Echelon Protocol has emerged as the core lending and money market layer for Move-based blockchains, boasting over $450 million in peak TVL (total value locked) and facilitating over $3 million in cumulative protocol revenue. By providing a secure, capital-efficient infrastructure for over-collateralized loans, Echelon bridges the gap between idle liquidity and scalable yield across

Aptos,

Initia, and Movement.

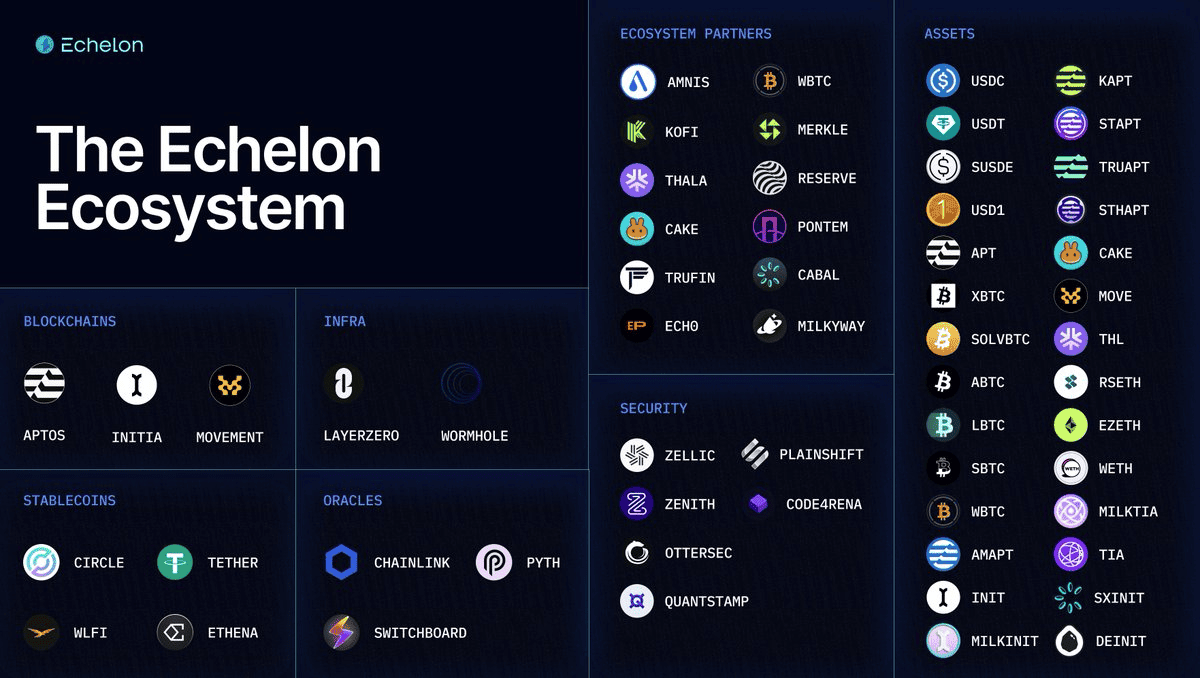

Echelon ecosystem | Source: X

In this article, you will learn what Echelon Protocol is, how its isolated lending pairs and interest rate mechanics work, the utility of the ELON token, and how Echelon is decentralizing the future of Move-based DeFi.

What Is Echelon Protocol (ELON) Lending Market?

Echelon Protocol is a

non-custodial lending protocol built on the Move language, specifically engineered for high-performance ecosystems like Aptos, Movement, and Initia. It currently manages significant liquidity, having reached a peak TVL of over $450 million and generating $3 million in cumulative revenue. The protocol focuses on providing permissionless access to leverage through a capital-efficient infrastructure that optimizes yield for both lenders and borrowers.

The system utilizes an isolated lending market structure to eliminate systemic contagion; each asset pair functions independently, ensuring that volatility in one "long-tail" asset does not jeopardize the broader protocol's solvency. To maximize capital efficiency, Echelon features an "E-Mode" (Efficiency Mode) that permits Loan-to-Value (LTV) ratios as high as 93% for correlated assets like stablecoins. Interest rates are determined by a dynamic Time-Weighted Variable Rate model, which utilizes a sharp "kink" in the utilization curve to maintain 24/7 liquidity for withdrawals.

Backed by a $3.5 million seed round led by Amber Group, Echelon is transitioning to a decentralized model via the ELON governance token, launching February 2, 2026. The token features a fixed supply of 100 million, with 8.5% dedicated to a community airdrop for early users and strategic partners. This decentralization milestone enables ELON holders to govern risk parameters and direct protocol emissions across the Move ecosystem.

How Does Echelon Protocol Work?

Echelon is a decentralized lending protocol that replaces traditional, human-managed credit systems with smart-contract-controlled lending pools. When you deposit assets, the protocol automatically handles interest, borrowing limits, and liquidations using Move’s built-in safety features, so there’s no bank, credit score, or manual approval involved. Everything runs on code: you supply assets to earn yield, or lock collateral to borrow another asset, and the rules are enforced transparently on-chain.

Practically, Echelon keeps risk contained by using isolated lending pairs, meaning each borrow market stands on its own. You deposit one token as collateral and borrow a specific token in return, with interest rates that adjust automatically based on supply and demand - low when liquidity is plentiful, higher when borrowing demand spikes.

To stay safe, you must keep your loan below a set loan-to-value (LTV) limit; if your collateral value drops too much, liquidators can step in and repay the debt for a small discount. Any rare losses are shared only within that specific pool, not across the entire platform, helping protect everyday users from broader protocol-wide risk.

What Are the Top 3 Features of Echelon Market?

Echelon offers advanced DeFi primitives designed for both retail users and institutional-grade yield seekers.

1. xLPT Staked LP Tokens: Echelon natively integrates with Thala Labs’ xLPT assets. This allows users to supply their staked liquidity provider tokens to Echelon. By doing so, users earn "layered" yield: Thala incentives, Echelon supply APY, and incentive rewards. To protect against oracle manipulation, Echelon uses a specialized pricing equation that "downscales" assets to their most conservative value.

2. Asset Specific E-Mode: Efficiency Mode (E-Mode) allows users to maximize their borrowing power when collateral and borrowed assets are highly correlated, e.g.,

stablecoin to stablecoin. For example, while standard

USDC LTV might be 80%, E-Mode can boost this to 93%, allowing for high-leverage looping strategies.

3. Multi-Chain Deployment: Echelon is not limited to a single chain. Its deployment across Aptos, Initia, and Movement ensures that Move-ecosystem liquidity is interconnected, allowing the protocol to act as the primary money market for the next generation of high-throughput blockchains.

What Is the ELON Token Used for?

The ELON token, scheduled to launch on February 2, 2026, is the governance backbone of the protocol. It represents a move toward decentralized ownership.

• Governance Participation: ELON holders can vote on protocol upgrades, asset listings, and risk parameters via the Echelon DAO.

• Directing Emissions: ELON is used to direct protocol emissions and incentives across various lending markets, determining which pools receive the highest rewards.

• Airdrop Distribution: 8.5% of the 100M supply was allocated to the community, including Echelon point holders, veTHL holders, and sENA stakers.

What Is Echelon (ELON) Tokenomics?

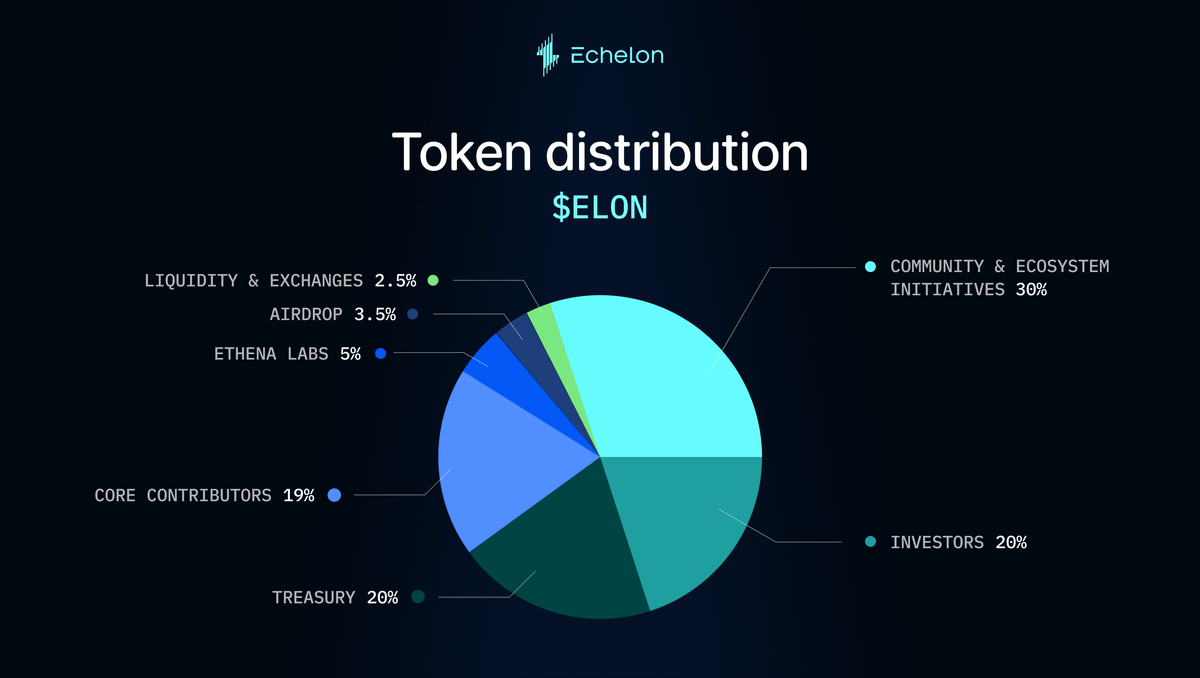

Source: Echelon on X

The ELON token is designed with a fixed maximum supply of 100,000,000 tokens to ensure long-term scarcity and sustainable governance as the protocol decentralizes.

ELON Token Allocation

The total supply is allocated across the following ecosystem stakeholders:

• Community and Ecosystem (30%): Dedicated to long-term growth and rewards, distributed over a 4-year vesting period.

• Investors (20%): Subject to a 1-year cliff followed by a 2-year linear vesting schedule.

• Treasury (20%): 5% is available at launch (TGE) for strategic needs, with the remaining 15% vesting over 4 years.

• Core Contributors (19%): Reserved for the development team with a 1-year cliff and 2-year vesting period.

• Airdrop (8.5%): Allocated to early Echelon points holders, veTHL holders, and sENA stakers.

• Liquidity and Exchanges (2.5%): Fully unlocked at TGE to provide immediate market liquidity.

