Crypto and traditional banking are finally starting to speak the same language. For years, you needed one app for your paycheck and another for

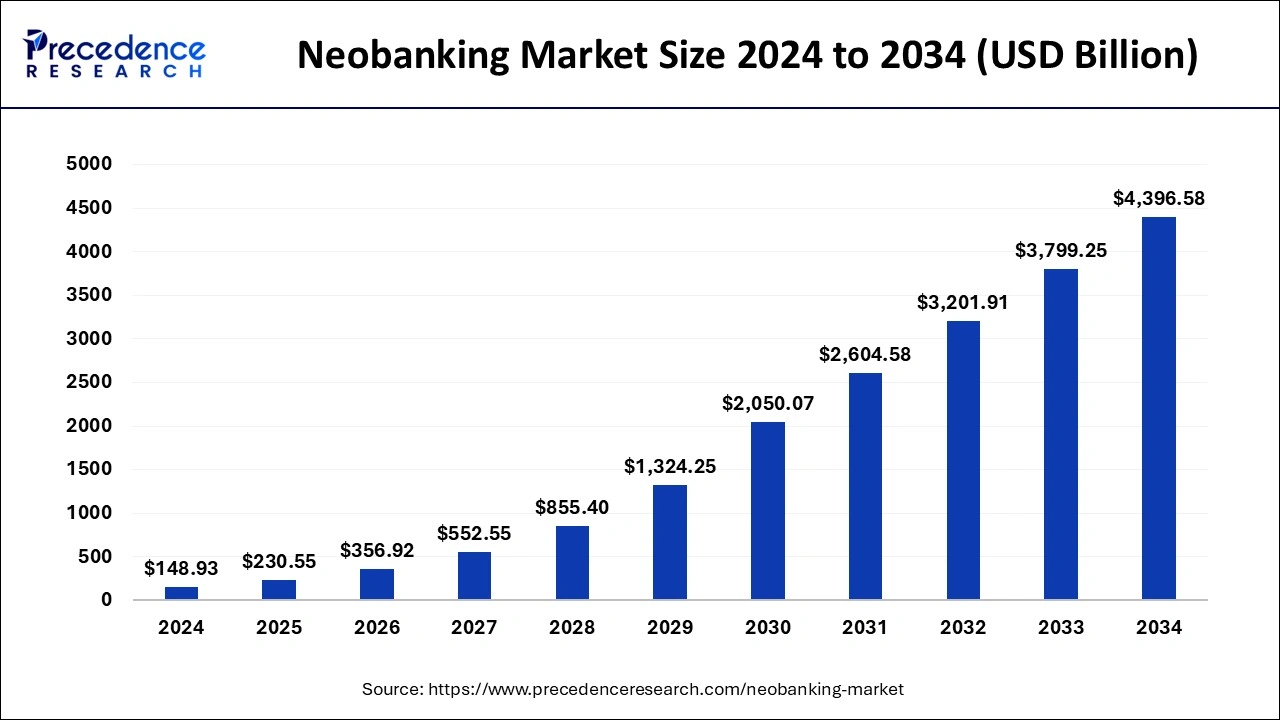

Bitcoin, hoping your bank would not panic every time you wired money to an exchange. In 2025, that is changing fast. The numbers show how big this change is. According to Precedence Research, the global neobanking market was worth $148.9 billion in 2024 and is expected to grow to more than $4.4 trillion by 2034. Europe is already leading the way, the U.S. is expected to grow quickly, and new hubs like the UAE are investing a lot in digital-only banking and crypto regulation.

At the same time, neobanks are weaving generative AI into their platforms, from smart budgeting assistants to

AI-powered chat interfaces, so that users can manage everything from savings to crypto inside a single digital finance hub.

Crypto neobanks and crypto-friendly banks are turning your phone into a single control panel for fiat,

Bitcoin and

stablecoins. Some let you earn cashback in BTC, others give you a full debit card and savings account wrapped around a

crypto wallet, and a few are quietly rebuilding payment rails on blockchain for instant, 24/7 settlement behind the scenes.

This guide breaks down what a "crypto neobank" actually is, why these players are growing so fast, how to judge them, and which three neobanks and three traditional banks stand out in 2025. You will see everyday apps like Revolut, Wirex and Cash App side by side with more conventional names such as Ally, Monzo and JPMorgan, so you can decide which mix fits your own stack.

