By August 2025,

total value locked (TVL) in

DeFi had climbed to 156 billion dollars, marking a three-year high. A major force behind this rebound has been the rise of

crypto treasuries like BTC,

ETH and

BNB, with funds and corporates looking beyond simple asset holding to generate consistent on-chain yield.

Stablecoins and

ETH are being actively deployed into

lending markets, staking pools, and other protocols, signaling that DeFi is becoming an essential component of institutional strategy.

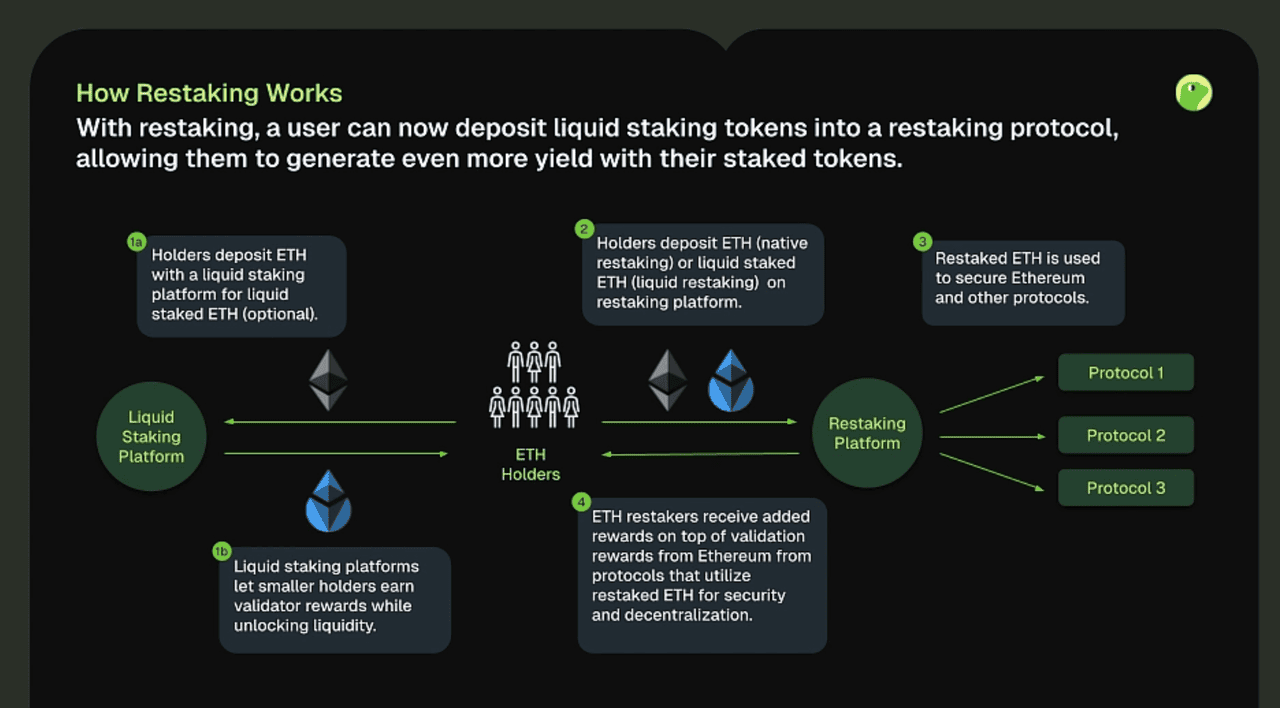

Liquid staking has played a crucial role in enabling this shift. It lowered the barrier to staking participation while keeping assets liquid, creating new ways for capital to flow through DeFi. Building on this foundation, restaking has emerged in 2025 as an important extension. By allowing staked assets to secure additional protocols, it combines yield generation with a stronger shared security model, further integrating DeFi into the broader financial landscape.

What Is Restaking and How Does It Work?

