Gold is one of the most traded assets in the

commodity market, but how you trade it matters just as much as why. Many traders assume spot and futures gold behave the same because both track the same price. In reality, they operate under very different rules.

Spot gold trading gives direct exposure to the current market price.

Gold futures trading adds leverage, margin, and time-based risk. This is where many retail traders get caught off guard. The same price move can mean a manageable gain in spot markets or a forced exit in futures.

With gold volatility rising alongside shifting interest rates and market sentiment, understanding these differences is essential before placing a trade.

What Is Spot Gold Trading?

Spot gold trading means buying or selling gold at the current market price, known as the spot price. This price reflects what gold is worth right now in global markets, based on real-time supply, demand, and market sentiment.

In spot trading, you are not speculating on future prices or using leverage. You gain direct exposure to gold’s price without margin requirements or expiry dates. If gold rises, your position rises. If it falls, losses are limited to the amount invested.

Spot trading is also different from buying physical gold. There is no bullion delivery, no storage costs, and no custody risk. Instead, traders access gold’s price movement digitally.

For instance, if spot gold is trading at $4,050 and you buy at the market price, a move up to $4,100 means your profit reflects the $50 price increase.

Spot trading suits traders seeking simple, direct exposure to gold without leverage or complexity.

What Is Gold Futures Trading?

Gold futures trading involves buying or selling futures contracts that set a predetermined price for gold at a future date. These contracts trade on futures markets and are standardized by size, pricing rules, and settlement terms.

Unlike spot trading, futures do not require owning gold. Traders speculate on price movements, often using leverage, which increases both potential gains and losses. The futures price can differ from the spot price because it reflects expectations, interest rates, and holding costs.

Most futures traders close positions before expiry. Physical delivery is rare, with the majority of contracts settled in cash.

Key distinction:

• Gold spot price: $4,050

• A gold futures contract is trading at $4,080

• You buy the futures contract, expecting prices to rise

• Gold moves to $4,120 before expiry

• You exit trade and profit from the price increase, without owning gold

Futures trading suits active traders and hedgers focused on short-term opportunities rather than long-term ownership.

Spot vs. Futures Gold Markets: Structural Differences

At first glance, spot and futures gold trades can look identical on a trading screen. Under the surface, however, the structure is very different.

In spot markets, trades are executed at the current market price, and traders gain direct exposure to gold. There are no contracts, no expiry dates, and no time limits. The full market value is paid upfront, which keeps risk straightforward and transparent.

In futures markets, traders do not own gold. Exposure comes through futures contracts that reflect expectations, interest rates, and time value. These contracts have a fixed horizon and must be closed or rolled. Traders post margin but are exposed to the full contract value, increasing both opportunity and risk.

Key takeaway

• Spot trading offers simple, direct exposure

• Futures trading offers leverage and flexibility, with higher risk

How Much Capital Do You Really Need to Trade Gold on Spot and Futures Markets?

The biggest difference between spot and futures trading is how much capital you need to open and maintain a position.

• Spot Trading

In spot trading, you pay the full amount upfront and your exposure matches your investment. With gold trading above $4,400 per ounce, investing $4,400 gives you exposure to one ounce at the current market price. There is no leverage, no borrowing, and no margin to maintain. The worst-case outcome is losing the amount invested, which makes spot trading easier for beginners to manage.

• Futures Trading

Futures trading works differently. Traders deposit an initial margin to control a much larger position. With 10x leverage, a $4,400 margin controls roughly $44,000 worth of gold. This increases buying power, but losses also accumulate faster. If account equity falls below required levels, margin calls or automatic liquidation can occur.

Simple comparison:

• Spot: $4,400 investment = $4,400 exposure

• Futures: $4,400 margin = up to $44,000 exposure

This capital asymmetry is why spot trading suits lower risk tolerance, while futures trading demands discipline and active risk management.

What Happens When the Market Moves Against You?

Gold prices move daily, often by 1–2%, and how that move affects you depends on the market you’re trading.

