Bitcoin DeFi (BTCFi) has become one of 2025’s breakout trends, transforming

Bitcoin from a passive “

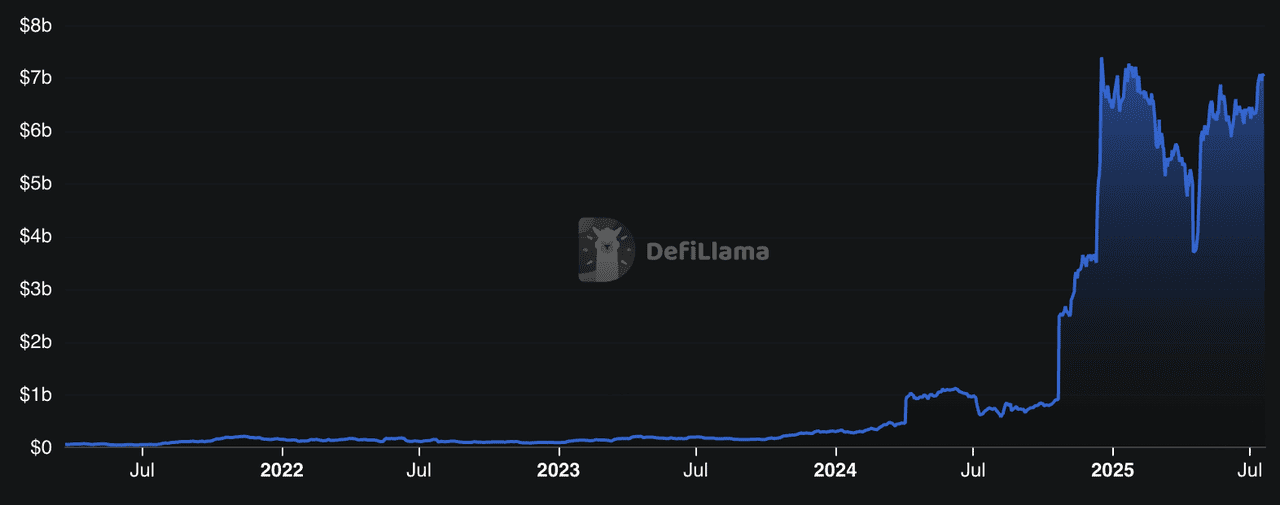

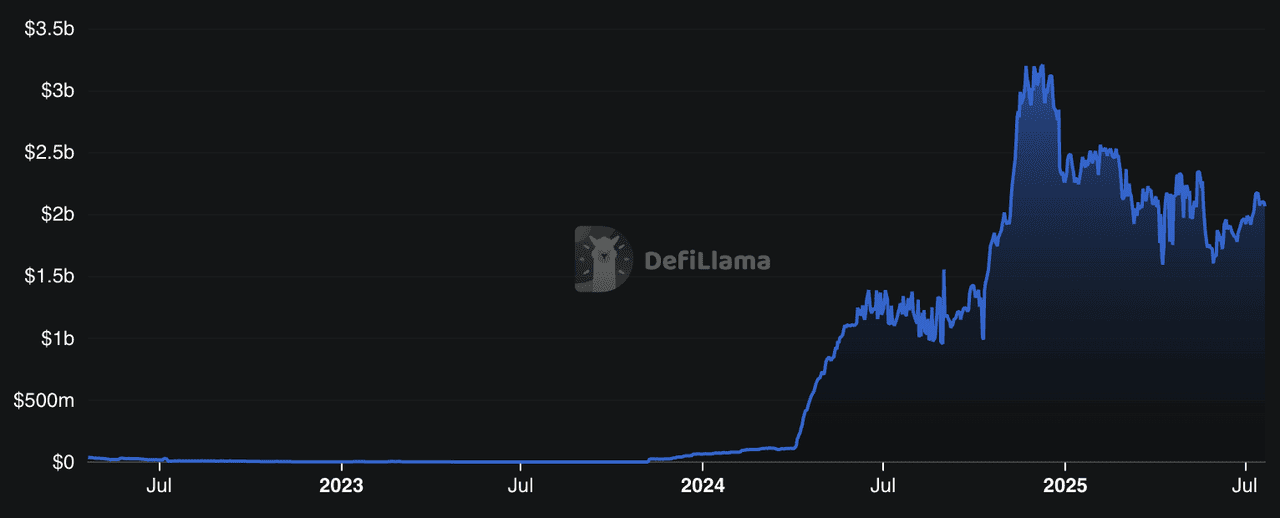

digital gold” into a dynamic, yield-generating asset. According to DefiLlama, BTCFi’s total value locked (TVL) skyrocketed from just $304 million in January 2024 to over $7 billion by December 2024, a staggering 22x growth in one year. As of mid-2025, BTCFi TVL (total value locked) has further climbed to $8.6 billion, with CoinMarketCap reporting a combined market capitalization of BTCFi tokens exceeding $1.1 billion in July 2025.

Bitcoin DeFi (BTCFi) TVL | Source: DefiLlama

This explosive growth has been fueled by Bitcoin’s all-time price highs above $123,000, institutional inflows, and the rise of innovations like liquid staking and restaking. Yet challenges remain: surveys reveal that nearly 36% of potential users still avoid BTCFi due to trust issues, while others cite concerns about security, liquidity, and Bitcoin’s limited

smart contract capabilities. Despite these hurdles, BTCFi is paving the way for Bitcoin holders to lend, borrow, stake, and participate in DeFi without relinquishing their BTC, unlocking a new era of financial utility for the world’s largest cryptocurrency.

What Is BTCFi and How Does It Work?

How BTCFi works | Source: Chainlink

BTCFi, or Bitcoin DeFi, is a new wave of decentralized finance applications that bring advanced financial tools directly to the Bitcoin ecosystem. Traditionally, Bitcoin was known as “digital gold” – a secure, decentralized store of value. But it lacked the flexibility of platforms like

Ethereum for smart contracts and DeFi apps. This began to change with innovations such as

Taproot (2021) for improved privacy and programmability, BRC-20 tokens for fungible token creation, and Bitcoin layer-2 networks for faster transactions.

