Tokenized stocks have rapidly evolved from a niche experiment into one of the fastest-growing segments of

real-world asset (RWA) tokenization in 2025. As global investors look for 24/7 access, lower barriers to entry, and assets that integrate directly with DeFi, tokenized equities on

Solana,

Ethereum, and modular chains have surged in adoption.

Two ecosystems are leading this shift:

Ondo Global Markets, which launched tokenized U.S. stocks in September 2025 and surpassed 1.39 billion USD in Total Value Locked (TVL) by mid-2025 after rising from under 200 million USD in early 2023, and xStocks, which dominates retail tokenized equity trading with more than 10 billion USD in processed volume in four months and a consistent 95 to 99% share of all tokenized stock trading activity on Solana.

This guide explores what tokenized stocks are, how they work, how Ondo and xStocks compare in 2025, and how investors can access these assets through reliable platforms like BingX.

What Are Tokenized Stocks and How Do They Work?

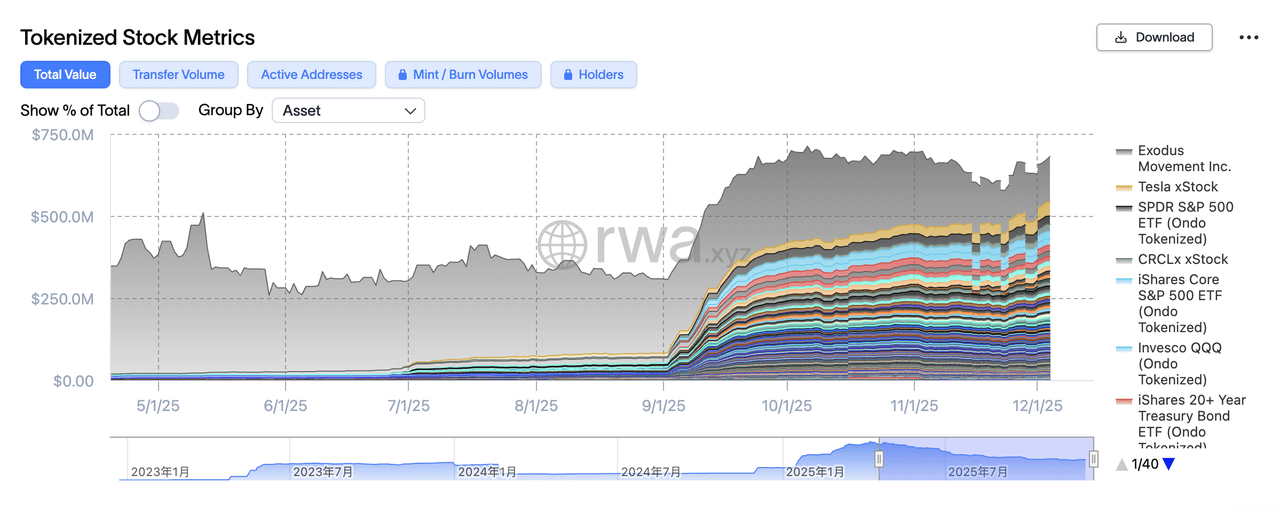

Total value of tokenized stocks (xStocks) | Source: RWA.xyz

A tokenized stock is a blockchain-based asset that mirrors the price movement of a traditional equity such as

Apple (AAPL),

Tesla (TSLA) or ETFs like

QQQ, which tracks the Nasdaq-100 Index, or

SPY, which tracks the S&P 500. Instead of holding the stock through a traditional brokerage, investors hold a digital token that represents economic exposure to the underlying security.

By late 2025, tokenized equities represented more than 664 million USD in on-chain value and contributed to over 36 billion USD across all RWA categories. Platforms such as xStocks processed more than 10 billion USD in trading volume within four months, reflecting accelerating demand for on-chain equity markets.

1. Fully Backed Tokenized Stocks

Fully backed tokenized stocks represent real shares held by a regulated custodian or broker-dealer, allowing each token to reflect live prices, dividends and corporate actions. Platforms such as Ondo Global Markets, Dinari, Securitize and many issuers listing on xStocks operate under this model. These providers offer 1:1 backed U.S. equities and ETFs using licensed custodians and transfer agents, giving users exposure that closely resembles traditional stock ownership with on-chain mobility.

2. Synthetic Tokenized Stocks

Synthetic tokenized stocks replicate equity prices through oracles and hedging mechanisms rather than holding the underlying shares. This structure is used by certain European issuers and specialized providers that track stock indices or single equities through derivatives. These tokens function more like perpetual structured products, offering flexibility and composability but without the ownership or custodial attributes of fully backed models.

Across both structures, tokenized stocks offer fractional ownership, 24/7 transferability, instant settlement, global access without a brokerage account and

DeFi applications such as borrowing, lending and collateralization.

