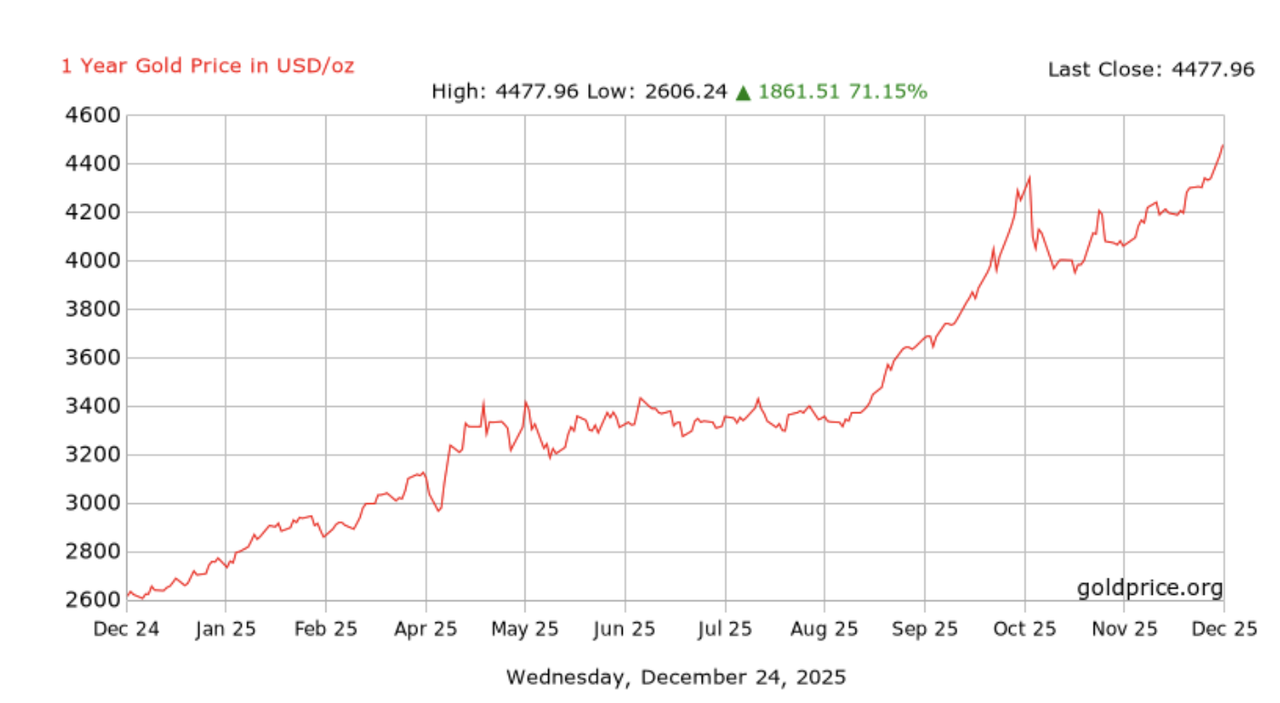

By December 2025, spot gold had surged beyond $4,500 per ounce, pushing the estimated total market capitalization of above-ground gold to over $30 trillion. This milestone places gold ahead of the market capitalizations of companies such as

Apple (≈ $4.0 trillion) and

Microsoft (≈ $4.1 trillion), and within striking distance of

Nvidia (≈ $4.4 trillion), reinforcing gold’s position as one of the world’s most valuable assets. The rally has been driven by persistent geopolitical uncertainty, continued central-bank buying, and expectations of easier global monetary policy.

Source: Gold Price

The strength in gold prices has also extended into the digital asset space. According to CoinGecko, the tokenized gold market has grown to approximately $4.5 billion in total market capitalization, with trading activity remaining elevated as investors seek stability alongside 24/7 on-chain liquidity. Blockchain-based representations of gold are increasingly viewed as a bridge between traditional value preservation and crypto-native accessibility.

In this article, we explore the 10 Best Gold-Backed Crypto Tokens to Watch in 2026, examining how each project connects physical gold reserves with decentralized finance infrastructure and what differentiates them in an increasingly competitive tokenized gold market.

What Is a Gold-Backed Crypto Token and How Does Tokenized Gold Work?