With BTCFi, Bitcoin holders can now earn passive income, take out crypto loans using

BTC as collateral, stake their Bitcoin to secure networks, and even trade synthetic Bitcoin assets – all while keeping full ownership of their private keys. These applications often use wrapped Bitcoin (e.g., WBTC), synthetic BTC tokens, and cross-chain bridges to connect Bitcoin’s liquidity with other blockchains like Ethereum or

Solana.

For beginners, think of BTCFi as turning your idle Bitcoin into a productive asset. Instead of just holding BTC in a wallet, you can lend it out, farm yields, or participate in decentralized exchanges securely. This makes Bitcoin not just a savings technology, but an integral part of a dynamic on-chain economy.

Why BTCFi Matters in 2025

Bitcoin’s dominance in the crypto world continues to grow. As of mid‑2025, its market capitalization stands around $1.38 trillion, making it the largest digital asset by a wide margin. Yet most BTC remains dormant in

cold wallets, unable to earn any yield. BTCFi changes that: by bringing decentralized finance tools to Bitcoin, it unlocks that “sleeping” liquidity so holders can lend, borrow, stake, trade, and even vote, without ever selling their BTC.

In January 2024, U.S. regulators approved the first 11

spot Bitcoin ETFs, marking a major milestone in institutional adoption.These ETFs attracted massive inflows, approaching $10 billion per day in early 2025 and exceeding $5.5 billion in total inflows by July, ushering Bitcoin into mainstream portfolios. That trend continues in 2025, with spot ETFs still drawing billions and elevating Bitcoin’s legitimacy in traditional finance.

BTCFi complements this institutional wave by offering yield-generating use cases. With

block rewards halving approximately every four years, miners increasingly rely on transaction fees to secure the network. BTCFi can increase transaction volume and fees, bolstering Bitcoin’s long-term security model.

