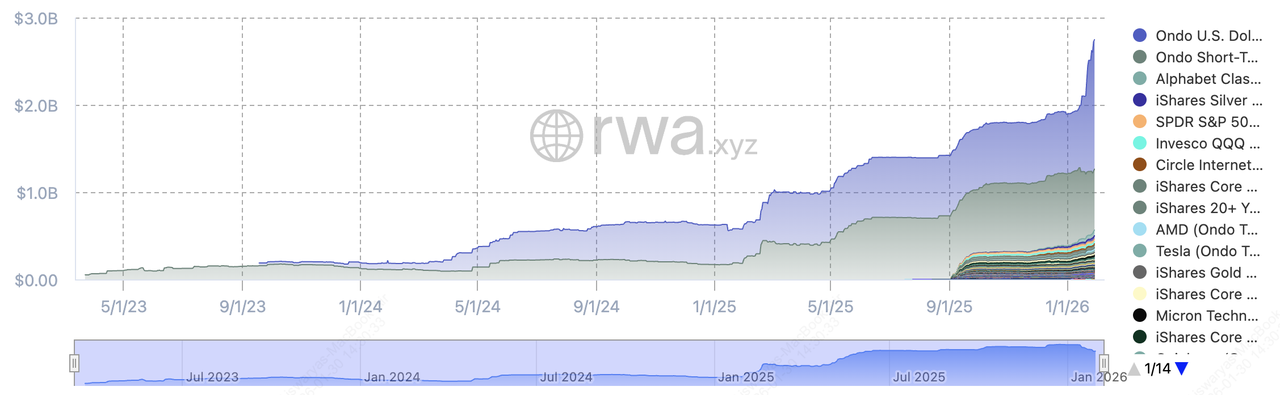

Ondo Finance is one of the largest

real-world asset (RWA) platforms in crypto, bringing institutional-grade U.S. Treasury yield on-chain through tokenized products like USDY and OUSG. As of early 2026, Ondo secures over $2.75 billion in TVL, dominates the tokenized Treasury market, and powers

on-chain access to conservative,

TradFi-style yield across multiple blockchains, while remaining fully aligned with regulatory and institutional standards.

Ondo Finance TVL | Source: RWA.xyz

In this article, you will learn what Ondo Finance is, how its tokenized Treasury products work, what role the

ONDO token plays in governance, and why Ondo has become a cornerstone of the fast-growing on-chain RWA economy.

What Is Ondo Finance (ONDO) RWA Tokenization Platform?

Ondo Finance is an RWA protocol that tokenizes institutional-grade U.S. Treasury exposure and delivers it on-chain as yield-bearing crypto tokens. Rather than relying on DeFi-native incentives, Ondo’s yield is generated off-chain from regulated short-term U.S. government securities, then wrapped into compliant on-chain products. As of early 2026, Ondo is one of the largest tokenized Treasury platforms globally, with over $2 billion in total value locked (TVL) across Ethereum and other major networks.

Ondo operates through two tightly connected pillars:

1. Tokenized asset products for asset management, including USDY, a

yield-bearing dollar token, and OUSG, tokenized short-term U.S. Treasuries backed by institutional asset managers.

2. On-chain infrastructure as the technology layer, including governance via the ONDO DAO, integrations with DeFi protocols like

Flux Finance, and upcoming infrastructure such as Ondo Chain to support compliant lending, collateralization, and settlement of RWAs at scale.

In 2025, Ondo accelerated from a niche RWA issuer into a core on-chain Treasury and tokenized markets platform. In addition to doubling its TVL, Ondo Finance expanded USDY and OUSG across multiple blockchains, and launched Ondo Nexus to improve liquidity and third-party issuance and

Ondo Global Markets.