Who Are the Most Popular Tokenized Stock Providers in 2025?

Most popular tokenized stock providers by marekt cap | Source: RWA.xyz

Several providers dominate the tokenized equity landscape in 2025, each serving different user needs across compliance, liquidity, and chain infrastructure. Here are the top five tokenized stock providers and platforms shaping the market this year:

1. Ondo Global Markets: Ondo issues fully backed tokenized U.S. stocks and ETFs supported by regulated broker-dealers. As part of an ecosystem that surpassed 1.39B USD in TVL, Ondo has become a central force in bringing traditional equities on-chain across multiple networks.

2. xStocks by Backed Finance: xStocks is the leading Solana marketplace for tokenized equities, listing 1:1 backed U.S. stocks and indices issued by Backed Finance, a Swiss-regulated RWA issuer. Backed provides the issuance and custody, while xStocks delivers high-speed, low-fee trading optimized for Solana.

3. Securitize Markets: Securitize offers regulated tokenized securities and funds, enabling institutional-grade financial products to move on-chain. While not exclusive to tokenized stocks, Securitize plays a key role in expanding regulated digital securities.

4. WisdomTree (Tokenized Funds): WisdomTree issues regulated tokenized money-market and treasury funds that provide secure, compliant access to traditional financial instruments on-chain. Though not a tokenized-stock issuer, its role in RWAs strengthens the broader ecosystem supporting on-chain equities.

5. Dinari (dShares): Dinari issues fully backed tokenized equities through its dShares model, offering transparent custodial documentation and regulatory alignment for users who prioritize compliance and asset provenance.

What Is Ondo Tokenized Stock and How Does It Work?

Ondo Global Markets is the tokenized equities framework introduced by

Ondo Finance, a leading real-world asset platform whose ecosystem surpassed 1.39 billion USD in Total Value Locked (TVL) by mid-2025. After establishing products such as USDY and OUSG, Ondo expanded into tokenized U.S. stocks and ETFs with the launch of Ondo Global Markets in September 2025.

Ondo’s tokenized stocks are fully backed 1:1 by the underlying shares. The assets are custodied with regulated broker-dealers such as Alpaca, supported by

Chainlink for real-time pricing and

LayerZero for cross-chain functionality. This structure allows each token to mirror the price, dividends and corporate actions of the real-world stock.

At launch, Ondo introduced more than 100 tokenized U.S. stocks and ETFs including AAPL, TSLA, SPY and QQQ. The platform plans to expand to more than 1,000 tokenized assets by the end of 2025 across Ethereum, Solana and

BNB Chain. Eligible investors can mint these assets with

USDC, transfer them any time and trade during U.S. market hours, with long-term plans to enable full 24/7 trading.

Key Highlights of Ondo Tokenized Stocks

1. Regulated custodial backing: Tokens are supported by real share ownership held with licensed broker-dealers, offering transparency that synthetic models do not provide.

2. Direct 1:1 asset correspondence: Each tokenized stock represents a specific underlying share, helping ensure accurate reflection of price changes and corporate actions.

3. Strong ecosystem foundation: Ondo’s broader RWA platform surpassed 1.39 billion USD in TVL by mid-2025, adding stability and credibility to its tokenized-equity products.

4. Expanding catalog of tokenized equities: The platform is scaling from more than 100 initial listings toward a target of over 1,000 tokenized stocks and ETFs across multiple chains.

5. Reliable market infrastructure: Chainlink provides verified pricing and LayerZero enables cross-chain transfers, supporting accuracy and interoperability.

6. Always-on mobility and fast settlement: Users can mint, hold and transfer tokenized equities at any time, benefiting from quick on-chain settlement without traditional brokerage delays.

What Are xStocks Tokenized Stocks and How Do They Work?

xStocks is the leading tokenized equities marketplace on Solana, providing fast, low-cost access to tokenized U.S. stocks and ETFs. The tokenized equities traded on xStocks are issued by Backed Finance, a Swiss-regulated RWA issuer that provides 1:1 backed representations of traditional stocks and indices. Backed Finance manages issuance and custody, while xStocks delivers Solana’s high-performance trading environment.

xStocks lists a wide range of Backed Finance-issued tokenized equities, including assets such as AAPL, TSLA, NVDA, META and major indices like QQQ. All tokens available on xStocks benefit from Solana’s high throughput and near-instant finality, enabling rapid settlement, low gas fees and a trading experience comparable to centralized platforms with the flexibility and portability of on-chain assets.

By late 2025, xStocks processed more than 10 billion USD in trading volume over a four-month period and consistently captured 95% to 99% of tokenized stock activity on Solana. The platform also recorded strong user growth, with more than 74,000 monthly active addresses and over 116,000 token holders.