In short, BTCFi transforms Bitcoin from static “digital gold” into a productive, capital-efficient asset, supporting passive income, institutional-grade tools, and sustainable network security, all while aligning with Bitcoin’s core principles.

Top BTCFi Projects to Watch in 2025

Here's a deep dive into the most popular BTCFi projects showcasing Bitcoin’s leap into DeFi by offering innovative staking, lending, and yield-generation tools that make BTC more productive.

1. Pendle (PENDLE)

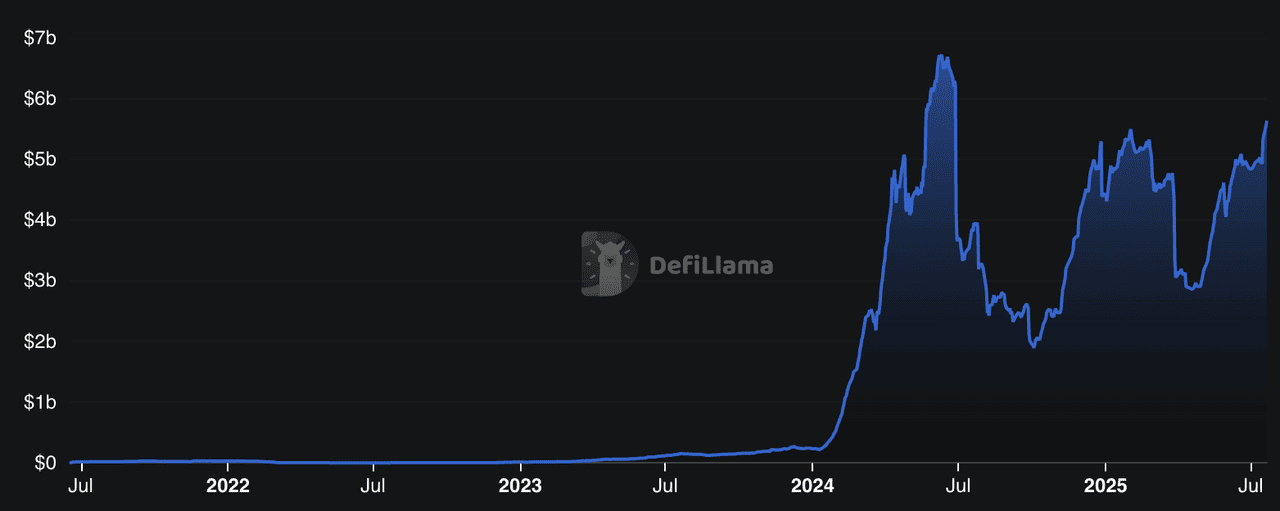

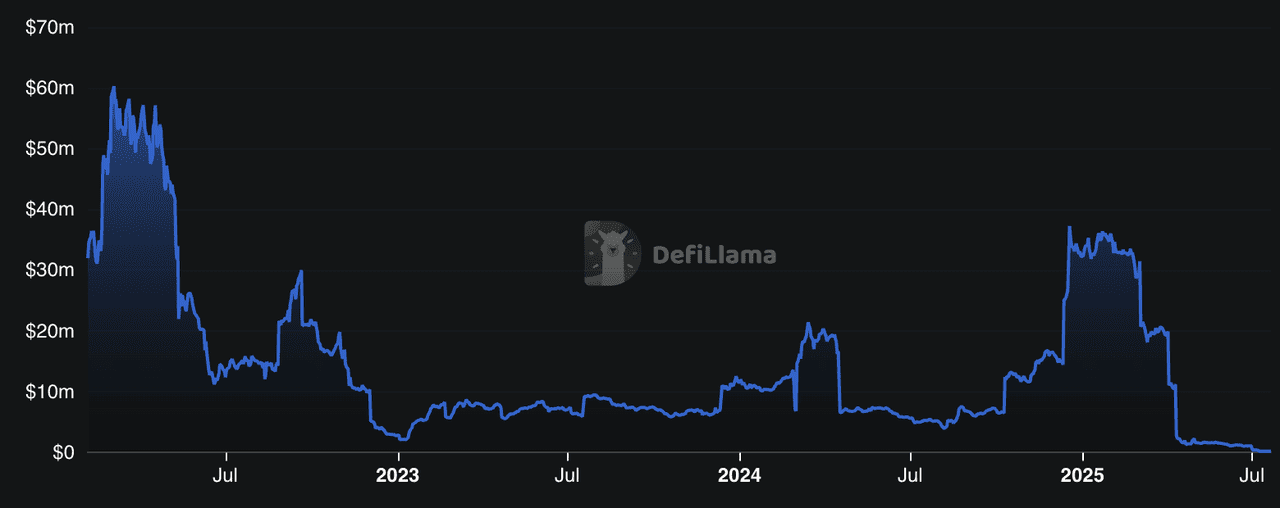

Pendle TVL | Source: DefiLlama

Pendle (PENDLE) is a decentralized yield-trading protocol that gives users unprecedented control over their yield-bearing assets. With over $5.6 billion in total value locked (TVL) and $53.9 billion in trading volume as of 2025, Pendle allows Bitcoin and crypto holders to split any yield-bearing token into two parts: Principal Tokens (PT) and Yield Tokens (YT). This process, called yield tokenization, lets users lock in fixed yields (e.g., 10–12% APY on assets like USDe), speculate on future yield changes, or hedge against yield volatility without losing ownership of their principal.

Built for cross-chain compatibility, Pendle operates on Ethereum, Arbitrum, BNB Chain, Optimism, and more, supported by its own Automated Market Maker (AMM) optimized for yield trading with concentrated liquidity and minimal impermanent loss. Beginners can think of Pendle as a platform where you “control your yield” by choosing to earn stable returns, bet on rising yields, or provide liquidity for extra incentives. Governance is driven by vePENDLE, a staking and voting mechanism where users lock PENDLE tokens to influence incentive allocations and earn protocol revenue. With its audits and layered risk management, Pendle bridges the gap between TradFi’s $400 trillion interest derivatives market and DeFi, making advanced yield strategies accessible to everyone.

