Crude oil remains the lifeblood of the global economy, and in 2026, the intersection of energy markets and blockchain technology has reached a fever pitch. While traditional oil trading often requires complex brokerage setups, the rise of "Oil-Themed Coins" and

Real-World Asset (RWA) tokens like

U.S. Oil Reserve (USOR) has opened the doors for crypto-native traders to gain exposure to black gold directly on-chain.

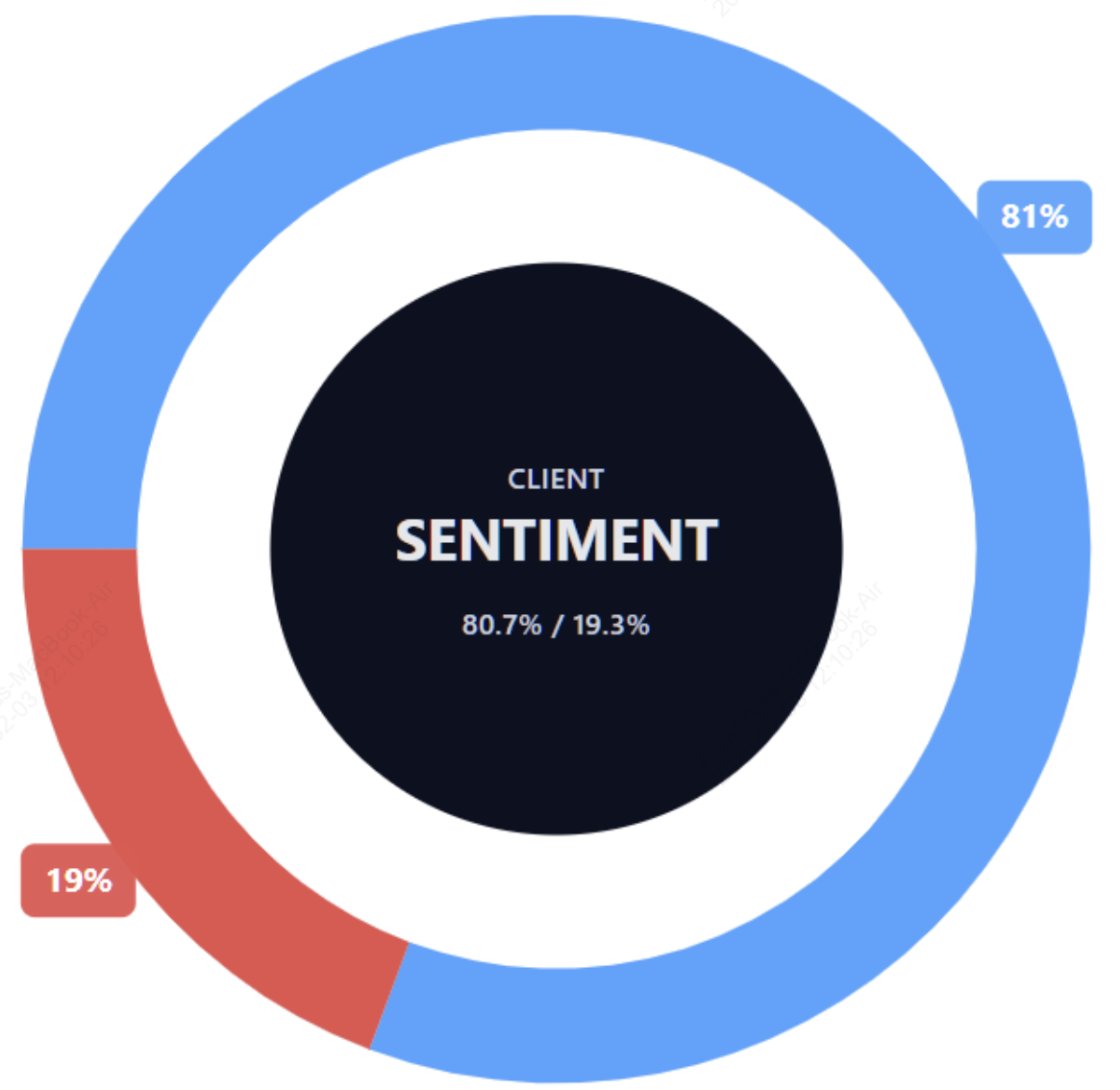

Investor sentiment toward crude oil | Source: Capital.com

The year 2026 is a "two-speed" market for crude. While structural oversupply keeps a lid on prices, with a Reuters poll projecting

Brent at $61.27 and

WTI at $58.15, geopolitical "tail risks" remain sharp. Analysts at BloombergNEF have warned that any significant disruption to Iranian exports could propel Brent toward $91 per barrel by Q4 2026. This volatility makes oil-themed assets some of the most sought-after plays for macro-driven traders.

