Using

crypto bridges in 2025 allows users to move assets efficiently, access cross-chain yield opportunities, and participate in multiple decentralized finance ecosystems without selling tokens. According to

CoinLaw, the

Total Value Locked (TVL) across all

DeFi protocols reached $123.6 billion in 2025, up 41% year-over-year and cross-chain bridges are critical to keep liquidity, tokens, and users flowing across multiple blockchain networks.

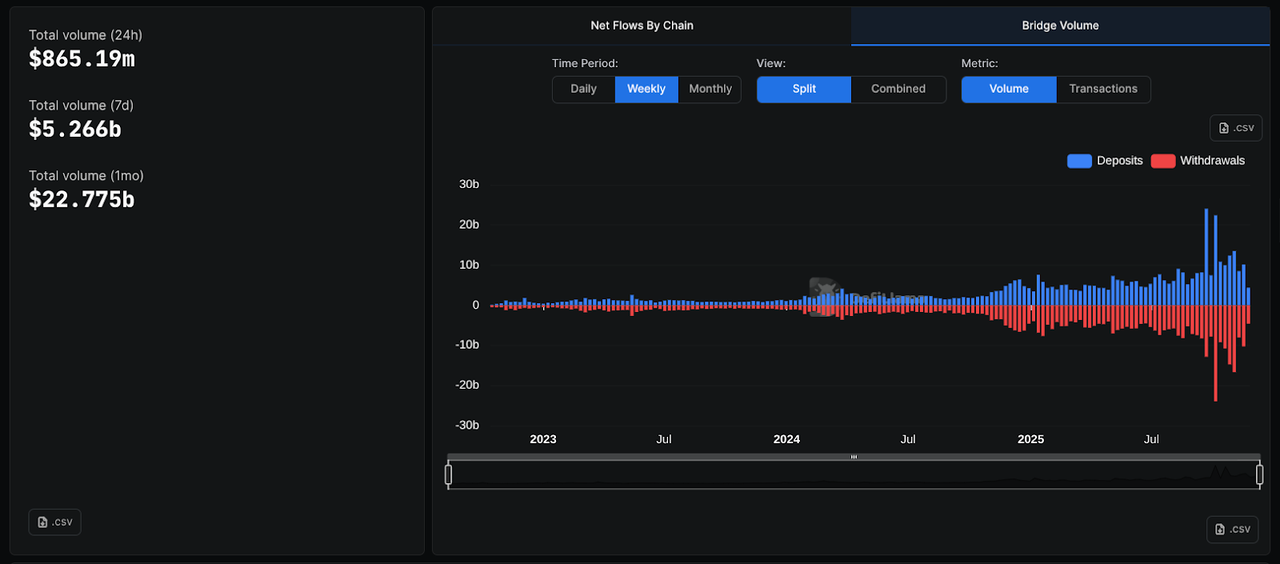

On November 25-28, 2025, DefiLlama records show total cross-chain bridge volume exceeding $880 million on several days in late November, driven by high activity in bridges like Symbiosis, THORChain, and Stargate which highlights the growing reliance on these protocols. Bridges enable assets to move seamlessly between blockchains, creating the interconnected network that powers DeFi, cross-chain swaps, and liquidity migrations. As cross-chain volume and protocol usage soar, choosing the right bridge can make a big difference in cost, speed, and security.

In this article we explain what crypto bridges are, how they work, explore popular bridge types, highlight the top five bridges of 2025, and provide guidance on how to choose the right bridge for your needs.

What Are Crypto Bridges?

Crypto bridges are specialized protocols that allow users to move tokens or digital assets from one blockchain to another even when the chains operate on different architectures, consensus mechanisms, or token standards. Since most blockchains function as isolated networks, a token that exists on one chain cannot be used on another chain without a bridging solution. For example, if you hold

USDC on Ethereum, you cannot use that same token on

Arbitrum or

Polygon because Ethereum USDC only exists on the Ethereum network. A crypto bridge solves this by either locking your Ethereum-based USDC and issuing an equivalent amount on the destination chain, or by using a liquidity pool to swap between native assets. Without a bridge, your Ethereum USDC would remain stuck on Ethereum, unusable in DeFi apps or trading platforms on other chains.

Bridges solve this problem by locking the original asset on the source chain and either creating a wrapped version on the destination chain or transferring the asset through shared liquidity pools, smart contracts, or cross-chain messaging systems. This process ensures that the value of the original asset is preserved while enabling cross-chain liquidity, trading, decentralized finance applications, and other forms of interoperability.

Bridge usage today happens on a large scale. Bridges connecting to the network

Solana have recorded total inbound volume exceeding $10.1 billion as of early 2025 after a 114% growth year-over-year. On a single recent day across all networks, cross-chain bridges collectively processed hundreds of millions in volume, underscoring how many users and institutions rely on bridging to move assets between chains.