Key Highlights of xStocks Tokenized Stocks

1. Backed-issued tokenized equities: xStocks lists 1:1 backed U.S. stocks and indices issued by Backed Finance, supported by regulated custodians.

3. High-performance trading environment: Solana’s low fees and fast execution provide a smooth, efficient trading experience.

4. Broad coverage of major U.S. stocks: Hundreds of popular equities and indices are available in tokenized form.

5. Strong user and volume growth: More than 10 billion USD in four-month trading volume reflects accelerating demand for on-chain equities.

6. Retail-friendly accessibility: Low entry costs, easy wallet integration and near-instant settlement make xStocks widely accessible to global users.

Ondo vs. xStocks: Which Is the Better Tokenized Stock Platform?

Ondo and xStocks are the two most influential tokenized stock ecosystems in 2025, each serving different user needs. Ondo focuses on regulatory alignment, institutional-grade custodial structures and a fully backed 1:1 issuance model across multiple chains. xStocks, on the other hand, operates as a dedicated tokenized-stock issuer on Solana, offering fast execution, deep liquidity and broad retail accessibility through a 1:1 backed model optimized for high-performance trading.

Ondo vs. xStocks: Detailed Comparison (2025)

| Category |

Ondo Global Markets |

xStocks (Backed Finance Tokens) |

| Primary chain |

Ethereum, Solana, BNB Chain |

Solana |

| Backing model |

1:1 backed U.S. stocks and ETFs via regulated broker-dealers |

1:1 backed tokenized stocks issued by Backed Finance |

| How it works |

Ondo mints backed equities through licensed custodians; cross-chain enabled |

xStocks lists and trades Backed-issued equities with fast, low-fee Solana execution |

| Ecosystem size |

1.39B USD TVL across Ondo RWA products |

10B+ USD trading volume in four months |

| Number of stocks |

100+ expanding toward 1,000+ |

300+ Backed-issued equities and ETFs |

| Market share |

Growing multi-chain presence |

95–99% of Solana tokenized-equity volume |

| Trading environment |

On-chain mobility with trading generally aligned to U.S. market hours |

Near-instant settlement and continuous on-chain trading with low fees |

| Accessibility |

Available globally, restricted in U.S./U.K./EEA |

Broad global access; issuer-level U.S. restrictions |

| Wallet support |

EVM wallets like MetaMask and Ledger |

Solana wallets such as Phantom and Solflare |

Choose Ondo if you want:

Ondo is ideal for users who prioritize regulatory clarity, verified custodial backing, and multi-chain access to tokenized U.S. equities.

• 1:1 backed tokens with strong custodial transparency

• regulatory alignment and clearly documented asset provenance

• a steadily expanding catalog of fully backed U.S. equities and ETFs

• multi-chain accessibility across Ethereum, Solana and BNB Chain

• an experience designed for users who prioritize safety and compliance

Choose xStocks if you want:

xStocks is best for users who value fast execution, low fees, and seamless access to Backed Finance’s tokenized stocks on Solana.

• fast, low-cost trading optimized for Solana’s high throughput

• broad access to popular tokenized U.S. stocks and indices issued by Backed Finance

• deep liquidity and strong daily trading activity

• straightforward access through retail-friendly Solana wallets

• a seamless on-chain trading experience with near-instant settlement

In short, Ondo is ideal for users who prioritize regulatory clarity, custodial transparency and a multi-chain, institution-ready structure, while xStocks is better suited for active traders seeking speed, liquidity and simple on-chain access to tokenized U.S. equities.