Additionally, Ondo Global Markets, Ondo Finance’s tokenized securities platform, has driven over $6.8 billion in cumulative trading volume and surpassed $460 million in TVL since launching in September 2025. In a major milestone, Ondo expanded Global Markets to Solana, bringing over 200 tokenized U.S. stocks and ETFs, including equities, sector ETFs, leveraged products, and commodity-linked funds, to Solana’s 3.2 million+ daily active users, with trades settling against NASDAQ and NYSE liquidity and enabling million-dollar order sizes with near-zero slippage.

How Does Ondo Finance work?

Ondo replaces complex brokerage, custody, and settlement processes with programmable tokens, while keeping the underlying assets, controls, and risk profile firmly rooted in traditional finance. Ondo Finance follows a compliance-first tokenization model, combining traditional asset management with blockchain settlement.

1. Investor Onboarding and Eligibility Checks

Before minting or redeeming certain Ondo products, users must complete KYC/AML verification and jurisdictional eligibility checks. This step aligns Ondo’s products with securities-style regulatory requirements and restricts transfers to approved wallets where required.

2. Capital Deployment Into U.S. Treasuries

Approved users deposit funds, most commonly USDC. Ondo allocates this capital into short-term U.S. Treasury bills and cash equivalents, managed through regulated custodians and asset managers. Yield accrues off-chain from these traditional instruments.

3. Issuance Via Cohort-Based Minting

For USDY, Ondo uses a cohort and waiting-period model. After depositing funds, investors receive a Temporary Global Certificate as proof of investment. USDY tokens are minted and delivered on-chain after a 40–50 day settlement window, reflecting compliance and fund-structure requirements.

4. On-Chain Holding, Usage, and Redemption

Once minted, Ondo tokens can be held in a crypto wallet and, within permitted regions and protocols, used in supported DeFi applications. When redeeming, tokens are converted back through regulated off-ramps, such as bank wires, rather than purely on-chain swaps.

What Are the Key Products in the Ondo Finance Ecosystem?

Ondo Finance offers a growing suite of institutional-grade, on-chain financial products designed to tokenize real-world assets, distribute regulated yield, and provide the infrastructure needed to use traditional securities seamlessly within the blockchain ecosystem.

U.S. Dollar Yield Token (USDY)