What Is a Crypto Neobank and How Does It Work?

A neobank is a bank that lives almost entirely on your phone. No branches, no paperwork, just an app, a card and usually a regulated banking partner in the background. A crypto neobank goes a step further by putting digital assets next to your regular checking or savings balance. In practice, that means you can move from fiat to crypto and back without leaving the app, like with Revolut, which lets you hold traditional currencies and

convert them into a wide range of crypto pairs in one interface.

You can also spend crypto through cards like Wirex, which draw from your fiat balance while using crypto behind the scenes, so you pay in stores or online without manually cashing out first. And you get crypto-aware saving and investing tools, as Cash App shows with salary deposits, savings and a built-in

Bitcoin wallet in the same place.

Behind that smooth interface, most of these apps still lean on licensed partner banks, regulated custodians and specialist crypto infrastructure. You are not bypassing the banking system. You are using a new front end that speaks both fiat and blockchain and hides the messy wiring underneath.

Why Are Neobanks Getting More Popular?

1. Instant Onboarding and 24/7 Money Access

The rise of neobanks is not just a design trend. It is about faster access, always-on services and regulation finally catching up with how people actually use money.

2. MiCA as the Core Rulebook for EU Crypto Banking

On the regulatory side, MiCA is the big story in 2024 and 2025. The Markets in Crypto Assets framework gives firms one rulebook for custody, trading and token services across the EEA, and Revolut securing a MiCA licence in Cyprus in October 2025 is the flagship example of how that works in practice.

3. Licences, Safeguards and Everyday User Protection

A MiCA licence or similar approval gives users real reassurance, because it means a regulator has reviewed risk controls, reserves and consumer protections, so you are less likely to face surprise restrictions such as sudden bans on crypto transfers.

4. Old Payment Rails vs. 24/7 On-Chain Settlement

Traditional banking frictions are pushing users toward neobanks. Remote work, global freelancing and 24/7 crypto markets do not fit with nine-to-five settlement windows and multi-day international wires, which is why platforms like JPMorgan’s Kinexys are rolling out on-chain FX settlement for dollars and euros that runs around the clock and enables near-instant cross-border payments.

5. Wallet-First Super Apps as the New ‘Primary Bank’

On the consumer side, younger users are comfortable treating a wallet-style app as their primary bank, as long as it offers direct deposit, a solid card and an easy way to buy or hold crypto. Cash App and Wirex are prime examples, built mobile first, crypto-aware and focused on rewards and yield, which makes them attractive as all-in-one finance apps.

6. Internet-Native Neobanks vs. Branch-Era Banking

In short, neobanks are winning because they feel like the internet, not like a bank branch, and crypto is the sharp edge that pushes them to modernise faster than traditional institutions.

Top Crypto Neobanks For Everyday Banking

Revolut

Revolut has evolved from a basic travel card into a full finance super app with over 65 million users, with crypto now at its core. Backed by a MiCA licence in Cyprus, it can offer regulated crypto services across all 30 EEA markets, letting you hold multiple fiat currencies, move money across borders and trade Bitcoin,

Ethereum and major

stablecoins in the same app, alongside physical and virtual cards and tiered plans.

Pro: Very convenient all-in-one setup for EEA users, combining banking, cards and regulated crypto trading in a single app.

Con: Tiered pricing makes it more expensive for smaller users, and in some regions certain assets still cannot be withdrawn fully on-chain.

Wirex

Wirex calls itself a Web3 money app and in practice works like a global crypto neobank built around its Visa and Mastercard. It supports dozens of fiat currencies and more than 200 crypto assets, lets you pay directly from your balances with automatic crypto to fiat conversion at checkout, and offers low single-digit cashback in its WXT token plus yield on selected balances via X Accounts.

Pro: Very strong for everyday spending and rewards, letting you treat crypto almost like regular money in one combined app and card.

Con: The best perks depend on holding WXT, which adds extra volatility and token risk on top of normal market moves.

