On 14 October 2025, the MON airdrop claims were opened for

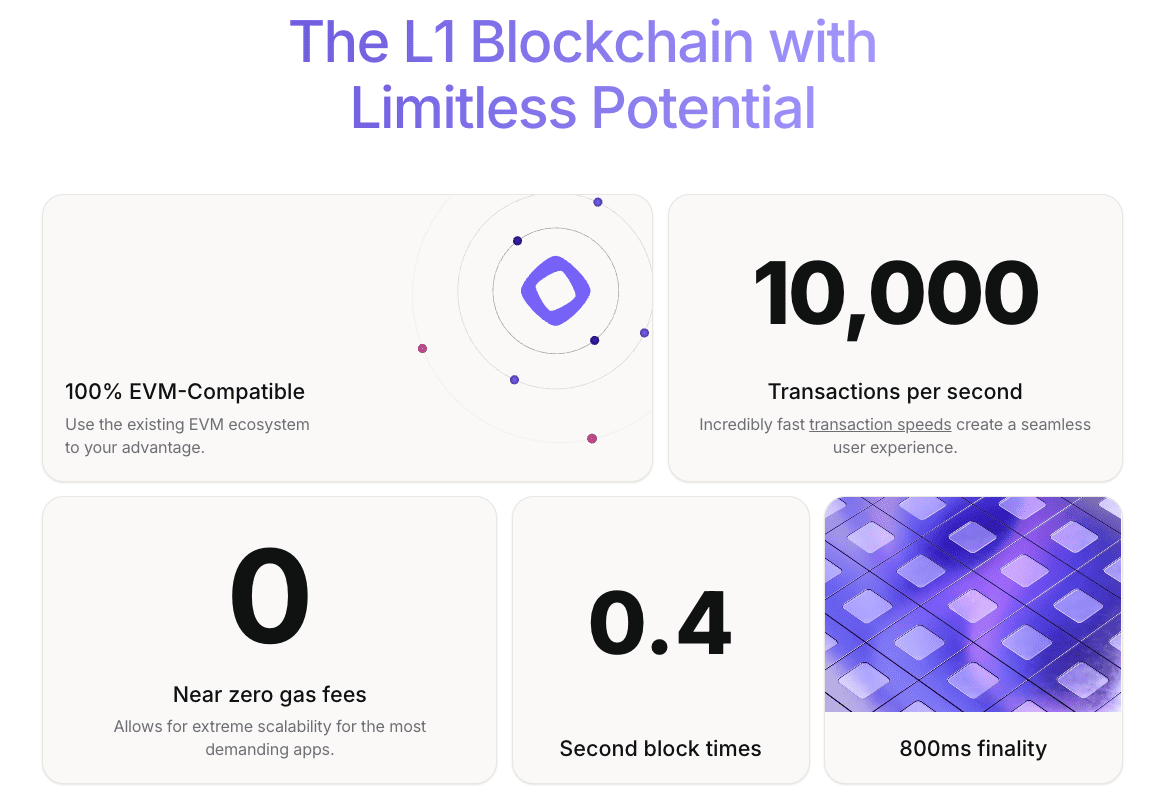

Monad, a high-performance, EVM-compatible

Layer 1 blockchain built to handle 10,000 transactions per second (TPS), 0.4 second block-times, and 0.8 second finality. With near-zero fees and a familiar

Ethereum-tooling stack, Monad sets a new benchmark for Web3 scalability.

This guide walks you through what Monad is, the MON airdrop mechanics, how to claim your $MON tokens, and how to trade MON tokens on BingX after claiming your

airdrop.

What Is Monad (MON) and How Does It Work?

Monad is designed for high-speed, low-cost blockchain applications, while retaining Ethereum compatibility so developers and users don’t need to relearn the stack. It supports dApps that demand rapid state updates and near-instant settlements, such as trading platforms, DeFi protocols with frequent transactions, real-time games or interactive social apps.

Because it uses the same Solidity,

MetaMask, and EVM libraries as Ethereum, migration is effortless. And thanks to its architecture, parallel execution, asynchronous consensus and custom database (MonadDB), it can scale many users without degrading performance and keeps hardware requirements modest, helping decentralise node participation.