Why Are Oil-Themed Coins Trending in 2026?

Oil-themed tokens have surged in 2026 as investors increasingly pivot toward RWA narratives that offer 24/7 liquidity and high-frequency speculative opportunities. Unlike traditional ETFs like USO, which are subject to stock market hours and management fees, these digital assets allow traders to front-run geopolitical headlines in real-time. In January 2026 alone, tokens like

USOR recorded 24-hour trading volumes exceeding $27 million, frequently outperforming the underlying commodity’s volatility by 10x or more as narrative-driven momentum takes precedence over Brent or WTI spot prices.

This trend is fueled by a shift in global market structure where AI-driven sentiment and decentralized liquidity redefine commodity exposure. With a median entry cost of less than $10, these assets provide:

• Narrative Front-Running: Capitalize on unverified on-chain "alpha," such as institutional wallet labels or political rumors, that traditional markets cannot react to instantly.

• High-Beta Exposure: Tokens often defy the "supply glut" forecasts of 2026, where WTI is projected to average $59/bbl, by generating triple-digit percentage gains through community-led hype cycles.

• Seamless On-Chain Hedging: Professional traders use crypto-native oil tokens to hedge against inflation and rising energy costs directly from their

Base or

Solana wallets, bypassing the complexity of futures contracts.

Top Oil-Themed Asset: U.S. Oil Reserve (USOR)

The standout performer of early 2026 is U.S. Oil Reserve (USOR). Built on the

Solana blockchain, USOR has captured the RWA Narrative by positioning itself as a crypto-native way to bet on U.S. energy independence and strategic reserve headlines.

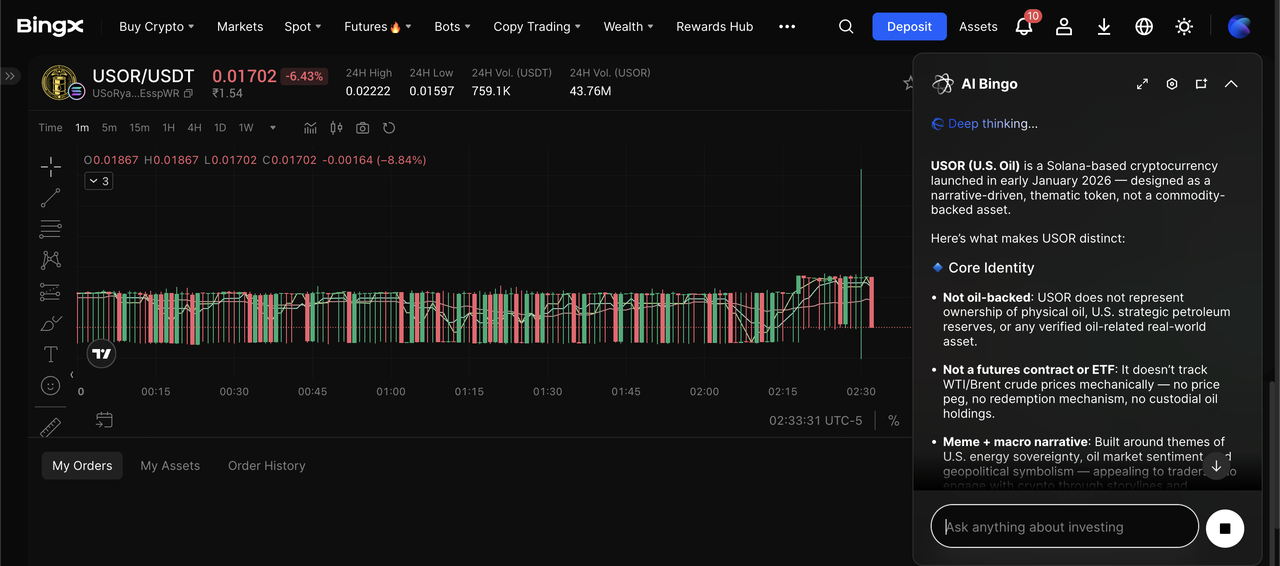

What Is USOR?