When blockchains remain isolated, liquidity stays siloed and opportunities remain limited. Bridges connect fragmented liquidity pools and enable seamless movement between ecosystems. With bridging activity at this scale users can stake assets on one chain, trade on another, and provide liquidity elsewhere without selling tokens. The high volumes flowing through bridges support cross-chain yield strategies, diversified decentralized finance participation, and efficient capital allocation across multiple networks. As decentralized finance continues to expand, bridges help create a unified, interoperable financial system, unlocking new opportunities and flexibility for users and developers alike.

Why Are Cross Chain Bridges Important in DeFi and Why Use Them?

Cross-chain bridges are essential in DeFi because they unlock liquidity, enable cross-chain yield strategies, and allow users to leverage the strengths of different blockchains simultaneously. Many blockchains specialize in certain traits such as low fees, high speed, rich dApp ecosystems, or strong liquidity, but no single chain offers everything. Bridges let users move assets freely across chains so they can stake on one chain, trade on another, and provide liquidity elsewhere without selling tokens.

In 2025, total cross-chain bridging volume reached over $23 billion in a single month, with daily volumes around $884 million and weekly volumes exceeding $5.2 billion. These numbers highlight the rapid growth and heavy usage of bridges across the ecosystem. Without bridges, assets and liquidity would remain siloed, limiting the potential of decentralized finance. Bridges connect fragmented liquidity pools into a unified and interoperable financial system, enabling users to access the best rates, yields, and opportunities across multiple chains while maintaining control over their assets.

What Types of Blockchain Bridges Are There?

There are several bridge models, each offering different tradeoffs in security, speed, and user experience. In the lock and mint model, tokens are locked in a smart contract on the source chain and a wrapped or pegged version is minted on the destination chain, which allows transfers between completely incompatible networks but increases reliance on custodial contracts and wrapped-asset security.

1.

Liquidity pool bridges operate differently by using shared or cross-chain liquidity pools where users effectively swap one asset for its equivalent on another chain, which often reduces slippage, avoids wrapped tokens, and provides faster settlement during high traffic periods.

2. Some modern bridges support native asset transfers when both chains recognize the same token standard, enabling users to move the actual asset instead of a derivative and lowering systemic risk since no wrapped token is involved.

3. Hybrid bridges combine multiple mechanisms such as messaging layers, oracle verification, MPC relayers, and liquidity routing, allowing them to optimize for speed, lower fees, cross-chain composability, or enhanced resilience against validator failure.

These structural differences give users flexibility to choose a bridge architecture that aligns with their priorities whether they value maximum security, low fees, broad chain support, or the simplicity of native transfers.

How Do Crypto Bridges Work?

