On December 4, 2025, an official bridge connecting

Solana (SOL) and

Base went live using

Chainlink CCIP for cross chain message security and Coinbase infrastructure for relay and indexation, creating a direct transfer corridor between the Solana and

Base ecosystems. This new bridge enables bidirectional movement of SOL and SPL tokens alongside arbitrary cross chain messages, unlocking composable workflows that combine Solana speed with Base compatibility. Early testers reported end to end transfer times that typically range from under a minute to a few minutes depending on finality and proof relay, and initial throughput measurements show the bridge handling tens of thousands of messages and transfers in its first weeks of operation.

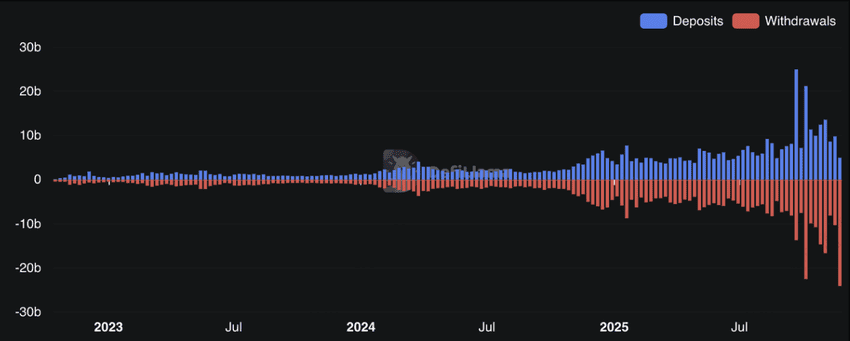

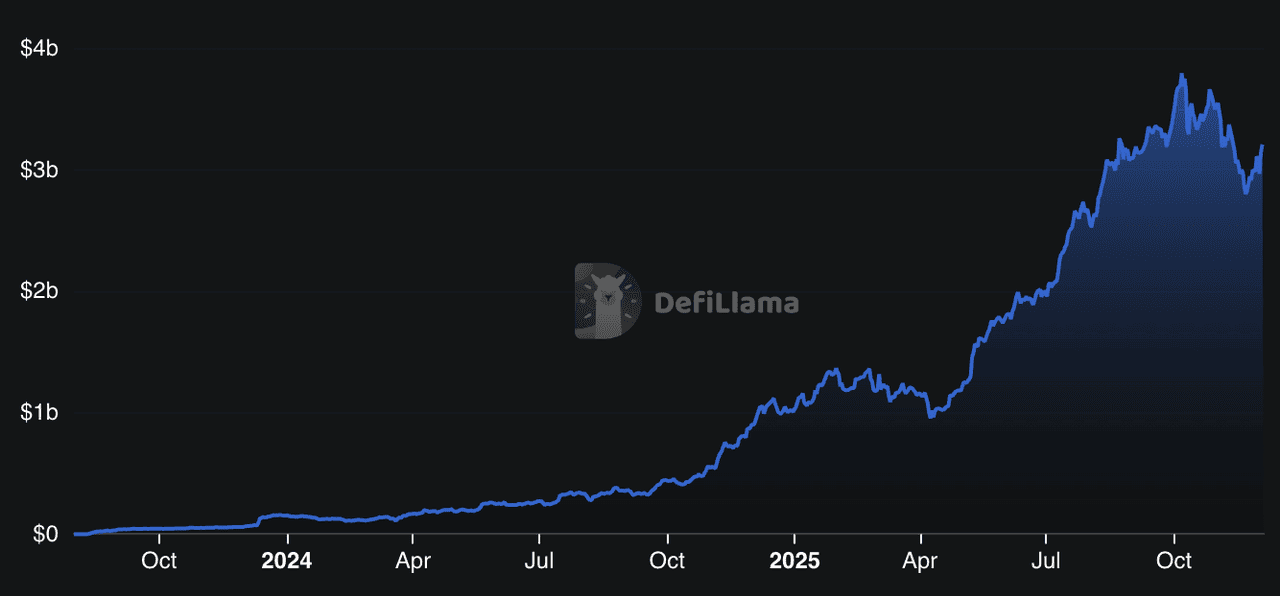

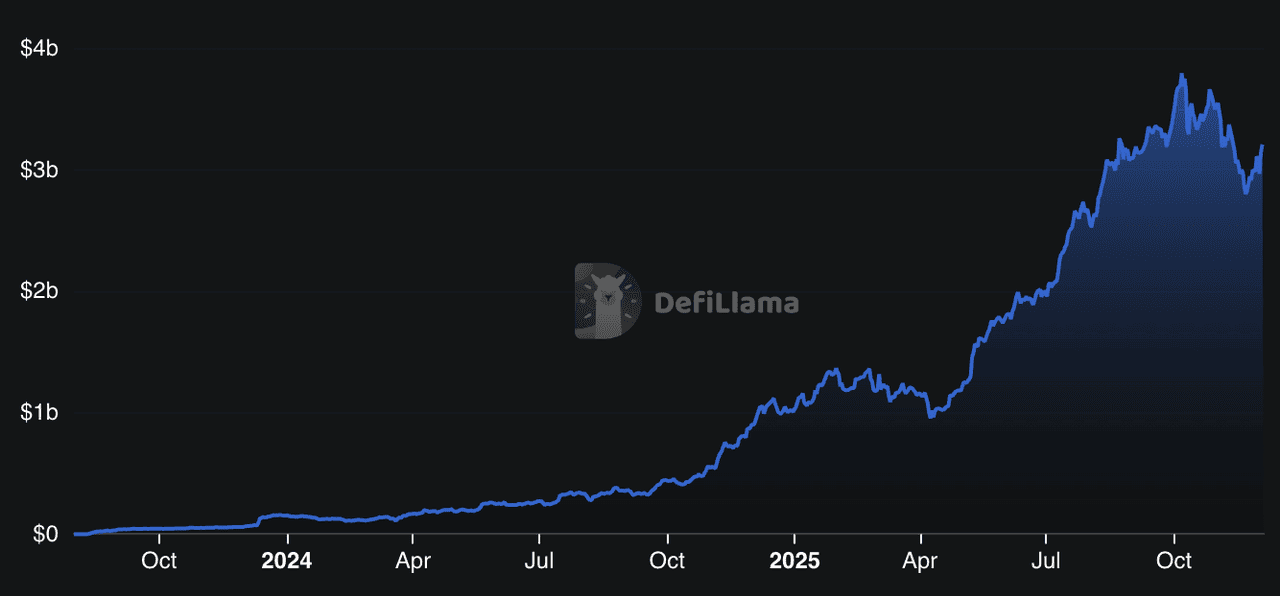

Total bridge volume | Source: DefiLlama

In 2025, cross-chain activity is steadily climbing higher, with total bridging volume across all chains reaching nearly $30 billion in November 2025, and daily transfers consistently averaging $600-700 million.

If you hold Base (

ETH) and want to dive into the lightning-fast, ultra-low-fee world of Solana (SOL) for DeFi, memecoins, NFTs, or high-yield opportunities, bridging from Base to Solana is now faster, cheaper, and more secure than ever. Whether you're moving assets from Coinbase's

Layer-2 ecosystem or just looking for the best of both worlds, getting your funds onto Solana has never been smoother.

The launch brings together two highly active communities and their liquidity pools which in aggregate register hundreds of millions of dollars in on chain value across trading and DeFi activity, and the bridge is expected to accelerate capital flows, enable multi chain applications, and reduce friction for developers who need native access to both Solana and EVM compatible L2 environments. This article explains what crypto bridges are, why to use them, how they work, top routes for Solana to Base transfers, a detailed step by step guide to move SOL to Base, common issues and solutions you may encounter, and the main risks to consider before bridging.

What Is Solana (SOL)?

Solana is a high-performance

Layer-1 blockchain engineered for speed, scalability, and ultra-low fees. Powered by its hybrid Proof-of-History (PoH) + Proof-of-Stake (PoS) consensus, Solana optimizes the way transactions are ordered, allowing throughput that far exceeds most competing networks.

In typical conditions, Solana processes 1,500–4,000 transactions per second (TPS), with stress tests showing peaks above 50,000 TPS. Average block times hover around 400 milliseconds, and transaction fees generally stay under $0.01, making Solana one of the most cost-efficient blockchains available.

