Cơn sốt

Tài Sản Thế Giới Thực (RWA) năm 2026 đã chính thức ập đến hệ sinh thái

Solana, được dẫn đầu bởi token

U.S. Oil (USOR) vô cùng bùng nổ và gây tranh cãi. Mặc dù đã giảm mạnh 82% từ đỉnh cuối tháng 1 là 0,0839 USD, USOR vẫn tăng đến 406.349% so với mức thấp nhất mọi thời đại chưa đầy một tháng trước. Đối với hơn 114.000 người nắm giữ đang theo dõi việc token hóa dự trữ năng lượng quốc gia có tốc độ cao này, sự biến động vừa là cảnh báo vừa là nam châm hút.

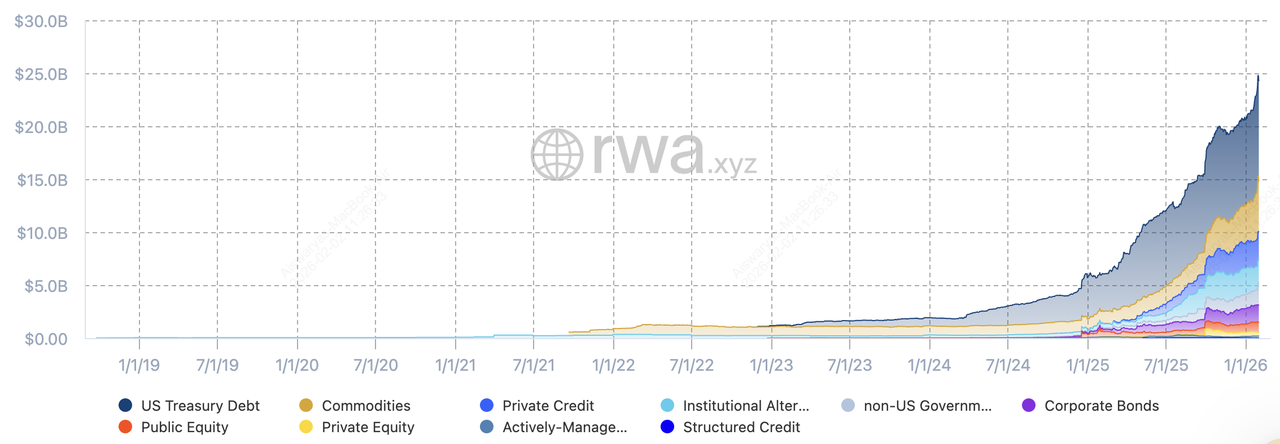

Tổng giá trị tài sản RWA được token hóa | Nguồn: RWA.xyz

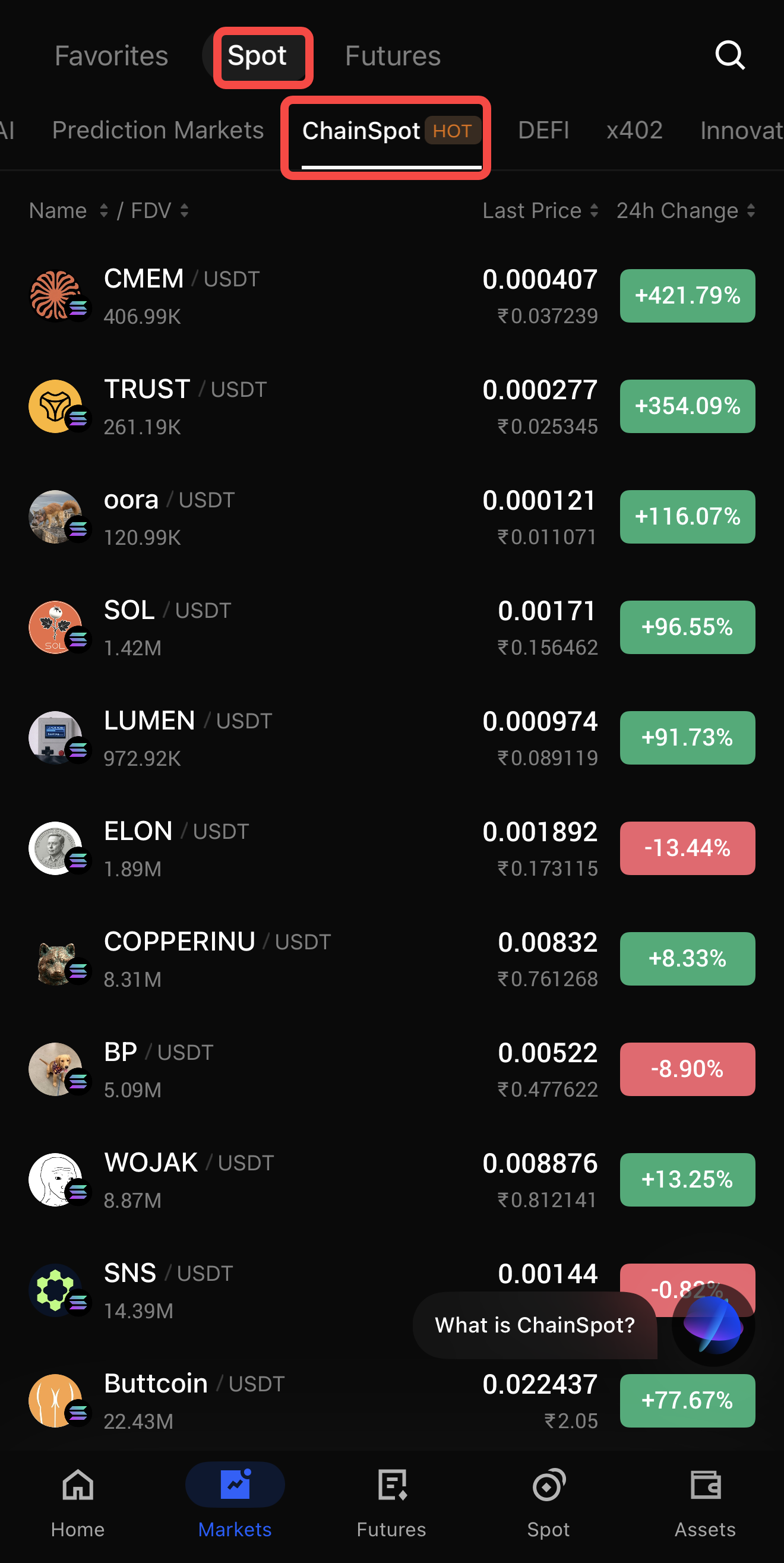

Để điều hướng trong vùng biển CeDeFi này mà không gặp phải sự phức tạp của việc bridging thủ công hay bảo mật khóa riêng tư,

BingX ChainSpot cung cấp cổng chuyên nghiệp để giao dịch theo xu hướng RWA với sự dễ dàng tập trung và lợi thế phi tập trung. Hướng dẫn này khám phá các bước cần thiết về cách mua USOR trên BingX ChainSpot, giúp bạn làm chủ câu chuyện Solana "được hỗ trợ bởi dầu mỏ" trong khi quản lý rủi ro biến động cao của USOR năm 2026.