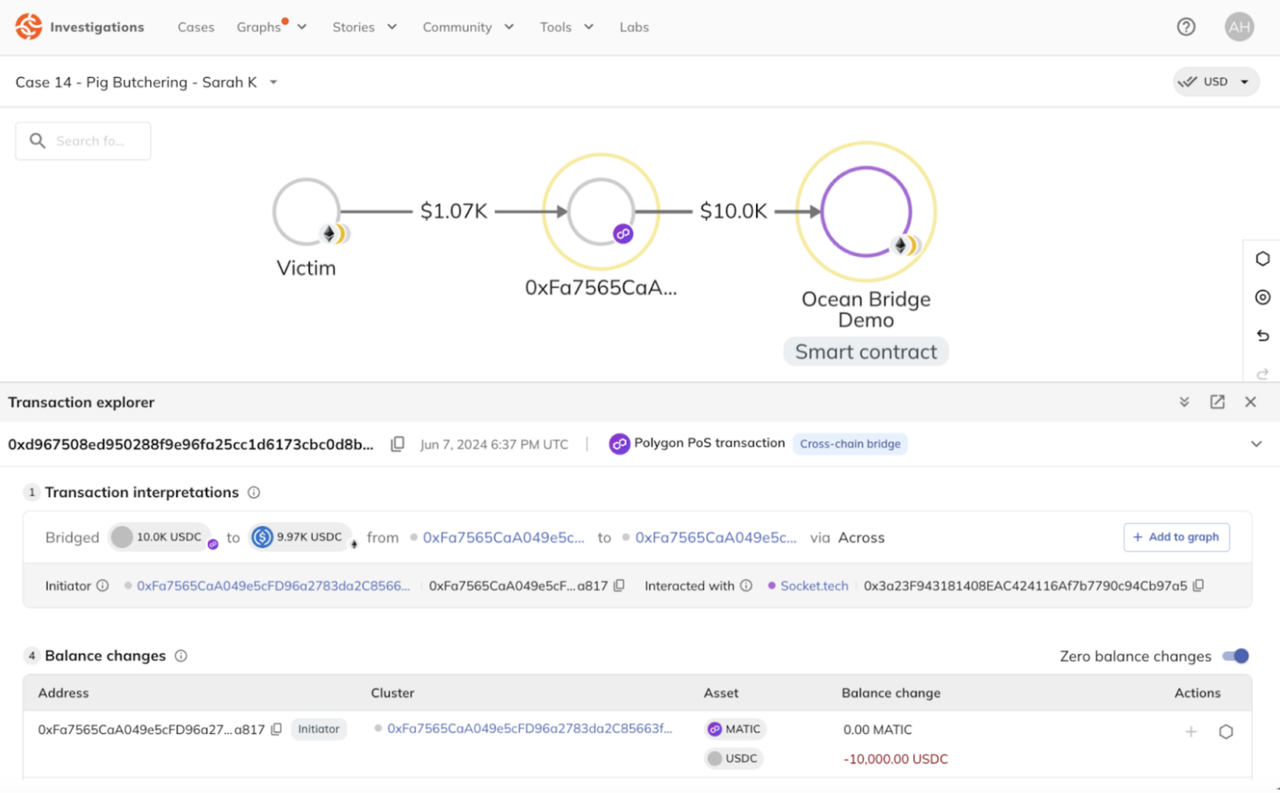

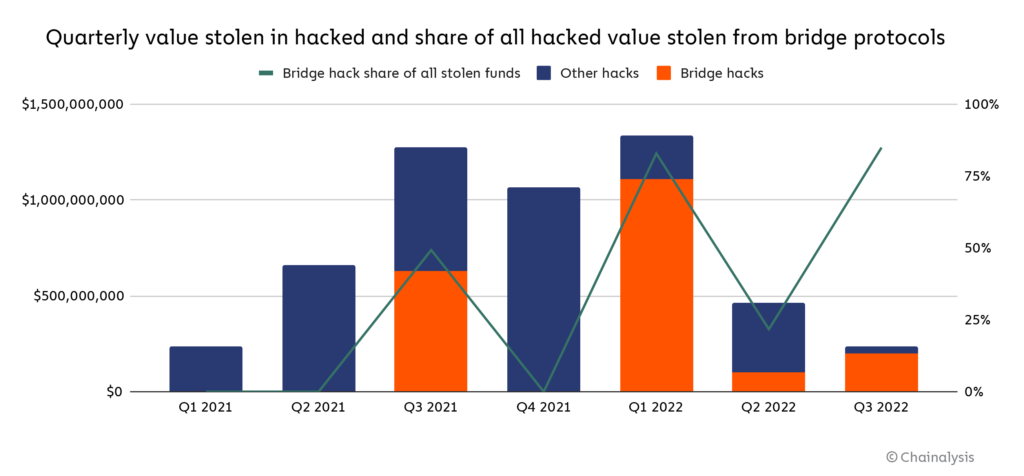

Source: Chainalysis

When a user wants to bridge assets, the bridge protocol usually initiates a smart contract on the source chain that locks or burns the tokens. A monitoring network such as validators, relayers, or oracles verifies the lock and triggers a corresponding mint or release on the destination chain.

In liquidity pool bridges, funds are sourced from pooled liquidity on each chain and tokens are swapped rather than wrapped. Once the bridging transaction is validated and confirmed on both chains, the user receives the new asset on the destination chain.

Bridges may also perform optional swap routing to minimize slippage or fees. Finality time, bridge fees, and gas costs vary by protocol, chain congestion, and token type, but many of the top bridges in 2025 offer transfers in under a minute and fees significantly lower than previous years.

What Are the 5 Best Crypto Bridges of 2025?

If you want to move assets seamlessly across blockchains, here are the five most popular crypto bridges of 2025 that offer the fastest speeds, lowest fees, and strongest security.

