Gold enters 2026 after one of the strongest rallies in its modern history, and the momentum has not cooled. After rising roughly 64% in 2025, gold extended its advance in January 2026, breaking above $5,100/oz for the first time as geopolitical tensions, policy uncertainty, and renewed ETF inflows pushed safe-haven demand higher.

The question for investors is no longer whether gold justified its rally, but whether it still plays a role at elevated prices, and how to manage exposure in a more volatile, macro-driven environment. With major banks now openly discussing $5,400–$6,000 targets and central banks continuing to diversify away from the U.S. dollar, gold is increasingly viewed less as a short-term trade and more as a structural allocation.

This guide breaks down gold’s 2026 investment outlook using updated forecasts from global banks, central-bank demand trends, ETF flows, and key macro scenarios. You’ll also learn how to trade gold on BingX, either through spot trading

tokenized gold cryptos and

crypto-settled gold futures., offering flexible ways to participate without holding physical bullion.

Key Highlights

• Gold rose 64% in 2025 and is already up more than 17% in early 2026, making it one of the best-performing global assets over the past two years.

• Spot gold broke above $5,000/oz in January 2026, with analysts now projecting $5,400–$6,000/oz by year-end, and some bull-case scenarios extending higher if geopolitical risk persists.

• Central banks are expected to buy around 60 tonnes per month in 2026, roughly 700–750 tonnes annually, continuing a multi-year trend of reserve diversification and de-dollarisation.

• Gold-backed ETFs recorded $89 billion in inflows in 2025, the highest since 2020, with holdings up around 20% year over year, signalling renewed institutional and retail participation.

• For investors seeking exposure, gold can be traded on BingX via tokenized spot gold or crypto-settled

gold futures, enabling both directional trading and hedging without physical storage or traditional commodity accounts.

What Is Gold (XAU) and Why Is It Considered a Safe-Haven Asset?

Gold is a physical precious metal that has functioned as money, a store of value, and a reserve asset for more than 5,000 years. Unlike fiat currencies, gold cannot be printed or directly debased by governments, and its supply grows slowly, historically around 1–2% per year, making it inherently scarce. For centuries, gold underpinned global monetary systems, including the gold standard that anchored major currencies until the early 1970s.

Gold’s reputation as a safe-haven asset comes from its ability to preserve purchasing power during periods of monetary stress, political uncertainty, and financial instability. It has historically performed best when inflation rises, real interest rates fall, currencies weaken, or geopolitical risk escalates. During major stress events—from the 1970s inflation shock to the 2008 global financial crisis and the 2020 pandemic—gold outperformed equities and bonds, acting as portfolio insurance when traditional assets struggled.

Entering 2026, this role has expanded. Gold is no longer viewed only as a crisis hedge, but increasingly as a strategic reserve asset, reinforced by sustained central-bank accumulation, record ETF inflows, and growing skepticism toward fiat-currency stability.

