Global financial markets are experiencing a profound "on-chain migration." As of January 2026, the U.S. Securities and Exchange Commission (SEC) has gradually clarified the regulatory scope applicable to tokenized securities, reaffirming that they remain within the existing securities law framework. Traditional capital markets have also begun to positively respond to the structural changes brought by digital assets and round-the-clock exchanges. The previously clear boundaries between U.S. stocks and crypto markets are being redefined at an accelerated pace. Prior to this, by the end of 2025, major exchanges including NASDAQ had successively submitted plans to the SEC, evaluating the formal integration of tokenized securities into trading and settlement processes, and exploring the possibility of launching the first batch of tokenized settlement transactions in the third quarter of 2026. Entering mid-January 2026, this trend has been further implemented. Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), publicly announced that it is developing a blockchain-based tokenized securities trading platform, aiming to support 24/7 trading and real-time settlement after obtaining approval.

Against this market backdrop, tokenized U.S. stocks are no longer just conceptual discussions, but are gradually transforming into actually operable asset forms. As trading time restrictions are broken and asset forms become more digitalized, investors' attention has turned to the capacity of trading platforms themselves, including product design, trading depth, and operational thresholds. This article will use actual usage scenarios as the background to explain how investors can trade tokenized U.S. stocks on BingX, and organize the positioning and differences of mainstream trading platforms at the operational level in 2026.

What are Tokenized Stocks?

Tokenized U.S. stocks refer to converting the price exposure of U.S. listed stocks into tradeable token assets through blockchain technology, allowing investors to participate in the U.S. stock market in the form of crypto assets. These tokens typically have high correlation with specific stock prices, such as tracking the price movements of

NVIDIA (NVDA) or

Tesla (TSLA), but essentially they do not represent direct ownership of the stocks themselves, but rather hold a digital mapping of their economic value.

From a market practice perspective, most tokenized U.S. stocks currently belong to "price-type assets," with their core function being to provide U.S. stock price participation and trading flexibility. As for

whether tokenized stocks include shareholder rights, including dividends, voting rights, or legal ownership, varies depending on different platforms and product designs, which is also one of the important distinctions between various trading platforms. For most users, the value of tokenized U.S. stocks lies not in corporate governance participation, but in whether they can allocate and adjust U.S. stock exposure in a more flexible manner.

In current market practice, tokenized U.S. stocks mainly possess the following characteristics:

1. Providing on-chain forms of U.S. stock price exposure: Tokenized U.S. stocks allow investors to participate in U.S. stock price fluctuations without opening traditional overseas brokerage accounts, and incorporate U.S. stock positions into existing crypto asset accounts for management.

2. Breaking traditional U.S. stock trading hour restrictions: Compared to U.S. stocks that only open during specific hours, tokenized U.S. stocks can be traded nearly 24/7 depending on platform design, allowing investors to adjust positions outside of U.S. stock market hours.

3. Becoming part of cross-asset allocation: Tokenized U.S. stocks can be allocated alongside

stablecoins, other crypto assets, or derivatives, allowing investment portfolios to be managed based on overall risk and exposure structure rather than focusing solely on a single market.

4. Lowering entry and operational thresholds for high-priced stocks: Through tokenized forms, investors can participate in high-priced U.S. stock price movements with smaller units and use familiar crypto trading interfaces to complete transactions.

5. Enhancing fund deployment and operational flexibility: When U.S. stocks exist in token form, funds are no longer locked within a single brokerage system but can quickly switch between different trading platforms and assets, improving overall capital utilization efficiency.

As exchange infrastructure and product design have gradually matured, tokenized U.S. stocks have transformed from conceptual products to cross-market tools with actual trading and allocation value between the end of 2025 and 2026, becoming an important bridge connecting the U.S. stock market and crypto financial systems.

Tokenized U.S. Stocks vs. Traditional U.S. Stocks: Key Differences Explained

Overall, the core differences between tokenized U.S. stocks and traditional U.S. stock investment lie not in the investment targets themselves, but in trading methods and asset structure. Tokenized U.S. stocks bring U.S. stock exposure into the blockchain environment, emphasizing trading flexibility and capital deployment efficiency; traditional U.S. stock investment is built on existing brokerage systems, focusing on equity holding and long-term investment attributes. The following compares the differences between the two investment methods from several practical perspectives.

| Comparison Aspect |

Tokenized Stocks |

Traditional U.S. Stock Investment |

| Trading Hours |

Nearly 24/7 trading depending on platform design |

Limited by U.S. stock exchange operating hours |

| Asset Form |

Exists as tokens on blockchain |

Exists as stocks in brokerage accounts |

| Account & Fund Structure |

Crypto asset accounts, managed together with stablecoins and other crypto assets |