In effect: you get the developer comfort of Ethereum plus the speed and efficiency of a next-gen chain.

What Are Monad’s Core Use Cases?

Source: Monad

Monad’s architecture uniquely positions it for use cases that require very high throughput, low latency, and low costs, all within the familiar EVM environment. Typical applications include:

• High-frequency trading platforms and real-time DeFi where state changes and contracts execute rapidly under tight latency constraints.

•

Gaming and interactive

on-chain social apps where asset transfers, game-moves or posts must settle instantly for smooth user experience.

• Migrated Ethereum dApps that want better performance but don’t want to rewrite contracts, thanks to full EVM bytecode compatibility.

• Validator networks and infrastructure where lower hardware requirements mean more distributed participation, supporting the decentralisation side of the trilemma.

What Is MON, the Native Token of the Monad Network?

The MON token is the native utility and governance asset for the Monad network, powering the ecosystem in multiple ways. It is used to pay for transaction fees and smart-contract execution on the chain; to stake and participate in network security; to vote in governance decisions; and to unlock community incentives for builders and validators.

MON Tokenomics

The MON token is the native asset powering the Monad network, used for transaction fees, staking, and governance. At the launch of Monad Public Mainnet on 24 November 2025, MON will have a fixed initial supply of 100,000,000,000 tokens, with a transparent allocation model designed to support long-term decentralization, ecosystem growth, and stakeholder alignment.

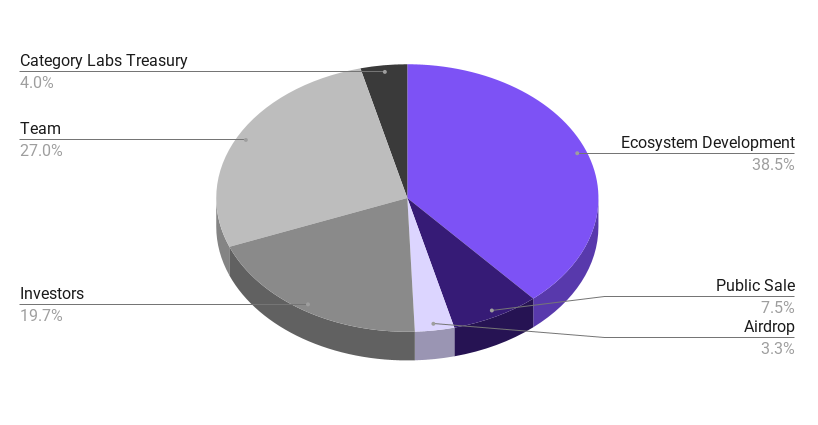

MON Token Allocation: Initial Supply Breakdown

MON token distribution | Source: Monad blog

Monad will launch with a total initial supply of 100 billion MON, allocated across six major groups:

• 7.5% — Public Sale: Sold on Coinbase at $0.025 per token and distributed at mainnet launch. Any unsold tokens are redirected to the Ecosystem Development fund.

• 3.3% — Airdrop: Distributed to around 289,000 eligible wallets, including Monad Community members, active on-chain users, contributors, and builders.

• 38.5% — Ecosystem Development: Fully unlocked at launch and managed by the Monad Foundation to support long-term ecosystem growth through grants, incentives, and infrastructure. 15–25 billion MON tokens will be delegated in Year 1 to strengthen validator decentralization.

• 27% — Team: Allocated to founders, employees, and contractors, locked for one year and then vested over a three-year schedule.

• 19.7% — Investors: Locked for one year with 1/48 monthly unlocks afterward, completing a four-year release cycle.

• 3.95% — Category Labs Treasury: Reserved for future team compensation, locked for one year and then released monthly over four years, mirroring investor terms.