In spot trading, price moves translate directly into profit or loss. With gold above $4,400, a 1% move equals about $44 per ounce. If the price drops, the loss is real but manageable, and the position stays open unless you choose to exit. This gives traders time to let their view play out without forced pressure.

In futures trading, leverage changes the impact. A 1% adverse move on a 10x leveraged position becomes a 10% loss on margin. Normal market swings can quickly erode capital, forcing traders out before their idea has time to work.

The difference is simple:

• Spot trading absorbs volatility

• Futures trading magnifies it

This is why futures trading requires strict risk control, while spot trading offers more room for error.

Who Uses Spot and Futures for Gold Trading?

The choice between spot and futures gold trading is less about market direction and more about how you trade.

Spot trading is commonly used for longer-term exposure. Traders buy spot gold to benefit from broader price trends rather than short-term swings. With no leverage or expiry dates, this approach suits investors who prefer lower stress and fewer decisions. It’s often favored by retail investors and portfolio managers who use gold as a hedge or a stabilizer within a diversified portfolio.

Futures trading is built for short-term activity. Futures traders focus on intraday or short-horizon moves and use leverage to amplify results. This market attracts active traders who watch charts closely and react quickly. Futures are also widely used by institutional traders to hedge large exposures or adjust risk efficiently.

In simple terms:

• Spot trading fits long-term investors and portfolio builders

• Futures trading fits active, short-term traders with higher risk tolerance

Understanding your trading style helps determine which market is the better fit before placing a trade.

Hedging and Strategy Use Cases: How Gold Is Actually Used

Gold futures are mainly used for hedging, not long-term ownership. Institutional investors use futures to manage risk quickly without selling physical gold. For example, a portfolio with $10 mn in gold exposure can short gold futures to reduce downside risk during uncertain periods.

Retail traders use futures more tactically. A trader holding spot gold may open a small short futures position ahead of major events. If gold falls, gains on the hedge can offset part of the spot loss.

The key difference is trading derivatives versus owning the asset. Futures offer flexibility but introduce leverage and

liquidation risk, while spot ownership provides stability.

Common mistakes traders make:

• Using futures for long-term holding instead of hedging

• Over-hedging with excessive leverage

• Ignoring margin requirements during volatile markets

Gold futures are precision tools. Used correctly, they reduce risk. Used poorly, they amplify it.

How to Spot Trade Gold on BingX: Tokenized Gold XAUT and PAXG

Spot trading gold on BingX allows users to gain exposure to gold prices without buying or storing physical gold. Instead, traders use tokenized gold, which tracks real bullion held in custody. On BingX, spot gold trading is done through

tokenized gold assets such as

Tether Gold (XAUT) and

Pax Gold (PAXG).

Step 1: Log In or Create a BingX Account

Visit the BingX website and

sign up using your email or phone number. Once

verified, log in to access the trading dashboard.