Overseas brokerage accounts, separated from crypto asset systems |

| Asset Rights |

Mostly price-type assets, usually do not include complete shareholder rights |

Direct stock ownership, including shareholder rights and dividends |

| Trading Units |

Can trade in fractional units, lowering entry threshold for high-priced stocks |

Usually traded in whole shares or fixed units |

| Operational & Deployment Flexibility |

Funds can quickly switch between different assets and strategies |

Funds mostly locked within single brokerage system |

2026 Global Tokenized Stock Market Predictions: Standard Chartered Projects a $2 Trillion Market by 2028

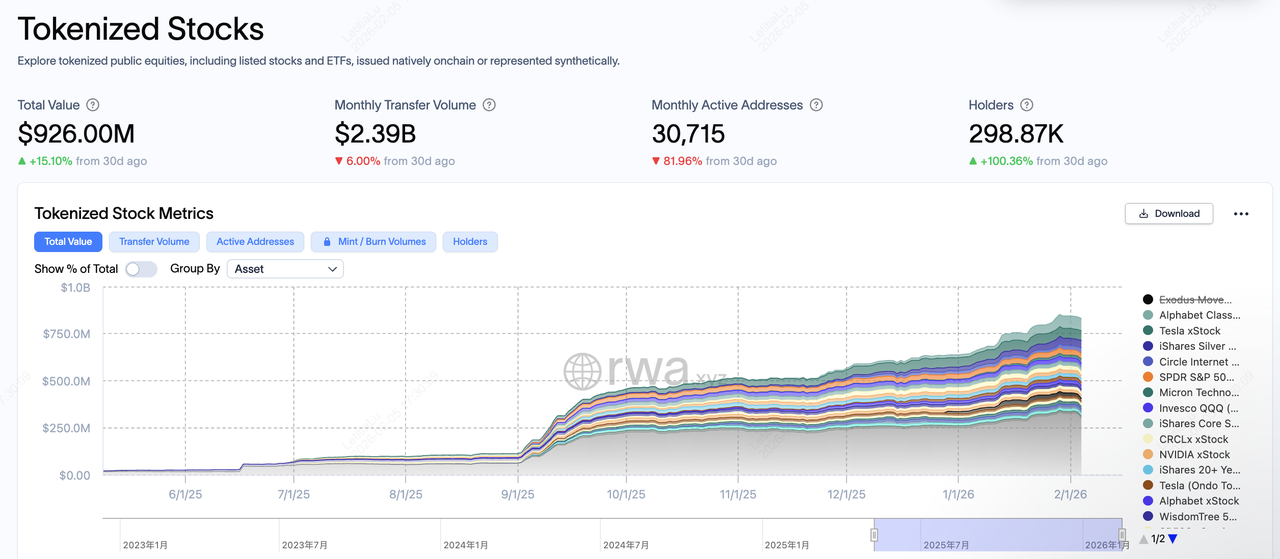

Source: RWA.xyz

Entering early 2026, tokenized U.S. stocks have gradually evolved from early experimental products to quantifiable cross-market asset classes. According to RWA.xyz statistics from late January 2026, global

tokenized stocks total market cap has approached $926 million, with monthly transfer transaction volume around $2.39 billion, active wallet addresses approximately 30,000, and cumulative holding wallets approaching 300,000. Compared to the nearly negligible scale before 2024, tokenized U.S. stocks showed significant acceleration growth from the second half of 2025 to early 2026.

When placing tokenized U.S. stocks in the broader context of

Real World Asset (RWA) tokenization, the growth trend becomes even more apparent. As of early 2026, the total Distributed Asset Value of RWA exceeded $24 billion, representing the total market cap of assets that actually exist in token form and can be freely transferred and traded on-chain; while the Represented Asset Value approached $370 billion, reflecting the nominal scale of underlying real assets currently incorporated into tokenization structures and corresponding to on-chain assets.

Within this structure, tokenized U.S. stocks remain a relatively early but clearly growing asset class in the RWA market. Market liquidity is currently mainly concentrated in large tech stocks and index-based targets, such as NVIDIA, Tesla,

Google (Alphabet), and tokenized products tracking

S&P 500 or

Nasdaq-100 ETFs. From a medium to long-term perspective, several financial institutions have also given positive expectations for the overall tokenized asset market. For example, Standard Chartered Bank predicts that global tokenized real-world assets (excluding stablecoins) could expand to approximately $2 trillion by 2028, reflecting institutionalization processes, increased institutional participation, and improved on-chain settlement efficiency will continue to drive market scale growth. Under this trend, tokenized U.S. stocks with high liquidity and strong market consensus are viewed as one of the application scenarios most likely to scale up first.

What Are the Common Ways to Invest in Tokenized U.S. Stocks?

For investors, participating in the tokenized U.S. stock market can currently be accomplished through the following three main channels. The three differ in asset form, operational thresholds, and risk structures, with different suitable use cases.

1. Centralized Crypto Exchanges (CEX)

Centralized exchanges are currently the most convenient and common entry method. These platforms provide operating interfaces similar to general crypto trading, supporting direct buying and selling of tokenized U.S. stocks with

USDT or

USDC and other stablecoins, with relatively stable liquidity and smaller bid-ask spreads. Taking BingX as an example, users can directly incorporate U.S. stock price exposure into crypto asset accounts through familiar crypto trading architecture, with overall operational processes highly consistent with general crypto asset trading and relatively low entry thresholds.

2. Decentralized Exchanges and DeFi Protocols (DEX)

Decentralized exchanges are more suitable for investors who prefer to maintain control over their assets and are familiar with on-chain operations. In the

Solana blockchain ecosystem,

Jupiter,

Raydium,

Kamino and other protocols already support on-chain trading of

xStocks and other tokenized stocks. Users can complete asset exchanges directly through wallets, enjoying 24/7 trading and highly autonomous management flexibility, but also need to bear slippage and smart contract-related risks themselves.

3. Decentralized Perpetual Contract and Derivatives Platforms (Perp DEX)

The third method is to obtain U.S. stock price exposure through

decentralized perpetual contract exchanges (Perp DEX).

Hyperliquid and

Aster and other platforms already provide perpetual contract trading related to stock indices or individual stocks. These products do not directly hold tokenized U.S. stocks but participate in price fluctuations through derivatives, usually accompanied by higher leverage and risk, more suitable for short-term trading or users with risk management experience.

