In September 2025,

Sun (SUN) has emerged as one of the most active tokens in the

TRON ecosystem. The governance and utility token of SUN.io has gained nearly 30% in the past month, lifting its market cap above $590 million with 24h trading volumes topping $490 million.

The rally has been fueled by a mix of new listings on Korean exchanges like Upbit and Bithumb, programmatic buyback commitments from SunPerp, and recurring token burns, all tightening supply while expanding access. With over 78,000 holders and 19.16 billion SUN in circulation, the token is now back in the spotlight as traders assess whether this momentum can extend further.

In this article, you will learn what Sun (SUN) is, how the SUN.io ecosystem works, and why the token has surged nearly 30% in the past month amid new listings, buybacks, and burns, and how you can trade SUN on BingX.

What Is SUN.io?

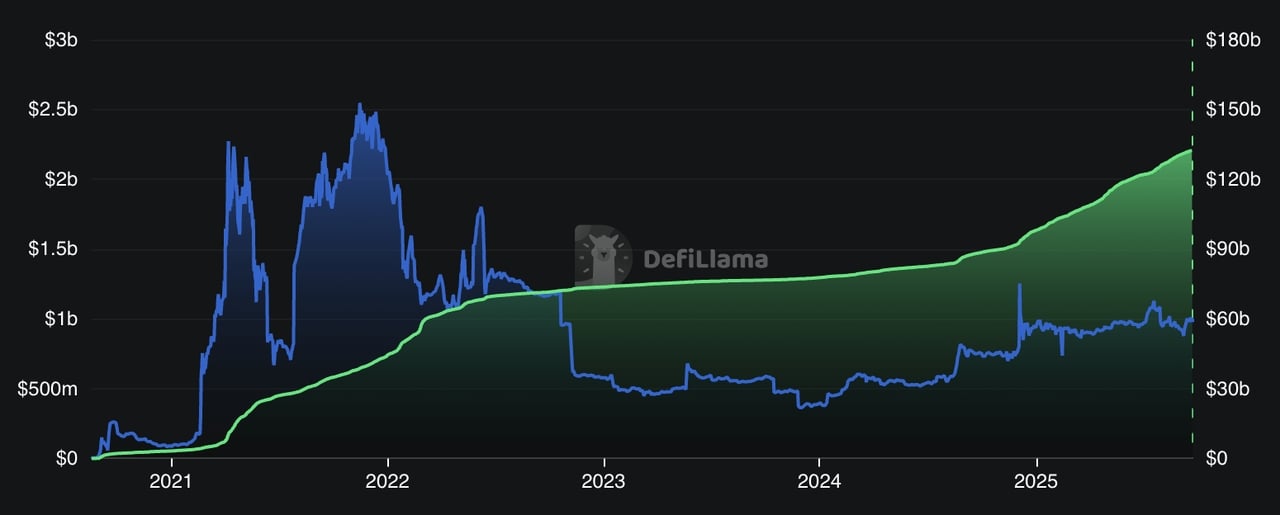

SUN TVL and DEX volume | Source: DefiLlama

SUN.io is

TRON’s flagship decentralized finance (DeFi) platform, designed to integrate multiple services a DeFi user might need, including trading,

stablecoin swaps,

liquidity mining, governance, and even

meme token launches, all into one platform. Launched in 2021, it has grown into the largest DeFi protocol on TRON with a total value locked (TVL) of nearly $1 billion as of September 2025, supporting billions in transaction volume and playing a key role in the network’s stablecoin and liquidity ecosystem.

SUN is the native governance and rewards token powering SUN.io. As of September 2025, SUN has a market cap of ~$593 million with over 78,000 holders, showing its central role in the TRON ecosystem.

Here’s how SUN.io works in practice:

1. SunSwap DEX for trading TRON tokens: Trade TRON-based tokens instantly without a centralized exchange. Version 3 (V3) introduces concentrated liquidity, allowing liquidity providers to choose price ranges and earn more fees on their capital. This feature helps traders get better prices and LPs improve fee efficiency.