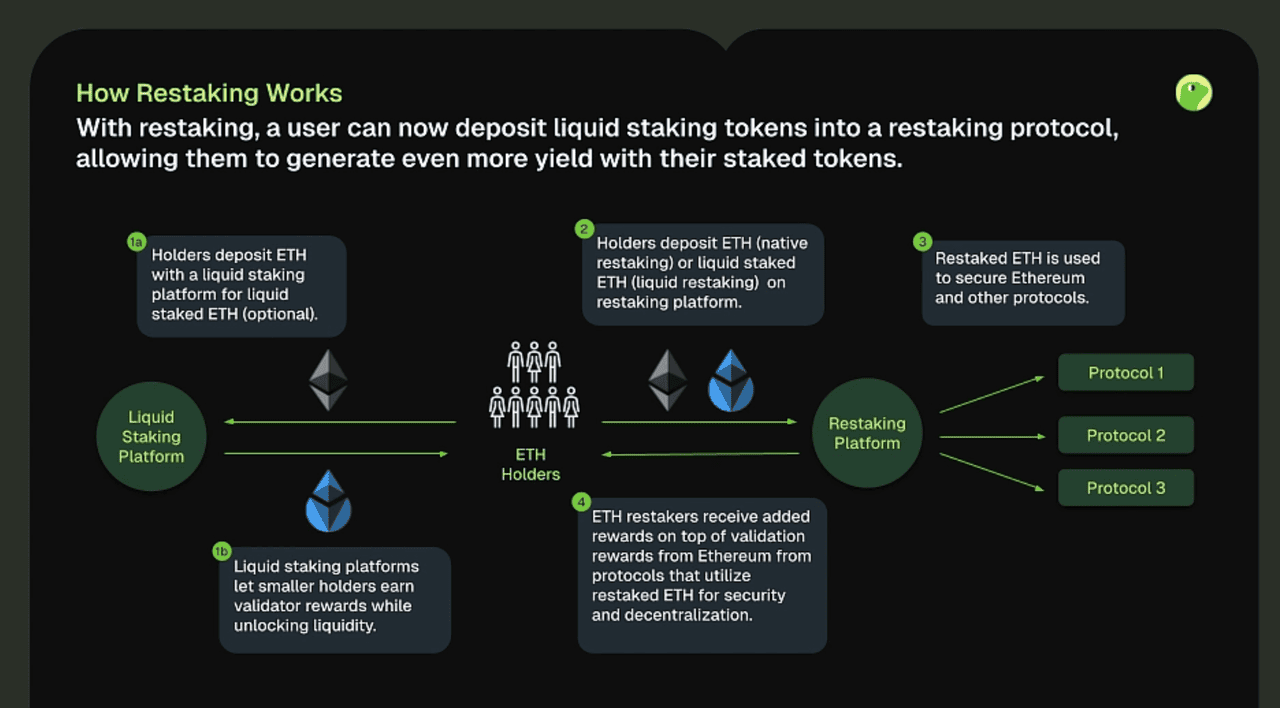

How Restaking Works | Source: CoinGecko

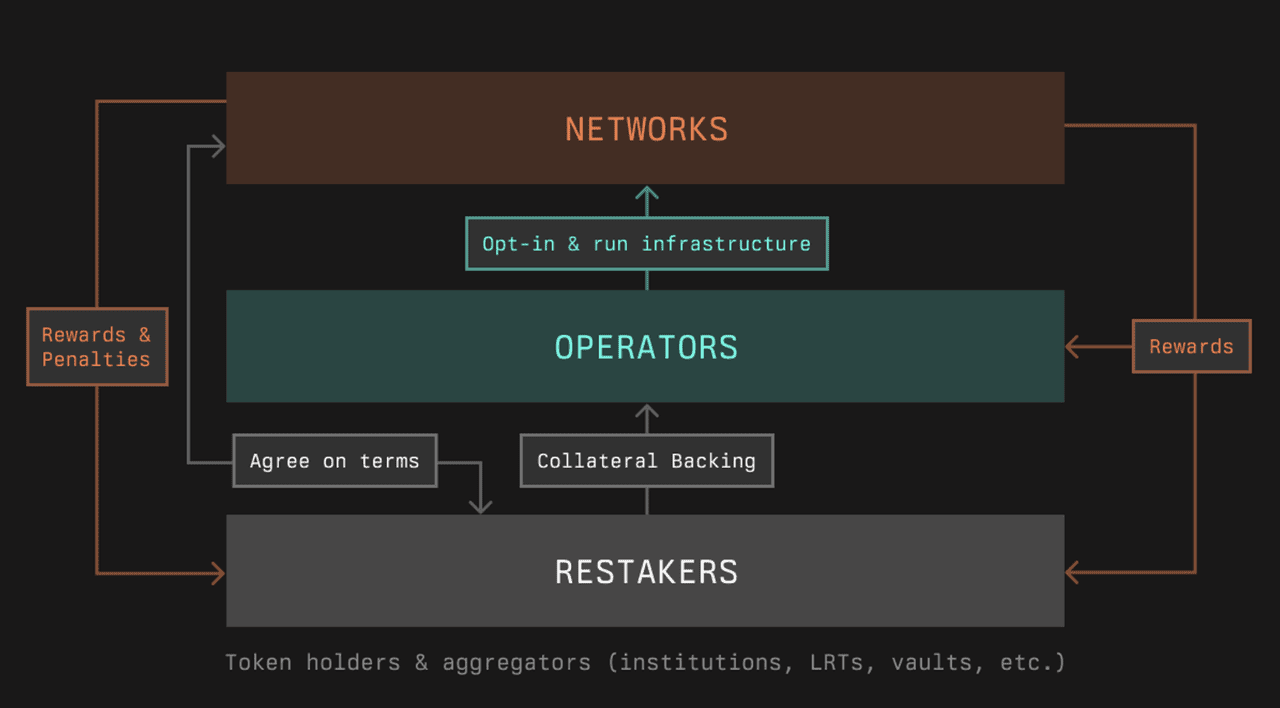

Restaking is one of the most talked-about innovations in DeFi during 2025. At its core, it is a way to increase the efficiency of staked crypto assets by allowing them to be reused for more than one purpose. Traditionally, when tokens like ETH are staked, they secure the base blockchain and generate rewards, but their utility ends there. Restaking changes this model by letting the same assets also secure additional protocols and middleware, creating new opportunities for both yield generation and network security.

The concept is closely tied to the rise of liquid staking, which first allowed stakers to maintain flexibility and continue using their assets across DeFi while still earning staking rewards. Restaking takes this a step further. Instead of staking once and being done, participants can opt into restaking and extend the security and value of their assets across multiple layers of the ecosystem. This makes restaking not only a yield opportunity but also an important building block for scaling decentralized infrastructure.

There are two main types of restaking:

• Native restaking: Native restaking is carried out directly by

validators. Those who already stake to secure a base blockchain can “opt in” to extend their staked assets to additional protocols. On Ethereum, this requires running a validator with at least 32 ETH, which makes it accessible mainly to node operators and institutions. Since no new token is created, native restaking reduces some risks but is less accessible to retail users.

• Liquid restaking: Liquid restaking makes the process more accessible to a wider group of users. It works by accepting liquid staking tokens (LSTs) and issuing liquid restaking tokens (LRTs) that represent a user’s position. These tokens can be traded, used as collateral, or deployed across DeFi while still earning rewards. The advantage is accessibility and liquidity, though it introduces additional smart contract layers and potential risks such as token depegging.

Together, native and liquid restaking form a dual model. Native restaking gives professional validators a way to extend the utility of their stake, while liquid restaking makes the same opportunities available to everyday DeFi participants.

Why Restaking Matters in 2025?

