Gold enters 2026 after one of the strongest rallies in its modern history. In 2025 alone, gold prices surged by more than 60%, repeatedly setting all-time highs as central banks accumulated hundreds of tonnes of bullion, real interest rates fell, and geopolitical risks intensified across major economies .

But the key question for investors today is no longer why gold went up, but how to invest in gold at elevated prices without taking unnecessary risk. With forecasts clustering between $4,500 and $5,000 per ounce for 2026, gold is increasingly viewed as a strategic hedge and portfolio stabilizer, not a short-term momentum trade. Understanding the different ways to invest in gold, and their trade-offs, is now more important than ever.

This article explores the most effective ways to

invest in gold in 2026, comparing physical gold, ETFs, futures, and

tokenized gold, so you can understand how each option works, what risks it carries, and which approach best fits your investment goals and experience level.

What to Expect in 2026 After Gold's 60%+ Gains in 2025

Gold had an exceptional performance in 2025, surging more than 60% year-over-year and repeatedly testing new all-time highs above $4,400–$4,500 per ounce, driven by strong central bank buying, inflation concerns, and geopolitical risks that pushed investors toward safe havens. This made gold one of the top-performing assets globally, significantly outpacing traditional benchmarks like global equities and bonds.

Looking ahead to 2026, analysts and major financial institutions remain cautiously bullish on gold, though with expectations of moderated gains rather than another blow-off rally. For example, Goldman Sachs forecasts gold could rise toward $4,900 per ounce by December 2026 under its base case scenario, reflecting continued demand for diversification and monetary easing tailwinds.

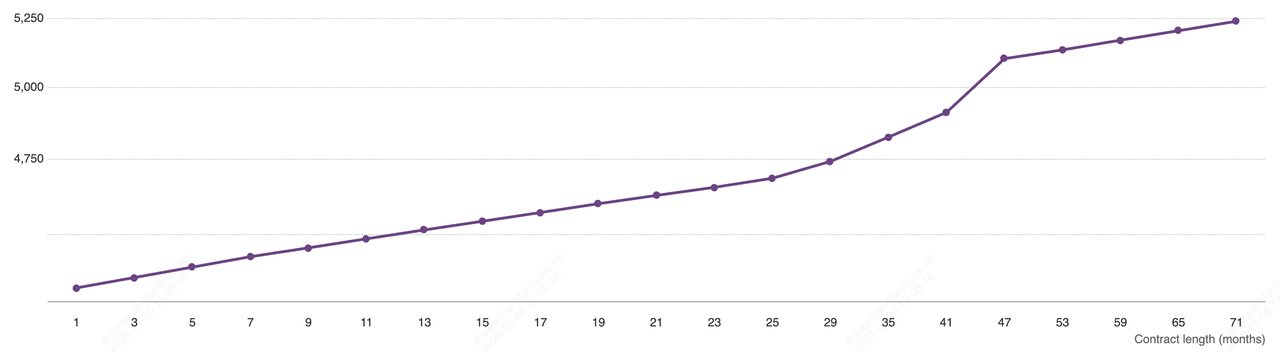

Gold price forecasts by JP Morgan | Source: JP Morgan

J.P. Morgan also suggests that gold could trend above $5,000 per ounce by late 2026 as structural drivers like a weaker U.S. dollar and persistent central bank accumulation stay intact. However, markets could see sideways moves or consolidation at key support levels depending on macroeconomic developments, real interest rate dynamics, and U.S. monetary policy decisions.

What Is Gold (XAU) and Why Is It Considered a Safe-Haven Asset?

Gold is a physical precious metal that occupies a distinct position in the global financial system as a non-sovereign store of value. Unlike fiat currencies, gold cannot be issued by central banks, expanded through monetary policy, or defaulted on by an issuer. Global gold supply grows slowly, historically at around 1–2% per year, driven primarily by mining output, which reinforces gold’s long-term scarcity.

Gold is considered a safe-haven asset because it has historically performed well when:

• Inflation rises and purchasing power erodes

• Real interest rates fall, reducing the appeal of yield-bearing assets

• Currencies weaken due to fiscal or monetary stress

• Geopolitical conflicts or financial crises increase market uncertainty

From a long-term perspective, gold has delivered annualized returns of approximately 7–8% since the end of the Bretton Woods system in 1971, according to historical price data. While this return profile is comparable to equities over multi-decade horizons, gold’s low correlation with stocks and bonds has made it particularly valuable as a diversification and risk-management tool. For this reason, gold is most often used not as a high-growth asset, but as a hedge against macroeconomic uncertainty and a stabilizer within diversified portfolios.

What Are the Best Ways to Invest in Gold in 2026?

In 2026, investors generally choose from four main ways to gain exposure to gold. Each method offers different levels of ownership, liquidity, complexity, and risk.

1. Physical Gold: Bars, Coins, and Jewelry

Physical gold in the form of bullion bars, investment coins, and jewellery is the most traditional way to own gold because you hold the metal outright, with no issuer, no platform risk. In a year like 2025, when gold rose over 60% and macro uncertainty stayed elevated, that “direct ownership” appeal tends to become more visible.

How Physical Gold Investing Works: Bars vs. Coins vs. Jewelry

1. Investment-grade bars typically align with global bullion standards. In the wholesale market, the LBMA “Good Delivery” standard sets a minimum fineness of 995.0 (99.5%) for gold bars.

2. Coins are widely recognized and easy to resell, but the trade-off is cost: retail buyers often pay around 6–10% premiums over spot for small quantities, and may face an additional 2–6% discount when selling back, depending on dealer conditions and coin type.

3. Jewelry is culturally important and highly liquid in many local markets, but it’s usually the least efficient “investment” form because resale value typically does not fully recover making charges/wastage paid upfront. In India, high prices have pushed buyers toward coins/bars specifically because jewellery carries extra making charges, one reason Reuters reported investment demand rising while jewellery demand fell in 2025.

Advantages: Where Physical Gold Shines

• True direct ownership, so no issuer default risk: You own the asset itself, not a claim on it.

• Universal recognizability: Standard bars/coins, especially those tied to LBMA-accredited supply chains, are easier to authenticate and resell in broader markets.

• Privacy and independence: You’re not dependent on an exchange, broker, or custodian to hold the asset.

Limitations of Physical Gold: The “Hidden” Costs That Hit Returns

• Premiums and spreads can be meaningful: Coins can cost 6–10% above spot and may be bought back at 2–6% below a dealer’s sell price, which can materially reduce short-term ROI unless you hold through a larger move.

• Storage and security are on you: Safe custody often means a home safe + insurance, or a vaulting solution; either way, it’s a real cost and operational burden.

• Liquidity varies by form: Coins are usually easier to liquidate quickly than jewellery, while large bars can require more formal verification and buyer networks.

Investing in physical gold is best suited for: long-term holders who value tangible ownership and are comfortable managing premiums, resale spreads, and secure storage, and who prefer gold in standardized forms like bars and coins when the priority is cost efficiency.

2. Gold ETFs and Gold Mutual Funds: Regulated Exposure Without Physical Ownership

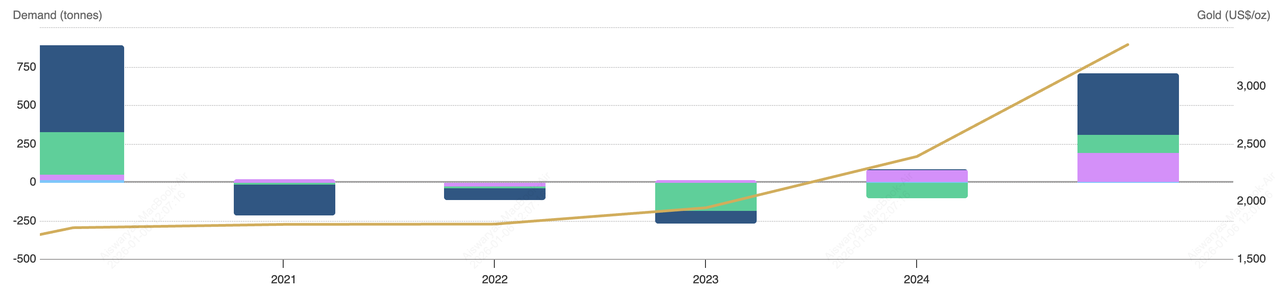

Gold ETF flows over the years | Source: World Gold Council

Gold ETFs and gold mutual funds provide paper-based exposure to gold prices, allowing investors to participate in gold’s performance without dealing with storage, purity verification, or physical custody. This structure has become increasingly popular as gold demand has shifted toward financial instruments rather than jewellery during periods of elevated prices.

