Liquidation in futures trading happens when your position is automatically closed because your margin can no longer cover losses. It’s a built-in safety mechanism used by exchanges to prevent traders from ending up with a negative account balance, especially in leveraged crypto markets.

This is one of the biggest risks in

crypto futures trading. With leverage, price doesn’t need to fall to zero for you to lose a position. A relatively small move in the wrong direction can push your margin below the required level and trigger liquidation while the asset is still actively trading.

Understanding how liquidation works doesn’t remove risk or guarantee profits. What it does is give you control. When you understand margin, key prices, and risk thresholds, you can manage downside proactively instead of reacting after the position is already gone.

What Is Liquidation in Crypto Futures Trading?

Liquidation is an automatic process where an exchange forcefully closes a trader’s position once the margin balance is no longer sufficient to support it. It’s not a penalty. It exists to limit losses and protect the trading system during volatile market conditions.

Liquidation occurs when adverse price movements cause unrealized losses to reduce margin below the

maintenance margin level. On BingX, this is reflected by the Risk indicator. When Risk reaches or exceeds 100%, the system takes control and closes the position using the trader’s collateral.

The key difference between a losing position and a liquidated one is control. A losing position is still active and manageable. A liquidated position is closed by the system, leaving no opportunity to adjust or exit manually.

Your deposited collateral is used to cover losses and liquidation fees. If the position closes above the bankruptcy price, any remaining margin is handled by the system. If it closes below that level, the

insurance fund absorbs the shortfall to prevent negative balances.

For example, you deposit 1,000 USDT and open a

BTC perpetual long position using 10× leverage, giving you control over a 10,000 USDT position. If

Bitcoin moves roughly 8–10% against your trade, losses quickly eat into your margin. Once the Risk level reaches 100%, the position is liquidated automatically to prevent losses from exceeding your deposit.

Key Prices You Must Understand Before Trading Crypto Futures

Managing margin starts with understanding which price the system actually uses. Many traders assume

liquidation is triggered by the chart price. That’s one of the most common and costly mistakes.

• Entry Price: The price at which your position is opened. If you add to a trade, this becomes your average entry price.

• Last Price: The most recent traded price shown on the chart. It’s used when you manually close a position but does not trigger liquidation.

• Mark Price: The price used to calculate risk and liquidation. It reflects the contract’s estimated fair value.

The mark price is derived from the index price, which aggregates spot prices from multiple major exchanges. This protects traders from liquidations caused by brief spikes, thin liquidity, or temporary wicks on a single platform. Simply put, charts show the last price, but liquidation is based on the mark price.

Initial Margin vs. Maintenance Margin

Initial margin is what allows you to open a leveraged position. Think of it as a down payment. For example, opening a 10,000 USDT position with 10× leverage requires 1,000 USDT as initial margin.