1. Symbiosis Finance

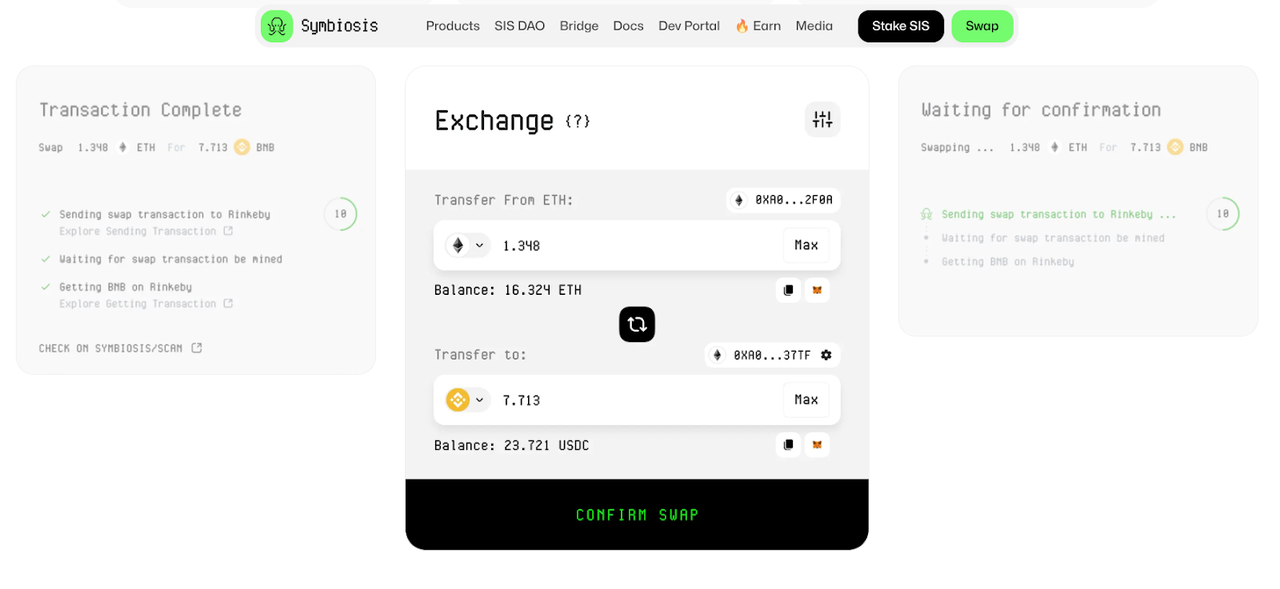

Source: Symbiosis

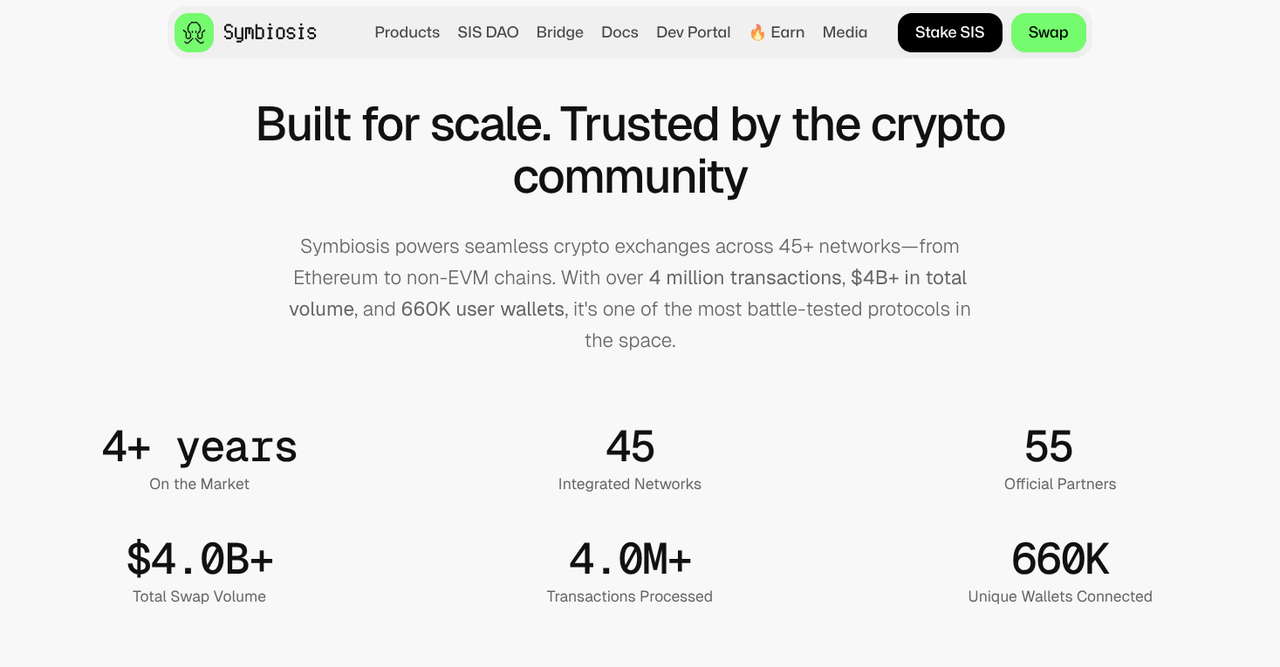

Symbiosis Finance supports more than 30 blockchains including both EVM and non EVM networks and over 430 token pairs, making it one of the most flexible bridging protocols available. The platform has liquidity across more than 48 chains and a 24-hour total value locked of around $10.67 million. Since launch, it has processed millions of cross-chain transactions and moved several billion dollars in total bridged volume across roughly 660,000 unique wallets. Its non-custodial relayer network uses multiparty computation cryptography to reduce single-point-of-failure risk and improve security.

Users can bridge or swap popular assets such as

Ethereum or

USDC as well as niche tokens across smaller ecosystems. The combined bridge and swap system allows assets to be transferred and converted in one workflow, reducing steps, minimizing slippage, and optimizing liquidity. Symbiosis also provides tools to track transactions and monitor liquidity pools. Its speed, reliability, and broad token support make it a top choice for traders who need coverage across multiple chains and a smooth experience. Adoption continues to grow with thousands of daily active users performing transfers and swaps.