Best Tokenized U.S. Stock Exchanges to Use in 2026

As tokenized U.S. stocks gradually become practically allocatable cross-market assets, the product design and infrastructure of trading platforms themselves have become key factors affecting user experience. Different platforms show significant differences in the presentation of tokenized U.S. stocks, trading depth, capital flow efficiency, and risk management. For investors, choosing the right platform is not only about whether they can trade, but also about whether operations are smooth, assets are easy to manage, and whether U.S. stock exposure can be naturally incorporated into existing crypto asset allocation. The following will organize representative tokenized U.S. stock trading platforms in the 2026 market and explain the positioning and differences of each platform at the operational level from the perspective of local usage scenarios.

1. BingX Centralized Exchange (CEX)

• Platform Features: Provides both 1:1 tokenized U.S. stock spot and U.S. stock perpetual contracts, fully integrating U.S. stock price exposure into existing crypto trading systems.

• Suitable Users: Whether newcomers to tokenized U.S. stocks or users with crypto trading experience who want to operate both spot and derivatives in the same account.

Among the many platforms providing tokenized U.S. stock related products, BingX is one of the representatives that most naturally integrates U.S. stock price exposure into crypto trading systems. Its core advantage lies in allowing users to participate in the U.S. stock market using familiar crypto trading logic without entering traditional overseas brokerage accounts or dealing with complex cross-border clearing and settlement processes.

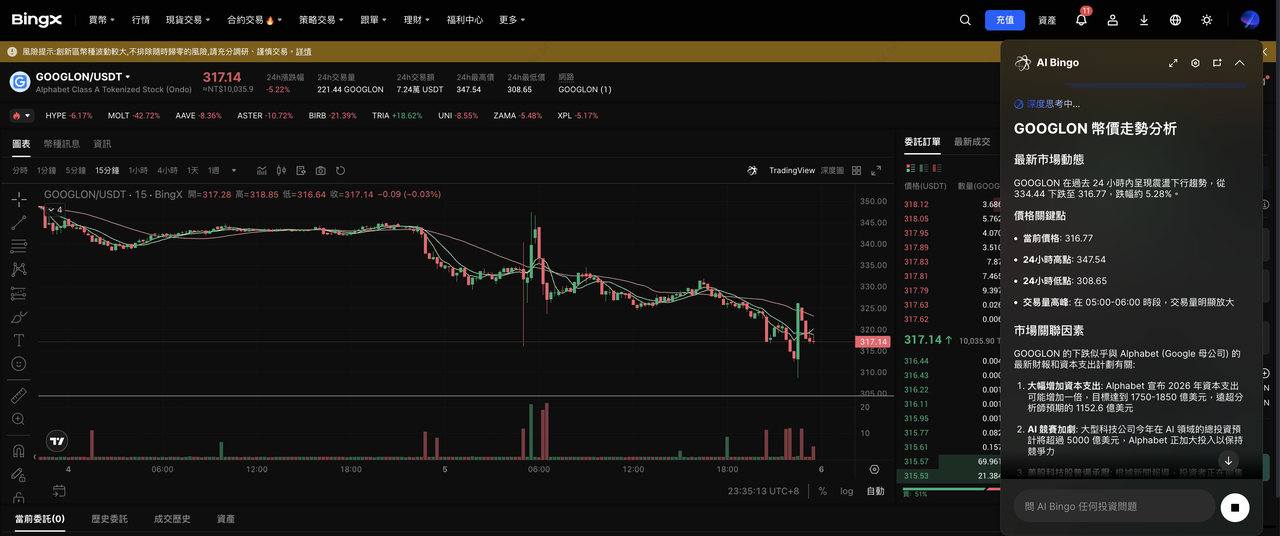

Entering early 2026, BingX officially launched

TradFi related services, significantly expanding the product depth and breadth of tokenized U.S. stocks. The platform currently supports over 25 tokenized stocks issued by

Ondo Finance with fully collateralized structures, as well as 10

Solana xStocks from Backed Finance, while also providing about 35 U.S. stock related perpetual contracts and index products. This product configuration allows investors to flexibly choose between "directly holding tokenized stocks" and "obtaining price exposure through perpetual contracts" based on trading strategies and risk preferences.

In terms of actual trading, BingX's covered targets focus on

AI stocks and

tech stocks with the highest market attention and relatively mature liquidity, including NVIDIA, Alphabet (Google), and

Apple, all of which can be directly positioned with USDT. Combined with a relatively friendly interface design for traditional Chinese users and competitive spot trading fee structure (maker 0.02%, taker 0.05%), BingX is more like a comprehensive entry point that can be used long-term in tokenized U.S. stock actual operations, rather than just an experimental product for trial. For users, this design means that U.S. stock exposure can be incorporated into existing crypto asset accounts for unified management, and adjustments can be made between spot and related derivatives according to personal trading rhythms without having to switch between different trading systems or account structures.

2. Kraken Centralized Exchange (CEX)

• Platform Features: Focuses on tokenized U.S. stock spot, with product structure and operational logic leaning toward traditional stock trading, emphasizing clear asset correspondence and account-level management.

• Suitable Users: Professional users with trading experience who are accustomed to more traditional operating interfaces and prefer to hold and allocate tokenized U.S. stocks in a "stock-like" manner.