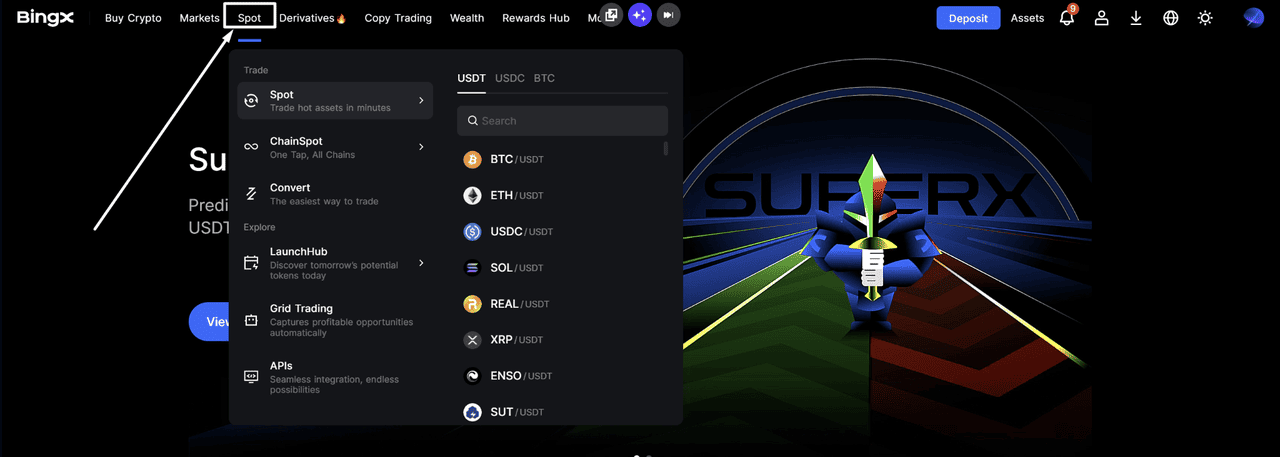

Step 2: Open the Spot Market

From the top navigation menu, select Spot. This takes you to the

spot trading interface, where all available trading pairs are listed.

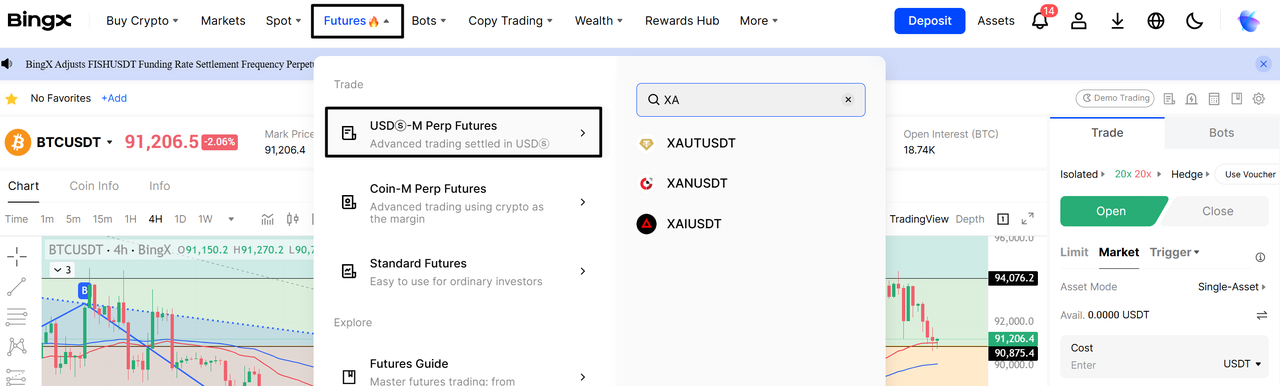

Spot tab dropdown menu showing the trading interface.

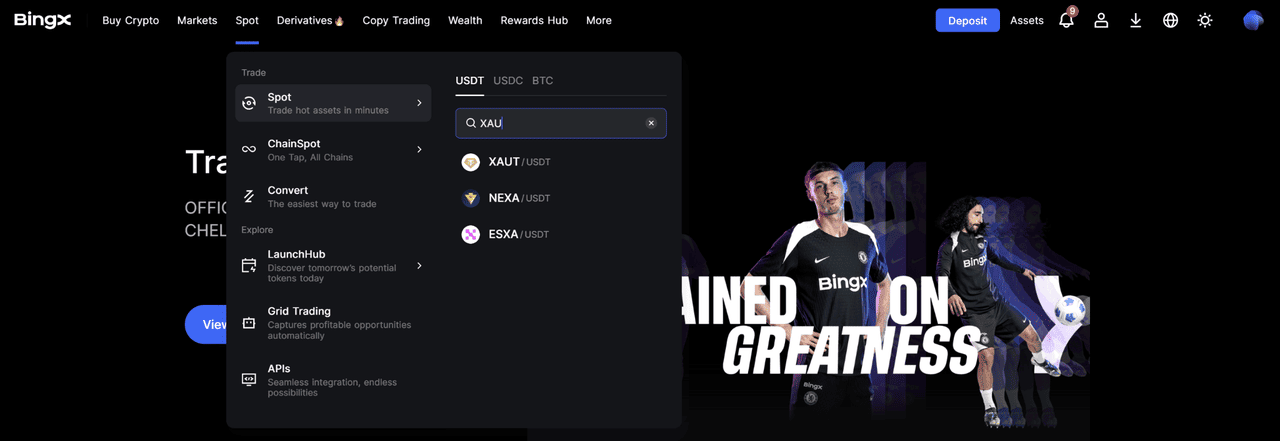

Step 3: Search for Tokenized Gold

In the search bar, type XAUT or PAXG. These tokens represent gold-backed assets that track live gold prices. Common pairs include

XAUT/USDT and

PAXG/USDT.

