As blockchains evolved into global settlement layers, a fundamental limitation became impossible to ignore: every validator must re-execute every computation. This design preserves trustlessness, but it also makes complex applications prohibitively slow and expensive. Anything involving historical data, advanced logic, or personalization quickly becomes infeasible on-chain.

Brevis Network solves this problem by introducing a verifiable computing layer that allows applications to run complex computations off-chain, while still proving, cryptographically, that those computations were executed correctly. Instead of asking the blockchain to redo the work, Brevis asks it to verify a tiny

zero-knowledge proof. Verification takes milliseconds. Trust is preserved. And suddenly, smart contracts gain access to unlimited compute and historical memory without sacrificing decentralization.

This article explores what Brevis Network (BREV) is, how its verifiable computing architecture works, why it enables scalable on-chain intelligence, and how to trade BREV on BingX.

What Is Brevis Network and How Does It Work?

Brevis Network is a verifiable computing infrastructure that allows blockchains to execute complex computations off-chain and verify their correctness

on-chain using zero-knowledge proofs, eliminating the need for validators to re-execute expensive logic. In practice, Brevis runs computation off-chain through its Pico zkVM or ZK Data Coprocessor, then submits a compact cryptographic proof that smart contracts can verify in milliseconds, an approach already used to secure over 300 million proofs and over $300 million in live reward programs across major DeFi and infrastructure protocols.

The Core Problem Brevis Solves: Blockchain’s “Black Box” Trade-Off

Every advanced decentralized application faces the same dilemma:

• On-chain computation: Trustless, but severely limited

Because validators must independently re-execute transactions, blockchains cannot efficiently handle tasks like:

1. Volume-based trading discounts

2. Loyalty and rewards based on historical behavior

3. Cross-chain data verification

4. Risk analysis across thousands of transactions

5. Private order books or dark pools

Brevis eliminates this forced compromise by separating execution from verification.

How Brevis Network's Verifiable Computing Works

Brevis follows a compute off-chain, verify on-chain model:

1. A prover executes complex logic off-chain (cheap, fast, unlimited).

2. The prover generates a zero-knowledge proof showing the computation was correct.

3. A smart contract verifies the proof on-chain in milliseconds.

4. The blockchain accepts the result without re-executing the computation.

This model preserves

Ethereum-level security while unlocking capabilities previously limited to centralized systems.

What Are the Three Pillars of the Brevis Network?

Brevis is built around three core components that work together to deliver scalable, trustless, and production-ready verifiable computing for blockchains.

1. Pico zkVM's Universal Verifiable Computation

Pico is Brevis’ open-source zero-knowledge virtual machine (zkVM). It allows developers to write any computation in Rust, execute it off-chain, and generate a proof that smart contracts can verify. Unlike traditional zkVMs that must choose between flexibility and performance, Pico uses a modular “glue-and-coprocessor” architecture:

• A general-purpose core handles arbitrary logic.

• Specialized coprocessors accelerate domain-specific tasks like blockchain data analysis or cryptographic operations.

This design delivers both programmability and speed, making Pico suitable for everything from DeFi logic to Ethereum block proving.

2. ZK Data Coprocessor for Blockchain Intelligence at Scale

Smart contracts are effectively blind to history. Reading thousands of past transactions on-chain is too expensive. The ZK Data Coprocessor solves this by:

• Fetching and analyzing blockchain history off-chain

• Computing results such as volumes, participation metrics, or eligibility

• Returning both the result and a cryptographic proof that the data exists and the computation is correct

This enables trustless features like:

• Volume-based DEX fee tiers

• Fair, continuous reward distributions

• Cross-protocol incentive programs

The coprocessor already powers over $300 million in live reward programs for major protocols.

3. ProverNet, a Decentralized ZK Proving Marketplace

After running hundreds of millions of proofs, Brevis identified a key insight: ZK workloads are not uniform. Some require low latency, others high throughput, and each benefits from different hardware. ProverNet is Brevis’ solution, a decentralized marketplace where:

• Applications submit proof requests with specific requirements

• Specialized provers compete to fulfill those requests

• A real-time auction mechanism matches jobs to optimal hardware

• Provers stake $BREV and face slashing if they fail to deliver

ProverNet is live in mainnet beta and represents the coordination layer for the future ZK economy.