From a market-structure perspective, ETFs have become a dominant driver of gold investment demand. According to the World Gold Council, global gold ETFs recorded approximately $77 billion in inflows in 2025, adding more than 700 tonnes of gold to holdings, one of the strongest ETF accumulation phases on record.

How Gold ETFs and Gold Mutual Funds Work

Gold ETFs are exchange-traded securities backed by physical gold held in vaults on behalf of the fund. Each unit typically represents 1 gram or 1/10th of an ounce of gold, and prices closely track the LBMA Gold Price. ETFs trade intraday on stock exchanges, just like equities, and require a brokerage account.

Gold mutual funds usually invest in one or more gold ETFs rather than holding gold directly. They can be accessed through lump-sum investments or

dollar-cost averaging (DCA) plans, making them more familiar to long-term retail investors who already use mutual funds.

• No storage or purity risk: Custody and verification are handled at the fund level, typically using LBMA-accredited vaulting standards.

• High liquidity: Gold ETFs can be bought or sold instantly during market hours, often with tight bid-ask spreads compared to physical bullion dealers.

• Low entry barrier: Investors can gain exposure with small ticket sizes, without paying large premiums above spot prices as seen with coins or bars.

• Regulated access: ETFs fit neatly into traditional portfolios and are eligible for use in brokerage accounts, retirement plans, and institutional mandates.

Limitations of Gold ETFs Most Investors Overlook

• Ongoing costs: Most gold ETFs charge annual expense ratios ranging from around 0.25% to 0.40%, which gradually reduce returns over long holding periods.

• Tracking error: While usually small, ETF prices can deviate slightly from spot gold due to fees, operational costs, and market frictions.

• Market-hours constraint: Unlike physical gold or tokenized gold markets, ETFs can only be traded when stock exchanges are open, a limitation during geopolitical shocks or off-hours volatility.

• Indirect ownership: Investors own shares of a fund, not specific gold bars, which introduces custodial and structural reliance on the financial system.

Gold ETFs and mutual funds are best suited for: investors who want regulated, liquid, low-maintenance exposure to gold within a traditional brokerage or mutual-fund framework, and who are comfortable trading gold as a financial asset rather than holding it as a physical store of value.

3. Gold Futures and Options: Derivatives for Traders and Hedgers

Gold futures chart | Source: World Gold Council

Gold futures and options are derivative contracts that let market participants speculate on or hedge against future moves in gold prices, without owning the metal itself.

How Gold Futures work

A gold futures contract is a standardized agreement to buy or sell a specific quantity of gold at a predetermined price on a future date. The COMEX gold futures (ticker: GC), traded on the CME Group, serve as the global benchmark for gold derivatives and are among the most liquid commodity futures worldwide.

Traders post a margin or collateral rather than the full notional value. For example, a single 1-ounce micro futures position might require roughly $150 of margin to control an exposure worth several thousand dollars, illustrating high capital efficiency.

• Contract specifics: The standard GC contract represents 100 troy ounces of gold; smaller versions like E-mini (50 oz) and Micro (10 oz) futures allow position sizes that better match an individual’s risk tolerance.

• Deep liquidity: Combined average daily volume for

gold futures and options regularly exceeds 300,000 contracts, providing tight pricing and deep order books that support efficient entry and exit.

• Market hours: While spot gold trades OTC, gold futures trade nearly 24 hours a day across Asia, Europe, and U.S. sessions, enabling around-the-clock price discovery.

