As of February 2026,

Midnight (NIGHT) has transitioned into its Kūkolu phase, marking a stable safe port for production-ready decentralized applications (dApps). With a recent 9.25% price surge and a surging spot volume of $27.68 million in mid-February 2026, the

NIGHT token is emerging as a leader in the

privacy sector.

In this article, you will learn what Midnight network is, how its unique NIGHT/DUST economic model works, why its TypeScript-based Compact language is a game-changer for privacy-centric developers, and how to trade NIGHT tokens on BingX.

What Is Midnight (NIGHT) Blockchain and Rational Privacy?

Midnight is a fourth-generation blockchain designed to solve the transparency-privacy paradox using the concept of Rational Privacy. In the crypto industry, most blockchains are either fully transparent, where anyone can see your balance, or fully dark and hidden from everyone, including regulators. Midnight provides a middle ground: Privacy by default, with disclosure by choice.

Built as a partner chain to

Cardano, Midnight leverages Cardano’s security while offering a specialized environment for confidential smart contracts. It enables use cases that require strict data protection, such as healthcare records, private financial trades, and identity verification, without sacrificing the auditability required by global regulators.

Midnight Privacy Network Mainnet Launch in March 2026: Upcoming Roadmap

The Midnight Network follows a strategic, four-phase rollout inspired by the Hawaiian lunar cycle, transitioning from a foundational liquidity stage to a fully decentralized privacy ecosystem. As of February 2026, the network is in the high-stakes Kūkolu phase, which serves as a safe port for production-ready applications. Charles Hoskinson confirmed at Consensus Hong Kong 2026 that the official Mainnet Genesis is targeted for the last week of March 2026, backed by institutional node partners like Google Cloud and Blockdaemon.

Following the mainnet launch, the roadmap shifts toward decentralization and cross-chain scaling. The Mōhalu phase, expected in Q2–Q3 2026, will open the network to Cardano Stake Pool Operators (SPOs) and activate the DUST Capacity Exchange, a marketplace for managing the network's unique transaction resource. By late 2026, the Hua phase will finalize this evolution through

LayerZero integration, allowing Midnight to function as a universal privacy-as-a-service layer for other major blockchains like

Ethereum and

Solana.

How Does Midnight Network Work?

Midnight operates through a Dual-State Architecture that fundamentally changes how blockchain data is handled. Unlike traditional networks where every action is recorded on a public ledger, Midnight separates the Public State, used for consensus and governance, from the Private State, where sensitive personal or business data lives.

This hybrid model is powered by three core pillars that work together to deliver Rational Privacy in the Midnight ecosystem:

1. Selective Disclosure via Zero-Knowledge Proofs (ZKPs)

At the heart of Midnight is the ability to prove a statement is true without revealing the data behind it. Using recursive zk-SNARKs, Midnight allows for Selective Disclosure, acting like a digital need-to-know filter. When you interact with a dApp, the computation happens locally on your device or the Private State. Midnight then generates a mathematical

ZK proof confirming the transaction is valid. You can prove you are over 18 or have a sufficient bank balance without ever putting your birthdate or total net worth on the blockchain. You stay in the driver's seat, deciding exactly what claims to share with third parties while keeping your raw data off-chain.

2. Compliance-First Design for the Real World

While legacy privacy coins often bypass laws, Midnight is built to satisfy global regulations like GDPR and HIPAA. Its Rational Privacy model bridges the gap between the wild west of anonymous crypto and the regulated needs of traditional finance and healthcare. Businesses can automate compliance by providing auditors with cryptographic proofs of correctness instead of raw, sensitive databases. This allows institutions to utilize blockchain efficiency without risking the exposure of proprietary business intelligence or protected health information.

