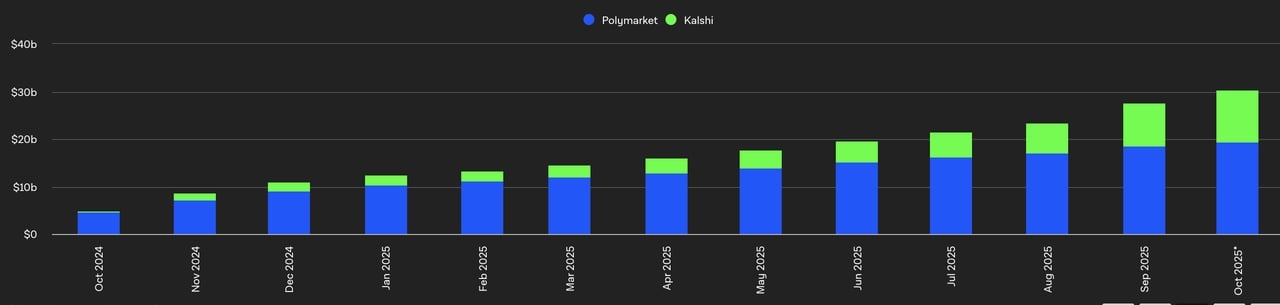

Prediction markets are no longer a niche experiment but are becoming one of Web3’s fastest-growing sectors. As of October 2025, total on-chain prediction market volume surpassed $2.6 billion, up more than 180% year-over-year, fueled by major events like the U.S. elections,

crypto ETF approvals, and global sports tournaments. Decentralized platforms are now competing on scale, UX (user experience), and data integrity, turning probability itself into a tradable asset class.

Polymarket and Kalshi cumulative monthly volume | Source: TheBlock

In this article, we spotlight the top five prediction markets of 2025, including what drives their growth, how they differ, and why they’re reshaping how people bet, speculate, and forecast online.

What Is a Decentralized Prediction Market and How Does It Work?

A decentralized prediction market is a blockchain-based platform where people can trade on the outcome of real-world events, from elections and crypto prices to sports matches or weather forecasts. Instead of betting through a company, users buy and sell digital “bids” through smart contracts, which automatically handle trades and payouts in crypto. If they bet correctly, the smart contract releases the winnings directly to their wallet without intermediaries or delays. The price of each bid shows what the crowd thinks the odds are, for example, if “Bitcoin will reach $100,000 by 2026” trades at $0.70, it means the market believes there’s a 70% chance that it will happen.

Decentralized prediction markets offer several advantages over traditional, centralized betting platforms, such as:

• On-chain transparency: Every trade and market outcome is recorded publicly on the blockchain, so anyone can verify prices and settlements.

• Self-custody of funds: You control your crypto wallet and assets at all times, no centralized exchange or bookmaker holds your money.

• Global, permissionless access: Most platforms allow anyone with a crypto wallet to participate, regardless of location (where legally permitted).

Yet the space also faces hurdles: regulatory clarity (especially in the U.S.), liquidity fragmentation, oracle integrity, and market design for capital efficiency.

The 5 Best Web3 Prediction Markets to Watch

Decentralized prediction markets are redefining how people forecast real-world events, from politics and sports to crypto and macro trends. In 2025, these five Web3 platforms stand out for their liquidity, innovation, and ability to merge transparent on-chain data with user-driven insight.

1. Polymarket

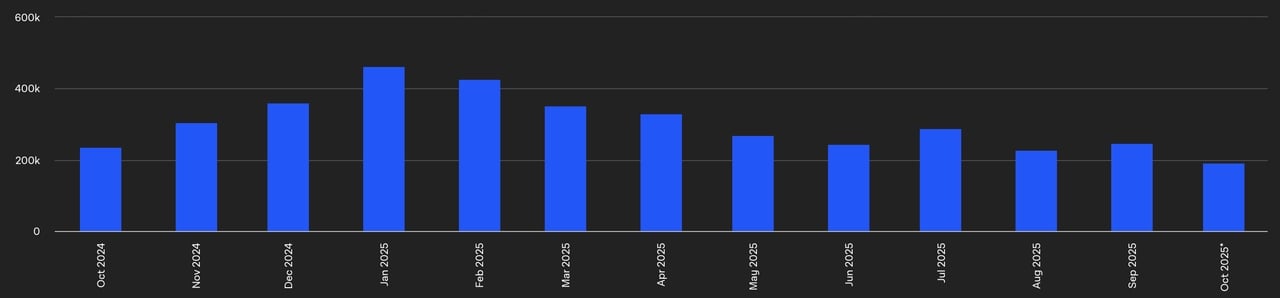

Polymarket active traders (monthly) | Source: TheBlock

Polymarket is the largest crypto-native prediction market by on-chain activity, running primarily on