Spot search bar with results for XAUT/USDT and XAUM/USDT.

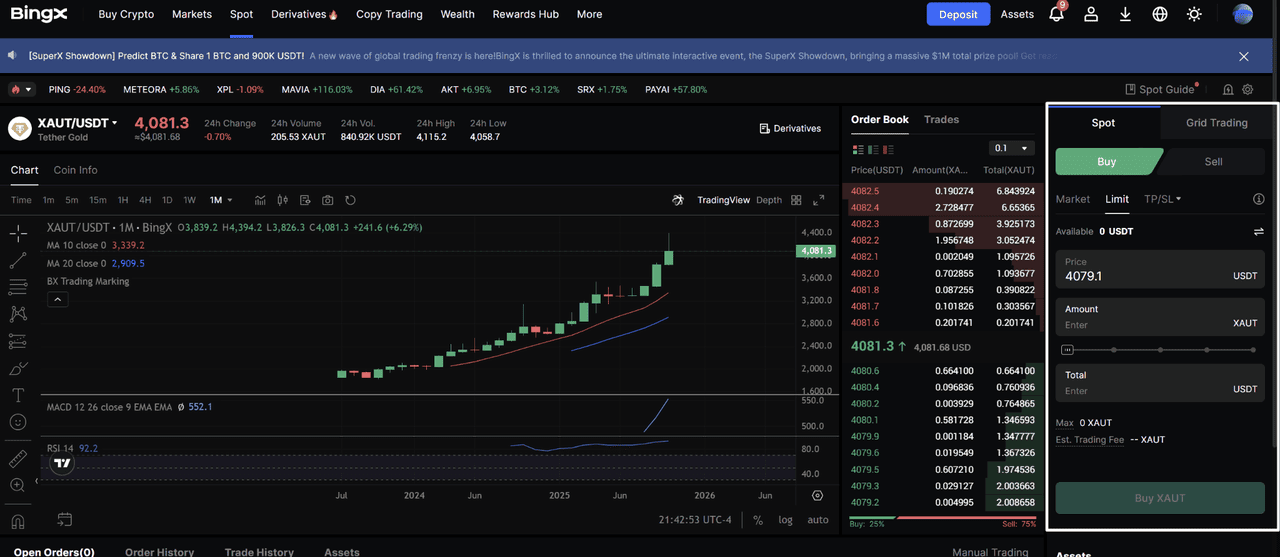

Step 4: Open the Trading Pair

Click on your chosen pair to open the trading screen. Here, you can view live price charts, the order book, recent trades, and volume data.