3. The Cardano Partner Chain Connection

Midnight is the first Partner Chain to Cardano, meaning it isn't an isolated silo. It leverages Cardano’s battle-tested security and Stake Pool Operator (SPO) network to secure its own ledger. Midnight acts as a specialized layer that any Cardano dApp can plug into when it needs a privacy feature. Using a native bridge, assets like NIGHT and confidential data can flow seamlessly between the two ecosystems. To make this possible, Midnight uses Compact, a smart contract language based on TypeScript. This allows millions of mainstream developers to build ZK-powered apps using familiar tools, removing the need for a Ph.D. in advanced cryptography.

What Is Midnight (NIGHT) Tokenomics: A Dual-Token Privacy Model

Midnight operates on a sophisticated dual-token system designed to solve the Privacy Trilemma, balancing privacy, programmability, and compliance. By separating governance and capital from the actual cost of network operations, Midnight provides a stable environment for both users and enterprises.

What Is the NIGHT Token Utility?

NIGHT is the unshielded native utility and governance token of the Midnight Network. It acts as the capital asset of the ecosystem, providing long-term value and network influence.

• Generates DUST: The primary utility of NIGHT is the continuous generation of the DUST resource required for transactions.

• Staking and Security: NIGHT is used to incentivize block producers or validators to secure the network.

• On-Chain Governance: Holders can vote on protocol upgrades, treasury disbursements, and ecosystem parameters via the Midnight DAO.

• Cross-Chain Asset: NIGHT exists as a native asset on both Cardano and Midnight, with a bridge ensuring a constant 1:1 supply parity.

• Public Transparency: Unlike privacy coins, NIGHT transactions are public and transparent, making the token compliance-friendly for exchanges and custodians.

What Is the DUST Token Used for?

DUST is the shielded, non-transferable operational resource of the Midnight Network. It is not a financial asset but a consumable fuel used to power the network's privacy features.

• Transaction Fuel: DUST is used to pay for transaction fees and the execution of smart contracts.

• Shielded Privacy: When you pay fees with DUST, your transaction metadata (like sender/receiver addresses) is protected, enabling rational privacy.

• Renewable Resource: DUST functions like a battery; it is consumed during use and regenerates automatically over time based on your NIGHT holdings.

• Non-Transferable: To remain regulatory compliant, DUST cannot be traded or sent between wallets; it can only be used by the wallet that generated it or delegated to a dApp.

• Self-Funding DApps: Developers can hold NIGHT to generate DUST, allowing them to sponsor transaction fees so their users can interact with dApps for free.

NIGHT vs. DUST: The Relationship Between Midnight's Native Tokens

The relationship between NIGHT and DUST is a Generator-Resource model. While NIGHT represents your stake and ownership in the network or the engine, DUST is the energy produced or the electricity to run your applications. This separation ensures that users never have to spend their governance power or capital just to perform a transaction. It decouples the price volatility of the NIGHT token from the operational cost of using the network, providing businesses with predictable expenses.

