Bitcoin usage is exploding, Ordinals, BRC-20s, and

BTC-Fi have pushed transaction fees to multi-year highs and exposed the limits of Bitcoin’s 7 TPS (transactions per second) base layer.

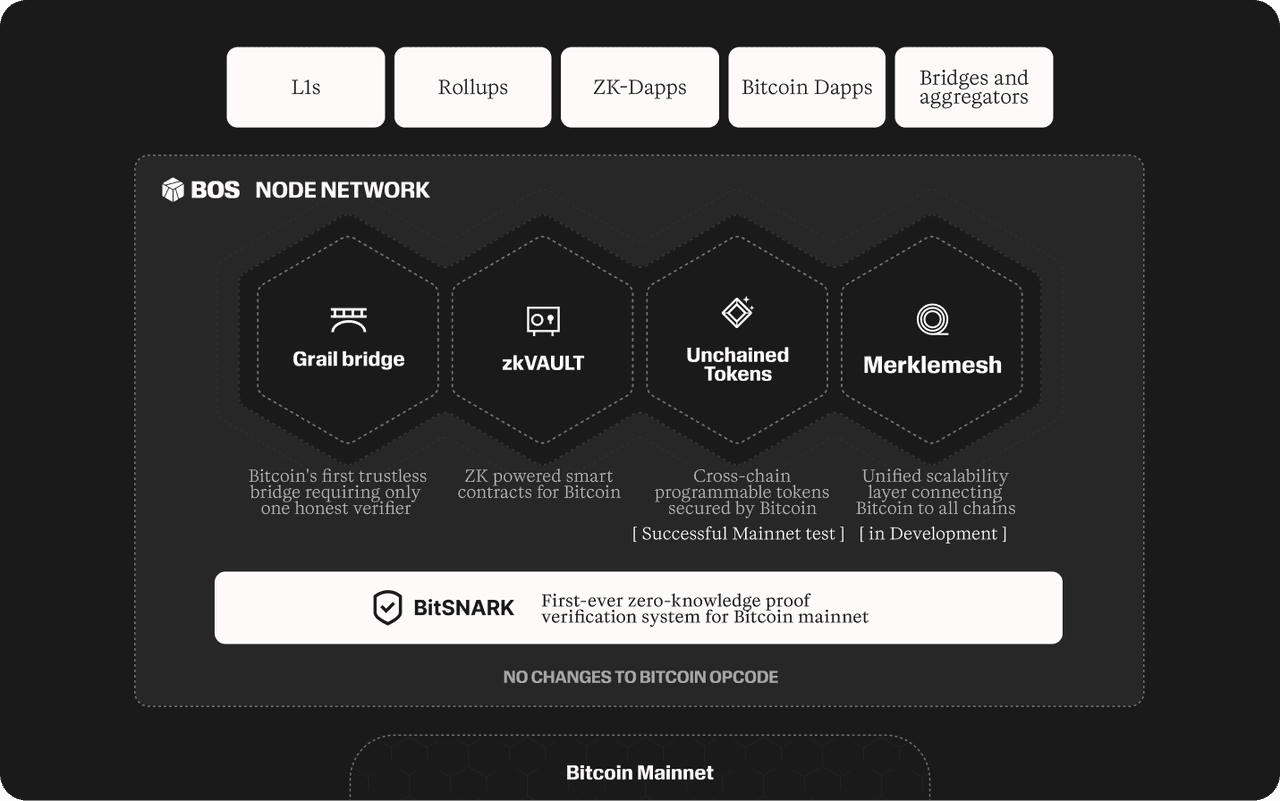

BitcoinOS (BOS) answers that pressure with a modular “operating system” that runs heavy computation off-chain, proves correctness with zero-knowledge proofs, and settles on Bitcoin without altering Bitcoin’s consensus. Its architecture revolves around BitSNARK, a ZK-verification VM purpose-built for Bitcoin, and Grail, a practical bridge that moves assets between Bitcoin (L1) and rollups (L2) with a powerful “honest-single” security guarantee.

Discover what BitcoinOS is and how it works, why BitSNARK and Grail matter, what sets it apart from other Bitcoin L2s, and the basics of the BOS token and ecosystem milestones.

What Is BitcoinOS (BOS) and How Does It Work?