Polygon with USDC settlement and UMA-backed resolution, and posting its biggest month of 2025 at roughly $1.43 billion in September trading volume. It also became the official prediction market partner of X, formerly Twitter, giving Polymarket odds front-page visibility across social feeds and news cycles. Looking ahead, Polymarket is widely expected to launch a native

POLY token following a tweet hint from its CEO in early October 2025, which could introduce governance rights, staking rewards, and fee incentives for active traders.

For traders, the near-term catalysts are regulatory and institutional: Polymarket acquired CFTC-licensed exchange and clearinghouse QCX/QCEX for $112 million, paving the way for compliant U.S. operations, while the Intercontinental Exchange (ICE), parent company of the NYSE, committed up to $2 billion in funding and partnership to integrate Polymarket’s event data into traditional financial systems. Together, these moves expand U.S. market access, deepen institutional liquidity, and strengthen Polymarket’s infrastructure as the dominant on-chain forecasting platform for 2025 and beyond.

Strengths

• You can access high liquidity across a wide range of markets, from politics and sports to macro events.

• The platform benefits from institutional backing by ICE, enhancing trust and infrastructure strength.

• Its integration with X (formerly Twitter) gives you real-time social and data insights directly within prediction feeds.

• On-chain transparency and efforts toward U.S. compliance add credibility and accessibility for both retail and professional traders.

Challenges

• You should remain aware of regulatory risks, particularly in countries with strict gambling or trading laws.

• Tokenomics design and incentive sustainability are still evolving and could affect long-term participation.

• Oracle reliability and insider manipulation remain key concerns; for example, markets like the Nobel Peace Prize saw sharp price swings before results were announced.

Polymarket continues to lead the sector by combining deep liquidity, institutional partnerships, and a clear roadmap toward regulated, data-driven growth.

2. Kalshi

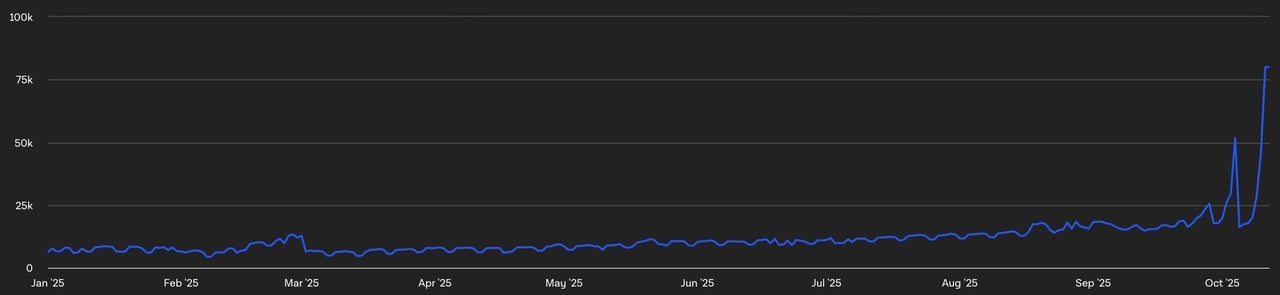

Kalshi daily active markets | Source: TheBlock

Kalshi is the first CFTC-regulated event-trading exchange in the U.S., giving American users a fully compliant way to trade on real-world outcomes like inflation data, Fed rate decisions, elections, and sports. In 2025, Kalshi’s trading volume surpassed $1 billion per month, with daily open interest regularly topping $250 million, and its valuation climbed to $5 billion after a $300 million Series C led by major institutional investors. It has even outpaced Polymarket during peak trading weeks around key U.S. events like the CPI release and presidential debates, highlighting its growing role as the bridge between Wall Street and prediction markets.