What Is NIGHT Tokenomics and Supply

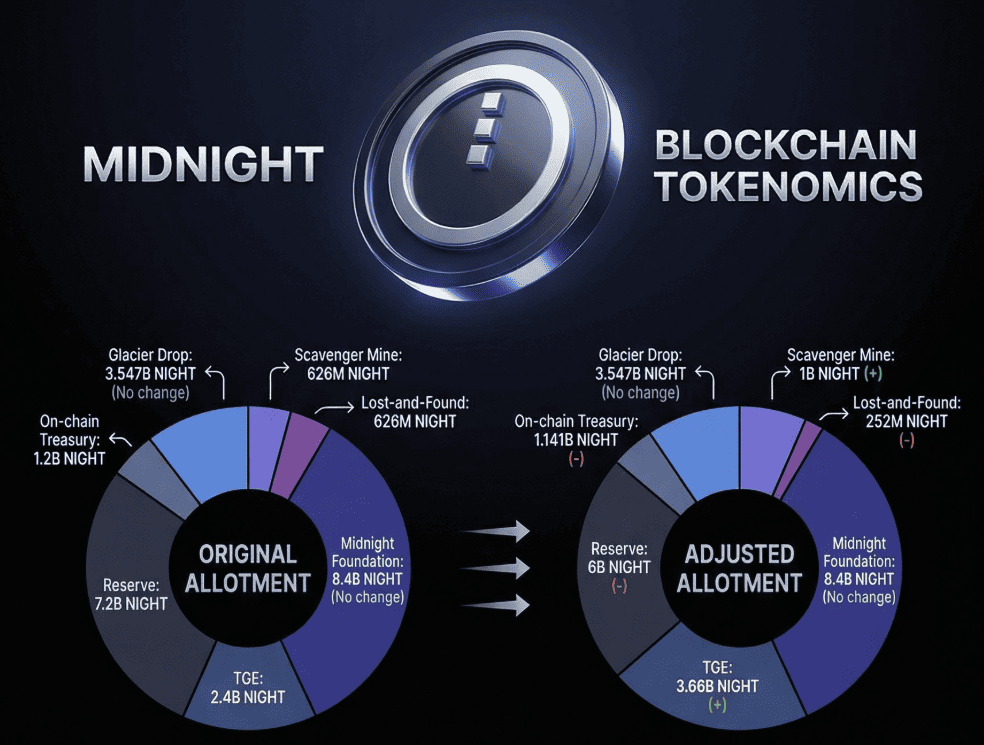

Midnight (NIGHT) tokenomics | Source: X

The Midnight Network features a fixed maximum supply of 24,000,000,000 or 24 Billion NIGHT tokens to ensure long-term scarcity and value preservation for its community.

• Cardano Community (50%): 12 billion tokens allocated to ADA holders via the Glacier Drop and Scavenger Mine to bootstrap the partner chain.

• Multi-Chain Distribution (20%): 4.8 billion tokens distributed to

Bitcoin (BTC) holders to encourage cross-chain privacy adoption.

• Ecosystem and Strategic Partners (30%): The remaining 7.2 billion tokens are split between holders of

ETH,

SOL,

XRP, and other major chains, as well as the Midnight Treasury for future development.

• Thawing Schedule: To ensure market stability, claimed tokens are subject to a 360-day thawing period, where 25% of the allocation is released every 90 days.

How to Trade Midnight (NIGHT) on BingX

Gain exposure to the privacy narrative by trading NIGHT with BingX’s AI-powered market tools.