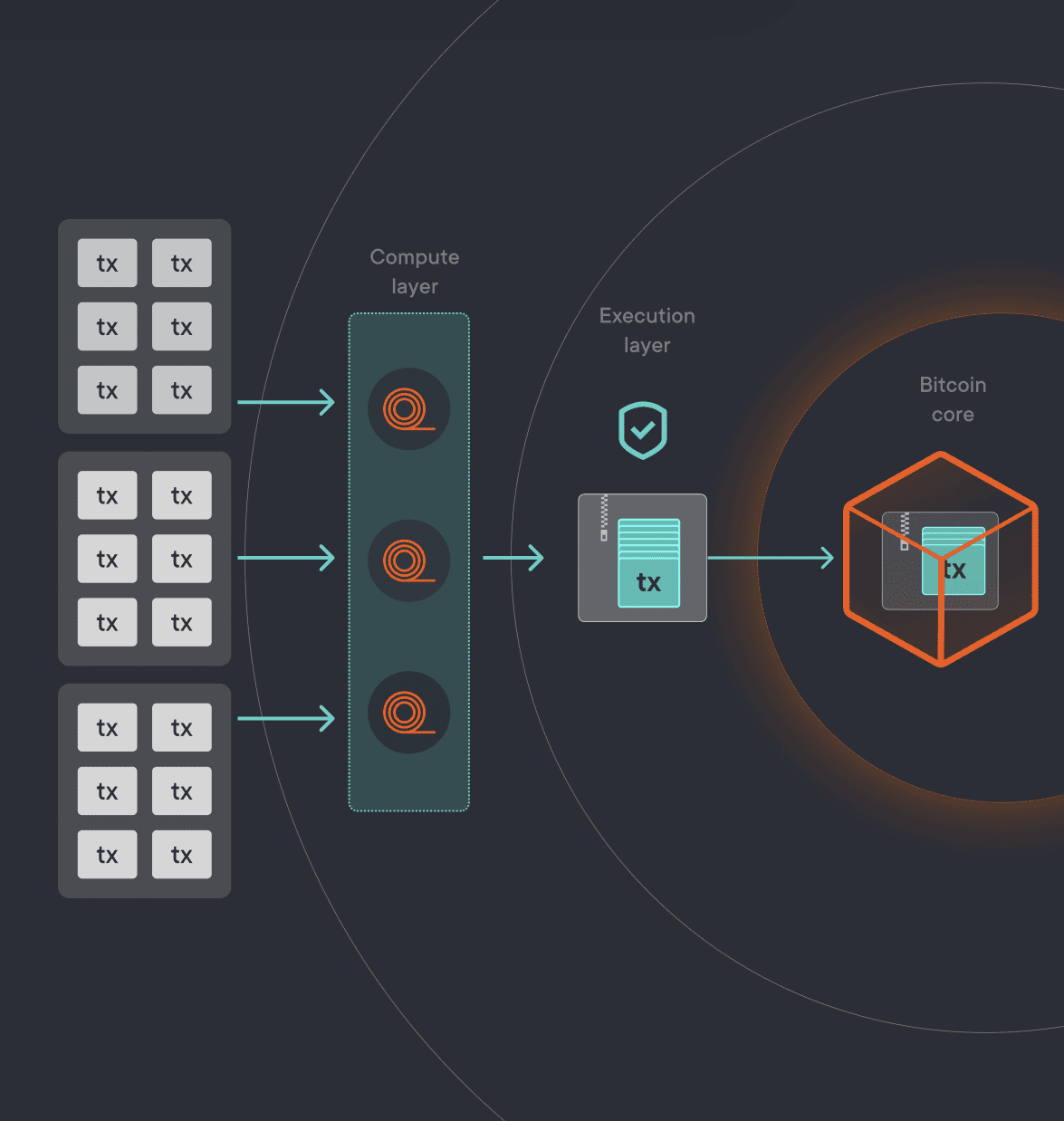

BitcoinOS is a modular framework that makes Bitcoin programmable and scalable without modifying Bitcoin’s base consensus. Instead of running complex smart contracts directly on Bitcoin, where block space is limited, applications and rollups execute computation off-chain, generate zero-knowledge proofs (zkSNARKs) that validate those results, and then settle those proofs on Bitcoin L1. In short: do the work off-chain, prove it on Bitcoin.

BitcoinOS's layers of functionality | Source: Sovryn

The core flow:

1. Compute Off-Chain: DeFi apps, rollups, and virtual machines run at high throughput in an execution environment off Bitcoin L1.

2. Generate ZK Proofs: Each execution produces zkSNARK proofs showing the computation was valid.

3. Verify on Bitcoin: These proofs are posted to Bitcoin, where a lightweight verifier confirms correctness and finalizes state updates, granting Bitcoin-level security and auditability.