Gold-backed crypto tokens are digital assets that represent verifiable ownership of physical gold held in secure, audited vaults. Each token is typically pegged 1:1 to a specific weight of gold, most commonly one troy ounce, the standard used by Tether Gold (XAUT) and PAX Gold (PAXG). This means holders can trade the token on exchanges or redeem it for the underlying metal, depending on the issuer’s terms.

How Tokenized Gold Tokens Work

1. Physical gold acquisition: The issuer purchases LBMA-certified bars and stores them in regulated vaults such as Brink’s, Malca-Amit, or Swiss facilities. As of September 2025, Tether confirmed 375,572 ounces, around 11.6 tons, backing XAUT, held in Switzerland.

2. Token minting on blockchain: Each unit of vaulted gold is tokenized via smart contracts, most commonly on Ethereum (ERC-20) or Tron (TRC-20), creating a transparent on-chain record.

3. 1:1 reserve verification: Tokens in circulation must match the exact amount of physical gold held in custody. Leading issuers publish audits and attestation reports, allowing the public to verify reserves at any time.

4. Redemption and burning: Tokens can be redeemed for physical gold, often in minimum redemption units such as 430 ounces, or converted to cash. Redeemed tokens are burned to maintain the peg.

This structure blends gold’s role as a safe-haven asset with crypto’s advantages, including fractional ownership, 24/7 global liquidity, and low-cost transfers. It also increases accessibility: investors in emerging markets who cannot open metal accounts or buy ETFs can hold tokenized gold in a regular crypto wallet.

Why Did Gold Price Surge to Record Highs in 2025?

By December 2025, spot gold had climbed above $4,500 per ounce, capping one of its strongest annual performances in decades and pushing the estimated total market value of above-ground gold beyond $30 trillion. At that level, gold’s market capitalization surpassed the combined valuations of Nvidia, Apple, Microsoft, and

Alphabet, underscoring the scale of the move. The rally reflected a sustained repricing of macro risk rather than a single shock, reinforcing gold’s role as a long-term store of value.

While

Bitcoin also reached an all-time high of $126,195 during the year, it later retraced by around 30%, trading back in the high-$80,000 range by year-end. The divergence highlighted gold’s appeal as a lower-volatility hedge compared with high-beta digital assets.

Top 5 Factors Behind Gold Prices Spiking in 2025

1. Federal Reserve policy pivot and falling real yields: The

Federal Reserve began cutting rates in September 2025, lowering the target range to 3.75–4.00%, followed by cuts in October and December to 3.50–3.75%. As markets priced further easing into 2026, real yields on U.S. Treasuries moved toward zero, reducing the opportunity cost of holding gold and supporting higher prices.

2. Central bank gold accumulation at structural highs: The World Gold Council’s Q3 2025 Gold Demand Trends report showed central banks purchased 220 metric tons in Q3, bringing year-to-date buying to 634 metric tons. Led by China, Russia, and Middle Eastern countries, this price-insensitive demand reflected long-term reserve diversification and provided steady support for gold prices.

3. Persistent geopolitical and fiscal risk premiums: Geopolitical tensions and trade uncertainty remained elevated throughout 2025. In the United States, a government shutdown from October 1 to November 12, 2025, disrupted economic data and revived fiscal stability concerns, sustaining safe-haven demand for gold late in the year.

4. U.S. dollar weakness and global reserve diversification: The U.S. dollar weakened through much of 2025 as rate differentials narrowed following Fed cuts. This increased gold’s appeal for non-U.S. investors and reinforced its role as a neutral reserve asset as central banks continued reducing dollar exposure.

5. Investment flows and year-end positioning dynamics: Gold-backed ETFs recorded strong inflows in Q1 and Q3 2025, including 226.5 metric tons added in Q1, the largest quarterly inflow since 2022. Holdings continued rising into November and December, supported by year-end rebalancing and thin liquidity, helping gold break decisively above $4,400.

Looking ahead, analysts expect gold to remain supported into 2026 if monetary easing continues and geopolitical risks persist, suggesting the 2025 rally was driven by structural demand rather than short-term speculation.