U.S. Oil Reserve (USOR) Là Gì?

U.S. Oil Reserve (USOR) là một token SPL gốc của Solana ra mắt vào đầu tháng 1-2026, định vị mình là "Dự Trữ Dầu Mỏ Thời Đại Số". Dự án tuyên bố cung cấp một chỉ số

on-chain tốc độ cao, minh bạch cho

tài sản dầu mỏ thế giới thực, với tổng nguồn cung cố định là 1.000.000.000 token.

Dự án phân biệt mình thông qua bảng điều khiển "Reserve Board" theo dõi Giá Trị Dự Trữ Chỉ Thị, được báo cáo gần đây là 803.020 USD tính đến đầu tháng 2-2026. Theo marketing của dự án, giá trị này được hỗ trợ bởi một kho bạc đa dạng của các tài sản thanh khoản cao bao gồm

Bitcoin BEP-20 (BTCB) ở mức 54,6%,

Ethereum (ETH) ở mức 19,2%, và

XRP ở mức 13,4%. Trong khi nền tảng sử dụng các từ khóa như "Gov-verified" và "Federal Custody", quan trọng cần lưu ý rằng Bộ Năng lượng Hoa Kỳ (DOE), cơ quan thực sự quản lý Dự trữ Dầu mỏ Chiến lược, chưa xác minh hay ủng hộ dự án này.

