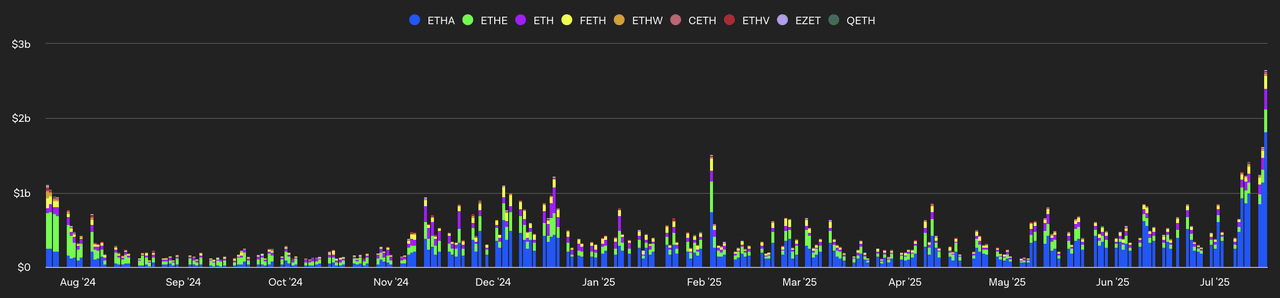

Ethereum ETFs have become one of 2025’s hottest investment vehicles, with net inflows crossing $5.5 billion by July 2025. As institutional interest grows and staking integration nears regulatory approval, these funds are helping investors gain exposure to ETH without managing private keys or wallets.

Spot Ethereum ETF volumes | Source: TheBlock

Whether you’re a beginner curious about

Ethereum or a seasoned investor diversifying your portfolio, here’s a closer look at why Ethereum ETFs are surging and which ones stand out in 2025.

What Are Spot Ethereum ETFs and How Do They Work?

Spot Ethereum ETFs are investment funds that hold actual

Ether (ETH) as their underlying asset. Unlike Ethereum futures ETFs, which track ETH prices using derivatives, spot ETFs directly buy and store Ether. This means the value of each ETF share reflects the real-time price of Ethereum, giving investors exposure to the cryptocurrency without needing to own it outright.

For beginners, spot Ethereum ETFs work like traditional stock funds. You can buy or sell them on major stock exchanges through your brokerage account, just as you would with

Apple or

Tesla shares. There’s no need to set up a crypto wallet, manage

private keys, or worry about blockchain transactions. The ETF provider handles custody of the Ether, storing it securely on behalf of all investors.

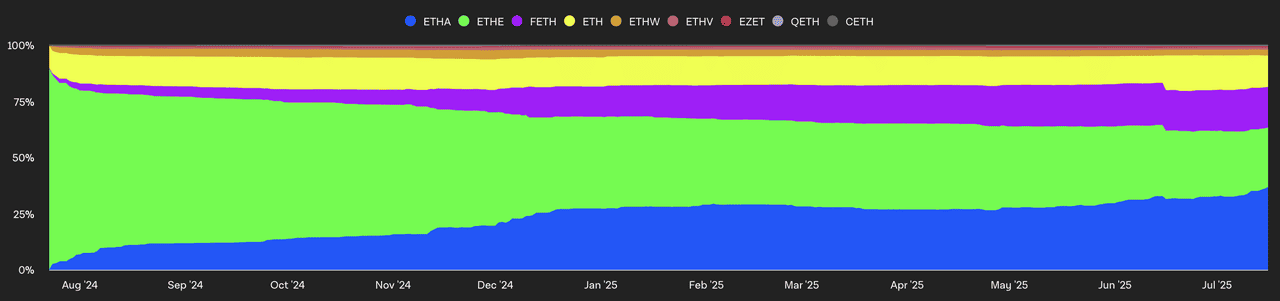

Spot Ethereum ETF on-chain holdings marketshare | Source: TheBlock

These ETFs became available in the U.S. in July 2024 after SEC approval, following the popularity of

spot Bitcoin ETFs earlier that year. By mid-2025, spot Ethereum ETFs collectively manage nearly 5 million ETH, equivalent to about 4% of the total Ethereum supply. As more institutional players like BlackRock and Fidelity embrace these products, they’re making it easier for traditional investors to access Ethereum and benefit from its growth, including potential

staking rewards in future ETF iterations.