Kalshi’s edge lies in its combination of regulatory clarity, institutional infrastructure, and data integration. The platform’s recent partnership with

Pyth Network allows real-time event data to be streamed on-chain across 100+ blockchains, setting the groundwork for hybrid decentralized products that link regulated market data with DeFi protocols. For traders, this means deeper liquidity, tax-reportable U.S. access, and transparent pricing on macro events, making Kalshi the most practical gateway for compliant prediction trading in 2025.

Strengths

• You can trade on a fully regulated U.S. platform, giving Kalshi a strong compliance advantage over most decentralized alternatives.

• The exchange provides deep institutional and retail access within U.S. markets, offering reliable liquidity for major economic and political events.

• It continues to scale rapidly, with rising trading volumes and growing participation from professional traders.

• Kalshi’s integration of regulated markets with on-chain data feeds bridges traditional finance with blockchain-based transparency.

Challenges

• Because Kalshi takes a regulation-first approach, you may find its expansion into permissionless or international markets slower.

• Liquidity outside the U.S. and in less common event categories can be limited compared to its core markets.

• The platform must carefully balance data transparency with regulatory compliance, ensuring user protection while maintaining openness.

Kalshi stands out as a compliant, data-driven marketplace that connects traditional event trading with the emerging infrastructure of decentralized finance.

Read more:What Is Kalshi Decentralized Prediction Market and How to Trade On It? (2026)

3. Myriad Markets

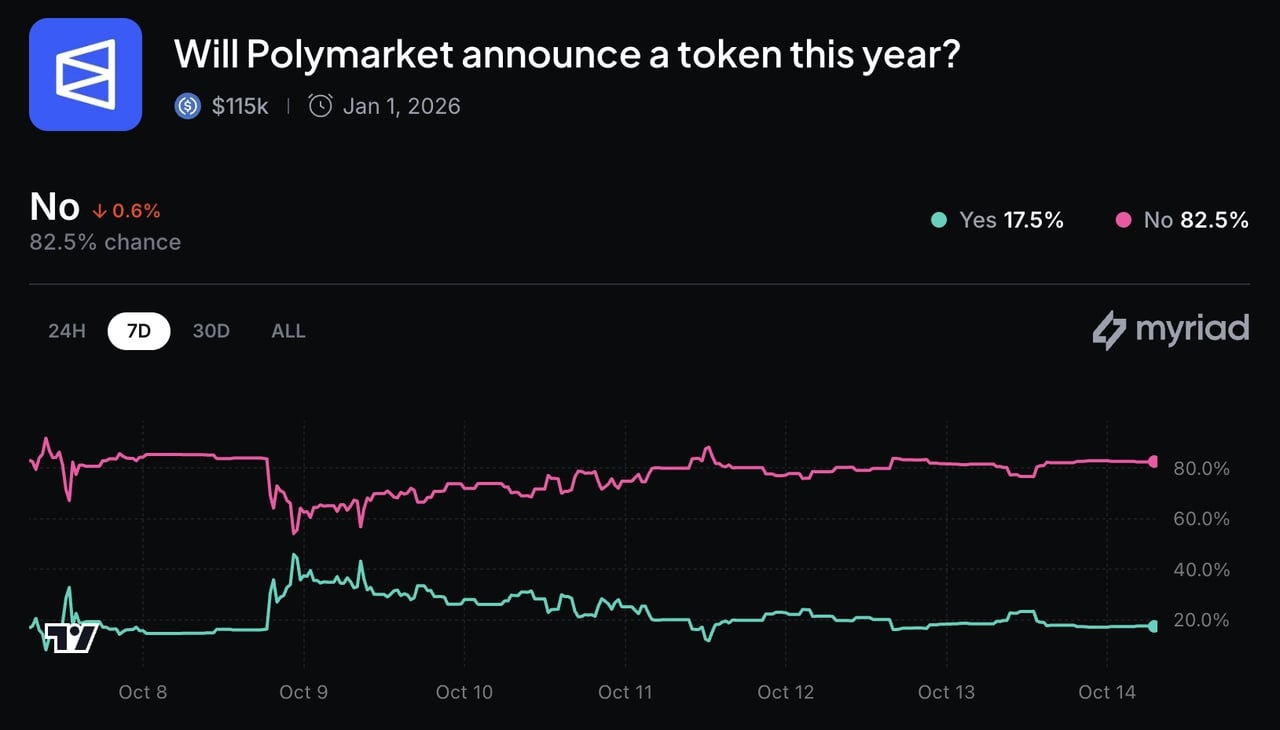

Myriad Markets' poll on when Polymarket could launch its native token | Source: Myriad Markets

Myriad Markets is an emerging Web3 prediction protocol designed as an infrastructure layer rather than a single app, enabling multiple frontends to share the same liquidity and oracle backend. Built for composability, it separates the market engine from user interfaces, letting projects integrate prediction functionality directly into their dApps while drawing from a unified liquidity pool. As of Q4 2025, Myriad has processed over $40 million in cumulative volume across crypto, macro, and cultural markets, and is gaining attention for reducing liquidity fragmentation, a common challenge among decentralized prediction platforms.