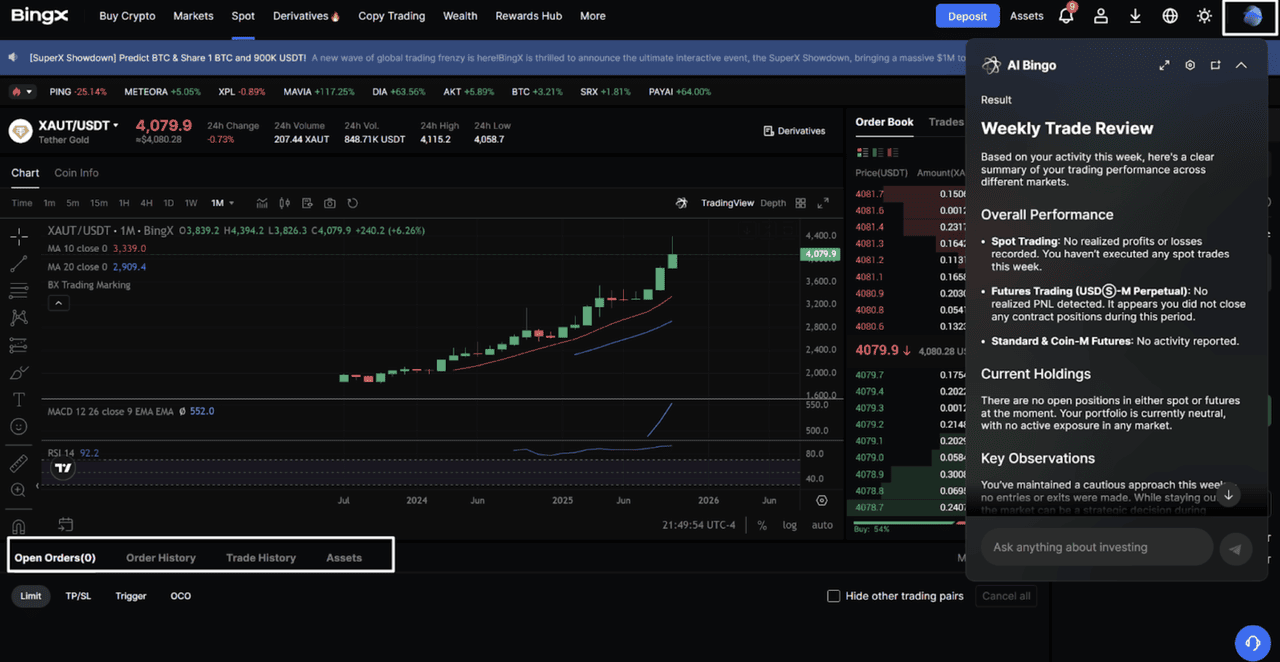

XAUT/USDT chart view on BingX Spot Market.

Step 5: Place a Spot Order

Choose an order type:

• Market order to buy instantly at the current price

• Limit order to buy at a specific price

Enter the amount and confirm the trade.

Step 6: Hold or Sell Anytime

Once purchased, tokenized gold appears in your assets. You can hold it for long-term exposure or sell it anytime at live market prices.

BingX dashboard showing order confirmation or portfolio view.

How to Trade Gold on BingX Futures: XAUT & PAXG Futures + Gold Futures

Gold futures trading on BingX lets traders gain exposure to gold price movements using crypto collateral, without owning physical gold or dealing with traditional commodity brokers. Instead of trading on exchanges like COMEX or MCX, BingX offers USDT-margined perpetual futures, similar to

BTC or

ETH futures.

In simple terms, gold futures trading involves:

• Trading price movements only

• Using leverage for capital efficiency

• Going long or short

This makes gold futures faster and more accessible for crypto-native traders.