Why Are Ethereum ETFs Gaining Popularity in 2025?

Ethereum ETFs have surged in popularity in 2025 as they open the door for both retail and institutional investors to gain exposure to ETH without directly owning or managing the cryptocurrency. These funds bridge traditional finance and blockchain by allowing people to invest in Ethereum through regulated stock exchanges.

Here’s why Ethereum ETFs are drawing so much attention this year:

1. Reserve Asset Potential: Ethereum powers over 54% of all

stablecoins, positioning itself as critical infrastructure for the growing digital dollar economy. This dominance gives ETH a unique role as a

digital reserve asset similar to gold or U.S. Treasuries in traditional finance.

3. Yield Opportunities with Staking ETFs: A major development in 2025 is the introduction of Ethereum ETFs with staking functionality. Leading issuers like BlackRock and Fidelity are seeking regulatory approval to let their ETFs stake held ETH, generating additional yield for investors. This feature could make these ETFs even more appealing by adding passive income potential.

4. Ethereum Price Outlook: Analysts are increasingly bullish on Ethereum’s long-term price trajectory, with some forecasting ETH could surpass $5,000 by the end of 2025 if staking ETFs are approved and institutional inflows continue to grow. This optimism is driving demand for ETFs as a simple and regulated way to capture potential upside.

For investors, these trends mean Ethereum ETFs are more than just a simple trading vehicle; they offer a secure, regulated way to participate in Ethereum’s growth story. Whether you're looking for long-term exposure or potential staking rewards, these funds are reshaping how people access the second-largest cryptocurrency.

The 7 Best Spot Ethereum ETFs to Watch in 2025

Here are seven leading Ethereum ETFs making headlines in 2025, each with unique features, fee structures, and institutional backing. These funds provide a beginner-friendly way to gain exposure to ETH while offering different levels of accessibility, size, and future potential.

1. iShares Ethereum Trust (ETHA)

Managed by BlackRock, the

iShares Ethereum Trust (ETHA) is the largest and most actively traded Ethereum ETF, with over $7.92 billion in assets under management (AUM) as of July 2025. Listed on NASDAQ, ETHA tracks the CME CF Ether-Dollar Reference Rate – New York Variant, offering investors direct price exposure to Ether without the need for crypto wallets or private keys. It charges a competitive 0.25% sponsor fee, temporarily reduced to 0.12% for the first $2.5 billion in assets during its first year.

The ETF leverages Coinbase Prime for institutional-grade custody and has seen massive trading activity, with a 30-day average volume of over 27 million shares. In July 2025, BlackRock also filed with the SEC to integrate staking, which could enable ETHA investors to earn passive income from Ethereum’s proof-of-stake rewards if approved. While ETHA simplifies access to Ethereum for traditional investors, it does not offer direct ETH ownership, meaning users cannot participate in DeFi or hold their assets in self-custody wallets.

2. Fidelity Ethereum Fund (FETH)

Fidelity’s Ethereum Fund (FETH) is the firm’s flagship crypto offering, managing over $1.74 billion in assets as of mid-2025. Designed for investors seeking a regulated, familiar way to access Ethereum, FETH provides exposure to ETH price movements without the complexities of wallets or private keys. With a 0.25% annual management fee, it has become especially popular among retirement investors using 401(k)s and IRAs due to its compatibility with tax-advantaged accounts. FETH leverages Fidelity’s decades of experience in financial markets and its robust infrastructure via Fidelity Digital Assets® for secure custody.

Launched alongside Fidelity’s Bitcoin fund in 2024, FETH reflects the company’s broader push into blockchain innovation after years of research and institutional custody services. Fidelity is also among issuers proposing to add staking functionality to its Ethereum fund, which could give FETH holders access to Ethereum’s proof-of-stake rewards in the future. However, investors should note that, like other ETFs, FETH does not provide direct ETH ownership or allow participation in DeFi and on-chain activities.

