JPY Coin (JPYC) is Japan’s first fully regulated yen-pegged

stablecoin, a 1:1 digital yen backed by real bank deposits and Japanese government bonds, and live on

Ethereum,

Avalanche, and

Polygon. Launched in October 2025 under Japan’s revised stablecoin laws, JPYC enables low-fee of often under $1 remittances, gasless payments via platforms like JPYPay.io, and real-world card spending through Tria Wallet.

With growing adoption, rising TVL, and strong engagement across X, JPYC is positioning Ethereum as Japan’s DeFi backbone for real-world assets, e-commerce, ATM withdrawals, and potentially trillions in cross-border payment flows.

In this article, you’ll learn what JPYC is, how the issuance, redemption, regulation system works, its use cases and potential impact, and what to watch out for if you plan to use or integrate it.

What Is JPYC, Japanese Yen Stablecoin?

Source: JPYC EX

JPYC is a Japanese-yen stablecoin, meaning each token is always intended to be worth 1 JPYC = 1 Japanese Yen. It behaves like a digital version of the yen that you can hold in your crypto wallet, send globally in seconds, or use inside Web3 apps. Because the value tracks the yen, beginners don’t need to worry about price volatility the way they would with Bitcoin or altcoins.

What makes JPYC stand out is that it is Japan’s first fully regulated yen stablecoin. JPYC Inc. is officially licensed as a Type II Funds Transfer Service Provider under Japan’s Payment Services Act, the same regulatory framework used for bank transfers and e-money issuance. This means JPYC must follow strict rules around identity verification, transaction monitoring, reserve management, and consumer protection, giving it a stronger compliance profile than most global stablecoins.

JPYC is also 100% fully backed. For every JPYC token in circulation, JPYC Inc. holds an equivalent amount of yen bank deposits and Japanese Government Bonds (JGBs) in custody. These reserves are kept separate from company funds and are held in trust, ensuring that JPYC can always be redeemed 1:1 for real yen. This reserve structure mirrors the standards used by major regulated stablecoins like USDC, but with Japanese sovereign assets as backing.

To make JPYC useful across Web3, the token is issued on multiple blockchains, including Ethereum, Polygon, and Avalanche. This multi-chain design gives users access to low-fee payments, DeFi applications, NFT marketplaces, and cross-border finance tools without needing to switch networks manually. If a wallet or dApp supports these chains, it can support JPYC.

How JPYC Stablecoin Works: Issuance, Redemption and Regulatory Framework

JPYC follows a regulated, bank-like process for issuing and redeeming its stablecoin, ensuring users can always convert between JPYC and Japanese yen while staying fully compliant with Japan’s financial laws.

Issuance and Redemption via JPYC EX

JPYC is issued and redeemed through the official platform JPYC EX. The process works like this:

• To issue JPYC: user sends Japanese yen via bank transfer, after completing identity verification, e.g. “My Number” card under Japanese regulations. JPYC Inc. then mints equivalent JPYC and delivers it to the user’s blockchain wallet.

• To redeem JPYC back to yen: user sends JPYC tokens back through JPYC EX. The tokens are burned, and equivalent yen is transferred from the trust reserve to user’s bank account.

The system is non-custodial: users hold their own tokens, reducing counterparty risk compared to traditional custodial exchanges or custodians. This issuance/redemption mechanism ensures that circulating supply always matches the reserves, supporting the 1:1 peg and giving users confidence in stability and redeemability.

