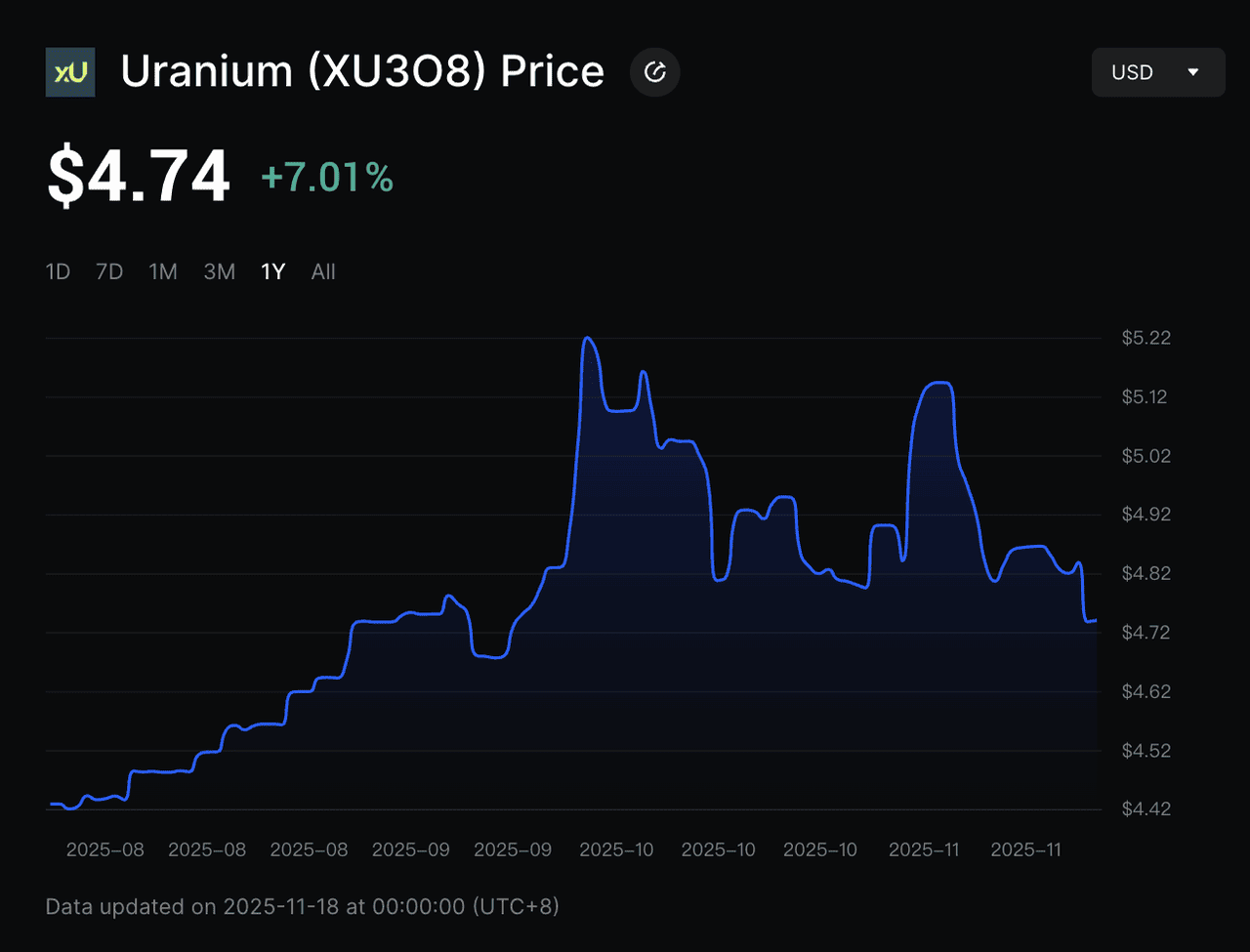

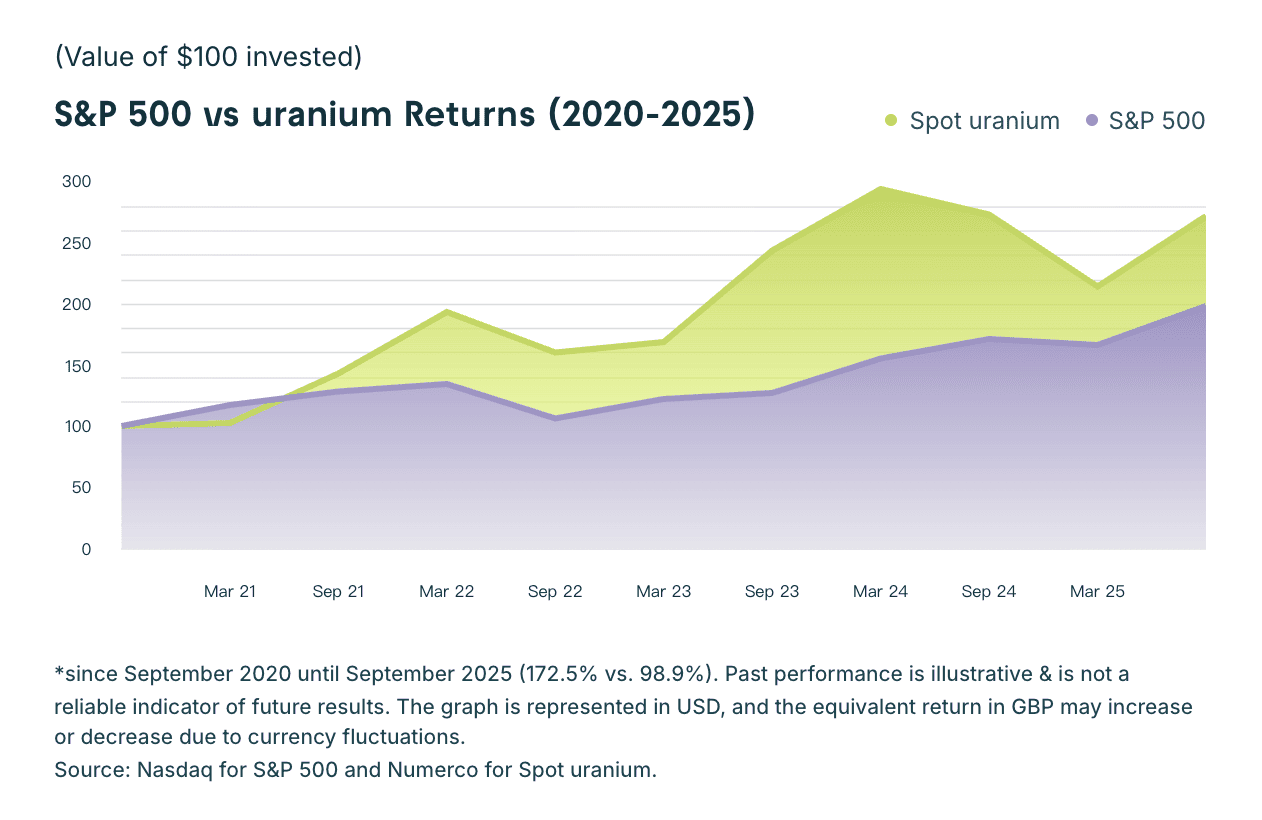

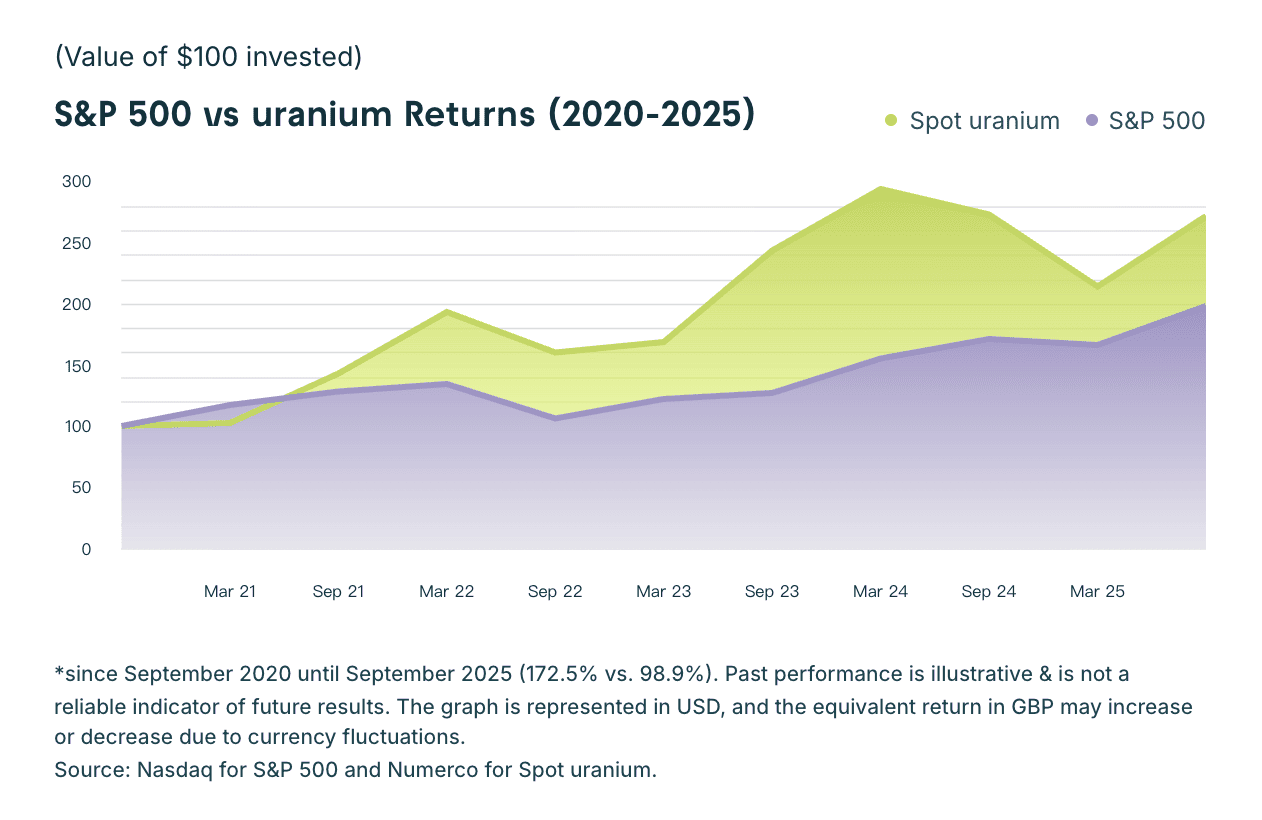

The uranium market is experiencing one of its strongest periods of momentum in recent years. Over the past five years, spot U₃O₈ returned 172.5%, significantly outperforming the 98.9% gain of the

S&P 500 between September 2020 and September 2025. This long-term strength, together