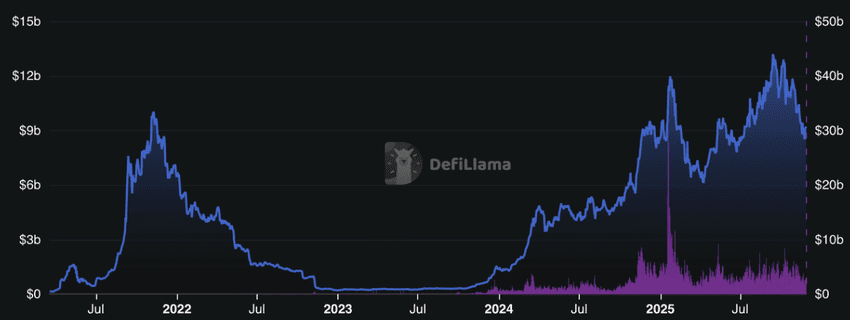

Solana DeFi TVL | Source: DefiLlama

The network's adoption has surged since 2023. Solana now records tens of billions of dollars in monthly transaction volume, supports millions of active wallets, and powers leading DeFi, NFT, and gaming applications. As of November 2025, the Solana ecosystem accounts for over $9.2 billion in total value locked (TVL). Its combination of speed, affordability, and developer activity positions Solana as one of the most influential chains in Web3.

What Is Base Chain?

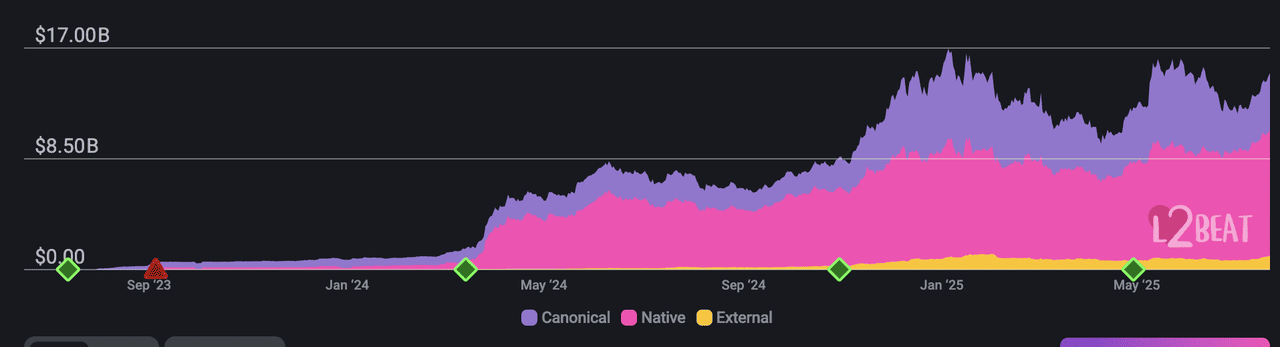

Base network TVL | Source: L2Beat

Base is an Ethereum Layer 2 blockchain developed by Coinbase to meet the increasing demands of decentralized networks and to make blockchain technology more accessible and efficient. Utilizing Optimistic Rollups, Base processes transactions off-chain before batching and submitting them to the Ethereum mainnet. This design relieves congestion on the main chain, lowers fees, and boosts transaction speeds, helping both developers and users benefit from faster and more economical interactions. By relying on Ethereum's robust security, Base maintains a high standard of safety and trust across its network.

As Coinbase continues to expand its reach, now operating in over 120 countries, supporting more than 245,000 ecosystem partners, and processing quarterly trading volumes approaching $400 billion, the rollout of the Base app signals a step-change in the company's vision. With over 8 million people engaging monthly across its platforms, Coinbase is positioning Base not just as a wallet or a tool, but as a foundational layer for the future of digital and financial life. Much like WeChat, Alipay, X (formerly Twitter), and Meta are building their own versions of "super apps," Coinbase is establishing Base as the definitive crypto-native alternative backed by the scale, security, and innovation of its Ethereum

Layer 2 blockchain architecture.

What Are Crypto Bridges?

Crypto bridges enable tokens and data to move between blockchains that can’t communicate natively. They typically lock or burn assets on the source chain and mint or release equivalent tokens on the destination chain, or route transfers through liquidity pools. Different designs, lock-and-mint, liquidity routing, and message-passing, rely on relayers, validators, or threshold signatures, each with its own trust model. Bridges matter because they allow users to move liquidity, NFTs, and strategies across ecosystems without centralized custodians. Major providers like

deBridge,

Wormhole, Synapse, and Allbridge secure billions in monthly cross-chain volume, with deBridge alone processing over $10B since 2023.