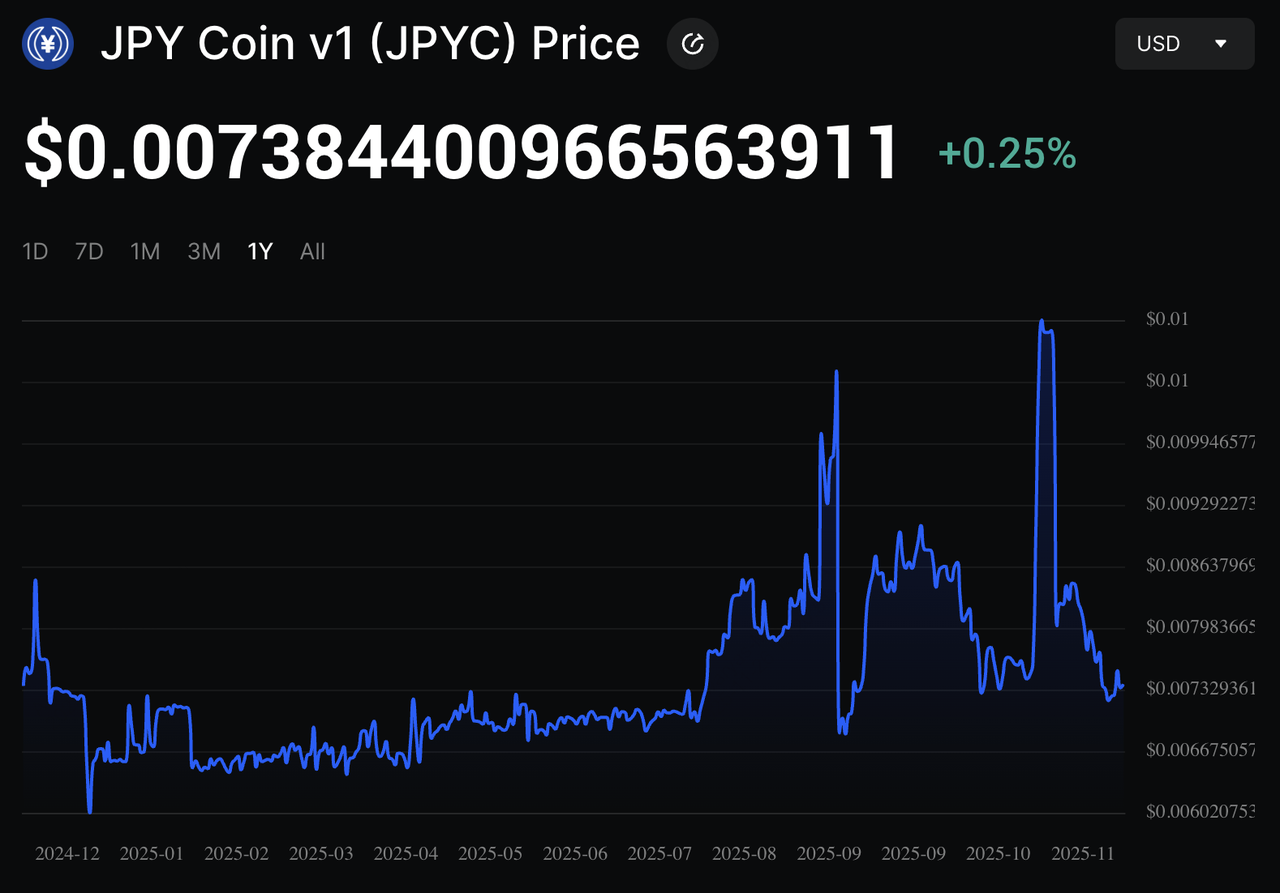

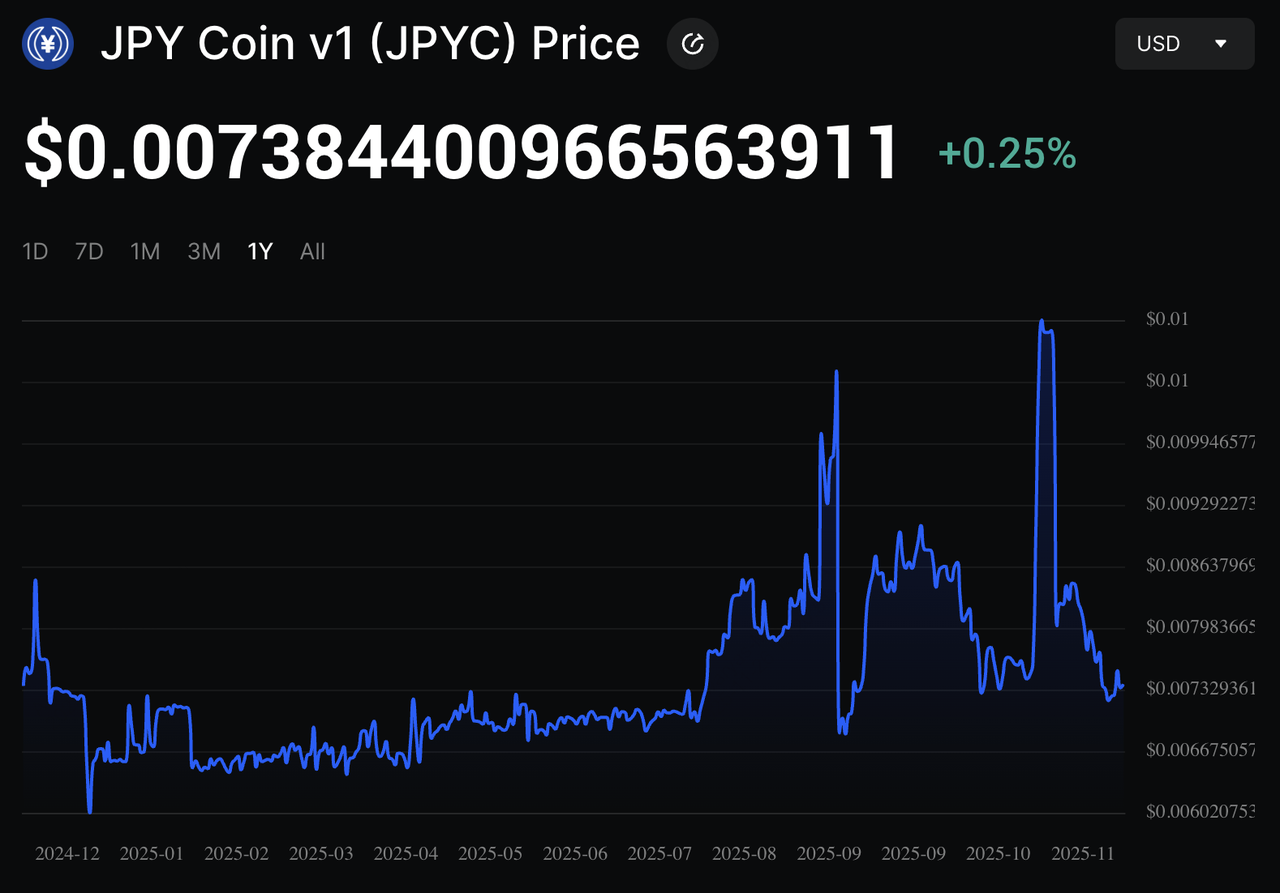

JPYC price trends | Source: BingX

Legal and Regulatory Framework

JPYC operates under Japan’s revised Payment Services Act, which since June 2023 defines legal requirements for stablecoin issuers, including licence requirements, asset backing, segregation of user assets, and AML/KYC compliance.

JPYC Inc. successfully registered with the Kanto Local Finance Bureau as a “Funds Transfer Service Provider,” giving it legal legitimacy to issue a yen-stablecoin. Because of this compliance, JPYC is classified not as a volatile “crypto-asset,” but as a regulated “electronic payment instrument,” enhancing trust for users, businesses, and regulators alike.

What Are the Real-World Use Cases of JPY Coin (JPYC)?

JPYC is designed not just for crypto-native users, but for real-world payments, remittances, business payments, and broader digital finance. Here’s how it’s being positioned:

• Payments and Remittances: JPYC offers almost-instant, low-cost transfers compared to traditional remittance services, making it suitable for remittances, cross-border payments, and casual transfers.

• E-commerce and Retail Payments: Through partnerships with payment service providers and point-of-sales networks, e.g. convenience stores, retail chains, JPYC enables mainstream payments using a yen-equivalent stablecoin, useful for online shopping, physical retail, and everyday purchases.