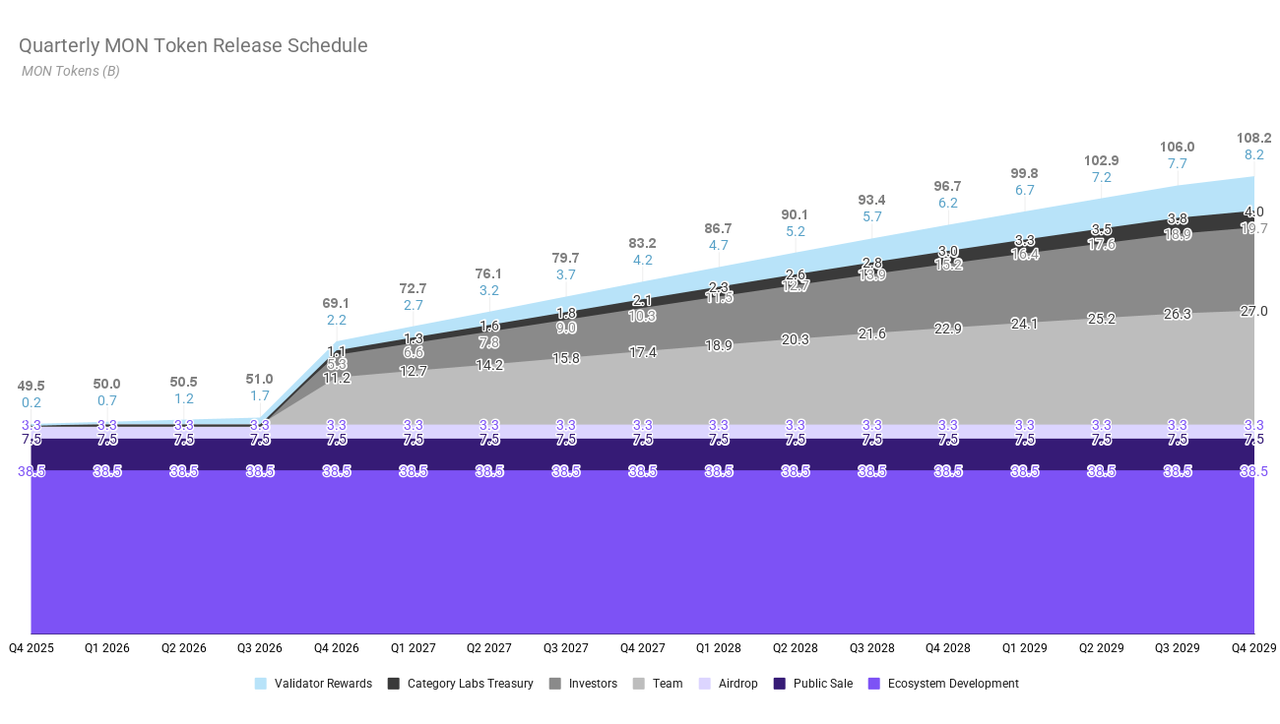

Estimated MON Token Release Schedule

MON unlocks gradually over four years (2025–2029), driven by:

- Team vesting

- Investor vesting

- Treasury unlocks

What Is the Monad Airdrop and How to Claim MON Tokens?

The MON airdrop is the flagship token-distribution event from the Monad Foundation, aimed at rewarding early supporters, builder-contributors and high-activity crypto participants with free MON tokens ahead of mainnet. The claim portal launched on 14 October 2025 at

claim.monad.xyz, the only valid site for participation.

In total, around 289 000 eligible wallets across five distinct tracks were invited to claim from a pool of 4.73 billion MON tokens, of which 3.33 billion or 70.4% were claimed.

How to Claim MON Airdrop

1. Visit the official claim portal: Navigate to claim.monad.xyz and verify the domain. This is the only official link.

2. Connect your wallet or account via Privy: Support includes

EVM wallets, such as MetaMask,

Solana wallets and optional verification via Twitter, Discord, Telegram, Farcaster or email.

3. Check your eligibility: Allocations are stacked across five tracks Monad Community, On-chain Users, Crypto Community, Crypto Contributors & Curious, and Monad Builders. If you qualify under multiple tracks, your allocation adds up.

4. Claim your tokens: if eligible, proceed with the claim transaction. The portal was open until 3 November 2025.

5. Wait for mainnet unlock: Claimed tokens are placed into an escrow smart contract and will be released to your wallet on the day of the Monad Public Mainnet launch on 24 November 2025.