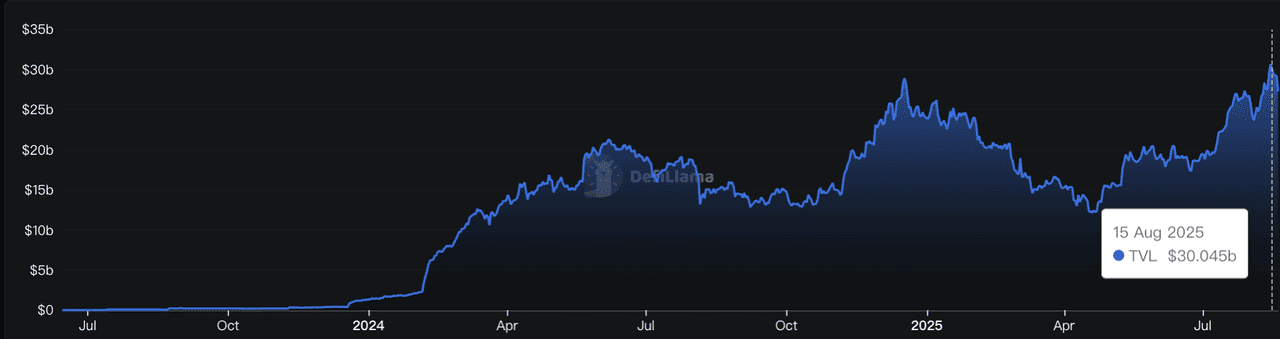

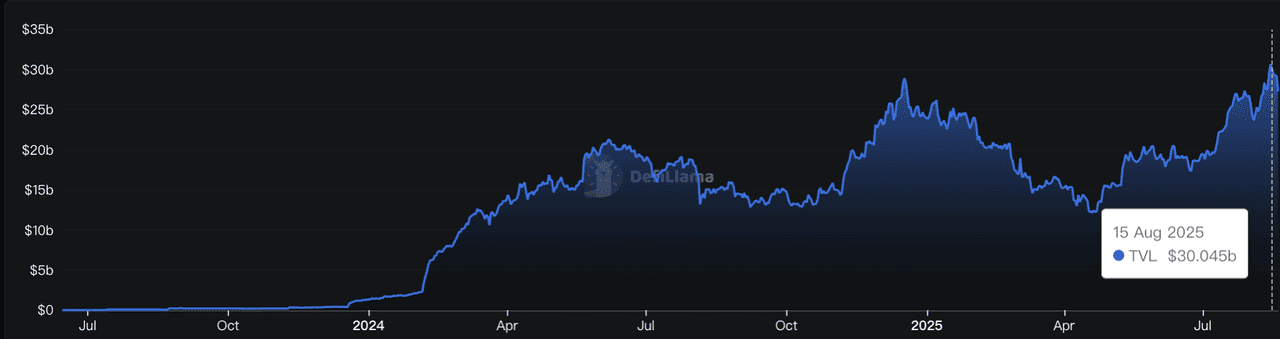

Liquid Restaking TVL reached 30B in August 2025 | Source: DefiLlama

• $40 billion market potential: Cointelegraph Research estimates the overall restaking market represents a $40 billion opportunity, as it allows staked assets to secure multiple protocols at once. Within that, liquid restaking TVL on Ethereum alone reached $30 billion in August 2025, showing strong traction even at this early stage.

• Institutional adoption supported by regulation: The 2025

GENIUS Act and SEC recognition of liquid staking have lowered compliance barriers, opening the door for funds, custodians, and exchanges to participate in restaking. Institutions are beginning to treat it as part of their broader DeFi yield strategies.

• Cross-chain expansion: Restaking is moving beyond Ethereum, with new frameworks enabling assets from multiple blockchains to contribute to shared security. This evolution is positioning restaking as a universal coordination layer across L1s,

L2s, and modular networks.

• Macro yield environment: With traditional yields remaining low, Ethereum’s average staking income of about 4.5% annualized, plus restaking rewards, offers an attractive alternative for investors seeking sustainable on-chain returns.

In short, 2025 is a pivotal year where restaking is moving from a niche DeFi innovation into a foundational layer of blockchain security and yield generation.

Top 8 Restaking Crypto Projects to Watch in 2025

Restaking has quickly scaled in 2025, with the market estimated at 40 billion dollars and 30 billion dollars in liquid restaking TVL on Ethereum as of August 2025. Protocols are taking different approaches, from validator-level participation to liquid restaking tokens accessible to everyday DeFi users.

Here are 8 projects leading the space this year:

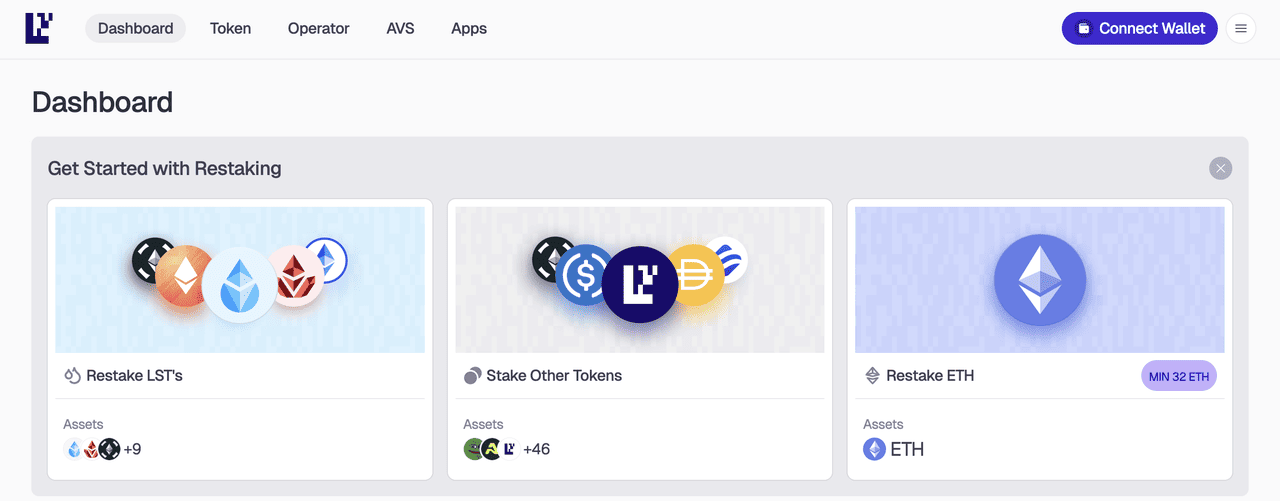

1. EigenLayer (EIGEN) - Restaking Protocol for Ethereum

Project Type: Foundational Ethereum Native Restaking Infrastructure Protocol

EigenLayer has established itself as the undisputed leader in the restaking space, with its TVL surging to over $15 billion and making it the third-largest DeFi project by total value locked. The protocol is preparing major upgrades for 2025, including Rewards v2 and the introduction of slashing capabilities, positioning it for continued dominance in the evolving restaking landscape.