What Are the Real-World Use Cases of Brevis (BREV)?

Brevis is not a research prototype. It is production infrastructure used daily across DeFi, infrastructure, and emerging AI use cases. Active use cases include:

1. Intelligent DeFi: Personalized fees and rewards

2. RWA and Stablecoins: Transparent incentive distribution

3. DEX Dark Pools: Private trading with on-chain security

4. Cross-Chain Systems: Trustless interoperability

5. Blockchain Bootstrapping: Verifiable growth programs

6. Verifiable AI: Provable, privacy-preserving AI outputs

What Is the BREV Token Utility?

The BREV token is the core economic and governance asset of the Brevis Network. Its primary roles include:

• Payments: All proving, verification, and settlement fees in ProverNet are paid in BREV

• Staking: Provers stake BREV to qualify for jobs; stakes are slashable for non-performance

• Delegation: Token holders can delegate BREV to provers and earn a share of fees

• Governance: BREV holders vote on proof size limits, security thresholds, slashing rates, and marketplace fees

As ProverNet migrates from

Base to a dedicated Brevis rollup, BREV becomes the native gas token of the network.

BREV Tokenomics Overview

BREV has a fixed total supply of 1 billion tokens, with 25% circulating at TGE.

BREV Token Allocation

• Ecosystem Development: 37%

• Community Incentives: 28.7%

• Team: 20%

• Investors: 10.8%

• Airdrops: 3.5%

Most allocations vest linearly over time, aligning long-term incentives with network growth rather than short-term emissions.

How to Claim Brevis Airdrop

If you registered during the eligibility window between December 29, 2025 and January 3, 2026, you’ll be able to claim your BREV tokens once Brevis officially opens the claim portal. To claim, visit the official Brevis claim page when announced, connect the same wallet or claim address you used during registration, review your allocation, and confirm the transaction. Tokens will be distributed directly to your wallet, after which BREV can be used for staking, delegation, governance, or trading once listings go live.

How to Trade Brevis (BREV) on BingX

You can trade BREV tokens on the BingX spot and futures markets, supported by

BingX AI tools that provide real-time insights and risk signals.

