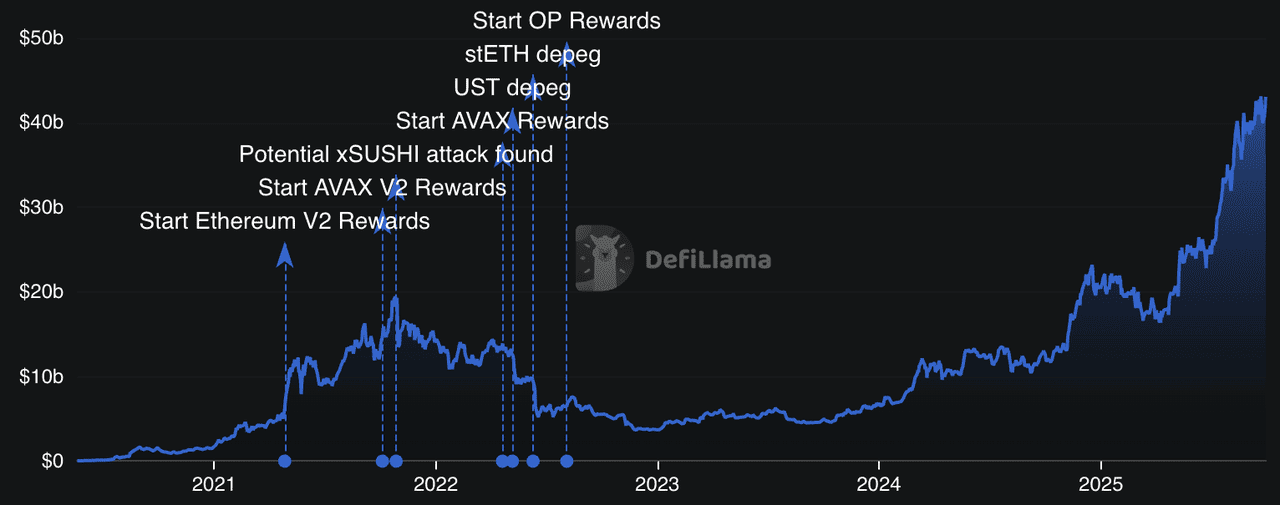

Aave (AAVE) has grown into the largest decentralized lending market, surpassing $71 trillion in cumulative deposits and a total value locked (TVL) of over $43 billion as of late-September 2025. Its record-high TVL signals strong demand for on-chain credit, with Aave continuing to dominate the

DeFi lending sector through transparent, non-custodial smart contracts. These metrics highlight both the scale of adoption and the protocol’s central role in decentralized finance.

Aave TVL | Source: DefiLlama

In recent months, Aave has accelerated development and ecosystem expansion. It announced the upcoming V4 upgrade expected in Q4 2025 with a modular hub-and-spoke design and health-targeted liquidations, launched Horizon for institutional borrowing against

tokenized RWAs, deployed Aave V3 on Aptos as its first non-EVM chain, and attracted billions in deposits with the opening of its Plasma integration. Together, these moves position Aave as both a retail-friendly and institution-ready credit protocol at the forefront of DeFi innovation.

Below, you’ll find a walkthrough of Aave’s mechanics, AAVE token utility, the latest developments in the Aave ecosystem, and step-by-step instructions to trade AAVE on BingX.

What Is Aave Lending Protocol and How Does It Work?

Aave is a decentralized, non-custodial lending protocol that lets anyone supply crypto assets to earn interest or borrow against them without needing a bank or intermediary. All activity is managed through smart contracts, ensuring transparency and security. When you supply assets, you receive aTokens, which increase in balance automatically as interest accrues in real time.

Borrowing on Aave is always overcollateralized, meaning you must deposit more value than you borrow to keep the system solvent. You can choose between variable rates, which fluctuate with market demand, or stable rates, which offer more predictable borrowing costs. Aave also tracks a health factor, a metric that determines how safe your loan is; if it falls too low, a portion of your collateral may be liquidated to repay part of the debt.

