Avici (AVICI) is a

Solana-native, self-custodial

neobank that aims to make crypto spendable in real life without forcing you to sell your holdings. Its core product is a Visa card tied to an on-chain smart wallet, so you can top up with crypto, pay anywhere Visa is accepted, and still keep control of your funds. Avici also offers virtual USD/EUR bank accounts for fiat on-ramps, and it plans to expand into on-chain credit scoring, lending, and even mortgages.

Since its October 2025 token launch, AVICI has surged more than 370% in a single month, rising from its $0.50 ICO price to over $6.15 as user growth, card adoption, and on-chain activity accelerated. In this article, you’ll learn what Avici is, how its self-custodial banking stack works, what AVICI does in the ecosystem, the project’s tokenomics, and how you can buy or trade AVICI on BingX.

What Is Avici Self-Custody Bank and How Does It Work?

Avici is building an “internet-native bank” for crypto holders. Instead of parking assets with a centralized exchange or a traditional bank, you hold funds in an Avici smart-contract wallet and spend through a Visa credit card. The idea is simple: hold crypto, get spending power, and withdraw anytime, without handing over ownership.

Avici positions itself as more than a reskinned crypto card. It’s trying to become a full self-custody financial layer where crypto behaves like a real bank account: receive fiat salary or wire transfers, convert to stablecoins on-chain, spend globally, and later access credit products that don’t rely on banks.

Avici Products and Key Features

At a high level, Avici works through three connected parts:

Avici Wallet + Card + Virtual Accounts: All-in-One Self-Custodial Banking Stack

Avici’s core banking experience is built around a seamless trio: a smart-contract wallet, a Visa card, and virtual bank accounts, working together as one self-custodial financial layer.

1. Avici Wallet (Self-Custodial Smart Wallet): The Avici wallet uses account abstraction and passkeys instead of traditional seed phrases, making self-custody feel like a familiar Web2 login. Every transaction requires biometric/passkey approval, and Avici sponsors gas on supported EVM networks and Solana, except

Ethereum mainnet. You can receive any ERC-20 or SPL token, swap across chains with low friction, and manage your entire balance from a single interface.

2. Avici Visa Card (Virtual + Physical): Once your wallet is funded, you can generate a virtual Visa card in minutes, or order a physical card for offline use. The card works at any Visa merchant and supports Apple Pay and Google Pay for tap-to-pay. You can also create multiple category-based cards for subscriptions, groceries, travel, etc., for cleaner budgeting. There are $0 card transaction fees and 0% Avici FX fees, while Visa may apply small cross-border charges; ATM withdrawals follow a standard fixed fee.

3. Virtual USD/EUR Bank Accounts (Fiat On-Ramp): Avici also provides USD and EUR virtual bank accounts powered by Bridge. These accounts let you receive payments via Wire, ACH, or SEPA directly in your name. Incoming fiat is automatically converted into

USDC and credited to your Avici wallet, instantly spendable via your Visa card.

What’s Coming Next on the Avici Roadmap?

What Sets Avici Apart From Other Crypto-Friendly Banks?

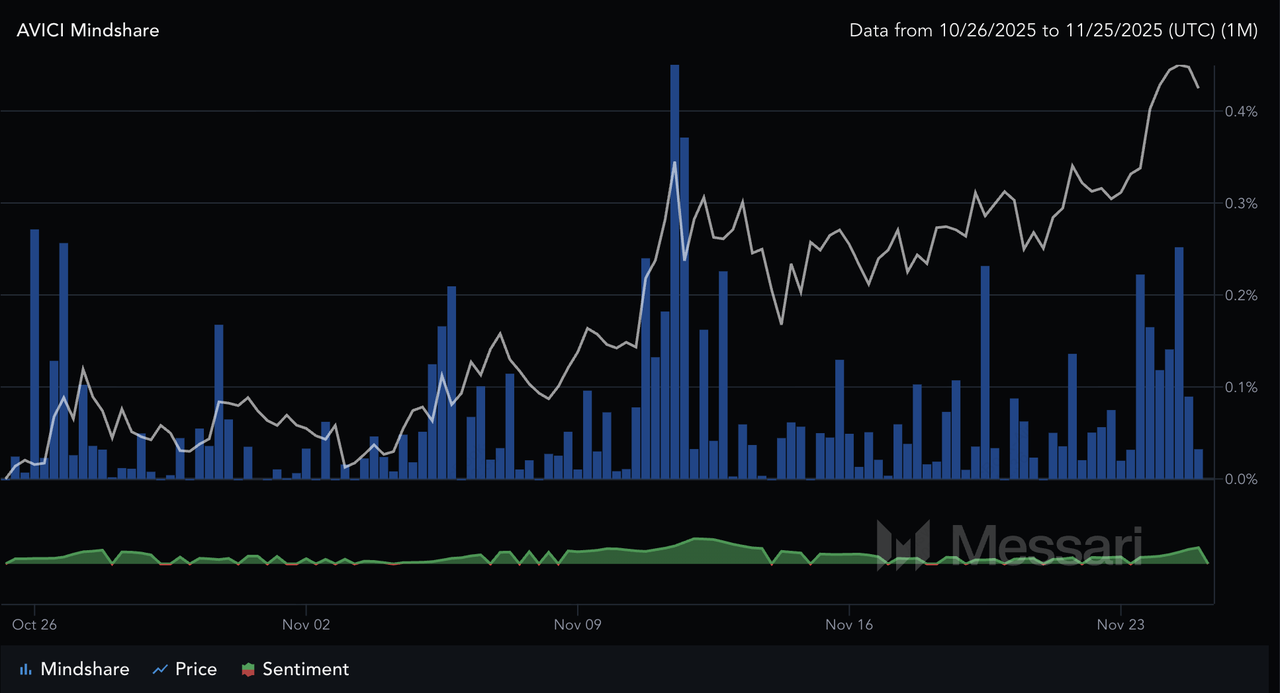

Avici's mindshare and sentiment on the rise | Source: Messari

Most crypto cards today work like custodial prepaid cards - you deposit funds into a company-controlled wallet, and they decide how, when, and where those funds can be used. Avici takes the opposite approach. It gives you a

self-custodial smart wallet, where you control your assets, and pairs it with a Visa credit line backed by your own crypto.

Instead of selling your

ETH,

SOL, USDC, or other assets to pay for daily expenses, you simply draw spending power from them while keeping full exposure to potential price upside. This is especially useful in bull markets: you can buy groceries, travel, or shop online without missing out on a 10%, 50%, or even 100% move in your long-term holdings.

Avici also stands out because its banking stack is designed to feel familiar to beginners. You log in using social accounts, approve transactions with biometrics, receive USD/EUR via Wire/ACH/SEPA, and tap-to-pay using Apple Pay or Google Pay, all while your funds remain on-chain and under your control. No seed phrases. No complex signing. No custodial risk.

What Made Avici's Token Launch on MetaDAO Unique?