with rising nuclear investment, accelerating data center electricity demand and renewed focus on energy security, has pushed uranium back into the spotlight for investors.

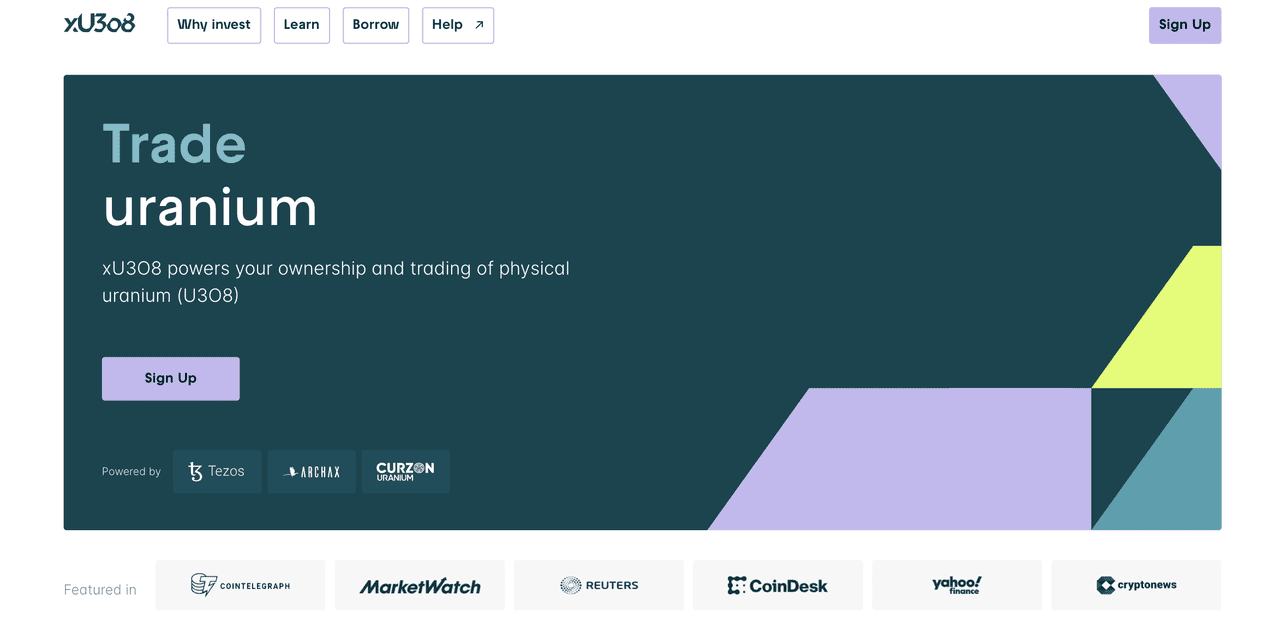

xU3O8 is a digital asset that represents fractional ownership of physical uranium, offering a new way for investors to participate in the commodity. It is a form of tokenized uranium, designed as a legally structured

Real-World Asset (RWA) that brings direct uranium exposure into a transparent, globally accessible format. Instead of navigating the complexities of the OTC uranium market or relying solely on uranium stocks, xU3O8 gives investors access to real uranium holdings through a blockchain-based structure that trades 24/7.

What Is xU3O8 the Tokenized Uranium Token?