Cách Hoạt Động của Token USOR: Câu Chuyện vs. Thực Tế Kỹ Thuật

Tổng quan về dự trữ USOR | Nguồn: USOR.tech

Về mặt kỹ thuật, USOR hoạt động như một tài sản tài chính phi tập trung (DeFi) tiêu chuẩn trên Solana, với thanh khoản chủ yếu được định tuyến thông qua bộ tổng hợp DEX Jupiter.

• Chỉ Số On-Chain: Dự án marketing $USOR như một "tài sản dự trữ" thay vì memecoin, tuyên bố mọi thùng dầu đều được đối chiếu với một sổ cái on-chain.

• Mô Hình Được Hỗ Trợ Bởi Kho Bạc: Thay vì các thùng dầu vật lý, "dự trữ" hiện tại bao gồm một rổ các loại cryptocurrency blue chip. Ví dụ, tính đến ngày 2-2-2026, nhà lãnh đạo kho bạc là BTCB (Bitcoin BEP2), khiến giá trị token phụ thuộc nhiều vào sức khỏe thị trường crypto hơn là hợp đồng tương lai dầu thô.

• Động Lực Đầu Cơ: "Sự phấn khích" chủ yếu được thúc đẩy bởi những tuyên bố chưa được xác minh về sự ủng hộ chính trị và hoạt động ví tổ chức "liên kết với BlackRock". Trên thực tế, USOR giao dịch như một token câu chuyện có độ biến động cao phản ứng mạnh với các tiêu đề địa chính trị và tin đồn về các "cột mốc token hóa dầu mỏ", chẳng hạn như việc triển khai được thảo luận rộng rãi vào ngày 1-2.

Giải Mã Đợt Tăng 400.000% của USOR: 3 Lý Do Hàng Đầu Đằng Sau Sự Phấn Khích

Sự quan tâm bùng nổ đối với USOR không chỉ đơn thuần là sản phẩm của đầu cơ ngẫu nhiên; nó là kết quả của "cơn bão hoàn hảo" về thời điểm địa chính trị và thanh khoản được thúc đẩy bởi câu chuyện.

1. Biểu Tượng "Meme" Địa Chính Trị: USOR đã thành công tận dụng tình cảm ủng hộ crypto "thời đại Trump". Tin đồn về các nhãn ví "Trump Team", được xác định thông qua phân tích heuristic on-chain, đã thúc đẩy mức tăng 600% vào giữa tháng 1-2026. Các nhà giao dịch coi USOR như một đại diện có đòn bẩy cao cho sự độc lập năng lượng của Hoa Kỳ, với các lượt đề cập trên mạng xã hội X (trước đây là Twitter) tăng vọt 450% trong tuần dẫn đến đỉnh của nó.

2. Biên Giới RWA: Khi vốn hóa thị trường RWA toàn cầu tiến gần 25 tỷ USD vào đầu năm 2026, USOR định vị mình tại giao điểm của hàng hóa năng lượng và blockchain. Trong khi

dầu mỏ (WTI) vật lý giao dịch gần 60 USD mỗi thùng, USOR cung cấp cho các nhà đầu tư bán lẻ cách giao dịch "thùng dầu số" mà không có sự phức tạp của các hợp đồng tương lai truyền thống hoặc ETF, thu hút sự chú ý của hệ sinh thái DeFi trị giá 1,5 nghìn tỷ USD.

3. Thanh Khoản Cực Đoan và Biến Động Động Lượng: Tại đỉnh vào ngày 21-1-2026, USOR đạt được khối lượng giao dịch 24 giờ là 27,4 triệu USD với vốn hóa thị trường vượt 55 triệu USD. Doanh số khổng lồ này, cao bất thường đối với một microcap Solana, đã tạo ra một "vòng lặp phấn khích" tự củng cố. Các nhà đầu cơ đòn bẩy cao được thu hút bởi độ biến động hàng ngày 295%, coi token là phương tiện chính cho luân chuyển vốn nhanh chóng trong thời kỳ trì trệ rộng hơn của thị trường crypto.