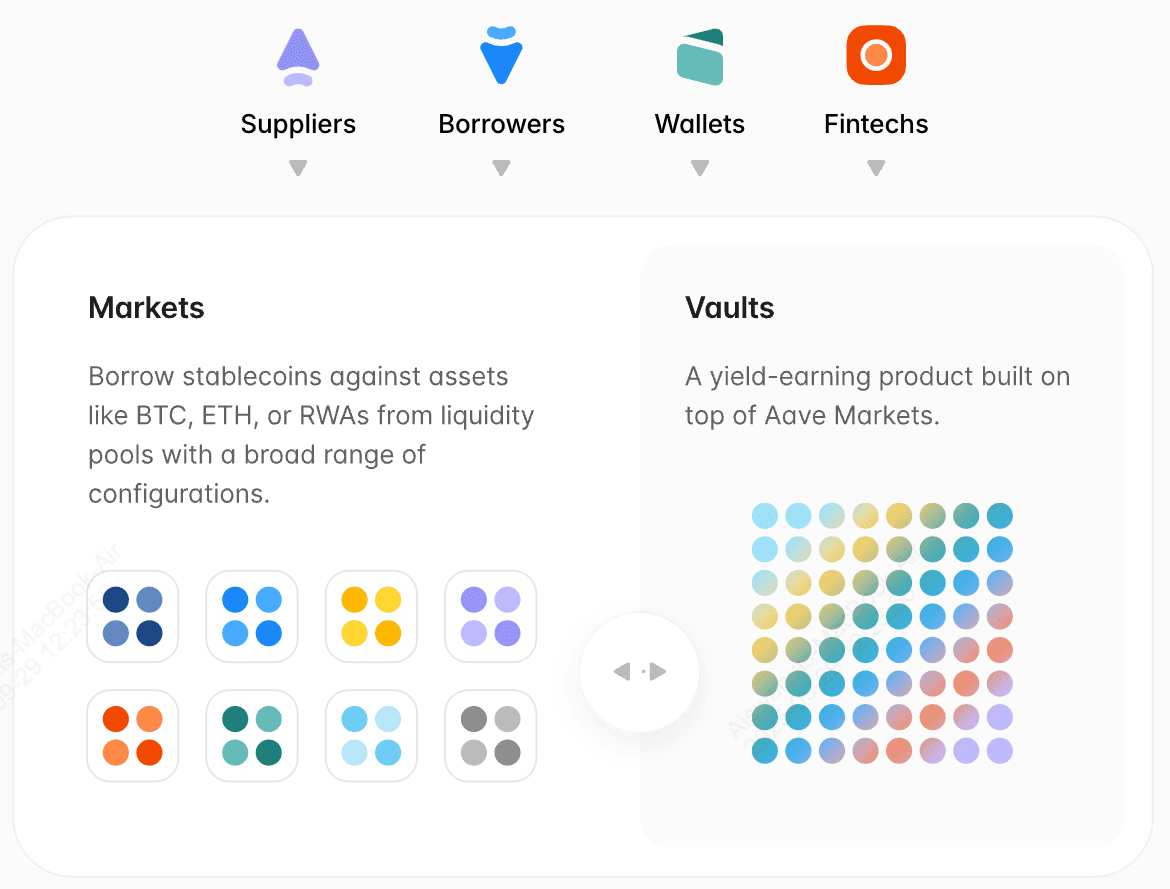

An overview of Aave protocol | Source: Aave docs

Beyond traditional lending, Aave introduced flash loans, an innovation unique to DeFi. These are uncollateralized loans that must be borrowed and repaid within a single transaction, making them useful for

arbitrage, refinancing, or collateral swaps. Together, these features make Aave a flexible and powerful tool for both everyday crypto users and advanced traders looking to maximize capital efficiency.

Recent Developments in the Aave Ecosystem in 2025

Aave has been one of the most active DeFi protocols in 2025, rolling out upgrades, expanding into new ecosystems, and attracting both institutional and retail users. These developments highlight how Aave is evolving from a blue-chip lending protocol into a broader multi-chain, institution-ready credit network.