ELON Token Emissions and Vesting Schedule

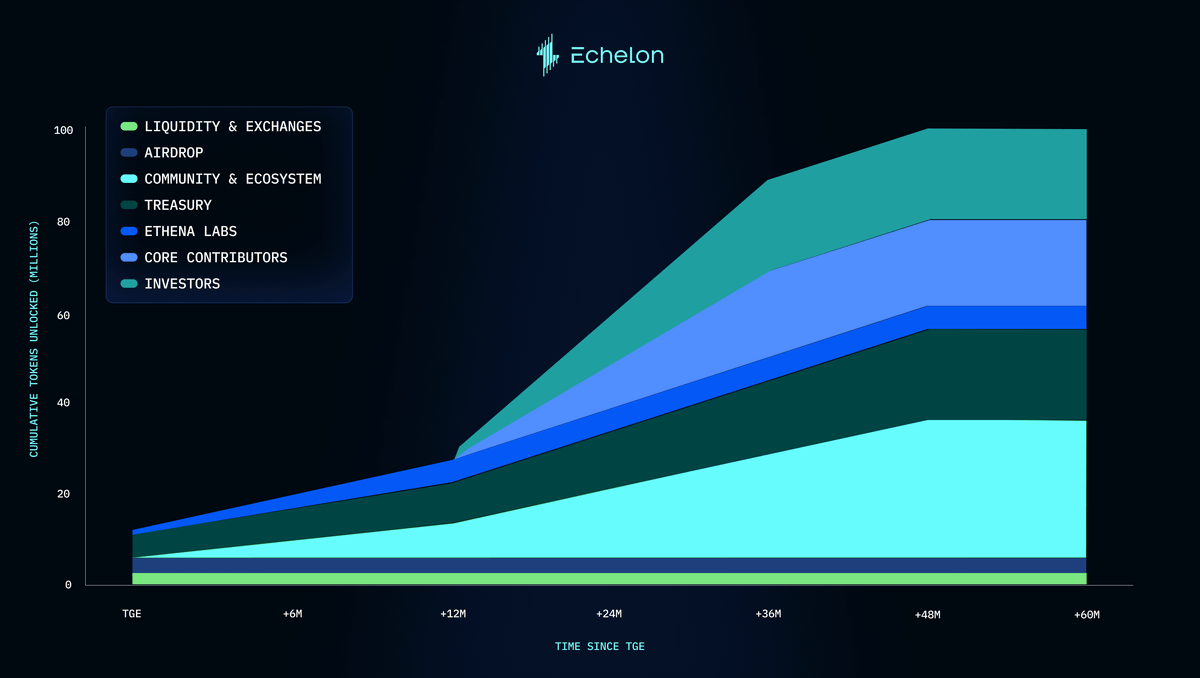

$ELON vesting schedule | Source: X

The ELON emissions schedule is strategically designed to balance immediate community liquidity with the long-term stability and development of the protocol. By utilizing a combination of immediate unlocks and multi-year vesting periods, Echelon ensures that the interests of early adopters, investors, and core developers remain aligned over time.

The specific vesting and unlock structures are as follows:

• Airdrops: 4.5% is unlocked immediately at the Token Generation Event (TGE) to reward early participants.

• Liquidity and Exchanges: 2.5% is fully unlocked at TGE to facilitate stable market trading.

• Treasury: 5% is available at TGE for strategic operations, with the remaining balance vesting over 4 years.

• Community & Ecosystem: Subject to a 4-year vesting schedule to support ongoing growth.

• Investors: Features a 1-year cliff followed by a 2-year linear vesting period.

• Core Contributors: Features a 1-year cliff followed by a 2-year linear vesting period.

How to Claim Your Echelon Protocol (ELON) Airdrop

Claiming your ELON tokens is a straightforward process handled through the protocol’s official governance portal. Because Echelon operates on the Move ecosystem, you will need a compatible wallet (such as Petra, Pontem, or Nightly) and a small amount of APT to cover network gas fees.

1. Connect Your Wallet: Visit the official Echelon Protocol dApp and link the Move wallet you used to interact with the platform or hold qualifying assets like veTHL or sENA.

2. Verify Eligibility: Navigate to the "Airdrop" tab. The interface will automatically scan your address for Echelon Points, veTHL holdings, or sENA staking status to show your total allocation.

3. Complete the Claim:

• veTHL Holders: Can claim their 100% unlocked allocation immediately.

• Points Holders: You must execute an on-chain contribution in APT, based on a $40 million protocol valuation to unlock your tokens.

4. Confirm and Receive: Approve the transaction in your wallet. Once confirmed, the ELON tokens will appear in your balance, allowing you to stake them for governance or transfer them to an exchange that will list ELON for trading.

For a detailed walkthrough of the contribution math and specific snapshot requirements, check out our comprehensive guide on

claiming the Echelon airdrop.

