Immunefi is the largest bug bounty and security coordination platform in Web3, protecting more than 650 protocols and more than $180 billion in onchain value across multiple blockchains. Its network of over 60,000 security researchers has helped prevent an estimated $25 billion in hack-related losses, making Immunefi a critical line of defense for leading DeFi, infrastructure, and Layer-1 projects.

Beyond bug bounties and audit competitions, Immunefi operates a unified security operations stack that brings bounties, audits, managed triage, real-time monitoring, and automated defensive tooling into a single command center. This shift from one-off audits to continuous security operations allows protocols to detect, triage, and respond to threats faster, before vulnerabilities turn into catastrophic exploits.

IMU is Immunefi’s native token. It’s designed to align incentives across security researchers, protocol teams, and the broader community, so more high-quality vulnerability signals flow into Immunefi’s security system, and security improves as usage grows.

What Is Immunefi (IMU)?

IMU is the utility and governance token that powers the Immunefi security ecosystem, designed around the principle that Web3 security must be continuous, incentive-driven, and operational, not limited to one-time audits. Immunefi coordinates bug bounty programs, Safe Harbor disclosures, audit competitions, managed triage, and monitoring workflows used by 650+ protocols across major blockchains, collectively protecting more than $180 billion in onchain value. Its marketplace connects these protocols with a global community of 60,000+ security researchers, enabling responsible disclosure before vulnerabilities are exploited.

At a practical level, Immunefi helps protocols pay ethical hackers to find critical bugs before attackers do, often calibrating rewards to the value at risk. Founded in 2020, Immunefi quickly filled a gap left by point-in-time audits by scaling crowdsourced security for DeFi. From early bug bounty programs, it expanded into audit competitions like competitive, time-boxed reviews and, by 2025, introduced a unified security operations stack that integrates bounties, audits, monitoring, and automated defenses. The launch of IMU in January 2026 formalized this coordination model, using tokenized incentives and governance to align researchers, protocols, and contributors as onchain value scales.

Immunefi was founded by Mitchell Amador, who serves as CEO, alongside a globally distributed leadership team spanning security research, engineering, and operations. The team’s background in Web3 security and ecosystem coordination underpins Immunefi’s focus on trust, rapid response, and outcome-driven defense.

How Does Immunefi Work and What Is IMU's Role in the ImmuneFi Ecosystem?

Immunefi works like a security marketplace + operations hub:

1. Protocols define what to protect: A project sets scope (contracts, apps, networks) and the rules for responsible disclosure through a bug bounty or competition.

2. Researchers hunt for vulnerabilities: Security researchers submit findings through Immunefi under defined rules, often supported by structured triage and coordinated disclosure flows (including Safe Harbor frameworks).

3. Security becomes operational, not episodic: Beyond bounties, Immunefi positions its platform (often referred to as a unified security operations stack) as an “all-in-one” workflow, pulling together bounties, audits/competitions, monitoring, and defensive controls so teams don’t stitch together point solutions.

4. IMU aligns incentives inside this loop: IMU’s role is to coordinate incentives, rewarding contributions, potentially gating advanced features, and enabling governance decisions that steer how the ecosystem evolves. The goal is a self-reinforcing cycle: more participation leads to better security signals, resulting in better defense, and more protocols adopting the stack.

What Is IMU Token Used For?

IMU is positioned as a utility + governance token (not a guaranteed revenue-sharing asset). In practice, its main uses are typically described as:

• Governance: voting and proposals around ecosystem direction and security standards.

• Incentives for security work: rewarding researchers and contributors who generate useful security signals and outcomes.

• Access alignment: supporting adoption of Immunefi’s broader security operations platform by aligning protocol participation and researcher engagement.