The protocol works by creating a marketplace where blockchain networks can tap into Ethereum's existing security infrastructure instead of building their own from scratch. This shared security model has attracted dozens of projects including data availability layers, oracle networks, and bridge protocols. EigenLayer's approach has proven so successful that it has spawned an entire industry of competing restaking protocols trying to replicate its model.

2. Solayer (LAYER) - Restaking Protocol for Solana

Project Type: Hardware-Accelerated Restaking and Scaling Protocol on Solana

Solayer has emerged as the leading restaking protocol on

Solana, successfully raising deposits of $155 million before its mainnet launch and hitting early deposit caps within 45 minutes during its initial phases. The protocol has unveiled its ambitious 2025 roadmap, introducing the revolutionary Solayer InfiniSVM, a hardware-accelerated SVM blockchain that promises infinitely scalable multi-execution cluster architecture with 100 Gbps performance capabilities.

The protocol differentiates itself by focusing on hardware acceleration and high-performance computing, promising to achieve 1,000,000+ transactions per second through its InfiniSVM technology. Solayer has also secured strategic partnerships and completed multiple funding rounds, positioning it as a serious competitor to Ethereum-based restaking solutions. The team includes former engineers from major tech companies who bring expertise in distributed systems and blockchain scalability.

3. Kernel DAO (KERNEL) - Restaking Protocol for ETH, BNB, and BTC

Project Type: Multi-Chain Restaking Protocol supporting ETH, BNB, and BTC across 10+ networks

Kernel DAO (formerly Kelp DAO) has rapidly emerged as one of the largest liquid restaking platforms with over $2 billion in TVL, successfully channeling over 10% of all EigenLayer deposits through its protocol within the first 15 days of launch. The protocol rebranded to Kernel DAO in late 2024, representing a strategic evolution that expands beyond its original Ethereum focus to include multi-chain restaking capabilities across 10+ Layer-2 integrations and 120+ DeFi integrations.

Kernel DAO's rsETH token serves as a liquid restaking token that enables users to maximize staking yields by converting liquid staking tokens like

stETH or

rETH into rsETH, facilitating simultaneous rewards from Ethereum staking and EigenLayer services. The protocol has achieved remarkable milestones including 300,000 unique addresses and has pioneered innovative features like Gain Vaults for automated yield optimization and Kernel Points to bring liquidity to previously illiquid EigenLayer points. With its rebrand to Kernel and expansion to

BNB Chain and other networks, the protocol is positioning itself as a leader in capital-efficient multi-chain restaking infrastructure.

4. Ether.fi (ETHFI) - Restaking Protocol for ETH, BTC and Stablecoins

Project Type: Native Liquid Restaking and DeFi Banking Protocol on Ethereum

Ether.fi stands out as the largest liquid restaking protocol by TVL, boasting over $2.8 billion in total value locked across multiple assets. The protocol has successfully pivoted to become a DeFi neobank, rolling out Visa payment cards in the U.S. and reporting net revenue of $67.9 million for the first six months of 2025, demonstrating its evolution beyond traditional restaking services.

Ether.fi pioneered native restaking through its eETH and

weETH tokens for Ethereum, expanded to

Bitcoin with eBTC, and now offers stablecoin restaking capabilities for enhanced yield optimization. The protocol enables users to earn rewards from ETH staking and restaking automatically without separate actions or lock-up periods, while eBTC provides dual yields from

Bitcoin staking through

Babylon and restaking through EigenLayer, Symbiotic, and Karak. With support for LBTC and WBTC deposits, stablecoin vaults, and integrations across 400+ DeFi protocols, Ether.fi has positioned itself as a comprehensive multi-asset financial platform.

5. Symbiotic - Restaking Project for ERC-20 Tokens

Project Type: Permissionless Multi-Asset Restaking Protocol on Ethereum

Symbiotic launched on Ethereum mainnet as the first fully permissionless restaking protocol to go live in a production environment, marking a significant milestone after two years of development and five independent audits. The protocol raised $5.8 million in funding from prominent investors Paradigm and cyber.Fund, signaling strong institutional backing for its innovative approach to decentralized restaking infrastructure.