U.S. Oil Reserve (USOR) is a Solana-native SPL token that debuted in early January 2026, positioning itself as a "digital-age oil reserve." While its branding suggests a link to physical commodities, USOR functions primarily as a high-speed, narrative-driven asset on the Solana blockchain. Instead of being backed by physical barrels of crude, its "reserve" typically consists of a treasury of blue-chip cryptocurrencies, making its value more sensitive to crypto market health and geopolitical sentiment than traditional energy futures.

The project gained massive hype by leveraging "Trump-era" pro-crypto sentiment and unverified rumors of "Trump Team" or "BlackRock-linked" wallet accumulation identified through on-chain heuristics. This "narrative front-running" drove explosive market performance, with USOR peaking at a $55 million market cap and $27.4 million in 24-hour volume in late January 2026. However, as of early February, the token remains highly volatile, experiencing sharp liquidity cascades and triple-digit swings as traders treat it as a high-leverage proxy for U.S. energy independence headlines.

Learn more about

how USOR works and where to buy it in our detailed breakdown.

How to Trade U.S. Oil (USOR) on BingX ChainSpot

USOR/USDT trading pair on ChainSpot powerred by BingX AI insights

BingX ChainSpot allows you to trade on-chain tokens like USOR directly using your Spot USDT balance.

2. Access ChainSpot: Navigate to the Spot tab and select ChainSpot.

4. Execute: Review the on-chain liquidity and confirm your trade. Your USOR will be reflected in your Spot balance instantly.

Other Top Oil-Themed Cryptos: Beyond the Benchmarks

While USOR and futures provide direct exposure to the RWA and macro cycles of 2026, several other tokens have attempted to capture the "energy narrative" on-chain. Below are the key players and their current market status:

1. Digital Oil Memecoin (OIL)

Digital Oil Memecoin is a

Solana-based memecoin that adopts the "commodity narrative" of crude oil. It markets itself using the concept of "digital barrels of oil," blending energy market humor and geopolitical themes with Web3 culture. Technically, Digital Oil is categorized as a memecoin because it prioritizes social sentiment and narrative-driven growth over traditional utility or complex technological innovation. The project focuses heavily on digital engagement through platforms like X and Telegram, utilizing humor and commodity-related metaphors, such as references to "cross-continental digital pipelines," to build a following.

2. Oil Token (OIL)

Positioned as a decentralized mining and investment platform, Oil Token aims to bridge blockchain technology with real energy-sector assets on the

Arbitrum network. It enables independent traders and financial organizations to acquire and manage tokenized commodities, transforming traditional oil investments into digital, transparent, and accessible instruments. The platform ensures transparent profit distribution, allowing investors to earn income from both rising market value and physical oil production. Holding the OIL token in a wallet acts as an "entrance ticket" to the decision-making apparatus of what the project describes as a large-scale economic corporation.

3. Wrapped OIL (wOIL)

wOIL is a wrapped representation of oil-based assets designed to bring crude oil exposure into the DeFi ecosystem, particularly through decentralized exchanges like

PancakeSwap. As a wrapped token, wOIL allows users to hold or provide liquidity for oil-indexed assets within smart contract platforms, earning rewards in the form of trading fees. These fees are generated whenever trades occur within the liquidity pool, providing a way for users to earn passive income while maintaining exposure to oil-themed price movements. However, like all wrapped assets, users must be aware of the underlying peg and the security of the bridging mechanism used to mint the token.

4. Petro (PTR)

Once the most famous sovereign digital currency, the Petro was a Venezuelan state-sponsored project backed by the country’s vast oil and gas reserves. Launched in 2018 to bypass U.S. sanctions and combat hyperinflation, it ultimately functioned more like a centralized government database than a true blockchain-based cryptocurrency. The project collapsed in January 2024 following years of limited adoption, skepticism regarding its physical backing, and a major corruption scandal involving the head of Venezuela’s crypto regulator. The failure of the Petro underscores the immense challenges of state-led crypto initiatives and the critical importance of transparency and trust in digital assets.