Gold’s Historical Performance In Each Market Cycle

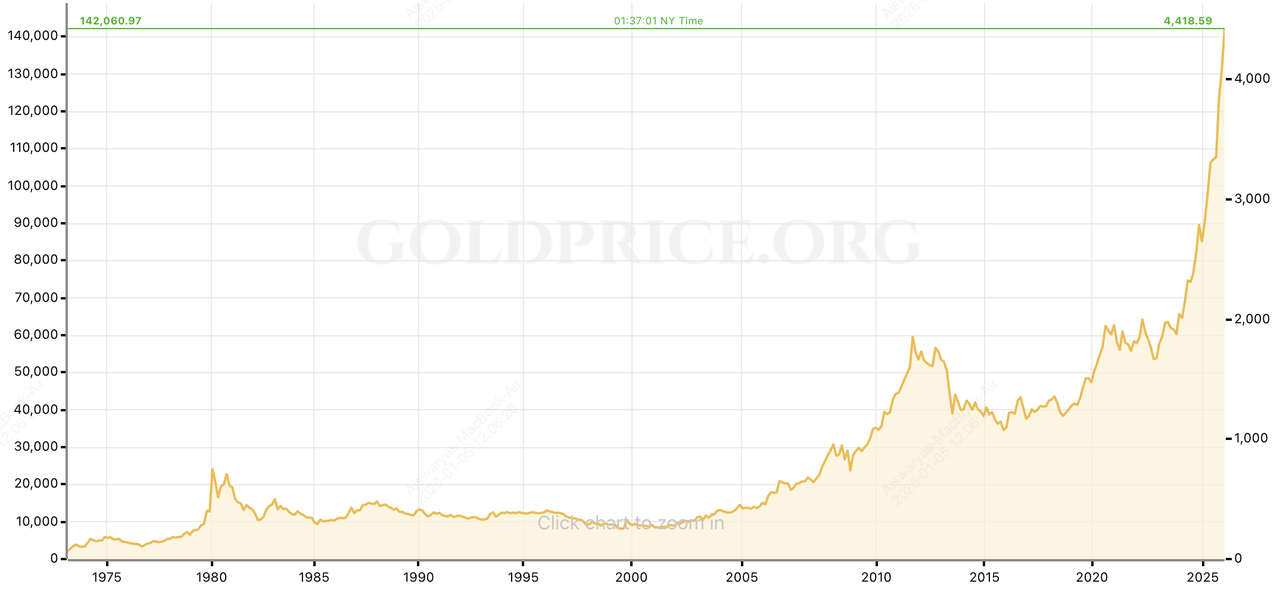

Gold's historical performance over the past few decades | Source: GoldPrice.org

Since the end of the Bretton Woods system in 1971, when gold was officially decoupled from the U.S. Dollar, gold has evolved into a freely traded macro asset and a core portfolio diversifier. From 1971 to 2025, gold delivered average annualized returns of roughly 7–8%, broadly comparable to long-term equity returns, but with much lower correlation to stocks and bonds. This diversification effect is a key reason gold is widely used as portfolio insurance rather than a pure growth asset.

Gold’s performance has been cyclical and highly sensitive to macro stress, with sharp rallies and corrections driven by inflation, interest rates, and geopolitical shocks:

1. 1970s inflation crisis: Gold surged from about $35/oz in 1971 to over $800/oz by 1980, a gain of more than 2,000%, as oil shocks, runaway inflation, and currency instability eroded confidence in fiat money.

2. 1980s–1990s disinflation: With high real interest rates and a strong U.S. dollar, gold underperformed, falling nearly 60% from its 1980 peak and spending two decades largely range-bound.

3. 2008 global financial crisis: Gold reasserted its safe-haven role, rising from around $650/oz in 2007 to over $1,900/oz by 2011, a gain of roughly 200%, as central banks slashed rates and launched quantitative easing.

4. Post-crisis normalization: Between 2011 and 2015, gold corrected by about 45% as monetary policy tightened, highlighting that gold can be volatile when crisis premiums fade.

5. Pandemic to structural breakout: Gold gained about 25% in 2020 during the COVID-19 shock, then consolidated before delivering an exceptional breakout in 2024–2025. In 2025 alone, gold surged roughly 64%, one of its strongest annual performances since the 1970s. The rally extended into early 2026, with prices breaking above $5,000/oz and reaching new record highs above $5,100, driven by record central-bank buying, renewed ETF inflows, geopolitical tensions, and falling real yields.

This latest surge reinforced gold’s modern identity, not just as a short-term crisis hedge, but as a core reserve and diversification asset increasingly held by central banks, institutions, and long-term investors seeking protection against inflation, policy uncertainty, and systemic risk.

Historically, gold has not risen in straight lines. However, its repeated ability to outperform during periods of monetary instability and market stress explains why it continues to play a central role in diversified portfolios heading into 2026, even at elevated price levels.

Gold Gained Over 60% in 2025: Key Factors Drove the Rally

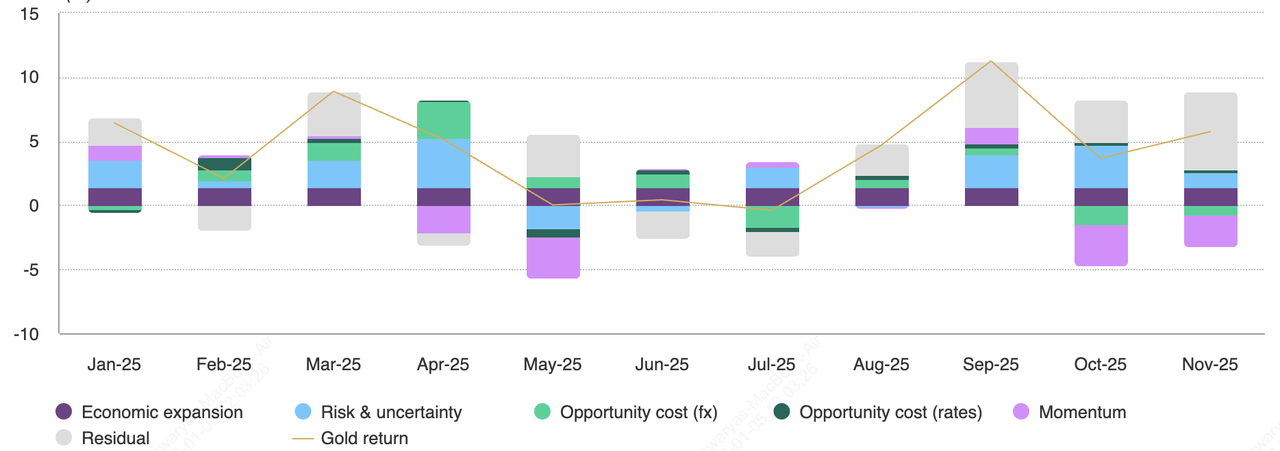

Key drivers of gold’s return by month | Source: World Gold Council

Gold’s 60%+ rally in 2025 was not the result of a single crisis event, but the alignment of multiple macro forces reinforcing one another. According to World Gold Council analysis, gold’s gains were unusually well distributed across risk, rates, currency, and momentum, making the rally structurally stronger and more persistent than many past gold

bull runs that relied on a single dominant driver.

