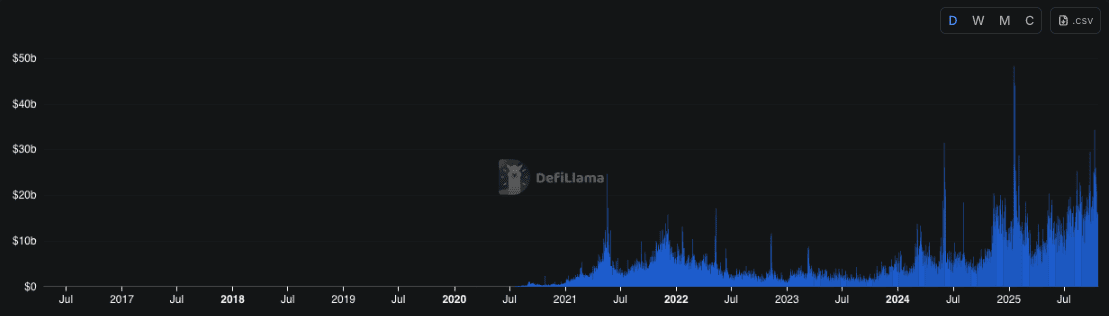

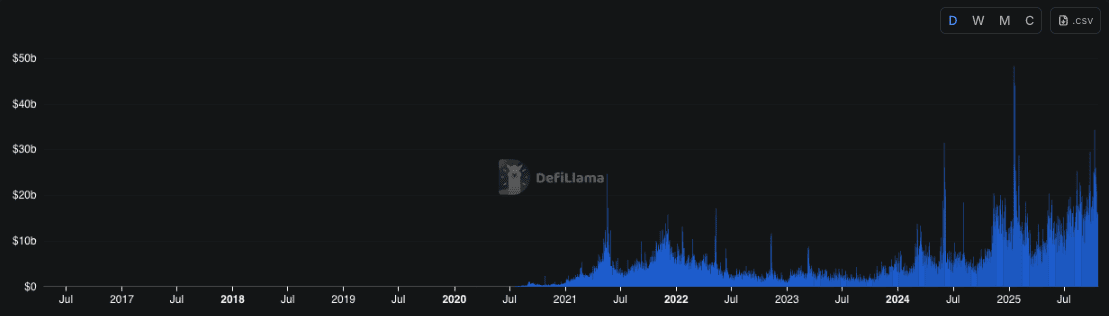

With a daily volume around $16 billion as of 21 October 2025,

Decentralized Exchanges (DEX) are moving fast. Blink and a new pair is already pumping or rugging.

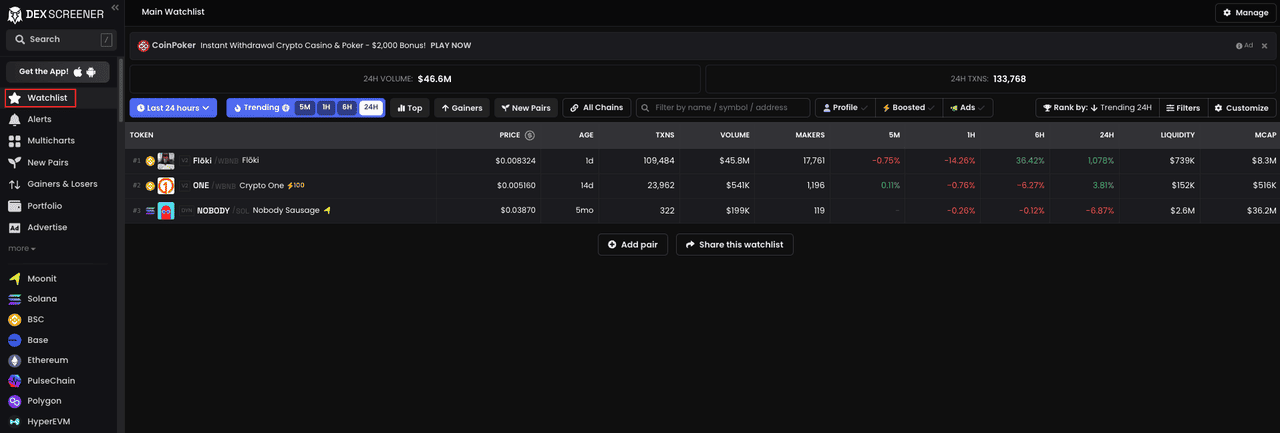

DEX Screener cuts through the noise by pulling live on-chain data from major DEXs and laying it out in clean

TradingView charts you can actually trade from. Scan trends, spot fresh listings, build watchlists, set alerts, then route orders when it is time to act.

