As

Bitcoin continues its ascent in 2025, reaching new all-time highs, one company's influence stands out: Strategy, formerly known as MicroStrategy. What began as a business intelligence firm has transformed into a Bitcoin

whale, wielding significant power over cryptocurrency's market dynamics and institutional adoption. But what exactly is Strategy and how has it managed to become such a key player in driving the

Bitcoin bull run?

Strategy's Business Intelligence Turned Bitcoin Treasury

Strategy's journey into the world of Bitcoin began in 2020 under the leadership of its then-CEO, Michael Saylor. Faced with a depreciating cash reserve, Saylor made the bold decision to adopt Bitcoin as the company's primary treasury reserve asset. This move wasn't just a speculative bet. It was a calculated strategy to preserve and grow shareholder value in an increasingly inflationary environment. Saylor predicted that

Bitcoin could hit $1 million by 2028, reinforcing the kind of exponential upside that Strategy has long bet on.

Since then, Strategy has relentlessly accumulated Bitcoin, employing a variety of financial strategies to increase its holdings. These tactics have included issuing convertible notes, conducting at-the-market equity offerings, and securing loans, all with the singular purpose of acquiring more Bitcoin.

Strategy's Outsized Role: The Corporate BTC Whale

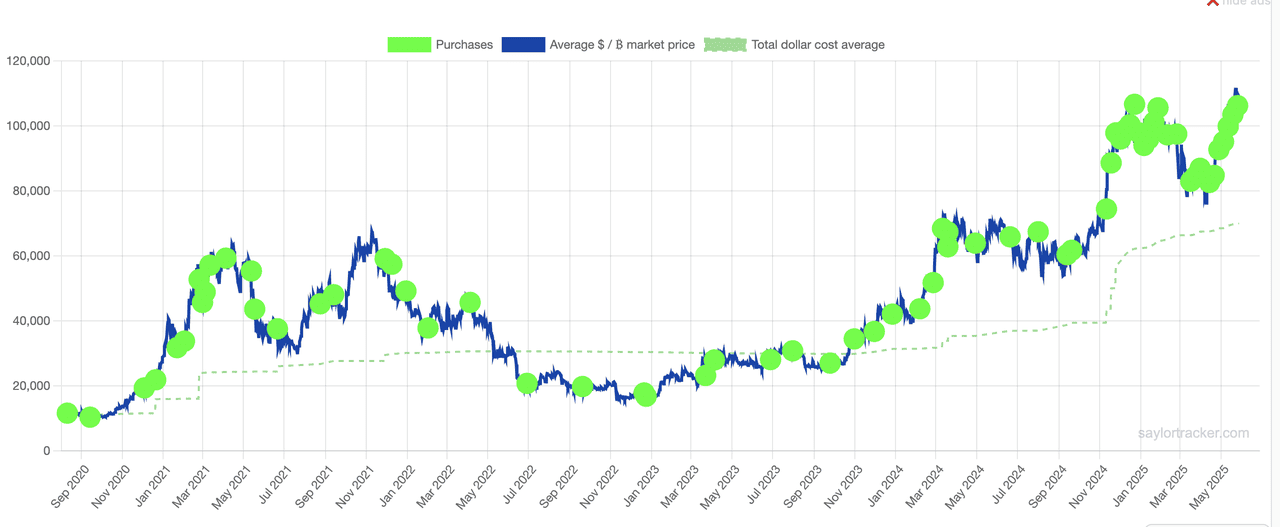

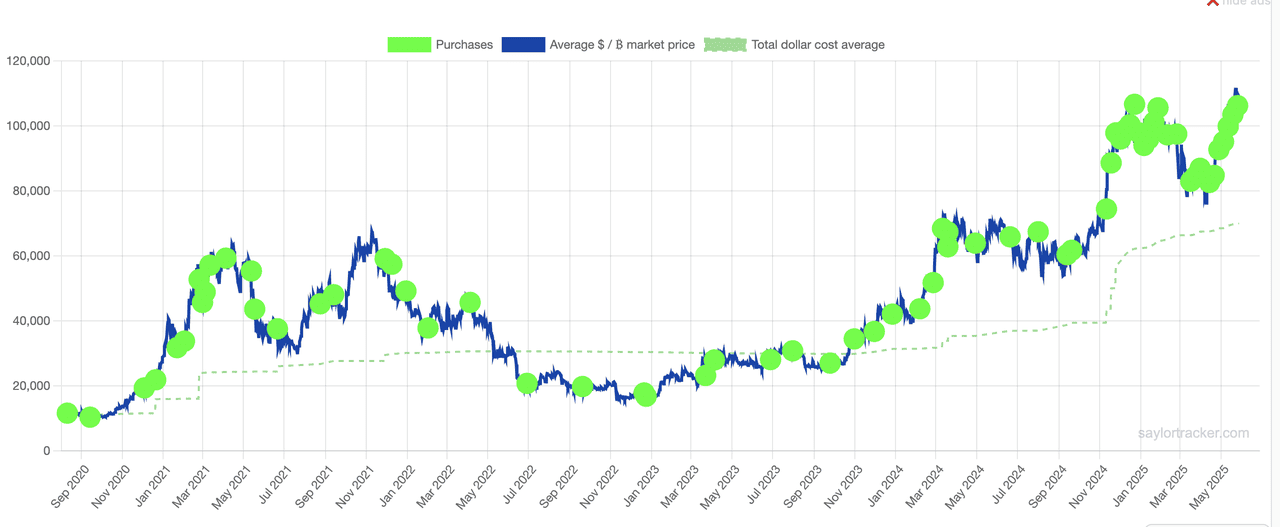

A history of Strategy's Bitcoin purchases over time | Source:

SaylorTracker

No single entity has had a greater impact on Bitcoin's institutional adoption and market psychology than MicroStrategy (now Strategy). The company, led by Michael Saylor, has consistently made headlines for its aggressive Bitcoin accumulation strategy. Just days before the conference, Strategy announced the purchase of 4,020 additional BTC for $427 million, bringing its total holdings to 580,250 BTC, nearly 3% of Bitcoin's circulating supply as of May 2025. This makes Strategy the world's largest corporate holder of Bitcoin by a wide margin.

The company's relentless accumulation, funded through innovative capital-raising strategies like at-the-market equity and preferred stock offerings, has set a precedent for how traditional corporations can participate in the crypto market. Strategy's actions send powerful signals to both institutional and retail investors, often influencing

sentiment and even short-term price movements.

Strategy's latest BTC purchase in May 2025 | Source:

X

Strategy's commitment to its Bitcoin treasury strategy remains as strong as ever. Strategy's latest acquisition underscores the company's conviction in Bitcoin's long-term potential and its continued commitment to making Bitcoin its primary treasury reserve asset. These consistent purchases have solidified their stance and have echoed throughout the market as many other organizations have started to accumulate Bitcoin as well.

How Strategy and Michael Saylor Drive the Bitcoin Bull Run

Strategy's impact on the Bitcoin market extends far beyond its massive holdings. The company's actions have a ripple effect on market sentiment, institutional adoption, and price dynamics:

• Legitimizing Bitcoin as a Treasury Asset: Strategy's bold move to embrace Bitcoin as a treasury reserve asset has paved the way for other corporations to consider similar strategies. By demonstrating that Bitcoin can serve as a viable alternative to traditional cash reserves, Strategy has legitimized Bitcoin as a legitimate asset class for institutional investors.

• Signaling Confidence to the Market: Each time Strategy announces a new Bitcoin purchase, it sends a powerful signal of confidence to the market. These announcements often trigger bullish sentiment, attracting new investors and driving up the price of Bitcoin.

• Reducing Bitcoin's Supply: Strategy's long-term accumulation strategy effectively removes a significant portion of Bitcoin's supply from the market, creating scarcity and potentially driving up prices over time.

• Inspiring Innovation in Bitcoin Financial Products: Strategy's active engagement with the Bitcoin market has inspired the development of new financial products and services, such as Bitcoin-backed loans and

Bitcoin ETFs. These products further integrate Bitcoin into the traditional financial system and increase its accessibility to a wider range of investors.

• Shaping the Narrative: Through conferences, interviews, and social media, Strategy executives, particularly Michael Saylor and Phong Le, have played a crucial role in shaping the narrative around Bitcoin. They have consistently advocated Bitcoin's long-term value proposition as a store of value, an

inflation hedge, and a transformative technology.

Strategy’s Pivotal Role at Bitcoin 2025 Conference

The Bitcoin 2025 Conference, held in Las Vegas from May 27–29, served as a pulse check for the crypto industry, bringing together over 30,000 attendees, 400+ speakers, and thousands of companies to discuss Bitcoin’s evolving place in technology, finance, and policy. While the event featured big names and major announcements, it was Strategy (formerly MicroStrategy) that took center stage in shaping the future of institutional Bitcoin adoption.

Strategy's presence was more than just prominent—it was foundational. CEO Phong Le led a keynote unveiling a new corporate finance framework centered around Bitcoin, introducing BTC-specific KPIs, valuation models, and credit risk tools tailored for treasury departments. This move positions Bitcoin not just as a speculative asset but as a core financial instrument for public companies. Strategy’s influence extended throughout the conference, with its executives leading sessions on treasury allocation, risk management, and Bitcoin-based financial reporting standards. These efforts signal a clear push toward institutional-grade adoption and offer a roadmap for other firms to follow. In doing so, Strategy is helping to legitimize Bitcoin in the eyes of traditional finance, marking a pivotal shift in how the asset is integrated into global capital markets.

The Road Ahead: What's Next for Strategy?

Strategy’s evolution from a traditional business intelligence firm into a Bitcoin-centric powerhouse has fundamentally reshaped both its corporate identity and the broader crypto landscape. At Bitcoin 2025, the company solidified its role as a key driver of institutional adoption by unveiling a new Bitcoin finance framework aimed at helping public companies integrate BTC into their treasuries. With CEO Phong Le and other executives leading sessions on corporate adoption and risk management, Strategy positioned itself not just as a market participant, but as an architect of Bitcoin's financial future.

Looking ahead, Strategy’s commitment to accumulating Bitcoin remains firm, reinforcing its belief in BTC as a long-term treasury reserve asset. While this bold strategy exposes the company to market volatility, it has already helped normalize Bitcoin in traditional finance circles. As institutional interest continues to grow and Bitcoin matures into a globally accepted asset, Strategy’s influence will likely expand. Its ongoing accumulation, advocacy, and leadership will continue to shape market sentiment, making it a central figure to watch in the next phase of Bitcoin’s evolution.

Related Reading: