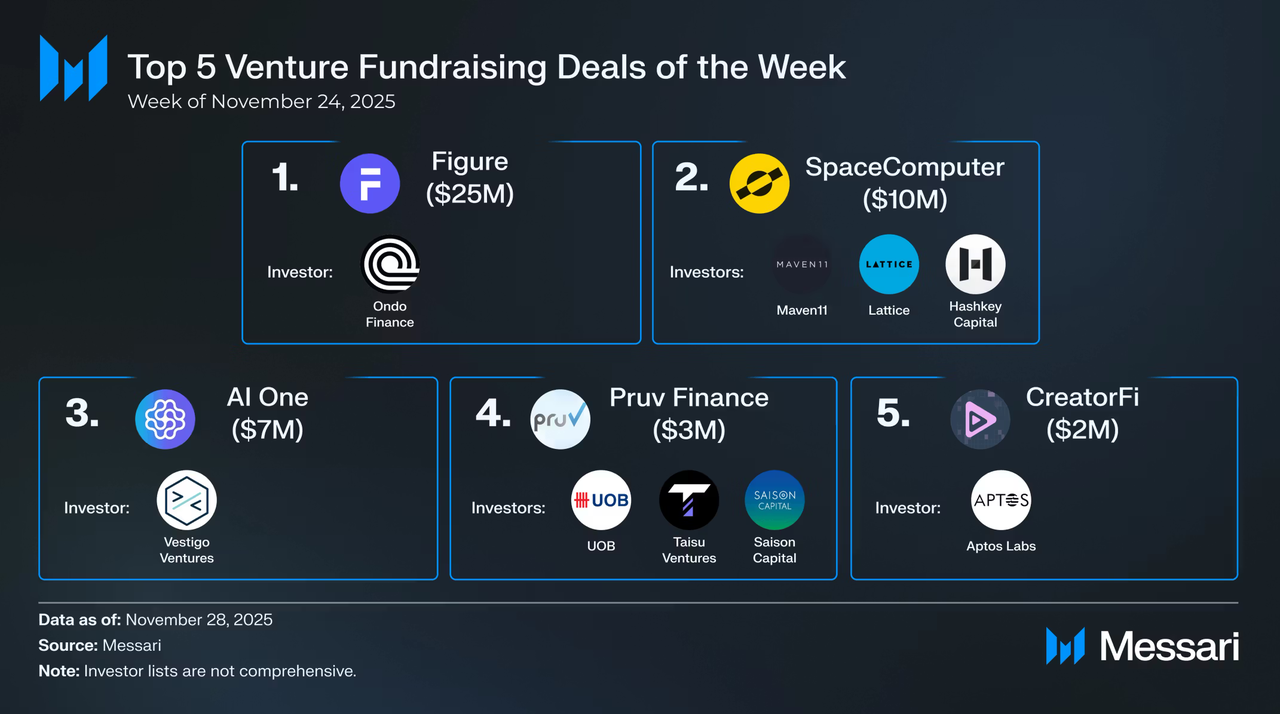

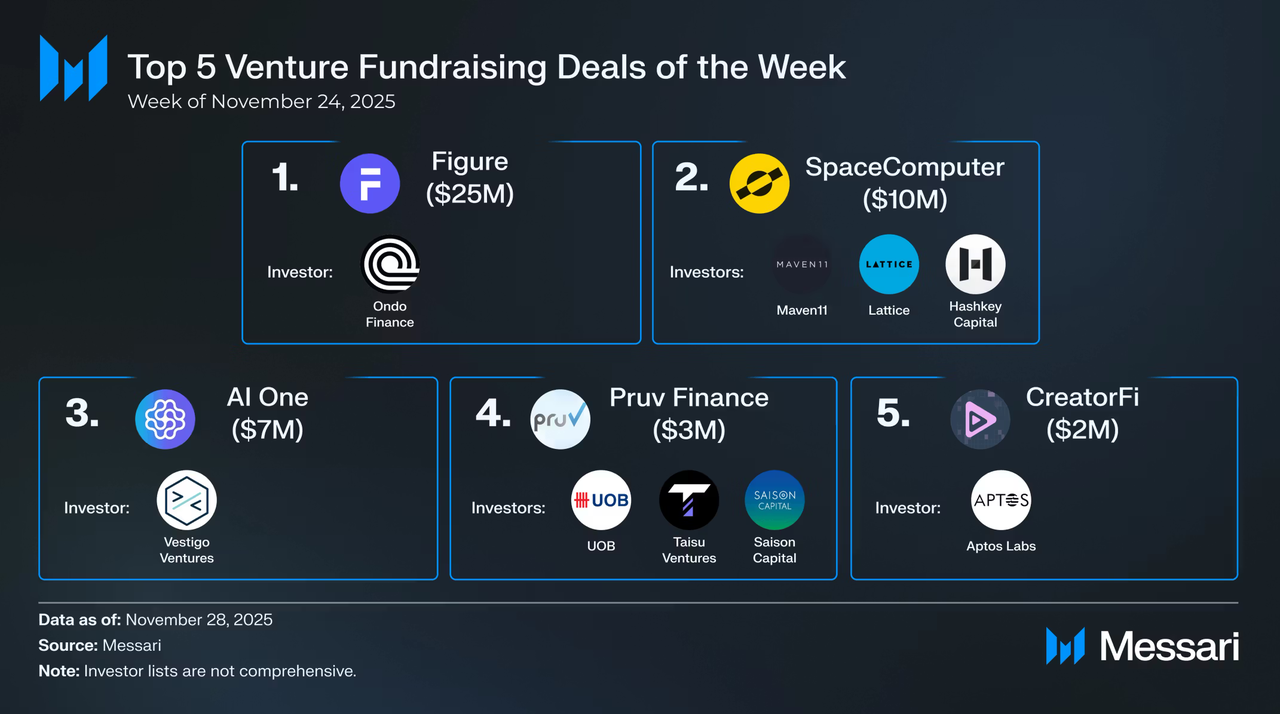

Altcoins absolutely still hit 100x in 2025, and the biggest part of that explosion happens before a major exchange listing, during the small-cap, illiquid, overlooked phase when only early-stage traders and on-chain explorers are paying attention. The market backdrop supports this: in the last week of November 2025, 14 early-stage projects raised $82 million, while institutional treasuries deployed another $267 million into

Bitcoin (BTC) and

Ethereum (ETH), and multiple acquisitions like Paxos–Fordefi, Robinhood–LedgerX, Naver–Dunamu, Exodus–Baanx/Monavate, signaled accelerating infrastructure expansion.

Top venture deals in late November 2025 | Source: Messari

Venture funds are gearing up too, Entrée Capital’s new $300 millionj fund and DWF Labs’ $75 million DeFi fund show that deep-pocketed players are actively hunting the next wave of high-upside narratives. With capital, M&A, and institutional flows this strong, early-stage tokens continue to generate massive asymmetry, most of which occurs long before the first centralized exchange listing gives public access.

This guide shows you how to build a repeatable process to find those coins early. You’ll learn where 100x coins usually come from, which chains and launchpads to watch, how to filter by narrative and market cap, and which on-chain and social signals actually matter.

Quick Answer: How Do You Find a 100x Coin Before a Major Exchange Listing?

To put it simply, you could increase your odds of finding a 100x coin by focusing on the right narratives, chains, launchpads, market caps less than $100 million, and on-chain or social data, then managing risk ruthlessly.