This design targets Bitcoin’s long-standing “scalability vs. expressivity vs. decentralization” trilemma by keeping security on L1 while pushing computation to ZK-powered layers.

BitcoinOS has also gained traction on the ecosystem and funding side, securing roughly $10 million in strategic financing led by Greenfield Capital with participation from FalconX, DNA Fund, Bitcoin Frontier Fund, and Sovryn to accelerate BTC-Fi, bridging, and rollup expansion.

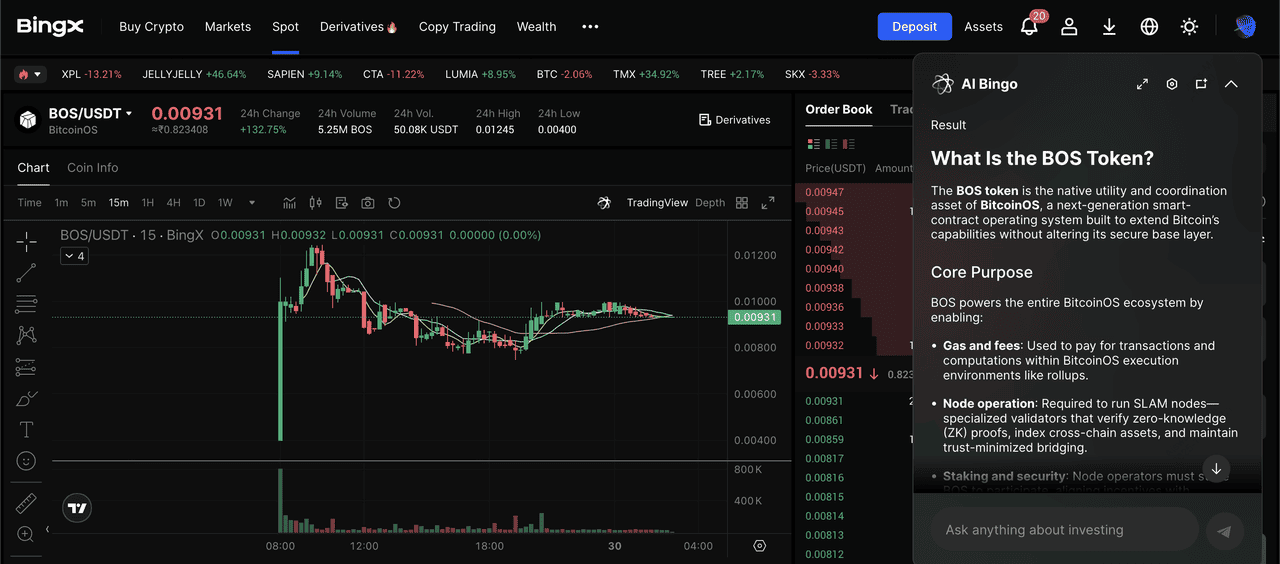

The BOS token has begun appearing on centralized exchanges, including a BOS/USDT spot listing on BingX, giving traders direct access to the network’s native asset.

How Does BitcoinOS Work?

An overview of how BitcoinOS works | Source: BitcoinOS docs

BitcoinOS pushes smart contract execution to rollups while using zero-knowledge proofs to verify results on Bitcoin itself. This lets builders deploy Turing-complete logic, create programmable assets, run DeFi protocols, and issue tokens, all while settling final state to Bitcoin.

Key Components of BitcoinOS

1. BitSNARK: ZK Verification, Optimized for Bitcoin

BitSNARK is a minimal, register-based VM designed specifically to verify zkSNARK proofs on Bitcoin. Compared with a general RISC-V approach (BitVM), BitSNARK slims the instruction set (three core ops), removes RAM and branching, and cuts the challenge game to essentially one type, shrinking program size and dispute steps for SNARK verification. Result: order-of-magnitude efficiency gains for bridge-grade ZK verification on Bitcoin.

A landmark: BitcoinOS verified a ZK proof on Bitcoin mainnet (block 853,626, July 2024). widely cited as a first, showcasing BitSNARK’s feasibility on L1.

2. Grail: Asset Bridge Between Bitcoin and Rollups

Grail operationalizes the bridge: operators lock funds on Bitcoin using

Taproot/BitSNARK paths, mint on L2 when proofs check out, and can redeem by burning on L2 and proving inclusion/state to unlock UTXOs on Bitcoin. The design aims for “1-of-N honest” security, a single honest verifier can prevent fraud, and introduces fee-aligned incentives and dynamic operator membership for liquidity and liveness.