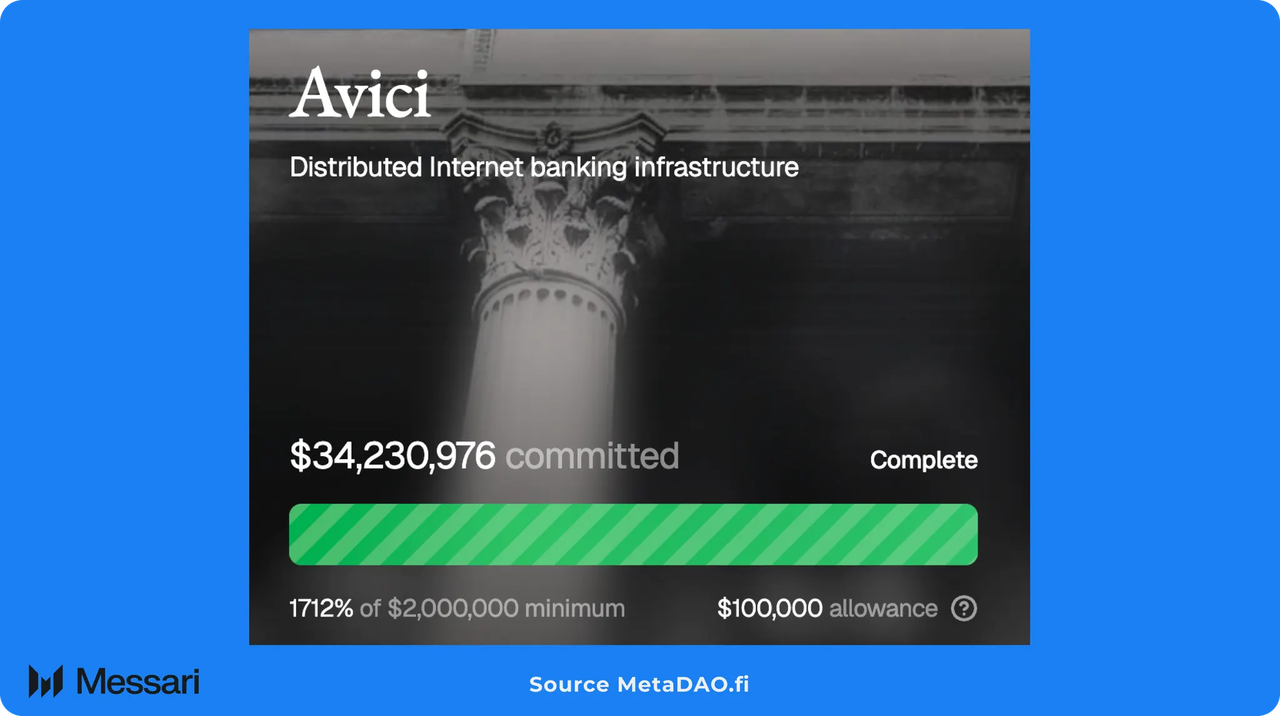

Avici token sale on MetaDAO | Source: Messari

The AVICI token launch stood out because Avici skipped the usual VC-heavy fundraising model and instead opted for a public, on-chain token sale through

MetaDAO, a Solana-based Internet Capital Markets (ICM) platform known for creating “unruggable ICOs.” This structure uses futarchy-driven governance,

AMM-based liquidity provisioning, and transparent treasury rules to make token launches fair, accountable, and resistant to manipulation. For Avici, this meant a sale where everyone participated on equal terms, with no private allocations, no discounted rounds, and no insider vesting cliffs.

A major differentiator was Avici’s commitment to 0% team allocation. Founders received no initial token supply, removing the usual insider overhang and reducing early sell pressure, one of the biggest risks in most new token launches. Of the 12.9 million total AVICI supply, 77.5% went directly to the public, while the remaining 22.5% was used for liquidity.

MetaDAO’s capped, refundable ICO model ensured fairness: if contributions exceeded the cap, tokens were distributed pro-rata and all excess funds were automatically refunded. After the raise, a portion of both tokens and USDC was deposited into an AMM pool, and MetaDAO’s treasury stabilized price by automatically buying below ICO price and selling above it.

The results validated demand. Avici raised $34.2 million, kept $3.5 million, and refunded the rest, nearly a 10× oversubscription. AVICI listed at $0.50 during its MetaDAO ICO in October 2025, shortly after the sale concluded. Following strong post-launch demand and rapid card adoption metrics, the token climbed to an all-time high of $5.94 in early November 2025. During this period, AVICI’s circulating market cap expanded from roughly $12 million at launch to approximately $77 million by late November 2025, reflecting a combination of oversubscription momentum, community-driven ownership, and growing user activity. For users, this meant entering an ecosystem that was community-owned from day one, structurally resistant to insider manipulation, and aligned with the project’s core message of self-custody and user sovereignty.

What Is the AVICI Token Utility?

AVICI is designed as the governance and coordination token of the Avici ecosystem. Its primary utility is to give holders influence over major decisions in the Avici DAO, including future token allocations, treasury spending, credit-system parameters, and smart-wallet/relayer rules. Because the team holds 0 tokens, AVICI holders have real authority over long-term direction.

As Avici rolls out its zk-credit score, lending via Avici Earn, and future banking products, AVICI is expected to become the core governance asset that determines how these systems evolve, how incentives are distributed, and how the ecosystem’s credit and spending infrastructure scales.

