Cyber is redefining the intersection of social media and blockchain by building the first social-first

Layer 2 optimized for

AI. As of February 2026, Cyber (formerly CyberConnect) has transitioned from a social graph protocol into a comprehensive specialized blockchain stack. By integrating account abstraction, seedless wallets, and AI copilots, Cyber removes the technical friction, like gas fees and complex seed phrases, that typically hinders mainstream adoption.

In this article, you will learn what Cyber is, how its AI-integrated Layer 2 works, the role of CyberID in digital identity, why the CYBER token is the utility engine powering this decentralized social future, and how to trade Cyber (CYBER) on BingX.

What Is Cyber (CYBER) AI Social Infrastructure?

Cyber is a specialized blockchain ecosystem designed to solve Web3’s usability problem through a dedicated social and AI layer. It operates as an

Ethereum Layer 2 (L2) built on the OP Stack, specifically engineered to support high-performance social applications and AI agents.

Key Components of the Cyber Ecosystem

Key products in the Cyber ecosystem | Source: Cyber

The Cyber ecosystem is built on a specialized three-layer architecture designed to unify social data, artificial intelligence, and decentralized finance into a single, user-friendly interface:

-

Cyber Network and Vault: A social-optimized Ethereum L2 powered by the OP Stack and EigenLayer. It offers a low-cost, high-speed environment for developers, secured by CyberVault, a staking mechanism where users lock CYBER to earn auto-compounding cCYBER rewards.

-

Cyber AI and Link3: A crypto-native AI model trained exclusively on on-chain data to power intelligent agents. This intelligence layer integrates with Link3, a decentralized professional network with over 2 million users, to create a hub for verified identities and social reputation.

-

Surf AI Copilot: The flagship command center and user interface. Surf acts as an AI crypto copilot that unifies research, trending signals, and execution, allowing users to bridge assets or execute trades through simple natural-language chat.

Cyber’s evolution from a social protocol into a high-throughput Layer-2 has been defined by tangible scale and balance-sheet validation rather than narrative momentum. A key inflection point came on July 17, 2025, when Enlightify Inc. disclosed plans to acquire up to $20 million worth of CYBER tokens over 12 months, marking the first known case of a publicly listed company allocating treasury capital directly into a decentralized social-AI infrastructure asset. This institutional commitment reframed CYBER from a community-driven experiment into a network with credible long-term capital backing.

At the protocol level, Cyber’s identity stack reached production scale following the CyberID migration to mainnet, where identities became ERC-721 assets secured by a one-time registration model rather than recurring fees. By February 2026, Cyber-native social applications such as Link3 had onboarded more than 2 million user profiles and processed tens of millions of on-chain interactions, creating real network density. Market data reinforced this shift: in February 2026, CYBER rallied over 42% in a week and its 24-hour trading volume experienced a near-2000% surge, a liquidity profile consistent with institutional participation rather than short-term retail speculation.

How Does Cyber Network Work?

Cyber replaces the fragmented experience of traditional blockchains with a unified stack that prioritizes user experience (UX) and AI interoperability.

1. Cyber's Social-First Layer 2 Architecture

Cyber is built using the OP Stack, making it fully EVM-compatible. It introduces native Smart Accounts, where every wallet acts as a programmable contract. This allows for gasless transactions, where developers or the protocol sponsor fees, making on-chain interactions feel as seamless as traditional web apps.

2. Grounded AI Intelligence

Unlike generic AI, Cyber AI is grounded, not generic. It indexes real-time data from sources like CoinGecko, Snapshot, and millions of social signals from X (formerly Twitter). This data is fed into the Surf AI copilot, allowing users to ask questions like "Which

AI agents on Base are trending today?" and receive verified, data-backed answers.

3. CyberGraph Decentralized Social Graph

Cyber hosts an enshrined social graph protocol that ensures users own their digital identity and connections. Your followers, posts, and reputation aren't locked in a single app; they are portable across the entire Cyber ecosystem, accessible via your CyberID.