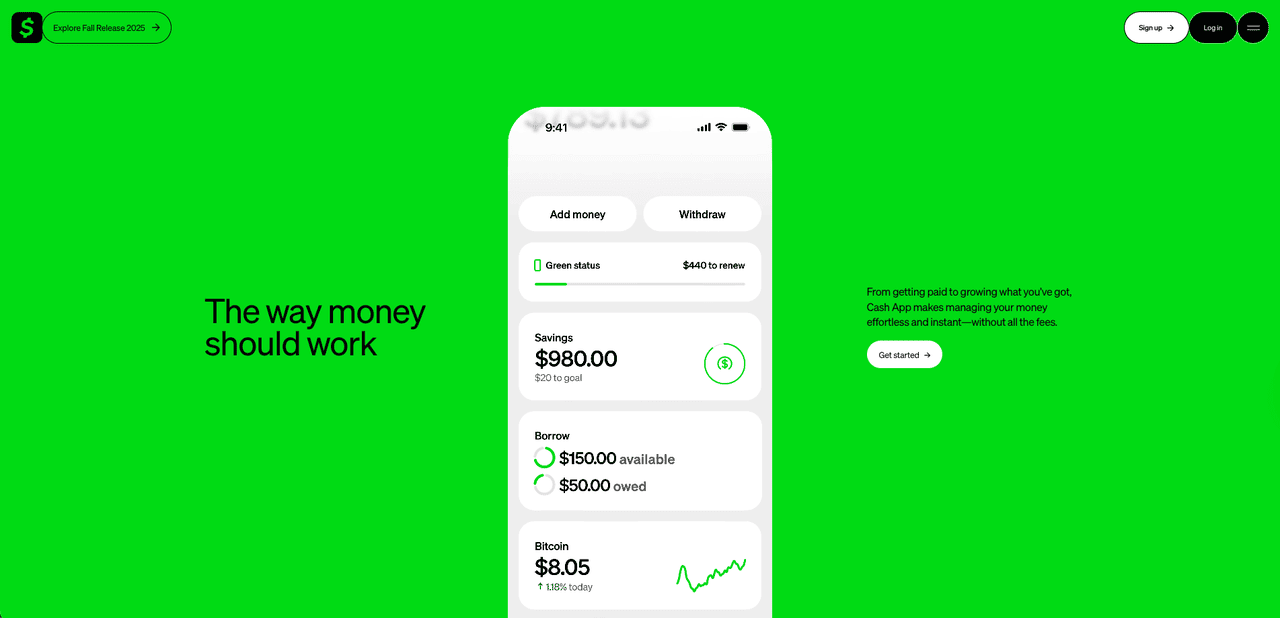

Cash App

In the US,

Cash App has quietly become a default bank replacement for millions of users who also want direct Bitcoin exposure. Built by Block, it combines a

peer-to-peer wallet with savings, stock investing and an integrated Bitcoin service. You can route your salary into Cash App, pay with the debit card, hold a savings balance and buy or sell Bitcoin from very small amounts, with the option to withdraw BTC to external wallets including

cold storage, which sets it apart from many purely custodial fintech apps. Its strength is a clear focus on Bitcoin and tight integration with Block’s wider payments ecosystem, rather than chasing a long list of

altcoins.

Pro: Extremely simple Bitcoin on-ramp for US users, with banking, card and BTC buys and withdrawals all in one app.

Con: Only supports Bitcoin, comes with relatively high spreads and sits under increased regulatory scrutiny after compliance issues at the parent company.