In practice, that means you:

1. Track fast, low-fee chains where new coins launch across networks like

Solana,

Base,

Sui,

TON,

Aptos, and niche L2s. If you’re focused on Solana specifically,

BingX ChainSpot offers a simple way to monitor early Solana tokens, trending sectors, and fresh deployments from within your BingX account.

3. Filter for small market caps, typically under $100 million, where a realistic 50x–100x upside still exists.

4. Use on-chain analytics tools such as memecoin terminal Axiom, on-chain search Spectre AI, DexScreener or Birdeye for liquidity and volume tracking, and RWA dashboards to check liquidity, holders, deployer behavior, and narrative flows.

5. Read X, Telegram, and Discord to identify genuine community momentum rather than bot-driven hype.

6. Avoid major red flags like unlocked team wallets, no liquidity lock, stealth taxes, shadow redeploys, or overly polished marketing for an early-stage project.

Once a coin finally lists on a major exchange like BingX, you can use that extra liquidity to take profits, hedge with futures, or exit safely instead of buying the top.

What Is a “100x Coin” and Is It Still Realistic in 2025?

A “100x coin” is an altcoin that multiplies its price by 100x from your entry. For example, a move from $0.05 to $5, or from a $20 million market cap to $2 billion.

Data from the last

bull market cycles shows that this is still possible. Many small-cap coins, especially in hot niches like

AI agents, RWAs, and

memecoins, have gone from sub-$20 million caps to multi-billion valuations in months when narratives lined up with liquidity.