Unlike other restaking protocols, Symbiotic supports any

ERC-20 token as collateral and features fully configurable slashing and reward mechanisms, offering unprecedented flexibility for both users and protocols. The protocol's modular design and permissionless nature allow it to support a wide variety of use cases and asset types, with nearly 50 networks, 78 operators, and 55 vaults already integrating the protocol. With its focus on immutability, decentralization, and comprehensive slashing implementation, Symbiotic represents the next evolution of restaking infrastructure, offering unprecedented customization for different security and economic models.

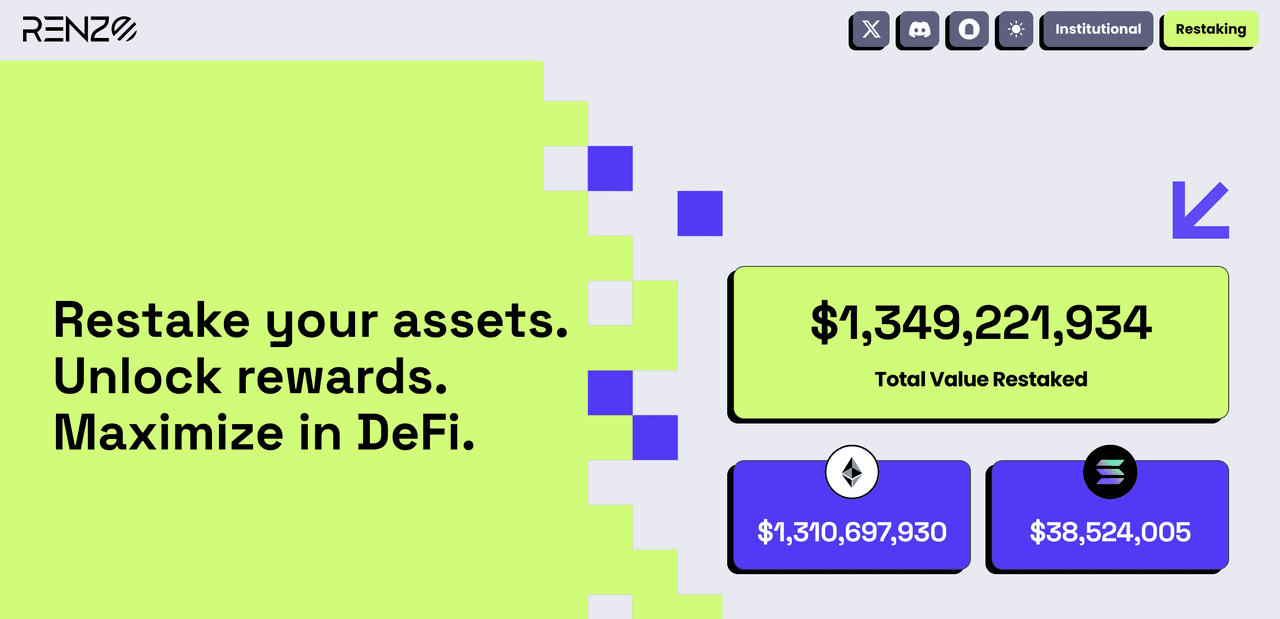

6. Renzo Protocol (REZ)- Restaking Project for ETH & SOL

Project Type: Multi-Chain Liquid Restaking Token Manager on Ethereum

Renzo Protocol has established itself as a leading Liquid Restaking Token (LRT) manager in the EigenLayer ecosystem with $3.3 billion in TVL. Despite facing a major de-pegging event in April 2024, Renzo has maintained its position as the second-largest liquid restaking protocol, demonstrating resilience and continued market confidence in its strategic approach to risk management.

Renzo's ezETH token serves as a reward-bearing liquid restaking token that auto-compounds both staking and restaking rewards, with extensive DeFi integrations across multiple blockchain networks. The protocol abstracts the complexity of restaking for users while maintaining high yields through strategic delegation and risk management. Renzo's multi-chain approach and focus on user experience make it an attractive option for both newcomers to restaking and experienced DeFi users seeking optimized yield strategies.