WTI and Brent Oil Perpetual Futures for Precision Trading

For traders seeking to track actual crude oil prices with institutional-grade accuracy,

crude oil perpetual futures on

BingX TradFi are the industry gold standard. Unlike narrative-based tokens, these contracts are mathematically pegged to the spot prices of the world’s most critical energy benchmarks, offering up to 500x leverage for maximum capital efficiency.

WTI vs. Brent: Which Crude Oil Benchmark Suits Your Strategy?

Understanding the data behind the two primary oil benchmarks is essential for timing entries and managing risk.

• WTI (West Texas Intermediate): WTI is a light, low-sulfur crude oil sourced mainly from the Permian Basin and other landlocked U.S. fields, with physical settlement at Cushing, Oklahoma, often called the “Pipeline Crossroads of the World.” It is widely used as the primary benchmark for U.S. oil prices and closely reflects domestic supply, shale production, and infrastructure dynamics. Traders typically use WTI to speculate on the health of the U.S. economy and energy independence, closely monitoring weekly EIA inventory data and movements in the U.S. Dollar Index (DXY), as falling inventories or a weaker dollar often support higher WTI prices.

• Brent (International): Brent Crude is produced from offshore North Sea fields such as Brent, Forties, and Ekofisk and serves as the pricing reference for roughly two-thirds of globally traded oil. Its offshore production allows easy tanker transport, making Brent more responsive to international trade flows and geopolitical developments than WTI. Traders favor Brent when positioning around global demand shifts, OPEC+ policy decisions, and geopolitical risks, particularly in the Middle East and key shipping routes, since supply disruptions or coordinated production cuts often trigger faster and larger price reactions in Brent markets.

Why Trade Oil Futures with Crypto?