For instance,

Virtuals Protocol, where the VIRTUAL token ran from around $0.05 to roughly $5.00 between mid-October and late December 2024, is a recent, concrete case study of a true 100x move. In less than three months, an emerging AI-agents + DeFi narrative (

DeFAI), growing on-chain activity, and accelerating liquidity turned what was essentially a niche small-cap token into one of the best-performing

AI assets of the quarter, showing how fast capital can rotate into a clear, easy-to-understand story when market conditions and timing line up.

However:

• Only a tiny minority of altcoins ever do 100x.

• Most 100x coins look risky, illiquid, and ugly at the start.

• Survivorship bias is huge: you mostly hear about winners, not the hundreds of similar projects that died.

Your goal isn’t to perfectly predict the next 100x. It’s to build a framework where you occasionally catch one while cutting losers quickly.

Why Do Most 100x Coins Pump Before Major Listings?

By the time a coin gets listed on a big exchange, a lot has already happened:

• Early insiders, seed investors, and launchpad buyers are heavily in profit.

• Liquidity grows, but so does selling pressure.

• The listing itself can act as exit liquidity for early holders.

The biggest percentage gains usually happen:

1. Pre-launch / launchpad stage for very early buyers.

2.

DEX-only price discovery, when the coin is live only on-chain, e.g., Solana, Base, TON DEXs, and still invisible to most retail.

3. Early narrative breakout, when a narrative like AI agents, RWAs, cat-themed memecoins, etc., starts trending and money rotates in.

CEX listings are important for liquidity and long-term adoption, but if your goal is 100x, you typically want to be early in the DEX phase, not late in the CEX phase.

How to Find a 100X Coin Before It Gets Listed on an Exchange: Step-by-Step Guide

If you want a realistic chance of catching a 100x coin early, you need a structured, repeatable process, this step-by-step guide shows you exactly how to filter narratives, chains, market caps, and on-chain signals before a token ever reaches a major exchange.

Step 1: Understand Niches, Narratives and Chain Rotations

Money doesn’t flow equally to everything. When a niche heats up, the easiest narratives for investors to understand usually pump the hardest.

What’s the Difference Between a Niche and a Narrative?

• A niche is a broad category like DeFi, RWAs, GameFi, AI, or memecoins.

• A narrative is a specific story inside that niche, like:

• Tokenized real estate within RWAs

• Decentralized savings accounts within DeFi

• AI trading agents within AI or DeFi (DeFAI)

• Cat-themed memecoins or political memecoins (PolitiFi) within memecoins

A simple test: “Would my non-crypto friend understand this in one sentence?”

If yes, the narrative has a shot. If you need a 30-minute whiteboard session, it’s probably too complex for mass speculation.

Follow the Logical “Sequels” of What’s Pumping Now

Narratives tend to move in logical sequels:

• Stablecoins get regulatory clarity, DeFi activity rises, and RWAs that trade against stablecoins start rallying.

• Ethereum DeFi heats up, capital later rotates to faster chains where similar products feel “cheaper” like Solana, Base, Layer-2s.

• Dog memecoins dominate one cycle, cat or food memes become the next “fresh” theme.

• AI infrastructure pumps first, then AI agents and AI+DeFi (DeFAI) become the next wave.

Your job: look at what’s already hot, then think about the next natural step that’s simple and investable.

Step 2: Start at the Right Chains and Launchpads

Not all blockchains are equal if you’re hunting early 100x candidates. You want chains that are:

• Fast and cheap, so micro-caps and memecoins can trade actively.

• Easy to access, with friendly wallets and low friction.

• Already full of users and capital.

As of 2025, that usually means:

• Solana – high throughput, sub-second finality, and fees typically around a fraction of a cent.

• Base – Coinbase’s

Ethereum L2, built for low-fee, high-throughput DeFi and retail flows.

• Sui / Aptos – newer high-performance chains attracting GameFi, DeFi, and RWA experiments.

• TON – deeply integrated with the Telegram wallet ecosystem (TON Space), giving near-instant access to hundreds of millions of users.

On these chains, many 100x memecoins and small-caps are born through launchpads and DEX listings rather than immediately on big exchanges.

Examples of where to look:

•

Memecoin launchpads and aggregators on Solana like

pump.fun, Moonshot and newer apps tracked by tools such as Axiom, a terminal that aggregates launches from multiple memecoin launchpads and lets you filter them via a “Pulse” page.