1. Aave V4 Upgrade Expected in Q4 2025

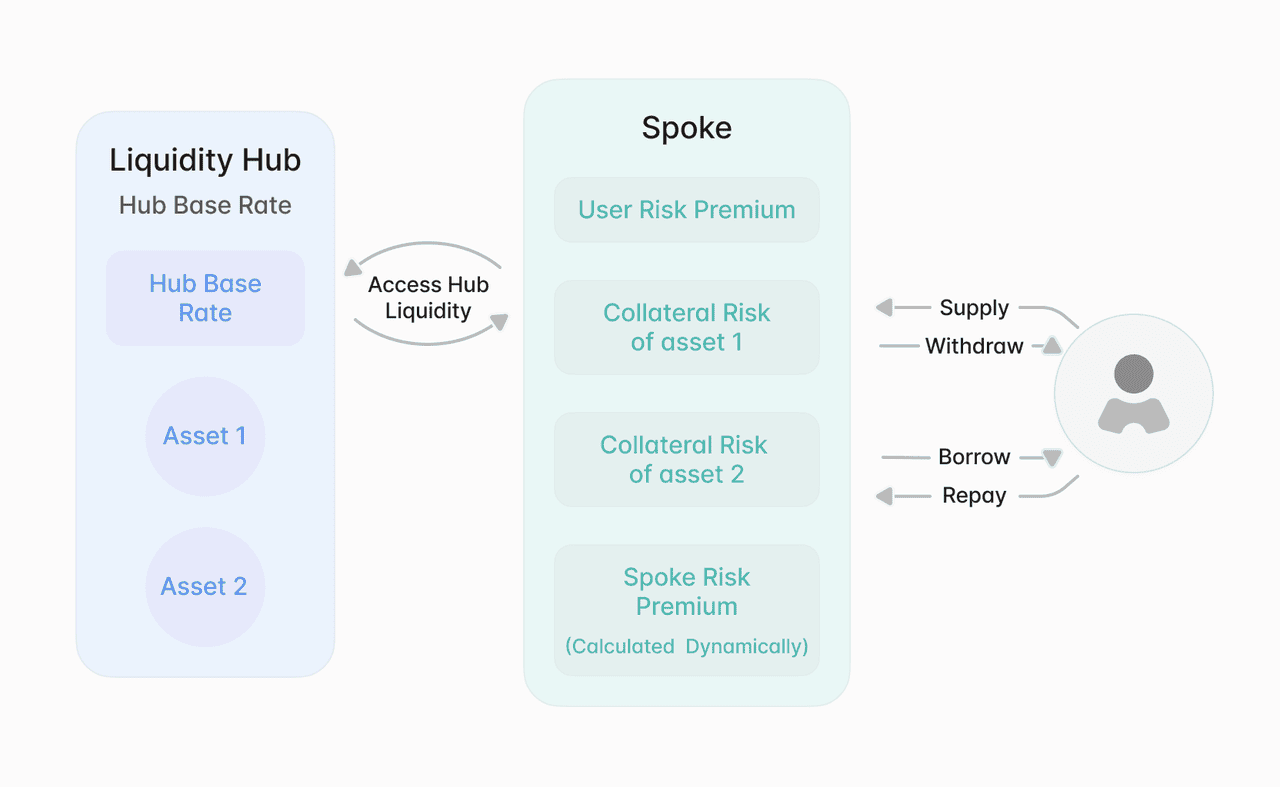

An overview of Aave v4 upgrade | Source: Aave docs

The upcoming V4 upgrade will shift Aave to a hub-and-spoke model, where a central liquidity hub connects to multiple modular “spokes” with distinct risk profiles and interest rate curves. It also introduces dynamic risk configurations and a health-targeted liquidation system that liquidates only what’s necessary to restore collateral safety. With features like a Position Manager for automation and multi-call batching, V4 is designed to enhance efficiency and user control.

2. Aave's Plasma Integration in September 2025

Reports suggest that Aave attracted nearly $3.5 billion in deposits within 24 hours of launching on the

Plasma network, although these figures remain early and should be verified with official dashboards. Plasma’s high-throughput,

stablecoin-focused design has already drawn strong liquidity flows. If sustained, this signals both institutional and retail appetite for Aave markets on specialized blockchains optimized for stablecoin finance.