2. Stargate

Stargate supports over 40 blockchains including major Layer 1 and growing Layer 2 networks. In a recent month, it handled more than $465 million in transfer volume and completed thousands of cross-chain transfers. The protocol focuses on native asset transfers instead of wrapped tokens, which simplifies the process and reduces exposure to wrapping risk. Shared liquidity pools offer deep liquidity and stable pricing across all supported networks, and the platform charges a standard 0.06% fee for most transfers. Many transfers settle quickly, making the bridge reliable for high-frequency or large-volume operations.

The system supports multiple stablecoins and governance tokens. Its infrastructure can handle peak activity without delays, ensuring smooth transfers even during high demand. Stargate is widely used by retail and institutional users for dependable and efficient cross-chain activity. Its combination of speed, reliability, and broad coverage makes it one of the most trusted bridging solutions in 2025.

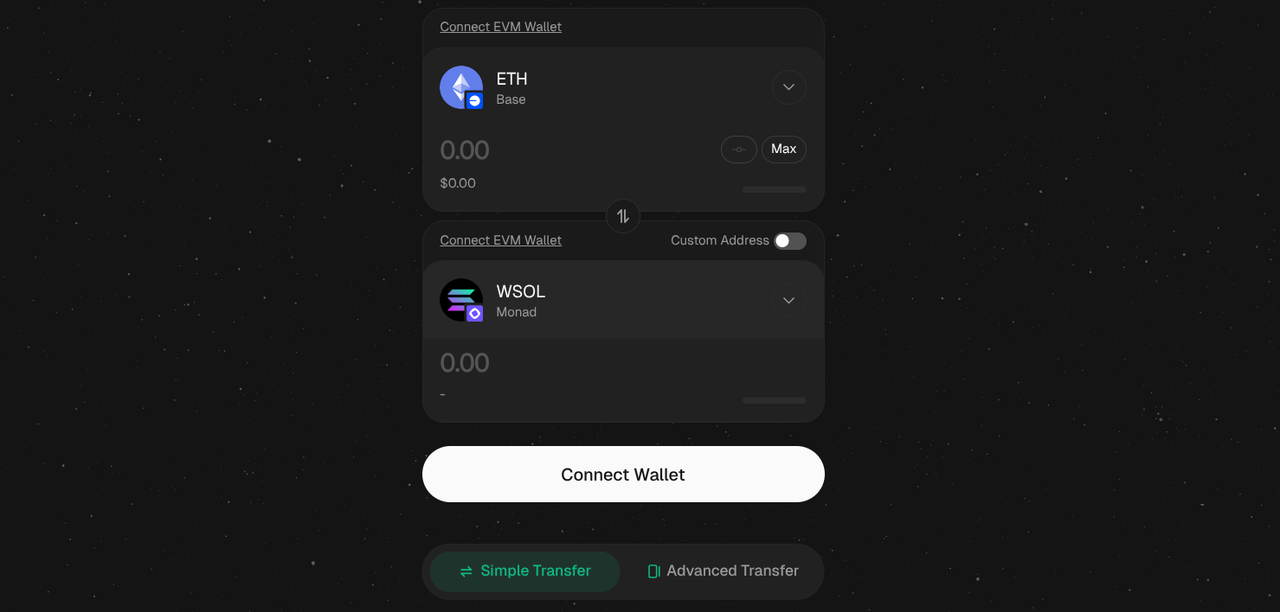

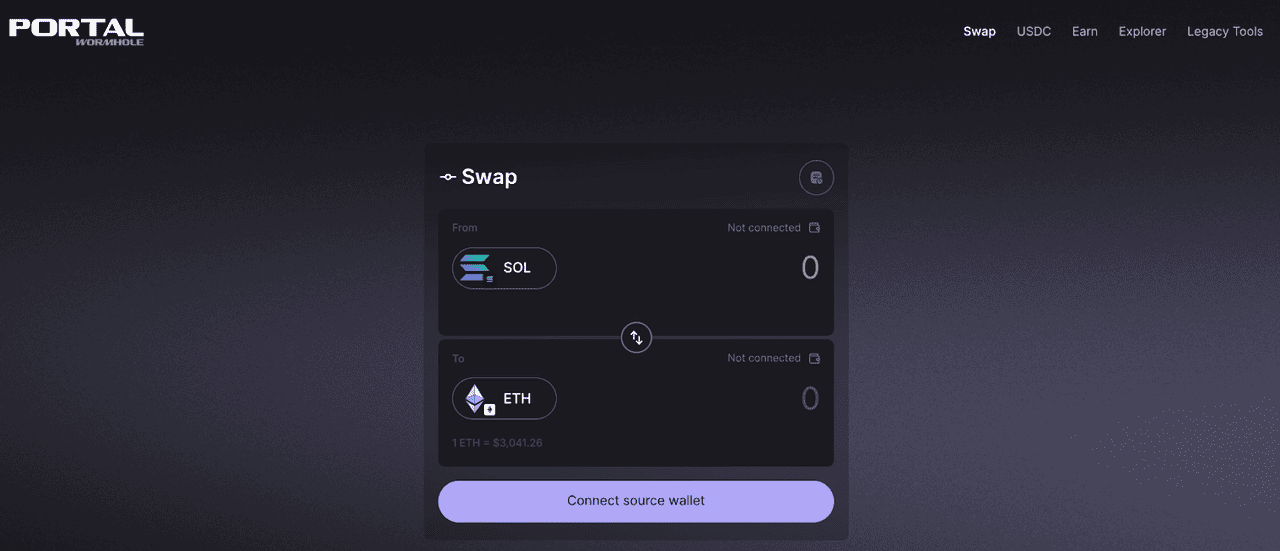

3. Portal by Wormhole

Portal Bridge connects many different blockchains including EVM chains, Solana, Cosmos-based networks, Aptos, Sui, and other emerging Layer-1 platforms. It uses a lock and mint mechanism in which tokens are locked on the source chain and pegged equivalents are minted on the destination chain. Portal supports 35 to 40 networks overall, making it one of the cross-chain bridges with the broadest chain coverage in 2025. The total volume bridged via Portal has now exceeded 60 billion dollars since inception. Many transfers via Portal cost under one cent, which makes it an especially attractive solution for frequent cross-chain users or for transfers of smaller amounts.