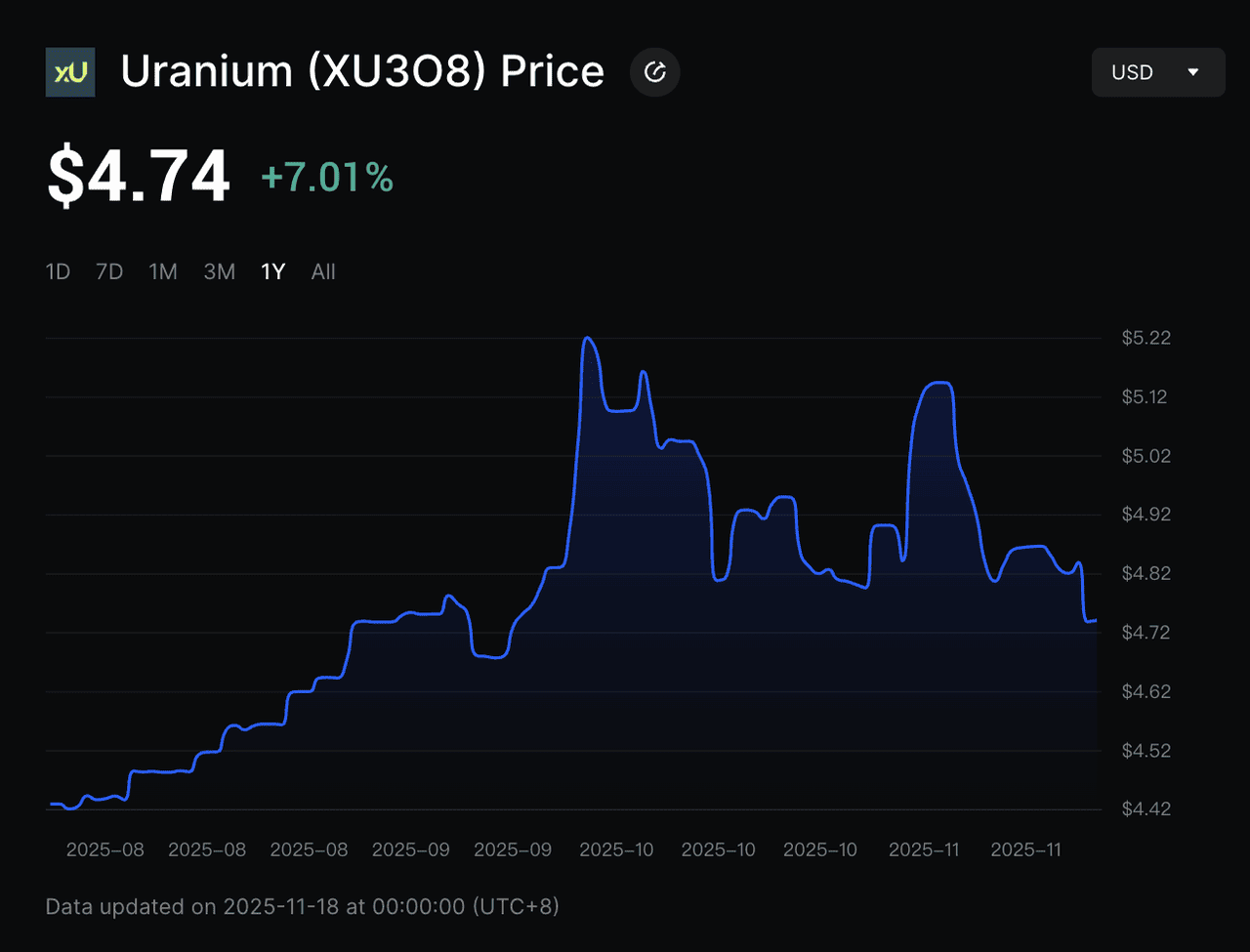

Uranium (XU3O8) is a digital asset that represents fractional ownership of physical uranium ore concentrate (U₃O₈). Each token corresponds to a share of real uranium stored in a regulated facility, making it one of the first ways for everyday investors to gain direct exposure to the commodity without navigating traditional barriers. The interface also displays a live U₃O₈ spot price feed, allowing holders to track market movements directly alongside their tokenized exposure.

Traditional uranium investing options typically include

mining stocks,

ETFs or futures contracts. These instruments provide indirect exposure and are influenced by company performance, market liquidity, production risks and broader equity trends. In contrast, xU3O8 reflects the underlying value of actual uranium held in storage, similar to how certain

gold-backed tokens track physical bullion.

Besides its physical backing, xU3O8 offers

lending functionality and can be used in

DeFi through

Morpho for users who want to supply tokenized uranium as collateral.

xU3O8 is built as a tokenized uranium asset, meaning the physical commodity is recorded on a blockchain as a Real-World Asset (RWA). This structure brings several key benefits:

• Fractional ownership that lowers the cost of entry

• Transparent, on-chain recordkeeping

• Global availability to investors who normally cannot access the OTC uranium market

• Direct linkage to the value of real U₃O₈

• Trading access that operates 24 hours a day and seven days a week

The asset is issued on Etherlink, a

Layer 2 network in the

Tezos ecosystem, and is supported by a legal framework that recognizes token holders as beneficial owners of the underlying uranium. This allows xU3O8 to combine the advantages of

commodity-backed investing with the efficiency and programmability of blockchain technology.

How Does Tokenized Uranium xU3O8 Work?

