Onchain perpetuals are back in focus in 2025 as builders look for a Mainnet-settled design with CLOB-like execution.

Synthetix (SNX) is positioning for that moment: offchain order matching, onchain settlement on

Ethereum, and a Q4 2025 launch window for a perpetuals

DEX built directly on L1.

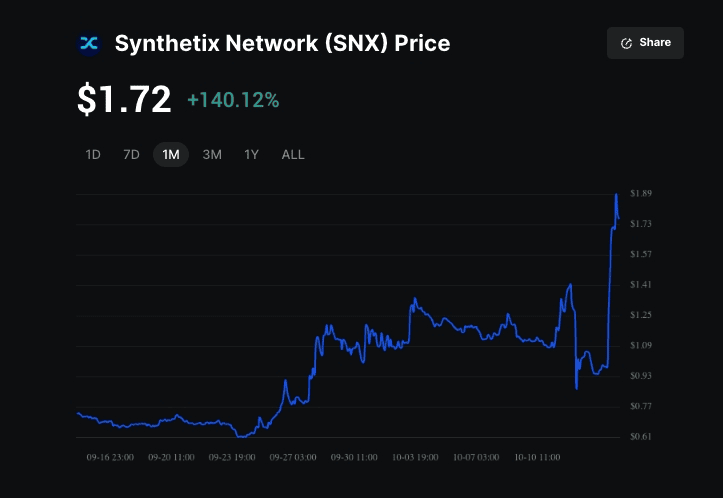

SNX jumped around 90% in 24 hours with around $600 million in trading volume on October 13, 2025. It gained over 200% in October as momentum built around the Mainnet perps launch and a revived bull case after

SNX inflation ended last year. With a cleaner, fee-driven narrative and less supply overhang, liquidity rotated in fast.

Synthetix (SNX) surged over 140% in the last 30 days | Source: BingX

What Is Synthetix (SNX) and How Does It Work?

Synthetix is a decentralized derivatives protocol on Ethereum that mints and settles synthetic assets (Synths) via

smart contracts. It pairs offchain order matching on a central limit order book with onchain settlement for Ethereum finality, with a Mainnet exchange slated for 2025. The goal: deep liquidity, low slippage, and CEX-like execution without giving up onchain custody.

Liquidity comes from pooled collateral, so you can swap between Synths without a direct counterparty. Trades clear peer-to-contract at oracle prices, removing order book depth as a bottleneck at execution. The protocol started with synthetic assets and later added decentralized perpetual futures. While Perps v2 ran on

Layer 2, the current design pivots back to Ethereum Mainnet for security and composability.

SNX

staking collateralizes the system. Roughly 171.71 million

SNX are staked, earning about 24.09% APY. Stakers can mint sUSD and swap into other Synths, and each mint assigns them a pro rata share of the global debt pool, which moves with Synth supply and prices.