2. StableSwap for low-slippage stablecoin trading: Swap between USDT, USDC, USDJ, TUSD, and other stablecoins with fees as low as 0.04%. The design minimizes slippage, meaning you receive more tokens even when swapping large amounts. For liquidity providers, it reduces the risk of impermanent loss compared to traditional pools.

3. Governance with veSUN for voting and earning rewards: By locking SUN, you receive veSUN, which comes with three benefits:

• Weekly rewards of 50% of stablecoin pool fees shared in TUSD.

• Up to 2.5× boost on liquidity mining rewards.

• Voting power in SUN DAO to decide which pools receive more incentives.

4. SunPump meme token launchpad: Launched in July 2023, SunPump is TRON’s first fair-launch meme platform. Anyone can create a token with a 20

TRX fee. Tokens grow in value through a bonding curve model, and once they hit a target of around 500K TRX, liquidity is automatically added to SunSwap and part of the supply is burned. This ensures transparency and community confidence from day one.

$SUN is your entry ticket to trading, earning, and participating in governance across TRON’s most active DeFi ecosystem.

Why Has SUN Token Surged Over 45% in the Past Week?

SUN token price surges 45%+ in one week | Source: BingX

SUN’s rally of over 45% gains over the past one week has been driven by a mix of exchange access, buyback momentum, and ongoing deflationary pressure. On September 22, leading Korean exchange Upbit listed SUN/KRW and

SUN/USDT, giving traders direct fiat and stablecoin pairs. New exchange listings often unlock new liquidity and expand order-book depth, helping attract fresh inflows and boosting visibility among retail traders.

At the same time, SunPerp, a perpetuals DEX on TRON, confirmed it would channel 100% of protocol revenue into SUN buybacks. This model creates a self-reinforcing loop: more trading volume generates more revenue, which in turn increases demand for SUN on the open market. Coverage of the announcement quickly triggered a sharp price jump, echoing past programs like SunPump’s revenue-funded burns.

Finally, SUN continues to benefit from its long-running repurchase and burn program. Since 2021, over 635 million SUN tokens, around 3.2% of supply, have been destroyed through more than 40 burn rounds, supported by fees from SunSwap V2 and revenue from SunPump. Together, these catalysts have tightened SUN’s circulating supply, fueling its nearly 30% monthly surge and 45%+ weekly jump.

What Is the SUN Token Utility and Tokenomics?

SUN is both the governance and incentive token of SUN.io, giving it a dual role in the TRON DeFi ecosystem. Through SUN DAO, holders can vote on pool weights and platform decisions, while locking SUN generates veSUN, which boosts liquidity mining rewards by up to 2.5×, shares in stable-pool fees, and grants governance power.

Demand for SUN is reinforced by multiple revenue-driven mechanisms. On SunSwap V2, 0.05% of every trade is retained in LP tokens and later converted into SUN for buybacks and burns. StableSwap allocates 50% of fees directly to veSUN holders. Meanwhile, SunPump and SunPerp funnel platform revenues into SUN buybacks, with SunPerp dedicating 100% of its protocol fees to repurchases. These mechanics create continuous buy-side pressure, linking network activity directly to token demand.