Cách Mua USOR trên BingX ChainSpot: Hướng Dẫn Từng Bước

Mua U.S. Oil Reserve (USOR) thông qua BingX ChainSpot là cách hiệu quả nhất để tiếp cận tài sản Solana có độ biến động cao này mà không cần

ví Web3 bên ngoài hoặc bridging. Bằng cách sử dụng các hướng dẫn riêng biệt sau đây cho Web và App, bạn có thể đảm bảo trải nghiệm giao dịch mượt mà trong khi tận dụng bảo mật CeDeFi của ChainSpot.

Cách Giao Dịch Token USOR trên BingX ChainSpot (Web)

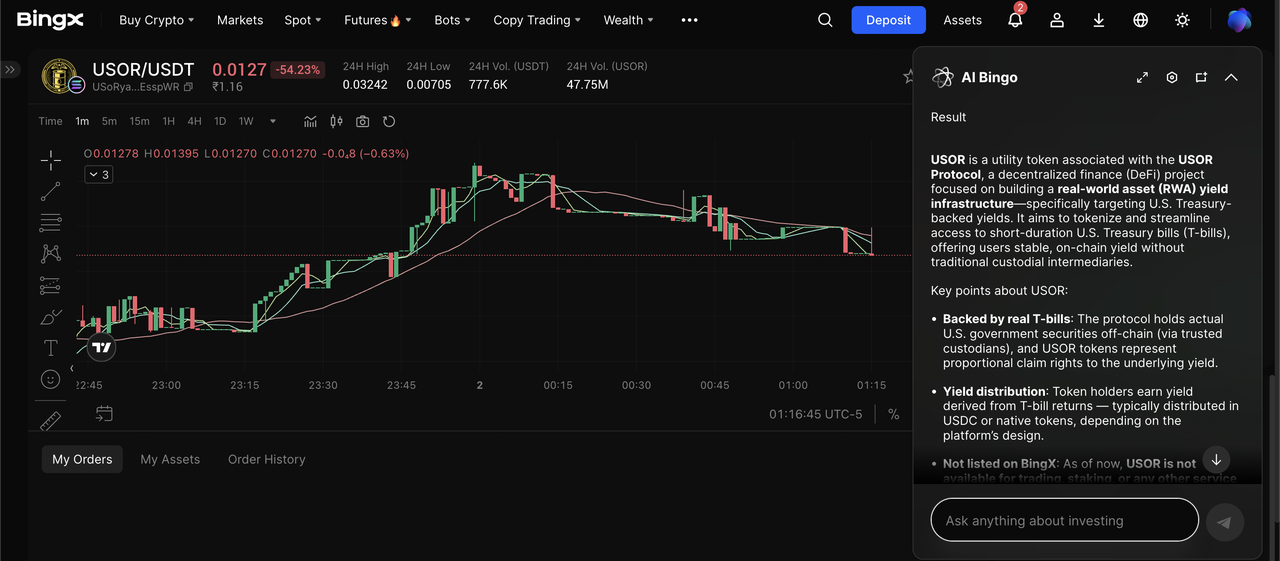

Cặp giao dịch USOR/USDT trên thị trường ChainSpot được hỗ trợ bởi BingX AI

Phiên bản desktop của BingX cung cấp cái nhìn toàn diện về các chỉ số on-chain như xu hướng người nắm giữ và theo dõi Lãi lỗ, làm cho nó lý tưởng cho phân tích chuyên sâu.

2. Điều Hướng đến ChainSpot: Di chuột qua tab Spot ở thanh điều hướng trên cùng và chọn

ChainSpot. Nếu được nhắc, hoàn thành bảng câu hỏi rủi ro một lần để kích hoạt giao dịch on-chain.