3. VanEck Ethereum ETF (ETHV)

The VanEck Ethereum ETF (ETHV) appeals to cost-conscious investors seeking a simple, low-fee way to gain exposure to Ethereum’s price movements. Launched in June 2024, ETHV charges one of the lowest sponsor fees in the market at 0.20%, with a full fee waiver on the first $1.5 billion in assets until July 2025. As of mid-July 2025, ETHV manages $189 million in assets under management (AUM) and has delivered a 2.84% YTD return, reflecting its growing traction among long-term holders.

ETHV is a physically backed fund, meaning shares are secured by ether held in cold storage with a qualified custodian, offering robust protection against cyber threats. VanEck’s reputation as a seasoned ETF provider and its focus on crypto-related products further enhance ETHV’s credibility as a reliable choice for investors seeking efficient Ethereum exposure without handling private keys or crypto wallets.

4. Bitwise Ethereum ETF (ETHW)

The Bitwise Ethereum ETF (ETHW) is designed for both retail and institutional investors seeking simple, cost-effective exposure to Ethereum. Launched in July 2024 and traded on NYSE Arca, ETHW currently manages over $431 million in assets under management (AUM) and charges a competitive 0.20% sponsor fee, with a six-month waiver on the first $500 million of assets after launch. As the world’s largest crypto index fund manager, Bitwise brings its extensive expertise and a team of over 90 crypto specialists to support ETHW investors with educational resources and transparent reporting.

The fund physically holds ether (ETH) in cold storage with Coinbase Custody Trust Co., offering enhanced security against cyber threats. Bitwise also donates 10% of ETHW profits to Ethereum open-source development, reinforcing its commitment to the ecosystem’s long-term growth. With features like daily proof-of-reserves reporting and a focus on retail accessibility, ETHW stands out as a solid option for beginners and seasoned investors alike who want to invest in Ethereum without managing private keys or wallets directly.

5. Franklin Ethereum Trust (EZET)

The Franklin Ethereum ETF (EZET) is Franklin Templeton’s flagship crypto offering, designed to provide investors with direct exposure to Ethereum’s price movements without the complexities of managing ETH wallets or private keys. As of August 2025, EZET manages $164 million in assets under management (AUM) and charges a highly competitive 0.19% annual sponsor fee, with a fee waiver in place until January 31, 2025, for the first $10 billion in assets.

Backed by Franklin Templeton’s 75+ years of global asset management expertise, EZET benefits from the firm’s early adoption of blockchain technology and a dedicated digital assets team of over 50 specialists. The ETF’s holdings are fully backed by ether (ETH) kept in secure cold storage with Coinbase Custody, ensuring robust security measures. EZET appeals to both institutional and retail investors, thanks to Franklin Templeton’s strong reputation, its pioneering work in integrating blockchain into traditional financial systems, and its clear focus on innovation in decentralized finance, NFTs, and Web3 infrastructure.

6. Invesco Galaxy Ethereum ETF (QETH)

The Invesco Galaxy Ethereum ETF (QETH) is a smaller but notable player in the Ethereum ETF market, managing $31 million in assets under management (AUM) as of mid-2025. Designed for investors seeking regulated access to Ethereum, QETH offers exposure to the spot price of ETH through Invesco’s global brokerage network. It charges a 0.25% annual management fee, aligning with industry standards, and trades on the Cboe BZX exchange.

The fund fully backs its shares with ether held in custody, though it does not participate in Ethereum’s proof-of-stake staking mechanism, meaning holders miss out on potential staking rewards. QETH’s creation and redemption process is cash-based rather than in-kind, which may make it slightly less tax-efficient than some peers. Despite its smaller size, QETH benefits from Invesco’s extensive infrastructure and reputation as a global asset manager, making it an attractive option for international investors and those looking for a straightforward, regulated gateway into Ethereum’s growing ecosystem.

