The narrative of

Ethereum vs. Solana has reached a new chapter in 2026. After a transformative 2025 that saw the launch of

Solana ETFs and the widespread implementation of the

Firedancer validator client,

Solana has solidified its position as the institutional choice for high-frequency DeFi and scalable dApps. As of February 2026, Solana maintains a dominant market presence with a market capitalization of $48.69 billion, processing nearly 1 billion transactions weekly.

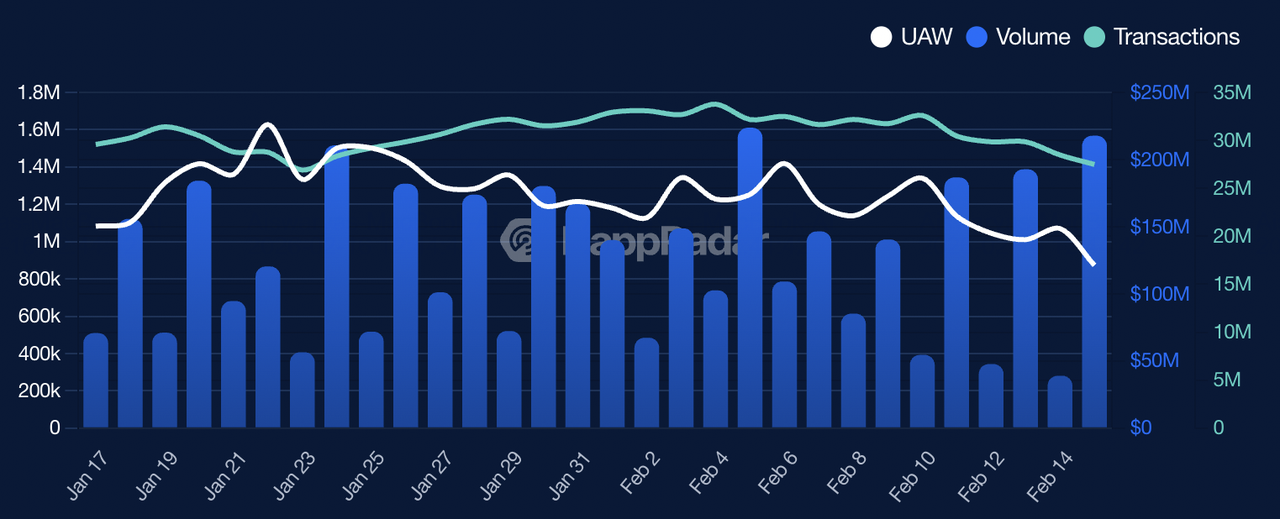

Solana's UAWs, volume, and transactions over the past 30 days | Source: DappRadar

While the broader market has seen a Meme Wane after the speculative memecoin frenzy of 2024-2025, the Solana ecosystem has matured into a robust financial layer. Recent breakthroughs, such as the partnership between Anchorage Digital and

Kamino for institutional SOL borrowing, demonstrate that capital on Solana is no longer just fast money; it is becoming patient capital.

This guide provides an overview of 10 of the best projects within the Solana ecosystem and their roles in the network’s 2026 development. By examining applications in DeFi and

decentralized physical infrastructure (DePIN), we analyze the technical and fundamental factors currently influencing Solana's on-chain activity.

What Is Solana and Its Role in the 2026 Crypto Economy?