• Chain-specific launchpads for GameFi, RWAs, and DeFi tokens.

Start here, and not on the “Top 100” list on a CEX.

Step 3: Use Market Cap and FDV to Filter for Realistic 100x Upside

Market cap is where most people go wrong.

• Market cap = price × circulating supply

• FDV (fully diluted valuation) = price × total supply

For a realistic shot at 100x:

• Current market cap usually needs to be less than $100 million, ideally in the $5–$30 million range. If it already sits at $800 million, a 100x would imply an $80 billion cap, bigger than many blue-chip cryptos, which is extremely unlikely in this cycle.

• FDV should not be absurd relative to current cap. A $20 million cap with a $5 billion FDV means huge unlocked supply and likely heavy sell pressure as tokens vest.

Basic rules to follow when using market cap and FDV to find the next 100x altcoin opportunity:

• Prioritize low–mid caps in hot niches.

• Avoid tokens where upcoming unlocks will double or triple supply in months.

• Check whether insiders, team, and VCs hold a massive chunk with short vesting schedules.

This single filter will remove most impossible 100x dreams.

Step 4: Study Token Design and On-Chain Data and Not Just the Website

Once a project passes the narrative + chain + market-cap filter, dig into mechanics and on-chain reality.

Token Design: Where Does Real Demand Come From?

Ask the following questions:

• Why would anyone need this token beyond speculation?

• Are there real sinks like burns, fees, staking requirements, collateral that could create sustained demand?

• Does the token capture value from protocol revenue, or is it just a meme or governance token?

For pure memecoins, speculative demand and community are the main drivers. For utility tokens, you want at least one clear, recurring use case.

On-Chain Data: Who’s Actually Buying?

Use on-chain tools and dashboards to answer:

• Number of holders and growth over time.

• Holder distribution – are a few wallets holding 60–70% of supply?

• Liquidity depth – how much size can you buy/sell without massive slippage?

• Volume trend – is volume rising organically or spiking for a day then dying?

Platforms like Spectre AI help here. It’s an on-chain AI search engine that aggregates token data, technical indicators and social sentiment, including TradingView-style charts, Bitquery-powered on-chain feeds and AI-generated summaries of overbought or oversold conditions.

Combine that with:

• DexScreener, Birdeye, or GeckoTerminal to monitor DEX pairs and liquidity.

• Chain explorers like Solscan, Basescan, Tonviewer, etc., to inspect holders and contract code.

This is how you separate hype from genuine early adoption.

Step 5: Read the Social Layer Without Getting Farmed

100x coins are born in social feeds, not just in whitepapers. Important channels to monitor social sentiment include:

• X (Twitter) – primary source for narrative discovery, founder communication, and early “alpha.”

• Telegram / Discord – where real communities hang out, coordinate, and shill.

• Spaces / podcasts / YouTube – long-form conversations where founders and key ecosystem players leak more than they realize.

When evaluating whether a new token has real momentum, look for consistent, human engagement rather than a wall of airdrop bots, and check whether influential accounts within that chain’s ecosystem are following or mentioning the project. Prioritize teams that are actively shipping updates instead of relying solely on crypto-Twitter hype, and note whether the project appears in ecosystem reports, hackathon recaps, or posts by infrastructure providers, strong signs of legitimate traction. Tools like Spectre AI and Santiment for social-sentiment tracking and X trending feeds, along with memecoin terminals such as Axiom for real-time launchpad activity and trending tokens, can help you surface these signals much faster.

Pro Tip: Look at which small-caps key ecosystem builders like wallets, DEXs, infrastructure teams mention or follow. Those connections often precede big moves.

Step 6: Understand Price Cycles and Timing: New vs. “Sleeping” Coins

Memecoins and micro-caps often follow a similar pattern:

1. Launch and hyper-pump – chart goes vertical as insiders and CT rush in.

2. Brutal dump – insiders sell, early buyers take profit.

3. Dead-cat bounces – a few hopeful spikes.

4. Flatline – price trades sideways at very low caps.

5. Either dies (no activity) or wakes up when the narrative comes back.

You can play both new and old coins:

• New launches – best asymmetric upside if you get in very early and sell quickly, but risk is extreme and rugs are common.

• Sleeping older coins – sometimes even better asymmetry. If an old cat memecoin with an active community trades at a $1 million cap and its previous high implies 50–100x, a revived narrative can send it back there.