In addition to traditional commodity exchanges, platforms like BingX offer

crypto-settled gold futures, enabling traders to gain gold price exposure using

USDT or other crypto collateral rather than fiat. These contracts mirror global gold price movements while allowing traders to go long or short, manage macro risk, and hedge crypto portfolios, all without needing access to traditional commodity brokers or physical settlement.

How Gold Options Work

Gold options are contracts that give buyers the right, but not the obligation, to buy (calls) or sell (puts) gold futures at a specified strike price before expiration. They are also primarily traded on COMEX, with numerous expiries and strike levels available.

• Options vs. futures: Unlike futures, where both sides must settle at expiry, options let holders choose whether to exercise. This makes options useful for hedging or positioning with defined risk.

• Volatility pricing: Options markets also reflect expected price volatility; tools like the CME Gold Volatility Index (CVOL) help traders gauge market risk expectations.

Advantages of Gold Futures and Options

• Profit in rising or falling markets: Futures allow both long and short positions, enabling traders to benefit whether gold prices rise or fall.

• High capital efficiency: Because only margin is required, traders can control larger exposures with smaller capital outlays.

• Tight liquidity and pricing transparency: COMEX gold futures are frequently among the most liquid commodity contracts globally, aiding efficient execution even during macroeconomic events.

• Hedging and risk management: Producers, funds, and institutions use these contracts to lock in prices or hedge inventory and portfolio exposures.

Risks of Trading Gold Futures and Options

• Leverage amplifies losses: While margin increases efficiency, it also magnifies losses if the market moves against you; active risk management is essential.

• Expiry and rollover risks: Futures contracts have fixed expiry dates and may require rolling positions to maintain exposure, which can incur costs or gaps.

• Complexity and execution risk: Options strategies like spreads, straddles, etc. require a deeper understanding of greeks, implied volatility, and timing.

Gold futures and options trading are best suited for: experienced traders and institutional hedgers who understand leverage, contract specifications, margin rules, and who actively manage positions in volatile markets.

4. Tokenized Gold: Digital Gold on Blockchain

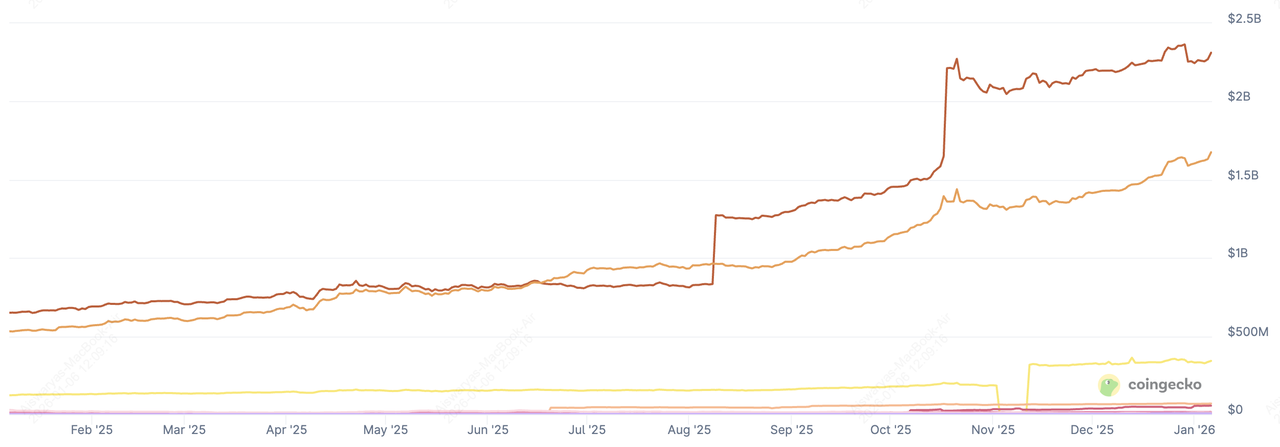

Market cap of leading tokenized gold cryptos | Source: CoinGecko

Tokenized gold is one of the fastest-growing ways to gain exposure to gold’s value by combining physical bullion backing with blockchain transparency and tradability. As of January 2026, the combined market cap of leading

tokenized gold assets like

PAX Gold (PAXG) and Tether Gold (XAUT) exceeded $4.5 billion, reflecting increasing institutional and retail demand for blockchain-based gold exposure.