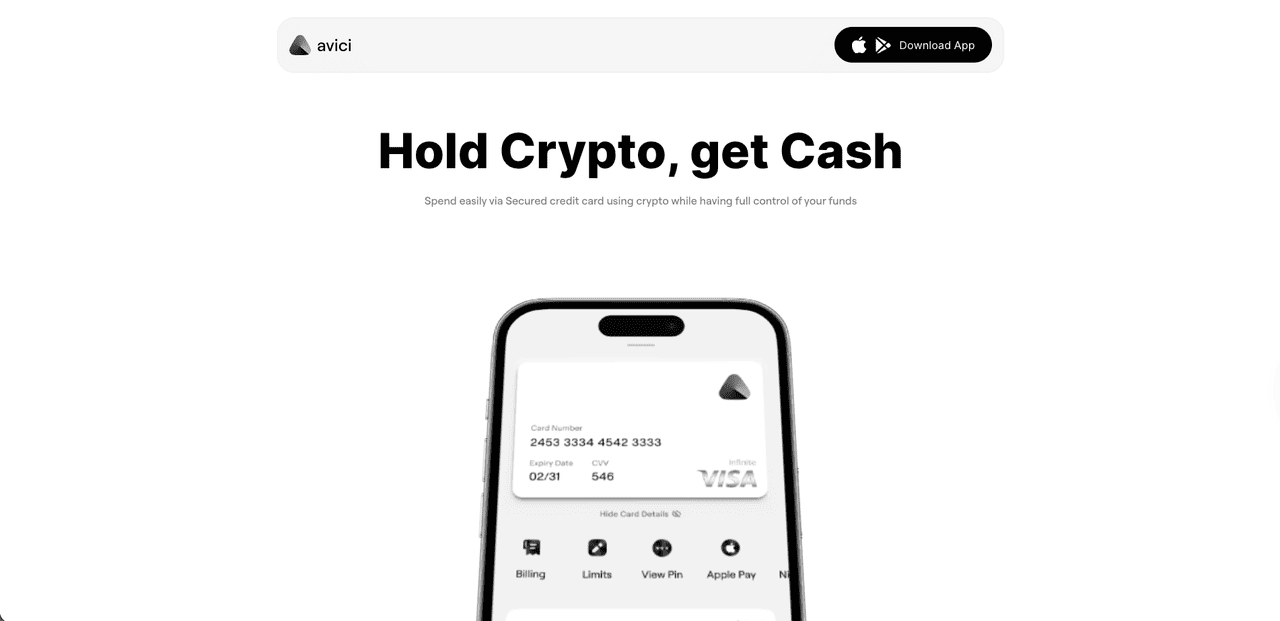

Avici

Avici is a self-custodial,

Solana-native crypto neobank built around a Visa card that lets you spend

USDC from chains like Solana,

Polygon and Arbitrum much like fiat, with virtual cards issued in minutes, optional physical cards and Apple Pay/Google Pay support. Already live in public beta with a few thousand active users and over $1.2 million in card volume, it combines fiat on-ramp accounts, stablecoin savings and swaps, and

WalletConnect dApp access in a single mobile app where funds stay in a smart contract wallet you control rather than a custodial balance.

Pro: User-friendly, fully on-chain setup where you keep control of your assets, with quick Visa card issuance, support for

USDC on several major chains and simple fiat on-ramps for everyday spending.

Con: Still a young project and token with details on team and long-term roadmap evolving, plus reliance on Solana and smart contracts, so users should be aware of typical early-stage and regulatory risks in the crypto neobank space.

Top Crypto-Friendly Banks To Bridge Your Existing Accounts

Ally Bank

Ally Bank is a long-standing U.S. online bank that many crypto users quietly use as their main fiat base. You cannot buy or trade crypto directly inside Ally, but it links smoothly to major exchanges like Coinbase and other regulated platforms, so funding your crypto account via ACH or card is usually simple. Through Ally Invest, you can also get exposure to Bitcoin and other

crypto-themed ETFs and funds if you prefer a regulated brokerage wrapper instead of holding coins yourself. Thanks to reliable transfers and a generally relaxed stance on exchange funding, Ally often shows up in rankings of the most crypto-friendly U.S. banks.

Pro: Strong, familiar online bank that works well as a fiat hub for funding exchanges and accessing crypto-related ETFs.

Con: No native crypto trading or wallet, so all actual coin activity still has to happen on external platforms.

Monzo

Monzo, the UK digital bank with the bright coral cards, takes a more cautious but still crypto-friendly route. There is no in-app crypto trading and no built-in

Bitcoin wallet, but you can fund FCA-regulated exchanges via bank transfer or card payments. To limit fraud and scam losses, Monzo caps crypto-related payments at a rolling thirty-day allowance of 5,000 GBP, a limit you currently cannot lift. For casual investors, that is usually enough to build a position over time while still using Monzo’s strong budgeting, savings and everyday banking features, even if high-volume traders may find the limits restrictive.

Pro: Clean, user-friendly UK bank that allows straightforward funding of regulated exchanges while adding a sensible fraud cap.

Con: No native crypto features and a strict 5,000 GBP rolling limit that can feel restrictive for more active or higher volume users.

JPMorgan Chase

JPMorgan Chase sits at the opposite end of the spectrum from retail-focused apps like Monzo or Ally. You will not get a personal crypto wallet in its consumer app, but behind the scenes it has become a key bridge between traditional finance and blockchain. Its blockchain unit, rebranded from Onyx to Kinexys by J.P. Morgan in 2024, builds bank-led blockchain rails for wholesale payments and tokenization.