3. Horizon RWA Lending for Institutions - August 2025

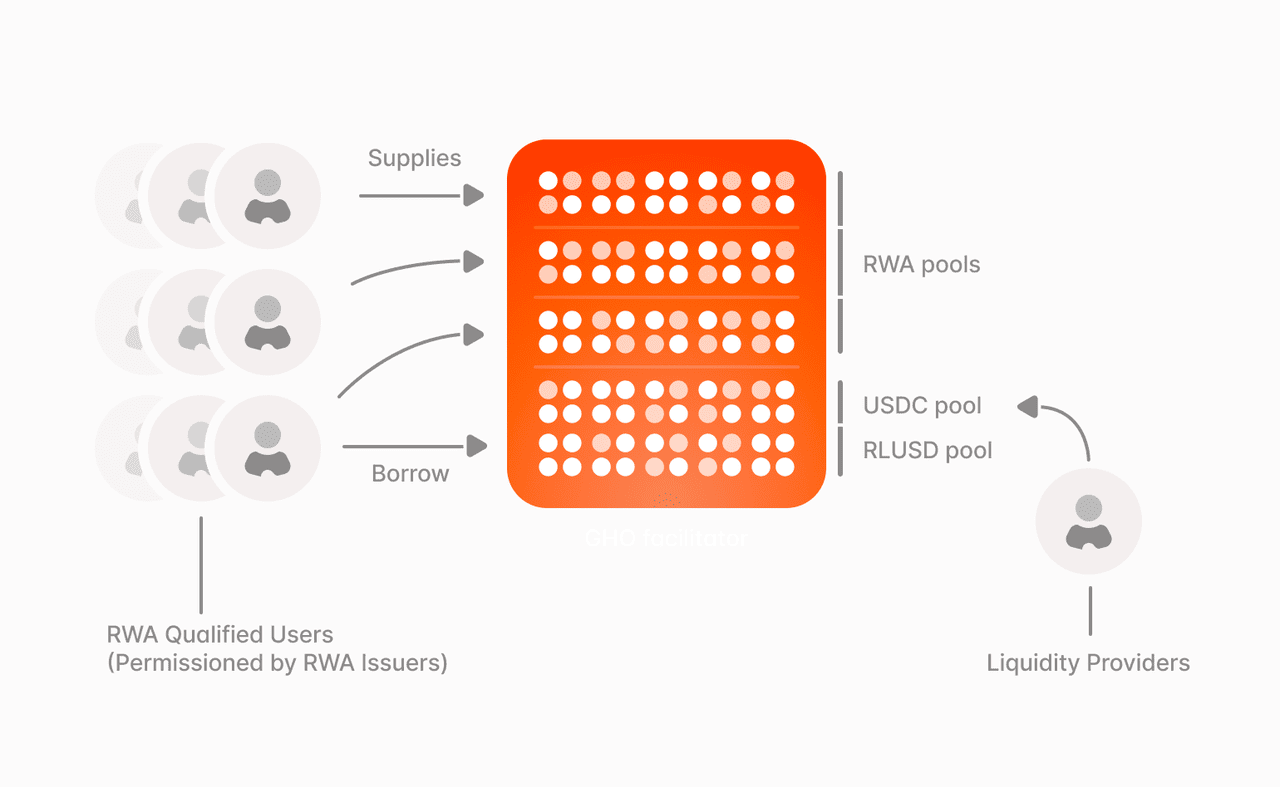

How Aave Horizon works | Source: Aave docs

Aave Labs launched Horizon, a permissioned Aave V3 market where institutions can borrow stablecoins such as

USDC,

RLUSD, or GHO against tokenized Treasuries and CLOs. Powered by

Chainlink NAV feeds, Horizon keeps collateral values updated in real time and is exploring

Proof of Reserves and SmartAUM. This move strengthens Aave’s appeal to regulated players and increases stablecoin liquidity through compliant

RWA adoption.

4. Aave's First Non-EVM Deployment on Aptos - August 2025

In August, Aave V3 officially deployed on

Aptos, marking its first-ever launch outside the Ethereum Virtual Machine (EVM) ecosystem. This expansion underwent audits and phased rollout with risk controls, making Aave accessible to Move-based developers for the first time. The Aptos deployment expands Aave’s reach, diversifies its liquidity base, and positions it as a multi-chain protocol beyond Solidity-led ecosystems.