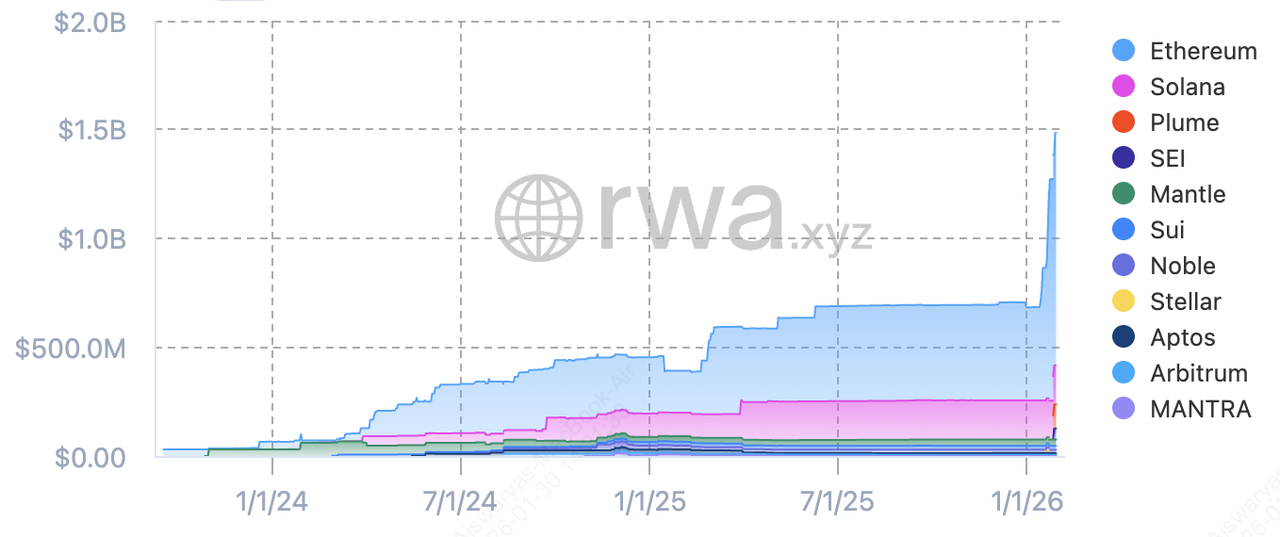

USDY total value by blockchain | Source: RWA.xyz

USDY is Ondo’s flagship yield-bearing dollar token, designed to combine the utility of a stablecoin with daily U.S. Treasury–backed yield. It is backed by a transparent portfolio of short-term U.S. Treasuries and cash equivalents, with daily third-party reserve attestations and a bankruptcy-remote structure. As of January 2026, USDY delivers around 3.55% APY, has grown to approximately $1.4 billion in TVL, and represents the largest single product within Ondo’s ecosystem, making it one of the biggest tokenized Treasury instruments globally.

Unlike traditional stablecoins, USDY accrues yield daily from off-chain Treasury exposure and offers two formats to suit different use cases: accumulating USDY, where yield is reflected through a rising token price, touching $1.12 in January 2026, and rebasing rUSDY, which maintains a $1 price while distributing yield via daily token rebases. Issuance follows a compliance-driven cohort model: eligible users complete KYC, deposit USDC, receive a Temporary Global Certificate, and receive minted USDY after a 40–50 day settlement window. Once issued, USDY is freely transferable, composable across major blockchains and DeFi protocols, and used for on-chain savings, collateral, lending, payments, treasury management, and cross-border settlements in supported jurisdictions.

Ondo Short-Term U.S. Treasuries (OUSG)

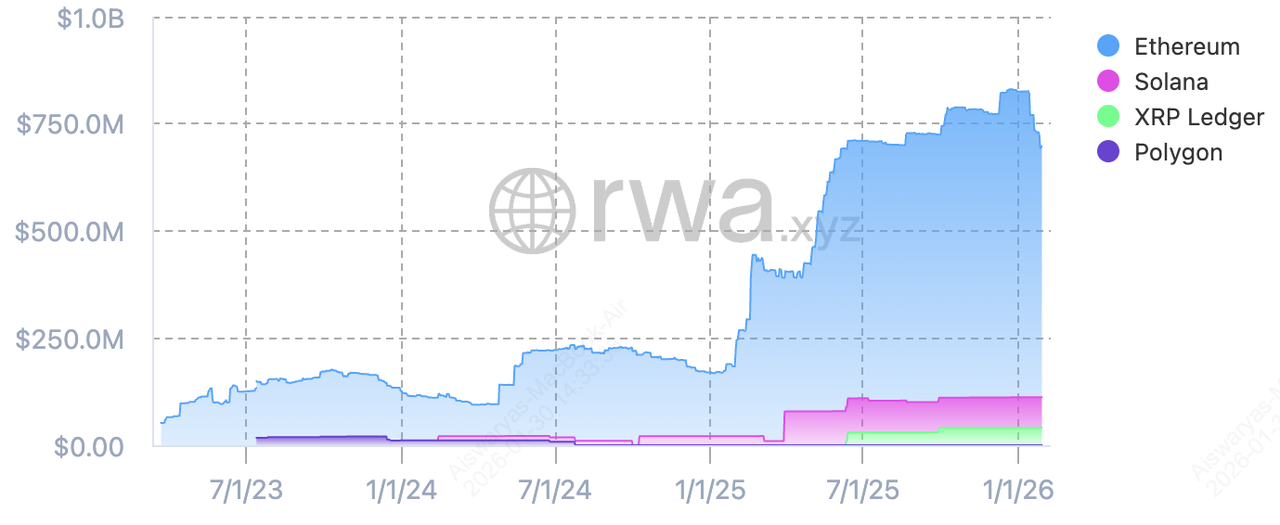

OUSG total value | Source: RWA.xyz

OUSG is Ondo’s institutional-grade, yield-bearing Treasury product, built specifically for accredited and qualified investors seeking low-volatility cash management on blockchain rails. It provides tokenized exposure to short-term U.S. Treasury bills and government money market funds, delivering approximately 3.49% APY as of January 2026. OUSG has grown to around $692 million in TVL, making it one of the largest on-chain Treasury funds by market capitalization, and a core pillar of Ondo’s $2B+ RWA ecosystem.