2. Babylon (BABY)

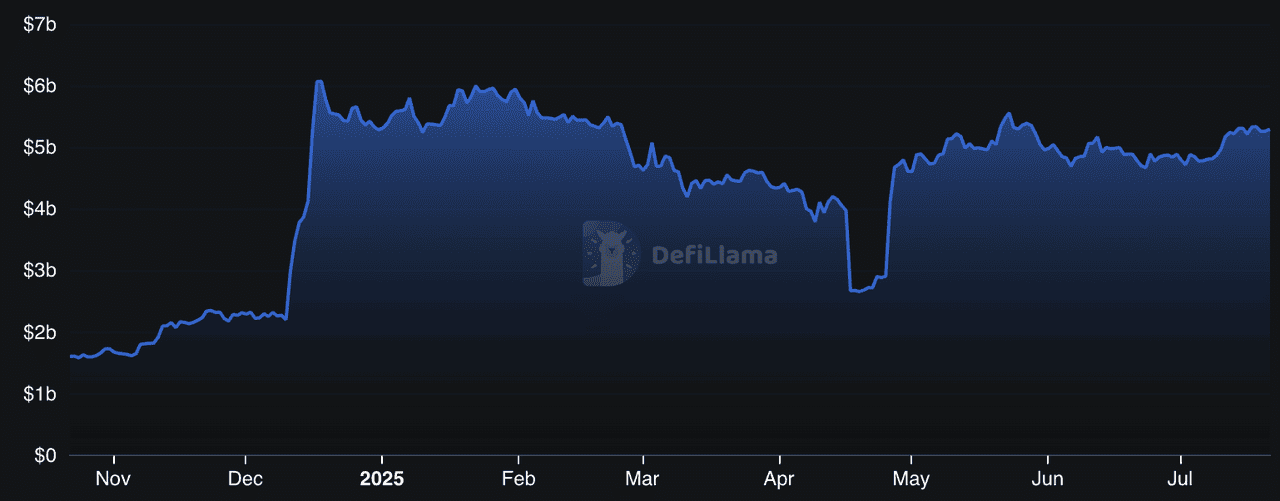

Babylon Protocol TVL | Source: DefiLlama

Babylon (BABY) is pioneering trustless Bitcoin staking, enabling BTC holders to earn rewards by securing Proof-of-Stake (PoS) networks without wrapping, bridging, or giving up custody of their coins. With over 44,000 BTC (worth ~$5.3 billion) staked as of 2025, Babylon’s protocol allows users to lock their Bitcoin directly on the Bitcoin network and participate in securing decentralized networks, earning yield in return. This innovation turns Bitcoin’s idle capital, historically held in cold storage, into a productive asset that contributes to the security of other blockchains.

Babylon’s staking process is fully self-custodial, meaning users maintain control of their private keys and can request unbonding anytime. The platform’s modular architecture also supports Bitcoin Supercharged Networks (BSNs), which leverage Bitcoin’s liquidity and community for enhanced security and growth. Backed by rigorous audits (Coinspect, Zellic) and a global network of over 250 Finality Providers, Babylon is designed for scalability and developer participation, offering a powerful new use case for Bitcoin in the DeFi economy. For beginners, think of Babylon as a way to “put your Bitcoin to work” by helping secure PoS chains while earning yield—all without leaving the Bitcoin blockchain.

3. BounceBit (BB)

BounceBit TVL | Source: DefiLlama

BounceBit (BB) is a CeDeFi (Centralized-DeFi) powerhouse that bridges Bitcoin’s unmatched security with the dynamic earning potential of DeFi. As of 2025, it manages a growing ecosystem featuring dual-token PoS Layer 1 infrastructure secured by BTC and BB tokens, Real World Asset (RWA) integration, and institutional-grade yield products. BounceBit allows users, both retail and institutional, to lend, borrow, and earn through innovative liquidity custody tokens (LCTs), which generate interest from centralized finance (CeFi) activities while remaining usable for staking and DeFi farming on-chain.

With over $5 billion in assets actively deployed, BounceBit democratizes high-yield strategies that were once exclusive to quant funds and large institutions. Its partnerships with CEFFU and Mainnet Digital enable secure, transparent, and regulated fund management, while its EVM compatibility ensures seamless interoperability across blockchains. For beginners, BounceBit can be seen as a “Bitcoin-powered financial hub” where your BTC not only stays safe but also earns passive income from both CeFi and DeFi without leaving the ecosystem.

4. Taker Protocol (TAKER)

Taker Protocol (TAKER) is a decentralized finance (DeFi) platform designed to unlock Bitcoin’s idle potential by creating money markets, lending platforms, and derivatives for BTC holders. With over 6.9 million total holders and 268 million transactions processed, Taker introduces Bitcoin Liquid Staking Derivatives (BTC LSDs) that can be used across lending, swapping, and yield farming. Its EVM-compatible Layer 1 blockchain ensures seamless integration with DeFi applications, supporting fast, low-cost transactions and instant finality.

Taker’s ecosystem features Lite Mining nodes (over 2.6 million deployed) for resource-efficient BTC mining, the Sowing platform for traffic distribution across Bitcoin services, and Taker Swap for decentralized trading with high liquidity and minimal slippage. By providing collateralized loans, flexible lending options, and cross-chain liquidity, Taker gives Bitcoin holders a way to earn passive income or borrow against their BTC without relinquishing control. For beginners, think of Taker as a “Bitcoin super app” that transforms your BTC into a productive asset while maintaining Bitcoin’s security and decentralization.