4. Multichain Identity via CyberID

CyberID is the naming system, e.g., user.cyber that simplifies long wallet addresses. It is an Omnichain Fungible Token (OFT) standard, meaning your identity can migrate across chains like

Solana and

Base, supported by Cyber’s recent bridging proposals in January 2026.

What Is the CYBER Token Used For?

The CYBER token is the utility and governance heart of the network. It is an OFT that facilitates value transfer and decision-making across the ecosystem.

-

Governance: Holders vote on protocol upgrades, DAO treasury allocations, and the integration of new social primitives.

-

Staking and Security: Users stake CYBER to secure the L2 network, receiving stCYBER or cCYBER and earning a share of protocol rewards.

-

Payment and Access: CYBER is used to pay for CyberID minting, transaction fees (when not sponsored), and access to premium Cyber AI features.

-

Network Incentives: A portion of the supply is reserved for Community Rewards, incentivizing developers and active social participants.

What Is Cyber (CYBER) Tokenomics?

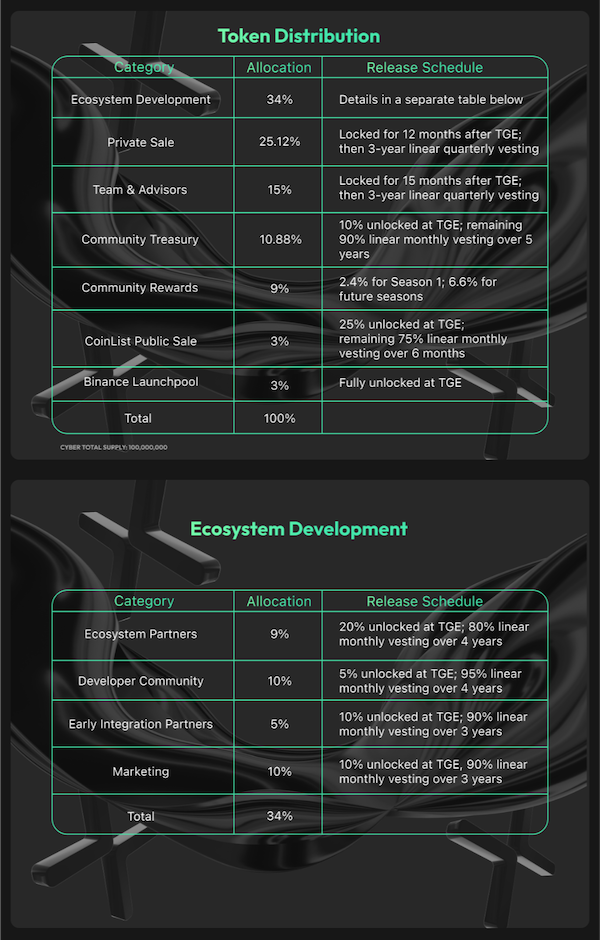

CYBER token distribution | Source: Cyber docs

The CYBER token has a fixed total and maximum supply of 100,000,000 tokens.

CYBER Token Allocation Breakdown

-

Ecosystem Development (34%): Reserved for growing the network, including developer communities (10%), marketing (10%), ecosystem partners (9%), and early integration partners (5%).

-

Private Sale Investors (25.12%): Distributed to early-stage investors with a 12-month lock followed by a 3-year linear vesting schedule.

-

Team & Advisors (15%): Allocated to core contributors, subject to a 15-month lock and a subsequent 3-year linear quarterly vesting period.

-

Community Treasury (10.88%): Managed by the CyberDAO to fund long-term project initiatives and governance-led activities.

-

Community Rewards (9%): Divided into 2.4% for Season 1 early adopters and 6.6% for future community incentive programs.

-

CoinList Public Sale (3%): Released with 25% available at the Token Generation Event (TGE) and the remainder vesting over 6 months.

-

Binance Launchpool (3%): Fully unlocked at TGE to provide immediate liquidity and broad distribution to users.