5. Aave and WLFI - June 2025

In June,

World Liberty Financial (WLFI) deposited over $50 million in

ETH, WBTC, and

stETH into Aave and borrowed about $7.5 million in

USDT, reportedly to mint

USD1 stablecoins via BitGo. However, rumors in August that AaveDAO would receive 7% of WLFI’s token supply were denied by the WLFI team. The episode underscores the need to separate verifiable, on-chain usage from speculative narratives, since such headlines can sway AAVE’s price in the short term even as fundamentals remain tied to lending activity and risk management.

AAVE Token: Utility, Tokenomics, and the Rise of GHO

The AAVE token sits at the center of Aave’s governance, risk management, and incentive system. In 2025, its utility has expanded beyond governance and staking into mechanisms that tie it directly to protocol revenue, treasury activity, and ecosystem stability. Here’s a deeper look at what the token does, how its economics are evolving, and the growing role of Aave’s native stablecoin, GHO.

AAVE Token Utility: What It Powers

Beyond a governance token, AAVE is now tied to cash flow capture, risk protection, and supply reduction strategies. This combination strengthens the token’s role in the ecosystem but still leaves it exposed to broader market conditions.

• Governance: AAVE holders can propose and vote on Aave Improvement Proposals (AIPs) that set listing criteria, risk parameters, and upgrades like V4’s hub-and-spoke design or Horizon’s RWA markets. This makes AAVE ownership a direct lever for shaping protocol policy.

• Safety Module: By staking AAVE, users backstop potential shortfall events (e.g., mass liquidations or collateral failures). In return, stakers earn protocol incentives, turning AAVE into a form of decentralized insurance capital.

• Buyback Program: A key shift came in April 2025, when the Aave DAO approved a $1 million/week AAVE buyback pilot, executed by the Aave Finance Committee (AFC) using treasury allowances and protocol revenue. After proving successful, allowances were extended mid-year. These buybacks reduce circulating supply, creating more direct alignment between Aave’s fee generation and AAVE token value.

AAVE Token and Allocation

The AAVE token has a capped supply of 16 million, with distribution designed to balance governance control, ecosystem growth, and long-term security.

• Ecosystem Reserve (~30%): For liquidity mining, protocol incentives, and ecosystem development.

• Team & Founders (~23%): Vested over multiple years to ensure alignment with long-term growth.

• Investors (~16%): Allocated across seed, early-stage, and strategic rounds.

• Safety Module / Insurance (~20%): Locked for backstopping risks in the system.

• Public Allocation (~11%): Distributed via the original 2020 token migration and market activity.

The addition of the buyback program in 2025 has effectively added a deflationary mechanism, reducing the free-floating supply while rewarding long-term stakers. For traders, this means monitoring weekly AFC updates and governance votes is now directly relevant to AAVE’s supply dynamics.

What Is GHO, Aave’s Native Stablecoin?