How to Trade Echelon Protocol (ELON) on BingX

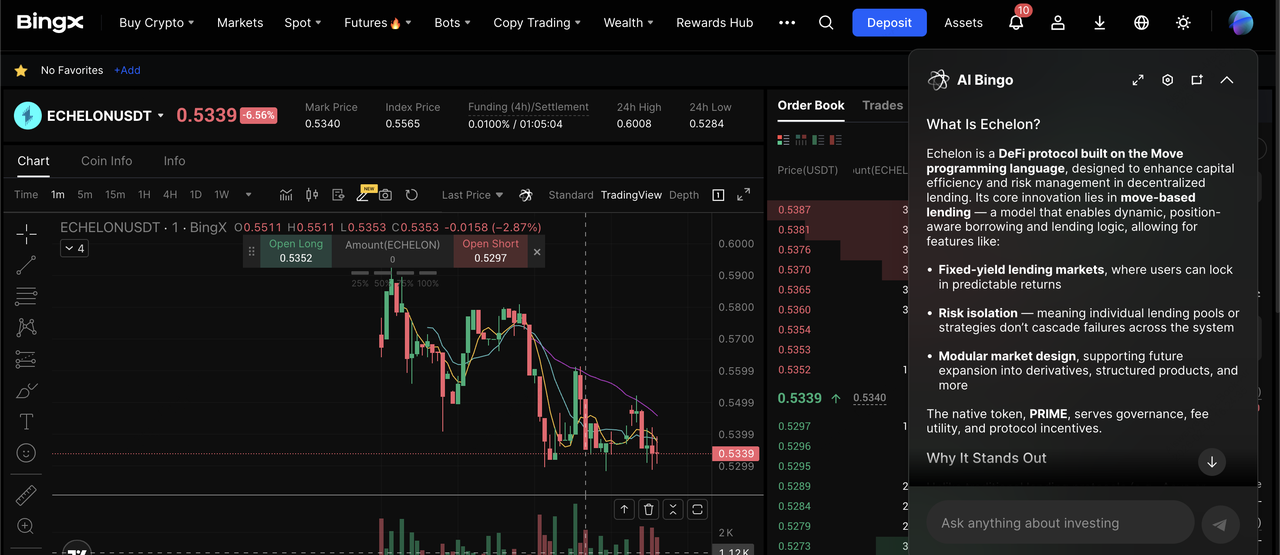

Echelon (ELON) perpetual contract on the futures market powered by BingX AI

Powered by

BingX AI insights, you can trade ELON/USDT perpetual contract on the futures market more efficiently using real-time market analytics and trend signals.

Long or Short ELON with Leverage on the Futures Market

3. Manage Risk: Use BingX AI tools for trend analysis and set stop-loss/take-profit orders to manage the volatility typical of new governance tokens.

3 Key Considerations Before Investing in Echelon (ELON)

Before committing capital to the ELON token or the Echelon lending markets, it is essential to evaluate the specific risk factors that define this decentralized Move-based ecosystem.

1. Ecosystem Dependency: As a core layer for Move, ELON’s success is closely tied to the adoption of the Aptos, Movement, and Initia blockchains.

2. Liquidation Risk: Users of the lending platform must monitor their health factors closely; Echelon’s high-efficiency models mean liquidations can trigger quickly during market volatility.

3. Governance Token Volatility: ELON is a governance asset, not a stablecoin or a direct claim on protocol deposits. Its price is driven by market demand and protocol growth.

Final Thoughts: Should You Use Echelon in 2026?

Echelon Protocol serves as a foundational "Universal Lending Market" within the Move ecosystem. Through its strategic integrations with partners like Ethena, Circle, and Thala, it provides the technical infrastructure required for capital-efficient lending and borrowing. For users exploring the Aptos, Initia, or Movement networks, Echelon offers a modular environment designed to facilitate on-chain liquidity and yield generation.

As the protocol transitions toward decentralized governance via the ELON token, its role in the Move ecosystem's growth remains a key focal point for participants looking for non-custodial financial services.