Enso Network is a specialized blockchain designed to solve the growing problem of blockchain fragmentation. As the crypto ecosystem expands into thousands of rollups, appchains, and Layer 1s, Enso acts as a universal translator that connects these disparate smart contracts into a single, unified execution layer.

As of February 2026, Enso has facilitated over $17 billion in on-chain volume and secured high-profile integrations with networks like

Monad, providing the infrastructure for truly seamless chain abstraction. In February 2026, Enso has experienced a massive surge in market interest, with its price climbing 70.67% in the last month to reach a market capitalization of approximately $23.13 million.

In this article, you will learn what Enso Network is, how its intent-based engine removes technical barriers for developers, the utility of the ENSO token, and why it is positioned as a critical pillar for the multi-chain future.

What Is Enso Network (ENSO) and Chain Abstraction?

Enso Network is a decentralized

Layer 1 blockchain, built on the Tendermint consensus engine, that functions as an Intent Engine. Its primary mission is to allow developers and users to interact with any smart contract on any chain through a single interface, without needing to understand the underlying complexities of each individual network.

Instead of writing manual integrations for every new protocol, developers use Enso to state a desired outcome, an intent, and the network automatically generates the necessary executable bytecode to fulfill it.

Enso operates through three core pillars:

-

Shared Network State: A global map that records smart contract data across all supported blockchains lik

Ethereum,

Solana, Move-based chains, etc. as Entities.

-

Modular Components: On-chain operations are broken down into Actions, e.g., Swap, Lend, and Shortcuts, pre-built workflows like Lend on

Aave then Swap on

Uniswap.

-

Decentralized Coordination: A network of specialized participants who compete to find the most efficient execution path for any user request.

How Does Enso Network Work?

Enso replaces traditional, rigid transaction logic with a flexible, competitive marketplace for execution. It moves away from how a transaction is done to what the final result should be.

1. Intent Submission

A Consumer, user or dApp, submits an intent to the Enso mempool. For example: I want to swap 1,000

USDC on

Ethereum for the highest yield-bearing asset on

Arbitrum. The user doesn't need to know which bridge to use or which DEX has the best liquidity; they only define the goal.

2. Competitive Pathfinding or Graphers

Graphers are the brains of the network. They run complex algorithms to search through Enso's map of smart contracts to find the most optimal path. Because only one solution can win, Graphers compete to provide the highest output at the lowest gas cost.

3. Verification and Simulation: Validators

Before any code is executed, Validators simulate the proposed solutions in a forked environment. They ensure the bytecode is safe, the state transitions are valid, and the outcome matches the user's intent. This prevents failed transactions and protects users from malicious code.

4. Execution and Fee Distribution

Once the winning solution is selected, the executable bytecode is returned to the user for final execution on the destination chain. Fees embedded in the transaction are then distributed back to the Action Providers, Graphers, and Validators in the form of ENSO tokens.

What Are the Key Components of the Enso Ecosystem?

Enso provides a suite of developer tools and on-chain primitives designed to turn complex multi-step DeFi strategies into single-click experiences.

1. Actions and Shortcuts

-

Actions: These are the atomic building blocks of Enso. They abstract isolated smart contract calls into simple, reusable components, e.g., Deposit, Borrow, Mint.

-

Shortcuts: Shortcuts are playbooks that combine multiple Actions into a shareable workflow. Developers can use templates to launch apps in minutes by simply picking the Shortcuts they need.

2. DeFi Navigator

The DeFi Navigator is a real-time dashboard for the Enso ecosystem. It allows builders to explore integrated protocols, filter by TVL or APY, and instantly generate SDK code snippets. It ensures that developers are always working with the most accurate, live

on-chain data.

3. Enso Checkout

Designed as the Stripe of Web3, Enso Checkout is a universal payment solution that allows users to pay for on-chain services with any token from any chain. It utilizes Enso's routing engine to handle the swaps and bridges in the background, offering a Web2-like checkout experience.

What Is the ENSO Token Used For?

The ENSO token is the native utility and governance asset of the network. It facilitates a circular economy where all participants are incentivized to maintain network efficiency.

-

Network Fees: ENSO is used to pay for executing intents and modifying state on the Enso Layer 1.