After undergoing security audits and upgrades following past incidents, Portal has strengthened its guardian node network and validation procedures. Many users rely on Portal for fast, low-cost transfers between widely different blockchain ecosystems, especially when they need access beyond just EVM-based networks. Its performance remains consistent even under high transaction volumes. Portal continues to add support for new chains and token types, keeping its coverage extensive for both developers and retail users.

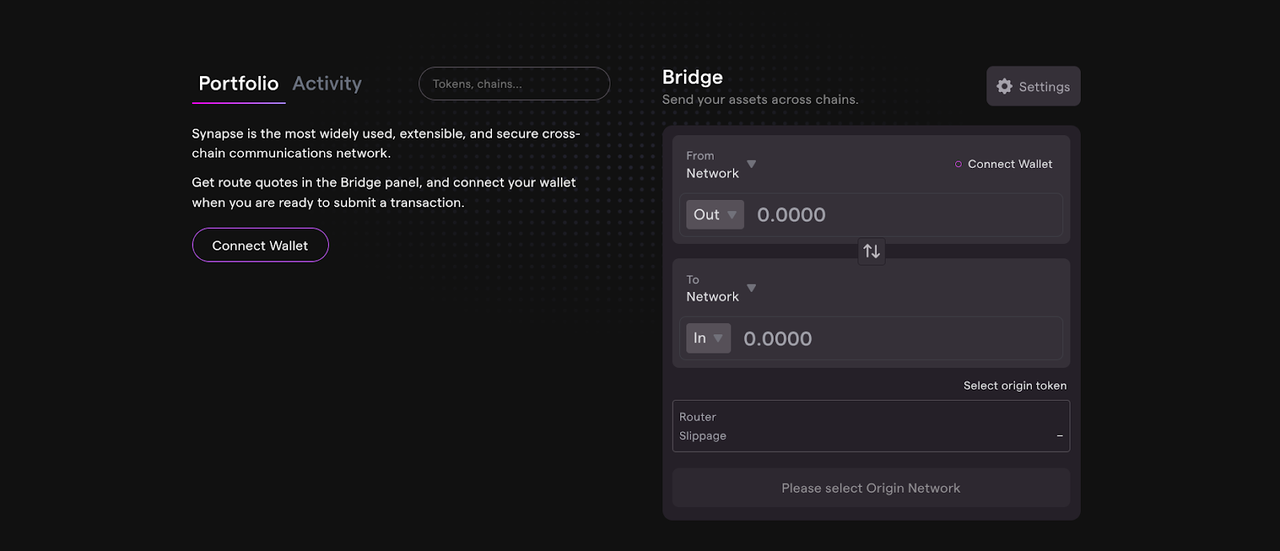

4. Synapse Protocol

Synapse Protocol enables bridging across more than 20 blockchains, primarily within the

EVM ecosystem but sometimes including non-EVM routes. Since it launched, Synapse has processed multiple billions of dollars in total bridging volume, making it a well-established and widely used bridge in the cross-chain infrastructure landscape. Its design combining liquidity pools with optimized routing allows many transfers to be up to 80% cheaper than comparable bridges on similar routes. Transfers typically complete within minutes, making Synapse suitable for users who value speed and low cost over maximal chain coverage.

The interface gives real-time slippage estimates and previewed outputs to help users avoid surprises on token amounts. Because of its audited smart contracts and liquidity management mechanisms, Synapse remains one of 2025's most efficient, cost-effective, and reliable bridges for token and stablecoin transfers between popular chains. Daily transfers often reach tens of thousands, and monthly active wallets exceed 120,000. Synapse also supports cross-chain swaps for both major and smaller tokens, increasing its usability for a wide range of users.