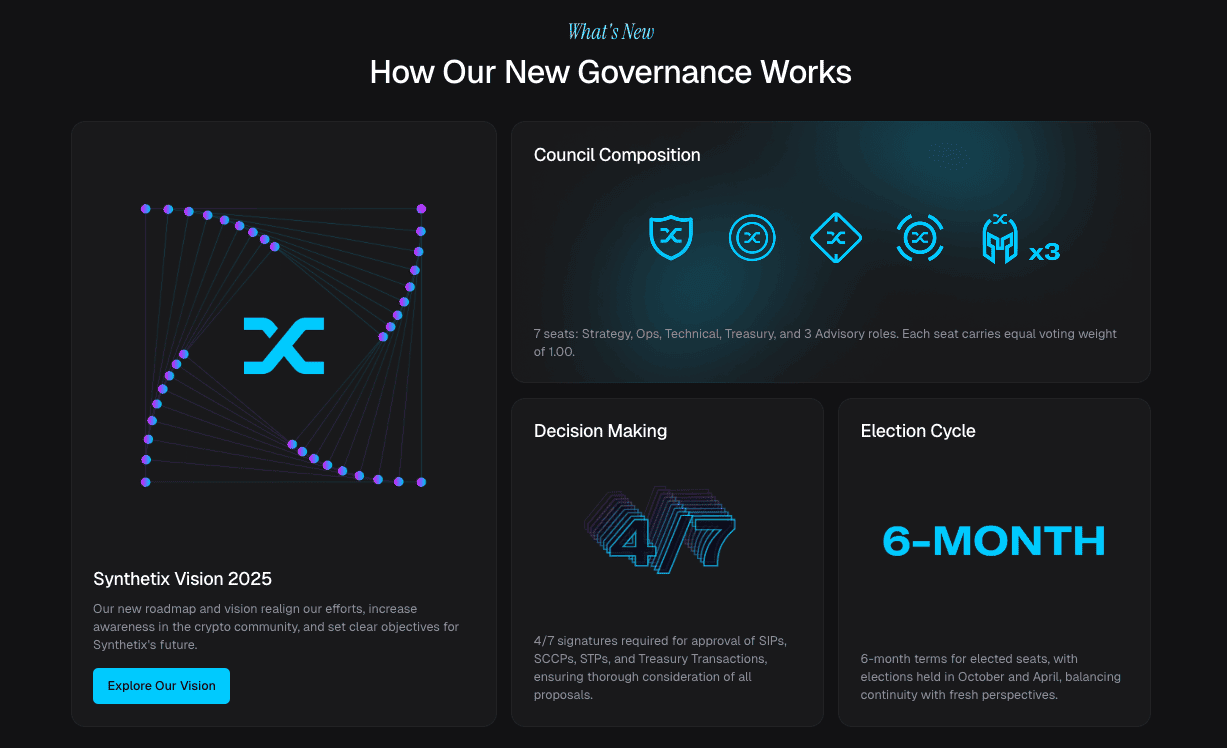

The v3 architecture adds cross-margin, multi-collateral support, and a modular, upgradeable framework. Front-end venues provide the trading interface, while Synthetix governs collateral, settlement, and risk parameters through community governance.

Source: Synthetix

Why Did SNX Token Price Jump By 94% In 7 Days?

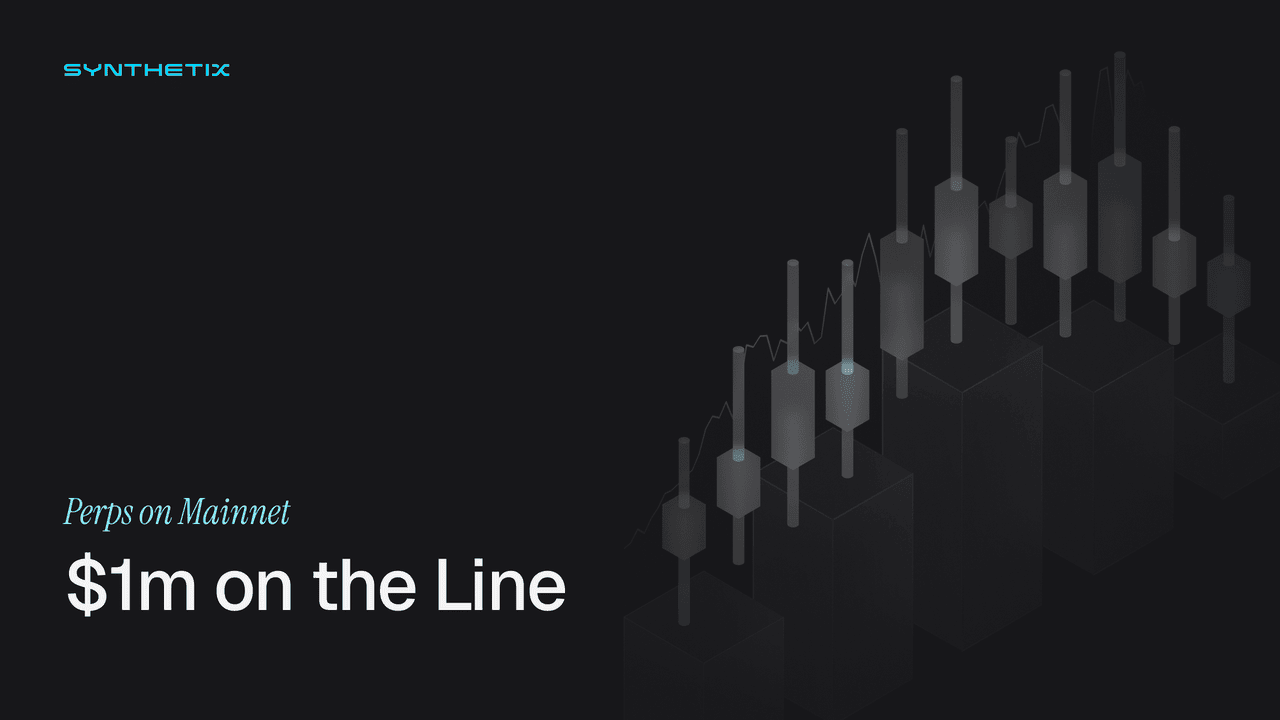

1. Synthetix Mainnet perps DEX is the clear catalyst

Synthetix has spent weeks priming a

Q4 launch of an Ethereum Mainnet perps DEX: offchain central limit order book matching, onchain settlement for finality, plus privacy-friendly “Private Perps.” A 1 million USD trading competition is set to battle-test the stack ahead of launch.

That kind of concrete roadmap concentrates attention and speculative flows.

Source: Synthetix

2. The token story got cleaner

Governance

ended ongoing SNX inflation in late 2023, shifting rewards toward fees. Less structural sell pressure and a simpler, fee-driven thesis make SNX a more straightforward bet when product momentum returns, so the “Mainnet perps” narrative lands on firmer ground than a momentum-only spike.

3. Narrative tailwinds did the rest

Weekly roundups and market chatter kept “Mainnet perps on Ethereum” in the spotlight. A steady cadence of credible updates often sets up technical breakouts and squeezes as shorts get run over and sidelined longs chase.