1. Geopolitical and Geoeconomic Risk Intensified

2025 saw a sharp repricing of global risk premia. Trade tensions, sanctions regimes, military conflicts, and rising political uncertainty across the U.S., Europe, and parts of Asia pushed investors toward defensive assets. Late-year developments, ranging from tariff threats to renewed concerns over central-bank independence—extended this risk premium into early 2026.

The World Gold Council estimates that geopolitical risk contributed roughly 8–12% to gold’s 2025 return, as investors increased allocations to hard assets amid elevated tail-risk scenarios. This backdrop did not fade after year-end; instead, it helped propel gold above $5,000/oz in January 2026, reinforcing its role as a geopolitical hedge rather than a short-lived crisis trade.

2. Falling Real Yields and a Lower Opportunity Cost

U.S. real interest rates declined meaningfully in the second half of 2025 as inflation cooled faster than nominal yields and markets increasingly priced in future rate cuts. Gold’s inverse relationship with real yields reasserted itself clearly.

As the opportunity cost of holding a non-yielding asset fell, gold became more attractive relative to cash and bonds. The World Gold Council attributes around 10% of gold’s 2025 gains to declining real yields and easier financial conditions. Entering 2026, expectations of further rate cuts—and political pressure on monetary policy—continue to support this dynamic.

3. U.S. Dollar Weakness and Fiat Debasement Concerns

The U.S. dollar weakened through much of 2025 amid expanding fiscal deficits, heavy government borrowing, and expectations of looser monetary policy. A softer dollar mechanically boosts dollar-denominated gold prices, but more importantly, it reinforced gold’s appeal as a hedge against long-term currency debasement.

Currency effects accounted for a high-single-digit share of gold’s annual return, according to WGC attribution models. This theme intensified into early 2026 as investors increasingly questioned the stability of fiat currencies in a world of rising debt, geopolitical fragmentation, and policy uncertainty.

4. Central Banks Purchased Over 750 Tons of Gold in 2025, Gold ETF Inflows Up 9%

Central banks remained the most consistent and price-insensitive source of demand. Official sector purchases stayed far above pre-2022 norms, with total buying estimated near 750–900 tonnes in 2025, led by emerging-market reserve managers actively diversifying away from U.S. dollar assets.

At the same time, investor demand surged. Gold-backed ETFs recorded record inflows in 2025, adding hundreds of tonnes of bullion, while futures positioning reflected growing conviction rather than short-term speculation. The World Gold Council estimates that momentum, positioning, and investor flows contributed nearly 9% to gold’s 2025 performance, an unusually large share outside of acute crisis periods.

Why Is Gold Rallying in January 2026?

By late December 2025, these forces pushed gold to an intraday record near $4,550/oz before a brief consolidation. Instead of reversing, the rally re-accelerated in early 2026, with gold breaking decisively above $5,000/oz and setting fresh all-time highs above $5,100.

Crucially, the move was not driven by speculative excess alone. It reflected policy shifts, reserve diversification, ETF inflows, and long-term portfolio reallocation, helping explain why many analysts view gold’s elevated price level entering 2026 as volatile but not fundamentally overstretched, and why pullbacks, if they occur, are widely seen as tactical buying opportunities rather than trend reversals.

Gold Price Forecasts for 2026: A Dip to $3,500 or a Surge to $6,000?

After an extraordinary 2025, and a powerful breakout in early 2026, most analysts now agree that the debate around gold is no longer whether it can clear $5,000, but how far the rally can extend and how volatile the path may be. While the pace of gains is expected to moderate after such a steep run, forecasts increasingly cluster around higher structural price levels, reflecting a re-rating of gold rather than a speculative overshoot.

What stands out across current forecasts is that even the more cautious views keep gold well above pre-2024 levels, signalling that gold’s role in portfolios has shifted from a tactical hedge to a strategic allocation.

After an extraordinary 2025, most analysts agree that gold’s pace of gains will slow in 2026, but there is far less agreement on how much downside risk exists and how high gold prices could ultimately go. What stands out across forecasts is that even the most cautious views keep gold well above pre-2024 levels, reflecting a structural re-pricing of the metal rather than a short-term spike.

Consensus Forecast Range: $4,700 to $6,000 in Focus

Recent surveys and bank outlooks highlight both strong upside potential and growing uncertainty around macro policy:

1. Average 2026 price expectations broadly cluster between $4,700 and $5,400 per ounce, depending on assumptions around rates and geopolitics.

2. Bullish scenarios:

• Goldman Sachs raised its end-2026 forecast to $5,400/oz, citing sustained central-bank demand and private-sector diversification.

• Societe Generale sees gold reaching $6,000/oz by year-end, noting that even this may prove conservative if geopolitical risks persist.