In the layout of tokenized U.S. stock related products, Kraken adopts a relatively conservative and structurally clear design approach. Its tokenized stocks (xStocks) are viewed as extensions of traditional stocks in digital trading environments, with product positioning closer to "stock corresponding assets that can be held and traded in crypto accounts" rather than tools with high trading flexibility or strategic extension as the core. In terms of product structure, Kraken's tokenized U.S. stocks adopt a 1:1 correspondence with physical stocks or ETFs, and use clear asset correspondence and holding logic as core explanations, making the overall user experience closer to traditional stock presentation on digital platforms.

In terms of actual usage, Kraken provides stable USDT spot markets and clear quotation mechanisms. USDT can be used to exchange for most mainstream crypto assets and serves as an intermediary tool for capital deployment and position conversion. Spot trading fees adopt a tiered system with transparent fee structures, but overall levels are relatively higher than some platforms oriented toward high-frequency trading; interface and function design are mainly in English, with operational logic leaning toward users familiar with trading processes. Overall, the tokenized U.S. stocks provided by Kraken are more suitable as options oriented toward holding and asset allocation, rather than for frequent rebalancing or multi-strategy operations as the main use case.

3. Jupiter Decentralized Exchange (DEX)

• Platform Features: Aggregates liquidity from multiple Solana DEXs to provide optimal price execution and real-time settlement for xStocks on-chain.

• Suitable Users: Users with DeFi operating experience who are willing to self-custody wallets and want to incorporate tokenized U.S. stocks into on-chain assets and DeFi strategies.

In the on-chain usage path of tokenized U.S. stocks,

Jupiter plays the role of a liquidity aggregation layer. As the main decentralized liquidity aggregator in the Solana ecosystem, Jupiter does not issue tokenized stocks itself but integrates trading depth from multiple

Solana DEXs to provide real-time quotations and optimal execution paths for xStocks and other tokenized U.S. stocks, allowing users to complete transactions in

self-custody wallet environments. By combining RFQ and

AMM liquidity sources, Jupiter can provide relatively competitive price efficiency under the premise of full on-chain settlement, becoming an important trading entry point for tokenized U.S. stocks in the Solana ecosystem.

In terms of usage, conducting tokenized U.S. stock trading through Jupiter means assets will be directly stored in users'

Solana wallets and exist as on-chain assets. This model does not involve centralized account custody nor relies on traditional brokerage structures, allowing tokenized U.S. stocks to be managed as part of crypto asset portfolios. However, actual operations still require self-handling of wallet security, trading slippage, and on-chain costs. Overall, Jupiter is more suitable for users who already have

DeFi foundations, are willing to self-custody assets, and want to hold and trade tokenized U.S. stocks on-chain, rather than groups that prioritize operational simplification.

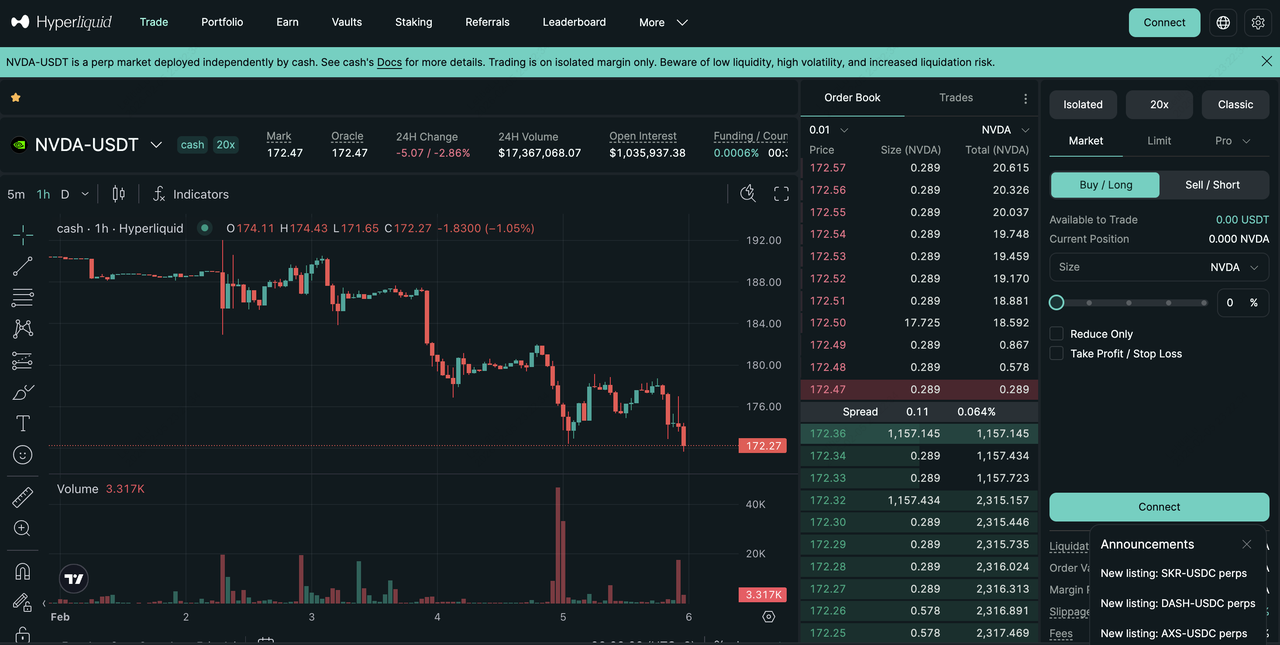

4. Hyperliquid Decentralized Perpetual Contract Exchange (Perp DEX)

• Platform Features: Fully on-chain, self-custody perpetual contract exchange, providing 24/7 U.S. stock and index price exposure through high liquidity and high leverage DeFi architecture.