One of Myriad’s most popular live markets illustrates its practical reach: a Polymarket POLY token launch prediction that has attracted over $115,000 in open interest, trading around an 82.3% probability of “No” and 17.7% for “Yes” by January 1, 2026. This blend of data-driven sentiment and open liquidity highlights how Myriad is becoming a real-time sentiment gauge for the broader prediction ecosystem. By offering developer-friendly APIs and multi-chain deployment plans, it’s positioning itself as the “liquidity layer” connecting both centralized and decentralized forecasting venues.

Strengths

• You benefit from an infrastructure-focused design that supports ecosystem growth and shared liquidity across multiple applications.

• The platform enables front-end experimentation, letting developers build unique user interfaces while maintaining a unified market backend.

• Myriad acts as a technical bridge between traditional Web2 prediction platforms and full Web3 markets, promoting broader accessibility and interoperability.

Challenges

• As a newer protocol, you may notice lower liquidity and trading volume compared to larger platforms like Polymarket or Kalshi.

• The ecosystem still requires strong incentives and user onboarding to attract developers and active participants.

• Cross-chain operations introduce complexity, and maintaining consistent market resolution across networks remains a key challenge.

While it’s still early in its growth phase, Myriad’s modular architecture has the potential to reduce market fragmentation and improve scalability across the Web3 prediction landscape.

4. Drift BET

Drift BET is a

Solana-based prediction platform developed by the team behind

Drift Protocol, one of the network’s largest on-chain derivatives venues with over $25 billion in cumulative trading volume. Launched in mid-2025, BET integrates prediction markets directly into Drift’s existing perpetuals and lending engines, allowing users to earn real yield on collateral while holding event positions. Traders can post margin in any of roughly 30 supported assets, including

SOL,

USDC, and mSOL, giving them capital flexibility far beyond single-asset markets like Polymarket.

This capital-efficient model reduces idle funds and transforms event speculation into a yield-bearing activity. For instance, users backing outcomes on presidential debates or Solana price predictions continue earning funding yield from Drift’s lending pools during the event period. BET also plans to introduce DAO-governed, permissionless market creation by early 2026, enabling anyone to launch verified markets tied to oracle-secured data feeds. In practice, Drift BET is turning prediction markets into an integrated part of DeFi’s trading stackm faster, yield-efficient, and fully composable within Solana’s low-fee ecosystem.

Strengths

• You can benefit from capital efficiency, as Drift BET allows flexible collateral options and generates yield on your positions while markets remain open.

• The platform takes advantage of Solana’s high speed and low transaction fees, providing a smoother trading experience.

• It integrates derivatives mechanics with prediction markets, offering tools familiar to DeFi traders within a new event-based format.

Challenges

• As a newly launched product, you may encounter lower trading volume and liquidity compared to established platforms.

• The combination of derivatives and prediction logic can introduce added complexity, requiring a clear understanding of margin and payoff structures.

• Reliable oracle resolution and data integrity are essential, and any inaccuracy could affect market outcomes.

Drift BET offers a practical option if you’re looking to enhance capital efficiency and earn yield while participating in event-driven forecasting rather than traditional betting.

5. O.LAB

O.LAB is a next-generation decentralized prediction and epistemic market protocol deployed on

BNB Chain, designed to serve as a “truth infrastructure layer” for Web3. Instead of focusing solely on binary outcomes, O.LAB introduces graded opinion markets, where participants express probabilities and confidence levels tied to their forecasts. Since its Q3 2025 testnet launch, the platform has hosted more than 3,000 community-driven forecasts spanning

AI, macroeconomics, and crypto governance topics. Its architecture combines prediction trading with a reputation-weighted accuracy system, rewarding users not only for being correct but also for how well-calibrated their forecasts are over time.

