The “Trump Coin ETF” is moving from headline fodder to a real (and controversial) possibility. In 2025, multiple issuers filed with the U.S. Securities and Exchange Commission (SEC) to list funds tied to

Official Trump ($TRUMP), the

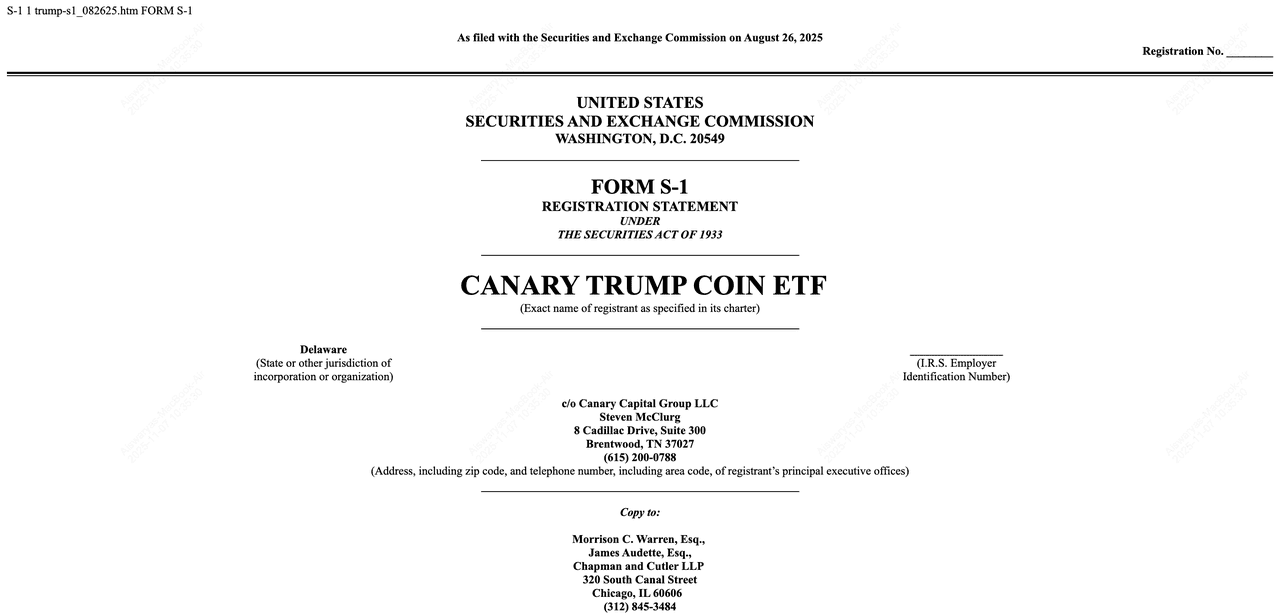

Solana-based memecoin associated with President Donald Trump. The highest-profile attempt so far is Canary Capital’s “Canary Trump Coin ETF,” which filed an S-1 on August 26, 2025, proposing a spot ETF directly backed by TRUMP held in regulated custody.

This guide explains what a Trump Coin ETF is, why it matters, which filings exist, and when it could get approved and launch for trading.

What Is the Official Trump (TRUMP) Meme Coin?

Official Trump (TRUMP) is a Solana-based memecoin launched on January 17, 2025, just days before President Donald Trump’s second inauguration, positioned as a digital show of support rather than a utility token. The project quickly exploded on social media, attracting billions in trading volume and fast listings on major crypto exchanges. Like most memecoins, TRUMP’s value is driven mainly by hype, speculation, and cultural momentum, not technical fundamentals.

What Is a Trump Coin ETF and How Does It Work?

An ETF or

exchange-traded fund is a security you buy/sell in a brokerage account, designed to track an underlying asset. A Trump Coin ETF is a stock-market fund that aims to track the spot price of $TRUMP so you can buy/sell exposure through a regular brokerage account, no wallet, keys, or on-chain steps required.