5. Solv Protocol (SOLV)

Solv Protocol TVL | Source: DefiLlama

Solv Protocol (SOLV) is a decentralized asset management platform that brings Bitcoin into the world of institutional-grade finance with transparency and efficiency. With over $2.29 billion in total value locked (TVL) and 19,385 BTC held in on-chain reserves (as of July 2025), Solv provides innovative products like SolvBTC, a 1:1 tokenized Bitcoin for seamless movement across DeFi, CeFi, and traditional finance, and xSolvBTC, which unlocks continuous yield on idle BTC. It also features BTC+ as an allocation hub to direct capital into high-yield strategies.

Backed by major players like Chainlink (for Proof of Reserve), Blockchain Capital, OKX Ventures, and Ceffu, Solv is building one of the largest on-chain Bitcoin reserves globally, ranking 1st among on-chain reserves and 5th compared to government holdings. For beginners, think of Solv as a “Bitcoin bank” for the decentralized world. It lets you securely deposit your BTC, earn yields, and access advanced financial products without giving up custody. With its institutional partnerships, audits, and compliance efforts, Solv is rapidly positioning itself as the backbone of a borderless Bitcoin economy.

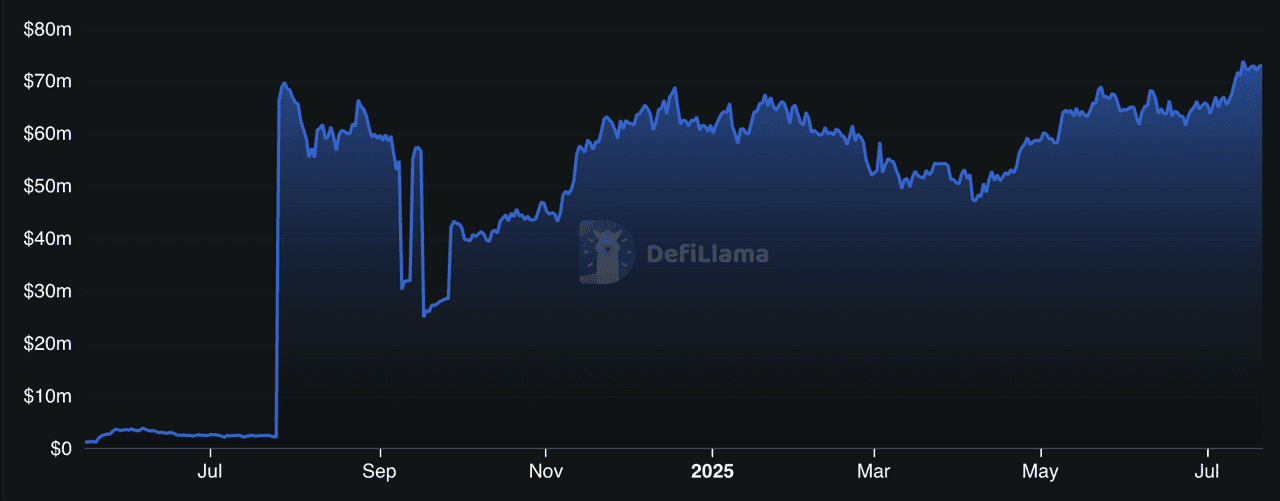

6. pSTAKE Finance (PSTAKE)

pSTAKE Finance TVL | Source: DefiLlama

pSTAKE Finance (PSTAKE) is unlocking the potential of Bitcoin by bringing liquid staking derivatives (LSDs) to BTC holders, allowing them to earn yield without sacrificing flexibility or security. With over $260,000 currently staked and partnerships with major players like Coinbase Ventures, Binance Labs, and Galaxy Digital, pSTAKE lets users stake their BTC via Babylon’s trustless protocol and receive liquid tokens (pBTC) that can be deployed across DeFi platforms for additional returns.

This means Bitcoin holders can now earn rewards from staking while still being able to trade, lend, or farm their assets, something previously impossible without wrapping BTC on other chains. Designed for multi-chain ecosystems, pSTAKE supports Ethereum, Cosmos, BSC, and other networks, making it easy for both beginners and institutions to access DeFi yields on their BTC. Backed by institutional-grade custody and audited smart contracts, pSTAKE combines Bitcoin’s security with DeFi’s capital efficiency, positioning itself as a leading player in the growing BTCFi landscape.