How Tokenized Gold Works

Tokenized gold represents ownership of physical gold stored in audited vaults, with each token typically backed 1:1 by tangible gold:

1. Custody and Verification: Physical gold, often LBMA-certified London Good Delivery bars, is purchased and securely stored by regulated custodians such as Paxos or Swiss vault operators.

2. Minting on Blockchain: Smart contracts on public chains like

Ethereum mint tokens like

PAXG or

XAUT, where 1 token = 1 troy ounce of gold.

3. On-Chain Transparency: Reserve attestations and

proof-of-reserve mechanisms ensure the

on-chain token supply matches off-chain gold holdings.

4. Trading and Redemption: Tokens can be traded 24/7 on centralized and

decentralized exchanges, and, depending on issuer policies, redeemed for physical gold or cash in specified quantities.

Advantages: Why Tokenized Gold Is Gaining Traction

• 24/7 Global Liquidity: Unlike traditional markets, tokenized gold trades around the clock across wallets and exchanges, enhancing access for global investors.

• Fractional Ownership: Investors can buy small fractions like 0.1 oz or even smaller units, lowering the entry barrier relative to traditional bullion.

• No Storage or Transport Hassles: Physical custody is handled by professional vaults, removing the need for personal storage or insurance costs.

• Blockchain-Level Transparency: On-chain records allow straightforward verification of token supply and transaction history, reducing opacity compared with some traditional gold instruments.

• DeFi Integration: Tokenized gold can be used in decentralized finance (DeFi) applications, as collateral for loans, liquidity provision, or yield strategies, expanding its utility beyond simple price exposure.

Limitations and Risks of Investing in Tokenized Gold

• Custody and Issuer Dependence: Token holders rely on issuers and custodians to secure and audit gold reserves. Regulatory oversight varies by jurisdiction, and weak auditing practices can undermine trust.

• Regulatory Uncertainty: Laws and classifications for tokenized gold differ globally. In some regions, tokenized gold may be treated as a commodity, while in others, it could fall under securities or payment regulations, affecting onboarding and compliance costs.

• Liquidity Variances: While major tokens like PAXG tend to have deep markets, lesser-known tokenized gold assets may have lower trading volume and wider spreads, making execution less efficient.

• okenized gold is best suited for: investors who want flexible, on-chain gold exposure without physical custody burdens and who may also want to use their holdings in broader digital financial strategies, such as DeFi lending or portfolio diversification within crypto wallets. Its strengths lie in accessibility, tradability, and transparency, while its risks underscore the importance of choosing reputable issuers and understanding regulatory dynamics.

Physical Gold vs. Gold ETFs vs. Gold Futures vs. Tokenized Gold: Key Differences

Physical gold, gold ETFs, gold futures, and tokenized gold all provide exposure to the price of gold, but they serve very different purposes within a portfolio. Physical gold offers direct ownership and long-term wealth preservation but comes with storage and security costs. Gold ETFs simplify access through traditional markets, making them suitable for investors seeking a regulated portfolio hedge without handling physical metal.

Gold futures and tokenized gold are more flexible and market-driven. Futures are designed for experienced traders who want leveraged exposure and the ability to profit from both rising and falling prices, but they carry higher complexity and risk. Tokenized gold combines physical backing with blockchain efficiency, offering 24/7 trading, optional leverage, and low barriers to entry, making it a practical digital hedge for modern, crypto-native investors.

| Feature |

Physical Gold |

Gold ETFs |

Gold Futures |

Tokenized Gold |

| Ownership |

Direct |

Indirect |

Price exposure |

On-chain, backed |

| Trading Hours |

Limited |

Market hours |

Market hours |

24/7 |

| Storage Needed |

Yes |

No |

No |

No |

| Leverage |

No |

No |

Yes |

Optional |

| Complexity |

Low |

Low |

High |

Low–Medium |

| Best Use |

Wealth preservation |

Portfolio hedge |

Active trading |

Digital hedge |

How to Trade Gold on BingX

BingX provides crypto-native access to gold markets, combining tokenized assets, derivatives, and

BingX AI–powered trading tools to help you analyze trends, manage risk, and execute trades more efficiently, all without relying on traditional commodity brokers or physical settlement.