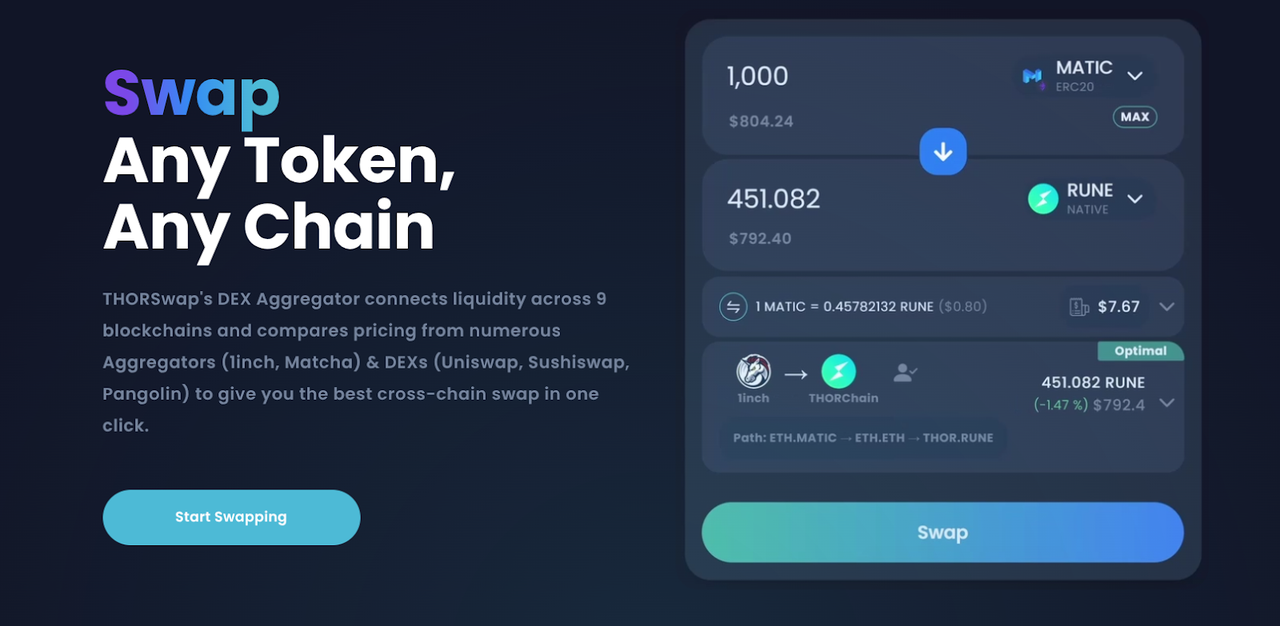

5. THORChain via THORSwap

THORChain is accessible through THORSwap, focuses on native-asset swaps rather than wrapped tokens. It supports around 16 blockchains including a mixture of EVM and non-EVM networks. Users can move native assets such as Bitcoin, Ether, and major stablecoins across supported chains while preserving their original form. In Q1 2025, THORChain processed a total USD volume of $19.62 billion, with a peak daily volume of 1.49 billion. During that period, liquidity providers earned 14.41 million in fees.

The platform's decentralized liquidity pools hold real native assets and enable direct swaps, reducing the risks associated with wrapped or synthetic assets and centralized custody. Swap fees average around 0.5%, but many small swaps can effectively cost very little because of the pool structure and liquidity. For users who value decentralization, transparency, native-asset integrity, and cross-chain swaps without wrapping, THORChain remains one of the most powerful and high-volume bridging options in 2025. THORChain continues to expand pool liquidity and add new assets to its network, keeping it competitive with the most active cross-chain bridges.

How to Choose the Right Cross Chain Bridge: Key Factors to Consider

Choosing the right cross-chain bridge depends on security, cost, compatibility, and how reliably it handles the assets you want to move.

1. Check chain and token support: Confirm the bridge supports both your source/destination networks and the specific asset you plan to transfer.

2. Evaluate total costs: Compare bridge fees, gas fees, and expected slippage — small percentage differences matter on large transfers.

3. Prioritize security: Review audits, decentralization of relayers/validators, custodial vs. non-custodial design, and protections like multisig or time-locked withdrawals.

4. Assess liquidity depth: Deeper pools reduce slippage and failed transactions, especially during volatile periods.

5. Look at speed and finality: Faster bridges are crucial if you’re moving funds for trading, yield farming, or liquidity operations.

6. Check reliability and track record: Consider uptime history, incident response, and whether past issues were resolved quickly.

7. Evaluate UX and transparency: Choose bridges with clear fee breakdowns, simple interfaces, and intuitive transaction prompts to reduce user error.

8. Match tools to your needs:

• Portal Bridge for low-cost transfers across non-EVM chains

• Synapse for fast, cheap bridging for stablecoins across EVM networks

• THORChain for native BTC/ETH swaps without wrapping

These factors together help you identify the safest and most efficient bridge for your goals.