Check:

• Is social activity still alive?

• Are devs or community quietly building, or is everyone gone?

• Does the narrative match an emerging macro trend, e.g., AI agents, RWAs, cat memes?

Sometimes the “next 100x” is a revived 2024 coin that fits a 2025 narrative.

Step 7: Factor in the New Regulatory Reality for Memecoins

In early 2025, SEC staff in the U.S. issued guidance suggesting that most memecoins are not securities, comparing them more to speculative collectibles than to traditional investment contracts. This has two big implications:

• Launchpads and devs feel more comfortable launching memecoins at scale.

• The next memecoin season could be bigger, with far more coins competing for attention.

For you, that means:

• Even more noise.

• Even more emphasis on narratives, chain selection, and real liquidity instead of blind gambling.

What Are the Top Tools to Help You Find 100x Coins Early?

Here’s a compact toolkit you can mix and match:

1. BingX ChainSpot – an all-in-one discovery and analytics hub that surfaces newly launched tokens, early contract deployments, trending chains, and emerging ecosystems across multiple networks. ChainSpot helps you identify narrative rotation and early traction before tokens reach large centralized exchanges, making it ideal for spotting high-potential microcaps at the DEX-only stage.

2. Spectre AI – a powerful on-chain AI search engine combining Bitquery data, TradingView technical indicators, social sentiment, and AI-driven insights to help you evaluate whether a token looks undervalued, overbought, or showing momentum inflection points.

3. Axiom – a

Solana-based memecoin trading terminal that aggregates launches from multiple launchpads. Its Pulse dashboard lets you filter new tokens by launchpad, liquidity, or hype level, making it ideal for early memecoin discovery.

4. On-chain scanners like DexScreener, Birdeye, GeckoTerminal – essential for tracking new pool creations, early liquidity depth, price action, and whale activity.

5. Sector dashboards, e.g., RWA.xyz – crucial for spotting flows into narratives like RWAs,

tokenized stocks, on-chain treasuries, or

stablecoin growth, often the earliest signals of capital rotation.

6. Blockchain explorers like Solscan, Basescan, Tonviewer – for checking holders, contract safety, liquidity locks, and whale concentrations.

7. AI assistants like Grok, ChatGPT – useful for narrative mapping and idea generation; always verify outputs with on-chain data.

Use these to build a repeatable research loop, not to blindly follow signals.

How to Spot Potential 100x Altcoins Using BingX ChainSpot

BingX ChainSpot is designed to help you discover early-stage tokens, trending ecosystems, and emerging narratives before they reach major exchanges. It aggregates real-time on-chain data across multiple networks, showing new contract deployments, rising liquidity, unusual volume spikes, and narrative momentum, all signals that often appear before a token experiences its first major breakout. Because ChainSpot tracks chain-level flows and sector rotations, it gives you a clearer view of where early capital is moving and which projects are gaining traction while still in their DEX-only phase.

Although no tool can guarantee a 100x, ChainSpot helps you identify patterns that frequently precede strong upside, such as early liquidity formation, rapid wallet growth, or sudden increases in social attention. Use these insights as part of a broader research process that includes on-chain verification, community analysis, and strict risk management. Early discovery always carries higher volatility and higher downside risk.

How to Use BingX ChainSpot to Find Early Opportunities: Step-by-Step Guide

BingX ChainSpot gives you a structured way to research early-stage Solana tokens, track narrative momentum, and trade trending on-chain assets directly from your BingX account, without needing a DEX or external wallet. It simplifies discovery and execution, while still exposing you to early-phase opportunities where asymmetric returns are possible.

Step 1: Begin Your Research for Potential 100x Coins

Start by identifying early narratives, micro-caps, and emerging trends using ChainSpot’s discovery feed. This puts you in front of new Solana-based tokens before they reach major exchanges, where early price expansion typically occurs. Use ChainSpot to observe ecosystem flows, rising categories, and attention hotspots to narrow down high-potential candidates.

Step 2: Open BingX ChainSpot

Access ChainSpot from your BingX app or web dashboard. This brings you to a curated hub of early Solana tokens, real-time analytics, trending projects, and simplified on-chain trading backed by BingX infrastructure.

Step 3: Check Trending Narratives Within the Solana Ecosystem

Since ChainSpot currently supports only Solana, use it to track which sectors, memecoins, AI agents, RWAs,

liquid staking, gaming, or governance tools, are showing strong momentum. Look for sectors with increasing volume, new deployments, or rapid user attention, as these often produce outsized early-stage winners.