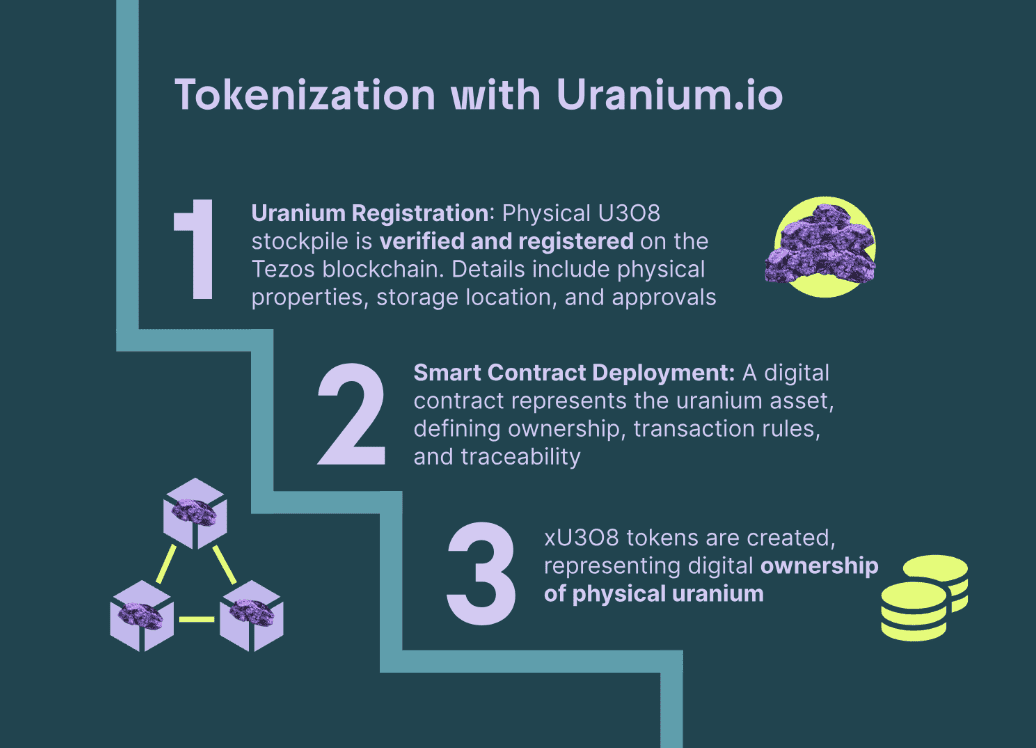

xU3O8 bridges the traditional uranium supply chain with blockchain technology, allowing real U₃O₈ to be owned and traded digitally.

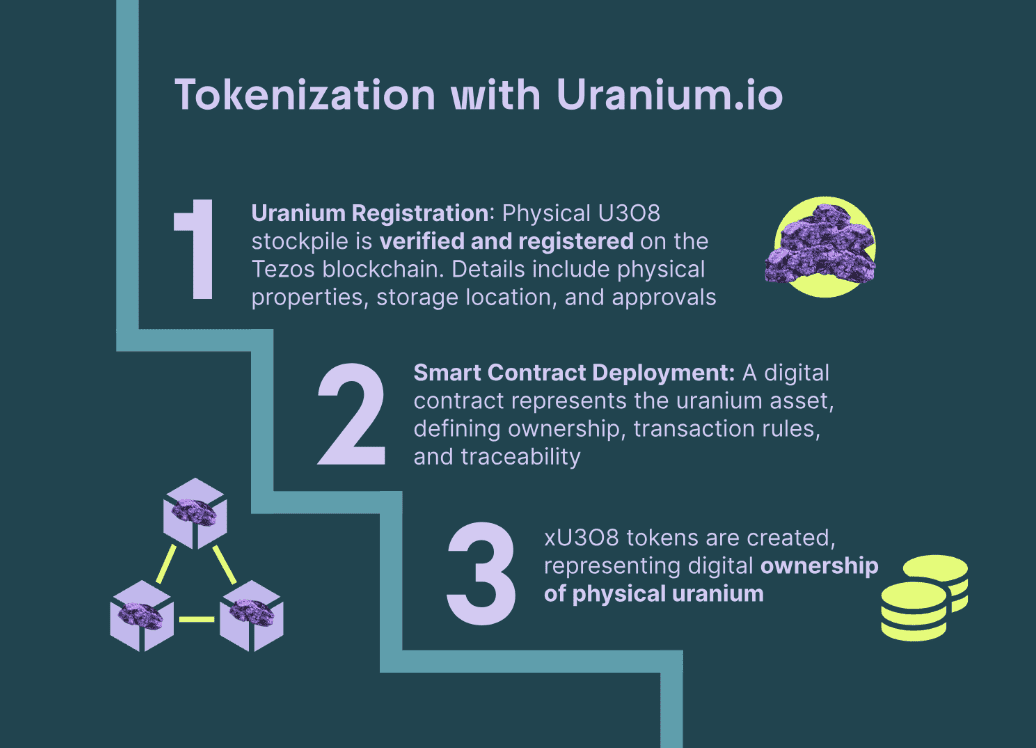

Step 1. Physical uranium production and storage: The uranium behind xU3O8 comes from the established nuclear fuel cycle. Ore is mined, processed into Uranium Ore Concentrate (U₃O₈ or yellowcake), refined and securely transported to a Cameco-operated facility. This ensures the underlying material is real, verified and stored within a regulated environment.

Step 2. Legal registration and ownership structure: The stored uranium is placed into a legal trust managed by Archax Ltd., a regulated trustee. Archax verifies the stockpile and maintains the official ownership register. Within this framework, xU3O8 holders are recognized as beneficial owners of the physical uranium, giving the token its status as a genuine commodity-backed Real-World Asset.