-

Staking and Security: Validators must stake ENSO to participate in consensus. As of early 2026, high-yield staking campaigns have been a major driver for locking up circulating supply.

-

Governance: Holders can vote on protocol upgrades, asset listings, and treasury allocations via the Enso DAO.

-

Incentive Distribution: A unique auction system allows participants to bid ENSO to claim cross-chain execution fees, ensuring value flows back to the network.

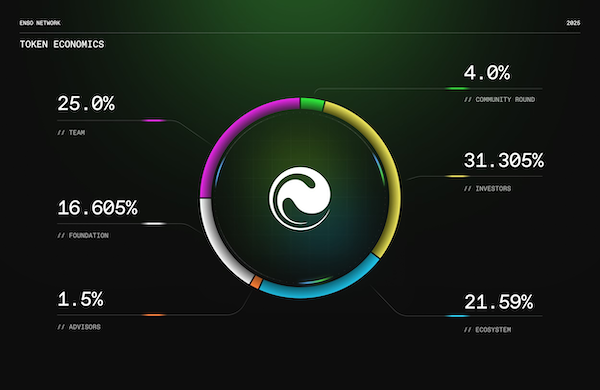

What Is Enso Network (ENSO) Tokenomics?

The ENSO token has a genesis total supply of 100,000,000 tokens, with a maximum supply capped at 127,339,703 tokens following a controlled 10-year inflation schedule.

ENSO Token Distribution

ENSO token allocation | Source: Enso docs

-

Investors (31.305%): Allocated to early strategic backers who have supported the project since inception; these tokens typically follow a 1-year cliff and a 2-year linear vesting schedule.

-

Team (25.00%): Dedicated to rewarding the long-term contributions of core developers and contributors to ensure continued protocol innovation.

-

Ecosystem (21.59%): Reserved for research and development, protocol expansion, grants, and community-driven initiatives like the EnsoDrop airdrops.

-

Foundation (16.605%): Managed by the Enso Foundation to cover operational costs, strengthen governance, and maintain the network’s long-term sustainability.

-

Community Round (4.00%): Distributed via an oversubscribed public sale on CoinList to broaden the decentralized holder base.

-

Advisors (1.50%): Allocated to key advisors who provided strategic guidance throughout Enso’s development journey.

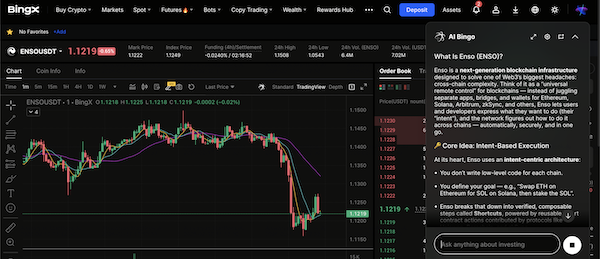

How to Trade Enso Network (ENSO) on BingX

BingX provides advanced tools and AI-driven insights to help you navigate the volatility of infrastructure tokens like ENSO.

How to Buy ENSO on the Spot Market

ENSO/USDT trading pair on the spot market powered by BingX AI insights

-

Fund Your Account: Log in to BingX and ensure you have

USDT in your fund account.

-

-

Execute Trade: Choose between a Market or Limit order to gain direct ownership of ENSO tokens.

Trade ENSO with Leverage on the Futures Market

ENSO/USDT perpetuals on the futures market featuring BingX AI

-

-

-

Set Leverage: Apply leverage to go long to predict price rise or short to predict price fall, while using BingX's risk management tools to monitor your liquidation price.

Final Thoughts: Should You Invest in Enso in 2026?

Enso Network represents a significant leap in blockchain usability. By abstracting the fragmentation tax that currently plagues DeFi, it positions itself as a critical middleware for the next wave of institutional and retail adoption. Its successful mainnet launch and integration with high-performance chains like Monad suggest strong fundamental momentum.

However, as a Layer 1 infrastructure play, ENSO's value is highly dependent on developer adoption. Investors should also remain aware of the token's unlock schedule and the competitive landscape of cross-chain coordination. If you believe the future of crypto lies in intent-based applications where the user never has to see a bridge again, Enso is a project worth watching closely.

Related Reading