• Suitable Users: Advanced traders familiar with DeFi operations, willing to self-custody assets, and with leverage and risk management experience.

In tokenized U.S. stock related applications,

Hyperliquid adopts an approach that does not focus on "tokenized stock spot" as the core, but allows users to directly obtain price exposure to U.S. stocks and related traditional assets through perpetual contracts. With the launch of the HIP-3 mechanism from the end of 2025 to early 2026, the platform began supporting perpetual contract markets for non-crypto assets, covering U.S. stock indices and individual stocks, becoming one of the important trading venues for tokenized U.S. stock "contract-type exposure" in 2026. These products do not involve holding physical stocks or tokenized stocks but track price trends through contract forms, emphasizing 24/7 trading and high liquidity.

From an actual usage perspective, Hyperliquid's advantages lie in concentrated trading depth, high execution efficiency, and the ability to combine high leverage for strategic operations, suitable for short-term trading, event-driven, or cross-market hedging scenarios. However, perpetual contracts do not represent asset holding; positions need to bear risks unique to derivatives such as margin maintenance, funding rates, and forced liquidation, and cannot be converted into tokenized U.S. stock assets that can be held or allocated long-term. Overall, Hyperliquid is more suitable as a high-efficiency tool for traders familiar with leverage and risk management to obtain U.S. stock price exposure, rather than an entry point primarily for long-term holding or asset management purposes.

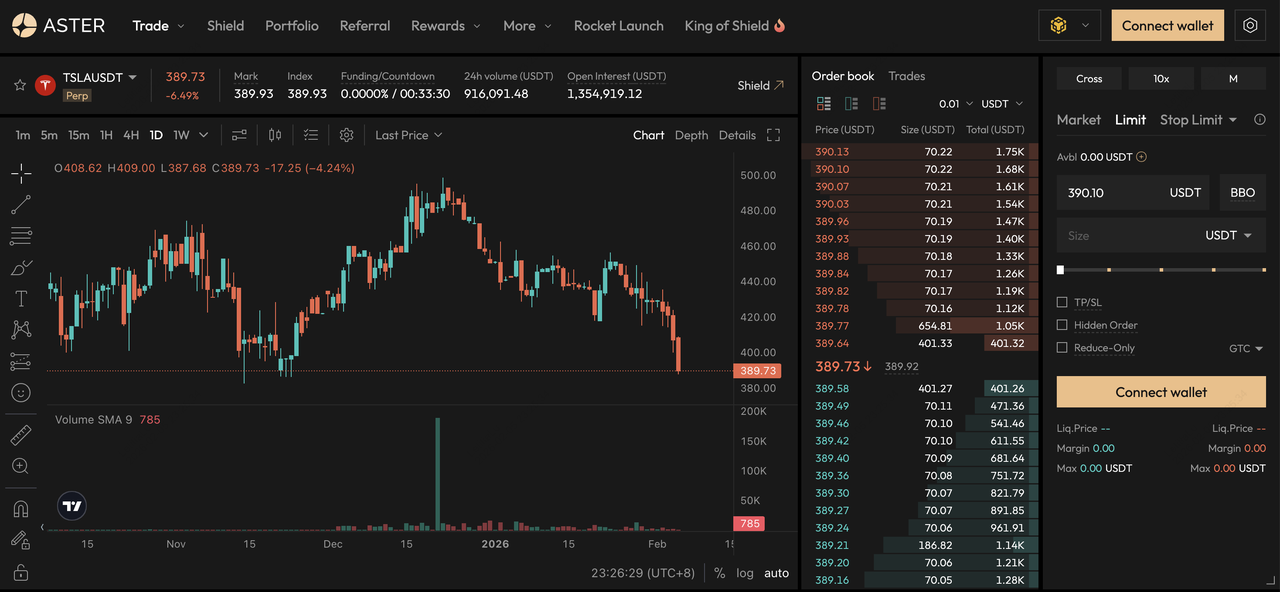

5. Aster Decentralized Perpetual Contract Exchange (Perp DEX)

• Platform Features: Self-custody, multi-chain perpetual contract platform combining U.S. stock price exposure with yield-bearing collateral design, emphasizing DeFi-native capital efficiency and high leverage flexibility.

• Suitable Users: Aggressive users with DeFi and derivatives trading experience, willing to self-manage wallets and risks, and pursuing capital efficiency.

Aster is a relatively new emerging perpetual contract platform formed by the integration of Astherus and

APX Finance in the second half of 2025, emphasizing multi-chain deployment and high-efficiency derivatives trading experiences. The platform supports

BNB Chain,

Ethereum,

Solana, and

Arbitrum, and provides 24/7 stock perpetual contract trading, allowing users to obtain price exposure to U.S. individual stocks and indices through contract forms without involving actual holding of tokenized stocks. Tokenized U.S. stock related targets are mainly concentrated on large tech stocks, with USDT as the settlement and margin unit, with operational logic highly consistent with mainstream perpetual contract markets.

In terms of product design, Aster's feature lies in emphasizing capital efficiency and operational flexibility. The platform allows users to use yield-bearing assets as trading collateral, where collateral can still generate returns while maintaining positions, and provides Simple Mode for streamlined operations and Pro Mode for advanced strategy-oriented interface options. From a user perspective, Aster's high leverage options and multi-chain availability are suitable for traders with derivatives experience who can self-manage risks for short-term operations or strategic allocation. However, its perpetual contract form also does not represent asset holding and needs to bear risks unique to derivatives such as margin, funding rates, and forced liquidation, making it less suitable as a primary tool for long-term U.S. stock exposure management.