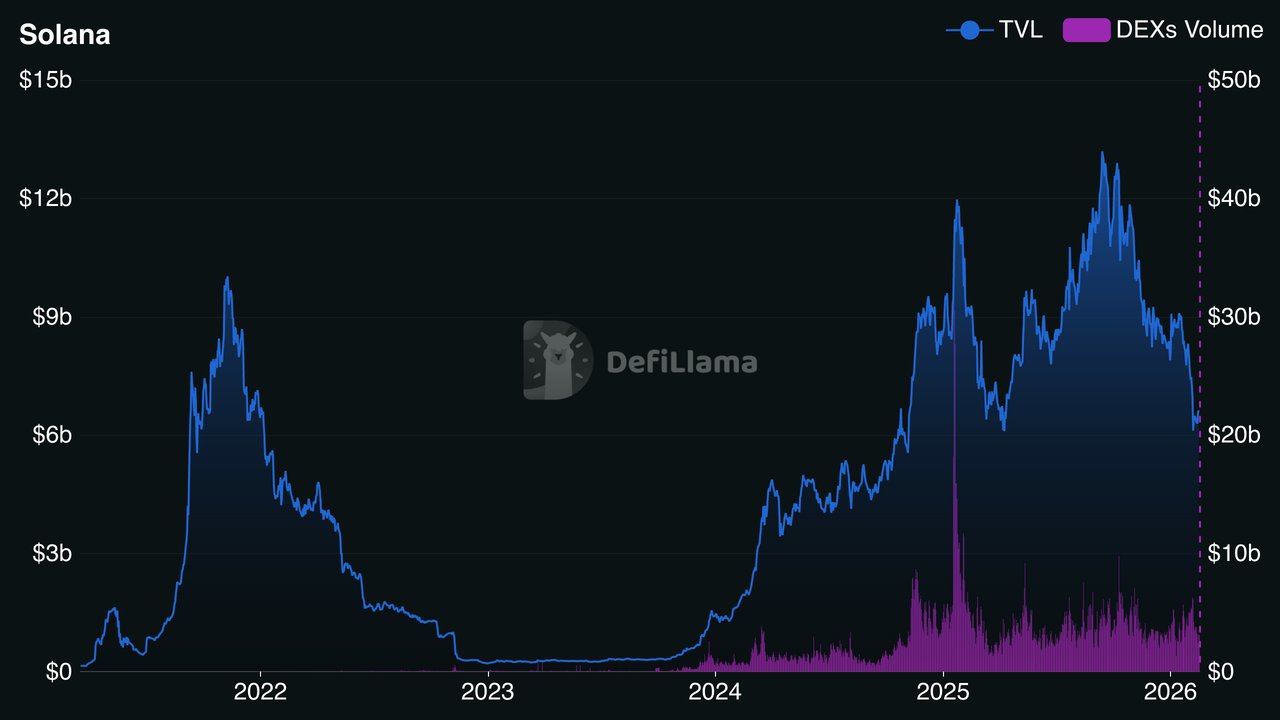

Solana's DeFi TVL and DEX volume | Source: DefiLlama

Solana is a high-performance

Layer 1 blockchain designed for mass adoption, characterized by its unique Proof-of-History (PoH) consensus mechanism. Unlike traditional blockchains that struggle with congestion, Solana’s architecture allows it to handle thousands of transactions per second with sub-cent fees.

In 2026, Solana ranks as a top-tier L1 by Total Value Locked (TVL), with $6.2 billion currently staked across its protocols. The introduction of Solang with Solidity support and the Neon EVM has successfully bridged the gap for

Ethereum developers, allowing them to deploy applications on Solana using familiar tools. Today, Solana is not just a chain for retail

memecoins; it is a hub for global payments via Visa and Shopify, institutional finance, and high-fidelity

gaming.

What’s Driving Solana Ecosystem's Momentum in 2026?

