METAX, backed 1:1 by real Meta shares and issued by Backed Finance on the

Solana blockchain, and METAON,

Ondo Finance’s

Ethereum and

BNB Chain-based tokenized version for non-U.S. users, together represent over $7.7 million in combined tokenized asset value and more than $25 million in monthly on-chain transfer volume. These tokens let investors access Meta’s market performance with blockchain speed, fractional ownership, and DeFi composability, without needing a traditional brokerage account.

In this article, you’ll learn what METAX and METAON are, how tokenized stocks work, how METAX and METAON are backed and regulated, their use cases, benefits, risks, and how to buy or trade Meta tokenized stocks, including on the BingX spot and futures markets.

What Is Meta Tokenized Stock and How Does It Work?

Meta’s tokenized stock is a blockchain-based digital asset that mirrors the real share price of Meta Platforms, Inc. (META), allowing users to buy, sell, and transfer Meta exposure 24/7 without a traditional brokerage account. These tokens track META’s market value in real time and are backed or economically linked to actual Meta shares held by regulated custodians. Tokenized Meta products make U.S. equities accessible to global investors, enable fractional ownership, and integrate seamlessly with DeFi platforms, while still excluding shareholder rights like dividends or voting.

What Is Meta Tokenized xStock (METAX)?

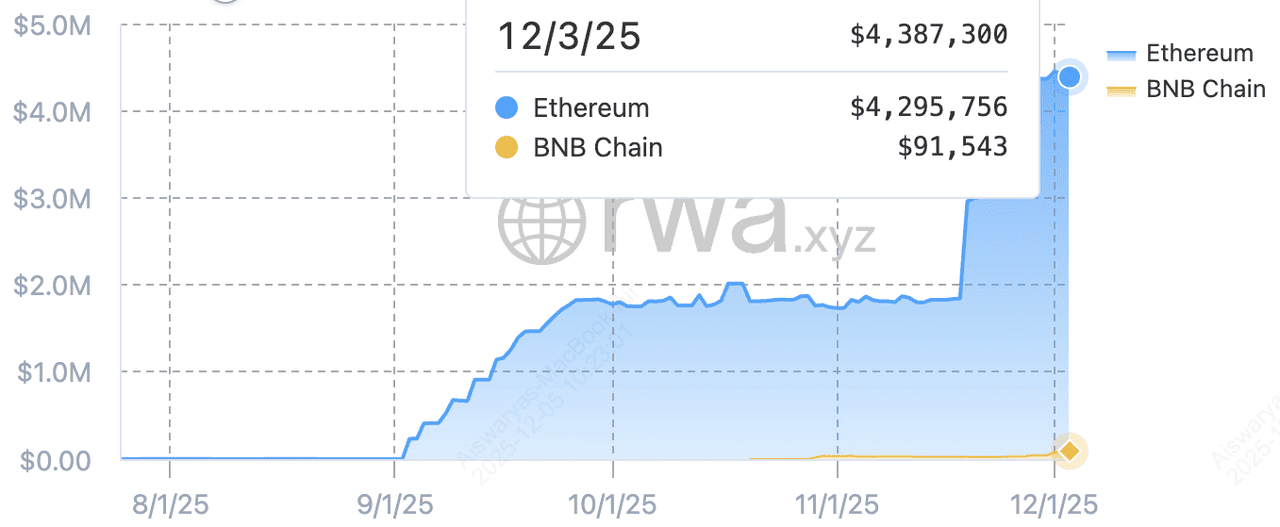

Total value of Meta tokenized xStock (METAX) | Source: RWA.xyz

METAX, issued by Backed Finance under Swiss financial regulations, is a fully collateralized tokenized version of Meta stock, backed 1:1 by real META shares held in regulated custody. Launched as part of the xStocks lineup, METAX is issued on the Solana blockchain as an SPL token, enabling ultra-fast, low-cost transactions and access to retail-focused liquidity hubs like

Raydium and

Jupiter. As of the latest reporting period, METAX has grown to a $3.39 million total asset value, with a net asset value (NAV) of $640, 2,920 holders, and $11.04 million in monthly transfer volume, reflecting rising on-chain adoption of tokenized equities.

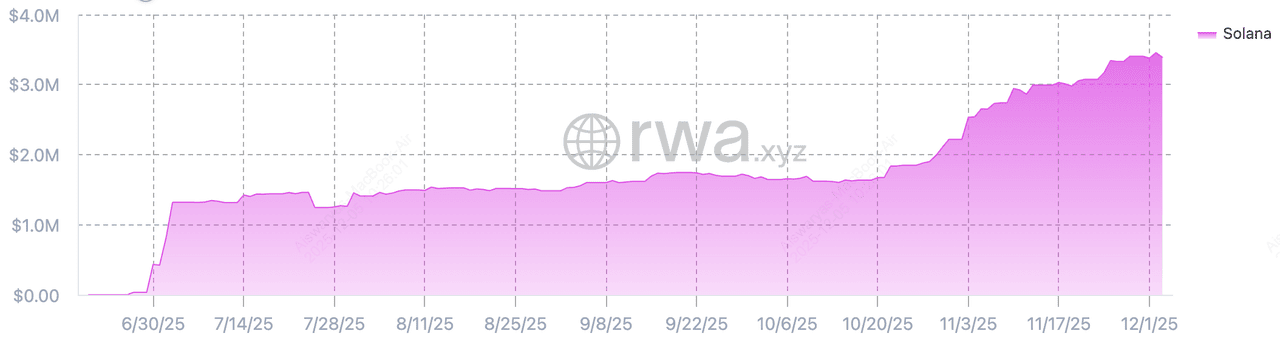

What Is Meta Ondo Tokenized Stock (METAON)?

Total value of Meta Ondo tokenized stock (METAON) | Source: RWA.xyz

METAON is the Ondo Finance tokenized version of Meta Platforms stock, giving holders economic exposure equivalent to owning META and automatically reinvesting dividends. Issued through

Ondo Global Markets, METAON allows non-U.S. retail and institutional users to mint and redeem tokenized U.S. stocks 24 hours a day, five days a week, with routing to traditional exchange liquidity. As of the latest data, METAON has expanded rapidly to a $4.39 million total asset value, with a NAV of $641, 197 holders, and a significant $14.65 million monthly transfer volume, marking a +398% surge in activity over the last 30 days.

METAON, on the other hand, is issued on the Ethereum and BNB Chain blockchains by Ondo Finance. On Ethereum, METAON benefits from institutional-grade settlement, strong oracle integrations, and mature DeFi collateral use cases. This multi-chain design allows META's tokenized shares to flow seamlessly across ecosystems, making them more flexible and usable than traditional off-chain equity products.

How METAX, METAON Tokenized Stocks Work: Issuance, Backing and Collateralization

Tokenized stocks convert real-world equities into blockchain tokens that mirror the underlying asset’s price while maintaining regulated collateral structures. METAX and METAON follow similar tokenization principles but are issued by different entities.

1. Custody and Backing

• METAX is fully collateralized 1:1 by real Meta shares held by a regulated Swiss custodian through Backed Finance.

• METAON is issued by Ondo Finance and backed by Meta shares held in qualified custodial accounts for non-U.S. investors, mirroring META’s economic exposure (including dividend reinvestment equivalents).

2. Minting and Redemption

• METAX mints new tokens only when Meta shares are deposited into custody; tokens are burned upon redemption to maintain the 1:1 ratio.

• METAON allows eligible users to mint and redeem tokenized Meta equity 24/5, with Ondo routing redemptions to traditional exchange liquidity.

3. Price Tracking

Both tokens track META’s real-time stock price using:

• Chainlink and Pyth equity oracles

• RFQ pricing models

• Market liquidity on DEXs and supported CEXs

4. On-Chain Trading & DeFi Integration

•

METAX exists on Ethereum (ERC-20) and Solana (SPL), enabling cross-chain trading,

lending, and liquidity provisioning.

• METAON operates on Ethereum as an ERC-20 token, tradable 24/7 with expanding DeFi integrations.

Together, METAX and METAON provide the economic performance of Meta stock with the speed, programmability, and global accessibility of blockchain-based settlement.

METAX vs. METAON: What Are the Key Differences?

METAX and METAON both offer on-chain exposure to Meta’s stock and track the same underlying META price, but they differ in issuance, design, and target users. METAX, issued by Backed Finance under Swiss regulation, is available exclusively on Solana, providing fast, low-cost settlement and deep integration with

Solana’s DeFi ecosystem. METAON, issued by Ondo Finance, is available on Ethereum and BNB Chain, offering broader multi-chain accessibility and institutional-grade minting and redemption tailored specifically for non-U.S. investors.

While both tokens track META’s price, METAX emphasizes Solana-native speed and composability, whereas METAON focuses on regulated global accessibility, deeper liquidity routing to traditional markets, and support for economic exposure features such as dividend reinvestment equivalents.

How METAX and METAON Meta Tokenized Stocks Ensure Regulatory Compliance

Both METAX and METAON follow strict regulatory frameworks to ensure compliant on-chain exposure to Meta’s stock. METAX, issued by Backed Finance, operates under Swiss financial regulations that require regulated custody of underlying shares, audited reporting, full asset segregation, and controlled minting and redemption for eligible participants.

METAON, issued through Ondo Finance’s Global Markets platform, is designed for non-U.S. investors and adheres to jurisdictional restrictions, KYC/AML requirements, and qualified-custodian oversight for the underlying META shares. By enforcing transparent reserve management, investor-eligibility rules, and compliance-driven trading limits, both METAX and METAON provide regulated pathways to equity exposure while balancing global accessibility with legal safeguards.

What Are the Real-World Use Cases of METAX and METAON Tokenized Stocks?

Tokenized versions of Meta stock unlock new ways for global users to access, trade, and integrate U.S. equities directly within the crypto ecosystem.

1. 24/7 Trading Access: Trade Meta exposure at any time on CEXs like BingX and DEXs, even when NASDAQ is closed.

2. Fractional, Global Ownership: Buy small fractions of Meta stock without brokerage accounts, geographic restrictions, or high capital requirements.

3. DeFi Integration: Use METAX and METAON for lending, borrowing, liquidity pools, yield strategies, and automated smart-contract trading.

4. Cross-Chain Utility: Access METAX on both Ethereum and Solana for faster settlement, lower fees, and multi-chain liquidity.

5. Portfolio Diversification and Composability: Combine traditional equity exposure with crypto assets and integrate Meta exposure into indexes, hedging tools, and structured products.

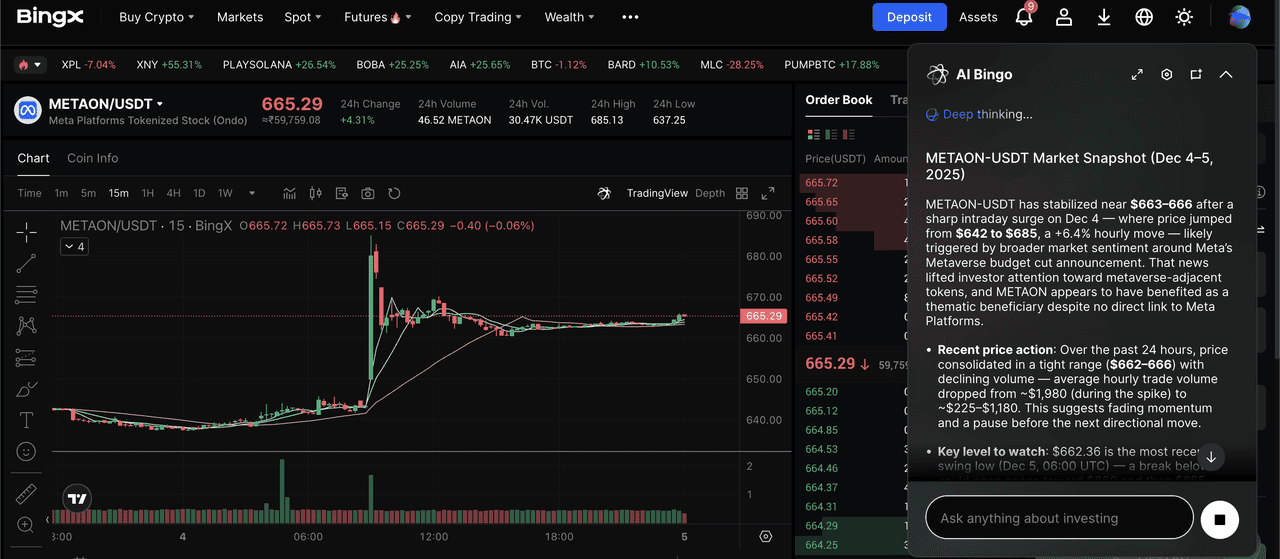

How to Buy Meta Tokenized Stock, METAX and METAON

You can buy and trade both METAX and METAON on BingX, one of the most accessible global platforms for tokenized equities. BingX supports spot and futures markets for Meta exposure, offers intuitive tools for managing TP/SL levels, and integrates

BingX AI for smarter trade insights and automated strategy assistance, making it easier for beginners and advanced traders alike to navigate tokenized stock markets with confidence.

Buy or Sell METAX and METAON on BingX Spot Market

METAX/USDT trading pair on the spot market powered by BingX AI insights

1. Log in to your BingX account.

2. Navigate to

Spot and Search for METAX or METAON.

5. Enter your desired amount and confirm the trade.

Spot trading gives you direct exposure to META’s price via METAX and METAON tokens.

Trade METAX with Leverage on BingX Futures Market

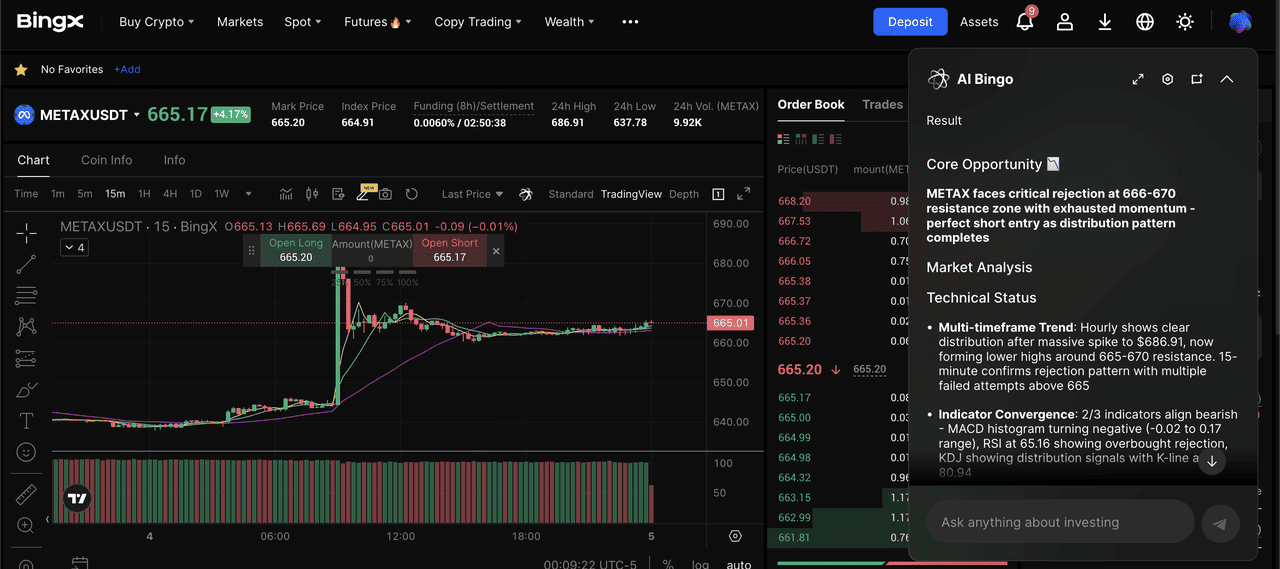

METAX/USDT perpetual contract on the futures market powered by BingX AI

BingX also supports METAX perpetual futures, enabling advanced trading strategies.

3. Choose your margin mode and leverage.

4. Open long (buy) or short (sell) positions.

This allows traders to profit from Meta stock volatility even during after-hours, earnings reports, or market-moving announcements.

What Are the Benefits of Investing in Meta Tokenized Stock?

Meta tokenized stocks like METAX and METAON offer investors a streamlined, borderless way to access Meta’s price performance with added flexibility that traditional brokers can’t match. They provide transparent, on-chain exposure to META’s value, enable fractional investing with minimal capital, and allow anyone globally to participate without U.S. brokerage requirements. Because these tokens are programmable, they can interact with smart contracts for automated strategies or collateral use, while platforms like BingX expand flexibility further through spot and futures trading with advanced tools such as leverage and TP/SL execution.

Key Considerations Before Buying and Trading META's Tokenized Equities

Tokenized Meta stocks offer unique benefits, but users should understand the following factors before investing or trading.

1. No Shareholder Rights: Holding METAX or METAON does not provide dividends, voting rights, or other corporate privileges associated with owning real META shares.

2. Regulatory Uncertainty: Tokenized equities operate in an evolving regulatory landscape, which may impact trading availability, redemption rules, or jurisdictional access.

3. Custodial and Issuer Dependence: The value and security of both tokens rely on proper custody of underlying shares and the issuer’s compliance, audits, and transparency.

4. Variable Liquidity: On-chain liquidity can fluctuate across exchanges and chains, sometimes resulting in wider spreads or less depth than traditional stock markets.

5. Jurisdictional Restrictions: Certain regions and user categories may be restricted from trading or redeeming tokenized equities due to regulatory requirements.

Final Thoughts: Should You Buy METAX or METAON Tokenized Shares?

METAX and METAON offer a modern, blockchain-based way to gain economic exposure to Meta’s stock, providing features such as fractional access, 24/7 trading, global availability, and seamless integration with on-chain markets. For users who want to participate in Meta’s price movements without relying on traditional brokerage accounts, or who wish to incorporate equity-like assets into DeFi, these tokenized versions present a convenient alternative.

However, they are not substitutes for holding actual META shares, as they do not provide voting rights, dividends, or direct ownership claims. As with any financial product, especially one operating within an evolving tokenization and regulatory landscape, investors should carefully assess the risks, liquidity conditions, and jurisdictional limitations before deciding whether METAX or METAON fits their strategy.

Related Reading

FAQs on Meta Tokenized Stocks, METAX and METAON

1. Are METAX and METAON backed by real Meta shares?

Yes. METAX is fully collateralized 1:1 with Meta shares held by a regulated Swiss custodian, while METAON is backed through Ondo Finance’s custodial infrastructure for non-U.S. investors.

2. Do Meta's tokenized equities provide shareholder rights?

No. Neither token grants dividends, voting rights, or corporate privileges; they only offer economic exposure to META’s price movements.

3. What blockchains are METAX and METAON issued on?

METAX is issued on Ethereum (ERC-20) and Solana (SPL), while METAON is currently issued as an ERC-20 token on Ethereum.

4. Where can I buy or trade METAX and METAON?

METAX is available on BingX for both spot trading and perpetual futures, while METAON can be accessed through Ondo-supported platforms for eligible non-U.S. users.

5. Can METAX and METAON be used in DeFi?

Yes. Both tokens can participate in DeFi activities such as lending, borrowing, liquidity pools, and automated trading strategies on supported platforms.