Powered by AI-assisted oracles and LLM-based evaluators for resolution, O.LAB minimizes human bias and accelerates settlement across its prediction categories. The protocol also plans to integrate yield-bearing DeFi assets as collateral, enabling users to

earn passive yield while participating in truth markets. Built on BNB Chain for scalability and low-cost execution, O.LAB’s vision is to create a verifiable, AI-augmented “truth machine,” a composable forecasting layer that connects epistemic reputation, predictive accuracy, and decentralized finance into one interoperable ecosystem.

Strengths

• You gain exposure to a broader ecosystem that aims to unify forecasting, opinion sharing, and market resolution within a single protocol.

• The platform plans to integrate AI and oracle systems, helping reduce reliance on human arbitration and improving settlement accuracy.

• O.LAB’s modular design could eventually support multiple prediction frontends, serving as a backbone for other applications in the Web3 ecosystem.

Challenges

• As an early-stage project, trading activity and real-world volume remain limited.

• The protocol faces execution risks in merging complex components like oracles, reputation systems, and market logic.

• Building liquidity and user trust will be essential for long-term adoption and stability.

If O.LAB’s roadmap unfolds successfully, you could see it evolve into a foundational infrastructure layer powering diverse prediction market applications.

How to Choose the Right Prediction Market for You

With so many platforms emerging across different blockchains and regulatory zones, selecting the right prediction market depends on your goals, location, and trading style. Whether you prioritize compliance, liquidity, yield, or innovation, the following factors can help you decide which platform best fits your strategy in 2025.

1. Geographic and Regulatory Access: If you're in the U.S. or need regulatory compliance, Kalshi or Polymarket via QCX are safer bets. In many regions, decentralized platforms like Polymarket, Myriad, Drift BET, or O.LAB may be more accessible, depending on local laws.

2. Liquidity and Event Types: Big events (politics, macro, major sports) will see better liquidity on Polymarket or Kalshi. Niche or custom questions might be more viable on Myriad or O.LAB.

3. Cost and Efficiency: Drift BET offers yield while you wait, reducing capital drag. Polymarket on Polygon keeps gas low. Complex protocols may introduce subtle inefficiencies.

4. Innovation Preference: If you want early alpha, Myriad and O.LAB offer bleeding-edge experimentation. For reliability, Polymarket and Kalshi remain safe anchors.

5. Risk and Trust: Always assess oracle design, slashing or resolution mechanisms, tokenomics if applicable, and reputational risk. Newer protocols carry more risk.

Key Considerations and Risks of Using Web3 Prediction Markets

Before trading on decentralized prediction platforms, it’s important to understand the unique risks that come with blockchain-based event markets. While these protocols offer transparency and accessibility, they also introduce challenges that can impact liquidity, fairness, and long-term sustainability.

1. Regulatory Uncertainty: Prediction markets often straddle the line between trading and gambling, meaning jurisdictions may impose restrictions or require formal licensing, especially for U.S. users.

2. Tokenomics and Launch Risk: Upcoming token launches, such as Polymarket’s potential POLY token, can create volatility if token distributions are uneven or large unlocks flood the market.

3. Oracle and Integrity Risk: Market outcomes depend on data oracles, errors, delays, or manipulation in resolution sources can distort payouts and undermine user trust.

4. Liquidity Fragmentation: With multiple emerging protocols, liquidity is spread thin across platforms, reducing capital efficiency and making large trades more costly.

5. Front-Running and Arbitrage: Advanced traders or bots can exploit timing mismatches or correlated event markets; research on Polymarket has already identified

arbitrage patterns from mispriced dependent markets.

Final Thoughts

2025 marks a defining moment for decentralized prediction markets as blockchain, data, and regulation begin to converge. Polymarket leads in liquidity and user growth, Kalshi defines the compliant U.S. frontier, Myriad builds modular infrastructure, Drift BET introduces yield-based efficiency, and O.LAB pioneers AI-driven truth markets on BNB Chain. Each represents a different approach to transparency, accessibility, and market design within the Web3 ecosystem.

However, the landscape remains highly experimental and sensitive to regulatory, liquidity, and oracle-related risks. Traders should approach these platforms with measured exposure, conduct due diligence on token launches and audits, and treat prediction markets as a high-volatility segment within the broader

DeFi ecosystem.

Related Reading