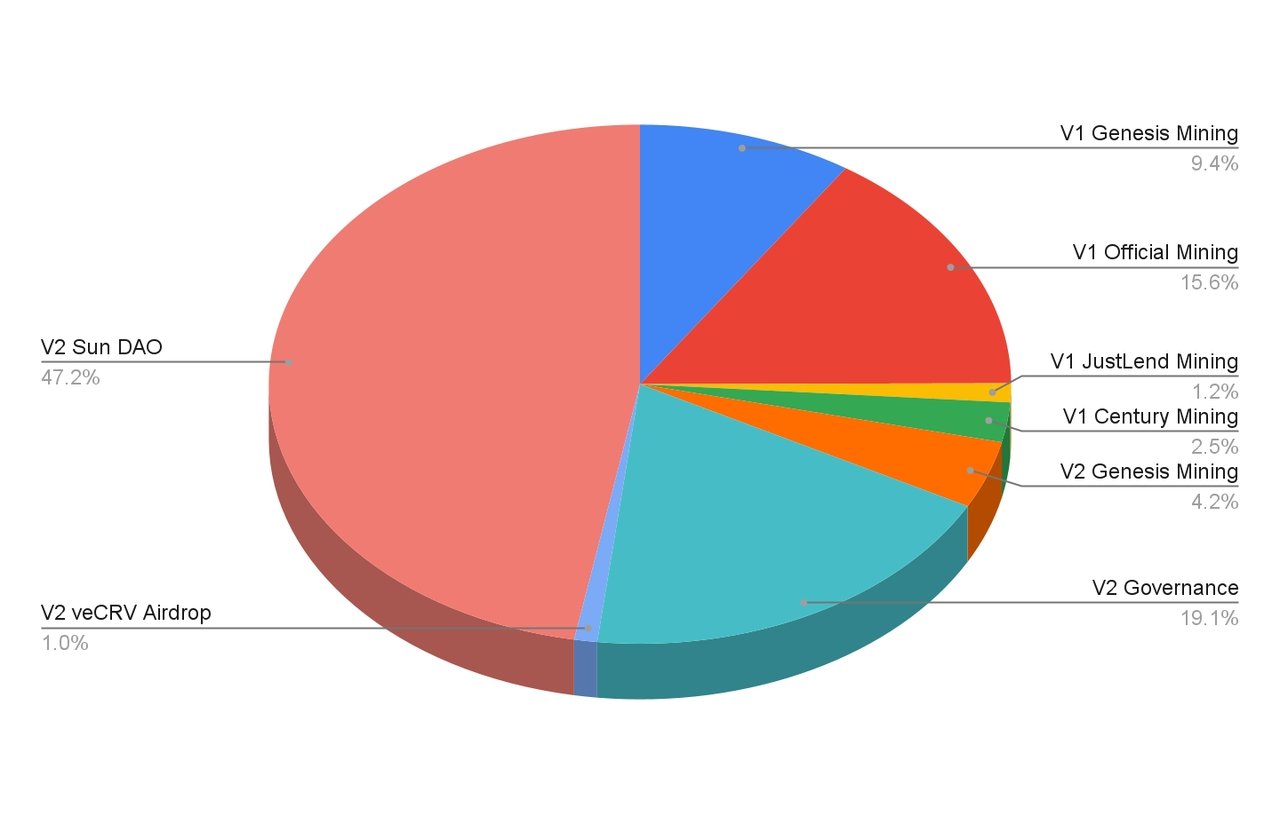

SUN Tokenomics

SUN has a total supply of 19.9 billion tokens, established after a 2021 redenomination that scaled supply at a 1:1000 ratio without changing market capitalization. Importantly, there were no team or VC allocations; distribution occurred through mining, airdrops, and DAO vesting, keeping token ownership community-focused.

The veSUN model ensures long-term alignment: the longer you lock SUN, the more veSUN you receive, though this balance decays linearly until unlock. This system incentivizes holders to commit tokens for extended periods, strengthening governance participation while reducing circulating supply.

SUN Token Allocation

SUN token distribution | Source: SUN.io docs

V1 Distribution

• Genesis Mining: 9.35%

• Official Mining: 15.59%

• JustLend Mining: 1.18%

• Century Mining: 2.47%

V2 Distribution

• Genesis Mining: 4.2%

• Governance Mining: 19.05%

• veCRV Airdrop: 1.0%

• Sun DAO Governance: 47.16% (locked for four years, released via linear vesting)

How to Trade SUN Token on BingX

If you want to get exposure to SUN, BingX offers simple ways to either build a long-term position or trade short-term market moves. With

BingX AI built into the interface, you can analyze support levels, volatility, and market momentum before placing trades.