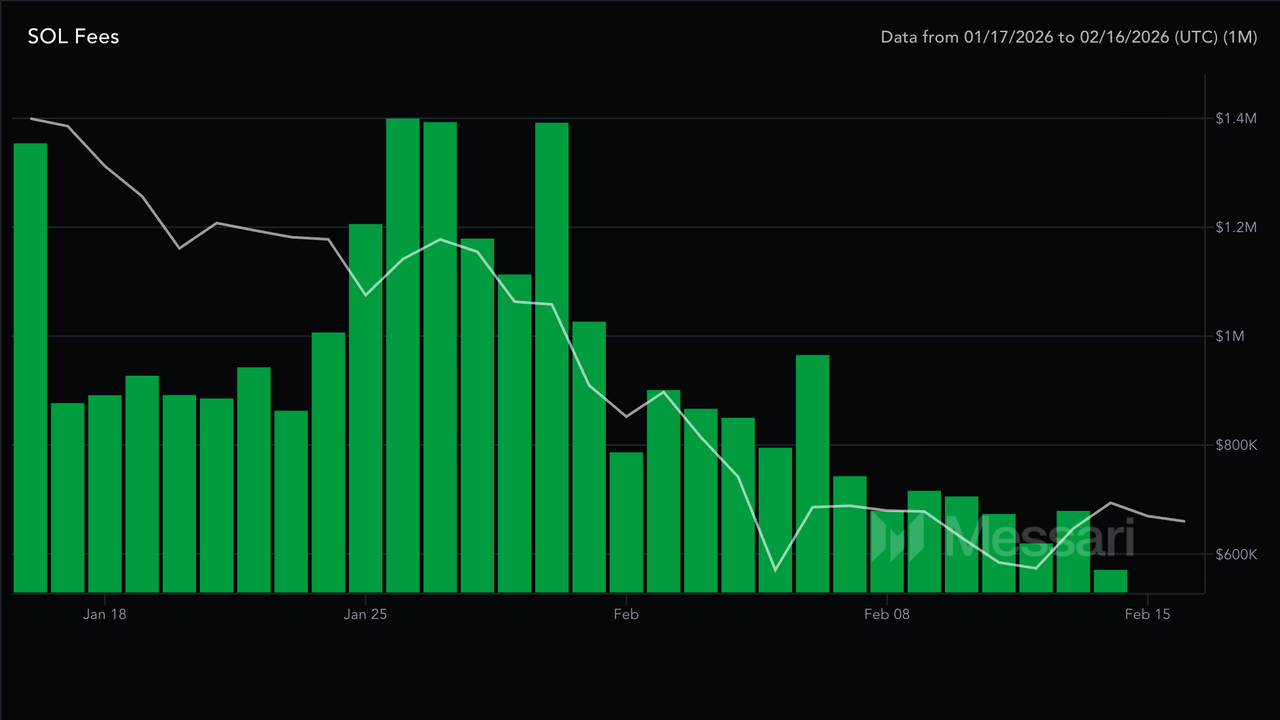

Solana network fees vs. price | Source: Messari

Solana’s resilience in early 2026, despite broader market volatility, is driven by three key pillars of growth:

1. Institutional Staking and Borrowing Mechanisms

On February 13, 2026, Solana's mindshare surged following a landmark development: institutions can now borrow against natively staked SOL. Through a collaboration with Anchorage Digital, investors can maintain their staking rewards while accessing liquidity. This move has transformed

SOL from a speculative asset into a sophisticated yield-bearing collateral for the world's largest treasuries.

2. The Rise of DeFi Super Apps on Solana

The era of fragmented dApps is ending. Lead projects like

Jupiter and Kamino have evolved into Super Apps, offering swaps, lending, perpetuals, and yield automation under a single interface. This consolidation has simplified the user experience, attracting over 16.79 million unique active wallets to the ecosystem.

3. DePIN and Real-World Utility

Solana has become the undisputed home for DePIN. Projects like

Helium and

Hivemapper leverage Solana’s low costs to manage hardware networks globally. This transition from "purely digital" to "real-world" utility provides a fundamental floor for SOL demand that is independent of market cycles.

What Are the 10 Best Solana Ecosystem Projects to Watch in 2026?

As the Solana ecosystem reaches a period of institutional maturity and high-frequency utility, the following projects have emerged as leaders based on technical innovation, liquidity depth, and user retention.

1. Stablecoin: USDS (USDS)

USDS has solidified its position as a primary liquidity pillar on Solana, serving as the decentralized, upgraded successor to DAI within the Sky Protocol, formerly MakerDAO. As of February 2026, the token maintains a robust minted market capitalization of approximately $9.71 billion, with a circulating supply of over 9.7 billion USDS. Its integration into Solana's high-speed architecture enables institutional-grade features like the Sky Savings Rate (SSR), currently yielding around 4.00%, and a $2.5 billion liquidity commitment aimed at bridging traditional finance with Solana’s growing

Real-World Asset (RWA) sector.