7. ALEX Lab (ALEX)

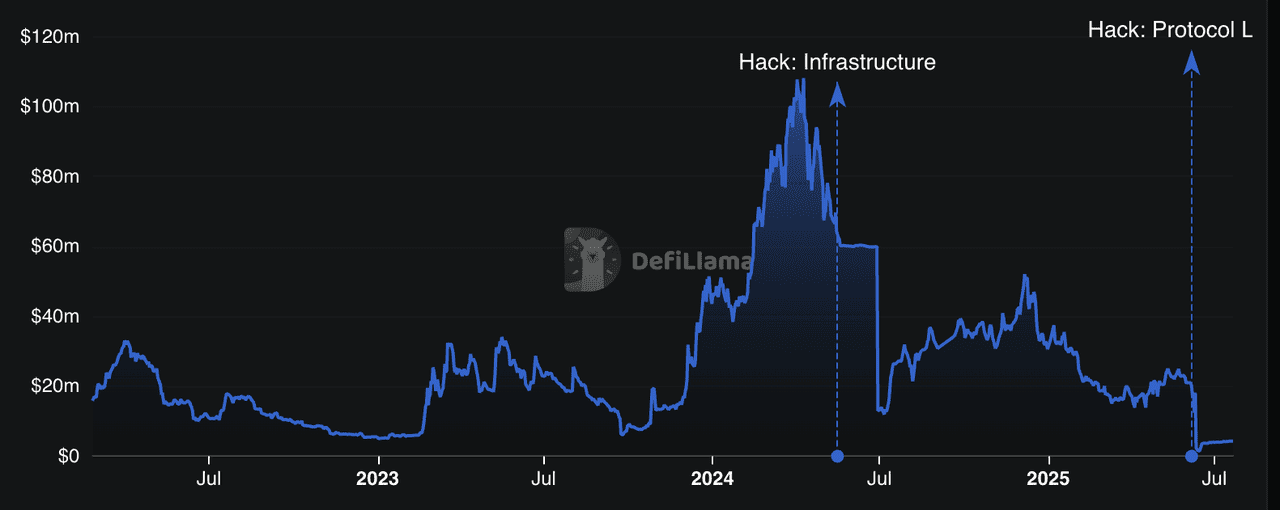

ALEX Lab TVL | Source: DefiLlama

ALEX Lab (ALEX) is a leading DeFi hub built on Bitcoin layer-2 networks like Stacks, designed to bring a full suite of decentralized finance services to BTC holders. With over 2.2 million blocks processed on Stacks, ALEX offers Bitcoin users access to decentralized exchanges (DEXs) for trading, launchpads for new project fundraising, lending platforms for earning interest or borrowing against BTC, and yield farming to maximize returns.

Its developer-friendly infrastructure supports smart contracts and seamless integrations, enabling builders to launch new dApps while leveraging Bitcoin’s security. ALEX’s community governance model empowers users to vote on protocol upgrades and allocate incentives, creating a dynamic ecosystem where both retail users and developers can participate in shaping the future of BTCFi. This makes ALEX not just a platform but a vibrant, user-driven economy for Bitcoin-based DeFi innovation.

