The global crypto investment landscape has evolved rapidly in 2025. Following the SEC’s approval of

spot Bitcoin and

Ethereum ETFs in 2024, the launch of staking-enabled Solana ETFs has marked the next major step in bridging traditional finance and blockchain-based yield.

A Solana Staking ETF is a regulated investment fund that gives investors exposure to Solana’s (SOL) price movements while also distributing staking rewards earned from participating in the network. It allows investors to benefit from Solana’s growth and yield potential without managing wallets, validators, or private keys.

The first U.S. Solana Staking ETF launched in July 2025, offering investors a new way to earn on-chain rewards through a traditional market structure. Just months later, the Bitwise Solana ETF (BSOL) began trading on October 28, 2025, becoming the first spot Solana ETF with staking listed on the New York Stock Exchange, solidifying Solana’s position as a leader in the new era of yield-generating crypto ETFs.

Investor Interest Surges in Solana Staking ETFs

Interest in staking-enabled ETFs has surged in 2025 as investors seek regulated ways to earn blockchain-based yield.

Solana (SOL), known for its speed and low fees, has become the leading choice for this new class of crypto funds.

The REX-Osprey Solana Staking ETF (SSK), launched on July 2, 2025, on the Cboe BZX Exchange, was the first U.S. ETF to combine SOL price exposure with staking rewards. Backed by Anchorage Digital, it drew $12 million in inflows and $33 million in volume on day one. The fund holds a diversified mix of Solana assets, including

JitoSOL and CoinShares’ Staked Solana ETP, with a 0.75% expense ratio and an estimated 5–7% annual yield.

The Bitwise Solana ETF (BSOL) followed on October 28, 2025, launching on the New York Stock Exchange with $69.5 million in first-day inflows. Managed by Helius Technologies, it provides direct spot exposure to Solana with fully integrated staking, targeting around 7% yield and waiving its 0.20% management fee for the first three months.

Together, SSK and BSOL signal the start of a new era for crypto-linked ETFs, blending traditional accessibility with on-chain income generation.

Rex Osprey SOL Staking ETF debut performance | Source: X

What Is Solana (SOL)?