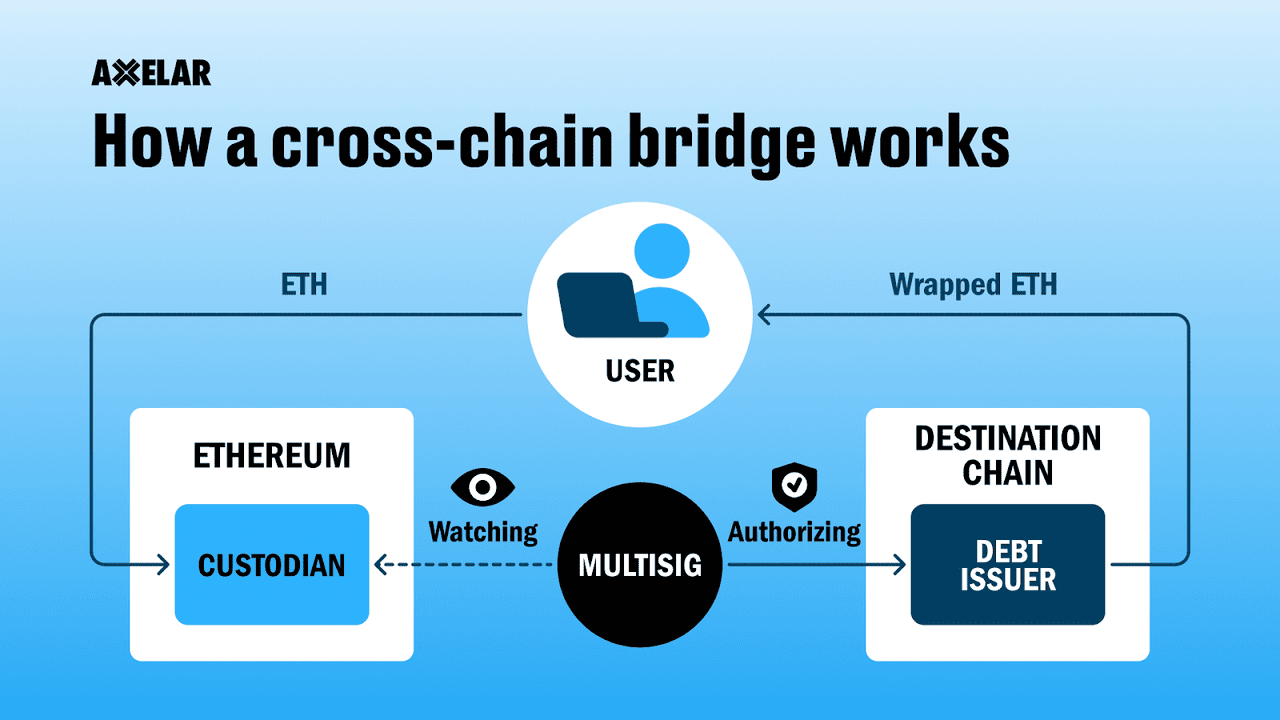

How Do Cross Chain Bridges Work?

A cross-chain bridge locks or burns your asset on the source chain, generating a verified message or proof through relayers or validators, and then minting or unlocking the corresponding asset on the destination chain once the proof is validated. Modern bridges use threshold signatures, MPC, or oracle networks to improve security and reduce single points of failure, while finality times vary by chain and design, typically ranging from a few seconds to several minutes. Understanding these timing and verification windows is essential, as incorrect claims or unsupported tokens can lead to failed transfers or require manual recovery.

Why Should You Use Crypto Bridges?

You should use crypto bridges when you need to leverage unique features on different chains such as lower fees, specialized dApps, greater liquidity, or specific token support that is not available on your current network. If you want to move SOL liquidity into Ethereum style tooling or into EVM native smart contracts that run on Base, you can access a much broader set of decentralized exchanges and composability options without selling your underlying position.

