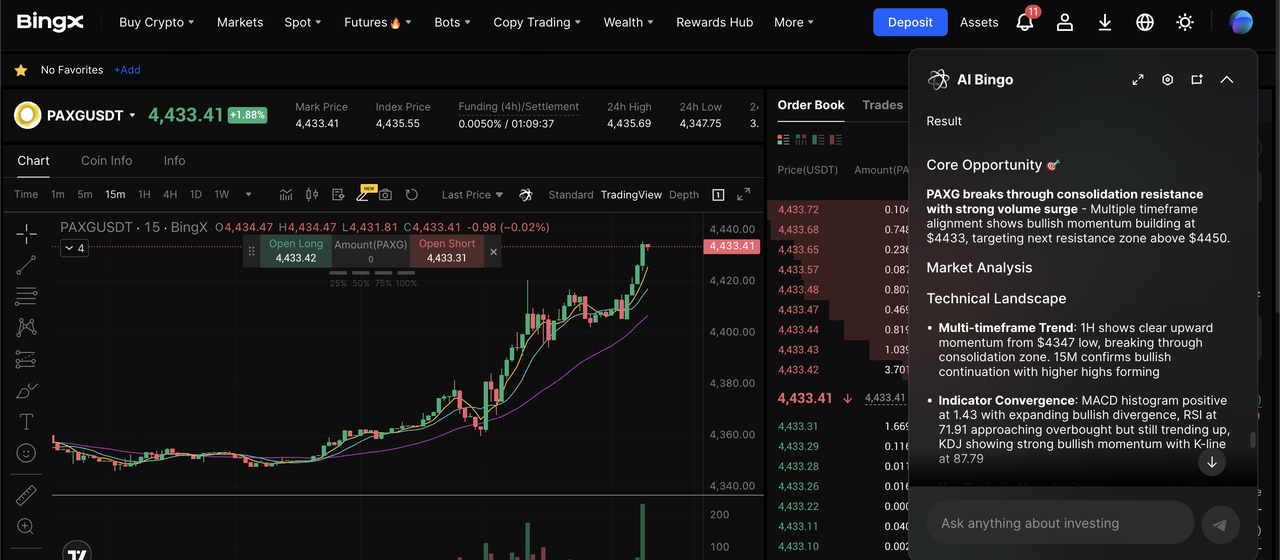

You can also trade tokenized gold perpetual contracts on the BingX futures market, such as

XAUT/USDT perpetual or

PAXG/USDT perpetual contract, which track gold prices in real time while settling in USDT. These contracts allow traders to go long or short with leverage, making them suitable for short-term trading or hedging gold exposure without holding the underlying tokens.

PAXG/USDT perpetual contract on the futures market powered by BingX AI

Why Trade Gold and Tokenized Gold Futures

Traders choose gold futures and tokenized gold futures for their flexibility and efficiency in responding to market conditions. These instruments allow you to go long or short on gold prices, making them useful not only for bullish bets but also for hedging during market downturns. With leverage, traders can control larger positions using less capital, while tokenized gold perpetuals on BingX add the benefit of crypto-settled, 24/7 access, making them especially attractive for experienced traders seeking to manage short-term volatility or hedge broader crypto and macro exposures.

Spot vs. Futures: Which Gold Investment Method Should You Choose?

| Feature |

Spot Tokenized Gold |

Gold Futures |

| Leverage |

No |

Yes |

| Risk Level |

Low |

High |

| Liquidation Risk |

None |

Yes |

| Complexity |

Low |

High |

| Trading Style |

Buy and hold |

Active trading |

| Best For |

Beginners |

Experienced traders |

Spot and futures offer very different ways to gain exposure to gold, and choosing between them depends on your risk tolerance, time horizon, and experience level. Spot investing in tokenized gold means you buy and hold gold-backed assets like XAUT or PAXG with no leverage, so your risk is limited to price movements only. There is no liquidation risk, no expiry, and you can hold the position indefinitely. This makes spot tokenized gold suitable for beginners, long-term investors, and anyone using gold as a portfolio hedge or store of value, similar to gold ETFs but with 24/7 crypto-market access.

Gold futures, including tokenized gold perpetuals on BingX, are designed for active trading and hedging, not passive holding. Futures use leverage, which allows traders to control large positions with relatively small capital but also increases downside risk; small price moves can lead to rapid losses or liquidation if margin is insufficient. Futures are best suited for experienced traders who actively monitor positions, use stop-loss orders, and trade gold to capture short-term volatility, hedge macro risk, or balance exposure during periods of market stress.

How Much Gold Should Beginners Allocate?

For most beginners, gold works best as a risk-reducing allocation, not a speculative bet. Many portfolio studies suggest allocating 5–15% of a diversified portfolio to gold, depending on risk tolerance and market conditions.

On BingX, beginners can start small by:

• Use gold as a stabilizer, not a speculative trade: Gold is most effective when used to reduce portfolio volatility rather than chase short-term price gains.

• Target a 5–10% allocation for most beginners: Portfolio studies suggest this range offers meaningful diversification benefits; more conservative investors may extend up to 15% during periods of high macro uncertainty.

• Avoid over-concentration: Allocations beyond this range can increase risk without significantly improving diversification.

• Start small with fractional exposure: On BingX, beginners can buy fractional tokenized gold on the spot market, lowering entry risk.

• Avoid leverage at the start: Unleveraged spot positions help protect capital while you learn how gold behaves in different market conditions.

• Build exposure gradually: Adding gold over time instead of all at once can reduce timing risk and smooth average entry prices.

Common Beginner Mistakes to Avoid When Investing in Gold

New investors often make avoidable mistakes when gaining gold exposure, especially when transitioning from crypto markets to gold-based instruments, where price behavior, volatility, and risk dynamics differ.

1. Using excessive leverage on gold futures: Gold typically moves in smaller percentage ranges than crypto assets, so high leverage can trigger liquidations quickly even on modest price fluctuations.

2. Treating gold as a short-term hype trade: Gold performs best as a long-term hedge and portfolio stabilizer, not as a high-volatility momentum asset.

3. Ignoring stop-losses and risk management: Macro-driven gold moves can be sudden and sharp, and failing to set stop-loss orders can result in outsized losses.

4. Over-allocating to gold at record price levels: Gold works best as a balanced allocation; concentrating too much capital at all-time highs increases drawdown risk if prices consolidate or retrace.

Conclusion: Is BingX a Good Place to Invest in Gold in 2026?

Gold in 2026 remains a strategic asset rather than a momentum trade, especially amid global debt, geopolitical uncertainty, and shifting monetary policy. BingX makes gold investing accessible by offering tokenized spot gold for beginners and gold-linked futures for advanced traders, all without physical custody or traditional brokers.

If you’re new to gold, start with spot tokenized gold on BingX, focus on risk management, and treat gold as a long-term hedge, not a leveraged gamble. As always, assess your financial situation and risk tolerance before investing or trading.

Gold prices can be volatile. Futures trading involves significant risk and may result in losses exceeding your initial investment. This article is for educational purposes only and does not constitute financial advice.

Related Reading