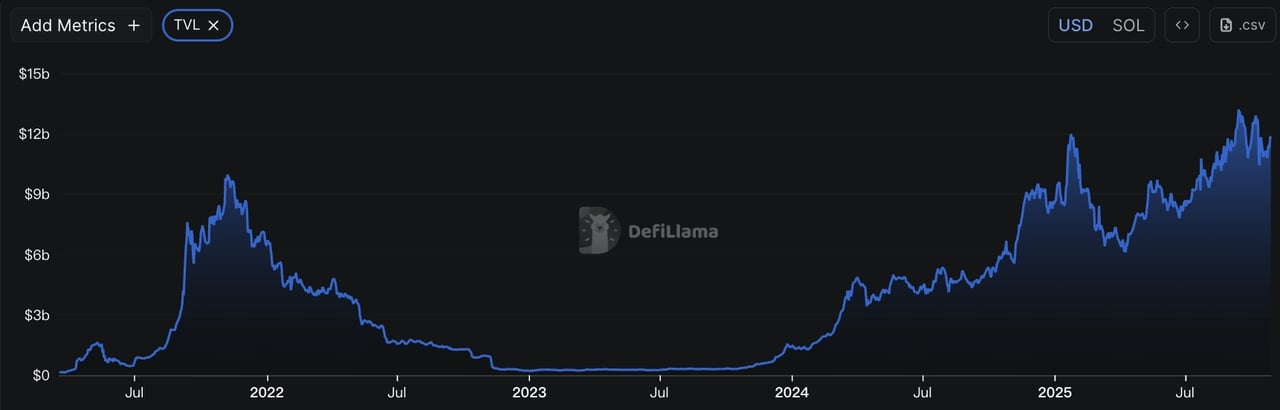

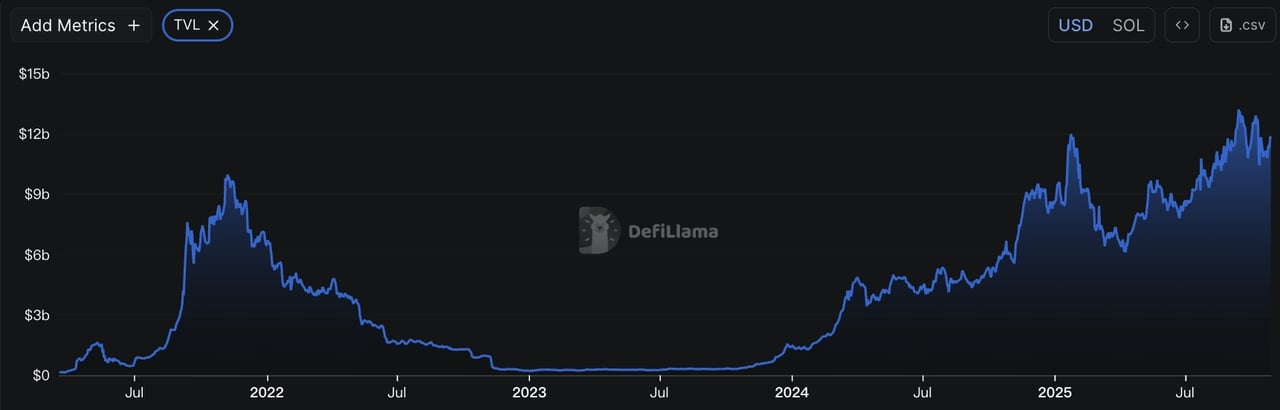

Solana is a high-performance blockchain often called an “

Ethereum killer” for its ability to process thousands of transactions per second at extremely low cost. In 2025, it remains one of the top-performing Layer 1 networks, with a total value locked (TVL) of around $11.8 billion, driven by strong growth across

DeFi,

NFTs,

memecoins, and gaming. Solana uses a hybrid Proof of History (PoH) and Proof of Stake (PoS) system to achieve fast finality and scalability.

Its major 2025 upgrades, including Firedancer by Jump Crypto and Alpenglow, are designed to increase throughput, reduce latency, and make the network more secure and reliable for large-scale adoption.

The Solana ecosystem has become one of the most active in crypto. DeFi platforms like

Raydium and

Jupiter lead decentralized trading, while

Pump.fun and

LetsBonk.fun dominate the

memecoin launchpad space. Beyond finance, Solana is expanding into consumer tech with the

Solana Seeker smartphone, integrating Web3 identity and wallet functionality into mobile hardware. Together, these advancements reinforce Solana’s position as one of the most innovative and scalable blockchains in 2025.

What Is a Solana Staking ETF?

A Solana Staking ETF is a regulated exchange-traded fund that gives investors exposure to Solana’s (SOL) price movements while also earning staking rewards generated by the network. Instead of buying and staking SOL directly, investors can purchase ETF shares through a traditional brokerage account, gaining both capital appreciation and passive yield without managing wallets or validators.

The REX-Osprey Solana Staking ETF (SSK), launched on July 2, 2025, was the first of its kind in the United States. The fund holds actual SOL tokens and stakes them through Anchorage Digital, a federally chartered custodian and staking partner. This setup allows the ETF to earn around 7% annual yield, which is distributed to investors. For individuals, this is comparable to earning interest from a high-yield savings account, but within a crypto investment context, combining blockchain rewards with traditional market accessibility.

How Does a Solana Staking ETF Work?

A Solana Staking ETF simplifies crypto investing by allowing you to earn staking rewards without needing to manage wallets, validators, or private keys. Here’s how it works step by step:

1. ETF Creation – The fund manager, REX-Osprey, buys actual Solana (SOL) tokens to back the ETF. These tokens form the core assets of the fund, which is traded under the ticker SSK.

2. Staking Integration – Instead of holding SOL passively, the ETF stakes these tokens on the Solana network through Anchorage Digital, a regulated crypto custodian. This means the SOL held by the fund actively participates in validating transactions and securing the blockchain.

3. Reward Distribution – As the staked SOL earns rewards from the network (currently around 7.3% annually), these rewards are collected and passed on to investors. This creates a passive income stream similar to earning dividends from stocks or interest from bonds.

4. Investor Access – Investors can buy or sell shares of the ETF on the Cboe BZX Exchange just like they would with any traditional stock or ETF, using a regular brokerage account.

This innovative structure complies with U.S. regulations because the ETF operates under the Investment Company Act of 1940 and uses a C-Corporation format. This approach ensures staking rewards can be distributed legally and securely, making it a convenient and regulated way for both retail and institutional investors to access Solana’s price growth and staking income.

Solana Staking ETF vs. Spot Solana ETF: What’s the Main Difference?

With the launch of new

spot Solana ETFs with staking, the gap between Solana Staking ETFs and spot Solana ETFs has narrowed considerably. Both offer exposure to Solana’s (SOL) price performance and staking rewards but differ in how these rewards are managed and regulated. Together, they show how staking and spot exposure are converging into a new class of regulated, yield-generating crypto investments.

The REX-Osprey Solana Staking ETF (SSK) launched on July 2, 2025, operates under a registered investment company (RIC) structure and is filed under the Investment Company Act of 1940. This framework, similar to mutual fund regulation, allows SSK to distribute staking rewards directly to investors. The fund stakes SOL through Anchorage Digital, earning about 7% annually, with income paid out regularly.