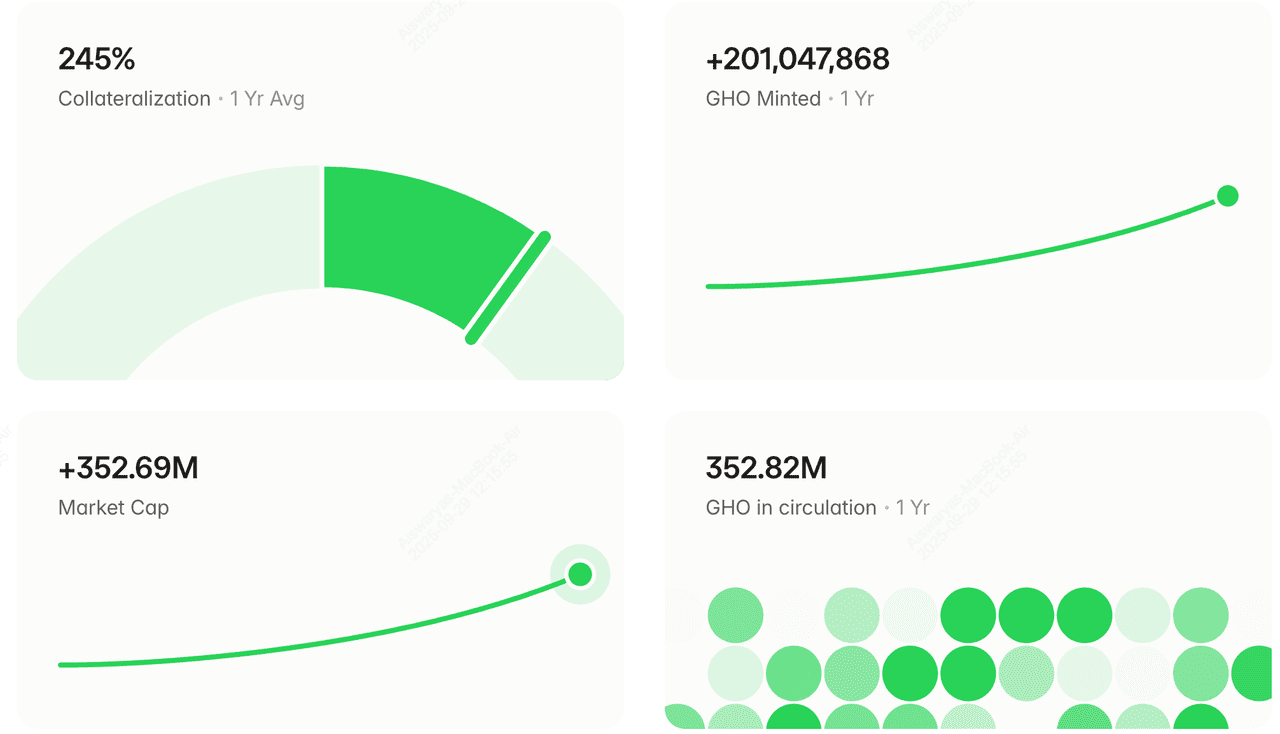

Key statistics about GHO, Aave's native stablecoin | Source: Aave

GHO is Aave’s attempt to bring stablecoins under its own roof. Users mint GHO by locking collateral into Aave V3 markets, ensuring it is fully overcollateralized. Governance sets mint caps and facilitator roles, preventing oversupply while spreading issuance across multiple sources. As of late September 2025, GHO has a circulating supply of more than 352 million tokens, with over 201 million GHO tokens being minted on Aave protocol in the past one year.

As of late 2025, GHO is live in the

Ethereum V3 market, with circulating supply expanding steadily. It is designed to maintain its $1 peg through arbitrage incentives and liquidation mechanisms, similar to other crypto-collateralized stablecoins but uniquely tied to Aave’s lending pools. Beyond basic borrowing, GHO is also being integrated into:

• Payments and DeFi strategies, serving as a native settlement asset across chains.

• Yield products, where staked GHO (or future derivatives) could earn returns from Aave protocol revenues.

• Institutional adoption via Horizon, where RWA-backed collateral (like tokenized Treasuries) can be used to mint or borrow GHO, bridging traditional finance and DeFi liquidity.

GHO is becoming the liquidity glue of Aave’s ecosystem, while AAVE provides the governance and security layer. Together, they expand Aave’s reach into both decentralized and institutional markets.

How to Trade AAVE on BingX

Trading AAVE on BingX gives you access to one of DeFi’s leading governance tokens with flexible options across Spot and Futures markets. With

BingX AI tools, you can analyze trends, monitor volatility, and make smarter, data-driven decisions before entering trades.