• Corporate and B2B Settlements: Enterprises and businesses can integrate JPYC for B2B payments, supplier settlements, or corporate remittances, leveraging blockchain’s speed and transparency while maintaining yen-based stability.

• DeFi and Blockchain Services: Because JPYC runs on public blockchains like Ethereum, Polygon, Avalanche, etc., it can be used in decentralized finance (DeFi), as stable asset for trading, liquidity provision, or as collateral, bridging fiat and crypto worlds.

Notably, JPYC also offers fraud compensation policy under certain conditions, giving additional protection to users, a rare feature among stablecoins.

How to Buy JPY Coin (JPYC)

You can buy JPYC directly through JPYC EX, the official issuance platform operated by JPYC Inc. Here's how:

1. After completing account registration and identity verification using your My Number card, you simply pre-order the amount you want and send a bank transfer in Japanese Yen.

2. Once the transfer is confirmed, JPYC EX issues the equivalent amount of JPYC (1 JPYC = 1 JPY) to your registered wallet address.

3. There are no purchase or redemption fees, and users can later redeem JPYC back into yen via bank transfer at the same 1:1 rate.

Safety Tip: Always use official JPYC channels and verified contract addresses to avoid fake tokens.

What Are the Key Strengths and Benefits of JPYC Yen Stablecoin?

JPYC brings the reliability of the Japanese yen onto public blockchains, offering users a safer, faster, and more practical way to move money across Web3 and the real world.