Bitwise’s Solana ETF (BSOL) and Grayscale’s Solana ETF (GSOL) operate as spot ETFs under the 1933 Act. They track SOL’s market price while staking part of their holdings on-chain to enhance returns. Instead of distributing yield, staking rewards are reinvested into the fund to grow its value. BSOL began trading on October 28, 2025, and GSOL followed on October 29, both listed on the NYSE.

Key Differences Between SSK, BSOL, and GSOL

1. Reward Distribution:

• SSK pays staking rewards directly to investors as income.

• BSOL and GSOL reinvest staking rewards into the fund, increasing its net asset value.

2. Regulatory Framework:

• SSK is filed under the "Investment Company Act of 1940", similar to mutual funds.

• BSOL and GSOL operate under the "Securities Act of 1933", like most spot crypto ETFs.

3. Investor Focus:

• SSK targets yield-focused investors seeking regular income.

• BSOL and GSOL focus on long-term growth through value compounding.

Both structures provide regulated, convenient access to Solana’s yield without requiring wallets, private keys, or validator setups.

| Feature |

Solana Staking ETF (SSK) |

Spot Solana ETFs (BSOL / GSOL) |

| Launch Date |

July 2, 2025 |

BSOL: Oct 28, 2025 / GSOL: Oct 29, 2025 |

| Structure |

Investment Company (RIC) |

Investment Trust (Spot ETF) |

| Regulatory Act |

Investment Company Act of 1940,

similar to mutual funds. |

Securities Act of 1933,

similar to most spot crypto ETFs |

| How It Works |

Holds and stakes SOL directly, distributing rewards as income |

Tracks SOL price and stakes on-chain, reinvesting rewards |

| Custodian / Partner |

Anchorage Digital |

Helius Technologies (BSOL) / Grayscale in-house (GSOL) |

| Management Fee |

0.75% |

BSOL: 0.20% (waived for 3 months) / GSOL: 0.25% |

| Yield Handling |

Rewards paid as income |

Rewards reinvested into fund value |

| Annual Yield (Est.) |

~7% |

~5–7% |

| Trading Venue |

Cboe BZX Exchange |

NYSE / NYSE Arca |

| Investor Focus |

Passive income |

Long-term growth and liquidity |

Beyond US Markets: Canada and Europe’s SOL Staking ETFs

While the United States only recently introduced staking-enabled ETFs, other regions moved earlier to adopt Solana-based investment products that combine regulated exposure with on-chain yield.

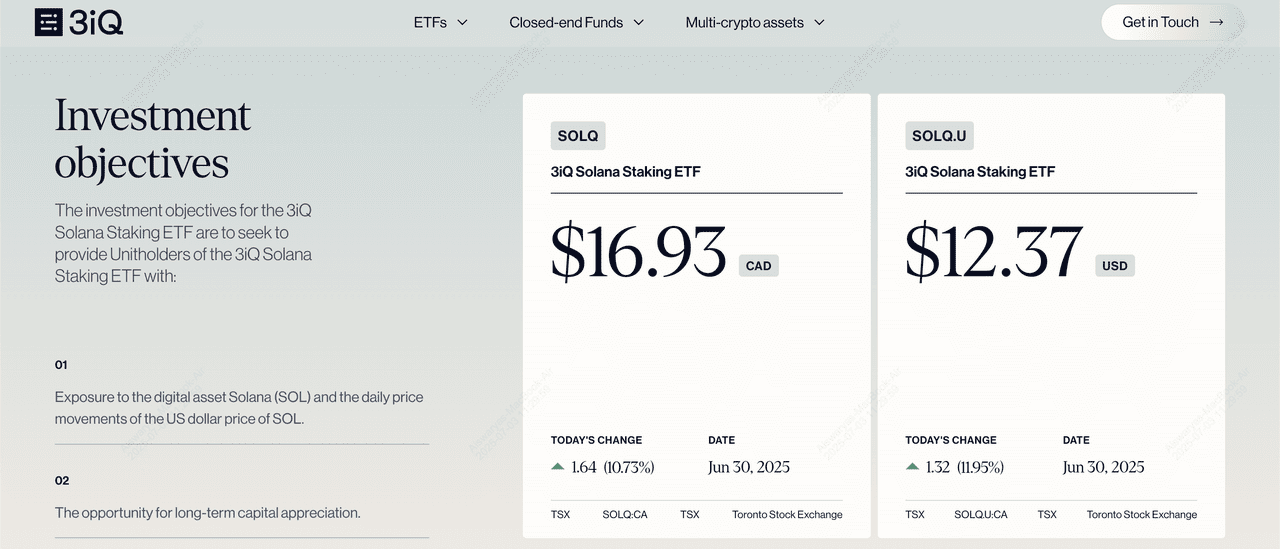

1. 3iQ Solana Staking ETF (SOLQ) – Canada:

Canada became the first country to launch spot Solana ETFs with staking in April 2025 on the Toronto Stock Exchange. Issuers including 3iQ, Purpose Investments, Evolve, and CI Galaxy rolled out staking-enabled funds that allocate up to 50% of their holdings to on-chain staking, generating 2–3.5% annual yields. The 3iQ Solana Staking ETF (SOLQ) quickly led the market, attracting 87.6% of total inflows, or roughly CAD 191 million by mid-June 2025. SOLQ also launched with zero management fees for its first year, helping drive strong early adoption among institutional and retail investors.

3iQ's Solana staking ETF performance | Source: 3iQ

2. Bitwise Solana Staking ETP (BSOL) – Europe: In Europe, Bitwise introduced its Solana Staking ETP on Xetra, offering a 6.48% APY with a 0.85% management fee, outperforming competitors such as 21Shares’ staking products, which average 5.49% with higher costs. BSOL uses institutional-grade cold storage and tracks the Compass Solana Total Return Monthly Index, providing full transparency and reliable staking-based performance. Its combination of strong yield, clear benchmarking, and regulated structure has positioned it as one of Europe’s most attractive Solana-linked investment products.

The Best Way to Invest in Solana in 2025: ETFs or Crypto?

A Solana ETF offers a simple and regulated way to gain exposure to Solana (SOL) without the need to manage wallets, private keys, or crypto exchanges. It suits investors who want the security and convenience of traditional finance while participating in Solana’s growing ecosystem. Since ETFs trade on public exchanges, they provide transparent pricing, high liquidity, and, in some cases, additional yield through staking rewards.

Still, Solana ETFs are not risk-free. Their prices move with SOL’s market volatility, which is influenced by investor sentiment, regulatory updates, and broader macroeconomic trends. It is also important to understand how each product works. Solana Staking ETFs distribute staking rewards directly to investors, while spot Solana ETFs with staking reinvest those rewards to increase fund value over time.

• If you’re a traditional investor: A spot Solana ETF is a great starting point. It provides exposure to Solana through familiar brokerage platforms, offering liquidity and compliance within a regulated market.

• If you’re an income-focused investor: A Solana Staking ETF may be more appealing. It combines SOL price exposure with regular staking income, creating a steady yield stream under a transparent and regulated structure.

• If you’re a crypto-native investor: You may prefer to

buy SOL directly on BingX, transfer it to your own wallet, and stake it on-chain for higher yields and full control over your assets.

Final Thoughts

The launch of spot and staking-enabled Solana ETFs marks a new chapter in connecting crypto with traditional finance. What started with Bitcoin and Ethereum ETFs has now expanded to Solana, giving investors a regulated way to access both price exposure and on-chain yield through familiar financial channels.

Whether through the income-focused REX-Osprey Solana Staking ETF (SSK) or the growth-oriented spot ETFs from Bitwise (BSOL) and Grayscale (GSOL), investors can now choose products that match their goals. As Solana’s ecosystem continues to expand across DeFi, NFTs, and Web3, these ETFs show how digital assets are becoming an integrated part of mainstream investing.

Related Reading

Frequently Asked Questions (FAQs)

1. What’s the price of the Solana Staking ETF (SSK)?

The Solana Staking ETF (SSK) trades on the Cboe BZX Exchange under the ticker SSK. Its price fluctuates throughout the trading day based on Solana’s market performance and investor demand, similar to other ETFs.

2. What’s the Solana Staking ETF (SSK) dividend?

The SSK ETF distributes dividends generated from staking rewards earned on Solana’s network. These rewards are typically around 7% annually, though the exact amount may vary depending on network performance and validator returns.

3. How often will SSK dividends be paid out?

Dividends from SSK are expected to be paid out monthly, aligning with its income-focused structure under the Investment Company Act of 1940. Investors can expect staking rewards to be distributed regularly as part of their ETF holdings.

4. Is the Solana Staking ETF (SSK) different from the Bitwise Solana ETF (BSOL)?

Yes. SSK distributes staking rewards directly to investors as income, while BSOL reinvests staking rewards back into the fund to increase its net asset value. Both offer exposure to Solana but follow different investment approaches.

5. Can I buy Solana ETFs on regular stock trading platforms?

Yes. Both SSK and BSOL can be purchased through standard brokerage accounts, just like traditional ETFs. This allows investors to gain exposure to Solana without using crypto exchanges or managing digital wallets.