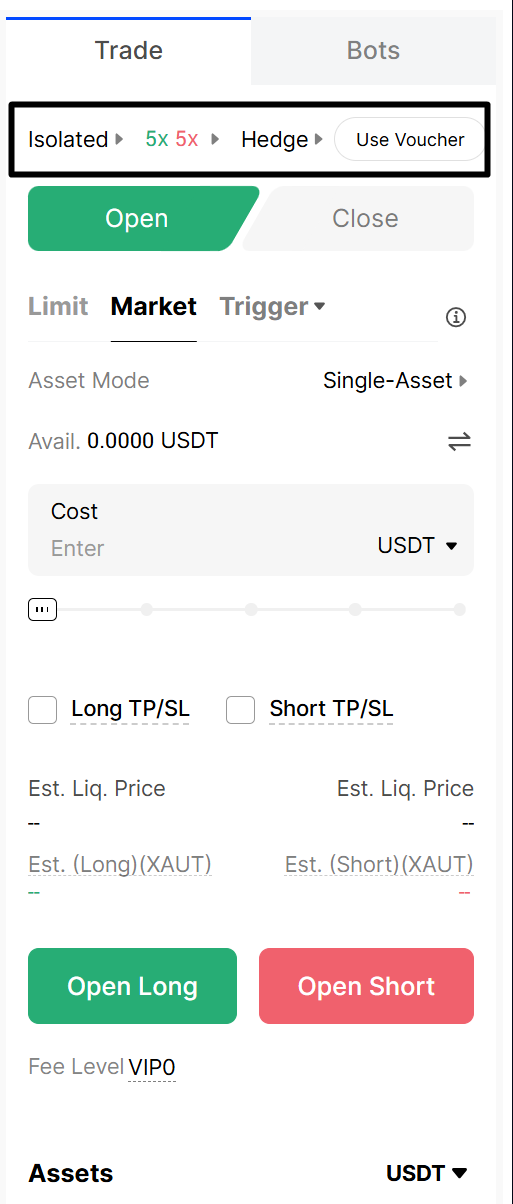

Step 1: Create and Fund Your Futures Account

Step 2: Open the Futures Trading Interface

Step 3: Choose Long or Short

• Go long if you expect gold prices to rise due to inflation, rate cuts, or geopolitical risk

• Go short if you expect gold prices to fall due to rising rates or a stronger USD

Step 4: Set Leverage and Order Type

Adjust leverage based on your risk tolerance.

• Use market orders for instant execution

• Use limited orders to enter at a specific price

Step 5: Manage Risk Actively

Why gold futures attract active traders:

• Trade gold using crypto balances

• Profit from both rising and falling prices

• No physical delivery or contract rollover

• Built for short-term traders and hedging strategies

Gold futures trading involves leverage and market sentiment risk. Used with discipline, it offers flexibility. Used without risk control, it can lead to rapid losses. On BingX, gold futures are traded via USDT-margined perpetual contracts linked to XAUT and PAXG prices.

Spot vs. Futures for Gold Trading: Which One Actually Fits You?

The choice between spot and futures gold trading is simpler than it sounds. It really comes down to how actively you want to trade and how much risk you’re comfortable with.

If you prefer a calm approach, spot trading is usually the better option. You buy gold at the current price and hold it. There’s no leverage, no margin calls, and no pressure to react to every price swing. Many retail investors use spot gold for long-term exposure or as a hedge when markets feel uncertain.

Futures trading is more hands-on. It’s designed for traders who watch the market closely and trade short-term moves. Futures allow you to go long or short and use leverage, but that also means losses can build quickly if the market turns against you. This style suits active traders and institutions that manage risk tightly.

A simple rule of thumb

• If you want to own exposure, choose spot

• If you want to trade price moves, choose futures

Knowing this difference upfront saves money, stress, and bad decisions later.

Final Takeaway

Gold may be the same asset, but spot and futures markets behave very differently. Understanding how each works helps you avoid unnecessary risk and trade with confidence. Spot trading suits long-term exposure and stability, while futures trading fits active strategies and short-term moves. Before placing a trade, choose the market that matches your goals. Explore gold spots and futures on BingX and trade with a clearer plan.

Related Articles

FAQs on Gold Spot and Futures Trading

1. What is the difference between spot and futures gold trading?

Spot gold trading gives direct exposure to the current market price with no leverage or expiry. Futures gold trading uses contracts, leverage, and margin, allowing traders to speculate on short-term price movements with higher risk.

2. Is trading spot gold safer than gold futures trading?

Yes, spot trading is generally safer for beginners because there is no leverage or liquidation risk. Losses are limited to the amount invested, unlike futures where leverage can amplify losses.

3. Can I trade gold on BingX without buying physical gold?

Yes. BingX offers tokenized gold such as XAUT and PAXG, which track physical gold prices without storage, delivery, or custody requirements.

4. How does gold futures trading work on BingX?

Gold futures on BingX are traded via USDT-margined perpetual contracts linked to XAUT and PAXG prices. Traders can go long or short using crypto collateral without owning gold.

5. Who should trade gold futures instead of spot gold?

Gold futures are better suited for active traders and institutions who trade short-term price movements, hedge exposure, and can manage leverage and margin risk.

6. Can beginners trade gold futures?

Beginners can trade gold futures, but it requires strict risk management. Many new traders start with spot gold before moving to futures.