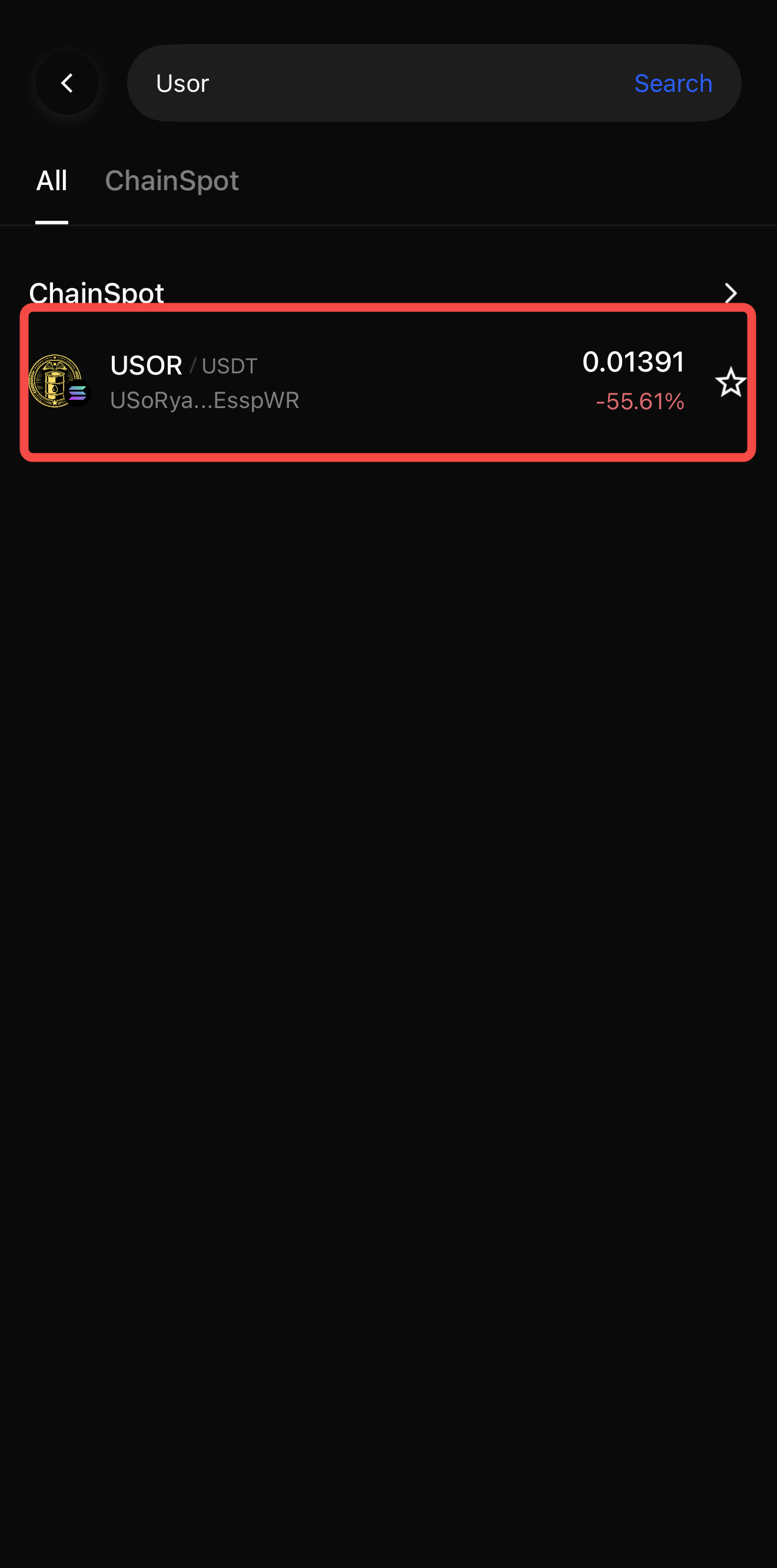

3. Tìm Kiếm và Xác Minh: Sử dụng thanh tìm kiếm và nhập "USOR".

Mẹo Chuyên Nghiệp: Luôn kiểm tra kỹ địa chỉ hợp đồng USoRyaQjch6E18nCdDvWoRgTo6osQs9MUd8JXEsspWR

để tránh các token sao chép độc hại.

4. Cấu Hình Giao Dịch Chọn cặp

USOR/USDT. Nhập số lượng USDT bạn muốn chi tiêu. Trong cài đặt, đảm bảo "Tự động trượt giá" được chọn; điều này cho phép AI quản lý độ biến động cực đoan điển hình của USOR để có tỷ lệ thành công cao hơn.