Top 10 Gold-Backed Crypto Tokens to Watch in 2026

The total market capitalization of gold-backed cryptocurrencies grew rapidly in 2025, rising from around $3 billion in October to over $4.5 billion by December, as spot gold prices broke above $4,500 per ounce. As investors seek stability and verifiable on-chain assets, tokenized gold is emerging as a key segment of real-world-asset adoption.

| Token |

Market Cap (Dec 2025) |

Info |

| Tether Gold (XAUT) |

$2.34 B |

The largest and most liquid tokenized gold asset |

| PAX Gold (PAXG) |

$1.62 B |

Regulated gold ownership for the digital age |

| Kinesis Gold (KAU) |

$347 M |

Yield-bearing gold for active holders |

| Matrixdock Gold (XAUM) |

$69.3 M |

Institutional-grade verified reserves |

| VeraOne (VRO) |

$47.9 M |

Europe-focused regulated gold token |

| Tether Gold Tokens (XAUT0) |

$44.5 M |

Liquidity extension for Tether’s ecosystem |

| Comtech Gold (CGO) |

$15.5 M |

Sharia-compliant gold from Dubai |

| Gold DAO (GOLDAO) |

$8.83 M |

Community-run tokenized gold reserves |

| VNX Gold (VNXAU) |

$4.18 M |

MiCA-aligned gold token for European investors |

| Kinka (XNK) |

$2.16 M |

Small-unit accessible gold exposure |

Below are the 10 largest gold-backed tokens by market capitalization as of late December 2025, based on current market data.

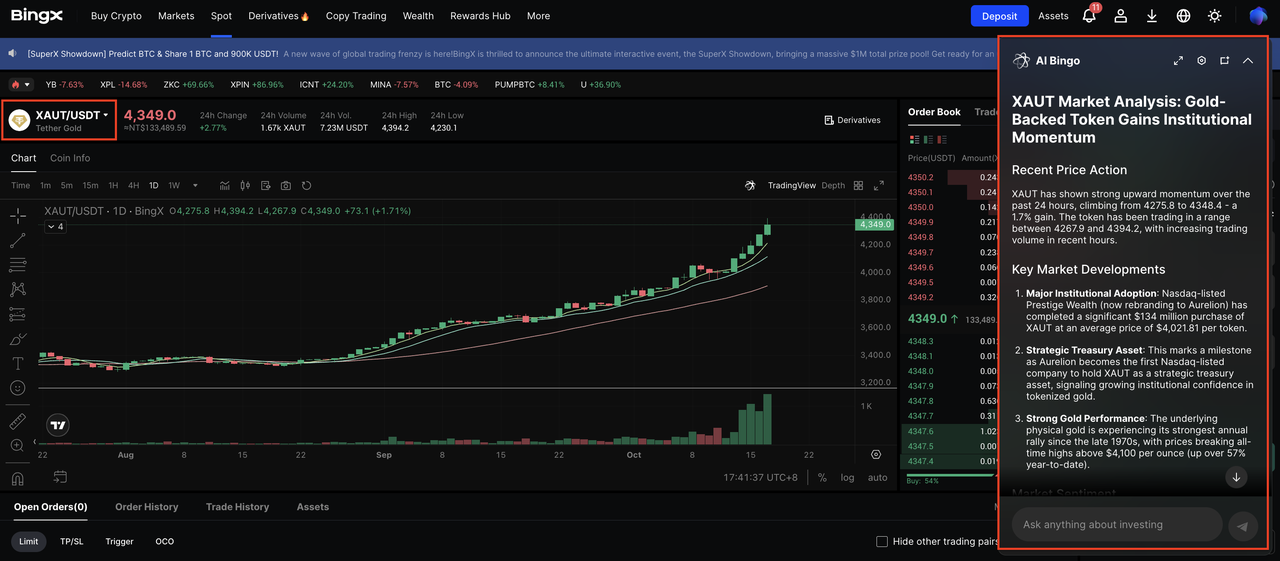

1. Tether Gold (XAUT)

Market Cap ≈ $2.34 B

Tether Gold (XAUT) is the largest and most liquid gold-backed crypto token in the world. Each XAUT is backed 1:1 by one troy ounce of LBMA-standard gold held in Swiss vaults, as part of the issuer’s audited reserves. With gold prices hitting new records, including an all-time high above $4,391 on October 17, 2025, XAUT offers a seamless bridge between traditional bullion and crypto. Its on-chain transparency, multi-chain support, including an omnichain version

XAUT0, and accessibility on major exchanges make it a benchmark choice for investors seeking tokenized gold exposure.