2. RWA: BlackRock USD Institutional Digital Liquidity Fund (BUIDL)

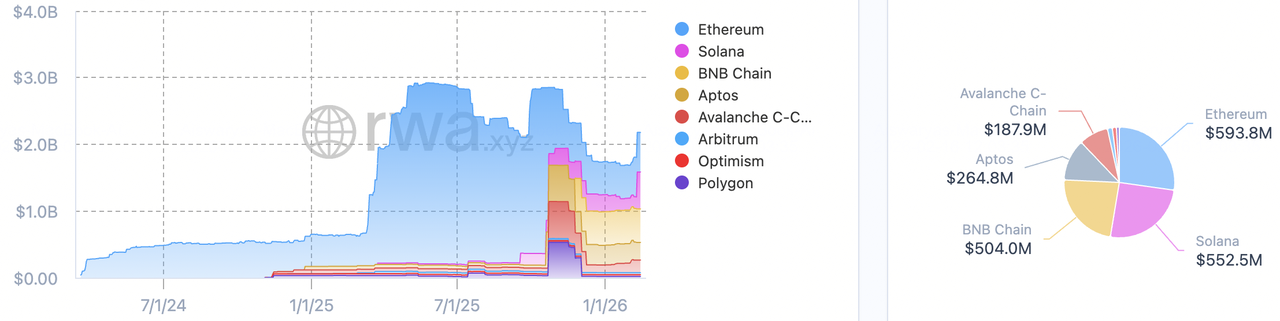

BUIDL Treasury market caps and breakdown by blockchain | Source: RWA.xyz

BlackRock’s BUIDL fund represents a landmark convergence of

traditional finance (TradFi) and Solana’s high-speed architecture. As of February 2026, BUIDL has amassed approximately $2.4 billion in Assets Under Management (AUM), maintaining a steady 7-day APY of 3.44%. By tokenizing U.S. Treasury holdings and cash equivalents, the fund provides institutional investors with near-instant, 24/7 liquidity and daily dividend payouts minted directly to wallets. Its expansion to Solana, which features a competitive 20 bps management fee via Securitize, underscores the network's role as a leading "capital market" for RWAs. This utility was further enhanced on February 11, 2026, with its integration into UniswapX, allowing whitelisted investors to swap BUIDL against

USDC with atomic, on-chain settlement.

3. PolitiFi Memecoin: Official Trump (TRUMP)

The

TRUMP token has evolved from a meme-centric asset into a high-velocity risk-on proxy for political sentiment on Solana. As of mid-February 2026, the token maintains a market capitalization of approximately $811 million, with a 24-hour trading volume exceeding $148 million, reflecting a remarkably high volume-to-market-cap ratio of over 18%.

While the token has retraced from its early 2025 highs, it remains a focal point for institutional interest, evidenced by Canary Capital’s 2026 amendment to its spot

Trump coin ETF filing, which signals a move toward a more regulated investment vehicle. However, the project faces significant supply-side pressure; approximately 80% of the total 1 billion supply is held by affiliated entities subject to a three-year vesting schedule, including a major 50 million token unlock that occurred in January 2026. Despite these dilution risks, the token's massive holder base of over 646,000 unique wallets ensures it remains a primary gauge for community-driven price discovery within the Solana political sub-sector.

4. Memecoin Launchpad: Pump.fun (PUMP)

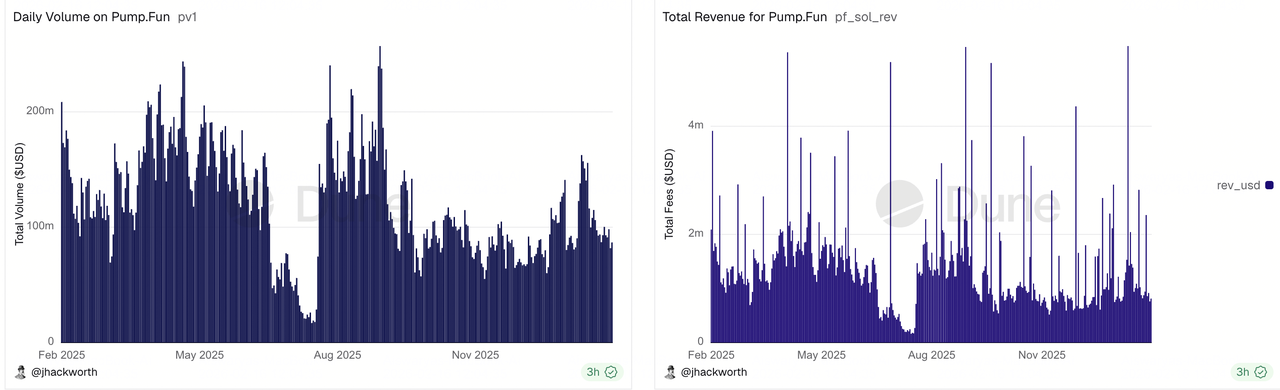

Daily volume and total revenue on Pump.fun | Source: Dune Analytics

Pump.fun has fundamentally altered the Solana token launch landscape by introducing a "fair launch" mechanism that eliminates the need for creators to seed initial liquidity. As of February 16, 2026, the platform has generated over $496.7 million in fees over the past 365 days alone, with a total address base exceeding 30.8 million. The protocol’s efficiency is highlighted by its daily performance; on February 15, 2026, it processed 2.28 million transactions and facilitated $86.79 million in trading volume.

The leading

memecoin launchpad platform continues to serve as Solana's primary retail engine, with 19,210 new tokens launched and 9,750 unique addresses creating coins in a single 24-hour period. While most assets remain speculative, evidenced by the high volume of tokens that do not graduate to

Raydium, the sheer scale of activity, totaling 16.25 million tokens launched since inception, underscores its role as the

Solana memecoin ecosystem's highest-velocity entry point for community-driven assets.