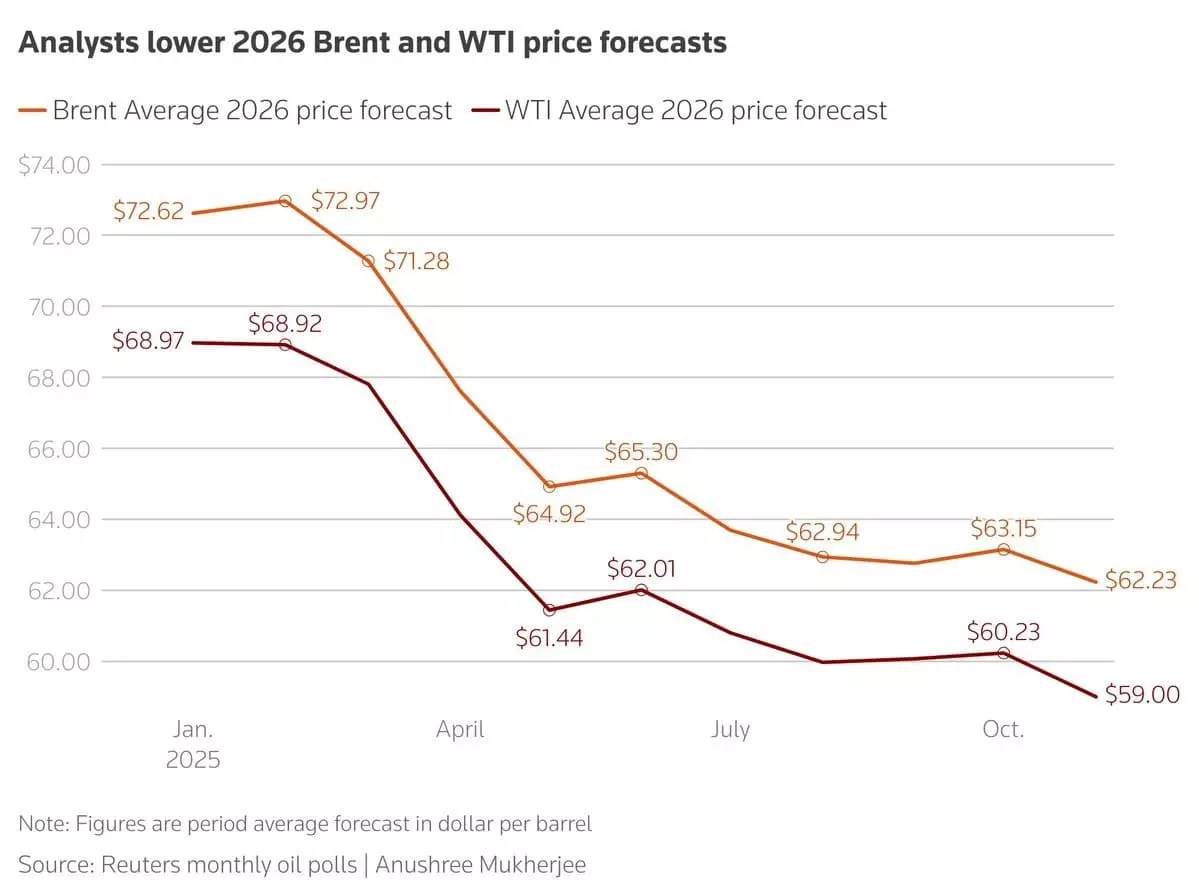

Crude oil forecasts for 2026 | Source: Reuters

Trading oil futures with crypto on BingX lets you use USDT as collateral, removing the need for a traditional commodities broker, margin account, or bank-based settlement. You can trade WTI and Brent-style oil benchmarks directly alongside crypto assets, with instant margining, real-time PnL, and 24/7 account access—making it easier to react to macro news, inventory data, or geopolitical events the moment they break.

• Deep Liquidity and Tight Spreads: Enter and exit large positions efficiently, even around high-impact events like EIA inventory releases or OPEC+ announcements, with reduced slippage compared to smaller venues.

• High Leverage of Up to 500x: Deploy capital efficiently for short-term macro trades or range strategies, especially in the $55–$65 oil band widely projected for 2026, where small price moves can still be monetized.

• Full Directional Control: Go long or short in one click, allowing you to capitalize on oversupply-driven downside pressure highlighted by major outlooks from Goldman Sachs and Reuters, without borrowing assets or managing complex derivatives infrastructure.