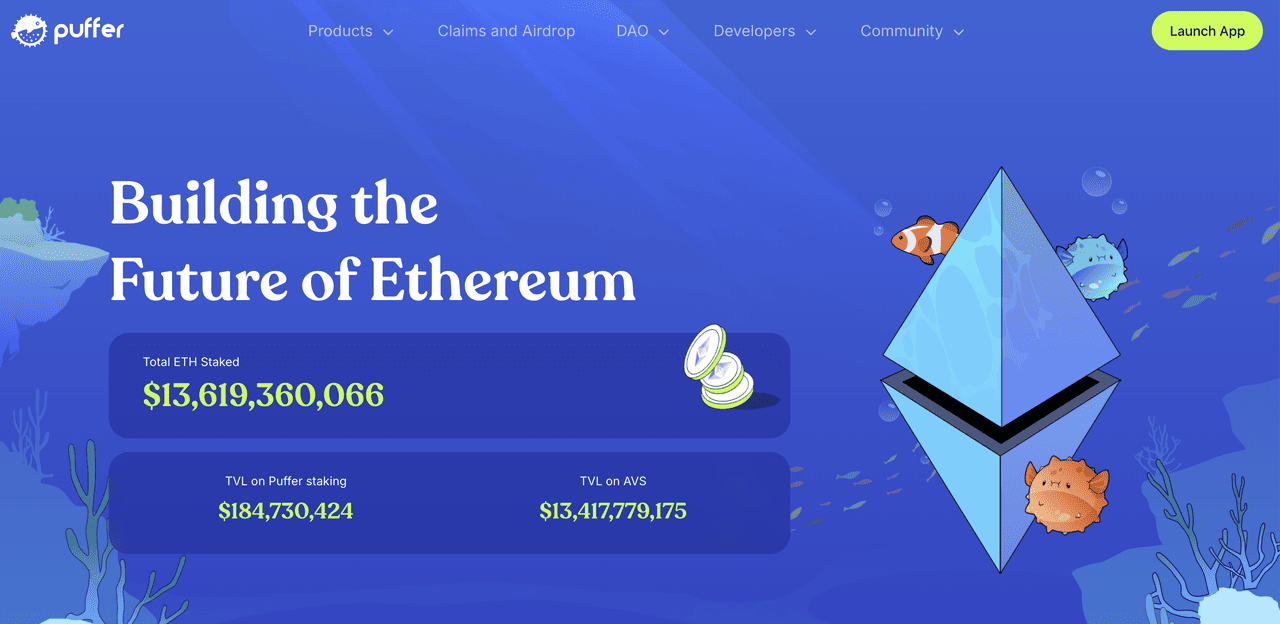

7. Puffer Finance (PUFFER) - Restaking Project for Ethereum

Project Type: Anti-Slashing Restaking and Infrastructure Protocol on Ethereum

Puffer Finance has established itself as a leading innovator in Ethereum infrastructure, rapidly achieving $832 million in TVL and securing strategic backing from prominent investors including Brevan Howard Digital, and Electric Capital. The protocol recently launched its CARROT token campaign for upcoming airdrops and has expanded beyond liquid restaking to develop a comprehensive suite including UniFi rollup technology and preconfirmation AVS on EigenLayer.

The protocol was founded with a focus on democratizing validator access and has implemented a unique permissionless validator model that allows home stakers to participate without the typical 32 ETH requirement. Puffer's anti-slashing technology uses advanced cryptographic techniques and automated risk management to protect users from validator penalties that have historically deterred participation. The platform has also gained attention for its academic partnerships and research contributions to Ethereum's proof-of-stake consensus mechanism improvements.

8. Swell (SWELL) - Restaking Protocol and Restaking Chain for Ethereum

Project Type: Liquid Restaking Protocol with Dedicated Restaking Layer 2 Chain

Swell Network has established itself as one of the biggest Ethereum restaking protocols with over $1.8 billion in total TVL across products and more than 167,000 users. The protocol operates both traditional restaking services and Swellchain, a first-of-its-kind restaking-powered Layer 2 network that represents a new category of blockchain infrastructure specifically designed for liquid restaking operations.

The protocol utilizes a unique "Proof of Restake" consensus mechanism that creates a self-reinforcing cycle where increased participation strengthens network security and generates higher yields. Swellchain has launched with gaming-focused applications and one-click leveraged restaking features through partnerships with

Euler. The project represents the first successful implementation of AltLayer's "restaked rollup" framework, serving as a proof of concept for future restaking-focused blockchains.

Honorable Mention: Platforms Offering Both Staking and Restaking

In addition to dedicated restaking protocols, several established platforms now combine traditional staking with restaking features. These players are not pure restaking projects but still play an important role in the ecosystem by expanding yield opportunities across multiple strategies.

1. Lido Finance (Ethereum): The largest liquid staking protocol, managing over 28% of Ethereum’s staked ETH. Its stETH token is widely integrated across DeFi and restaking platforms, with billions already restaked, making

Lido a central piece of the ecosystem.

2. Pendle Finance (Ethereum): Known for yield tokenization,

Pendle lets users trade future yield streams and has become a key hub for leveraged restaking strategies. Its growth reflects how restaking has created new opportunities for DeFi yield markets.

