A

tokenized stock is a blockchain-based representation of real-world equities, allowing you to gain price exposure to public company shares such as

Apple (AAPL),

Tesla (TSLA),

Nvidia (NVDA),

Meta (META),

Google's Alphabet (GOOGL),

Coinbase (COIN), or

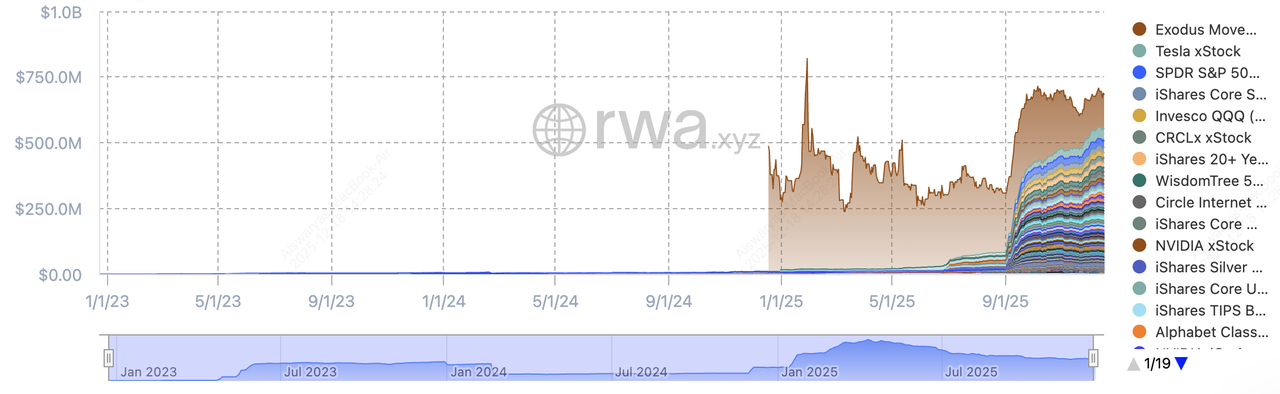

Palantir (PLTR) directly inside the crypto ecosystem. As of December 2025, tokenized public stocks represent around $683 million in total on-chain value, generate roughly $1.74 billion in monthly transfer volume, and are held by more than 129,000 wallets, with close to 49,000 monthly active addresses. These numbers show that tokenized equities have moved beyond experimentation and are now emerging as a real bridge between traditional finance and

on-chain markets.

Total value of tokenized public stocks | Source: RWA.xyz

This guide explains what tokenized stocks are, how they work, the advantages and risks involved, and why BingX is the ideal platform to buy leading tokenized stocks.

What Are Tokenized Stocks?

Tokenized stocks, sometimes referred to as tokenized equities, are digital tokens issued on a blockchain that track the value of real company shares or ETFs. Depending on how they are structured, these tokens either represent a 1:1 claim on real shares held by a regulated custodian or provide synthetic price exposure using derivatives and oracle-based pricing systems.

Unlike traditional stocks that trade through brokers during limited market hours, tokenized stocks trade like crypto assets. They can be bought, sold, and transferred 24/7, often in fractional amounts, using stablecoins or other digital assets. In most cases, you receive economic exposure to the stock’s price, but not full shareholder rights such as voting or direct participation in corporate actions, and the regulatory framework is still evolving across jurisdictions.

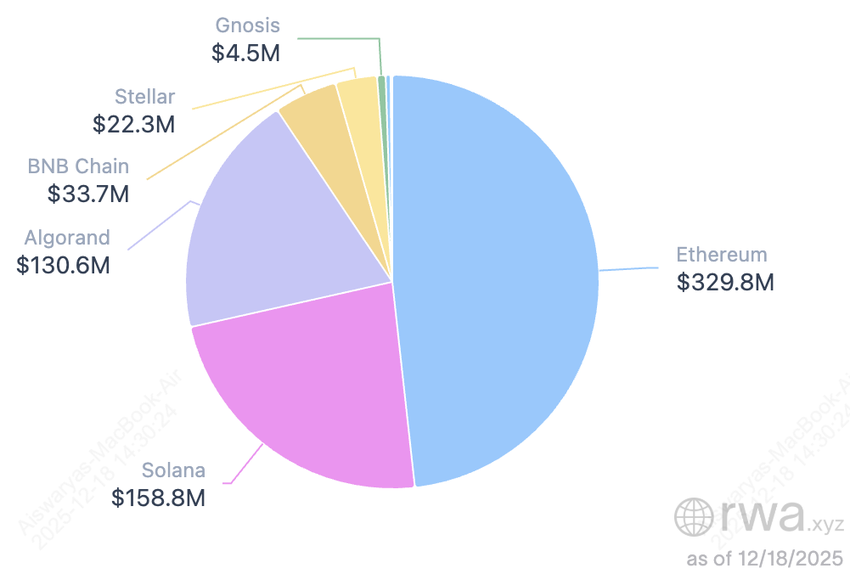

Breakdown of tokenized stocks by blockchains | Souce: RWA.xyz

As of December 2025, tokenized stocks are issued across multiple blockchain ecosystems.