Below are three practical ways to invest or trade gold on BingX, each suited to different risk profiles and objectives.

1. Spot Trading Tokenized Gold

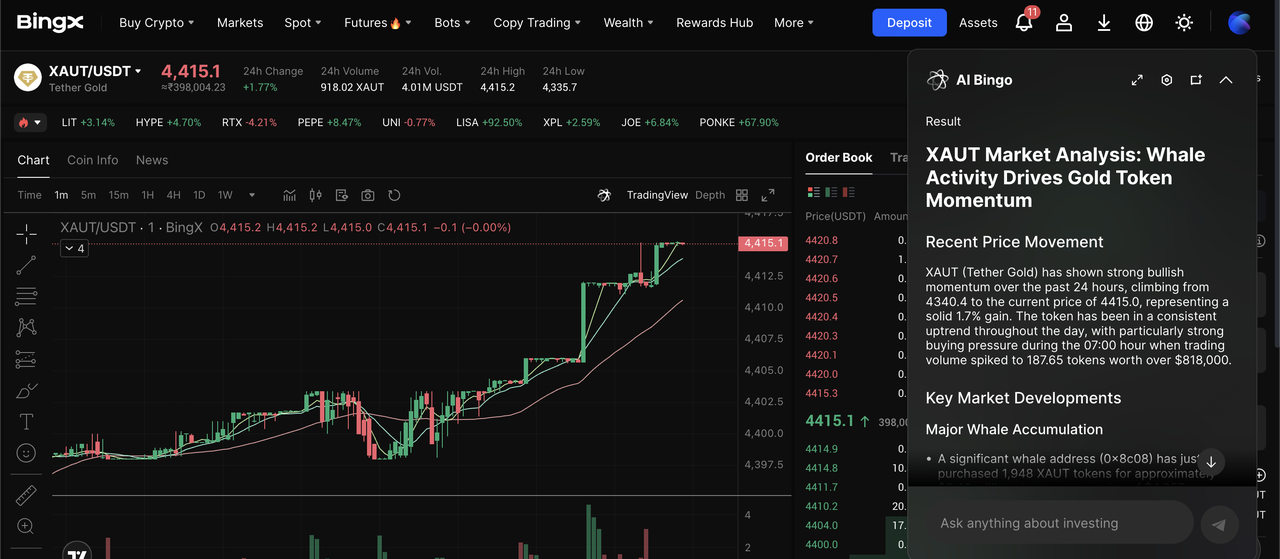

XAUT/USDT trading pair on the spot market

Spot trading tokenized gold is the most straightforward way to gain gold exposure on BingX. Assets like XAUT/USDT and PAXG/USDT are backed 1:1 by physical gold stored in professional vaults and track global gold prices closely.

3. Use BingX AI insights (trend indicators, momentum signals) to assess timing.

4. Place a

market or limit buy order.

5. Hold the tokens as a digital gold position or rebalance when needed.

Best for: investors seeking unleveraged, low-maintenance gold exposure for diversification, similar to holding gold ETFs but with 24/7 crypto-market access.