OUSG is structured as interests in a 3(c)(7) fund offered under Regulation D Rule 506(c) and is backed by a diversified portfolio managed by leading institutional partners, including BlackRock (BUIDL), Franklin Templeton, Fidelity, WisdomTree, and Wellington Management, alongside USDC and bank deposits for liquidity. The product supports 24/7 instant minting and redemption via USDC, with a $5,000 minimum and 0% mint/redeem fees, while management and fund expenses are capped at 0.15% with management fees waived until July 1, 2026. OUSG is available on Ethereum, Polygon, Solana, and XRPL, and is widely used for institutional treasury management, yield-bearing collateral in permissioned DeFi environments, bilateral settlement, and on-chain cash management strategies that prioritize capital preservation over speculative returns.

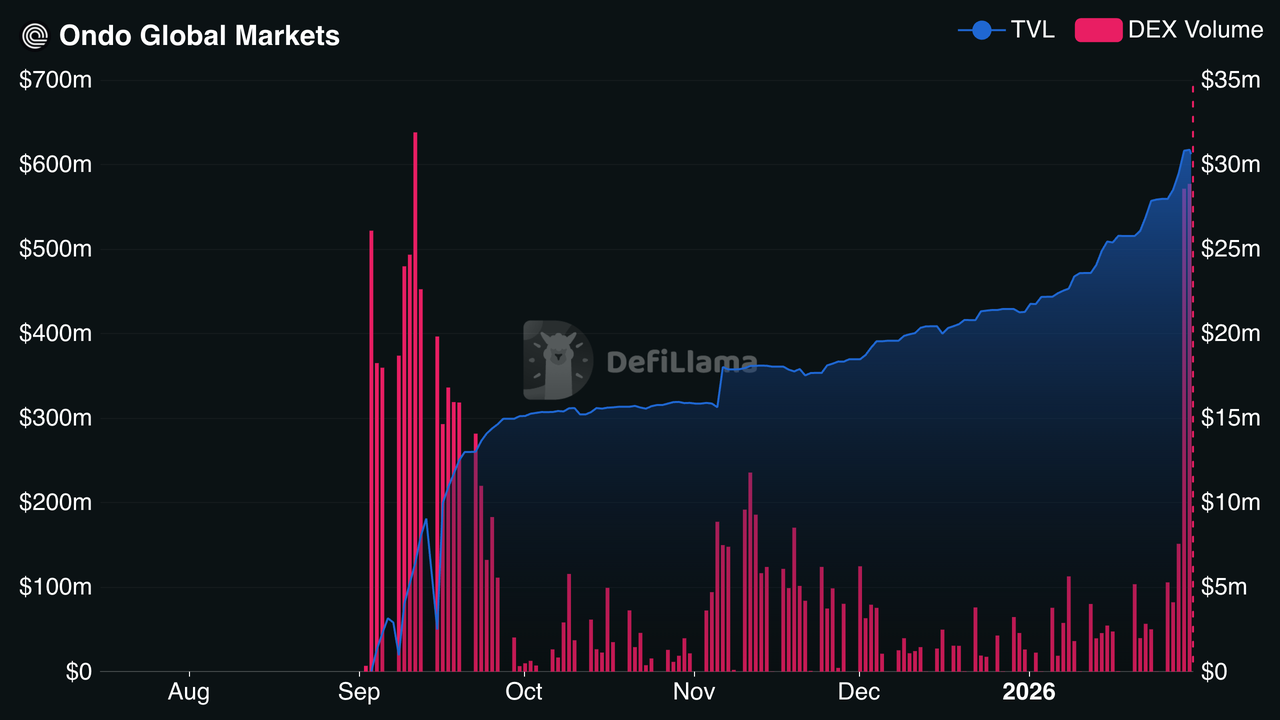

Ondo Global Markets

Ondo Global Market TVL and volume | Source: DefiLlama

Ondo Global Markets is Ondo’s platform for tokenized stocks, ETFs, and traditional securities, built primarily for non-U.S. investors seeking compliant, on-chain access to global capital markets. It has emerged as the world’s largest tokenized securities platform, recording over $6.8 billion in cumulative trading volume and over $460 million in TVL since launch. Assets are backed 1:1 by traditional securities and settle on blockchain rails, while sourcing liquidity directly from major U.S. exchanges rather than on-chain pools, enabling brokerage-level pricing and million-dollar trade sizes with near-zero slippage.

A major expansion in January 2026 brought over 200

tokenized U.S. stocks and ETFs to Solana, making Ondo Global Markets the largest RWA issuer on Solana by asset count and opening access to 3.2M daily active users. The catalog spans blue-chip equities, growth and tech stocks, broad-market and sector ETFs, leveraged long/short ETFs, and commodity-linked funds, including gold and silver like

SLVon, underscoring strong demand for scalable, institutional-grade on-chain access to U.S. and global markets, without relying on traditional brokerage infrastructure.

Ondo Chain

Ondo Chain is a public, proof-of-stake Layer 1 blockchain purpose-built for institutional-grade real-world assets, designed to move capital markets on-chain at scale rather than optimize for general-purpose DeFi. Unlike traditional L1s, Ondo Chain embeds RWA-specific primitives directly at the protocol level, including enshrined oracles, on-chain proof of reserves, and permissioned institutional validators. Validators, expected to include regulated financial institutions, can stake RWAs and high-quality liquid assets to secure the network, bridges, and oracle systems, while being monitored to prevent front-running and enforce best execution.