Crypto bridges unlock powerful benefits that centralized exchanges cannot provide:

1. Access to Better Yield and DeFi Opportunities: Ethereum hosts blue-chip protocols like

Aave,

Lido,

Rocket Pool,

Curve, and

Uniswap, offering yields unavailable on Solana. Solana, meanwhile, offers lightning-fast trading and high-performance dApps like

Jupiter,

Raydium,

Kamino,

Drift, and Sanctum.

2. Cost Efficiency and Flexibility: deBridge charges 0.03 SOL flat fees for many transfers Ethereum gas typically ranges from $5–$15, but can spike during congestion.

On the other hand, Solana transfers cost fractions of a cent. Bridging allows you to use assets without selling, preserving tax lots and avoiding unnecessary trades.

3. Multi-Chain Diversification: Holding assets across chains reduces exposure to:

• Network downtime

• Congestion

• Single-chain smart contract failures

Bridges help users deploy capital where opportunities are best without changing their core holdings.

What Are the Top Ways to Bridge From Solana to Base?

The primary and recommended route for Solana to Base transfers is the newly launched official Base Solana bridge which uses Chainlink CCIP for secure message verification combined with Coinbase node and relay infrastructure to ensure reliable proofs and high availability. For tokens not yet listed for direct minting the bridge offers mediated flows that use wrapped representations or liquidity backed routes so that SPL tokens can be used on Base as EVM compatible tokens while maintaining a path to redeem back into their native form.

In addition to the official route several third party protocols provide alternate bridging services between Solana and EVM chains using liquidity pools, custodial wrapped solutions, or multi hop bridging through intermediate chains, which can increase flexibility for obscure tokens at the cost of additional fees and slightly longer settlement times. When possible choose the official bridge for the best support of SOL and core SPL tokens, use third party platforms for niche tokens after testing small amounts, and prefer routes with on chain proofs, transparent relayer sets, and published audit histories to reduce risk.

How to Bridge From Solana to Base Network: Step-by-Step Guide

Bridging from Solana to Base allows you to move assets seamlessly between ecosystems so you can access Base-native dApps, liquidity, and trading opportunities. Follow these steps to bridge your assets from the Solana network to Base chain:

1. Connect Your Solana Wallet and Check Balances

Open your preferred Solana wallet and verify you have sufficient SOL or the SPL token you plan to bridge, and make sure you also hold a small extra amount for transaction fees and potential retries. You can fund your SOL wallet directly on the

BingX Spot Market. Confirm that your wallet is up to date and that you can view the transaction history because you will reference transaction signatures if you need to reconcile a pending bridge.

2. Open the Official Base Solana Bridge Interface

Choose the official bridge portal and select Solana as the source chain and Base as the destination, confirm the correct recipient address on Base and double check address formats because EVM addresses differ from Solana address formats. Ensure the token you wish to bridge appears in the supported tokens list; if it is not listed consider using a trusted third party route but start with a test amount first.

3. Submit the Lock or Burn Transaction on Solana and Wait for Confirmations

Authorize the bridge transaction in your wallet and monitor the Solana transaction until it reaches the required number of confirmations for the bridge, which typically means waiting for on chain finality and the bridge relayers to observe the emitted event; confirmation expectations vary but are often under a minute on Solana under normal load. Keep the transaction signature and bridge reference ID in your notes because you may need these if the claim step requires manual intervention.

4. Claim the Minted or Unlocked Asset on Base

After the bridge relayers publish the verified proof to Base the bridge interface will show the claim step and the corresponding wrapped or native representation will be minted or unlocked in your Base wallet, at which point you can use the token on Base dApps; if the claim does not appear within the expected window check the bridge status, ensure your Base wallet address is correct, and contact bridge support with your transaction signature if manual resolution is required.

What Are the Common Issues When Bridging Solana and Base?

1. Delayed or Stuck Transfer Due to Solana Congestion or Relayer Lag

Transfers can appear stuck when Solana experiences brief congestion or when relayers have not yet processed the event. First confirm that your Solana transaction reached finality by checking the signature and required confirmations on a block explorer. If it is finalized but still pending, review the bridge status page to see if relayers are backlogged or processing events slowly. Always save your transaction signature since support teams need it for manual reconciliation. If delays persist longer than the usual window, contact bridge support and include the signature, timestamp, and your destination address so operators can reprocess the claim.