5. AI Meme Coin: Pippin (PIPPIN)

PIPPIN has emerged as a premier

AI-meme hybrid, evolving from a viral SVG unicorn image into a fully autonomous digital entity. As of February 16, 2026, the project maintains a market capitalization of approximately $709 million, with 24-hour trading volume holding steady at $62.45 million. Unlike static memecoins, PIPPIN is powered by a modular Python framework based on BabyAGI, allowing the agent to operate 24/7 on social platforms like X.

The project’s sustainability is driven by its existence-driven architecture, where its actions are governed by internal states such as energy and happiness. With a fixed supply of 1 billion tokens, effectively 100% in circulation, and a growing holder base of over 35,600 unique wallets, PIPPIN serves as a successful case study for CC0 (public domain) branding. Its open-source nature allows developers to freely expand its ecosystem, bridging the gap between high-beta meme culture and functional

AI agent experiments on Solana.

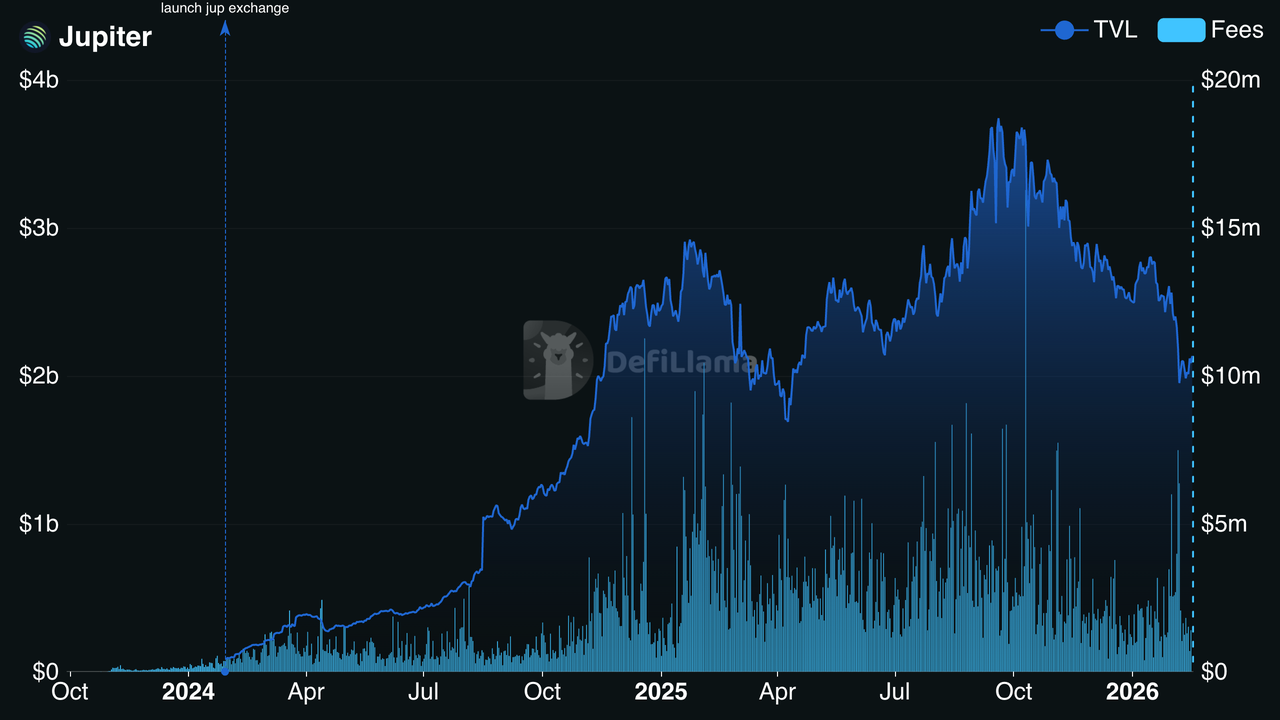

6. DEX Aggregator: Jupiter (JUP)

Jupiter TVL and fees | Source: DefiLlama

Jupiter continues to serve as the dominant front-end for Solana DeFi, facilitating over $700 million in daily swap volume by aggregating liquidity across the entire network. As of February 16, 2026, the protocol holds a Total Value Locked (TVL) of $2.16 billion, reflecting significant capital commitment despite a recent 2-year low in unique active addresses. The project is currently undergoing a pivotal tokenomic shift; the JupiterDAO is voting on a Going Green proposal to eliminate net emissions by pausing team vesting and returning 700 million JUP to the community treasury. With a circulating supply of 3.24 billion JUP and a holder base exceeding 852,000, Jupiter’s 2026 roadmap focuses on evolving into a DeFi Super App, integrating mobile payments and professional-grade perpetuals to unify Solana’s historically fragmented retail flow.