Long or Short NIGHT Perps with Leverage on Futures

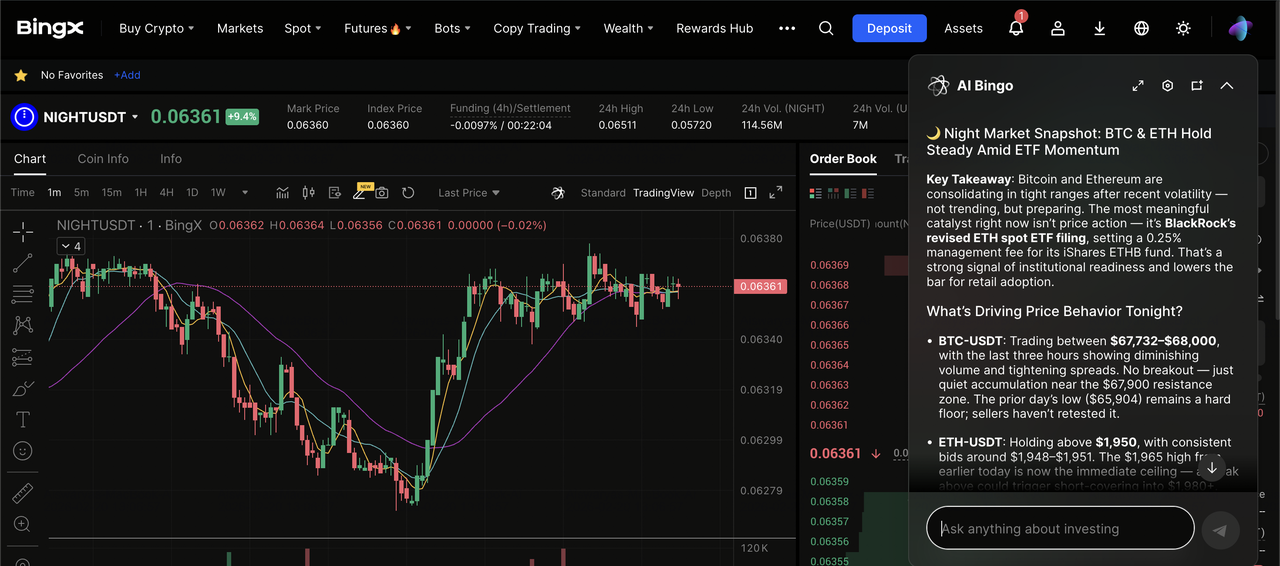

NIGHT/USDT perpetual contract on the futures market powered by BingX AI insights

For experienced traders, BingX offers NIGHT Perpetual Contracts, allowing you to go long or short on Midnight’s volatility with up to 20x leverage.

1. Transfer

USDT funds to your Futures wallet.

3. Choose margin mode (Isolated or Cross) and set leverage.

4. Go Long if you expect price to rise, or Short if you expect it to fall.

7. Place the trade and monitor PnL, margin, and funding fees.

Reminder: Use leverage carefully, always

manage risk with stop-loss orders.

3 Key Considerations Before Investing in Midnight

Before investing in Midnight, it’s important to understand the key factors that can impact its adoption, token value, and long-term sustainability within the Web3 privacy landscape.

1. The Token Thawing Supply Overhang

Midnight’s Glacier Drop distributed 4.5 billion NIGHT to over 8 million addresses, but these tokens are subject to a 360-day thawing period. Every 90 days, 25% of this allocation is released, with major unlock windows in late March and June 2026. This scheduled influx of supply could create persistent sell pressure, potentially capping price gains despite positive network news.

2. Mainnet Execution and Initial Centralization

Midnight is currently in its Kūkolu phase, launching as a Federated Mainnet in late March 2026. During this stage, the network is secured by institutional partners like Google Cloud and Blockdaemon rather than independent community nodes. Investors should monitor the transition to the Mōhalu phase later in 2026, as any delays in decentralizing to Cardano Stake Pool Operators (SPOs) may impact long-term trust.

3. The Selective Disclosure Regulatory Gamble

Unlike anonymous privacy coins, Midnight’s Rational Privacy model allows users to provide ZK-proofs of compliance to regulators without exposing raw data. Success depends on global regulators, like those enforcing MiCA in 2027, accepting this middle ground as a valid compliance tool. If authorities take a hardline stance against all forms of on-chain encryption, Midnight’s primary use case for enterprise and institutional finance could face significant adoption hurdles.

Final Thoughts: Is Midnight (NIGHT) a Good Buy in 2026?

Midnight (NIGHT) presents a neutral-to-bullish outlook for 2026, functioning as a sophisticated infrastructure bet on the programmable privacy narrative. By lowering the barrier for millions of TypeScript developers and offering a battery model that stabilizes operational costs, Midnight effectively addresses the two primary obstacles to institutional blockchain adoption: technical complexity and gas price volatility. If the network successfully transitions to its decentralized Mōhalu phase and attracts significant third-party dApp volume, NIGHT could cement its position as a cornerstone privacy layer for the broader Web3 ecosystem.

However, investors must maintain a balanced perspective regarding the significant market headwinds. The upcoming quarterly token thawing events through December 2026 will introduce billions of tokens into circulation, potentially creating persistent sell pressure that could cap price rallies despite positive technical milestones. Furthermore, while Midnight’s compliance-first Rational Privacy is designed to be regulatory-friendly, the evolving global legal landscape for privacy-preserving technology remains a critical variable.

Risk Reminder: Cryptocurrency investments, especially in early-stage projects like Midnight, carry extreme volatility. The NIGHT token is subject to technical execution risks, competition from established privacy protocols, and potential supply-side dilution from scheduled unlocks. Always conduct thorough research and never invest more than you can afford to lose.

Related Reading