How to Stay Safe When Claiming Monad (MON) Airdrop

Always follow strict security practices when claiming MON: never share your private key or seed phrase under any circumstance, as Monad will never request them; only use the official claim portal at claim.monad.xyz and avoid links shared through DMs, Telegram groups, or social posts; and carefully review wallet addresses, connection requests, and signing prompts to ensure you are only approving legitimate transactions you fully understand.

How to Trade Monad (MON) on BingX After the Token Launch

BingX lets you trade MON easily using both spot and perpetual futures, with BingX AI tools helping you analyze volatility, funding rates, entry timing, and overall market conditions.

Buy or Sell MON Tokens on BingX Spot Market

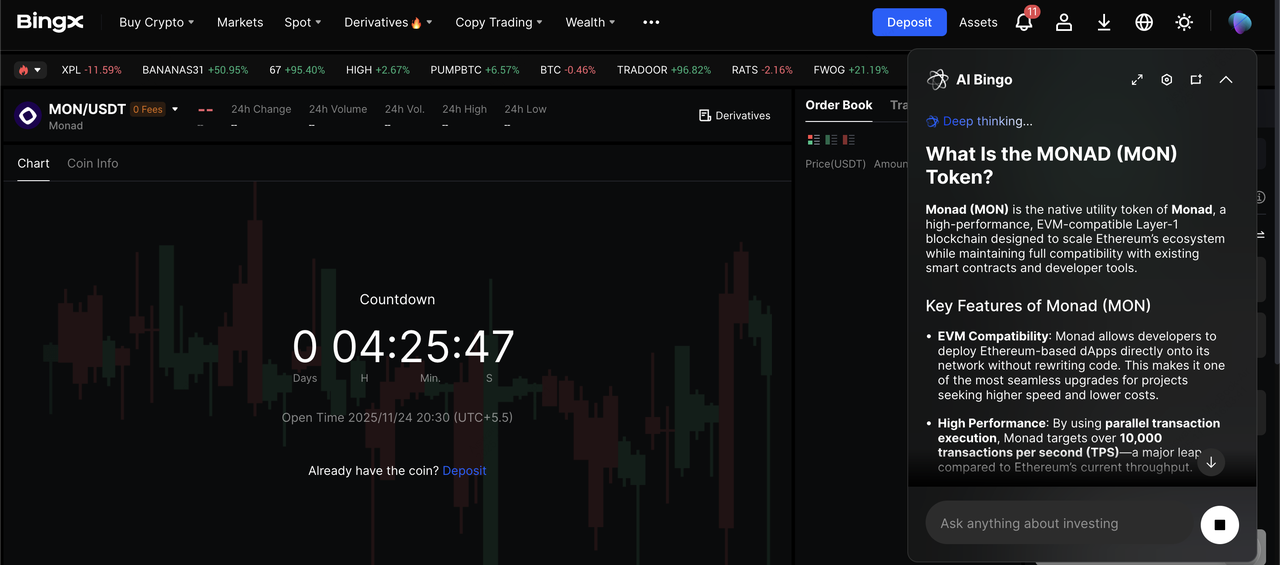

MONAD/USDT trading pair on the spot market powered by BingX AI insights

Spot trading lets you buy or sell real MON tokens, ideal if you claimed MON from the airdrop or want long-term exposure after the mainnet launch.

1. Search for MON/USDT: Go to the Spot section on BingX and enter

MONAD/USDT in the search bar to access the pair.

2. Deposit or Transfer MON: If you claimed MON via the airdrop, withdraw it from your wallet to your BingX MON deposit address. Send a small test amount first to confirm the network and contract.

3. Choose Your Order Type

• Limit Order: Set your preferred price and wait for the order to fill.

4. Manage Your Position: Use the trading dashboard to track open orders, fills, and your MON balance.

5. Secure Your Assets: You may hold MON on BingX or transfer it back to your

self-custody wallet depending on your strategy.

Tip: Newly listed tokens often face sharp swings; use limit orders to avoid slippage.