5. Thực Hiện & Theo Dõi Xem lại phí gas ước tính, được khấu trừ bằng USDT, và nhấp Mua USOR. Sau khi xác nhận, theo dõi Giá vốn trung bình và Lãi lỗ chưa thực hiện trực tiếp trong bảng điều khiển.

Cách Mua và Bán Coin USOR trên BingX Chain (App)

Ứng dụng BingX (v4.58 trở lên) được tối ưu hóa cho tốc độ, cho phép bạn phản ứng với các tiêu đề địa chính trị và tăng giá khi đang di chuyển.

1. Kiểm Tra Trạng Thái: Mở Ứng dụng BingX. Nhấn vào biểu tượng hồ sơ của bạn để xác minh rằng xác minh danh tính của bạn ở Cấp 2. Đi đến Tài sản của bạn để đảm bảo USDT của bạn trong ví Spot.

2. Truy Cập ChainSpot: Nhấn vào tab Spot ở cuối màn hình. Trong các biểu tượng tính năng bên dưới biểu đồ giá, nhấn ChainSpot.

3. Định Vị USOR: Nhấn biểu tượng tìm kiếm ở góc trên bên phải. Nhập "USOR" và chọn token chính thức. Bạn cũng có thể tìm thấy nó trong danh mục "Xu hướng" hoặc "Solana" nếu hiện tại nó có khối lượng cao.

4. Đặt Lệnh: Nhập số lượng USDT của bạn. Nhấn bánh răng cài đặt để xác minh rằng "Tự động trượt giá" được bật. Điều này rất quan trọng đối với USOR vì thanh khoản mỏng thường có thể dẫn đến giao dịch thất bại ở chế độ thủ công.

5. Xác Nhận và Xem: Nhấn Hoán đổi và xác nhận giao dịch. Token sẽ được tự động chuyển vào Tài khoản Spot của bạn. Bạn có thể xem nắm giữ của mình bằng cách đi đến Tài sản và Spot và tìm kiếm USOR.

5 Rủi Ro Chính Cần Xem Xét Trước Khi Mua Token U.S. Oil Reserve (USOR)

Trước khi giao dịch USOR, điều quan trọng là phải tách biệt câu chuyện viral khỏi thực tế kỹ thuật và pháp lý của tài sản. Tính đến đầu năm 2026, các rủi ro sau xác định hệ sinh thái USOR:

1. Không Có Bằng Chứng về Việc Được Hỗ Trợ Bởi Hàng Hóa: Mặc dù dự án tuyên bố về "dự trữ được chính phủ xác minh" và "quyền nuôi con liên bang", không có bằng chứng pháp lý hoặc tài chính nào cho thấy USOR được hỗ trợ bởi dầu thô vật lý. Bộ Năng lượng Hoa Kỳ (DOE), cơ quan quản lý Dự trữ Dầu mỏ Chiến lược (SPR), không có ủy quyền nào cho token này. Hãy coi mọi đề cập đến "thùng dầu số" như một câu chuyện marketing chứ không phải hàng hóa có thể đổi được.

2. Biến Động High-Beta & "Cascades Thanh Khoản": USOR thể hiện độ nhạy cảm giá cực đoan đối với các tiêu đề địa chính trị. Sau "triển khai token hóa" chưa được xác minh vào ngày 1-2-2026, token trải qua một cuộc sụp đổ 70% trong vài giờ. "Cascade thanh khoản" này xảy ra khi các sổ lệnh mỏng trên

Solana DEXs không thể hấp thụ các lệnh bán, dẫn đến trượt giá lớn nơi giá thực hiện thấp hơn đáng kể so với tỷ giá thị trường.