How to Buy and Sell BREV on Spot Trading

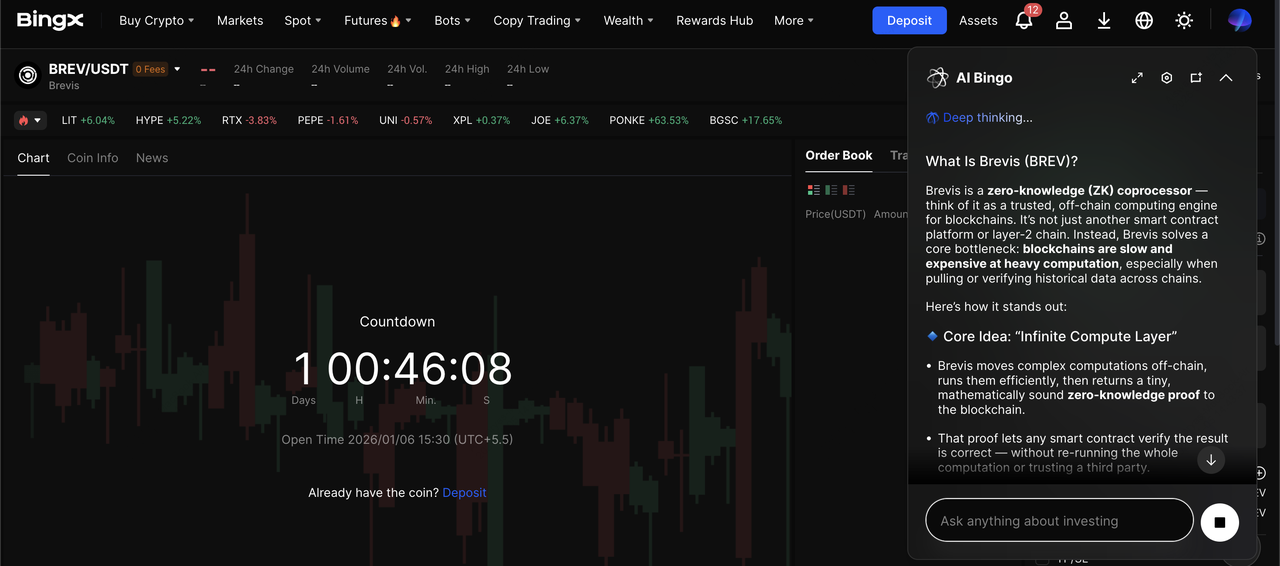

BREV/USDT trading pair on the spot market powered by BingX AI insights

On the

BingX spot market, you can buy or sell BREV directly using

USDT without leverage, making it suitable for holding or gradual accumulation. Simply log in to your BingX account,

deposit USDT into your Spot Wallet, search for the

BREV/USDT pair under Spot Trading, choose a

market or limit order, and confirm the trade.

How to Trade Brevis (BREV) with Leverage on BingX Futures

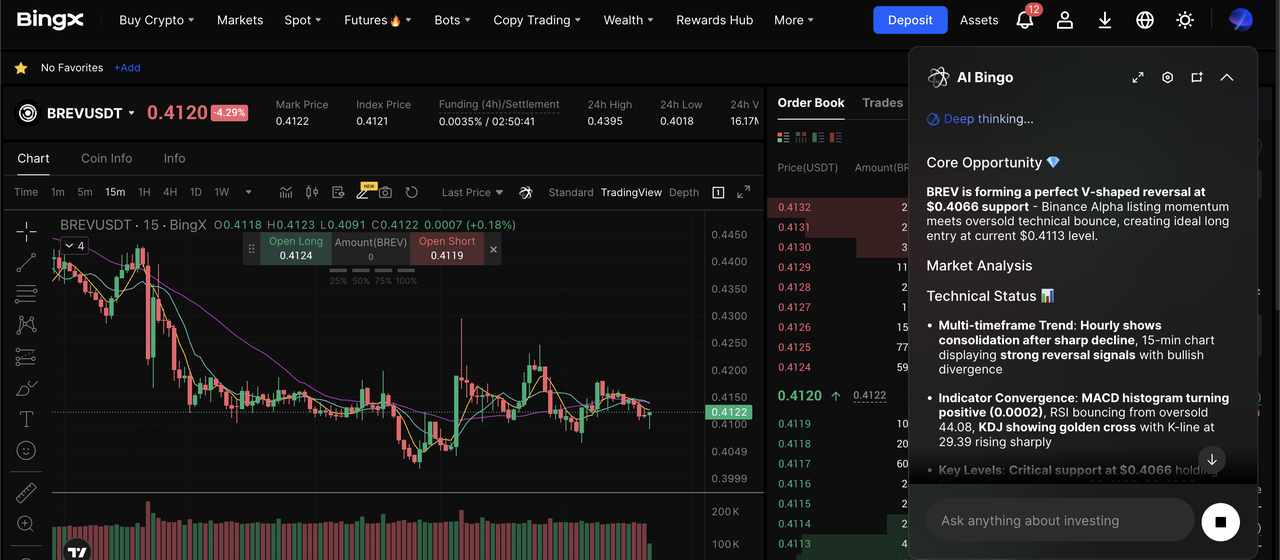

BREV/USDT perpetual contract on the futures market powered by BingX AI

BingX also offers

BREV/USDT perpetual futures for traders who want to go long or short with leverage and higher capital efficiency. After transferring funds to your Futures Wallet, select the BREV perpetual contract, set your position direction and leverage, place a market or limit order, and manage risk using

stop-loss and take-profit tools, keeping in mind that

futures trading carries higher risk due to leverage.

Final Thoughts

Brevis Network represents a critical shift in how blockchains scale, not by asking validators to do more work, but by proving work instead of repeating it. By combining Pico zkVM, the ZK Data Coprocessor, and ProverNet, Brevis transforms blockchains from limited state machines into platforms capable of supporting real-world complexity.

That said, BREV remains an infrastructure-stage asset. Adoption, proving demand, and ecosystem growth will ultimately determine its long-term value. If you choose to participate or invest in Brevis Network (BREV), stay informed, follow official updates, and manage risk carefully.

Related Reading