2. Token Not Whitelisted or Unsupported Token Mapping

If a token is not whitelisted on Base, the bridge may reject the transfer or mint a wrapped version that dApps cannot use. Before bridging any SPL token, verify that it appears on the bridge supported token list and make sure the mint address matches exactly. If a token is unsupported, swap it for SOL or another supported token before bridging. If you accidentally receive an unusable wrapped asset, keep all transaction details and contact the bridge operator for recovery instructions, which may involve manual burn and redemption handling.

3. Insufficient Gas or Residual Balance Errors on Base

Sometimes your funds arrive but you cannot interact with them because your Base wallet has no native token for gas. To prevent this, always leave a small Base native token balance in the wallet before bridging so you can pay for approvals, swaps, and claim steps. If you forgot, you can purchase a small amount through an on ramp or receive a transfer from another wallet. Some bridges offer fee forwarding where claim gas is deducted from the bridged funds, so check whether that option is available if you often bridge with low balances.

4. Manual Claim or Proof Verification Required

Occasionally the automatic claim step fails because the relayer did not submit the proof correctly or because the destination chain temporarily rejected it. In these cases you may need to provide the Solana transaction signature, bridge reference ID, and your destination address so the operator can rebuild and re broadcast the proof. Save screenshots of your wallet confirmation and any error messages because they help support teams trace the event quickly and resolve the issue without requiring repeated transfers.

5. Mismatch in Token Decimals or Approval Behavior

Some bridged assets use different decimal precision or approval mechanics than their original SPL version, which can cause errors in swaps or smart contract interactions on Base. Before bridging, check the token decimals and compatibility notes inside the bridge or the destination dApp. If decimals do not match what the dApp expects, you may need to wrap, unwrap, or convert the token using a trusted router. Developers should test these differences in advance on testnets so users do not run into unexpected approval failures.

What Are the Risks to Consider When Bridging Solana to Base?

Even though the official Base Solana bridge uses established security primitives there remain inherent risks including validator compromise, software bugs, misconfigured token mappings, and delays during high network congestion periods that can expose users to temporary illiquidity. Bridges increase the attack surface because they rely on correct behavior across multiple systems and proof relay layers, and historical incidents show that bridge exploits have led to large losses when assumptions about decentralization or key management prove false.

Additional risks include wrapped token mismatch where the bridged representation on Base has different decimal or approval semantics than the original SPL token, smart contract bugs in destination dApps that accept bridged tokens, and front end phishing risks when users accidentally interact with spoofed bridge portals. To mitigate these risks, use the official bridge for core assets, start with small amounts to test the full round trip, confirm the bridge has audits and a reputable relayer set, and avoid leaving large idle balances on a destination chain where you cannot recover quickly.

How to Buy ETH or SOL Directly on BingX

ETH/USDT trading pair on the spot market powered by BingX AI insights

1. Create or log in to your BingX account: Sign up with your email or mobile number and

complete KYC if required in your region.

3. Go to Spot Trading: Open the Spot Market and search for

ETH/USDT or

SOL/USDT.

4. Use BingX AI for market insights: Check AI-generated signals, market trends, and price analysis to make informed decisions before placing your trade.

5. Enter the amount of ETH or SOL you want to buy: Choose

Market Order for instant execution or Limit Order to set your preferred price.

6. Confirm your purchase: Review your order, tap Buy, and your ETH or SOL will be added to your BingX Spot Wallet.

7. Store or transfer your ETH, SOL tokens: Keep your ETH or SOL securely on BingX or withdraw to a self-custody wallet for DeFi, staking, or Web3 apps.

Conclusion

Bridging Solana to Base opens practical and strategic options for both users and developers by combining Solana high throughput and low costs with Base EVM compatibility and broader dApp composability, and the official Base Solana bridge launched in December 2025 is an important step toward tighter multi chain integration. If you follow careful practices such as using the official bridge when possible, verifying token support, leaving reserve gas for claim steps, testing in small amounts, and keeping detailed transaction records, you can minimize common failures and enjoy faster access to new markets and services.

At the same time remain mindful of systemic bridge risks including validator and relayer trust assumptions and potential wrapped token complexities; bridging is a powerful tool when used judiciously and securely, and the new Base Solana corridor is likely to become a primary route for cross chain value flows as applications and liquidity adapt to multi chain operation.

Related Reading