Ethereum remains the largest base with about $329.8 million in TVL, supported by its mature smart contract infrastructure and institutional adoption.

Tokenized stocks on Solana follow with roughly $158.8 million, driven by high throughput, low fees, and strong DeFi-native integrations.

Algorand has grown into a major hub with around $130.6 million, reflecting its focus on compliant, asset-backed tokenization. Smaller but growing shares are held by

BNB Chain ($33.7 million),

Stellar ($22.7 million), and Gnosis ($4.7 million). This multi-chain distribution allows tokenized stocks to integrate with a wide range of trading platforms, wallets, and DeFi protocols, improving accessibility and liquidity over time.

Why Are Tokenized Stocks Popular in 2025?

Tokenized stocks are gaining momentum in 2025 because real liquidity, institutional infrastructure, and regulatory pathways are now in place. The broader

real-world asset (RWA) tokenization market has grown to $35–36 billion on-chain, nearly 10× since 2022, while tokenized public equities alone account for roughly $683 million in value and $1.7+ billion in monthly transfer volume.

Issuers like Backed have demonstrated product-market fit at scale, while major exchanges are consolidating issuance, custody, and settlement under single frameworks. At the same time, traditional finance is accelerating adoption:

Ondo Global Markets has received regulatory approval to distribute tokenized U.S. stocks and ETFs across the EEA, Nasdaq has formally requested SEC rule changes to list tokenized securities, and LSEG has committed £100 million to blockchain-based market infrastructure.

Together, these developments show that tokenized stocks are no longer speculative experiments but are becoming a parallel distribution channel for global equities, operating alongside traditional markets rather than replacing them.

For platforms like BingX, tokenized stocks represent a practical convergence of TradFi and crypto, offering you access to global equities without leaving the digital asset ecosystem, while maintaining familiar trading workflows and liquidity.

How Do Tokenized Stocks Work?

While implementations vary by issuer and platform, most tokenized stock systems follow a similar lifecycle:

First, a licensed issuer or financial institution purchases real shares of a public company through traditional markets and holds them with a regulated custodian. These shares serve as the backing for asset-backed tokens, with audits or on-chain proof-of-reserve mechanisms used to verify that token supply matches shares held.

Next, the issuer mints tokens on a blockchain using smart contracts. Each token represents one share or a defined fraction, while price oracles, often provided by infrastructure providers like

Chainlink, feed real-time stock prices on-chain to keep token values aligned with the underlying asset.

Once issued, tokenized stocks can be traded on centralized exchanges or directly on-chain via decentralized platforms. Because settlement happens on the blockchain, transfers typically complete in seconds rather than the T+1 or T+2 cycle used in traditional equity markets. Depending on the structure, holders may later redeem their tokens for

stablecoins, fiat, or, in some regulated models, an equivalent claim on the underlying securities.

How Are Tokenized Stocks Different From Traditional Shares?

Tokenized stocks sit between traditional shares and brokerage-based fractional shares. Unlike traditional equities, they settle instantly, trade 24/7, and live on-chain, but they usually do not grant full shareholder rights. Compared to fractional shares, tokenized stocks offer greater portability, DeFi integration, and global access, though with higher technical and regulatory risk.

In practice, tokenized stocks are best viewed as a complement, not a replacement, to traditional investing particularly useful for tactical trading, hedging, and crypto-native strategies.

What Are the Different Types of Tokenized Stocks?

Tokenized equities are generally issued under three distinct structural models, each with different risk, rights, and regulatory characteristics.

1. Asset-Backed (Wrapped) Tokenized Stocks

These are the most widely adopted format today. Each token is backed 1:1 by real shares held by a regulated custodian, giving holders direct economic exposure to the underlying stock price. Issuers typically publish audits or on-chain proof-of-reserve data to confirm backing. While dividends or corporate actions may be passed through, voting rights are usually not. Products like xStocks by Backed dominate this category, with more than $10 billion in combined on-chain and exchange volume processed within six months

2. Synthetic Tokenized Stocks

Synthetic tokens replicate stock price movements using derivatives, smart contracts, and oracle data, without holding real shares. They offer broad global access and capital efficiency but introduce higher counterparty, oracle, and model risk, since holders have no legal claim on underlying equities.

3. Natively Issued On-Chain Shares

In this emerging model, the token itself is the legal security, and companies issue equity directly on a blockchain. Ownership records are maintained on-chain via regulated infrastructure. While still early, proposals from Nasdaq, DTCC, and European DLT venues suggest growing momentum toward fully native, programmable equity issuance.