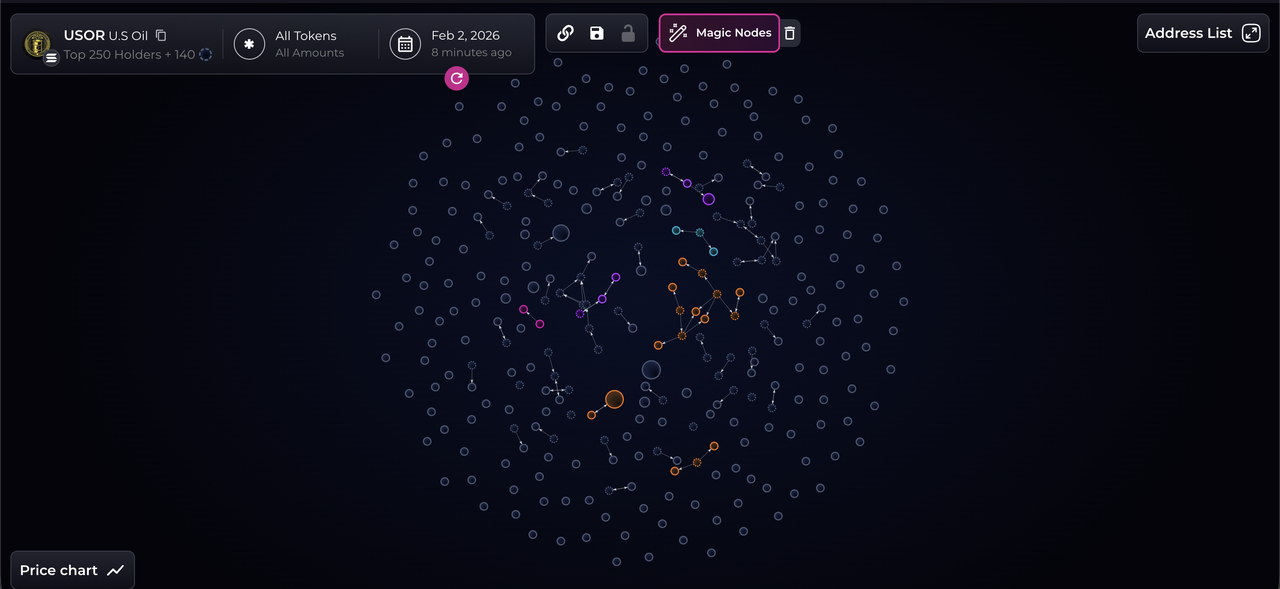

Phân tích on-chain USOR trên Bubblemaps

3. Tập Trung Nguồn Cung Shadow: Phân tích on-chain của Bubblemaps tiết lộ rằng hơn 26,18% nguồn cung được nắm giữ trong các cụm kết nối với nhau liên kết với những người triển khai dự án. Điều này tạo ra "Rủi ro Cá voi" nghiêm trọng; trong khi dự án có hơn 114.000 người nắm giữ, một nhóm nhỏ người trong cuộc nắm giữ đủ nguồn cung để làm sụp giá xuống gần bằng không (hỗ trợ 0,0042 USD) nếu họ chọn thoát đồng thời.

4. Trạng Thái "Vùng Xám" Quy Định: Không giống như Oil ETF được quy định hay hợp đồng tương lai hàng hóa đã đăng ký, USOR hoạt động mà không có sự giám sát từ SEC hoặc CFTC. Trong trường hợp "rug pull" hoặc thất bại hợp đồng thông minh, các nhà đầu tư không có biện pháp pháp lý hoặc bảo vệ bảo hiểm thường thấy trong các thị trường năng lượng truyền thống.

5. Rủi Ro Gắn Nhãn Heuristic: Các tin đồn phổ biến liên quan đến ví "liên kết với BlackRock" hoặc "Trump Team" mua USOR dựa trên gắn nhãn heuristic được điều khiển bởi AI, không phải tiết lộ chính thức. Những nhãn này có thể dễ dàng bị thao túng bằng cách "dusting" các ví có profile cao để tạo ra cảm giác tích lũy tổ chức giả.

Kết Luận

Mua USOR trên BingX ChainSpot là phương pháp thuận tiện nhất cho người mới bắt đầu để tiếp xúc với câu chuyện Solana đang thịnh hành này mà không có sự phức tạp của ví DeFi. Tuy nhiên, sự thuận tiện không loại bỏ rủi ro. Tính đến tháng 2-2026, USOR vẫn là một token có beta cao, được thúc đẩy bởi tình cảm. Luôn sử dụng các quy mô vị thế thận trọng và không bao giờ đầu tư nhiều hơn những gì bạn có thể chịu được mất trong các tài sản nặng về câu chuyện.

Bài Viết Liên Quan