How to Trade WTI and Brent Oil Futures on BingX: Step-by-Step Guide

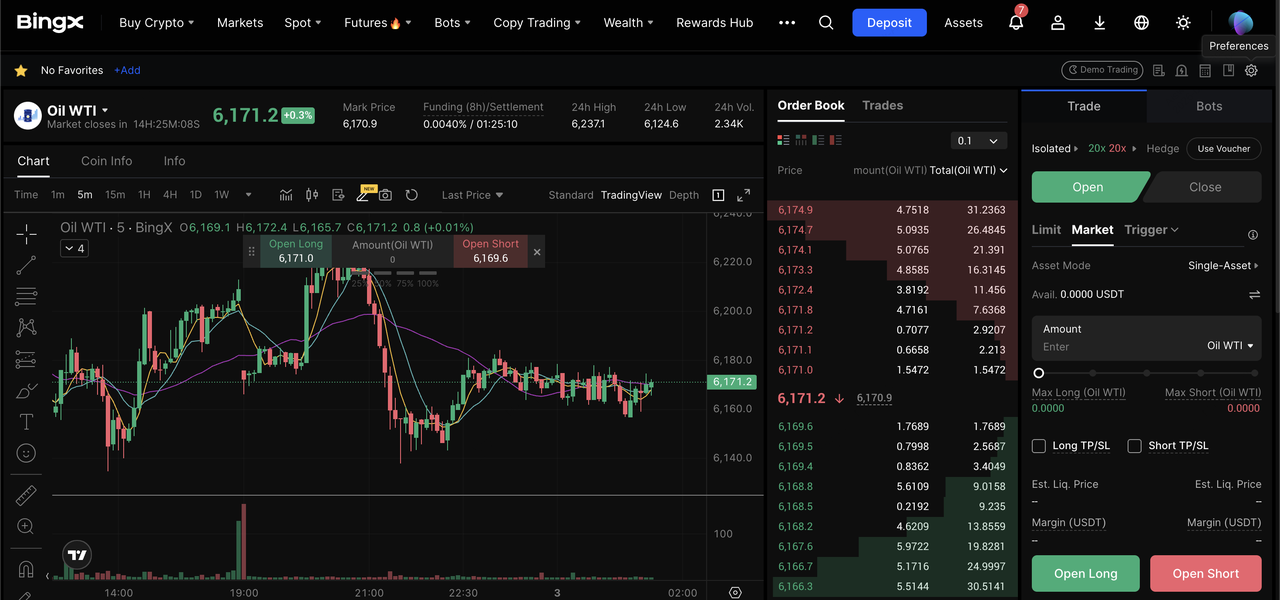

WTI oil perpetual futures on the BingX futures market

If you prefer benchmark-linked exposure over narrative tokens, follow these steps to trade WTI or Brent on BingX Futures:

1. Transfer USDT: Move USDT into your Futures Account.

2. Select Contract: Go to the Futures tab, choose USD-Margined Perpetuals, and search for

Oil WTI or

Oil Brent.

3. Analyze the Chart: Look for key levels. For instance, as of February 2026, WTI has seen strong support near $57.68, while Brent faces resistance at $63.80.

4. Set Leverage & Order: Choose your leverage carefully as oil can "gap" during weekend closes and place a

Limit or Market order.

Risk reminder: Trading oil futures with leverage involves significant risk of capital loss. Unlike the 24/7 crypto market, commodity futures operate in defined sessions. This creates "gap risk," where prices may jump significantly upon market reopen, potentially bypassing your Stop-Loss levels and leading to liquidation. Always maintain a healthy margin buffer and avoid excessive leverage during high-impact geopolitical events.

USOR vs. Crude Oil Futures: Which Is Right for You?

Choosing between these assets depends on whether you prioritize speculative momentum or macroeconomic precision. USOR operates as a high-volatility, Solana-based RWA narrative token with a $18 million market cap and circulating supply of 1 billion tokens. It is characterized by extreme price swings, notably gaining nearly 200% in a single week in January 2026, making it ideal for spot traders seeking to capitalize on "oil hype" and liquidity-driven pumps within the DeFi ecosystem without the complexities of leverage or session-based trading breaks.

| Feature |

USOR (ChainSpot) |

WTI/Brent Futures |

| Asset Type |

Solana-based Token |

Derivative Contract |

| Tracking |

Narrative/Sentiment |

Real Oil Benchmarks |

| Leverage |

No (Spot-based) |

Up to 500x |

| Best For |

Narrative pumps & RWA hype |

Professional macro hedging |

| Trading Hours |

24/7 |

Session-based (Closed Sundays) |

Conversely, WTI and Brent Perpetual Futures are designed for disciplined macro traders aiming to capture the $55–$65 annual average price targets projected by Reuters and the EIA. These derivative contracts offer up to 500x leverage and track real-world benchmarks with mathematical accuracy, allowing you to hedge against specific geopolitical "tail risks," such as the $91 Brent spike scenario. While USOR provides 24/7 narrative exposure, futures offer the professional tools needed to go short during a supply surplus or execute precise entries using key technical levels like the $57.68 WTI pivot.

Final Thoughts: How Crypto Traders Can Navigate the 2026 Energy Cycle

Whether you choose the high-momentum volatility of USOR or the structured precision of WTI/Brent Futures, crude oil remains a foundational asset for any diversified 2026 portfolio. As the market enters a period of structural divergence, the primary narrative is one of surplus management. Most analysts, including those from Reuters and J.P. Morgan, expect prices to remain under pressure. In this environment, the most successful traders will be those who remain agile, using technical pivots to guide their entries and exits.

However, it is essential to remember that all oil-linked assets carry significant risk. Markets in 2026 are highly sensitive to "tail risks," such as sudden geopolitical shifts in the Middle East or changes in OPEC+ production policy, which can cause rapid price reversals that bypass standard stop-loss orders. When trading with crypto, leverage can amplify these moves, leading to accelerated losses or liquidation. Always employ a disciplined

risk management strategy, keep your position sizes manageable, and never trade more than you can afford to lose.

Related Reading