Where Can You Invest in Tokenized Stocks?

You can access tokenized stocks through centralized platforms or directly on-chain, depending on your preferences and jurisdiction.

1. Buy and Sell Tokenized Shares on Centralized Platforms (CeFi) Like BingX

Platforms like BingX provide a familiar trading experience. You open an account,

complete KYC where required, deposit fiat or stablecoins, and trade tokenized tickers such as

AAPLX,

TSLAX, or

NVDAX. These platforms typically offer deeper liquidity, tighter spreads, and simplified execution, and may also support futures tied to tokenized equities. Availability varies by region.

2. Trade Tokenized Stocks On-Chain via DeFi

Crypto-native users can buy tokenized stocks directly through wallets and decentralized protocols. After setting up a compatible

non-custodial crypto wallet, such as

Phantom or

MetaMask, you fund it with stablecoins, connect to a supported DEX or RWA protocol, and swap into the desired tokenized stock. This approach enables self-custody and DeFi integration, but requires careful verification of contract addresses, liquidity depth, and issuer credibility.

Tip: Always verify official contracts and review liquidity, holders, and transfer activity using analytics tools before deploying significant capital.

How to Buy Tokenized Stocks on BingX

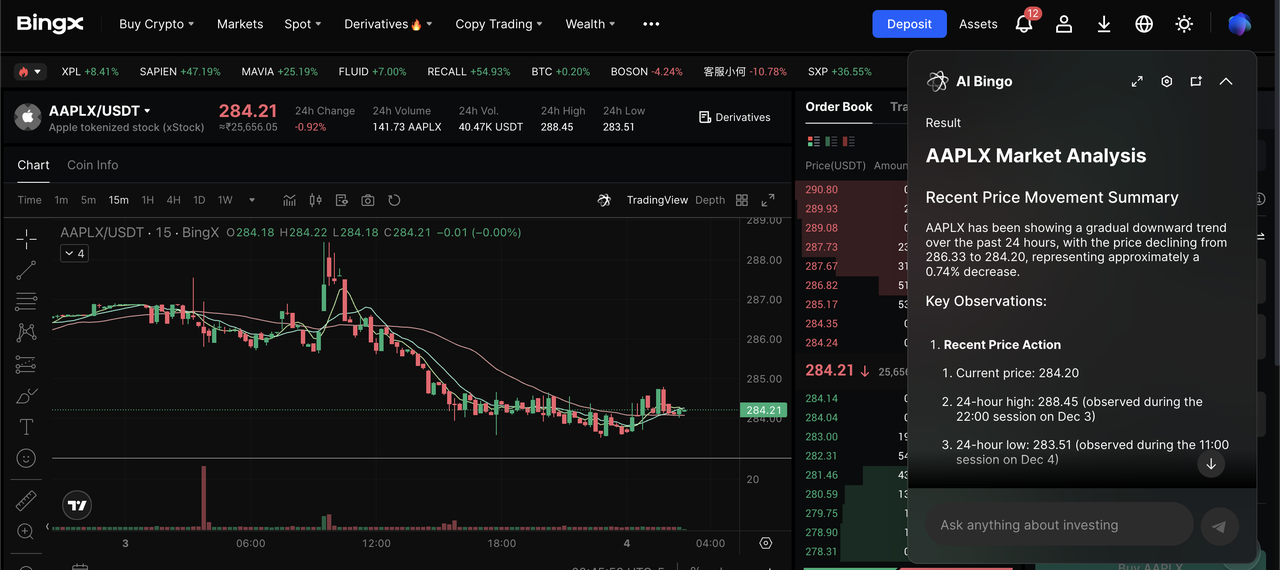

BingX offers one of the most streamlined ways to trade tokenized stocks, combining deep liquidity, fast execution, and BingX AI insights. As of December 2025, BingX supports nearly 30 tokenized stocks across spot and futures markets.