How to Choose a Tokenized U.S. Stock Exchange in 2026

After individually introducing the five major platforms above, it can be clearly seen that tokenized U.S. stocks have significant differences in their presentation across different exchanges, from product structure and trading depth to actual operational positioning. For users, the key to choosing exchanges lies in whether the platform can stably accommodate their trading habits and asset allocation needs in long-term use.

The following will use the same comparison standards to organize several tokenized U.S. stock related exchanges that users most commonly encounter, and provide horizontal comparisons from aspects such as product forms provided by platforms, trading and liquidity structures, asset holding methods, and operational thresholds as overall reference for choosing tokenized U.S. stock trading platforms in 2026.

| Comparison Item |

BingX |

Kraken |

Jupiter |

Hyperliquid |

Aster |

| Main Product Form |

Tokenized stock spot + U.S. stock perpetual contracts |

Tokenized stock spot (1:1 structure) |

Tokenized stocks (xStocks) |

U.S. stock perpetual contracts |

U.S. stock perpetual contracts |

| Self-Custody |

No |

No |

Yes |

Yes |

Yes |

| Trading Type |

Spot + Derivatives |

Spot |

On-chain spot |

Perpetual contracts |

Perpetual contracts |

| Entry Threshold |

Low ~ Medium |

Medium |

Medium ~ High |

High |

High |

| Platform Features |

Integrates tokenized stocks and perpetual contracts in same account, operational logic similar to general crypto trading |

Clear structure, leaning toward digital presentation of traditional assets, more conservative pace |

Solana on-chain liquidity aggregation, high price efficiency, direct DeFi integration |

Fully on-chain, high liquidity, high leverage U.S. stock price exposure tool |

Multi-chain deployment, supports yield-bearing collateral, emphasizes capital efficiency |

| Suitable Users |

Whether newcomers to tokenized U.S. stocks or users with crypto trading experience who want to operate both spot and derivatives in the same account |

Professional traders accustomed to institutional operations, preferring holding and allocation orientation, able to accept higher entry thresholds |

Users with DeFi experience, willing to self-custody, and incorporating U.S. stock exposure into on-chain asset allocation |

Advanced traders familiar with leverage and risk control, mainly focused on short-term or event trading |

Aggressive users with DeFi and derivatives experience, willing to self-custody and pursuing high capital efficiency |

How to Buy Tokenized U.S. Stocks in 2026: A Step-by-Step Guide

Entering 2026, tokenized U.S. stocks have evolved from experimental products to asset forms that can be actually allocated and managed on mainstream crypto trading platforms. For most users, the overall operational process no longer requires understanding traditional U.S. stock clearing, settlement, or trading hour restrictions, but follows familiar crypto trading logic to establish and adjust U.S. stock price exposure within the same account.

Currently, the most common and easiest method to get started is direct operation through BingX. The overall process can be divided into four stages: account registration, fund preparation, selecting trading forms and establishing positions, and subsequent position management and adjustment.

Step 1: Register Account and Complete Identity Verification

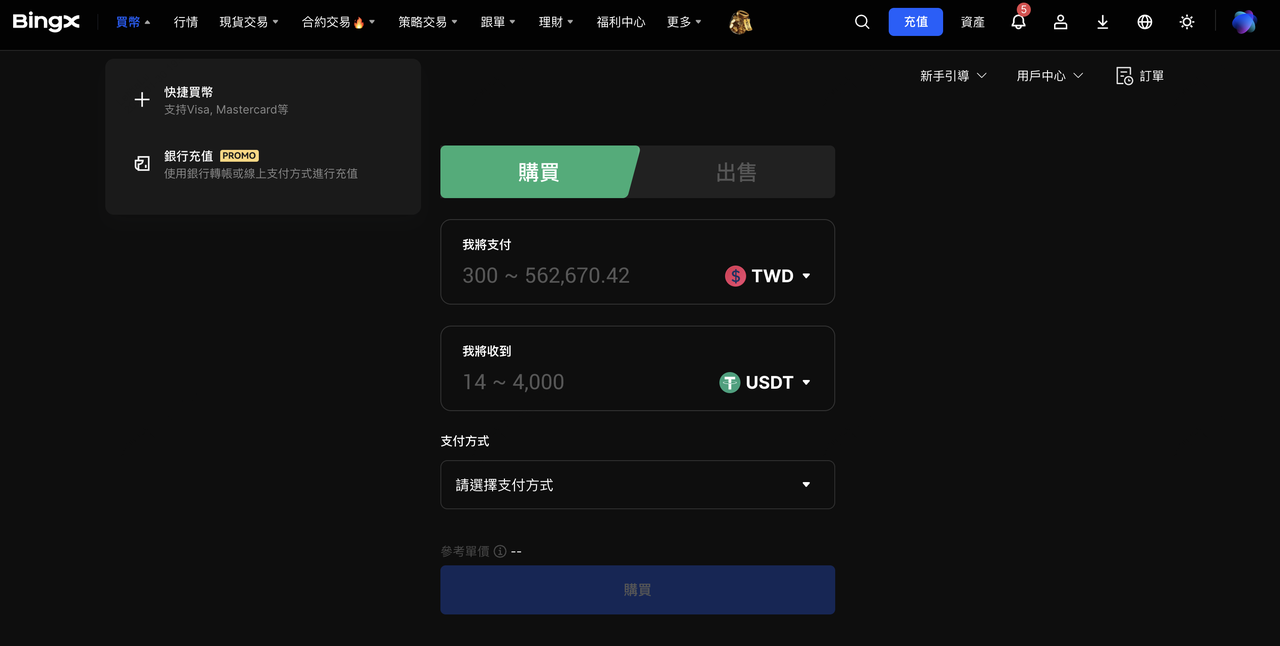

Step 2: Prepare Trading Funds (USDT)