The network is engineered to support compliant lending, borrowing, staking, collateralization, and cross-chain issuance of tokenized securities, with native bridging enabled through Ondo’s decentralized verifier network (DVN) and multi-attestation architecture. By sourcing liquidity directly from traditional financial venues and allowing features such as gas fees payable in RWAs, Ondo Chain reduces latency and operational friction for institutions while remaining open to developers and users.

In practice, Ondo Chain serves as the settlement and execution layer for products like Ondo Global Markets, enabling use cases such as prime brokerage, cross-collateralization between crypto and RWAs, on-chain wealth management, and large-scale tokenized fund distribution, all while preserving regulatory safeguards and transparency that general-purpose blockchains were not designed to provide.

Additional Ondo Ecosystem Components

• Flux Finance: A decentralized lending protocol governed by the Ondo DAO, built on Compound-style architecture, enabling borrowing and lending using both permissioned RWAs (like OUSG) and open-access assets.

• Ondo Nexus: Liquidity and issuance infrastructure that connects third-party RWA issuers to Ondo’s ecosystem, helping accelerate the growth of tokenized assets on-chain.

• Ondo Bridge: Cross-chain infrastructure that allows Ondo-issued assets to move between supported blockchains while maintaining compliance controls.

• Ondo Converter: A utility layer that facilitates conversions between tokenized assets, yield-bearing variants, and supported settlement assets such as stablecoins.

What Is the ONDO Token Used for?

The ONDO token is the governance backbone of the Ondo ecosystem, giving holders direct control over how one of the largest on-chain RWA platforms evolves over time. Governance is executed through the Ondo DAO, where ONDO holders shape both protocol-level rules and capital allocation decisions.

In practical terms, ONDO is used to:

• Vote on protocol governance: Approve or reject proposals covering market parameters, oracle updates, asset listings, protocol pauses, and upgrades across Ondo-linked protocols such as Flux Finance.