Buy and Sell Tokenized Stocks on BingX Spot Market

AAPLX/USDT trading pair on the spot market powered by BingX AI insights

1. Create or log in to your BingX account and complete KYC if required

2. Deposit funds using

USDT,

USDC, fiat, or

P2P methods

3. Search for the ticker, such as AAPLX, TSLAX, or NVDAX

5. Manage your portfolio using

BingX AI tools, alerts, and charts

Trade Tokenized Stocks with Leverage on BingX Futures

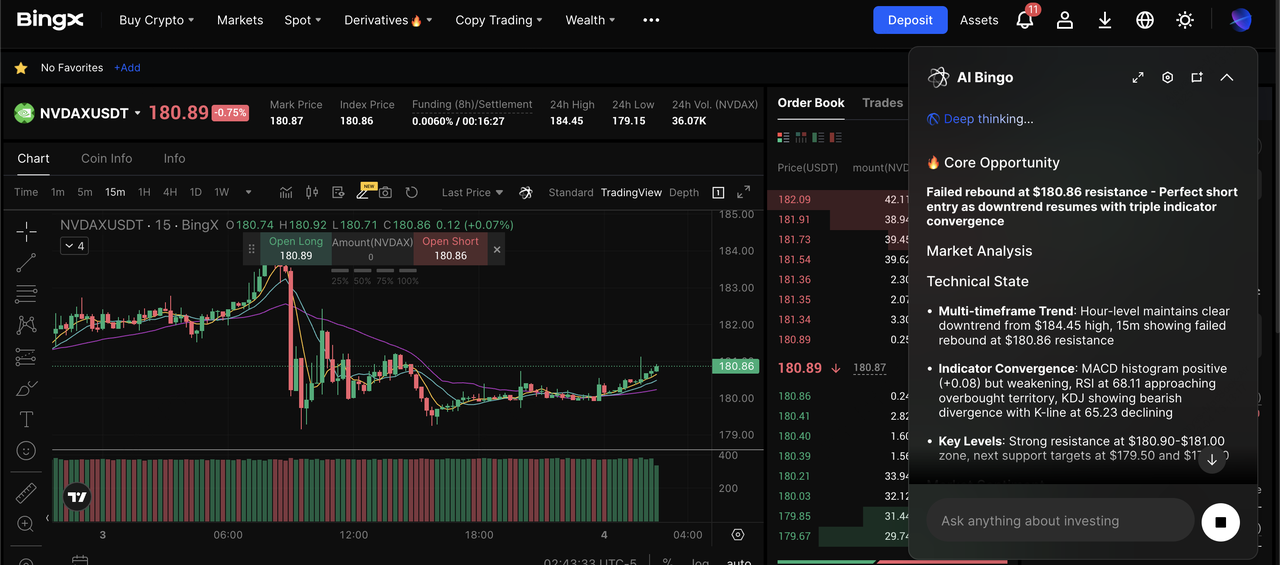

NVDAX/USFT perpetual contract on the futures market powered by BingX AI

For advanced users, BingX also offers perpetual futures on selected tokenized equities.

1. Transfer funds to your Futures Wallet

3. Choose leverage carefully

4. Open a long or short position

5. Set risk controls and monitor PnL in real time

What Are the Pros and Cons of Investing in Tokenized Shares?

Investing in tokenized shares offers a mix of powerful advantages and unique risks, making it important to understand both the benefits and trade-offs before adding them to your portfolio.

Key Benefits of Tokenized Stocks

Tokenized stocks offer several advantages that are difficult or impossible to achieve through traditional brokerage systems:

1. Fractional Ownership: You can buy small portions of high-priced stocks like NVIDIA or Tesla, enabling low-capital entry, dollar-cost averaging, and granular position sizing.

2. 24/7 Global Trading: Tokenized stocks trade beyond traditional market hours, allowing you to react instantly to earnings, macro data, or geopolitical events, even on weekends.

3. Fast On-Chain Settlement: Transfers typically settle in seconds rather than T+1 or T+2, reducing counterparty risk and freeing capital faster for reuse.

4. DeFi Composability: Some tokenized equities can be used as collateral, liquidity assets, or yield components in DeFi protocols, enabling strategies that blend stocks, stablecoins, and leverage.

5. Unified Crypto Experience: You trade tokenized stocks using the same wallets, stablecoins, and interfaces you already use for crypto, without FX conversions or separate brokerage accounts.

6. Lower Barriers for Global Investors: In supported jurisdictions, tokenized stocks offer compliant access to U.S. equities and global indices without requiring a local broker.

What Are the Main Risks of Tokenized Stocks?

Before investing, you should understand the key risks:

1. Regulatory uncertainty varies by jurisdiction

2. Limited shareholder rights in most structures

3. Issuer and custodian risk

4. Liquidity fragmentation across chains and venues

5. Smart contract and oracle vulnerabilities

6. Potential price divergence from underlying stocks

Rule of thumb: treat tokenized stocks as high-innovation instruments and size positions conservatively.

Conclusion: Should You Invest in Tokenized Stocks?

Tokenized stocks offer a powerful way to access global equities inside the crypto ecosystem, combining 24/7 trading, fractional ownership, fast settlement, and DeFi compatibility. They are especially useful for crypto-native investors seeking flexibility and capital efficiency.

However, they come with meaningful trade-offs, including evolving regulation, reduced shareholder rights, and infrastructure risk. For most investors, tokenized stocks work best as a supplement to traditional portfolios, not a replacement. Careful platform selection, position sizing, and ongoing due diligence remain essential.

Related Reading