Tether Gold (XAUT) is backed by more than 375,000 troy ounces of LBMA-certified gold stored in Swiss vaults, with its market cap surpassing $2 billion in October 2025, making it the largest tokenized gold asset on-chain. It trades on major exchanges with 24/7 global liquidity, and although it relies on centralized custodianship, regular audits and established governance frameworks have made XAUT one of the most trusted real-world-asset (RWA) gold tokens in the market.

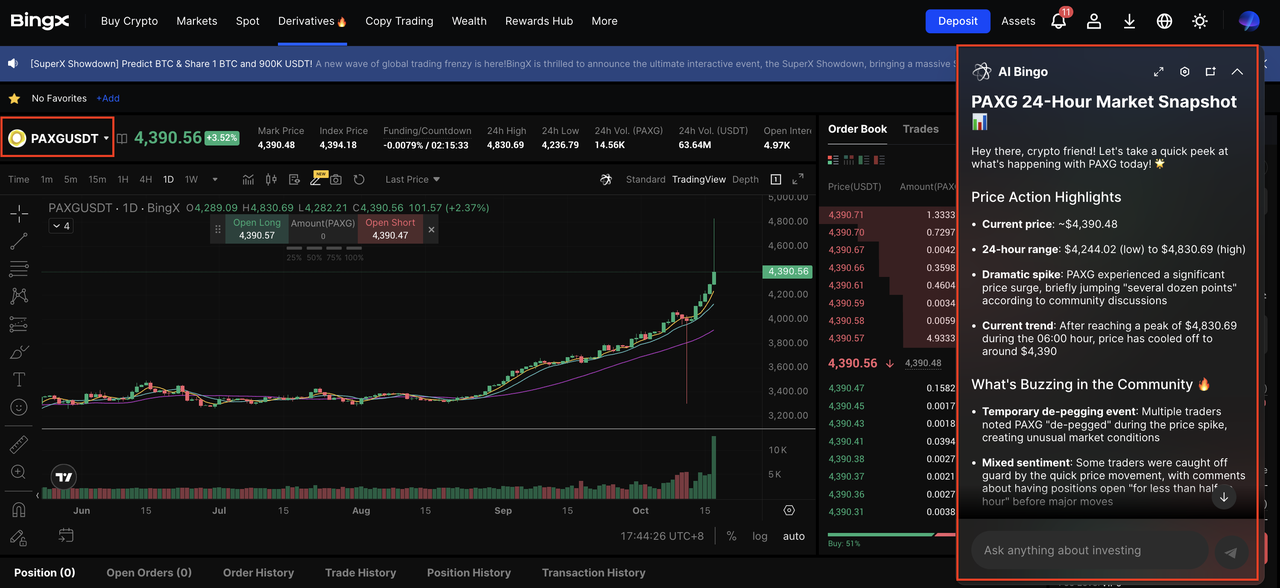

2. PAX Gold (PAXG)

Market Cap ≈ $1.62 B

PAX Gold (PAXG) is a fully regulated digital asset that represents direct ownership of London Good Delivery gold bars held in secure vaults. Issued by Paxos Trust Company under NYDFS oversight, each token corresponds to one troy ounce of physical gold and is supported by monthly independent audits. Holders can redeem PAXG for physical bullion or cash, making it one of the most legally robust and institutionally trusted gold-backed tokens on the market.

With a market cap of about $1.31 billion in late October 2025, PAXG is the second-largest tokenized gold asset. In October 2025, combined trading volume of PAXG and XAUT crossed $3.2 billion, reflecting accelerating demand for on-chain gold exposure. While its liquidity is slightly below XAUT, PAXG’s regulatory clarity and redemption guarantees make it especially appealing to compliance-focused institutions, though minimum bar redemption sizes and geographic restrictions can limit convenience for small retail users.