7. NFT Project: Pudgy Penguins (PENGU)

Pudgy Penguins has successfully scaled from a digital collectible into a global consumer brand with a presence in over 3,100 Walmart locations and a burgeoning footprint in major international markets like Japan (Don Quijote) and Korea (Lotte). As of February 2026, the PENGU token on Solana maintains a market capitalization of approximately $483 million, supported by a robust holder base of over 850,000 unique wallets. The ecosystem’s "phygital" strategy has generated over $13 million in retail revenue through the sale of 1.2 million physical toys, each featuring QR codes that bridge users into the Pudgy World

metaverse. This retail momentum is now entering the finance sector with the launch of the Visa-powered Pengu Card, which offers up to 12% cashback rewards and 7% yield on crypto balances, effectively positioning PENGU as a versatile social and utility currency at over 150 million global merchants.

8. AI Agent: Virtuals Protocol (VIRTUAL)

Virtuals Protocol has emerged as a foundational infrastructure for "productive AI agents," facilitating the creation and tokenization of autonomous on-chain programs. As of February 16, 2026, the protocol supports an ecosystem of over 18,000 deployed agents with a total Agentic GDP (aGDP) exceeding $470 million. The recent launch of the Virtuals Revenue Network and the Agent Commerce Protocol (ACP) on February 12, 2026, has introduced a specialized commerce layer, distributing up to $1 million per month to agents based on measurable economic output. With a market capitalization of approximately $414 million and a large holder base of over 1.04 million addresses, the protocol leverages Solana’s high-frequency settlement to enable a seamless agent-to-agent economy, supported by strategic infrastructure integrations like

Coinbase’s Agentic Wallets.

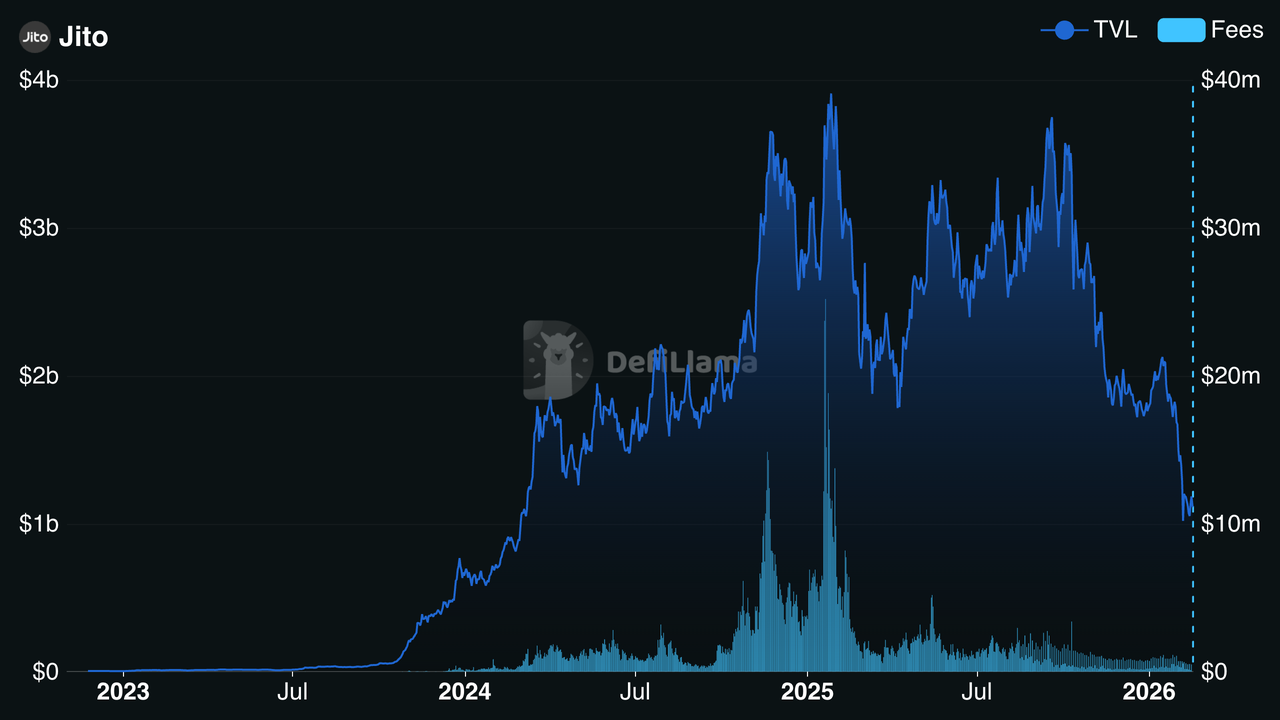

9. Liquid Staking: Jito (JTO)

Jito TVL and fees | Source: DefiLlama

Jito is the central infrastructure for MEV-enhanced

liquid staking on Solana, currently serving as the network's largest protocol with a Total Value Locked (TVL) of $1.1 billion, representing approximately 38% of Solana's ecosystem TVL. By distributing Maximum Extractable Value (MEV) rewards through its JitoSOL