Avici (AVICI) Tokenomics

AVICI has one of the smallest fixed supplies among Solana-based financial tokens, with 12.9 million tokens and a distribution model built around fairness and community ownership.

AVICI Token Allocation Breakdown

• 10,000,000 AVICI (77.5%) — ICO Tokens: Sold directly to the public through MetaDAO's Internet Capital Markets system.

• 2,900,000 AVICI (22.5%) — Liquidity Provision

- 2,000,000 AVICI deposited into the Futarchy AMM

- 900,000 AVICI added to a Meteora liquidity pool

• 0 AVICI — Team Allocation: The team intentionally received no tokens at launch; any future allocation must be approved by the community through a decision-market proposal in the Avici DAO.

How to Trade Avici (AVICI) on BingX

Trading AVICI on BingX is fast, intuitive, and supported by real-time insights from

BingX AI. You can buy and hold AVICI on the Spot Market, or trade short-term price movements with Futures if you prefer directional exposure with leverage.

Buy or Sell AVICI on the Spot Market

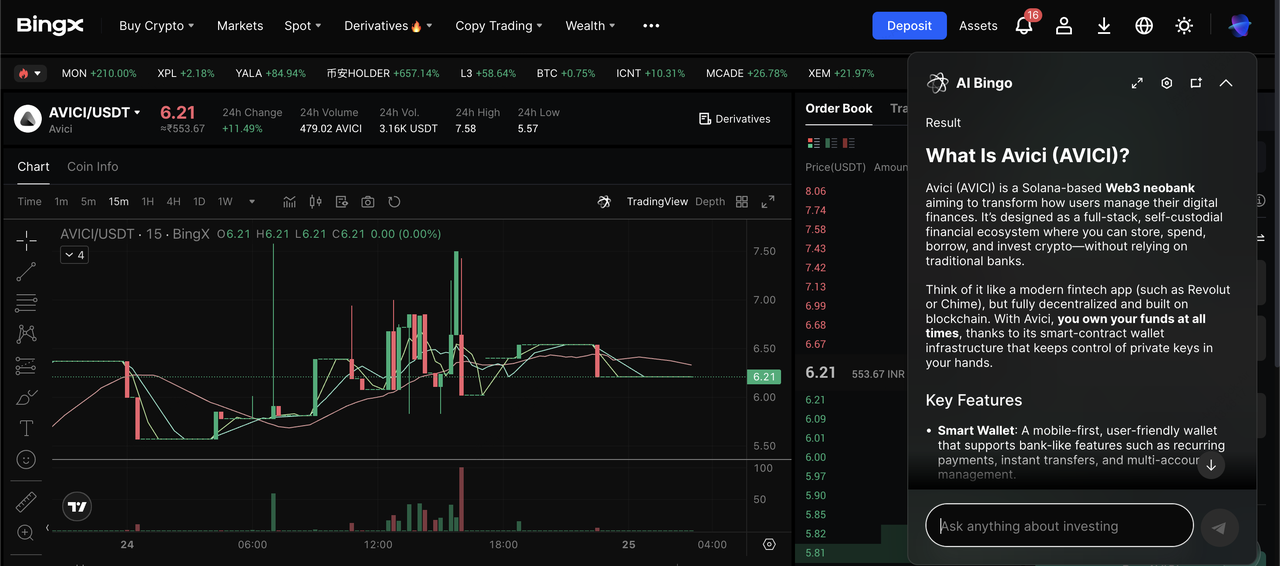

AVICI/USDT trading pair on the spot market powered by BingX AI insights

1. Create a BingX account and complete your

KYC to verify your account.

4. Choose

Market Order for instant execution, or Limit Order to set your preferred buy price.

5. Once filled, the tokens appear instantly in your Spot Wallet.

Tip: AVICI is a low-cap token and can move quickly. Start with small position sizes and use BingX AI insights to monitor momentum and volatility.