• Bank of America projects gold could hit $6,000 as early as spring 2026, arguing that investment demand remains structurally under-allocated.

3. More cautious scenarios: Some banks still expect periods of consolidation or pullbacks if rate-cut expectations reverse or geopolitical tensions ease. However, sub-$4,000 downside cases are now increasingly rare and largely conditional on a sharp improvement in global stability and monetary tightening, scenarios most analysts view as low-probability.

The dispersion in forecasts reflects how sensitive gold has become to policy credibility, geopolitics, and capital allocation decisions, rather than mine supply or jewellery demand alone.

From a constructive standpoint, J.P. Morgan expects gold prices to average around $5,055/oz in Q4 2026, arguing that official-sector buying and long-term investor demand remain under-represented at current portfolio weights.

Goldman Sachs adds that gold is now highly responsive to incremental allocation shifts, estimating that each 0.01 percentage-point increase in U.S. investor allocations could lift gold prices by roughly 1.4%, underscoring how relatively small sentiment changes can have outsized price effects in a tight market.

Central Banks Expected to Buy Over 750 Tons of Gold in 2026

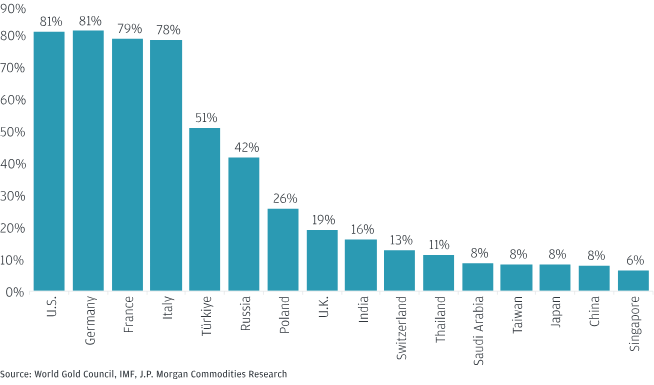

Gold as a percentage of total reserve holdings across select central banks | Source: JPMorgan

One of the most durable pillars of gold’s 2026 outlook remains structural central-bank demand, which has fundamentally reshaped the gold market over the past several years.

• Central-bank purchases are expected to average around 60 tonnes per month in 2026, translating to roughly 700–750 tonnes for the year.

• Gold’s share of global official reserves has already risen toward ~15%, and some estimates suggest it could move closer to 20% if diversification trends continue.

• At current prices, incremental reserve rebalancing by under-allocated central banks could represent hundreds of billions of dollars in additional demand over time.

Crucially, this demand is policy-driven rather than price-driven. Central banks buy gold to diversify reserves, reduce reliance on the U.S. dollar, and hedge against geopolitical and financial sanctions, not to trade short-term price cycles. This makes official-sector buying far less sensitive to near-term volatility.

As a result, many analysts believe that while gold may experience sharp pullbacks and periods of consolidation in 2026, its downside risk appears shallower than in previous post-rally cycles. In a world of persistent geopolitical tension, rising debt, and declining confidence in fiat stability, pullbacks are increasingly viewed as rebalancing opportunities rather than trend reversals.

Is Gold Overowned or Still Underallocated in Investment Portfolios?

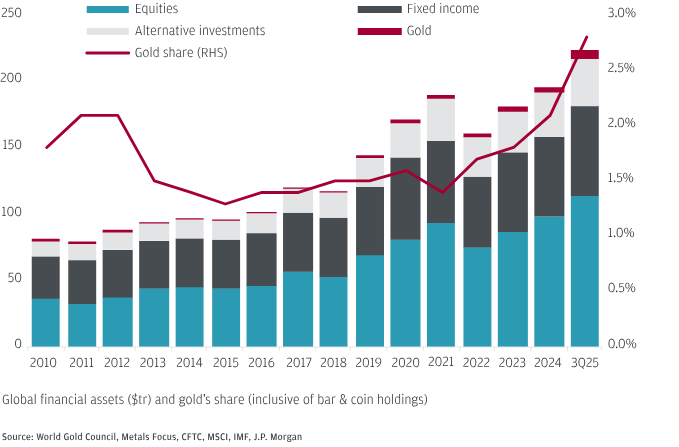

Investors hold 2.8% AUM in gold | Source: JPMorgan

Despite record gold prices in 2025 and early 2026, investor positioning still appears modest by historical and strategic standards. Global physically backed gold ETFs held roughly 3,900–4,000 tonnes of gold entering 2026, with assets under management exceeding $500 billion following record inflows in 2025. While ETF holdings have risen sharply, up around 20% year over year, they remain well below levels that would typically signal speculative excess in a mature bull market.

More importantly, portfolio-level allocation data reinforces the view that gold is not overcrowded. JPMorgan estimates that investors hold roughly 2.8% of assets under management in gold, a figure that has risen only gradually despite gold’s multi-year rally. Independent research and bank estimates suggest institutional allocations increased from roughly 2% to around 2.5–2.8% over the past year, still below the 4–5% strategic allocation often recommended during periods of elevated macro and geopolitical stress.