Step 3. Tokenization through smart contracts: Once verified, the uranium is recorded on-chain. A smart contract represents the asset, defines ownership and governs transfers. xU3O8 tokens are created to reflect fractional shares of the uranium in storage, and supply increases only when additional uranium is added. Storage and administrative costs are covered through a small daily mint to the project treasury, which gradually adjusts each holder’s proportional share.

Step 4. Trading and digital market access: After minting, xU3O8 is listed on Uranium.io and supported exchanges. Investors can buy, sell and hold fractional exposure to uranium with transparent on-chain ownership and 24/7 market access. While retail users cannot redeem physical uranium, regulated industrial entities may do so under applicable rules.

Why Is Uranium Gaining Investment Interest?

Rising Nuclear Demand and a Strengthening Uranium Market

Long-term performance has been one of the strongest drivers of renewed interest. According to Nasdaq and Numerco, over the past five years, spot U₃O₈ delivered a 172.5% return, significantly outperforming the 98.9% gain of the

S&P 500 between September 2020 and September 2025. This outperformance reflects global nuclear expansion, including reactor life extensions, new construction and growing interest in small modular reactors. As demand expectations strengthen, investors are increasingly viewing uranium as a strategic, long-duration commodity.

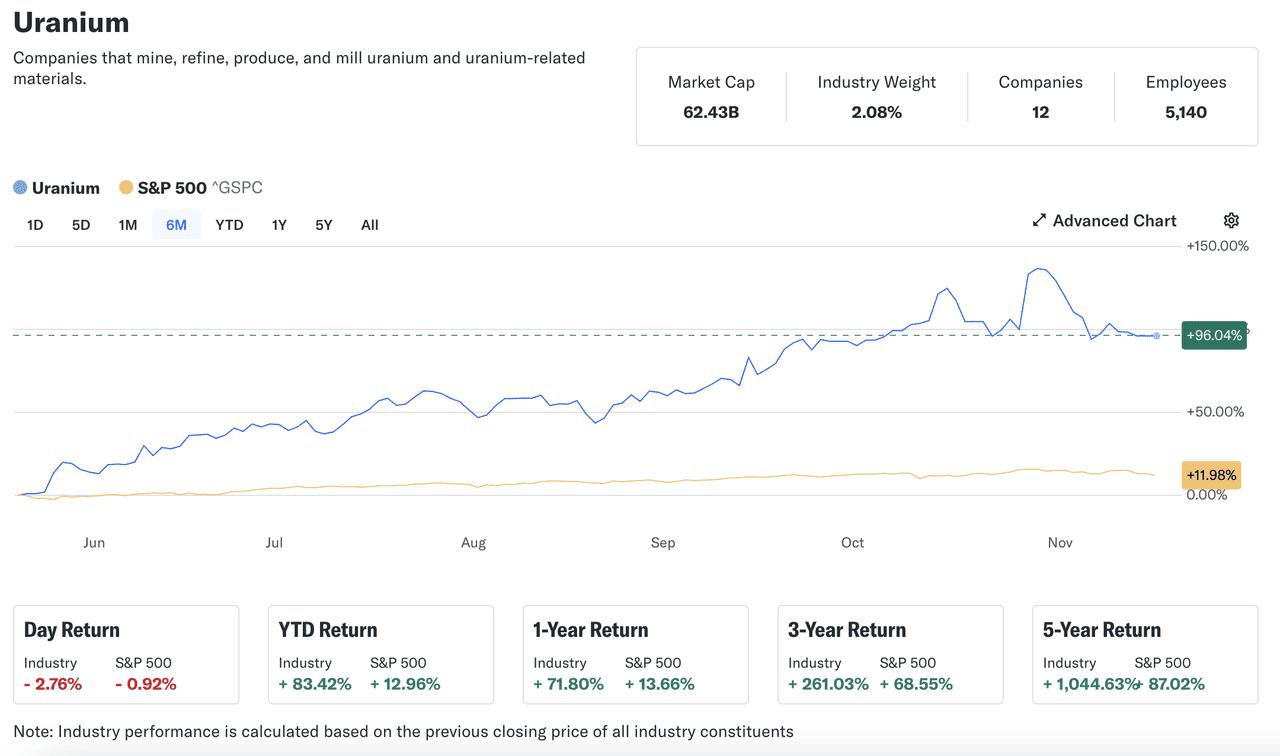

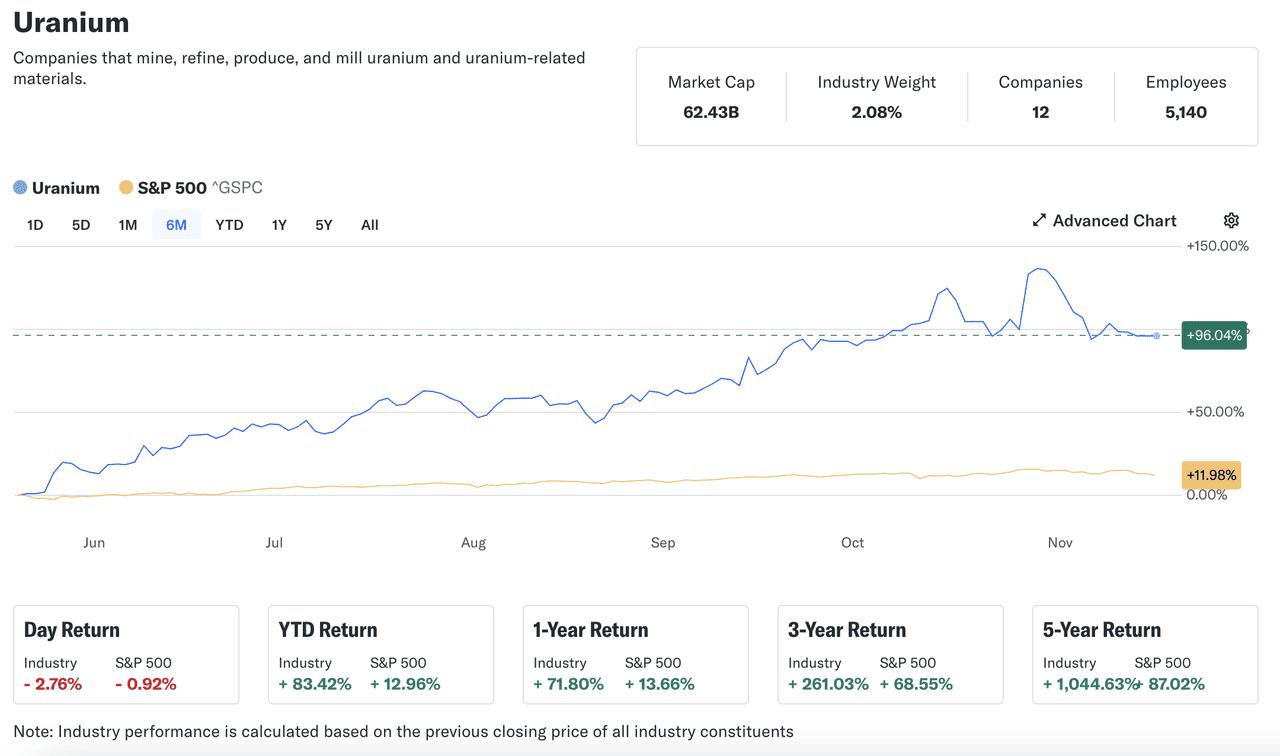

AI, Data Centers and Rising Interest in Investing Uranium Stocks

Recent top uranium stocks show how strongly the sector has responded to growing energy demand. Accoding to Yahoo Finance, Uranium Energy Corp (UEC) is up +67.71% YTD, Centrus Energy (LEU) has surged +268.77% YTD and Energy Fuels (UUUU) has gained more than +297% YTD, making them among the strongest performers in the market this year.

This momentum is closely tied to the rapid expansion of

AI computing and hyperscale

data centers, which require stable, continuous baseload electricity. Nuclear power remains one of the few scalable low-carbon sources capable of meeting these demands. As a result, more investors are evaluating top uranium stocks, uranium ETFs and direct commodity exposure to capture this emerging energy-security trend.

Supply Deficits Support Uranium Stock Performance and Broader Investor Demand