Trading tokenized U.S. stocks on BingX mainly uses USDT as the pricing and settlement unit, so you need to prepare USDT as trading funds before starting. In practice, there are two common deposit methods:

Method 1: Transfer existing USDT assets

If you already hold USDT on other exchanges or wallets, you can directly transfer USDT to the designated BingX wallet address. After funds arrive, you can enter relevant markets for trading. This method has a simple process and more controllable cost structure, suitable for users who already have crypto assets.

Method 2: Purchase with credit or debit card

BingX

Quick Buy supports purchasing stablecoins or Bitcoin directly with credit or debit cards through third-party payment services, with relatively fast processes, suitable for users who want to complete deposits immediately. Note relevant fees and exchange rate differences; overall costs are usually higher than directly transferring USDT.

After completing fund preparation, you can proceed to the next step to select trading forms and establish tokenized U.S. stock positions.

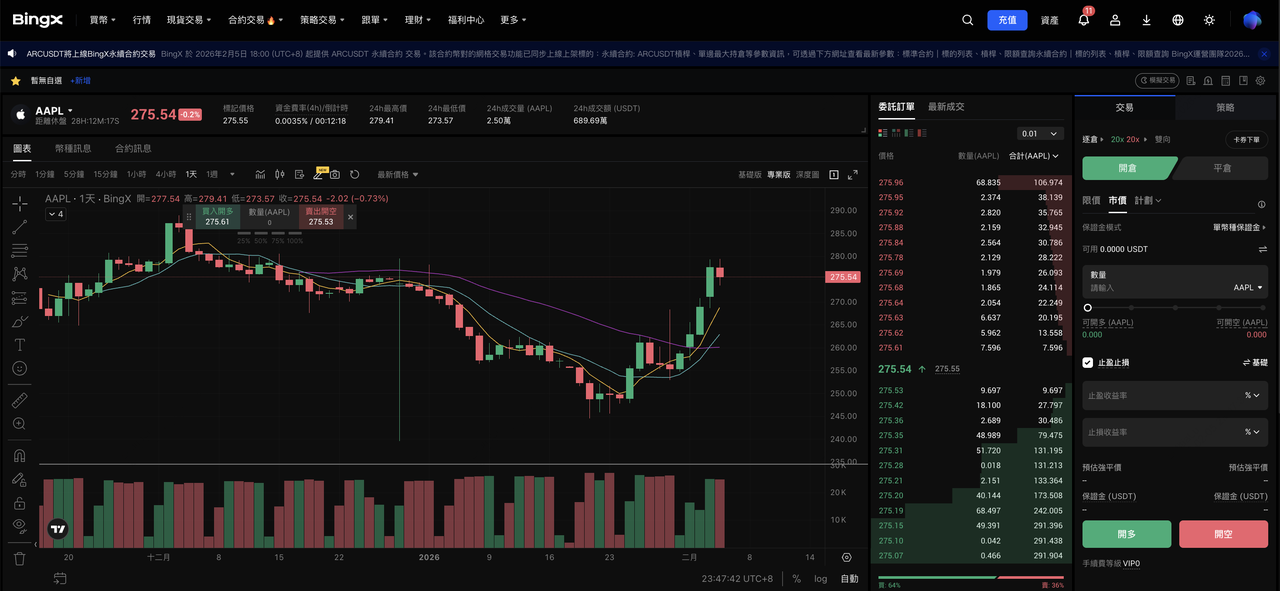

Step 3: Select Trading Form and Establish Position

After completing fund preparation, you need to choose trading forms based on your operational purposes. BingX currently provides two main paths: tokenized U.S. stock spot and tokenized U.S. stock perpetual contracts, corresponding to different use cases.

1. Buying Tokenized U.S. Stock Spot:

• Select

market order or limit order and place order, and can refer to real-time market analysis and price information provided by

BingX AI to assist in determining entry timing

• After execution, tokenized U.S. stocks will be displayed in spot assets, suitable for operations primarily for holding or asset allocation purposes

2. Trading Tokenized U.S. Stock Perpetual Contracts:

• Select market order or limit order, and can combine real-time market analysis and risk reminders provided by BingX AI to perform long or short operations according to strategy

• This type of trading does not involve actual holding of tokenized stocks but tracks price trends through contracts, more suitable for short-term or strategic operations

Step 4: Position Management and Adjustment

After completing trades, tokenized U.S. stock price exposure will be directly integrated into the same crypto asset account and can be managed together with other crypto assets. If holding tokenized U.S. stock spot, positions will continuously reflect corresponding stock price changes, suitable as part of medium-term holding or asset allocation; if perpetual contract positions, you need to continuously monitor margin levels,

funding rates, and market volatility.

In practical operations, users can adjust between spot and perpetual contracts within the BingX platform according to market conditions, such as using tokenized U.S. stock spot as core allocation while combining perpetual contracts for short-term hedging or strategic operations. Since all positions are concentrated in the same account, there's no need to switch between different platforms or systems, allowing tokenized U.S. stocks to be more naturally integrated into overall crypto asset management processes rather than becoming independent, fragmented investment targets.