• Native Japanese yen on blockchain: JPYC gives the yen a direct, on-chain presence, reducing reliance on USD stablecoins like USDT or USDC. This helps Japanese users avoid currency-conversion fees, FX volatility, and compliance friction when interacting with Web3 services.

• Fully regulated and legally compliant: As Japan’s first licensed yen stablecoin, JPYC follows the Payment Services Act and operates as a Type II Funds Transfer Service Provider. This regulated structure shows how stablecoins can work safely within national financial laws and sets a model other countries may follow.

• Bridges traditional finance with Web3 and DeFi: JPYC combines the trust of yen-denominated fiat with blockchain speed and programmability. Users can make payments, send remittances, settle invoices, or use JPYC in DeFi apps — all while maintaining stable value and regulatory clarity.

• Better cross-border payments and business transfers: Because JPYC runs on public chains like Ethereum, Polygon, and Avalanche, anyone with a wallet can send or receive yen-stablecoins globally in seconds. This is especially useful for Japanese businesses, expats, global partners, and freelancers who need fast, low-cost international payments.

JPYC represents a major step toward mainstream, compliant blockchain payments, positioning the Japanese yen as a trusted digital currency for both real-world finance and decentralized applications.

Key Risks and Limitations of JPY Coin (JPYC) Stablecoin

While JPYC offers many advantages, there are some caveats and risks to keep in mind:

• Regulatory and redemption dependency: As a regulated “electronic payment instrument,” JPYC’s stability depends on compliance with Japanese law, proper management of reserve assets, and the issuer’s trust, misuse, mismanagement, or regulatory changes could affect redeemability or trust.

• Adoption hurdle in a cash-preferred country: Japan remains a cash- and card-centric society. Broad adoption of JPYC, among retail, businesses, and everyday users, may take time.

• Liquidity and ecosystem maturity: While JPYC is multi-chain, its on-chain liquidity, adoption across dApps, stablecoin trading pairs, and integrations are still growing. Until a larger ecosystem forms, usability in DeFi or cross-chain flows may be limited.

• Dependence on reserves of yen deposits and JGBs: The backing depends on yen savings and Japanese government bonds. Macroeconomic conditions, bond-market risks, or bank-deposit risks may affect the perceived stability or safety of reserves, though this is true for most fiat-backed stablecoins.

Closing Thoughts

JPYC is Japan’s first fully regulated yen-pegged stablecoin, offering a legally compliant and 1:1 collateralized digital representation of the Japanese yen. Its combination of regulated issuance through JPYC EX, multi-chain availability, and practical payment and remittance use cases positions it as a useful tool for bringing yen-based value into DeFi, e-commerce, and cross-border transfers.

For users, businesses, and developers looking for a fiat-backed stablecoin with strong regulatory foundations, JPYC presents a credible option. As adoption expands, it may influence how digital yen circulates across both traditional finance and blockchain ecosystems.

However, like all stablecoins, JPYC carries risks related to regulation, reserve management, liquidity, and broader market conditions. Users should evaluate these factors carefully and only transact through official channels and supported wallets.

Related Reading

FAQs on JPYC Stablecoin

1. Is JPYC always worth 1 Japanese Yen?

Yes. JPYC is designed to maintain a 1 JPYC = 1 JPY value at all times. Each token is backed by yen bank deposits and Japanese Government Bonds (JGBs), allowing users to redeem JPYC for real yen through JPYC EX.

2. Is JPYC yen stablecoin regulated in Japan?

JPYC is issued by JPYC Inc., a licensed Type II Funds Transfer Service Provider under Japan’s Payment Services Act. This makes it one of the few fully regulated yen stablecoins, subject to strict requirements around KYC, reserves, auditing, and consumer protection.

3. What can I use JPYC for?

You can use JPYC for low-cost remittances, e-commerce payments, card spending via Tria Wallet, business settlements, or as a stable asset in DeFi apps on Ethereum, Polygon, and Avalanche. Some platforms also support gasless transactions, so you can pay without holding

ETH,

AVAX, or

POL.

4. How do I convert JPYC back to Japanese Yen?

Redemption is handled through JPYC EX. Users send JPYC from their wallet, the tokens are burned, and the equivalent amount in yen is deposited to their registered bank account. Bank transfers generally reflect quickly depending on the user’s financial institution.

5. What are the risks of using JPYC?

While JPYC is regulated, fully backed, and redeemable, users still face risks such as blockchain transaction errors, wallet security issues, regulatory changes, or liquidity limitations on certain networks or dApps. Always verify contract addresses, use supported wallets, and transact via official JPYC channels.