3. Jito (Solana): The leading liquid staking protocol on Solana with over 11 million SOL staked.

Jito combines high staking yields with MEV reward sharing and is now expanding into multi-asset restaking through its upcoming Jito staking / restaking initiative.

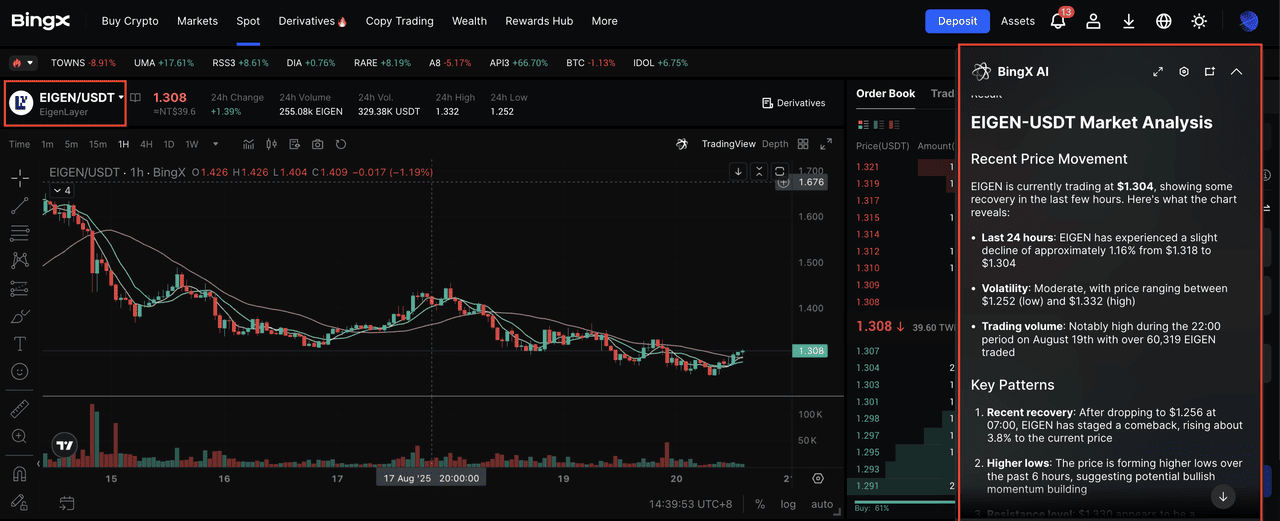

How to Trade Restaking Projects Tokens on BingX

Restaking project tokens are gaining attention in 2025 as investors look to capture the growth of DeFi’s newest infrastructure layer. BingX makes it easy to access these tokens through its spot and futures markets, while BingX AI provides real-time insights to help traders make smarter decisions.

Step 1: Find Your Trading Pair

Step 2: Analyze with BingX AI

Click the AI icon on the trading page to access

BingX AI. The tool highlights price trends, support and resistance levels, and market signals to guide your strategy.

Step 3: Execute and Monitor Your Trade

Use a market order for instant execution or a limit order to set your preferred entry. Keep monitoring BingX AI to adjust your trade as market conditions shift.

With BingX and BingX AI, trading restaking tokens becomes more accessible and data-driven, whether you’re building a long-term position or taking advantage of short-term opportunities.

Risks and Considerations Before Using Restaking Projects

While restaking offers attractive opportunities, it also comes with risks that users should carefully evaluate:

• Smart contract risk: Restaking adds extra layers of contracts, which increases the potential attack surface. Bugs or exploits could impact staked assets.

• Slashing risk: Validators who restake may be penalized if they fail to meet requirements across multiple protocols. This can lead to losses for participants.

• Liquidity risk: Liquid restaking tokens (LRTs) may not always hold their value or trade at 1:1 with underlying assets, especially during market stress.

• Adoption uncertainty: The growth of restaking depends on protocols adopting it for security. If demand slows, the yield opportunities could shrink.

• Regulatory risk: While regulation is improving, frameworks around staking and restaking are still developing, which could impact long-term adoption.

In short, restaking introduces both new opportunities and new risks. Diversification, careful platform selection, and an understanding of the trade-offs are essential before committing assets.

Final Thoughts

Restaking has quickly become one of the defining narratives in DeFi’s 2025 cycle. By allowing staked assets to secure multiple protocols, it improves capital efficiency and strengthens network security. With liquid restaking TVL surpassing 24 billion dollars and the market opportunity estimated at 40 billion, adoption is accelerating across both retail and institutional players.

As DeFi heads toward 200 billion dollars in total value locked by the end of 2025, restaking is set to remain a key driver of growth and a cornerstone of decentralized finance.

Related Reading