Bank of America has gone further, arguing that gold remains structurally underowned. Its research shows that professional and high-net-worth investors hold less than 1% of assets in gold, while gold represents only about 4% of the total global financial asset pool. In stress-tested portfolio models since 2020, BofA suggests gold allocations of 20% or more can be justified on diversification and risk-adjusted return grounds, well above current positioning.

Taken together, these figures suggest that gold’s price strength has not exhausted investor positioning. Instead, the rally has occurred alongside relatively restrained allocations, leaving room for further inflows if geopolitical uncertainty persists, confidence in fiat currencies erodes further, or institutional investors reassess diversification strategies in 2026.

What Could Hold Gold Back in 2026? Three Risks to Watch

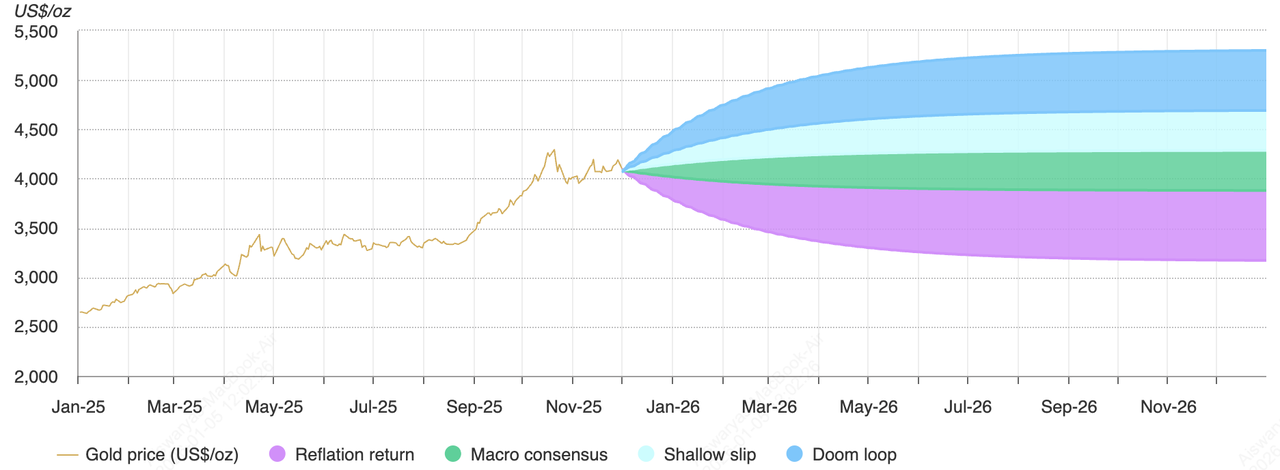

2026 implied gold performance based on hypothetical macroeconomic scenarios | Source: World Gold Council

While gold’s medium-term outlook remains broadly constructive, 2026 carries clear downside risks tied to monetary policy, physical demand, and investor positioning. Several credible scenarios could interrupt or reverse gold’s post-2025 momentum.

1. Hawkish Federal Reserve Surprise and Rising Real Yields

Gold remains highly sensitive to real interest rates. Historically, periods of rising real yields and a strengthening U.S. dollar have been among the most consistent headwinds for gold. If inflation re-accelerates or fiscal stimulus drives stronger-than-expected growth, the Federal Reserve could delay rate cuts or signal a more restrictive stance.

Under the World Gold Council’s “reflation return” scenario, defined by firmer growth, higher real yields, and a stronger dollar, gold could experience drawdowns of roughly 5–20% from elevated levels, even without a broader financial crisis. At prices above $5,000/oz, such pullbacks would be sharp but not historically unusual.

2. Physical Demand Fatigue at Elevated Prices Above $5,000

At current price levels, price-led demand destruction is already visible. Jewellery demand in key markets such as India and China has softened, as higher prices discourage discretionary purchases. Analysts note that while bar-and-coin demand remains resilient, especially among wealth-preservation buyers, overall physical consumption no longer provides the same stabilising floor it once did.

While jewellery demand is no longer the primary driver of gold prices, sustained weakness could amplify downside moves during periods of investor profit-taking, particularly if central-bank purchases slow from recent peaks, even if they remain structurally strong.

3. Short-Term Positioning and Momentum Risk

Although gold appears underallocated at a portfolio level, short-term positioning can still become crowded. The World Gold Council estimates that momentum, futures positioning, and ETF flows contributed nearly 9% to gold’s 2025 return, an unusually large share outside acute crisis periods.

This makes gold vulnerable to fast, sentiment-driven pullbacks if geopolitical tensions ease, ETF inflows slow, or investors rebalance after a strong run. Even modest profit-taking can lead to outsized price moves given gold’s sensitivity to marginal capital flows. Importantly, most analysts view such pullbacks as tactical corrections rather than structural trend reversals, provided macro uncertainty and central-bank demand remain intact.