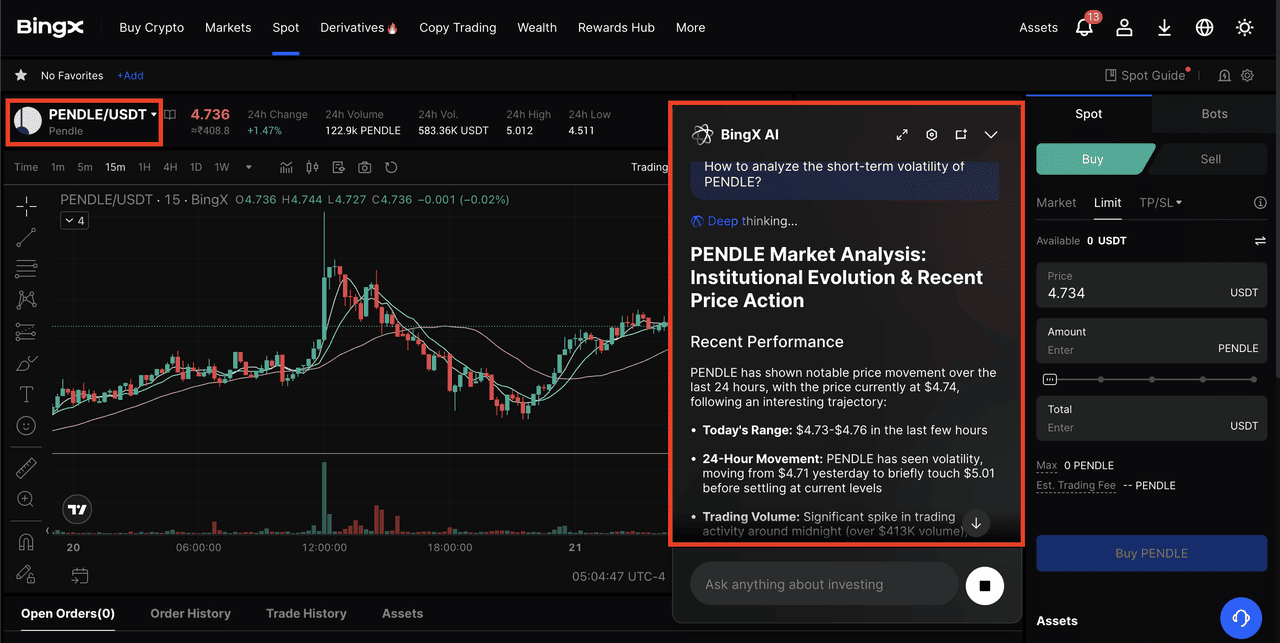

How to Trade BTCFi Tokens on BingX

PENDLE/USDT trading pair with BingX AI insights on BingX spot market

Trading BTCFi tokens on BingX is beginner-friendly and packed with features to help you trade confidently. Here’s how to get started step by step:

1. Create an Account: Visit BingX.com, sign up for a free account, and complete KYC verification to unlock full trading access.

2. Deposit Funds: Transfer

USDT, BTC, or other supported cryptocurrencies into your BingX wallet quickly and securely.

3. Search for BTCFi Tokens: Go to the Spot Market and search for tokens like PENDLE/USDT,

BABY/USDT, or

BB/USDT. You can also explore other BTCFi pairs listed on BingX.

4. Place Your Order: Choose between a market order for instant buying or a limit order to set your preferred price. Beginners often start with market orders for simplicity.

5. Store Securely: After buying, you can keep your tokens in your BingX wallet for easy trading or transfer them to a hardware or self-custody wallet for long-term storage.

Plus,

BingX AI offers automated insights and real-time analysis of BTCFi tokens, helping you identify trends, set alerts, and make informed decisions. With BingX’s intuitive interface, deep liquidity, and powerful

AI tools, anyone can start trading BTCFi tokens and join Bitcoin’s growing DeFi movement.

Closing Thoughts: The Future of BTCFi

BTCFi is shaping Bitcoin’s evolution from a static store of value into a dynamic financial platform. In the coming years, we may see more advanced applications, wider institutional participation, and innovations like Bitcoin-native stablecoins and enhanced cross-chain solutions.

As developers build on Bitcoin’s secure foundation, BTCFi could support everything from decentralized lending markets to scalable layer-2 networks, unlocking new financial opportunities for millions of users. However, it’s important to recognize the risks. BTCFi is still an emerging sector, with potential smart contract vulnerabilities, regulatory uncertainty, and market volatility.

Disclaimer: Cryptocurrency investments involve risk, including possible loss of principal. Always conduct your own research and consider your risk tolerance before participating.

Related Reading