Unlike other crypto ETFs listed and under review in global financial markets, the $TRUMP ETF targets a memecoin associated with a sitting U.S. President, an unprecedented mix of political risk, concentration concerns, and market-manipulation scrutiny compared with

BTC/

ETH funds. Even Canary’s filing flags the “high degree of risk” and the relatively new, loosely regulated spot venues where TRUMP trades.

On Aug 26, 2025, Canary Capital filed an S-1 for a spot Trump Coin ETF under the Securities Act of 1933. Unlike

futures products, this structure proposes holding TRUMP tokens in regulated custody as the underlying asset. Fees and ticker were not disclosed in the initial filing.

How a TRUMP Coin ETF Works

• You trade shares like a stock. If approved, the ETF would be listed on a U.S. exchange. You’d place orders during market hours from a brokerage account; the share price should closely track $TRUMP’s market value.

• The fund holds

TRUMP tokens, not derivatives. Canary’s filing describes a spot, fully-backed structure: the trust would hold $TRUMP tokens in custody to match shares outstanding.

• Creations/redemptions keep price in line. Authorized Participants (APs) deliver TRUMP to the trust to create new shares or take TRUMP out when they redeem, which helps the ETF’s market price stay close to its net asset value (NAV). This mechanism is outlined in the S-1 risk/operations sections for the proposed trust.

What Makes Trump Coin ETF Different From Other Crypto ETFs in the Market?

A Trump Coin ETF stands apart from other crypto ETFs already in the market or under consideration because it would take a highly speculative memecoin and move it into the mainstream, letting both retail investors and institutions access $TRUMP through regular brokerage accounts instead of crypto wallets.

It would also be the first U.S. ETF tied to a sitting president’s personal crypto project, introducing unprecedented governance, ethics, and regulatory questions. And it arrives a year after the SEC has already approved spot Bitcoin ETFs in January 2024 and

spot Ethereum ETFs in May 2024, and more recently a spot

Solana ETF and a

Solana staking ETF in October 2025, alongside generic listing standards for some crypto and commodity products. Together, these moves signal a broader shift toward faster approvals and a more open stance on digital-asset funds in the United States.

Approval will depend on how well the product fits into the SEC’s updated listing framework and whether the TRUMP market looks mature enough to support a spot ETF. Since Sept 17, 2025, exchanges can use generic listing standards for some spot crypto and commodity ETFs, which can shorten timelines if the asset meets liquidity, pricing, and reporting requirements.

However, regulators will still scrutinize TRUMP’s market depth, volatility, custody setup, and surveillance-sharing agreements, especially given its memecoin status and concentration risks. Some analysts also note that having a related futures market can boost regulatory confidence for spot products. Even if approved, investors should understand that a Trump Coin ETF still carries sharp price swings, and tracking depends on the fund’s creation/redemption process, liquidity, and custody, as detailed in its prospectus.

What Is the Current Status of Trump Coin ETFs? (As of November 2025)

Multiple issuers have already pushed Trump-linked ETFs into the SEC pipeline, ranging from fully backed spot proposals to more experimental structures that rely on offshore subsidiaries.

1. Canary Trump Coin ETF: Spot, Fully Backed

Source: SEC filings

Filed on August 26, 2025, Canary’s S-1 proposes a spot ETF under the Securities Act of 1933, meaning the fund would hold TRUMP tokens in regulated custody rather than futures or derivatives. Analysts called it the first direct, fully backed attempt for TRUMP, but flagged hurdles around market depth, surveillance-sharing, and custody concentration, all areas the SEC weighs when evaluating spot crypto products.