At the center is JPM Coin, a deposit token that lets institutional clients move tokenized USD and EUR on-chain in real time via Kinexys Digital Payments, with on-chain FX settlement now being rolled out. For most retail users this remains invisible and only surfaces through exchanges and fintech apps that plug into these rails, but for corporates and crypto businesses that need 24/7, high-value fiat and token flows, JPMorgan is one of the clearest examples of a truly crypto-friendly bank on the institutional side.

Pro: Deep, institutional-grade blockchain rails with JPM Coin and Kinexys, giving large clients real-time, on-chain settlement inside a fully regulated global bank.

Con: No direct benefit for everyday users, since there is no retail crypto wallet or trading and most of the innovation lives entirely in the background.

Which Crypto Neobank Is Right For You? Final Checklist

Here is a quick side-by-side snapshot of each bank and app so you can see where it works, how it handles crypto and which option best fits your use case.

| Bank / App |

Type |

Main Region / Availability |

Crypto Angle |

Best For |

| Revolut |

Crypto neobank / super app |

UK, EEA (MiCA licence CY) |

In app trading for BTC, ETH, stablecoins plus multi fiat and cards |

One app for banking, travel and casual crypto |

| Wirex |

Crypto neobank / Web3 money app |

Global (card focused) |

Visa/Mastercard linked to 200+ crypto and fiat, cashback in WXT, yield accounts |

Spending crypto like cash with rewards |

| Cash App |

Bitcoin first finance app |

United States |

Simple BTC buying, selling and withdrawals plus debit card and savings |

US users who mainly want Bitcoin plus basic banking |

| Avici |

Crypto neobank (self-custodial) |

Global (app + Visa card, region dependent) |

Self-custody smart contract wallet with Visa card backed by USDC, swaps, P2P transfers and fiat on/off-ramps |

For Users who want card payments and stablecoin saving with self-custody |

| Ally Bank |

Traditional online bank |

United States |

Smooth transfers to exchanges, crypto related ETFs via Ally Invest |

Using a classic bank as fiat base for crypto |

| Monzo |

Digital retail bank |

United Kingdom |

Allows transfers and card payments to regulated exchanges, no native trading |

UK app banking without blocking crypto transfers |

| JPMorgan Chase |

Global bank with Kinexys blockchain rails |

Global (institutional) |

JPM Coin and tokenised deposits for real time on-chain settlement and FX |

Corporates and crypto businesses needing 24/7 payment infrastructure |

Final Notes

In 2025, the real question is not whether your bank is “crypto-friendly", but how deeply you want crypto wired into your everyday finances. For some, a super app like Revolut, Wirex or Cash App will be the main hub for salary, spending and Bitcoin. Others will be better off keeping a classic account at Ally or Monzo and using it as a clean bridge to exchanges, ETFs and self-custody. As long as you stay focused on regulation, security and your own risk tolerance, you can turn that old pain point between bank and wallet into a smooth, almost invisible part of your financial setup.

FAQs on Crypto Neobanks

1. Can I use a crypto neobank as my main bank account?

Yes, apps like Revolut, Wirex and Cash App can handle salary, cards and savings, but some classic services and full on-chain withdrawals for every asset may still require a separate bank or exchange.

2. What is the difference between a crypto neobank and a crypto-friendly bank?

A crypto neobank lets you buy, hold and often spend crypto directly in the app, while a crypto-friendly bank like Ally or Monzo mainly acts as a smooth fiat bridge to exchanges, ETFs or self custody.

3. Are my funds safe in neobank apps and crypto-friendly banks?

Fiat is usually held with licensed partner banks and can be covered by deposit insurance, but crypto is not, so you should always check who holds custody, which licences they have and whether they publish audits.

4. How do fees compare between traditional banks and neobanks?

Neobanks tend to charge via spreads and tiered plans for in app trading, while traditional banks keep funding cheap but leave you to pay fees at exchanges or on ETF products.

5. Neobanks vs. crypto-friendly banks vs. traditional banks: how do I choose the right account?

If you want everything in one app, pick a crypto neobank; if you prefer a conservative base account and separate crypto platforms, go with a crypto-friendly bank, and always match your choice to your risk tolerance and how actively you use crypto.