• Control emissions and incentives: Decide how ONDO emissions are allocated to incentivize liquidity, adoption of tokenized RWAs, and ecosystem growth.

• Treasury oversight: Participate in decisions on treasury deployment, partnerships, and long-term funding strategies tied to Ondo’s expansion into tokenized Treasuries, equities, and global markets.

• Delegated governance: Delegate voting power to other participants, enabling more active governance even for passive holders.

Note: ONDO does not represent direct exposure to Treasury yield itself; instead, its value is tied to governance power over the infrastructure and rules governing one of the fastest-growing institutional RWA ecosystems in crypto.

How to Trade Ondo Finance (ONDO) on BingX

Powered by BingX AI insights, BingX combines real-time market analytics, trend signals, and risk indicators to help you trade ONDO more efficiently across both spot and derivatives markets.

How to Buy or Sell ONDO Tokens on the Spot Market

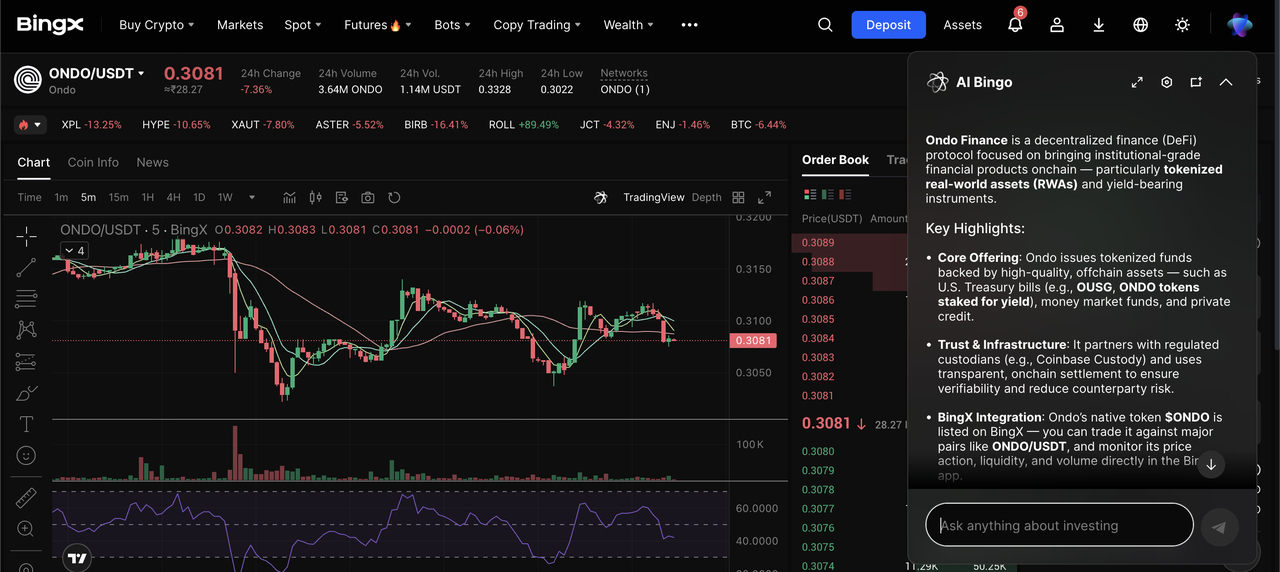

ONDO/USDT trading pair on the spot market powered by BingX AI insights

Long or Short ONDO with Leverage on the Futures Market

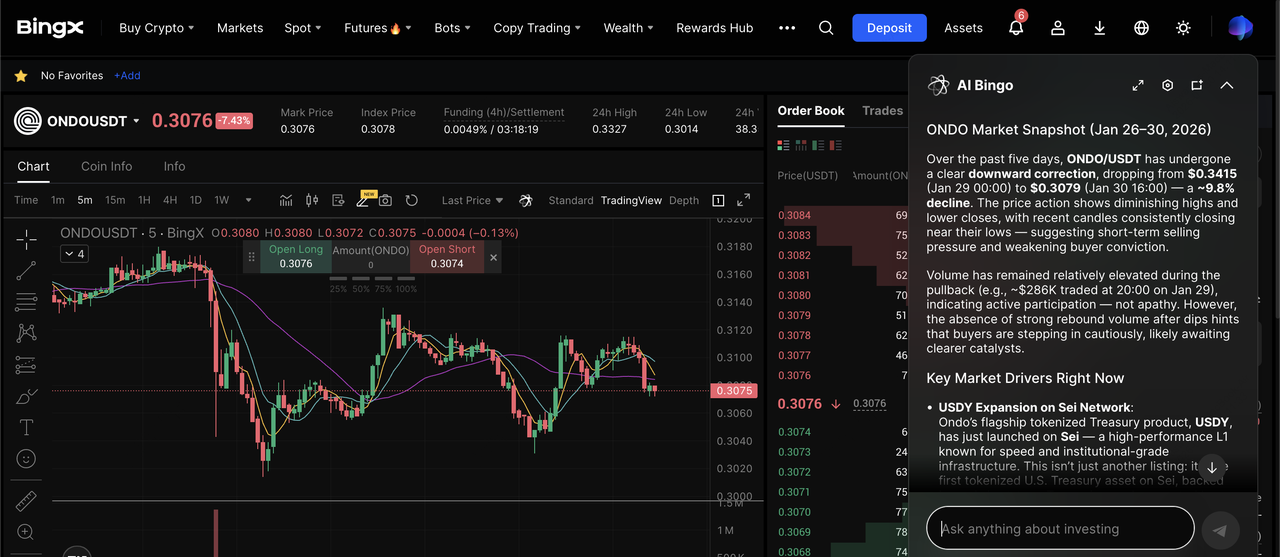

ONDO/USDT perpetual contract on the futures market powered by BingX AI

2. Open a long or short position: Use BingX Futures to go long if you expect ONDO’s price to rise or short if you expect a decline, applying leverage carefully while monitoring margin and

liquidation risks.

Pro Tip: Spot trading is generally suited for long-term exposure, while futures trading is designed for experienced traders seeking short-term strategies or hedging; always

manage risk accordingly.

3 Key Considerations Before Investing in Ondo Finance (ONDO)