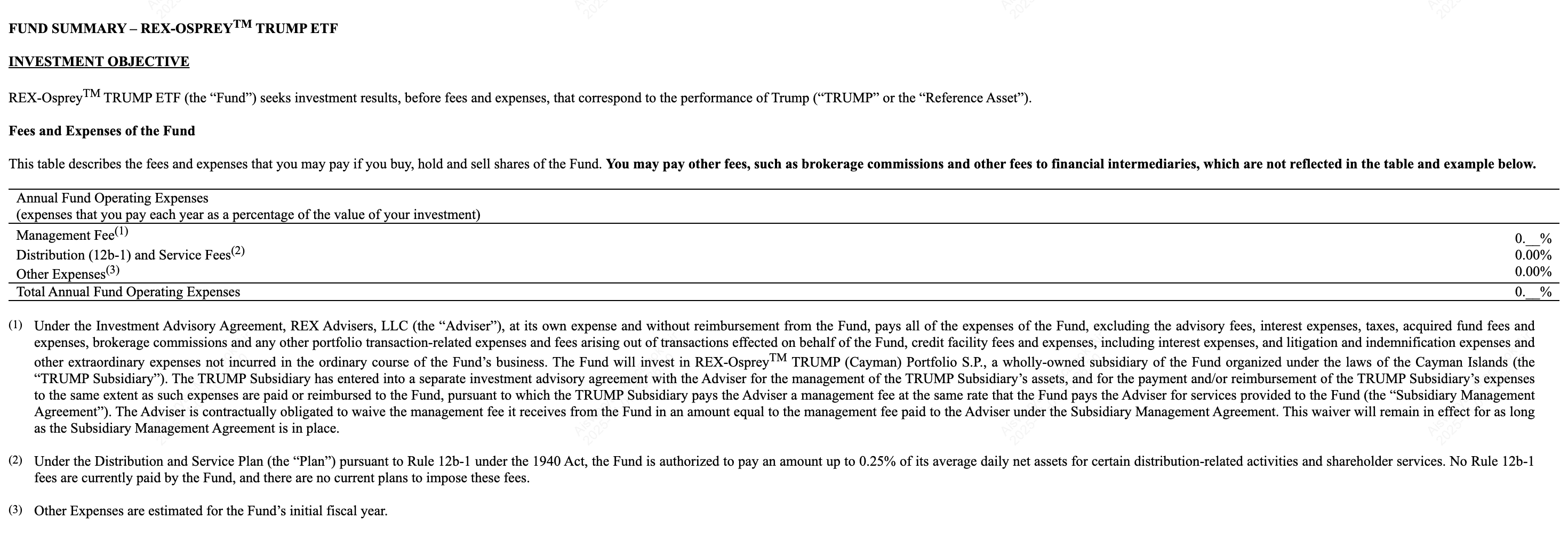

2. Rex-Osprey Trump ETF Filings: January 2025

Source: SEC filings

On January 21–22, 2025, Rex Advisers and Osprey Funds submitted paperwork for an ETF that could gain exposure to TRUMP partly through a Cayman Islands subsidiary, alongside parallel filings for

DOGE,

BONK,

SOL, and

XRP. The structure differed from traditional BTC/ETH spot products and tested how far the SEC’s crypto-friendly leadership, and new policy overhaul, would allow issuers to go.

Recent media coverage highlighted that SEC staff have suggested many memecoins are not securities, placing TRUMP outside certain legacy rules. However, filings still warn that spot markets trading TRUMP are new and largely unregulated, increasing risks of price manipulation, fraud, and security breaches - key factors the SEC can use to delay or deny an ETF launch.

When Could a Trump Coin ETF Launch?

The SEC could approve a Trump Coin ETF, but only if the underlying market shows enough maturity for a spot product. Since September 17, 2025, U.S. exchanges are allowed to use generic listing standards for certain crypto and commodity ETFs, which cuts down on lengthy, custom approval cycles.

In late October 2025, Reuters reported that Litecoin and

Hedera ETFs cleared this path, proving the rules can be used for non-BTC, non-ETH assets. However, TRUMP still has to meet the same tests around pricing transparency, sufficient liquidity, and reliable reporting. Canary’s filing will be judged on whether surveillance-sharing agreements, diversified custody, and market depth can reduce manipulation risks, areas where regulators have historically pushed back on emerging tokens.