Years of underinvestment and delayed mine restarts have kept global uranium production below consumption. This structural deficit has supported spot U₃O₈ prices, which rebounded from around 63 dollars per pound in early March 2025 to the 80-dollar range by September. Improving fundamentals have lifted uranium stock performance across the sector. With strong YTD gains in companies like UEC, LEU and UUUU, investors are increasingly comparing traditional uranium equities and ETFs with newer alternatives such as xU3O8, which offers direct exposure to the underlying commodity rather than company-specific risks.

xU3O8 Tokenomics Overview

xU3O8 is designed to represent fractional ownership of physical uranium through transparent on-chain accounting and a legally enforceable link to real U₃O₈ stored in a regulated facility. The model mirrors traditional commodity-backed products while leveraging blockchain accessibility.

xU3O8 Token Structure, Backing and Supply

1. Physical and legal backing: xU3O8 is fully supported by verified U₃O₈ held in a Cameco-operated storage facility. All uranium is placed inside a legal trust managed by Archax Ltd., a regulated trustee that maintains the official ownership register. This structure ensures that each token corresponds to a proportional share of real uranium and that holders are recognized as beneficial owners under an enforceable legal framework.

2. On-chain issuance and asset representation: The token is issued on Etherlink, a Layer 2 within the Tezos ecosystem. A smart contract records ownership, manages transfers and ensures transparency. Tokens are minted only when new uranium is added to the trust, keeping supply directly tied to the physical inventory.

3. Fee mechanism and supply adjustments: To cover storage and administrative costs, the system performs a small daily mint to the project treasury. Token holders keep the same number of tokens, but their proportional share adjusts gradually over time. This mechanism is similar to the fee model used in traditional commodity ETFs and preserves long-term alignment between physical assets and circulating supply.

xU3O8 Token Utilities

1. Direct commodity exposure in a digital format: xU3O8 gives investors access to physical uranium without navigating the complexities of the OTC uranium market. The token trades 24/7 on Uranium.io and supported exchanges, offering global accessibility and transparent on-chain ownership.