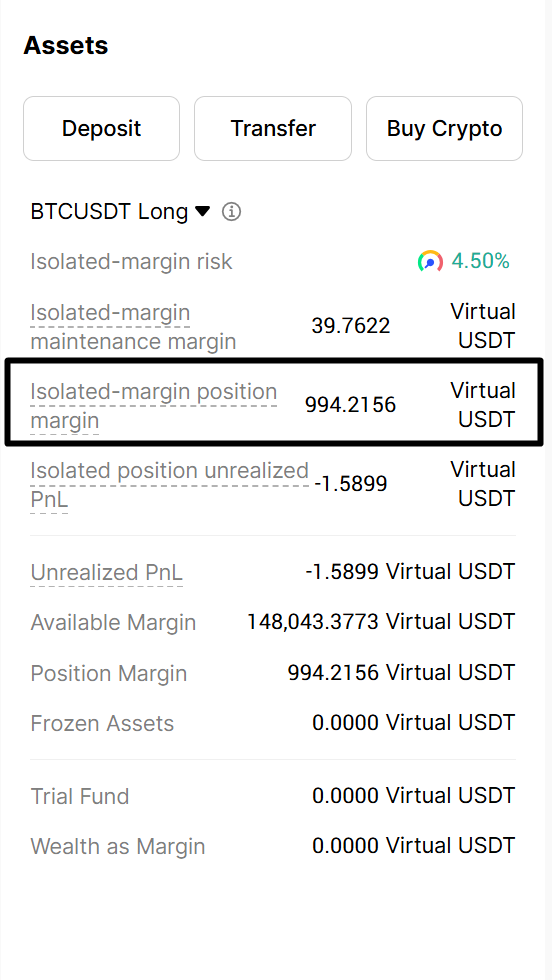

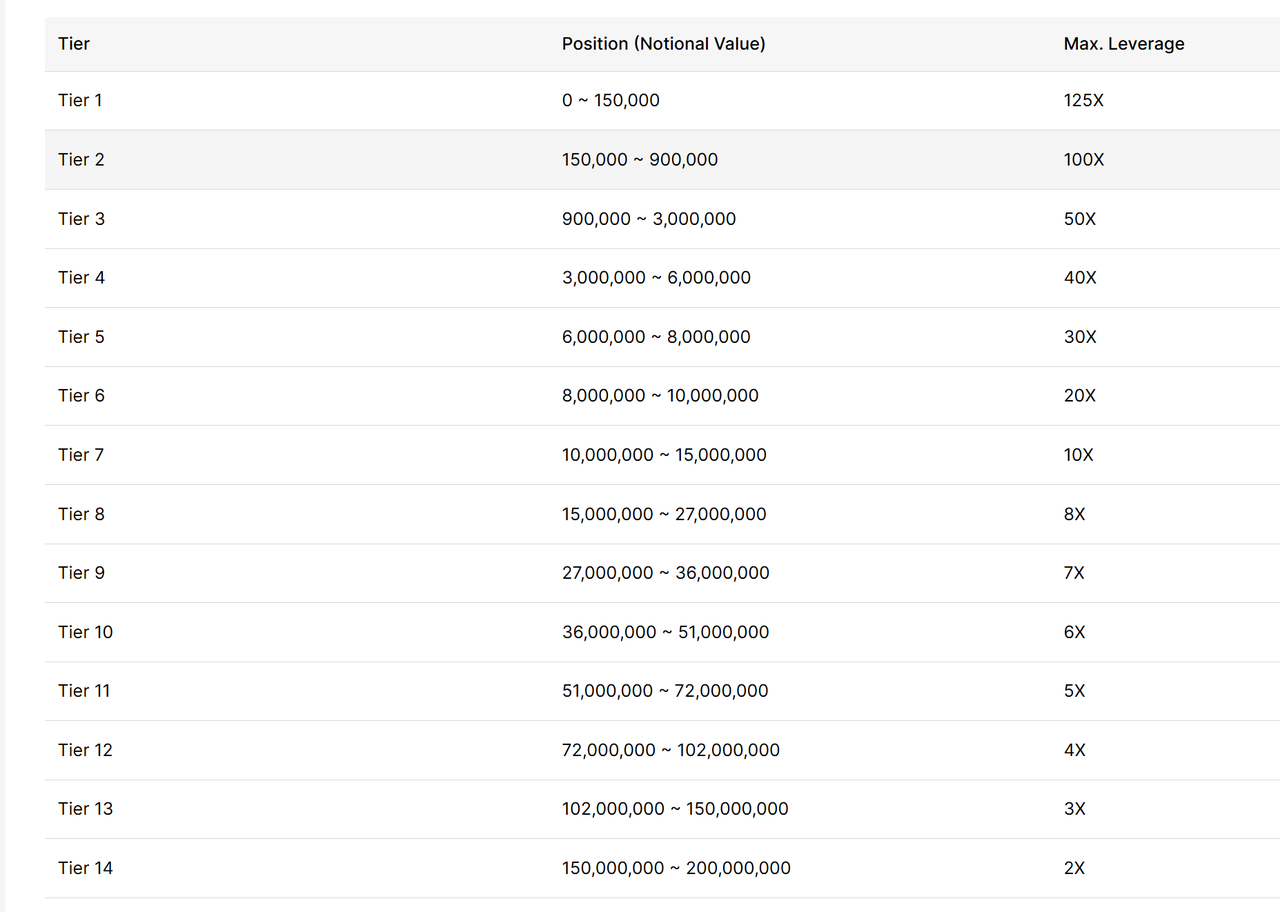

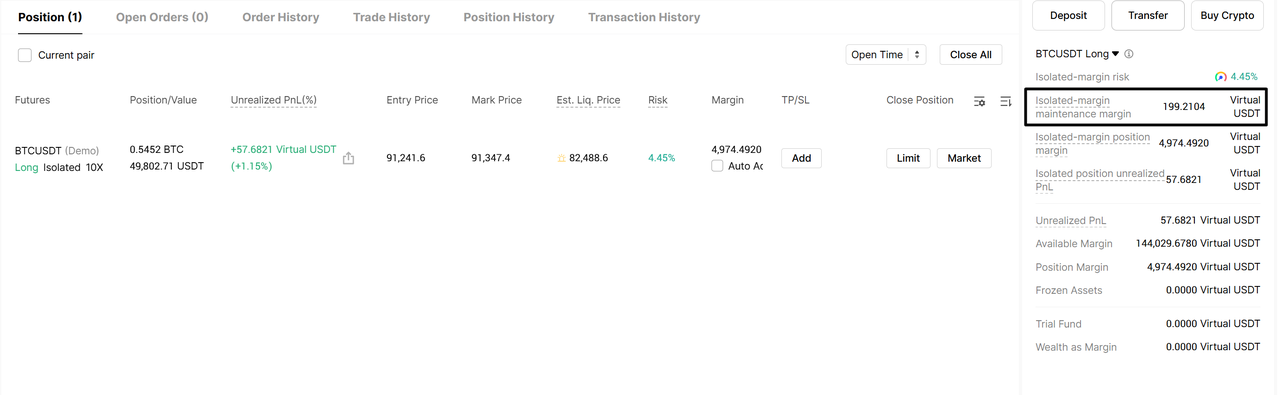

Source: BingX

As shown in the table above, BingX uses a tier-based margin system. Smaller positions allow higher leverage, while larger positions are restricted to lower leverage. As you move up tiers, both initial margin and maintenance margin increase, reducing the chance that large trades destabilize the market.

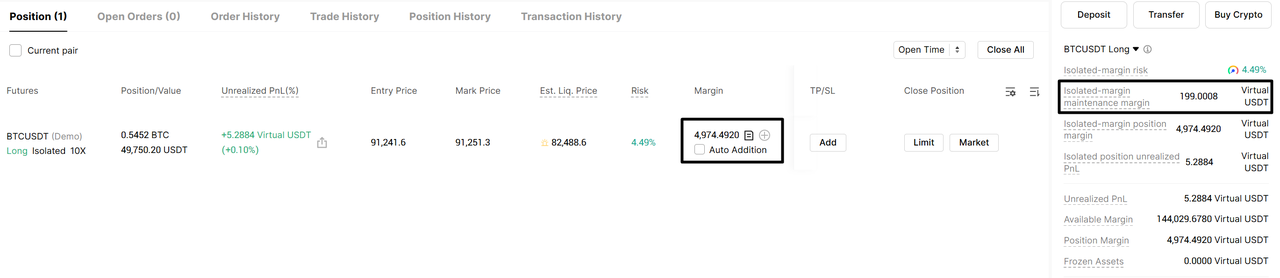

Source: BingX

Maintenance margin is the minimum balance required to keep a position open. It is always lower than the initial margin and acts as a safety floor. Larger positions typically require higher maintenance margin rates due to increased risk

Liquidation occurs when losses reduce your remaining margin below this floor. On BingX, this happens when the Risk indicator reaches 100%.

For example, if you open a position with 1,000 USDT and the maintenance margin requirement is 40 USDT, liquidation occurs once losses reach 960 USDT. At that point, the system closes the position to prevent further losses.

What Is Liquidation Price in the Futures Market?

The liquidation price is the level at which your position is automatically closed because your margin can no longer meet the maintenance requirement. On BingX, this corresponds to the Risk indicator reaching 100%.

This is different from the bankruptcy price, which is the theoretical point where your margin balance reaches zero. It represents the absolute limit of your deposited collateral and the final boundary of the position.

In rare cases of extreme volatility, a position may close at a price worse than the bankruptcy price. When this happens, the insurance fund covers the shortfall to prevent negative balances and maintain market stability.

How to Calculate Liquidation Price When Trading Crypto Futures

Most exchanges, including BingX, display your liquidation price automatically. Still, understanding the logic behind it helps you manage risk more effectively.