There is also a meaningful precedent: a Dogecoin ETF has already been approved and is preparing to trade, which signals a sharp shift in tolerance for speculative crypto products. That puts TRUMP into a category the SEC has recently allowed, but not automatically. TRUMP’s political ties, issuer concentration, and lack of a futures market could still slow approval or trigger extra scrutiny.

Even if the ETF launches, investors should expect significant volatility and understand that tracking quality will depend on the ETF’s creation/redemption mechanics, custody, and liquidity, all of which will be spelled out in the fund’s prospectus.

Beyond the $TRUMP ETF: Other Ways to Invest in TRUMP Coin

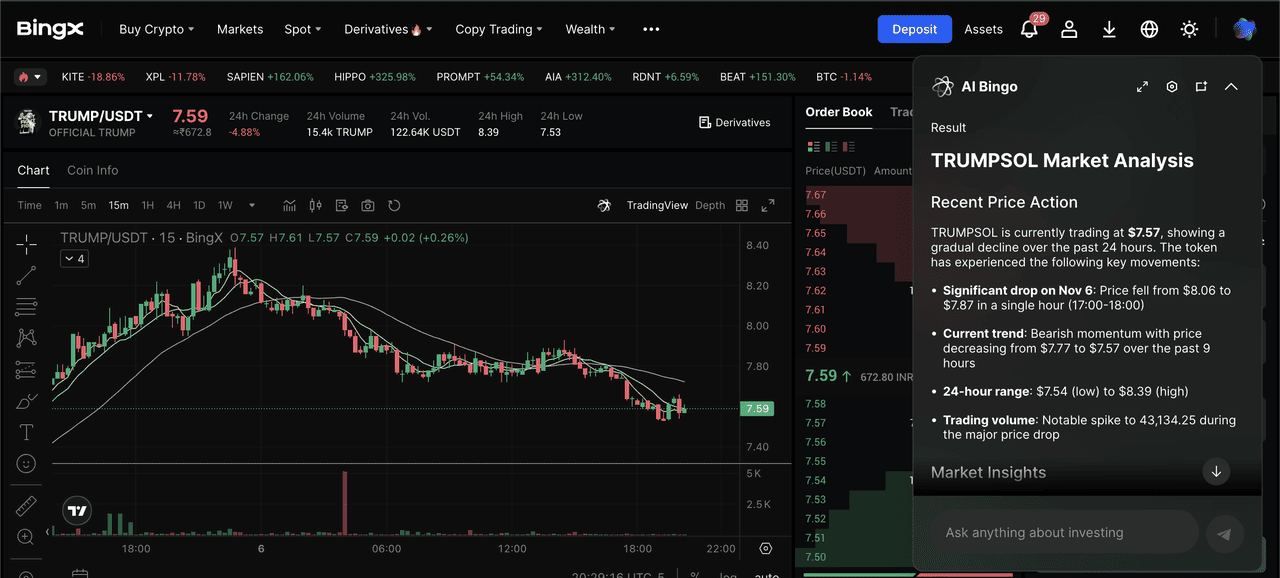

If a Trump Coin ETF is still months away, you don’t need to wait. You can already trade TRUMP directly on BingX, with tools like

BingX AI to help track price signals, volatility, and risk metrics in real time.

1. Buy or Sell TRUMP on the Spot Market

TRUMP/USDT trading pair on the spot market powered by BingX AI

Spot trading lets you own the actual TRUMP token. Here’s how to get started on BingX:

2. Deposit Funds: Add

USDT or supported crypto to your Spot Wallet. You can deposit directly or

purchase USDT using bank card or

P2P.

3. Find TRUMP: Go to Spot Trading, search “TRUMP”, and choose a pair like

TRUMPSOL/USDT.

4. Place an Order: Select a

Market order for instant buy/sell, or a Limit order to set your preferred price.

5. Manage Your Tokens: Once filled, TRUMP will appear in your Spot Wallet, where you can hold, sell, transfer, or convert to other assets.

Spot trading is best if you want direct exposure and the ability to hold TRUMP long-term or move it on-chain.