2. Integration with Web3 financial applications: Because xU3O8 exists natively on-chain, it can be incorporated into decentralized finance systems such as lending protocols, collateral frameworks or digital portfolio tools. This creates more flexible use cases than traditional uranium investments.

3. Institutional-grade redemption pathways: Retail users cannot redeem physical uranium directly, but regulated industrial entities may do so under the trust’s rules. This maintains regulatory compliance while enabling institutional convertibility when required.

Risk and Considerations Before Investing in Uranium Project xU3O8

xU3O8 offers a new way to gain exposure to physical uranium, but investors should understand the risks tied to both the uranium market and tokenized real-world assets. The following points outline the core considerations before participating.

• Commodity price volatility: Uranium prices move with geopolitics, reactor cycles, supply disruptions and policy changes. Since xU3O8 reflects physical U₃O₈ prices, volatility can be significant during periods of market uncertainty.

• Storage and administrative dilution: Secure uranium storage requires professional management. xU3O8 uses a small daily mint to cover these costs, adjusting each holder’s proportional share over time, similar to fee dilution in commodity ETFs.

• Limited redemption access: Retail users cannot redeem physical uranium. Only regulated industrial entities may redeem under the trust’s rules. xU3O8 should be viewed as a digital exposure tool, not a path to receiving physical U₃O₈.

• Network and smart contract risks: xU3O8 depends on Etherlink and smart contract infrastructure. While audited, blockchain systems can still face technical issues, bugs or disruptions that may affect performance or accessibility.

• Regulatory uncertainty: Tokenized assets operate under evolving regulations. Changes in securities or commodity rules may affect trading availability, redemption processes or custody requirements in different jurisdictions.

How to Buy Tokenized Uranium XU3O8 using Crypto on BingX

xU3O8 is available on BingX, allowing users to trade tokenized uranium in a simple and accessible way. Buying xU3O8 on BingX works similarly to trading any other digital asset on the platform.

Step 1: Search for xU3O8/USDT on the Spot Market

Go to the Spot Market on BingX and type xU3O8 in the search bar. Select the XU3O8/USDT trading pair to open the market page.

Step 2: Choose your order type

You can buy xU3O8 instantly using a market order or set a specific entry price using a limit order. Market orders execute immediately at the best available price, while limit orders wait until the market reaches your chosen level.

Step 3: Complete your purchase

Enter the amount of USDT you want to use and confirm your order. Once executed, your xU3O8 tokens will appear in your BingX Spot Wallet, where you can hold or trade them at any time.

Step 4: Monitor price movements with BingX tools

Use the integrated charting features, order book, depth data and BingX AI insights to track uranium-related price trends and stay informed about market activity.

Step 5: Withdraw to an external wallet if needed

If you prefer self-custody, you can withdraw xU3O8 to any wallet that supports its network. Always double-check the supported chain before withdrawing to avoid transfer issues.

Final Thoughts

Uranium has re-emerged as one of the most compelling commodity narratives in 2025, supported by long-term structural demand, nuclear energy expansion and the rapid rise of AI-driven power needs. At the same time, tokenization is reshaping how investors access real-world assets, opening new avenues for global participation in traditionally restricted markets.

As tokenized commodities continue to grow and the uranium market evolves, products like xU3O8 may play an increasingly meaningful role in the future of digital investing and real-world asset integration.

Related Reading

Frequently Asked Questions (FAQ) about Uranium (XU3O8)

1. What exactly does one xU3O8 token represent?

Each xU3O8 token represents a fractional ownership share of verified physical U₃O₈ held in a Cameco-operated storage facility. The uranium is held under a legal trust managed by Archax Ltd., and token holders are recognized as beneficial owners.

2. Is xU3O8 backed by real uranium or just tracking the price?

xU3O8 is fully backed by real uranium. Tokens are minted only when additional U₃O₈ is purchased and placed into the trust, ensuring supply directly reflects the physical inventory.

3. Can retail investors redeem physical uranium through xU3O8?

No. Due to regulatory and safety restrictions, physical redemption is limited to approved industrial entities. Retail investors gain exposure to uranium prices rather than receiving U₃O₈ directly.

4. How often does the supply of xU3O8 change?

Supply increases only when new uranium is added to the trust. A small daily mint to the project treasury covers storage and administrative costs, adjusting each holder’s proportional ownership over time.

5. Which wallets support xU3O8?

xU3O8 is issued on Etherlink, a Layer 2 within the Tezos ecosystem. It can be stored in Etherlink-compatible wallets, including Temple Wallet, Kukai Wallet,

Ledger (via Tezos apps) and other

Web3 wallets that support Tezos L2 networks.

6. What blockchain does xU3O8 use?

xU3O8 operates on Etherlink, a Tezos Layer 2 network. The smart contract ensures transparent ownership tracking and supply management.