Grail targets near-trustless BTC bridging with no soft fork, a pain point for Bitcoin-aligned DeFi where most bridges today rely on trusted multisigs or majority assumptions.

3. zkBTC: Bitcoin Made Programmable

zkBTC is a 1:1 verifiable token backed directly by native BTC, allowing users and institutions to deploy Bitcoin in lending, trading, collateralized borrowing, and yield strategies without giving up custody or relying on wrapped tokens. Minted through Grail Pro, zkBTC keeps control of the underlying UTXOs with the holder or operator, using zero-knowledge proofs to enforce validity. As zkBTC adoption grows, more BTC gets locked into the network, strengthening liquidity across the BitcoinOS ecosystem and powering BTC-Fi at scale.

4. Charms: Programmable Tokens on Bitcoin

Charms is the universal token standard on BitcoinOS, enabling programmable fungible and non-fungible assets backed by ZK-validated metadata inside the UTXO model. With Charms, tokens can support custom issuance, governance, staking, lending markets, DEX trading, and full DeFi logic, all while settling back to Bitcoin for security. Charms assets are portable and composable across chains without relying on trust-based bridges, making Bitcoin not just a store of value, but a foundation for a programmable asset economy.

5. SLAM Nodes and Unified Multichain UX

SLAM nodes aggregate and verify data across multiple blockchains, making BitcoinOS applications feel like one unified network rather than a fragmented set of chains. Users can move assets and interact with dApps across ecosystems without managing complex flows or separate bridges, improving UX and reducing friction. Behind the scenes, SLAM nodes use zero-knowledge proofs to secure interoperability, so Bitcoin-anchored rollups and chains function like a single, cohesive environment.

What Makes BitcoinOS Different?

BitcoinOS stands out because it brings ZK-first security directly to Bitcoin L1, verifying proofs on-chain instead of relying on federations or external validator sets. Its custom verifier, BitSNARK, is a minimal VM designed solely for zkSNARK verification, reducing dispute complexity and making trust-minimized bridges and rollups practical. Combined with Grail’s 1-of-N honest guarantee, where just one honest participant can block invalid exits, BitcoinOS enables true Bitcoin L2s where gas is paid in BTC, settlement is enforced by Bitcoin, and bridging is near-trustless. The result is real scalability with programmable assets, private transactions, and cross-chain DeFi, all anchored to Bitcoin’s security.

BOS Token Utility and Tokenomics

The BOS token powers incentive alignment across the BitcoinOS ecosystem. Compute and verification fees are paid in BTC, then routed to buy BOS on the open market and burn it, while service providers, such as provers and monitors, earn BOS for validating activity. This creates a usage-linked economic loop: more network demand leads to more BTC fees, more BOS buy-and-burn, and stronger incentives for operators to keep the system secure and responsive.

BOS Token Distribution

BOS has a max supply of 21,000,000,000 tokens with emissions scheduled across roughly 12 years.

• 35% — Founding entities, including 10% for Sovryn

• 32% — Ecosystem growth and incentives with long-dated vesting

• 33% — User sales, spanning both developers and regular users

How to Trade BitcoinOS (BOS) on BingX

BingX makes trading simpler with built-in

BingX AI, which can summarize market news, flag volatility, and help you plan entries with tools like

DCA (dollar-cost averaging) and smart alerts.

