Owning tokenized stock generally does not grant traditional shareholder rights unless the tokens are issuer-sponsored and natively recorded on a company's official register. Most retail "stock tokens" are synthetic derivatives providing price exposure without voting rights, dividends, or legal ownership, making it essential to distinguish between real equity and custodial entitlements.

The intersection of blockchain and traditional finance has birthed

tokenized stocks or tokenized equities, digital assets that mirror the value of blue-chip equities like

Apple,

Tesla, or

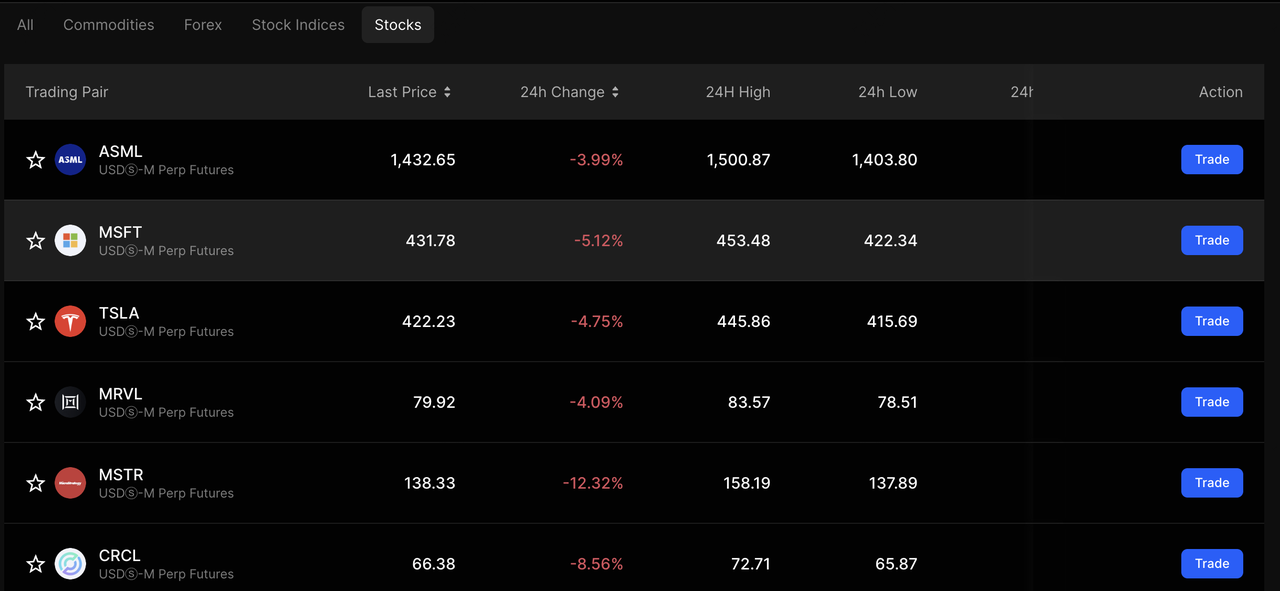

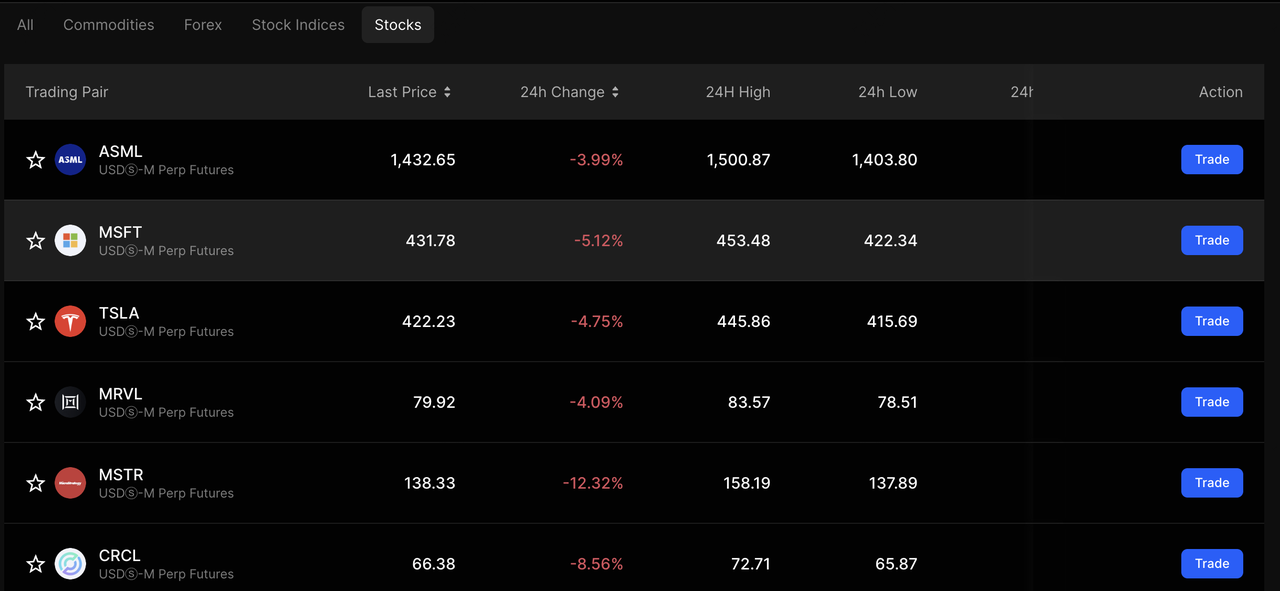

Nvidia. While these assets promise 24/7 trading and fractional ownership, a critical question remains for investors: does holding a token make you a legal owner of the company? As of early 2026, new SEC guidance and market developments have clarified the sharp divide between synthetic exposure and true shareholder status.

What Are Tokenized Stocks and How Do They Work?

Tokenized stocks are digital representations of traditional equity shares issued on a blockchain. They aim to solve the inefficiencies of legacy markets, such as T+1 settlement cycles and restricted trading hours. By converting a share into a token, investors can trade in fragments (fractionalization) and move assets across decentralized protocols. However, the legal weight of these tokens depends entirely on their structure: Wrapped/Synthetic models versus Native Issuer models.

Latest Developments in Tokenized Securities Market

As of January 2026, the tokenized securities market has undergone a significant regulatory and operational shift, marked by the SEC’s January 28, 2026, joint staff statement. This guidance effectively "drew a line in the sand" by distinguishing between issuer-sponsored tokens or legal equity and third-party synthetic products or derivatives. By classifying most synthetic retail tokens as security-based swaps, the SEC has signaled a crackdown on products that offer price exposure without the underlying legal rights of a shareholder, forcing a pivot toward natively tokenized shares that integrate directly with a company’s master securityholder file.

Simultaneously, the "convenience gap" that once drove investors toward unregulated tokenized stocks is closing as traditional infrastructure modernizes. The DTCC is on track to launch 24/5 trade capture and clearing in Q2 2026, providing a regulated foundation for NYSE and Nasdaq to debut extended trading sessions up to 22–24 hours by late 2026. This evolution is complemented by a surge in Direct Registration (DRS) interest, as blockchain-based transfer agents now allow investors to bypass "street name" brokerage custody and hold shares directly on the issuer's books, a move popularized by high-profile initiatives like Trump Media’s (DJT) February 2026 shareholder token program.

Does Tokenization Grant Shareholder Rights to Stock Buyers?

The short answer: Usually not for retail products. In the current market, most tokenized stocks available on crypto exchanges are "synthetic" or "wrapped" products.

According to SEC guidance issued in January 2026, shareholder rights, such as voting in board elections or receiving audited financial statements, are only guaranteed if the token is issuer-sponsored. In this model, the company (the issuer) recognizes the blockchain as its official ledger. If you buy a third-party token that simply tracks a stock's price, you are a contract holder with that provider, not a shareholder of the underlying company.

The Two Faces of Tokenized Shares

To understand your rights, you must identify which model you are holding:

1. The Synthetic/Wrapped Model for Price Exposure Only

Most "stock tokens" fall into this category. A third-party provider or an SPV (Special Purpose Vehicle) buys the actual stock and issues tokens against it.

• Rights: You typically get price exposure (if the stock goes up, the token goes up).

• Dividends: Some providers "pass through" dividends by reinvesting them into the token's value, but you have no legal claim against the company if they don't.

• Voting: Non-existent. The custodian or provider holds the voting power.

2. The Native/Issuer-Sponsored Model for True Equity

This is the emerging gold standard for 2026. Companies like those participating in Nasdaq’s tokenization pilot issue shares directly on-chain.

• Rights: These tokens are fungible with traditional shares and carry full material rights, including voting, dividends, and liquidation claims.

• Legal Standing: Your ownership is recorded by a transfer agent, making you a "Registered Owner" or "Beneficial Owner" with full legal protections.

What Are the Top 3 Risks of Holding Tokenized Stocks?

Despite the convenience, tokenized stocks carry unique risks that traditional brokerage accounts do not:

1. Counterparty Risk: If the third-party issuer of a synthetic token goes bankrupt, you may be treated as an unsecured creditor rather than a shareholder.

2. Regulatory Scrutiny: As seen in the SEC's January 2026 crackdown, many "stock tokens" are being reclassified as security-based swaps, which may lead to delistings in certain regions.

3. Liquidity Gaps: Unlike the NYSE or Nasdaq, tokenized stock markets can have thin order books, leading to high slippage during off-market hours.

Is Owning Tokenized Stock Worth It in 2026?

Tokenized stocks remain a niche tool for investors seeking 24/7 liquidity or fractional access to expensive shares, but they are not a 1:1 replacement for traditional shareholding. If your goal is to exercise corporate governance or ensure maximum legal protection, traditional brokerage or issuer-sponsored native tokens are the only reliable paths.

For those holding third-party tokens, the reality is simple: you are betting on the price of the stock, not owning a piece of the company. As the market moves toward tighter regulation in late 2026, investors should prioritize "issuer-sponsored" tokens that explicitly grant shareholder rights in their smart contracts.

In short, if you want to vote and have a legal claim on assets, stick to registered equity. If you only care about price action and 24/7 flexibility, tokenized synthetics are a viable, albeit higher-risk, alternative.

Related Reading