2. Trading Tokenized Gold on Futures for Leveraged, Directional Trades

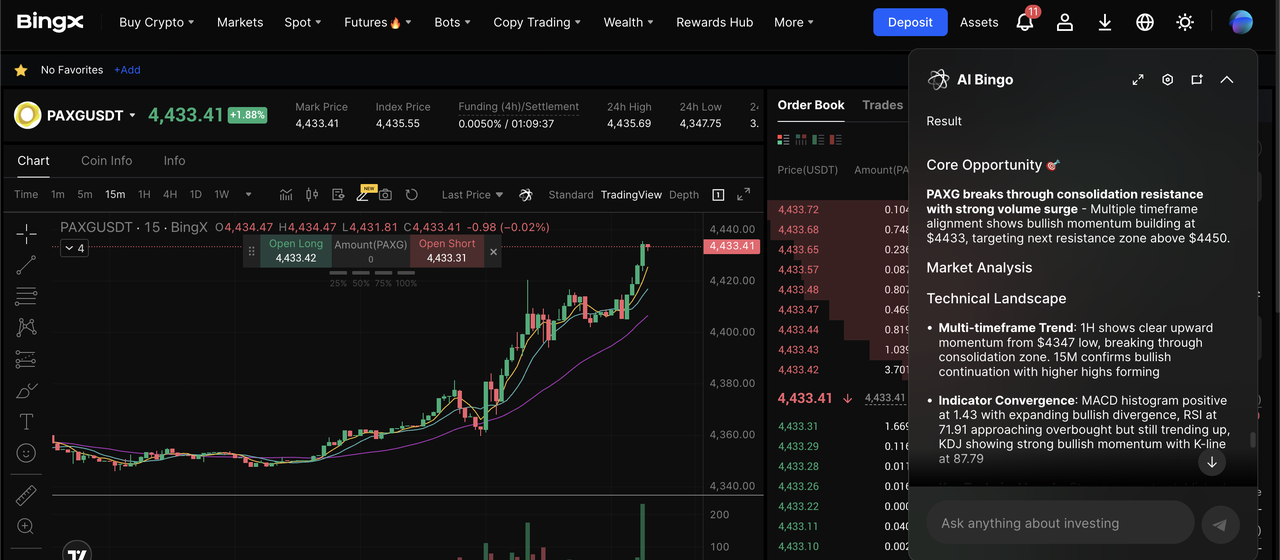

PAXG/USDT perpetual contract

For more active strategies, BingX allows you to trade tokenized gold–linked perpetual futures, enabling both long and short positions with leverage.

1. Transfer funds to your USDT-margined Futures wallet.

3. Choose cross or isolated margin and set leverage according to risk tolerance.

4. Use BingX AI signals to identify trend strength and volatility conditions.

5. Enter a long (bullish) or short (bearish) position.

Best for: traders aiming to capitalize on short-term gold price moves or hedge portfolios, while accepting the higher risk that comes with leverage.

3. Trading Gold Futures With Crypto for Macro Hedging Without Fiat

GOLD/USDT Perpetual Contracts on BingX

BingX also supports crypto-settled gold futures, allowing traders to express views on gold prices using crypto collateral rather than fiat, a setup well suited to crypto-native portfolios.

1. Fund your BingX account with USDT or supported crypto assets.

3. Go long to benefit from rising gold prices or short to hedge against declines.

4. Monitor positions in real time and adjust margin or exits as volatility changes.

Best for: experienced traders who want to hedge crypto market risk, trade macro themes like interest rates, geopolitics, or diversify beyond pure digital assets, without accessing traditional commodity exchanges.

Conclusion: Which Gold Investment Method Is Right for You in 2026?

Gold in 2026 is unlikely to repeat the explosive gains of 2025, but it remains a strategic portfolio asset amid high global debt, persistent geopolitical tensions, and uncertain monetary policy. Most institutional forecasts cluster in the $4,500–$5,000 per ounce range, with upside primarily linked to renewed stress scenarios rather than strong economic growth.

The right way to invest in gold depends on your experience level, time horizon, and risk tolerance. If your goal is long-term wealth preservation and you value direct ownership, physical gold may be suitable despite its storage costs. If you prefer simplicity and regulation within traditional markets, gold ETFs offer a low-maintenance way to hedge portfolio risk. More experienced traders seeking to capitalize on short-term price movements or hedge macro exposure may consider gold futures, though these require disciplined risk management. For investors who want flexible, 24/7 access to gold without physical custody, tokenized gold on BingX provides a modern alternative that combines physical backing with digital liquidity.

For most beginners, gold works best as a risk-reducing allocation, not a leveraged bet. Regardless of the method you choose, disciplined position sizing, clear objectives, and an understanding of volatility are essential. Gold prices can fluctuate significantly, and leveraged products carry higher risk, so always assess your financial situation and risk tolerance before investing or trading.

Related Reading