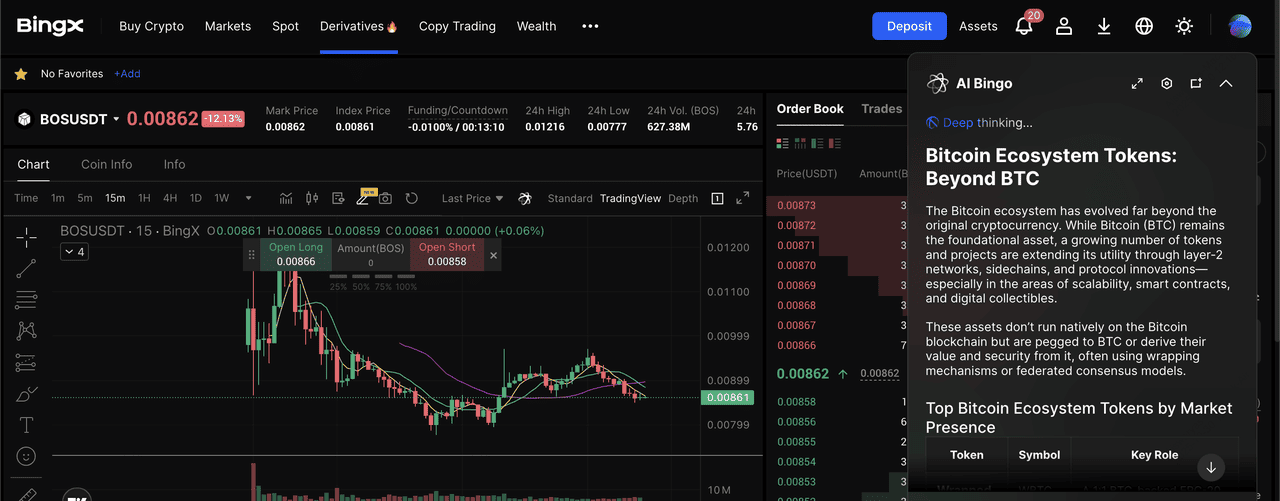

Spot Trading: Buy or Sell BOS/USDT

BOS/USDT trading pair on the spot market powered by BingX AI

1. Create and verify your BingX account by completing

KYC for full access.

2. Deposit

USDT via card, bank transfer, or crypto transfer and move funds to your Spot wallet.

4. Choose an order type:

• Limit Order: Set your desired price and wait for a fill.

5. Confirm your trade and monitor open orders or holdings directly in your Spot portfolio.

Futures Trading: Long or Short BOS

BOS/USDT perpetual contract on the futures market powered by BingX AI

1. Make sure you’ve enabled

Futures mode and transferred margin, e.g., USDT, to your Futures wallet.

3. Select Long (price up) or Short (price down), set leverage, and place your order.

4. Manage your position with

take-profit, stop-loss, and trailing stops to control risk, and use BingX AI to track market sentiment before adjusting exposure.

Key Considerations Before Buying BitcoinOS (BOS)

Before you buy BOS, weigh these fundamentals that can materially affect price, usability, and long-term value.

• Bridge and operator risk. Even with ZK proofs and an “honest-single” security model, real-world factors, operator coordination, liquidity depth, dispute handling, and UX, can introduce failure modes; review each bridge/rollup’s parameters and audits before transacting.

• Token volatility & vesting overhangs. Early allocations and multi-year emissions can pressure price; check current circulating supply, unlock schedules, and burn mechanics on the official token page and your exchange’s disclosures before taking a position.

• Roadmap & adoption execution. Outcomes like broader rollup interoperability, deeper liquidity, and institutional integrations depend on timely delivery and partner traction; funding helps, but consistent execution and usage growth are what sustain value.

Conclusion

BitcoinOS positions itself as a ZK-first compute layer that brings programmability and asset mobility to Bitcoin without altering its base consensus. By pairing BitSNARK for on-chain proof verification with the Grail bridge for near-trustless BTC movement across rollups, the project aims to expand Bitcoin’s utility into DeFi, applications, and institutional rails. The BOS token aligns this ecosystem through fee routing and incentive mechanics, while recent funding and a growing developer narrative suggest continued momentum.

Still, BitcoinOS is an emerging network. Bridge mechanics, operator incentives, liquidity, and roadmap delivery all carry execution risk, and the BOS token remains subject to volatility and supply unlocks. If you choose to explore the ecosystem or trade BOS, rely on official links, start small, and never commit more than you can afford to lose.

Related Reading

FAQs on BitcoinOS (BOS)

1. How does BitcoinOS scale Bitcoin?

BitcoinOS scales by performing computation off-chain and verifying results on Bitcoin using zkSNARK proofs, allowing higher throughput while keeping settlement anchored to Bitcoin’s security.

2. What is BitSNARK in BitcoinOS?

BitSNARK is a minimal virtual machine optimized for verifying zkSNARK proofs on Bitcoin, designed to reduce dispute complexity for bridges and rollups.

3. What makes BitcoinOS different from other Bitcoin layer-2s?

BitcoinOS focuses on verifying ZK proofs directly on Bitcoin, uses a purpose-built verifier (BitSNARK), and relies on Grail’s “honest-single” security model instead of federated multisigs or majority-based validators.

4. How do I trade BOS on BingX?

Create an account, complete KYC, deposit USDT, and search for BOS/USDT in the Spot market. BingX AI can summarize market news, track volatility, and help plan entries with tools like DCA.

5. Does BitcoinOS come with risks?

Yes. Bridge operation, liquidity depth, roadmap delivery, and token volatility are key risks. Always start small, use official links, and never invest more than you can afford to lose.