Long or Short MON Perpetual Futures on BingX

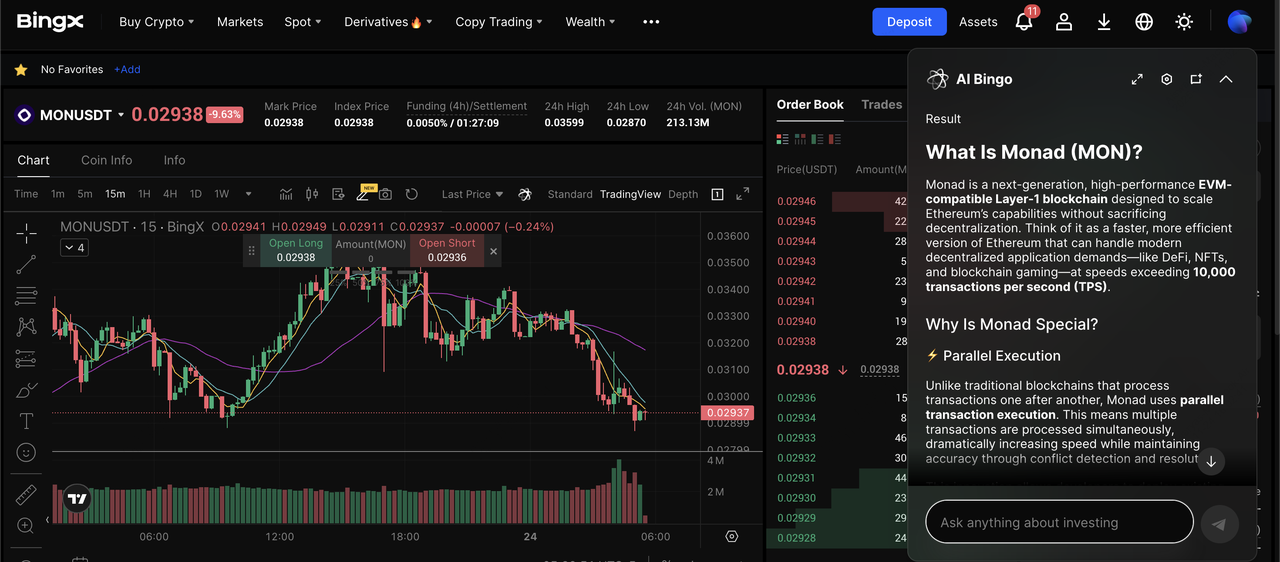

MONAD/USDT perpetual contract on the futures market powered by BingX AI

Futures let you trade MON with leverage without holding the token, ideal for short-term moves or hedging after the airdrop.

2. Review Key Contract Specs

- Check essential parameters:

- Leverage options, 5×, 10×, etc.

- Initial and maintenance margin

- Mark vs. index price

- Liquidation rules

3. Choose Long or Short and Set Leverage

- Long (Buy) if you expect MON to rise

- Short (Sell) if you expect MON to fall

Use lower leverage during volatile launch periods.

4. Set Entry, Exit and Risk Controls: Enable risk tools:

- Reduce-only orders

- Margin-level alerts

5. Monitor Funding and Volatility: Funding updates several times daily:

- Positive: Longs pay shorts

- Negative: Shorts pay longs

6. Close Your Position Anytime: Close manually or rely on SL/TP orders. All P&L (profit and loss) settles in

USDT for easy tracking and withdrawal.

Conclusion

Monad’s launch marks one of the most anticipated Layer-1 rollouts of 2025, combining high throughput, sub-second finality, and full EVM compatibility with a broadly distributed token airdrop. With MON now tradable on BingX through both spot and perpetual futures markets, users can engage with the ecosystem early, whether by holding tokens, providing liquidity, or trading short-term price movements.

That said, new-token markets carry heightened risks. Airdrop periods attract fake websites, early price discovery is volatile, and funding rates can shift quickly. Always use the official claim portal, avoid sharing private keys, confirm deposit routes, and begin with small test transfers. Futures traders should use conservative leverage, set risk controls, and monitor unlock schedules that may influence supply over time. Trade cautiously and rely only on verified information to navigate MON’s early market phases safely.

Related Reading