Before investing in ONDO or using Ondo’s tokenized RWA products, it’s important to understand the structural and market risks that come with blending traditional finance and blockchain infrastructure.

1. Regulatory and eligibility constraints: Many Ondo products involve KYC/AML checks, jurisdictional limits, and transfer restrictions, meaning access and usability can vary by region and investor status.

2. Off-chain dependency risk: While settlement occurs on-chain, the underlying assets rely on traditional custodians, asset managers, and legal structures, introducing counterparty and operational risk typical of institutional finance.

3. ONDO token volatility: ONDO is a governance token, not a yield-bearing asset, and its price can fluctuate significantly even when underlying Treasury-backed products remain stable; treat it as a market-risk crypto asset, not a proxy for fixed income.

Final Thoughts: Should You Buy Ondo Finance (ONDO) in 2026?

Ondo Finance sits at the center of one of crypto’s fastest-growing sectors: tokenized real-world assets, with more than $2 billion in TVL, deep institutional partnerships, and products like USDY and OUSG that bring U.S. Treasury yield on-chain at scale. If the long-term trend toward compliant, on-chain capital markets continues, Ondo’s infrastructure, and the governance role of ONDO, positions it as a key beneficiary of that shift.

That said, ONDO is not a yield token and does not provide direct exposure to Treasury returns; it is a governance asset whose value depends on ecosystem growth, adoption, and market sentiment. As with any crypto asset, price volatility, regulatory changes, and execution risk remain important considerations. If you’re evaluating ONDO in 2026, treat it as a long-term infrastructure and governance bet, not a substitute for fixed-income yield, and size your exposure accordingly.

Related Reading