Step 4: Scan Newly Launched or Emerging Tokens

Use the New Tokens and Trending sections to filter fresh launches by liquidity, holder growth, trading volume, or narrative tags. Prioritize tokens gaining organic traction rather than those driven purely by hype or short-lived pumps.

Step 5: Review Key On-Chain Indicators

Evaluate liquidity depth, early trading volume, wallet distribution, contract transparency, and whether the contract is verified. Tokens with sustainable liquidity, healthy holder distribution, and clean contract metadata generally have a higher probability of long-term survival.

Step 6: Cross-Check Broader Signals Before Trading

Validate ChainSpot insights with external signals: DEX charts, community activity, social sentiment, and narrative strength across Solana. This helps distinguish genuine early traction from temporary inflows or manipulated activity.

Step 7: Trade Directly on ChainSpot Using Your BingX Balance

Once a token meets your criteria, you can buy it instantly using

USDT from your BingX Spot Account.

• No need for wallets, bridges, or DEX switching.

• Purchased assets are automatically transferred to your Spot Account.

• Sell orders follow the same simple workflow.

Step 8: Apply Proper Risk Controls

Even strong early signals come with significant volatility. Start small, set clear entry and exit plans, and monitor ChainSpot for changes in liquidity or narrative strength. Early-stage Solana tokens can move quickly, both up and down, so manage risk accordingly.

How BingX Fits In: What to Do When Your Coin Finally Lists

This guide focuses on finding coins before major exchange listings, but if your thesis is correct, the highest-conviction projects eventually make it to bigger platforms like BingX, where the liquidity, tools, and infrastructure give you far more control over your position.

Once a token you hold gets listed on BingX, you can:

1. Take profits into deeper liquidity on the BingX spot market instead of dumping into thin DEX pools that cause massive slippage.

• Hedge your early-stage gains, e.g., short the token while still holding your spot bag.

3. Rotate capital into more established assets like

BTC,

ETH,

SOL, or major RWA tokens, or move into stablecoins for capital preservation during high-volatility phases.

4. Monitor multi-exchange price discovery more efficiently, since BingX often becomes one of the reference venues for early liquidity.

And if your goal is to find the next 100x before everyone else, BingX ChainSpot becomes especially useful. It aggregates newly launched tokens, chain trends, and early-stage blockchain activity into a single dashboard, making it easier to track emerging ecosystems, identify new contract deployments, and spot narrative momentum before a coin gets listed on centralized exchanges.

For users who don’t prefer DEXs or launchpads, BingX also acts as the clean entry point when a project finally matures enough to be listed. That stage usually happens after the explosive early-phase growth, but it is still valuable for trend traders and momentum investors who want structured risk tools, transparency, and liquidity.

What Are the Key Risks of Hunting for 100x Coins?

You must treat this as high-risk speculation, not investing. The hunt for the next 100x altcoin comes with significant risks, including:

1. Rug pulls and exploits – devs can drain liquidity or mint more tokens via hidden functions.

2. Illiquidity – you might “paper 100x” on-screen but be unable to sell size.

3. Narrative rotation – trends die overnight; a new meta, e.g., another chain or niche, can drain liquidity.

4. Psychology – greed and fear will tempt you to hold too long or cut winners too early.

5. Regulatory and counterparty risks – particularly in DeFi, launchpads, and offshore DEX ecosystems.

Never risk money you can’t afford to lose. Diversify your high-risk bets, and keep the core of your portfolio in assets and strategies you understand deeply.

Final Thoughts: Can You Really Spot a 100x Coin Before the Crowd?

Spotting a 100x coin before it becomes widely known is possible, but never guaranteed. The best you can do is improve your odds by focusing on chains where early winners frequently emerge, following narratives that logically build on what the market is already rewarding, and applying strict filters around market cap, FDV, token design, liquidity, and on-chain activity. Paying attention to social signals, ecosystem involvement, and early developer or community traction can also help you identify projects gaining momentum before they appear on major exchanges.

Even with a solid process, this remains a high-risk strategy. Most early-stage tokens will not become long-term winners, which is why disciplined position sizing, diversification, and predefined exit plans are essential. Use frameworks like the one in this guide to stay structured and avoid emotional decision-making, but always conduct your own research and be prepared for the possibility of loss. The real advantage is not prediction, but maintaining consistency, patience, and risk awareness while the broader market chases hype.

Related Reading