Liquidation depends on four key factors: entry price, position size, margin balance, and maintenance margin. Instead of memorizing formulas, think in terms of usable loss.

Start with your total margin balance. Subtract the maintenance margin. The remaining amount is the maximum loss your position can sustain. Divide that figure by your position size to estimate how far price can move against you.

• For a long position, subtract this amount from your entry price

• For a short position, add it to your entry price

Source: BingX

If you open a 1 BTC long position with 5,000 USDT margin and a 200 USDT maintenance margin, your usable loss is 4,800 USDT. For a USDT-margined contract, this means the BTC price can fall by roughly 4,800 USDT before liquidation, assuming a 1 BTC position. Adding margin increases this buffer and pushes the liquidation price further away.

Isolated Margin vs. Cross Margin: Liquidation Risk

The margin mode you choose determines how much of your capital is exposed if a trade goes wrong.

Isolated Margin

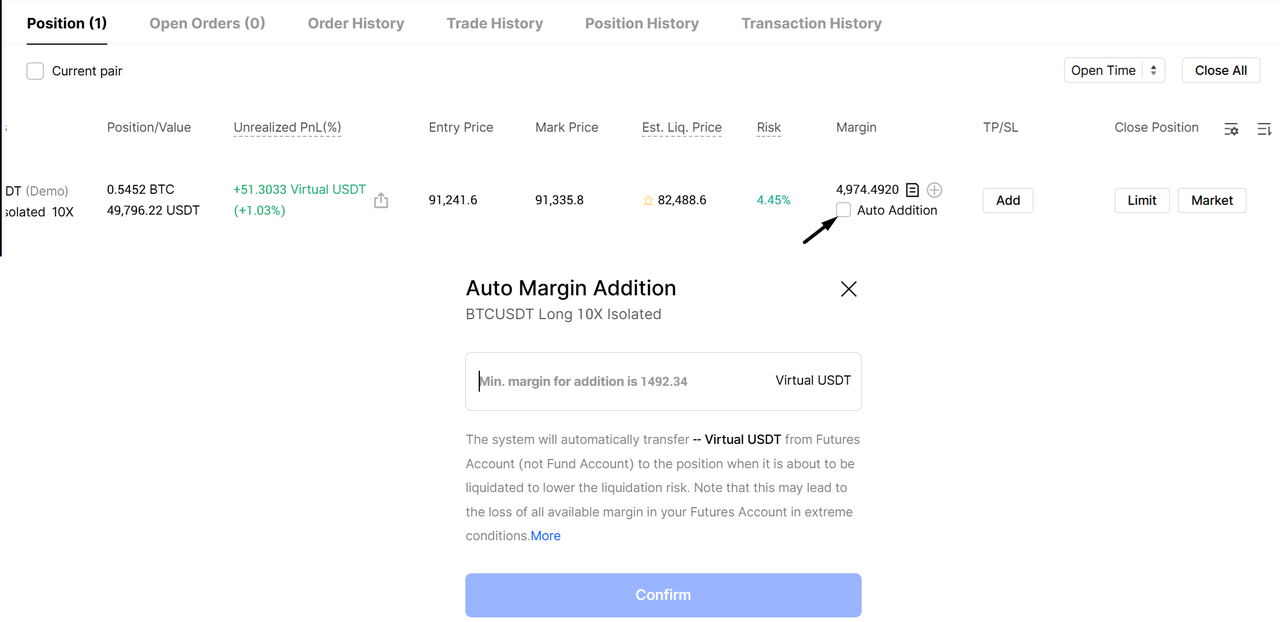

With

isolated margin, only the funds assigned to a single position are at risk. The screenshot above shows a BTCUSDT long using isolated margin, where the position has its own margin, risk level, and liquidation price. For example: You open a BTC long with 5,000 USDT in isolated margin. If the trade moves against you and Risk reaches 100%, only that 5,000 USDT position is liquidated. Your remaining wallet balance stays untouched.

Source: BingX

What the chart should show:

• Entry price at the top

• Liquidation price below

• A shaded “isolated margin buffer” zone

• Wallet balance shown outside the risk area

This creates a firewall around each trade.

Cross Margin

With

cross margin, your entire futures wallet is shared across positions. Profitable trades can support losing ones, but the downside is larger.