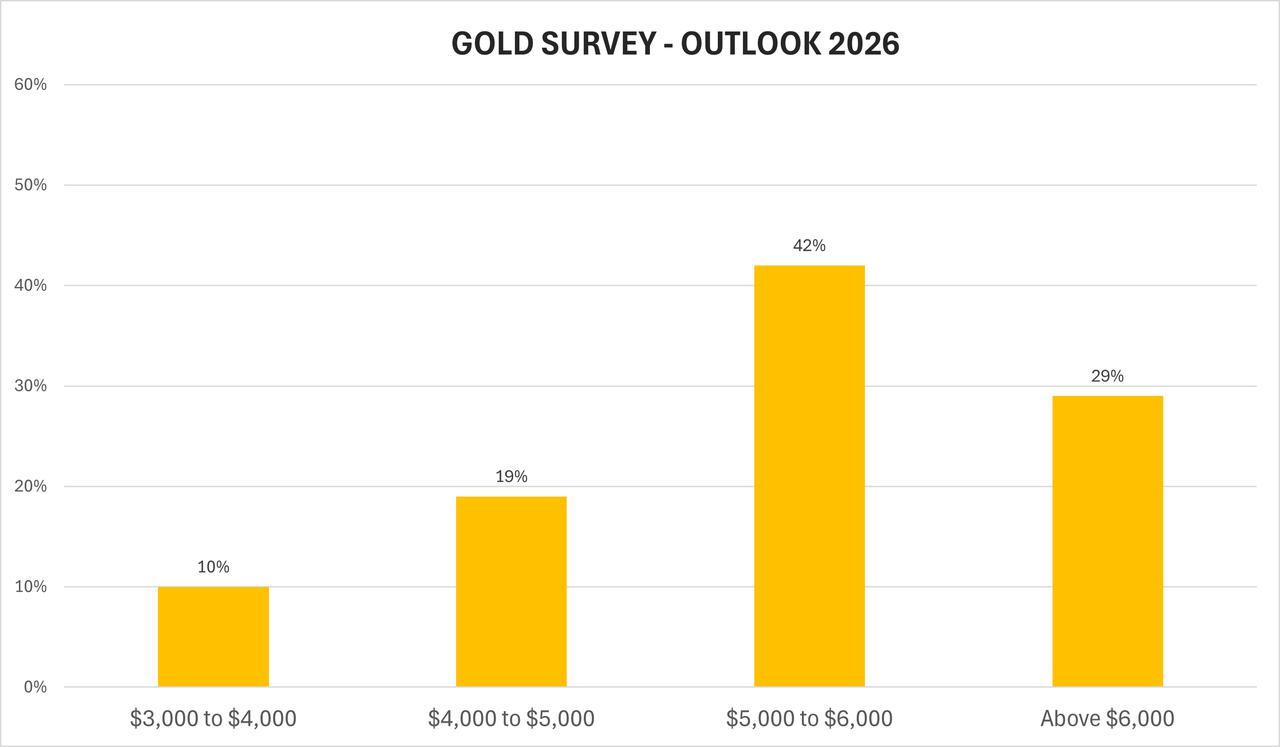

Gold Price Prediction for 2026: How High or Low Can Gold Prices Go?

Kitco's survey on gold outlook for 2026 | Source: Kitco

Gold’s 2026 outlook is best approached through scenario analysis rather than a single price target. After surging roughly 64% in 2025 and breaking above $5,000/oz in early 2026, gold has entered a new price regime shaped by geopolitics, central-bank reserve diversification, ETF inflows, and declining confidence in fiat stability.

Across banks, commodity strategists, and institutional research, one conclusion stands out: gold is unlikely to repeat the speed of its 2025 rally, but it is also unlikely to revert to pre-2024 levels absent a major shift in macro and policy conditions.

1. Base Case: Elevated Consolidation Above $5,000

Expected range: $4,800–$5,400 per ounce

This has emerged as the new consensus baseline following gold’s breakout above $5,000. Updated forecasts from major banks cluster around sustained prices well above prior cycle highs, reflecting a structural re-pricing rather than a speculative overshoot.

• Goldman Sachs raised its end-2026 forecast to $5,400/oz, citing persistent central-bank demand and private-sector diversification.

• J.P. Morgan expects gold to average roughly $5,055/oz in Q4 2026, arguing that official-sector buying and long-term investor allocations remain underappreciated.

• Surveys referenced by Kitco and Reuters show most banks now anchoring expectations between $4,700 and $5,400, rather than sub-$5,000 levels.

In this scenario, central banks continue buying gold at roughly 60 tonnes per month, ETF holdings remain elevated, and interest rates drift lower but without aggressive easing. Gold trades in a wide but elevated range, with pullbacks attracting structural buyers and rallies moderated by tactical profit-taking.

2. Bull Case: Sustained Risk-Off Push Toward $6,000

Expected range: $5,400–$6,000+ per ounce

The bullish scenario assumes that geopolitical and policy risks persist or intensify, rather than fade. Potential catalysts include escalating trade conflicts, deeper geopolitical fragmentation, renewed doubts over central-bank independence, or a sharper global slowdown.