Long or Short AVICI on BingX Futures

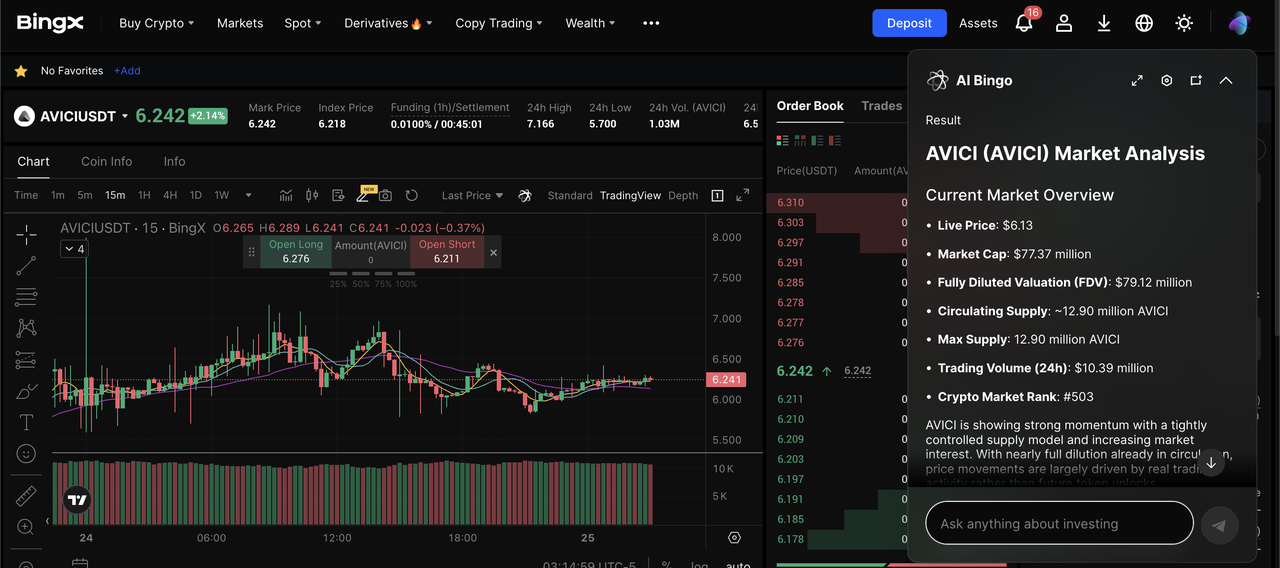

AVICI/USDT perpetual contract on the futures market powered by BingX AI

If you want to trade AVICI price swings without holding the token directly,

BingX Futures lets you long (bet price goes up) or short (bet price goes down) using leverage.

2. Select Long if you expect AVICI to rise, or Short if you expect a pullback.

3. Choose your leverage level; lower leverage is safer for beginners.

5. Confirm the order and manage your trade in real time with BingX AI trend signals.

Important: Futures increase both profits and losses. Use leverage cautiously, especially with fast-moving assets like AVICI.

Final Thoughts: Should You Invest in Avici?

Avici is tapping into a clear market gap: turning on-chain value into everyday spending power without giving up ownership. Its self-custodial wallet and Visa layer makes crypto feel like a bank account, and its upcoming zk-credit narrative gives it a longer runway than most “crypto card” projects.

That said, risks are real. AVICI has already rallied sharply after launch, and adoption still needs to scale beyond early crypto natives. Price will likely track card usage growth, product execution, and broader “Web3 neobank” sentiment. Treat AVICI like a high-beta frontier finance token: follow user metrics, transaction volume, and roadmap delivery, and not just hype.

Related Reading

FAQs on Avici (AVICI)

1. Is Avici a debit card or credit card?

As of November 2025, Avici’s current product is a Visa credit card backed by your crypto through the Avici wallet. You top up with crypto and spend at Visa merchants.

2. Does Avici custody my funds?

No. Avici is designed around self-custody. Your assets sit in an Avici smart wallet you control, and you can withdraw anytime.

3. What blockchains does Avici support?

Avici is Solana-native and also supports EVM assets through its smart wallet and cross-chain swap layer.

4. What makes AVICI tokenomics different?

AVICI has a 12.9 million max supply and sold 77.5% to the public via MetaDAO with no team allocation and no vesting, creating a community-heavy float.

5. Where can I store AVICI tokens?