liquid staking token, the protocol offers a dual-yield profile, comprising standard staking rewards of 6–8% APY and an additional 1–3% from MEV tips. In 2026, Jito has expanded its influence via the Block Assembly Marketplace (BAM), a specialized transaction-sequencing layer that has already crossed 20% network stake weight or 88 million SOL. This infrastructure, combined with a multi-asset restaking framework that tokenizes assets as Vault Receipt Tokens (VRTs), makes Jito a foundational security and yield-optimization layer for Solana’s emerging Internet Capital Markets.

10. Mobile Token: Seeker (SKR)

The

SKR token serves as the native utility and governance asset for the

Solana Mobile ecosystem, powering the economic layer of the Seeker Android device. Launched via a major

SKR token airdrop in January 2026 to over 100,000 users and developers, the token has a total supply of 10 billion, with 30% allocated for initial distribution. As of February 16, 2026, SKR maintains a market capitalization of $112.41 million and a circulating supply of 5.33 billion tokens. The ecosystem incentivizes long-term participation through a staking model featuring a 48-hour inflation cycle, starting at 10% annually and tapering to a 2% terminal rate. With 150,000 preorders for the Seeker device across 50 countries, SKR is positioned as the primary incentive for DePIN and mobile-native DeFi adoption.

How to Trade Solana Ecosystem Tokens on BingX

BingX provides a seamless gateway to the Solana ecosystem, offering both high-liquidity Spot markets and advanced Futures for the top SOL-based tokens.

1. Buy and Sell Solana Ecosystem Coins on the Spot Market

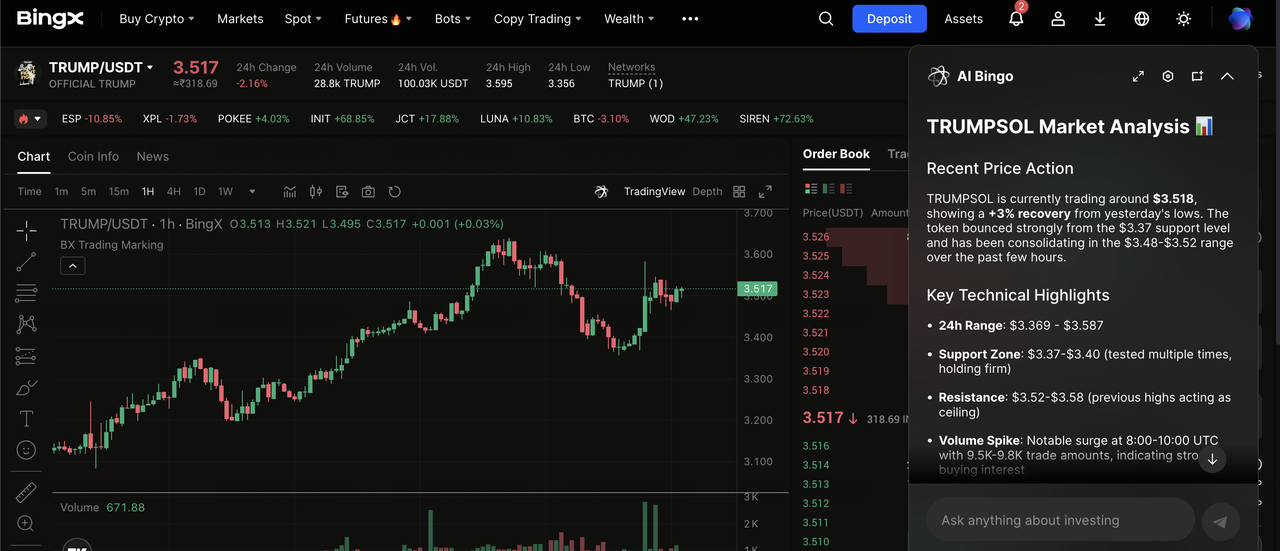

TRUMP/USDT trading pair on the spot market featuring BingX AI insights

Ideal for long-term holders looking to accumulate assets like SOL, JUP, or SKR.