How to Trade Cyber (CYBER) on BingX

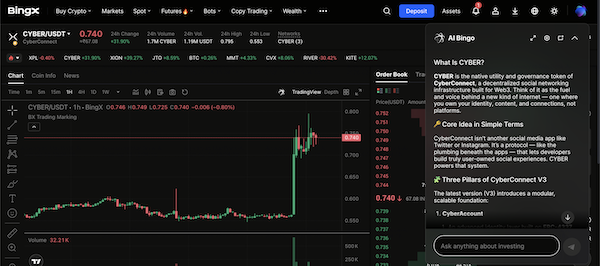

BingX AI equips traders to capitalize on CYBER's price action through AI-powered market insights, smart trend analysis, and data-driven trading signals, helping you identify high-conviction entries, manage risk, and respond faster as liquidity and volatility accelerate.

How to Buy and Sell CYBER on the Spot Market

CYBER/USDT trading pair on the spot market powered by BingX AI insights

-

-

-

Long or Short CYBER with Leverage on Futures

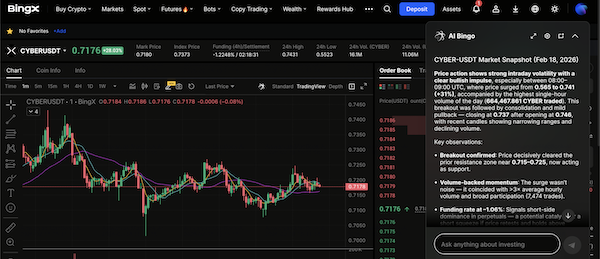

CYBERUSDT perpetuals on the futures market featuring insights from BingX AI

For experienced traders, BingX offers CYBER/USDT perpetual contracts.

-

Open BingX Futures: Deposit or transfer

USDT into your Futures wallet.

-

-

Choose margin mode: Select Isolated for risk limited to that position or Cross for shares margin across positions.

-

Set leverage and position size: Pick your leverage (start lower if volatility is high) and enter the amount you want to trade.

-

Choose order type: Use Limit for precise entry or Market for instant execution, which comes with higher slippage risk.

-

-

Place the trade: Choose Long if you expect CYBER to rise, or Short if you expect a drop.

-

Monitor and manage: Track

liquidation price, margin ratio, and funding; adjust TP/SL or add margin if needed, and close the position when your target or risk limit is hit.

3 Key Considerations Before Investing in Cyber (CYBER)

Before investing in Cyber (CYBER), it’s essential to understand the key risk factors, market dynamics, and on-chain fundamentals that can influence its price, volatility, and long-term sustainability as a Layer-2 social and AI infrastructure token.

-

Market Sentiment vs. Fundamentals: Recent price action is driven by high-volume speculation; ensure you distinguish between short-term pumps and long-term ecosystem growth.

-

Technical Dependency: Cyber relies on third-party infrastructure like EigenLayer; delays in these external roadmaps can impact Cyber’s scaling.

-

Governance Role: Remember that CYBER is a utility and governance token. Its value is tied to network adoption and the success of its AI-social integration.

Final Thoughts: Should You Buy Cyber in 2026?

As we move into mid-2026, Cyber has transitioned from a niche social protocol into a foundational infrastructure layer for the burgeoning AI-agent economy. Its integrated Layer 2 and specialized AI stack position it as a frontrunner for those who believe the future of Web3 lies in autonomous agents performing complex social and financial tasks. With the recent $20 million strategic commitment from Enlightify Inc. (NYSE: ENFY), the project has reached a level of institutional validation that separates it from speculative social coins.

However, the rapid convergence of AI and blockchain introduces unique complexities that demand a disciplined approach to risk. Cyber's utility is tied to a metamorphic landscape where technological disruptions and regulatory shifts occur swiftly. While its growth metrics and ecosystem depth are compelling, the extreme volatility seen in its 2,000% volume surge serves as a reminder that liquidity-driven rallies can lead to sharp corrections.

Risk Reminder: Cryptocurrency investments are subject to high market risk and extreme volatility. Cyber’s price may be influenced by concentrated ownership, software vulnerabilities, and evolving global regulations. Always perform your own research and manage your risk by using tools like Stop-Loss and Take-Profit on BingX to protect your capital.

Related Reading