Whether you chase early memecoin momentum or track long-tail altcoins, this guide shows what DEX Screener is, how it works, the features that matter, and the smart way to use it without getting burned.

What Is DEX Screener and How Does it Work?

DEX Screener is a free analytics platform for decentralized exchanges that aggregates real-time on-chain data from many DEXs across dozens of blockchains and displays it in clean TradingView charts. You can track token prices, liquidity, market cap, trading volume, and live trade feeds without creating an account, and the same toolkit is available on iOS and Android.

Because it focuses on on-chain pairs, it is ideal for long-tail

altcoins and new tokens that have not reached centralized exchanges. Build watchlists, set alerts, and even route trades by connecting a self-custody wallet, giving you one consistent workspace for discovery, analysis, and execution across networks.

Under the hood, DEX Screener runs a custom indexer that parses raw blockchain logs directly from supported networks, rather than relying on external APIs. That design delivers fast updates and consistent tracking for the same pair across chains. Coverage spans

Ethereum,

Solana,

BNB Chain, Arbitrum, Avalanche, Polygon, and more, with activity from Uniswap, PancakeSwap, SushiSwap, Raydium, Trader Joe, Balancer, KyberSwap, and others. Tron and several Tron-native DEXs are not included. Charts support multiple timeframes, chart types, and indicators like