Under this backdrop:

• Societe Generale sees gold reaching $6,000/oz by year-end, cautioning that even this could prove conservative.

• Bank of America projects gold could hit $6,000 as early as spring 2026, arguing that investment demand remains structurally under-allocated despite the rally.

• Goldman Sachs highlights gold’s sensitivity to marginal flows, estimating that each 0.01% increase in U.S. investor allocations could lift prices by around 1.4%, creating asymmetric upside if diversification accelerates.

This scenario does not require a 2008-style crisis. It assumes persistent uncertainty, declining confidence in fiat currencies, and continued reserve diversification, conditions already partially in place entering 2026.

3. Bear Case Under $5,000: Policy Reversal and Real-Yield Shock

Expected range: $4,200–$4,700 per ounce and tail risk below $4,000

The bearish case has narrowed meaningfully since gold’s breakout above $5,000. It rests on a reflationary macro surprise, where growth strengthens, inflation re-accelerates, and the Federal Reserve delays or reverses rate cuts—pushing real yields higher and strengthening the U.S. dollar.

• The World Gold Council’s “reflation return” scenario models 5–20% drawdowns from elevated levels under rising real yields.

• Some cautious forecasters, including StoneX, still flag deeper downside risk if risk premiums unwind sharply and investment demand cools.

However, most analysts now view sub-$4,000 outcomes as low-probability tail risks, requiring a combination of policy tightening, easing geopolitics, and fading central-bank demand, conditions that currently appear unlikely. Even in this bearish scenario, prices remain well above pre-2024 levels, reflecting gold’s structural re-rating.