Buy, Sell, and Hold AAVE on Spot Trading

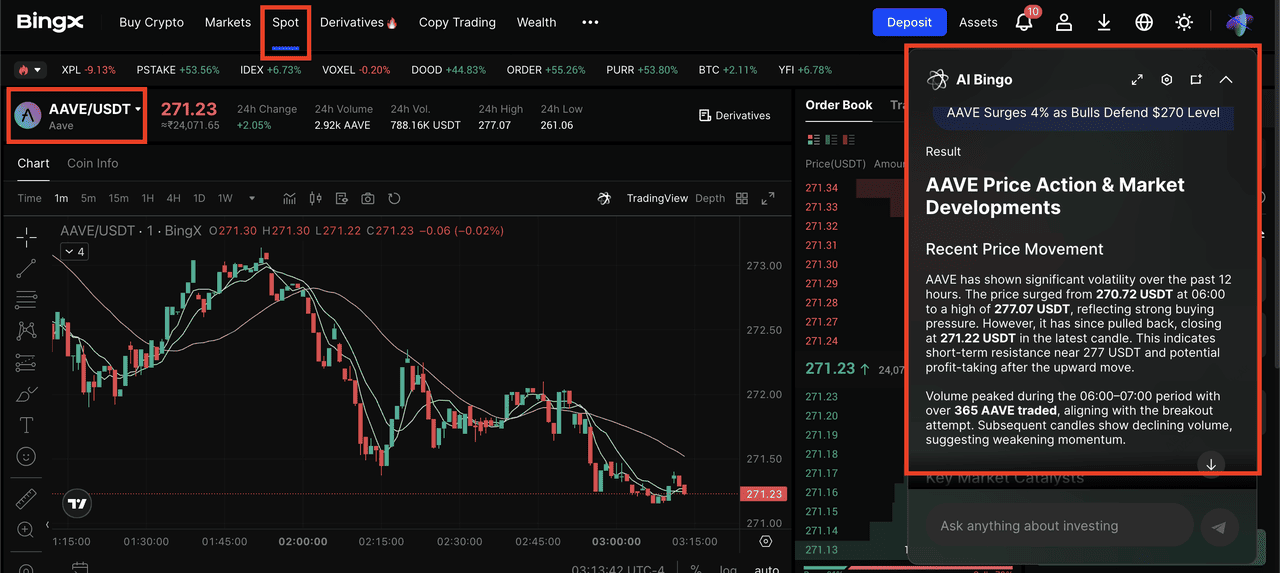

AVE/USDT trading pair on the spot market powered by AI Bingo, BingX's AI-powered assistant

1. Fund your account: Start by depositing USDT into your BingX wallet. You can convert fiat into USDT via card payments, bank transfers, or move crypto from another wallet or exchange.

2. Find the AAVE/USDT trading pair: Go to the

Spot market and search for

AAVE/USDT. This pair gives you direct exposure to AAVE’s price against the stablecoin USDT.

3. Choose order type:

• A

Market Order buys AAVE instantly at the current price, useful for fast entries but with less control over execution.

• A Limit Order lets you set a preferred buy price; it will only execute once the market reaches your target, offering more precision.

4. Position sizing: Manage risk by avoiding lump-sum buys. Instead, consider

dollar-cost averaging (DCA); for example, making weekly purchases to smooth out price volatility over time.

5. Monitor catalysts: Keep an eye on factors that can move AAVE’s price, such as the rollout of V4 upgrades, expansions in GHO minting capacity, new chain integrations like Aptos or Plasma, and governance votes on listings, risk parameters, or buyback allowances. These events often drive liquidity and short-term volatility.

Pro Tip: Track Aave TVL/active loans and utilization; sustained growth often aligns with stronger protocol revenues and narrative support for AAVE governance value.