3. Kinesis Gold (KAU)

Market Cap ≈ $347 M

Kinesis Gold (KAU) turns physical gold into a yield-bearing digital currency. Each token is backed 1:1 by allocated, audited bullion stored in global vaults, while users earn micro-yields from transaction fees within the Kinesis Monetary System. This model allows holders to benefit from both gold price appreciation and passive income, positioning KAU as one of the few tokenized gold assets with built-in rewards. With growing adoption in emerging markets and active exchange listings, KAU appeals to investors seeking security, liquidity, and yield in a single asset.

4. Matrixdock Gold (XAUM)

Market Cap ≈ $69.3 M

Matrixdock Gold (XAUM) provides institutional-grade tokenization with independently verified proof-of-reserves, transparent custody, and audited supply data. Operated from Singapore, XAUM targets professional traders, asset managers, and fintech platforms seeking compliant, on-chain exposure to gold without the complexity of physical storage. Its emphasis on regulatory alignment and real-time asset verification makes XAUM a trusted gateway for institutions entering the RWA gold market, even as the broader sector approaches $4 billion in capitalization.

5. VeraOne (VRO)

Market Cap ≈ $47.9 M

VeraOne (VRO) offers a regulated European path to digital gold ownership, backed by fully audited bullion held in secure French vaults. Unlike ounce-based tokens, VRO is denominated in grams, giving retail users an accessible entry point into gold markets with small unit purchases. Through euro-linked settlement, licensed custody, and public attestations of reserves, VeraOne appeals to EU investors seeking transparent, regionally regulated gold exposure without relying on offshore issuers or ETF intermediaries.

6. Tether Gold Pool (XAUT0)

Market Cap ≈ $44.5 M

Tether Gold Pool (XAUT0) is designed to scale liquidity and price discovery across centralized and decentralized markets. It is tied to the same Swiss vault reserves that back XAUT but optimized for institutional market-making, arbitrage, and cross-venue trading. By separating liquidity functions from primary issuance, XAUT0 helps tighten spreads, deepen order books, and support 24/7 global trading without adding custodial complexity. As tokenized gold volumes rise above $3.7 billion, XAUT0 has become a key liquidity layer in Tether’s RWA ecosystem.

7. Comtech Gold (CGO)

Market Cap ≈ $15.5 M

Comtech Gold (CGO) delivers Sharia-compliant, traceable, and DMCC-certified gold on-chain. Each token is backed by one gram of physical bullion stored in Dubai, with full supply-chain verification from mint to vault. Built on the XDC Network, CGO provides low-cost transfers, fast settlement, and compliance features tailored for investors across the Middle East, Africa, and South Asia. Its halal-certified structure and transparent attestation framework make it a leading choice for faith-aligned commodity investing within Web3.

8. Gold DAO (GOLDAO)

Market Cap ≈ $8.83 M

Gold DAO (GOLDAO) tokenizes physical gold bars into on-chain assets and governs them through DAO voting and treasury management. Holders can propose decisions, vote on reserve policies, and direct future allocations, creating a decentralized model of collective gold ownership. While smaller than regulated issuers, GOLDAO stands out for its community governance and transparency, offering a novel experiment where token holders manage real-world gold reserves using on-chain rules instead of centralized custodianship.

9. VNX Gold (VNXAU)

Market Cap ≈ $4.18 M

VNX Gold (VNXAU) is a MiCA-aligned digital gold token issued from Liechtenstein, backed by bullion stored in Swiss vaults and verified through regular public attestations. Its regulatory structure appeals to European institutions that require compliance with EU securities rules rather than offshore frameworks. By combining audited reserves, euro-friendly rails, and transparent redemption options, VNXAU offers a smaller but highly regulated alternative for investors seeking tokenized gold without exposure to U.S. or Asian custodians.

10. Kinka (XNK)

Market Cap ≈ $2.16 M

Kinka (XNK) aims to make gold accessible at retail scale by representing small, fractional units tied to audited bullion held in secure vaults. Built for simplicity and low minimum purchases, XNK focuses on everyday users who want easy entry into gold ownership without traditional storage, account setup, or minimum-bar requirements. While small in liquidity, its transparency and micro-unit format position it as a retail-friendly bridge between bullion investing and everyday crypto users.