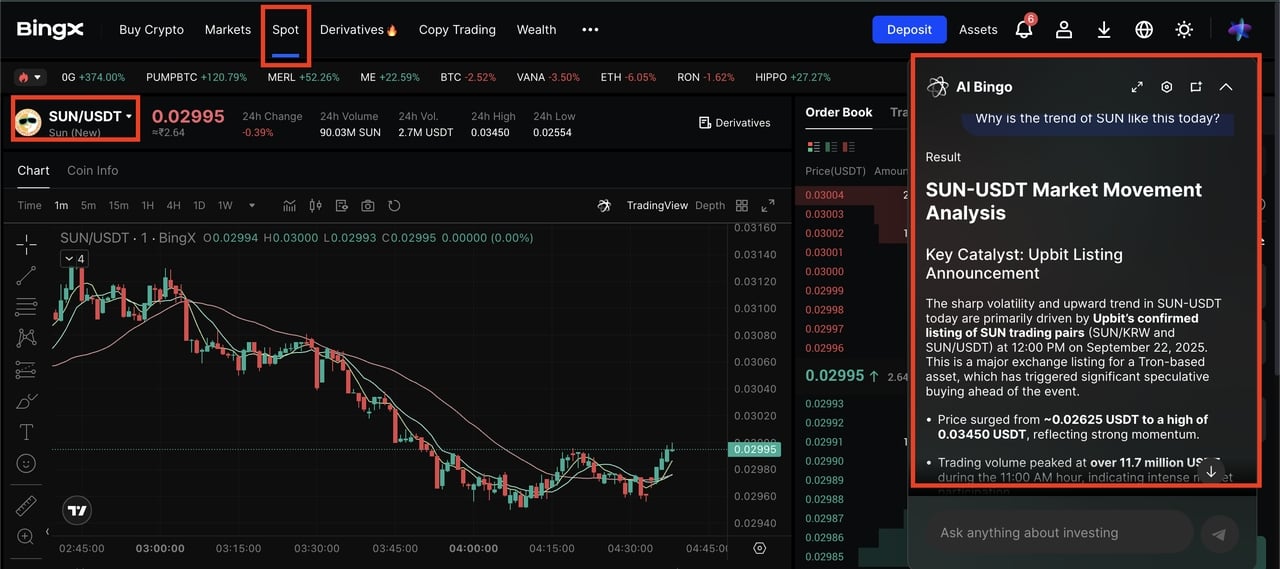

Buying and Selling SUN on the Spot Market

Buy or sell SUN/USDT on BingX spot market powered by AI Bingo insights

If you want to build a long-term position in SUN,

spot trading is the simplest and most beginner-friendly option.

• Go to the Spot section and search for

SUN/USDT.

• Use the chart’s AI icon to highlight key support and resistance levels.

• Beginners can start by placing limit orders near support levels to cost-average into dips instead of buying at peaks.

• Spot trading is best if you plan to hold SUN long-term to benefit from buybacks, burns, or governance rewards.