Are Crypto Bridges Safe to Use?

Crypto bridges do carry real risk because they manage large liquidity pools and operate across multiple chains, which widens the attack surface. Since 2021, bridge exploits have caused more than $4.3 billion in losses, including several high profile hacks over $300 million each caused by smart contract flaws, compromised validator keys, and relayer failures.

In 2025, leading bridges have strengthened security with multi layer audits, decentralized relayer networks, MPC signing, real time monitoring, and bug bounty programs that offer up to $10 million for critical findings. Users can reduce risk by using the bridges mentioned in this article, including Symbiosis Finance, Stargate, Portal Bridge, Synapse Protocol, and THORChain via THORSwap, verifying contract addresses from official sources, avoiding very large transfers in a single transaction, and checking network status before moving assets.

While no bridge is fully risk free, the most established protocols offer significantly higher levels of transparency, security hardening, and reliability compared to earlier years.

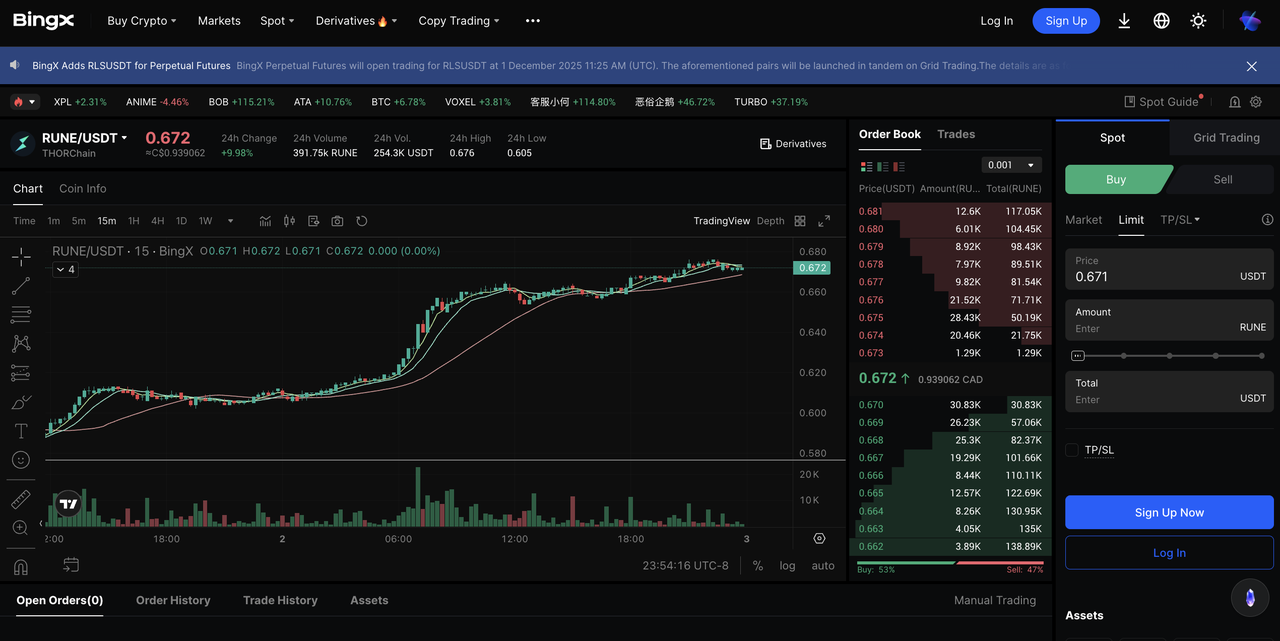

How to Buy Cross-Chain Bridge Governance Tokens on BingX

1. Create or log in to your BingX account: Sign up with your email or mobile number and

complete KYC if required in your region.

4. Use BingX AI for market insights: Check AI-generated signals, market trends, and price analysis to make informed decisions before placing your trade.

5. Enter the amount of governance bridge tokens you want to buy: Choose

Market Order for instant execution or Limit Order to set your preferred price.

6. Confirm your purchase: Review your order, tap Buy, and your RUNE, STG or SIS will be added to your BingX Spot Wallet.

7. Store or transfer your STG, RUNE, SIS tokens: Keep your RUNE, STG or SIS securely on BingX or withdraw to a self-custody wallet for DeFi, staking, or Web3 apps.

Conclusion

As DeFi expands toward 42.76 billion dollars in TVL in 2025, crypto bridges remain essential for building a connected and interoperable blockchain ecosystem. Leading bridge solutions such as Symbiosis Finance, Stargate, Portal, Synapse, and THORChain offer strong chain support, fast transfers, low fees, and a variety of technical models including native asset transfers, liquidity pool swaps, and wrapped token workflows. When used correctly and with attention to security, these bridges unlock multi chain liquidity, cross chain yield strategies, and seamless asset movement across decentralized networks. Understanding how bridges work and knowing how to choose the right one is essential for any user navigating the expanding DeFi landscape.

Related Reading