2. Long or Short TRUMP on BingX Futures

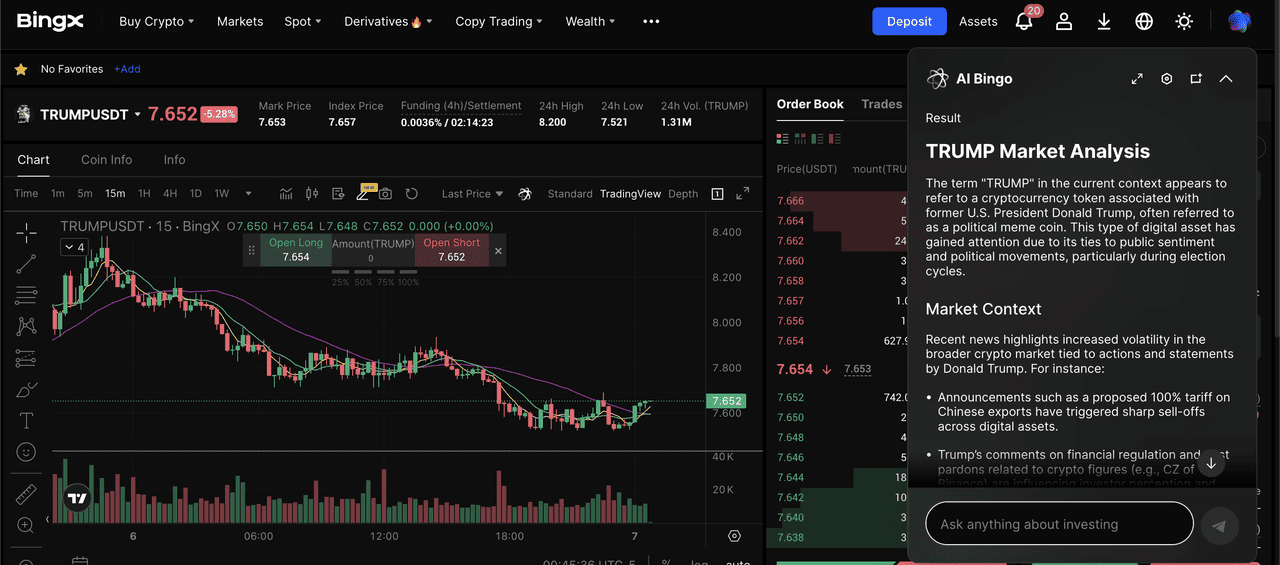

TRUMPUSDT perpetual contract on the futures market powered by BingX AI

If you want flexibility to profit in both rising and falling markets, you can

trade TRUMP futures on BingX.

• Go long if you expect TRUMP’s price to rise.

• Short if you think it may drop after news events, unlocks, or market volatility.

Here’s how futures trading works on BingX:

2. Choose Long (Buy) or Short (Sell), set order size, and manage leverage responsibly.

4. Monitor positions and funding rates, then close anytime to realize profit or limit losses.

Futures are ideal for active traders who want to hedge or speculate, but they carry higher risk, especially with leverage. Beginners should start small and consider practicing in

BingX Demo Trading before using real funds.

Final Thoughts

A Trump Coin ETF marks one of the most unusual intersections of crypto, politics, and traditional finance. If approved, it would give everyday investors and institutions regulated, stock-market access to $TRUMP without using wallets or on-chain transfers. The filings from Canary Capital, and earlier attempts from Rex-Osprey, show how quickly meme assets are being packaged into mainstream financial products. But approval is not guaranteed. The SEC will still evaluate market depth, custody, volatility, and surveillance controls before any fund reaches live trading.

Until then, investors who want exposure don’t need to wait. TRUMP is already available on major exchanges, and platforms like BingX provide both spot and futures trading, along with AI-powered insights to help track price trends and risk.

As with any memecoin, price swings can be extreme. Anyone considering an ETF or direct token purchases should understand the risks, do their own research, and only invest what they can afford to lose.

Related Reading