What Is the SNX Token Utility?

1. Collateral for Synths: Stake SNX to mint sUSD and back all Synths via a pooled-collateral model.

2. Fee sharing: Earn a pro-rata share of trading fees from Synth swaps and integrated perps venues; rewards depend on maintaining the target collateralization ratio.

3. Governance: Use SNX to participate in decentralized governance through DAOs and elected councils that set upgrades, parameters, budgets, and grants.

4. Security of settlement: Staked SNX underwrites the shared debt pool, enabling peer-to-contract execution at oracle prices with deep, predictable liquidity.

5. Incentives framework: Community programs are set by governance; historically this included token emissions, while rewards now center on protocol fee generation.

SNX Tokenomics

SNX’s monetary design evolved with the protocol. It launched with a fixed cap, then introduced inflation in March 2019 to incentivize staking and deepen collateral. Emissions tapered over time to bootstrap liquidity before governance ended them, effectively capping supply just under 300 million and shifting rewards toward fee accrual tied to real usage.

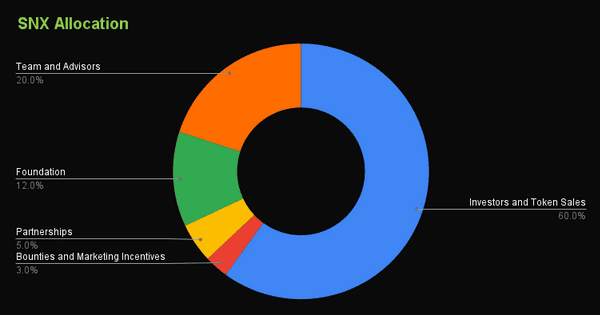

Early distribution came via an ICO that sold more than 60 million SNX for roughly 30 million USD. Of the initial 100 million issued, 60% went to sale participants, 20% to the team and advisors, 12% to the foundation, 5% to partnerships, and 3% to bounties and marketing.

On risk management, Synthetix favors over collateralization, with required ratios cited at 750% in some contexts and 400% in others. For stakers, the takeaway is simple: maintain your ratio to stay eligible for fees, since returns now hinge on protocol activity rather than new emissions.

SNX Token allocation | Source: CoinGecko

How to Trade Synthetix (SNX) on BingX

Whether you are building a long-term SNX position, trading short-term volatility, or reacting to major news events, BingX provides flexible ways to trade the token.

With

BingX AI integrated directly into the trading interface, you can access real-time insights to support smarter trading decisions across both spot and futures markets.

Buy or Sell SNX on the Spot Market

SNX/USDT trading pair on the spot market powered by Bingx AI

2. Plan the trade: On the chart, click the AI icon to view support and resistance, breakout zones, and suggested entry areas. Decide your entry, stop loss, and take profit.

3. Place and manage the order: Choose Limit or

Market, set size, and confirm. Add your stop loss and take profit immediately. If needed, deposit SNX or USDT and verify the correct network before trading.

Always conduct your own research (DYOR). Diversify your portfolio and never invest more than you can afford to lose.

How to Trade SNX Perpetual Futures

SNX/USDT perpetual contract on BingX futures powered by AI Bingo

Futures, especially perpetual futures, let you trade SNX price movements with leverage; you don’t necessarily need to hold the underlying SNX. You can go long (betting price will rise) or short (betting price will fall). BingX offers a

SNX-USDT perpetual contract.

1. Switch to the futures/perpetual trading section in BingX: Navigate to

Futures and locate SNX-USDT perpetual contract.

2. Review contract specifications: Things to check include:

• Leverage limits, e.g. 5×, 10×, etc.

• Maintenance margin and initial margin rates

• Funding rate (periodic payments between longs and shorts)

• Mark price, index price, and settlement rules

3. Choose direction (Long or Short) and leverage: Based on your market view, open a long or short position. Leverage amplifies both gains and losses, so use with caution.

4. Set entry, exit & risk controls

• Use take-profit orders

• Monitor your margin level

• Be mindful of liquidation risk (if losses push margin below maintenance).

5. Monitor funding and rollovers: As a perpetual contract, there will be a funding rate mechanism (to keep contract price close to the spot). Depending on whether you're long or short, you may either pay or receive funding periodically.

6. Close the position: When your target is hit (or your stop), close the position, and your P&L (profit/loss) will be settled in USDT.

Conclusion

Synthetix is betting that pooled collateral and peer-to-contract execution can bring perps to Ethereum Mainnet without sacrificing speed or custody. The SNX run-up shows that pitch is landing, helped by the move from inflation to fee-driven rewards.

What matters next is proof in usage. Watch the Mainnet perps rollout, fee generation, and whether front ends turn interest into steady volume.

Mind the basics while you do: high collateral needs, shared debt exposure, oracle risk, gas costs, and phishing. Verify everything on official channels and only stake or trade with parameters you can track.

Related Reading