Key Considerations Before Buying Tokenized U.S. Stocks

Before investing in tokenized U.S. stocks, you need to first understand the essential differences between their product structure and traditional U.S. stocks, avoiding viewing them as complete substitutes for directly holding stocks. Overall, tokenized U.S. stocks are tools with clear purposes but vastly different structures. Clarifying whether you're buying "price exposure" or "equity assets" before investing is more important than choosing the targets themselves.

1. Tokenized U.S. stocks do not equal stock ownership and usually do not carry shareholder rights: Most tokenized U.S. stocks only provide price exposure and do not represent direct ownership of physical stocks. This means holders usually do not have voting rights, shareholder meeting participation rights, or other corporate governance rights. Whether dividend or other rights are included depends on product design and platform explanations; you should confirm whether the target you're purchasing includes any shareholder-related rights before trading.

2. Product structures differ significantly across platforms: Even when tracking the same U.S. stock, tokenized products provided by different platforms may be completely different in asset backing methods, clearing mechanisms, and risk bearing. Some are 1:1 corresponding tokenized assets to physical stocks, while others are merely price-tracking synthetic assets or perpetual contracts; you cannot judge solely by names in practice.

3. Liquidity and execution prices are still affected by market conditions: Tokenized U.S. stock trading depth depends on platform activity and market participation. During non-U.S. stock hours or severe market volatility, spread widening or increased slippage may occur; you should pay attention to real-time order book depth and execution methods before placing orders.

4. Perpetual contracts are derivatives, not asset holding: If obtaining U.S. stock exposure through perpetual contracts, you're not actually holding any tokenized stock assets but participating in price-tracking contract trading. These products need to bear risks unique to derivatives such as margin, funding rates, and forced liquidation, unsuitable for long-term holding or stable allocation purposes.

5. Compliance and legal applicability depend on regulations of different countries and platform jurisdictions: Tokenized U.S. stocks have not yet formed globally consistent legal positioning; their compliance usually depends on the platform's jurisdiction and local regulations. In different countries, tokenized U.S. stocks may be viewed as securities, derivatives, or crypto financial products. Before trading, you should understand the nature of products provided by platforms under their applicable regulations rather than assuming they're equivalent to traditional U.S. stocks.

Conclusion: Why BingX Is a Practical Choice for Buying Tokenized U.S. Stocks in 2026

Entering 2026, tokenized U.S. stocks have evolved from early exploration stages to asset forms that can be actually allocated and managed. For users, the focus of platform selection has shifted to whether they can long-term support their operational needs in terms of trading efficiency, product completeness, and asset management.

From practical operations perspective, platforms that can simultaneously provide tokenized U.S. stock spot and perpetual contracts while operating with consistent crypto trading logic have advantages in user experience and asset integration. Users can complete spot allocation, contract strategies, and subsequent position adjustments within the same account without switching between different systems or account structures, helping reduce operational friction and improve management efficiency.

Overall, the key to buying tokenized U.S. stocks in 2026 lies not in the complexity of product packaging but in whether platforms can clearly distinguish between holding and trading purposes while matching users' risk tolerance and operational habits. For users who want to participate in U.S. stock markets through crypto trading frameworks and naturally incorporate related exposure into overall asset management processes, this integrated operational approach remains the most practical and easiest to execute long-term choice.

Related Reading

FAQs on Buying Tokenized U.S. Stocks

1. Is it legal to buy tokenized U.S. stocks in Taiwan?

Currently, Taiwan does not prohibit individuals from trading tokenized U.S. stocks through crypto platforms, but from a securities law perspective, the legal characterization and applicable regulations of related products still lack clear conclusions, with practice mostly determined by platform jurisdictions and regulatory frameworks of various countries. For investors, it's important to note that tokenized U.S. stocks are usually viewed as "price exposure tools" rather than stock assets protected by securities law. You should fully understand their legal positioning and potential risks before investing.

2. Does buying tokenized U.S. stocks mean you own actual U.S. shares?

No. Most tokenized U.S. stocks only track target stock prices and do not represent actual stock ownership, usually lacking shareholder voting rights, dividend claim rights, or other corporate governance related rights. You should confirm whether the target you're purchasing includes any shareholder rights design before trading.

3. Do I need an overseas brokerage account to buy tokenized U.S. stocks?

No. Operating tokenized U.S. stocks through crypto trading platforms follows the same process as general crypto asset trading, without needing to handle traditional stock account opening, clearing, or settlement procedures.

4. What currency is used to buy tokenized U.S. stocks?

Most tokenized U.S. stocks use USDT and other stablecoins as pricing and settlement units. Users typically need to first obtain stablecoins before conducting spot or perpetual contract trading.

5. Are tokenized U.S. stocks good for long-term investment?

Suitability depends on product form and investment purpose. Tokenized U.S. stock spot is closer to allocation-type tools but still lacks shareholder rights; perpetual contracts are derivatives more suitable for trading purposes. If the goal is long-term holding and corporate governance participation, traditional stocks are still more suitable.

6. What are the main risks of buying tokenized U.S. stocks?

Main risks include lack of shareholder rights, platform risk, price slippage, leverage and forced liquidation risks, and uncertainties that may arise from regulatory differences across countries.

7. What are the key advantages of Tokenized U.S. Stocks vs. Traditional U.S. Stocks?

Operational logic consistent with crypto trading, 24-hour trading capability, centralized asset management in the same account, and flexible combination with other crypto assets or derivatives.