Long or Short AAVE on Perpetual Futures

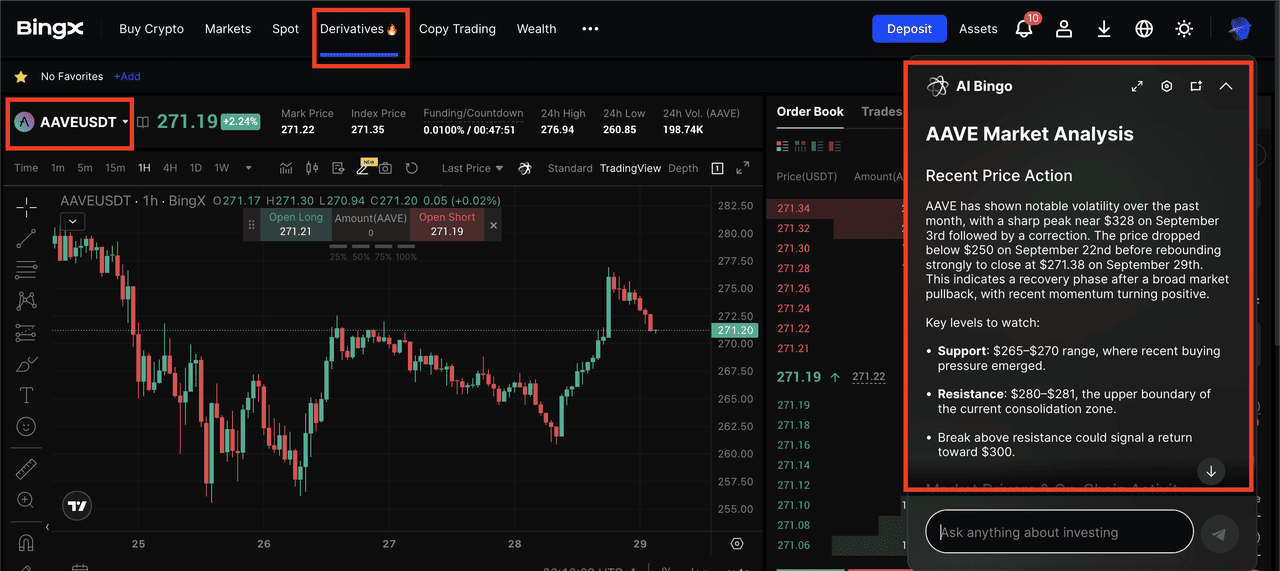

AAVE/USDT perpetual contract on the futures market powered by AI Bingo

1. Select AAVE/USDT Perpetuals: Open the

Futures tab on BingX and choose the

AAVE/USDT perpetual contract, which allows you to speculate on AAVE’s price with leverage without owning the underlying token.

2. Start low leverage (2–3×): Begin with minimal leverage until you fully understand funding rates, maintenance margin, and liquidation thresholds. This reduces the risk of being liquidated by normal price swings.

3. Plan entries and exits:

• Go Long when confirmed catalysts, such as V4 testnet launches, Horizon’s RWA adoption, or Plasma integrations, are accompanied by rising volume and open interest.

• Go Short if hype fades or rumors unwind, e.g., WLFI speculation, and price momentum shows signs of reversal with declining volume.

4. Risk controls: Always use

stop-loss and take-profit orders to protect against sudden volatility. Keep position sizes small enough so that routine 5–10% swings don’t liquidate your margin.

5. Key futures signals: Watch for

funding rates (positive and climbing means longs are crowded), spikes in open interest - often precede squeezes, and the basis between spot and futures prices - wide gaps can indicate overextension and potential mean reversion.

Key Considerations When Investing in Aave

Before investing in or trading AAVE, it’s important to balance opportunity with risk by evaluating protocol fundamentals, catalysts, and market signals. A structured checklist can help you avoid chasing hype and focus on verifiable trends.

• Look for clear catalysts: Check if there’s a tangible driver such as an approved AIP, a testnet or mainnet upgrade, e.g., V4, a major asset listing, or a new RWA partnership like Horizon. These events tend to create more durable price momentum.

• Verify on-chain activity: Rising TVL, loan volume, and utilization rates show real growth in borrowing demand. If price is moving without these fundamentals improving, the rally may be short-lived.

• Confirm narratives: Rumors can drive temporary volatility, but sustainable trends rely on verified information. Always check if a story has been confirmed or denied by primary sources, e.g., Aave governance forums or official statements, such as with the WLFI token rumor.

By using this framework, traders can better distinguish between speculative noise and genuine growth signals, making investment decisions in Aave more informed and risk-aware.

Closing Thoughts: Why Aave Still Matters

Aave remains one of the most important players in decentralized finance, combining scale, innovation, and reach. It continues to rank among the largest lending protocols with record-breaking deposits and loans in 2025, reflecting sustained demand for on-chain credit. Its track record of innovation, from the introduction of flash loans to the upcoming V4 modular design and RWA-backed Horizon markets, positions Aave at the forefront of DeFi development. At the same time, its expansion beyond Ethereum into ecosystems like Aptos and Plasma broadens its liquidity footprint and user base.

Taken together, these developments show how Aave is evolving from a blue-chip DeFi lender into a multi-chain, institution-ready credit network. Active governance, buyback programs, and stablecoin integration through GHO further strengthen its ecosystem. That said, AAVE’s performance remains tied to broader market conditions, protocol risk, and fast-moving narratives. For traders and investors, the key is to stay informed, manage exposure carefully, and recognize that while Aave’s fundamentals are strong, volatility is part of the DeFi landscape.

Related Reading