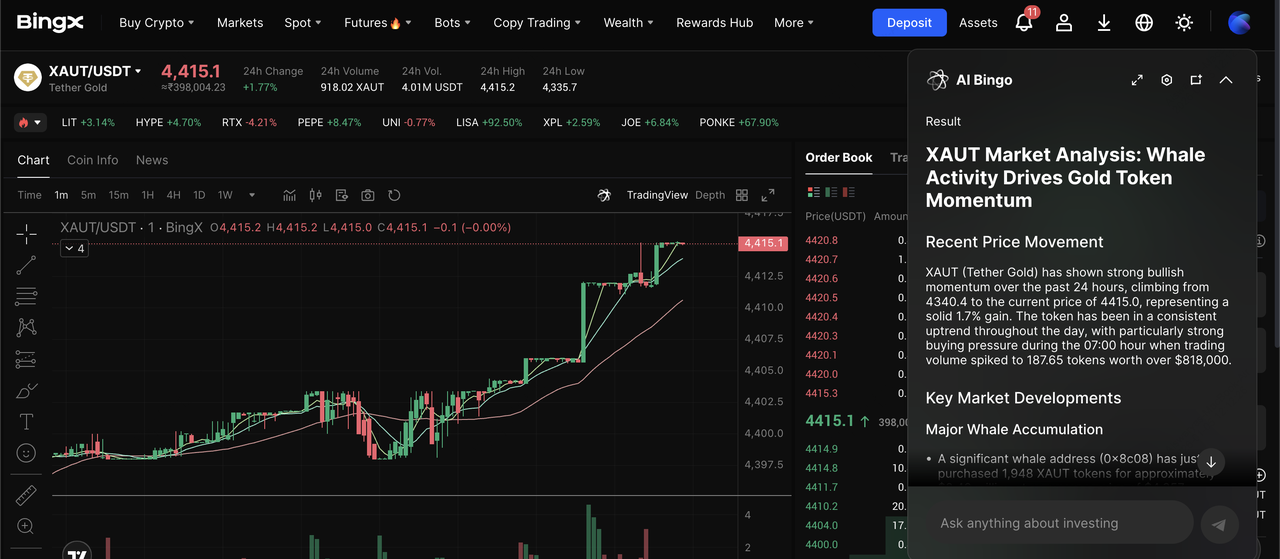

How to Trade Gold Spot and Futures on BingX

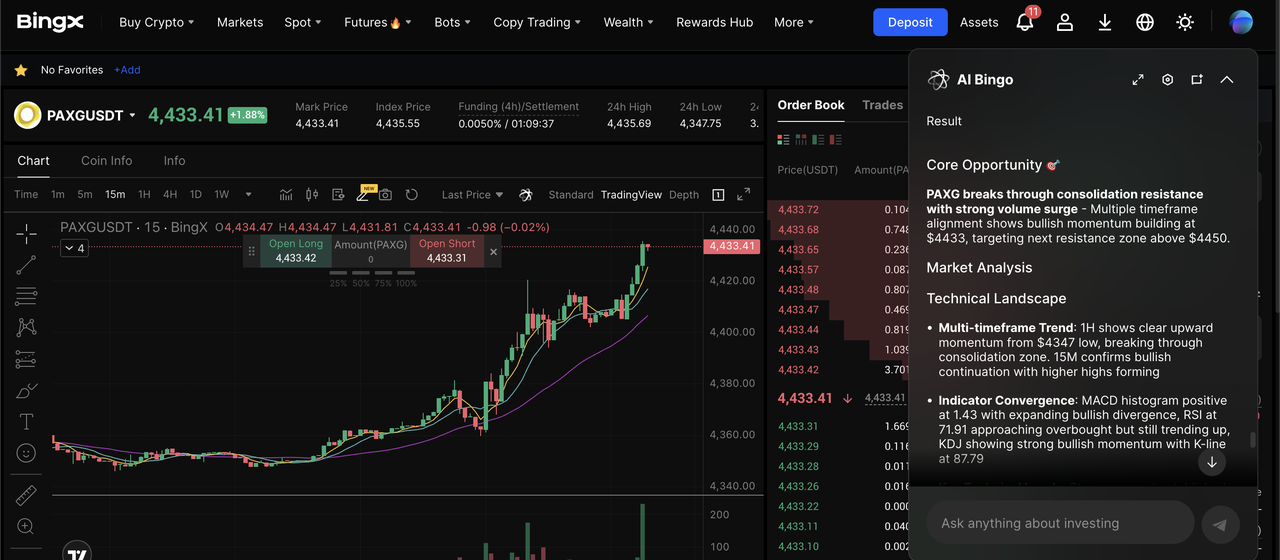

BingX is one of the most versatile platforms for trading gold because it allows you to access multiple gold-linked instruments within a single crypto-native ecosystem. Whether you prefer long-term exposure through tokenized spot gold via

Tether Gold (XAUT) or

Pax Gold (PAXG) or active trading and hedging via crypto-settled gold futures, BingX combines deep liquidity, competitive fees, and flexible order types to support different strategies and risk profiles. What sets BingX apart is

BingX AI, which delivers real-time market data, trend analysis, and risk indicators directly in the trading interface, helping traders identify momentum shifts, key price levels, and volatility in gold markets.

1. Buy and Sell Tokenized Gold on the BingX Spot Market

XAUT/USDT trading pair on the spot market powered by BingX AI insights

BingX supports tokenized gold products that track physical gold prices, allowing you to gain exposure without storing bullion.

3. Buy gold-backed crypto tokens on the BingX spot market using

USDT, just like any other crypto asset

4. Hold, trade, or rebalance your position anytime

Spot tokenized gold offers direct, unleveraged exposure with transparent pricing, making it a simple and efficient way to diversify your crypto portfolio without taking on leverage risk.

2. Trade Gold Tokens with Leverage on Futures Market

PAXG/USDT perpetual contract on the futures market powered by BingX AI

Tokenized gold futures on BingX track gold prices while settling in crypto, allowing you to trade gold without holding physical metal or using fiat-based brokers.

3. Choose direction: go Long if you expect gold to rise, or Short if you expect a pullback or want to hedge.

4. Select margin mode and leverage: use Isolated Margin and keep leverage low (e.g., 2x–5x) to reduce liquidation risk.

5. Set your order type: use a

Limit Order for a specific entry price or a Market Order for instant execution.

7. Monitor and manage the position: adjust stops as price moves, and reduce exposure during major macro events if volatility spikes.

Trading tokenized gold futures is best suited for active traders looking to go long or short gold, hedge macro or crypto exposure, or trade gold’s volatility around events like Fed decisions and geopolitical developments.

3. Long or Short Gold Futures With Crypto on BingX

Trade gold futures with crypto on BingX futures market

For active traders, BingX offers crypto-settled gold futures, enabling directional trades and hedging strategies.

1. Open the Futures trading section on BingX

3. Go long if you expect prices to rise, or short to hedge downside

4. Use low leverage (2x–5x) to manage volatility

5. Apply stop-loss and take-profit orders

Trading gold futures lets you profit in both rising and falling markets while hedging crypto or macro risk, all without relying on fiat rails or traditional commodity brokers.

Should You Invest in Gold in 2026?

Gold in 2026 is unlikely to repeat the pace of its momentum-driven surge in 2025, but it has firmly transitioned into a higher structural price regime. After breaking above $5,000/oz in early 2026, gold is increasingly viewed as a strategic reserve and diversification asset rather than a late-cycle trade. Elevated global debt, persistent geopolitical risk, continued central-bank accumulation, and uncertainty around monetary policy all support this shift, with most major banks now clustering forecasts between $4,800 and $5,400, and credible bull cases extending toward $6,000 under sustained stress scenarios.

For investors, this means gold’s role is less about chasing upside and more about portfolio resilience and risk management. Gold historically performs best as a stabilizer during periods of macro uncertainty rather than as a leveraged return engine. While platforms like BingX allow investors to gain exposure through tokenized spot gold or crypto-settled gold futures, gold prices can still experience sharp pullbacks driven by shifts in real yields, policy expectations, or investor positioning. As a result, disciplined position sizing, diversification, and volatility awareness remain essential when allocating to gold in 2026.

Related Reading