moving averages or

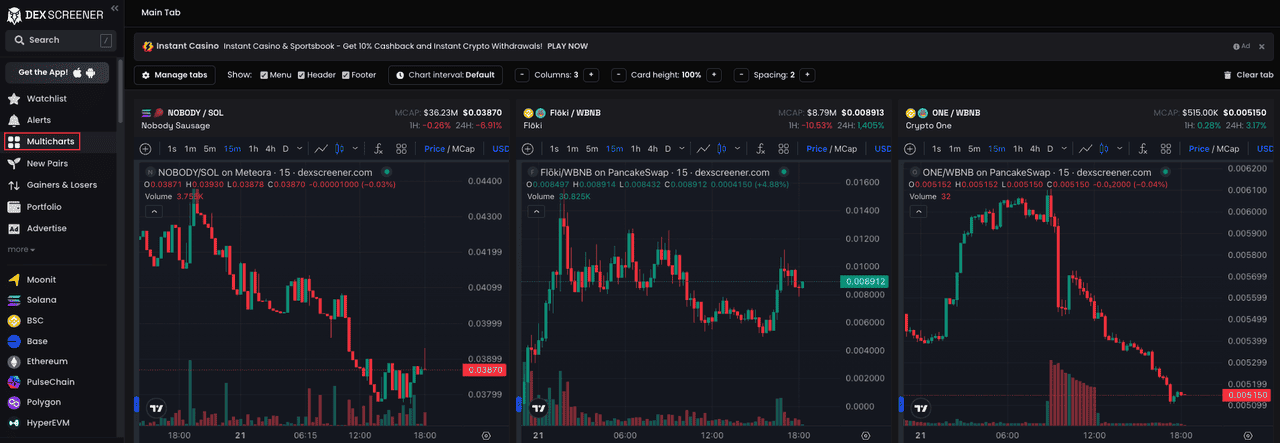

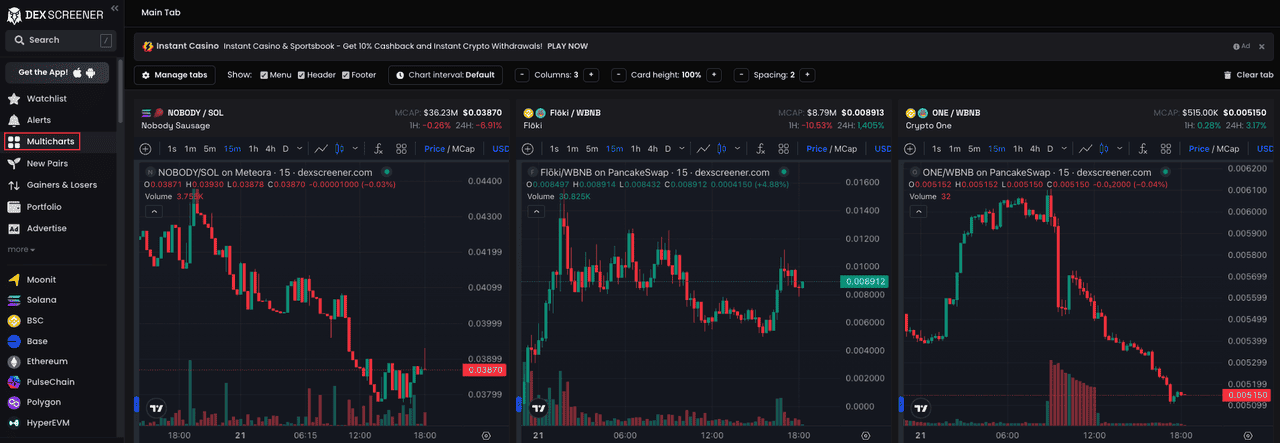

RSI, and a Multicharts layout lets you pin up to 16 synchronized charts side by side.

Key Features of DEX Screener

DEX Screener puts the right signals in one place. You get early visibility on new pairs, hard on-chain data, and filters that weed out illiquid traps.

That is especially useful for

memecoins, where listings land on DEXs first, moves are sudden, and small orders can swing price. With real-time feeds, a New Pairs stream, and strict filters for volume and liquidity, you cut noise, spot real momentum, and validate a setup in seconds without hopping between tools.

These are the main features on the platform:

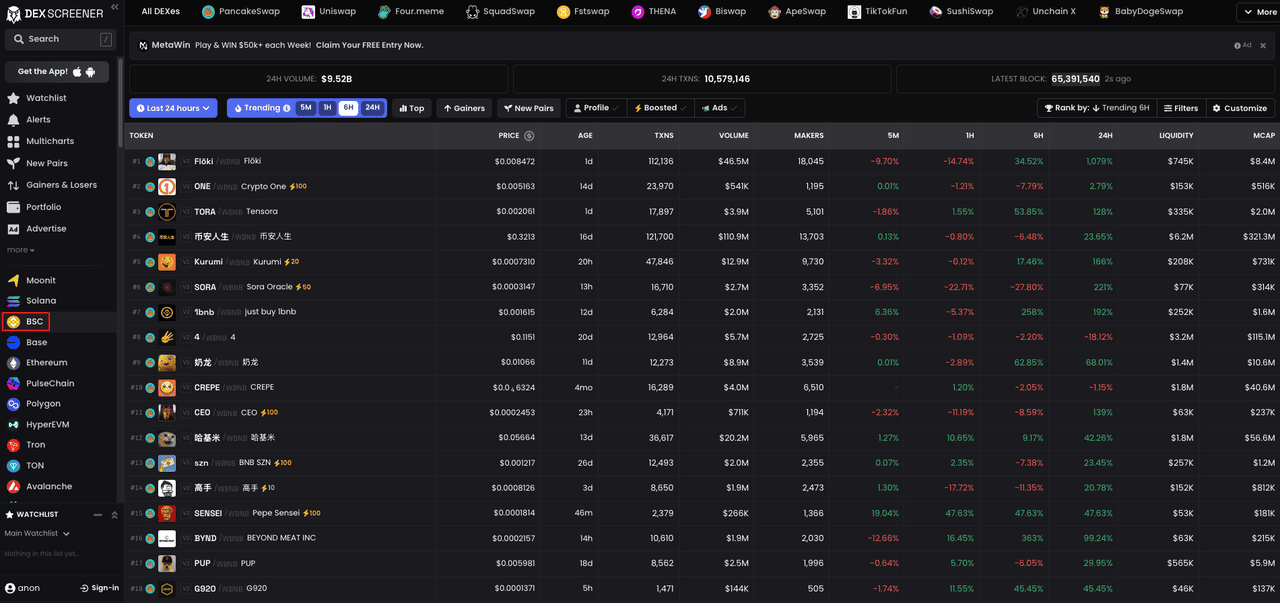

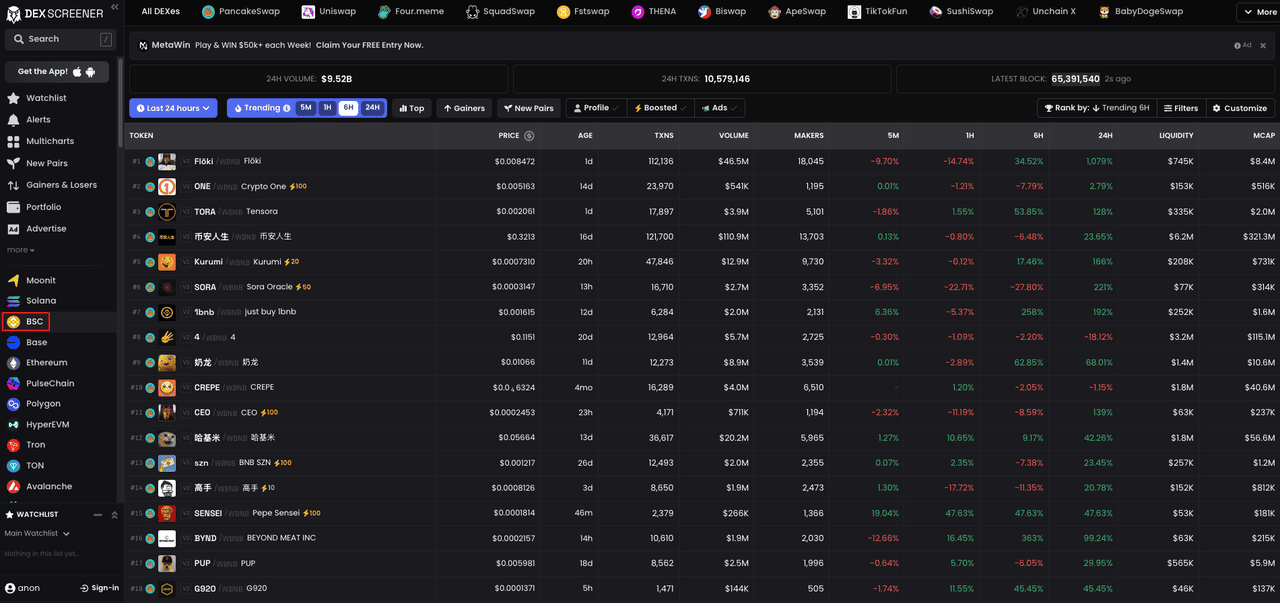

• Trends: A dedicated Trends page surfaces pairs that are moving now. Filter by trend type (price change, volume increase, new listings), pick a timeframe (from 5 minutes to 24 hours), and scope your search to a specific blockchain. It’s a fast way to scan heat across the market.

• New Pairs: This feed lists freshly created

trading pairs as they appear on supported DEXs. Alongside price, you’ll see listing time, liquidity, early volume, and percentage moves. If you hunt for first entries or track incubating communities, this stream is essential.

• Gainers & Losers: A sortable leaderboard of the best and worst performers across all chains or a single network. Use the built-in filters to add constraints like liquidity, FDV, or minimum volume to avoid illiquid outliers.

• Interactive Charts: Every pair page includes a full TradingView chart plus key fundamentals on the right rail: liquidity, market cap and FDV, recent trades, top holders, and links to official resources. Indicators, drawings, and multiple timeframes are all available.

• Multicharts: Build a custom mosaic of up to 16 live charts. Each pane can track a different pair or timeframe, which is handy for monitoring related markets or staging a playbook for entries and exits.