IMU Tokenomics Overview

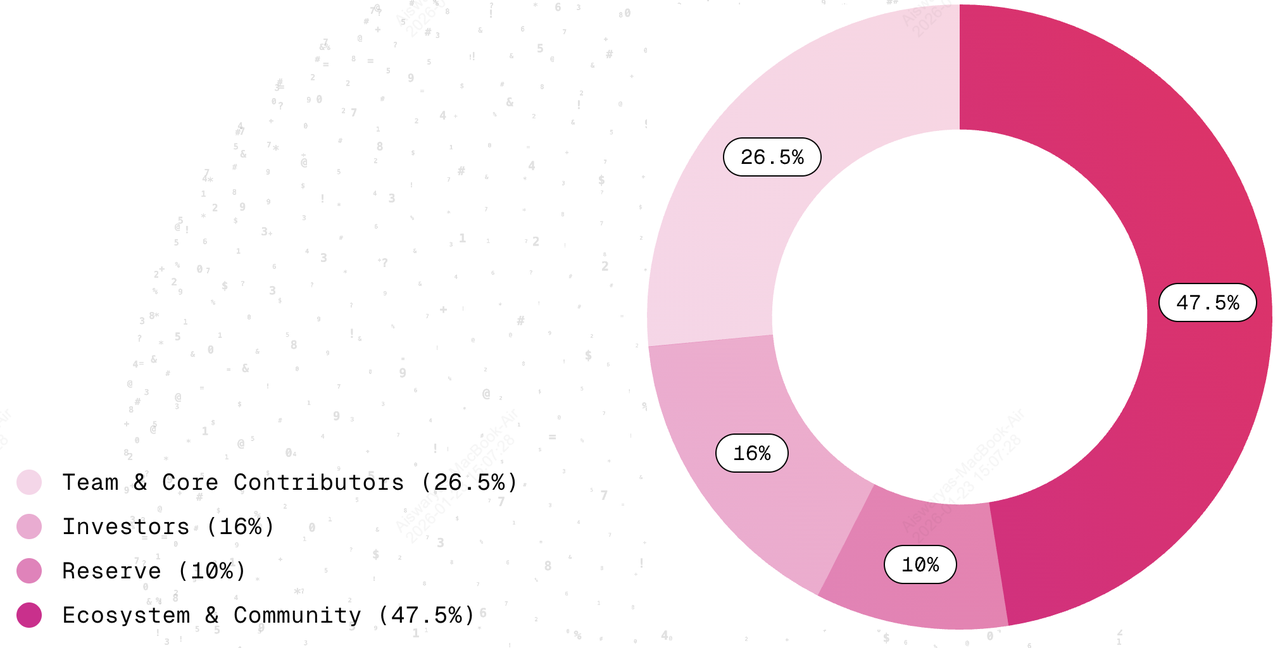

IMU token distribution | Source: Immunefi Foundation

IMU has a fixed total supply of 10,000,000,000 tokens.

IMU Token Allocation

• Ecosystem & Community — 47.5%

• Team & Core Contributors — 26.5%

• Early Supporters / Investors — 16%

• Reserve — 10%

Note: Release/vesting schedules vary by allocation bucket and are typically staged over time; always verify circulating supply and unlock timelines from official sources before making trading decisions.

How to Trade Immunefi (IMU) Token on BingX

You can trade the Immunefi token easily using BingX’s spot and derivatives markets, supported by BingX AI tools that help traders analyze trends, manage risk, and optimize execution.

Buy or Sell IMU on Spot

IMU/USDT trading pair on the spot market powered by BingX AI insights

1. Log in to BingX, complete your

KYC, and deposit or

buy USDT.

3. Choose

Market for instant or Limit at your target price.

4. Enter the amount and confirm the order.

Trade IMU With Leverage on the Futures Market

IMU/USDT perpetuals on the futures market powered by BingX AI

1. Transfer USDT to your Futures wallet.

3. Set leverage carefully and place Long or Short.

Risk reminder: leveraged trading amplifies both gains and losses. Only use leverage if you fully understand

liquidation mechanics.

What Makes Immunefi (IMU) Different From Other Bug Bounty Programs in Web3?

What sets Immunefi apart from most Web3 bug bounty programs is its focus on continuous, protocol-level security coordination rather than one-off vulnerability payouts. Instead of acting as a simple listing board for bounties, Immunefi operates as an end-to-end security operations layer, combining structured bug bounties, audit competitions, Safe Harbor disclosures, managed triage, and real-time monitoring in a single workflow. This allows protocols to move faster from discovery to mitigation, while giving researchers clear rules, legal protection, and access to higher-value rewards that scale with the funds at risk.

The IMU token deepens this differentiation by turning security into an incentive-aligned system rather than a transactional service. IMU is used to reward high-quality security contributions, support governance over bounty standards and platform evolution, and align long-term participation from both protocols and researchers. As more value flows through Immunefi-protected contracts, IMU helps reinforce a feedback loop where better incentives attract better security signals, making Immunefi not just a bug bounty platform, but a scalable security coordination protocol for Web3.

Top 3 Key Considerations Before Trading IMU

Before trading IMU, it’s important to understand how security tokens behave differently from typical DeFi or L1 assets, and what practical factors can influence price action beyond market sentiment.

• IMU Token's Utility and Adoption Risk: IMU’s value depends on real usage within the Immunefi ecosystem, such as governance participation, researcher incentives, and protocol adoption of its security stack. If these mechanisms see low engagement or slow rollout, token demand may lag despite Immunefi’s strong brand in Web3 security.

• Immunefi's Reputation and Event Risk: Security platforms are highly trust-sensitive. A high-profile exploit, dispute, or delayed response involving an Immunefi-protected protocol can negatively affect market perception of IMU, even if the incident is outside the platform’s direct control.

• IMU Supply and Unlock Dynamics: IMU has a fixed supply but multiple allocation buckets with scheduled unlocks. Team, investor, and ecosystem releases can introduce periodic selling pressure, making it essential to monitor circulating supply, vesting timelines, and unlock events alongside price trends when planning entries or exits.

Final Thoughts: Should You Buy Immunefi (IMU)?

IMU is a Web3 security token built around a simple thesis: as onchain value grows, security must scale faster, and incentives should make that happen automatically. Immunefi already sits at the intersection of protocols and whitehats via bounties and competitions, and IMU is designed to formalize that coordination into a tokenized incentive loop.

Still, IMU is not a “guaranteed value” asset. Your edge comes from understanding the mechanism, security incentives, adoption, and unlock dynamics, then sizing risk appropriately in volatile markets.

Related Reading