Source: BingX

You open the same BTC long, but now your wallet holds 20,000 USDT total. If trade keeps losing, the system pulls a margin from the full wallet to keep it alive. If losses continue, the entire wallet can be drained before liquidation occurs.

What the chart should show:

• Entry price

• Liquidation price much farther away

• A large shared margin zone connected to the wallet

• A warning label: “All funds at risk”

How Does Liquidation Work in Trading Futures?

When Risk reaches 100%, the system freezes the position and takes control. The exchange attempts to close the trade near the bankruptcy price using market orders, and standard taker fees apply.

If the position closes at a better price, any surplus is handled by the system. If it closes worse, the insurance fund absorbs the difference.

In extreme cases where the insurance fund is insufficient, auto-deleveraging (ADL) may reduce exposure by closing positions from profitable traders to maintain system stability.

What Are the Common Liquidation Mistakes Futures Traders Make?

Most liquidations don’t happen because traders get the direction wrong. They happen because risk isn’t managed properly. Here are the most common mistakes that lead to forced liquidation:

• Using excessive leverage: High leverage magnifies small price moves. Even normal market volatility can push a position into liquidation when there’s little margin buffer.

• Ignoring the maintenance margin: Many traders focus only on entry price and stop-loss levels, forgetting that liquidation is triggered by margin requirements, not by price targets.

• Confusing mark price with last price: Liquidation is based on the mark price, not the chart price. Relying only on the last traded price can create a false sense of safety.

• Waiting too long to act: Traders often delay adding margin or reducing position size until risk is already near 100%, leaving the system no choice but to liquidate.

• Overestimating trade conviction: Adding margin to a weak setup instead of reassessing the trade can increase losses rather than prevent them.

Avoiding these mistakes doesn’t require better predictions. It requires disciplined position sizing, early decision-making, and respect for margin mechanics.

How to Avoid Liquidation and Manage Risk in Crypto Futures

Liquidation isn’t about being wrong on direction. It happens when leverage and poor risk control leave no margin for error. The goal is to structure trades so one move cannot wipe out your account, even in volatile conditions.

• Keep leverage low (2×–5×): Lower leverage increases the distance between your entry and liquidation price. This gives your trade room to survive normal price swings, funding rate noise, and temporary wicks.

• Risk only 1–2% of your account per trade: Size positions so the maximum loss, including slippage, is a small fraction of your total balance. This keeps a single liquidation from causing long-term damage.

• Place stop-losses well before liquidation: A

stop-loss should exit the trade before margin pressure builds. Liquidation should never be your exit strategy.

• Use isolated margin by default: Isolated margin caps losses to one position. Even if a trade fails completely, the rest of your futures balance stays protected.

• Be cautious when adding margin: Adding margin increases survival time, not trade quality. Only add margin if the original setup is still valid and risk remains controlled. Otherwise, closing early preserves capital.

In crypto futures, survival comes first. Traders who last long enough are the ones who eventually win.

Conclusion

Liquidation isn’t bad luck. It follows clear rules based on margin, risk levels, and key prices. Traders who understand entry price, mark price, and maintenance margin avoid most surprises. Before opening your next futures trade, check your liquidation price, size your position carefully, and manage risk first.

Related Articles

FAQs on Liquidation Price in Crypto Futures Trading

1. What triggers liquidation in futures trading?

Liquidation is triggered when your margin balance falls below the maintenance margin level. On BingX, this happens when the position’s Risk indicator reaches 100%, and the system automatically closes the trade to prevent further losses.

2. Is liquidation based on mark price or last price?

Liquidation is based on the mark price, not the last price shown on the chart. The mark price reflects the asset’s fair value and helps prevent liquidations caused by short-term price spikes or low liquidity.

3. Can I lose more than my initial margin?

In most cases, no. Exchanges use insurance funds to cover losses if a position closes worse than the bankruptcy price, preventing negative account balances under normal market conditions.

4. Does adding margin stop liquidation?

Adding margin increases your usable loss buffer and moves the liquidation price further away. However, it only makes sense if your trade idea is still valid. Adding margin to a weak setup can increase losses.

5. Is isolated margin safer than cross margin when trading crypto futures?

For most beginners, yes. Isolated margin limits risk to a single position, while cross margin shares your entire wallet balance, meaning one bad trade can affect all open positions.