• Step 2: Use

BingX AI to identify historical support and resistance levels.

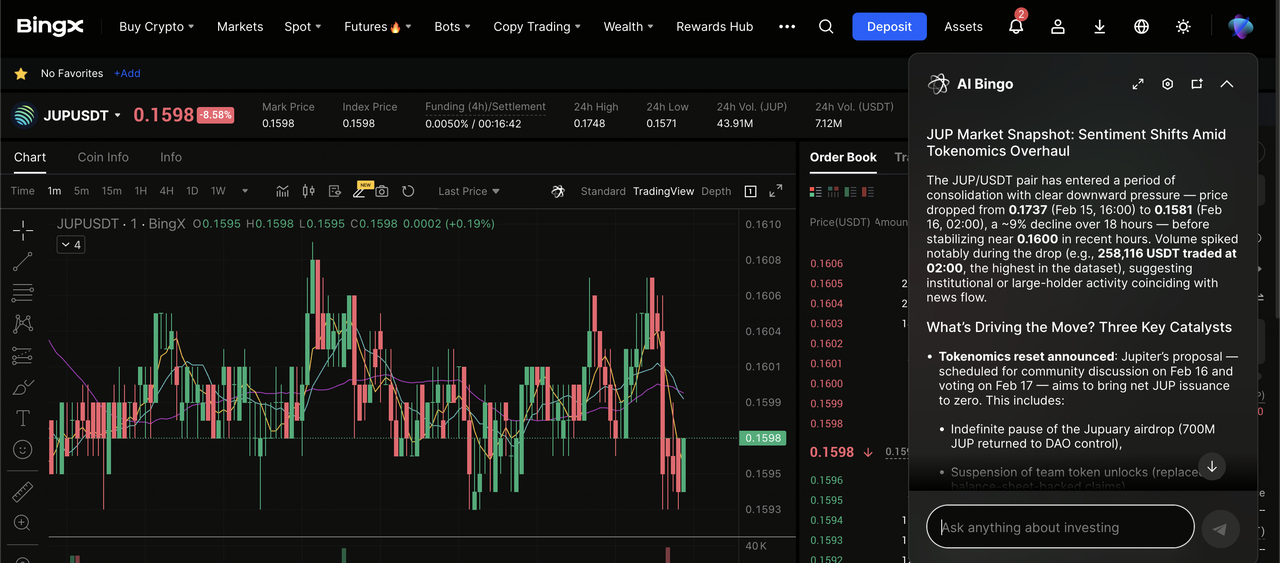

2. Trade Solana Perpetuals with Leverage on the Futures Market

JUPUSDT perpetuals on the futures market powered by BingX AI insights

For traders looking to capitalize on Solana’s high volatility, the Futures market offers the flexibility to go Long or Short.

Key Considerations Before Investing in Solana Ecosystem Projects

While the network's technical maturation and rising institutional interest, evidenced by the launch of Solana ETFs and the Alpenglow consensus upgrade, provide a constructive long-term outlook, participants should remain aware of significant risks:

• Market Volatility: Solana-based assets, particularly within the AI-agent and memecoin sectors, e.g., PUMP,

PIPPIN, TRUMP, are subject to extreme price swings and speculative bubbles.

• Security and Fraud: On-chain launchpads like Pump.fun continue to face challenges with high rates of rug pulls and fraudulent projects. Always perform thorough due diligence before participating in permissionless launches.

• Regulatory and Legal Uncertainty: Ongoing litigation involving ecosystem entities and potential regulatory shifts regarding tokenized assets could impact liquidity and platform availability.

• Technical Execution: Future performance is contingent on the successful deployment of major network patches and validator upgrades. Technical failures or unforeseen congestion can lead to service interruptions.

Final Thoughts

By early 2026, the Solana ecosystem has moved beyond early experimentation into a more mature phase defined by institutional participation and a broad range of real-world applications. Growth across areas such as DePIN, liquid staking, and integrated Super Apps has helped create a diversified network economy that serves both retail users and professional capital, strengthening Solana’s position as a high-performance blockchain platform.

At the same time, participants should remain mindful of key risks. Solana-based assets can experience sharp volatility, particularly in fast-moving sectors like AI agents and memecoins, while permissionless launch environments continue to carry security and fraud risks. Regulatory uncertainty and the successful execution of future network upgrades also remain important variables, making thorough due diligence and risk management essential when engaging with the ecosystem.

Related Reading