7. Grayscale Ethereum Mini Trust (ETH)

Grayscale’s Ethereum Mini Trust (ETH) is designed for investors seeking a low-cost, streamlined way to gain exposure to Ether’s price movements without directly holding the asset. Launched in July 2024, ETH manages over $2 billion in assets and charges an industry-leading low fee of just 0.15%, making it one of the most cost-efficient Ethereum ETFs on the market. Unlike Grayscale’s original Ethereum Trust (ETHE), which has historically charged higher fees and traded at steep premiums or discounts to NAV, the Mini Trust offers a simplified structure with shares directly tracking Ether’s spot price.

The fund’s Ether holdings are secured by

Coinbase Custody Trust Company, ensuring robust protection of digital assets in cold storage. Trading under the ticker ETH on NYSE Arca, it provides a convenient way for both retail and institutional investors to integrate Ethereum exposure into their brokerage accounts. However, the fund does not participate in Ethereum staking, meaning holders miss out on potential yields from the network’s proof-of-stake system. With its combination of affordability, transparency, and Grayscale’s decade-long expertise in crypto asset management, the Ethereum Mini Trust has quickly become a preferred choice for cost-conscious investors seeking regulated Ether access.

How to Buy Ethereum ETFs

Buying Ethereum ETFs is a beginner-friendly process, allowing you to gain exposure to ETH through traditional investment platforms. Here’s how to get started step by step:

1. Choose a Brokerage Platform: Open an account with a broker that supports ETF trading. Popular options include:

• Fidelity and Charles Schwab: Ideal for long-term investors and retirement accounts (401(k), IRAs).

• Robinhood and Webull: Great for beginners looking for commission-free trading.

• E*TRADE and TD Ameritrade: Offer advanced trading tools and research for active traders.

• Interactive Brokers: Preferred for international access and professional-level tools.

2. Fund Your Account: Transfer funds into your brokerage account using a bank deposit, wire transfer, or even PayPal on some platforms.

3. Search for Your Chosen Ethereum ETF: Enter the ticker symbol (e.g., ETHA for BlackRock’s iShares Ethereum Trust, FETH for Fidelity Ethereum Fund) into the platform’s search bar.

4. Place an Order: Choose between a

market order (buys at current price) or a limit order (sets your preferred price). Confirm the purchase during stock market hours (typically 9:30 AM to 4 PM EST).

5. Monitor Your Investment: Use your brokerage app to track price movements, dividends, and potential staking yield as proposed by some ETF issuers.

For more experienced investors, these ETFs can also be combined with options strategies like covered calls or protective puts to hedge or enhance returns.