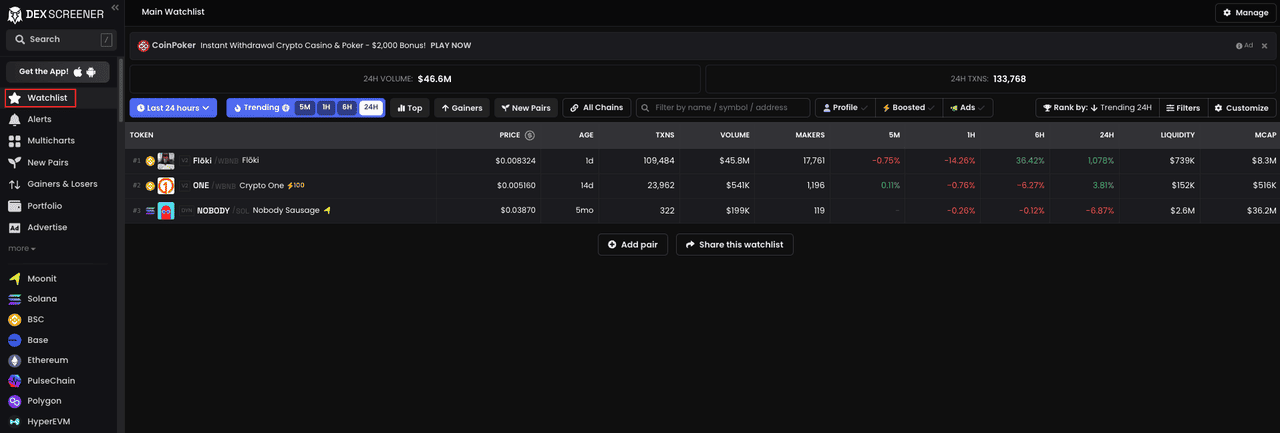

• Watchlists: Save pairs to a main list or create unlimited custom lists organized by theme, chain, or strategy. Watchlists sync across devices when you sign in.

• Alerts: Set an alert for a target price or percentage move and let the platform ping you via browser notifications. Alerts attach to specific pairs, so you can monitor multiple setups passively.

• Trading from the interface: When a pair is tradable on a supported DEX, you’ll see a button such as “Trade on

Raydium.” Connect your wallet, set size and slippage, and route the order without leaving your analysis screen.

How to Use DEX Screener

1. Open the platform and choose a chain.

Head to the

official website or app and select the blockchain you care about (for example, BNB Chain). The homepage highlights active pairs if you want to jump straight to what’s moving.

2. Drill into a pair page.

Click any pair to open its chart. You’ll see price action front and center; to the right, scan liquidity, market cap/FDV, 24-hour volume, live trade prints, top holders, contract links, and social profiles.

3. Build watchlists and alerts.

Add promising pairs to a watchlist and set alerts for your trigger levels. Choose either an absolute price or a percentage move. Enable browser or mobile notifications so you don’t need to babysit charts.

4. Track portfolios and top wallets.

Paste a wallet address into the portfolio view to see token balances and pair exposure without connecting your

wallet. On some pairs, you can inspect “Top Traders” and holder distribution to understand who is moving the market.

5. Customize your workspace.

Save a Multicharts layout for your core markets, keep a separate watchlist for each chain, and use the mobile app to mirror alerts and lists across devices.

Key Considerations When Using DEX Screener

On-chain data is usually solid, but busy or new networks can lag, so for large or time-sensitive trades confirm the contract and liquidity on an explorer or the DEX. Volatility is extreme on memecoins and low caps, size to liquidity, expect slippage, and indicators cannot fix thin books.

Guard against rug pulls by verifying that liquidity is locked and checking the unlock time, confirming renounced ownership or constrained mint authority, running a quick honeypot test with a tiny buy and sell, watching for aggressive taxes or paused trading, and avoiding tokens where the deployer or a few wallets hold most of the supply.

Stay secure with trusted wallets, exact contract checks, seed protection, and regular approval revokes. Treat hype as noise, lean on liquidity, volume, and time live, and backstop DEX Screener with a second tool and a contract scanner.

Conclusion

DEX Screener compresses the sprawling world of on-chain trading into a single, usable interface. You get live data from many DEXs and blockchains, TradingView-grade charts, fast discovery tools, and practical workflows like watchlists, alerts, and in-panel trading. If you focus on memecoins and early-stage tokens, the New Pairs and Trends feeds can surface opportunities as they appear, while liquidity and holder data help you judge what’s viable.

The platform won’t make decisions for you, and it can’t remove the inherent risks of volatile, permissionless markets. What it does offer is clarity: verifiable on-chain facts, consistent charts, and flexible layouts so you can act with a plan. Start with tight filters and small positions, automate alerts around the levels that matter, and build a workspace that mirrors your process. Used that way, DEX Screener becomes less of a website and more of a trading cockpit for the decentralized side of crypto.

Related Reading