Together, these ten projects represent nearly all of the tokenized gold market, showing how blockchain technology is reshaping access to one of the world’s oldest stores of value. From large-scale institutional offerings to retail-focused innovations, digital gold is becoming a key part of the on-chain economy.

Physical Gold vs. Gold ETF vs. Tokenized Gold Coin: What Are the Differences?

Gold has always been seen as a store of value, but investors today have multiple ways to gain exposure. Physical gold offers tangible ownership, gold ETFs provide convenience within traditional markets, and gold-backed crypto introduces blockchain transparency and 24/7 liquidity. Each suits different investment goals and risk profiles.

| Category |

Physical Gold |

Gold ETF |

Gold-Backed Crypto

(Digital Gold) |

| Ownership |

Direct possession of bars or coins |

Shares representing pooled gold holdings |

On-chain tokens backed by specific vaulted gold |

| Accessibility |

Requires physical storage and security |

Limited to stock market trading hours |

24/7 trading on crypto exchanges |

| Transparency |

Dependent on dealer or vault audit |

Periodic fund disclosures |

Public blockchain proof of reserves |

| Liquidity |

Slower to sell or transport |

High liquidity during market hours |

Instant global transfer and fractional trading |

| Cost Structure |

Storage and insurance costs |

Management and brokerage fees |

Low custodial fee (around 0.2–0.5% annually) |

| Redemption Option |

Physical delivery possible |

No direct redemption for gold |

Redeemable in metal or fiat (for most major issuers) |

| Who It Suits |

Long-term holders who value tangible assets |

Traditional investors seeking regulated exposure |

Investors wanting flexible, verifiable, and globally accessible exposure to gold |

In short, physical gold provides ownership you can hold, ETFs simplify access through traditional brokers, and gold-backed crypto bridges both worlds with verifiable ownership and round-the-clock liquidity.

How to Buy and Trade Gold-Backed Tokens on BingX

Whether you’re investing for long-term stability or trading short-term movements in gold prices, BingX supports leading gold-backed cryptocurrencies, Tether Gold (XAUT) and PAX Gold (PAXG), through both Spot and Futures Markets.

With

BingX AI integrated directly into the trading interface, you can access real-time insights, price analysis, and gold market forecasts to make more informed trading decisions.

1. Buy or Sell Gold-Backed Tokens on the Spot Market

If your goal is to accumulate gold-backed assets or take advantage of price dips, the

Spot Market is the most straightforward option.

Step 1: Go to the BingX Spot Market and search for your preferred trading pair, for example,

XAUT/USDT or

PAXG/USDT.

Step 2: Click the AI icon on the chart to activate BingX AI, which displays support and resistance levels, detects potential breakout zones, and suggests entry points based on current price action.

Step 3: Choose between a Market Order for instant execution or a Limit Order at your preferred price. Once your trade is completed, your tokens will appear in your BingX balance, ready to hold or transfer to an external wallet.

2. Trade Gold-Backed Tokens with Leverage on Futures

For more active traders, the BingX

Futures Market allows you to trade gold-backed tokens with leverage, enabling profit opportunities in both rising and falling gold markets.

Step 2: Click the AI icon on the chart to activate BingX AI, which analyzes price trends, volatility, and momentum in real time to assist with trade timing.

Step 3: Adjust your leverage level, set your entry price, and choose between a Long (Buy) or Short (Sell) position depending on your market outlook. Manage your position using

Stop-Loss and Take-Profit levels for better risk control.

Final Thought

The surge in gold prices throughout 2025 is more than a reaction to economic uncertainty; it marks a structural shift in how markets define and store value. As physical gold breaks above $4,300 per ounce and tokenized gold surpasses $3 billion in market capitalization, the metal is quietly embedding itself into the digital financial infrastructure.

Beyond short-term speculation, the rise of tokens like Tether Gold (XAUT) and PAX Gold (PAXG) reflects a transformation in the architecture of trust. Investors are no longer satisfied with owning gold; they now expect verifiable, borderless, and instantly transferable ownership. This evolution turns gold from a static hedge into a composable financial component that can interact with broader blockchain ecosystems.

Gold tokenization is not just about putting metal on-chain, it is about putting the concept of value itself on-chain. 2025 may well be remembered as the year gold completed its digital transition from vaults to the networked economy.