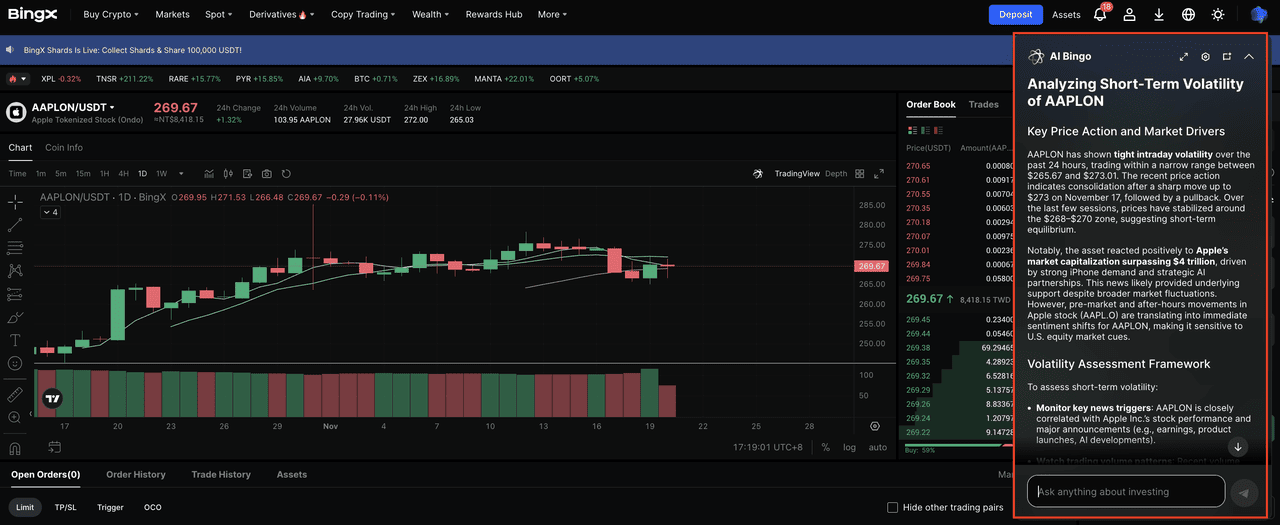

How to Buy Tokenized Stocks on BingX

BingX is one of the best platforms to buy tokenized stocks, supporting assets issued by Backed Finance on Solana through xStocks as well as fully backed providers linked to Ondo. BingX offers 35 fully backed tokenized equities from issuers such as Ondo, including Alphabet (GOOGLon), S&P 500 (SPYon) and other U.S. equity trackers. It also lists 6 Solana-based tokenized stocks from Backed Finance via xStocks, such as AAPLx and NVDAX, giving users fast execution and low network fees. These tokens mirror the price of their underlying equities and provide flexible, fractional exposure without requiring a traditional brokerage account.

Step 1: Create and Secure Your BingX Account

Sign up or log in, complete KYC if required in your region and enable two-factor authentication for extra security.

Step 2: Deposit USDT Into Your BingX Wallet

Transfer USDT using your preferred blockchain network. Confirm the correct deposit chain, check minimum amounts and review any applicable fees before confirming.

Step 3: Search for the Tokenized Stock You Want to Trade

Step 4: Use BingX AI for Market Insights

Tap the AI icon to view support and resistance levels, recent volatility, trend analysis or liquidity indicators before placing an order.

Step 5: Buy the Tokenized Stock

Choose either a

market or limit order, enter the amount of USDT you want to invest, review liquidity and confirm the trade. The tokenized stock will appear instantly in your Spot wallet.

Risks and Considerations Before Investing in Tokenized Stocks

Tokenized stocks provide flexible, global exposure to traditional equities, but they also introduce risks that differ from standard brokerage accounts. Before trading assets issued by platforms such as Ondo or xStocks, consider the following:

1. Regulatory uncertainty: Tokenized stocks operate across both crypto and securities frameworks. Rules vary by region, and future regulatory changes may impact availability, trading hours or how issuers are allowed to operate.

2. Custodial vs. synthetic exposure: Fully backed models like Ondo and xStocks rely on regulated custodians holding real shares, but synthetic tokenized stocks do exist elsewhere in the industry. Users should verify each token’s backing model before investing.

3. Issuer and platform risk: Stability depends on the reliability of custodians, issuers and blockchain infrastructure. Outages, paused minting, or changes in issuer or custodian policy can temporarily affect trading or access.

4. Liquidity and slippage: While xStocks offers deep liquidity for major tickers, liquidity can vary by asset. Less-traded equities may experience wider spreads or higher slippage compared to traditional brokerage markets.

5. Jurisdiction and withdrawal limitations: Fully backed assets often include stricter regional restrictions and may limit redemption or cross-chain withdrawals depending on the issuer’s compliance obligations.

6. Infrastructure dependencies: Tokenized stocks rely on pricing oracles, custodial partners and blockchain networks. Issues affecting providers like Chainlink, LayerZero or underlying custodians may temporarily disrupt pricing or settlement.

Final Thoughts

Tokenized stocks have evolved from an experimental concept into one of the fastest-growing segments in the RWA space, bringing traditional equities into a 24/7, globally accessible, crypto-native environment. Platforms like Ondo and xStocks represent two leading approaches: one centered on regulatory clarity and multi-chain infrastructure, and the other optimized for speed, liquidity and user accessibility on Solana.

As the market expands, investors can choose between fully backed models that mirror traditional ownership and high-performance on-chain trading environments tailored to active participants. Regardless of preference, the rise of tokenized stocks signals a broader shift toward more open, programmable and interoperable financial markets.

For users looking to participate in this growth, BingX provides an accessible entry point with support for both Ondo-linked assets and xStocks-issued tokenized equities. Whether you’re building long-term exposure or trading short-term market movements, tokenized stocks offer a new bridge between traditional equities and on-chain finance.

Related Reading