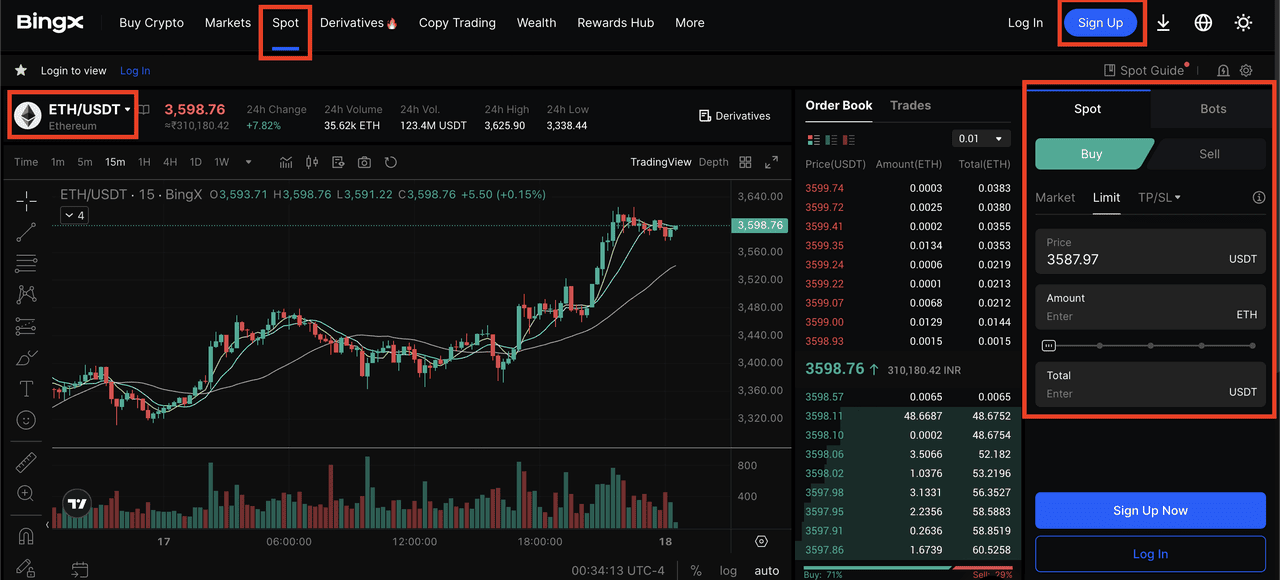

Alternate Option: Buy Ethereum Directly on BingX

If you prefer owning ETH outright instead of through an ETF, BingX offers a simple, beginner-friendly option. You can create an account, complete

KYC verification, deposit

USDT,

USDC, or fiat currency, and instantly buy ETH through the

Spot Trading section. Once purchased, you can securely store your ETH in your BingX wallet or transfer it to a personal wallet for self-custody and DeFi participation.

Buying Ethereum on BingX gives you full ownership of your Ethereum, enabling you to stake it for rewards, use it in DeFi applications, or transfer it globally 24/7. Unlike ETFs, you’re not limited to stock exchange hours and you won’t pay annual management fees.

What Are the Pros and Cons of Buying Ethereum ETFs?

Before deciding whether Ethereum ETFs are right for you, it’s important to weigh their benefits and drawbacks. This section breaks down the key advantages and disadvantages to help beginners understand how these funds compare to owning ETH directly.

Advantages

• Easy Access via Traditional Brokers: You can buy Ethereum ETFs through popular platforms like Fidelity, Schwab, or Robinhood, no need to set up a crypto wallet or use a crypto exchange.

• Regulated Investment Vehicle: These ETFs are approved and overseen by the U.S. SEC, making them more appealing for conservative or first-time investors.

• Retirement Account Compatibility: ETFs can be held in tax-advantaged accounts like 401(k)s or IRAs, which isn’t possible with direct ETH holdings.

• Potential for Staking Rewards: Some ETF issuers, including BlackRock, have filed to enable ETH staking within their funds, potentially allowing investors to earn passive income in the future.

Disadvantages

• No Direct Ownership of ETH: ETF investors don’t hold the actual cryptocurrency, meaning they can’t use ETH in DeFi, NFTs, or for on-chain staking today.

• Ongoing Management Fees: Ethereum ETFs typically charge annual fees ranging from 0.15% to 0.25%, which can eat into long-term returns.

• Limited Trading Hours: Unlike crypto markets that operate 24/7, ETFs can only be traded during regular stock market hours (typically Monday–Friday, 9:30 AM to 4 PM EST).

Closing Thoughts: Should You Invest in an Ethereum ETF?

Ethereum ETFs are transforming how investors gain exposure to crypto, bridging traditional finance and blockchain. With over $5.5 billion in inflows in 2025 and the potential approval of staking-enabled Ethereum ETFs, these funds could attract even more institutional capital and retail interest. Analysts suggest that such developments may support Ethereum’s price recovery, with some predicting a push toward its previous all-time high if demand continues to outpace supply.

However, it’s important to remember that Ethereum ETFs come with trade-offs. While they offer regulated, convenient access to ETH, they don’t provide direct ownership or the ability to participate in DeFi and staking today. Always consider your risk tolerance and do your own research before investing. Like all crypto-related products, Ethereum ETFs remain subject to market volatility and regulatory changes that could impact their future performance.

Related Reading