Trading SUN with Perpetual Futures for Leverage and Short-Term Moves

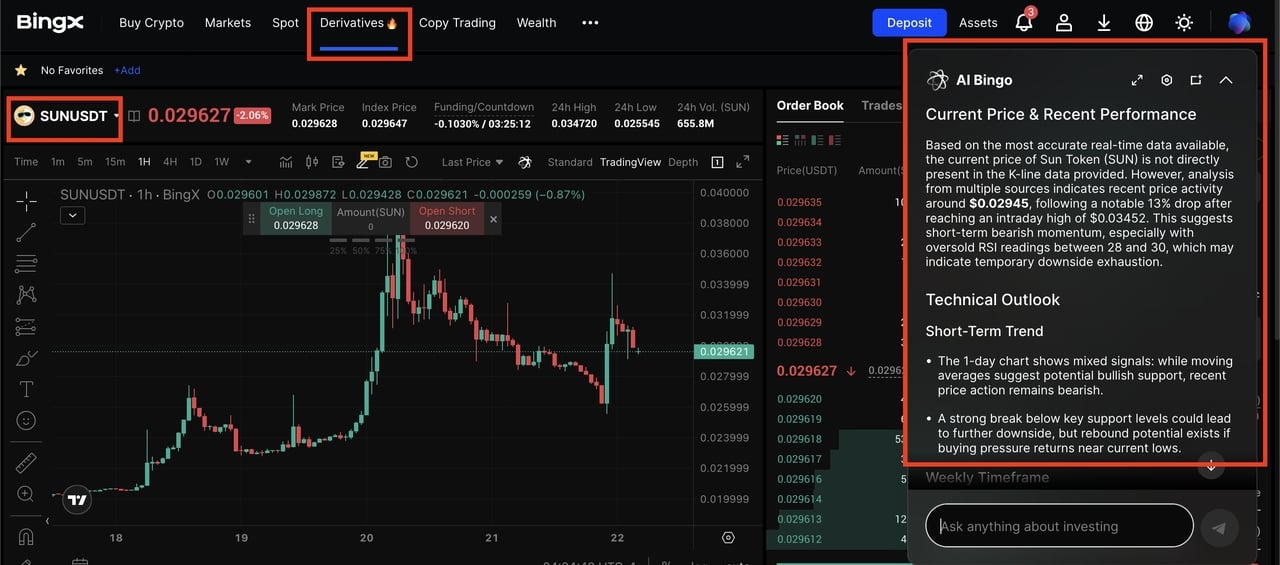

Long or short SUN on BingX futures market, powered by AI Bingo - BingX's AI assistant

For traders looking to profit from short-term volatility,

BingX Futures offers the flexibility to go long or short with leverage.

• Use AI Bingo to track real-time momentum, volatility spikes, and suggested stop-loss or take-profit levels.

• Futures allow you to go long (bet on SUN rising) or short (bet on SUN falling).

• Start with low leverage, e.g., 2–3×, and smaller position sizes; news like buyback announcements or listings can create sharp gaps.

• Always set stop-loss orders to manage downside risk.

Pro Tip: Track upcoming catalysts such as the next burn report, DAO votes, or exchange listings before trading. These events often drive sudden volatility, giving both spot investors and futures traders clearer entry and exit opportunities.

Key Considerations When Investing in SUN Tokens

Before investing in SUN, it’s important to understand the factors that can influence both short-term price moves and long-term value.

• Governance and execution risk: SUN’s buyback initiatives, such as SunPerp’s 100% revenue model, rely on protocol revenue and operator follow-through. These are off-chain commitments and may not always be sustained.

• Token emissions vs. buybacks: While recurring burns and buybacks reduce supply, incentive emissions for liquidity providers can offset these effects. The balance depends on the project’s tokenomics and governance decisions.

• Listing-driven volatility: Major exchange listings often spark short-term rallies or “listing pumps” but can be followed by price corrections once liquidity stabilizes.

Conclusion

SUN’s recent strength is largely explained by three mechanics working together: broader market access following the Upbit KRW/USDT listing, programmatic demand from SunPerp’s stated 100% revenue buybacks, and continued supply reduction via recurring burns. Combined with SUN.io’s existing fee-share and veSUN incentives, these catalysts tightened float and supported the 30-day uptrend.

That said, crypto markets remain highly volatile. Listing-driven momentum can fade, buyback policies depend on ongoing protocol revenue and execution, and smart-contract or governance changes can alter token flows. Manage position size, use risk controls, and avoid relying on any single catalyst.

FAQs on SUN.io (SUN)

1. What is SUN (SUN) and how does it work?

SUN is the governance and incentive token for SUN.io, a TRON DeFi hub combining DEX trading, stablecoin swaps, liquidity mining, and SUN DAO.

2. Why did $SUN rise almost 30% in September 2025?

A KRW/USDT listing on Upbit, SunPerp’s 100% revenue buyback, and ongoing burn cycles tightened float and drew new liquidity, driving a ~30-day upswing.

3. How do SUN token burns work on SUN.io?

SunSwap V2 retains 0.05% of trades in LP tokens, later converted to SUN for burning; SunPump revenue also funds burns on a recurring schedule.

4. What incentives do veSUN holders get?

veSUN holders receive 50% of fees from stablecoin pools, enjoy up to a 2.5× boost on liquidity mining rewards, and gain voting power in SUN DAO to decide how rewards are distributed across liquidity pools.

Related Reading