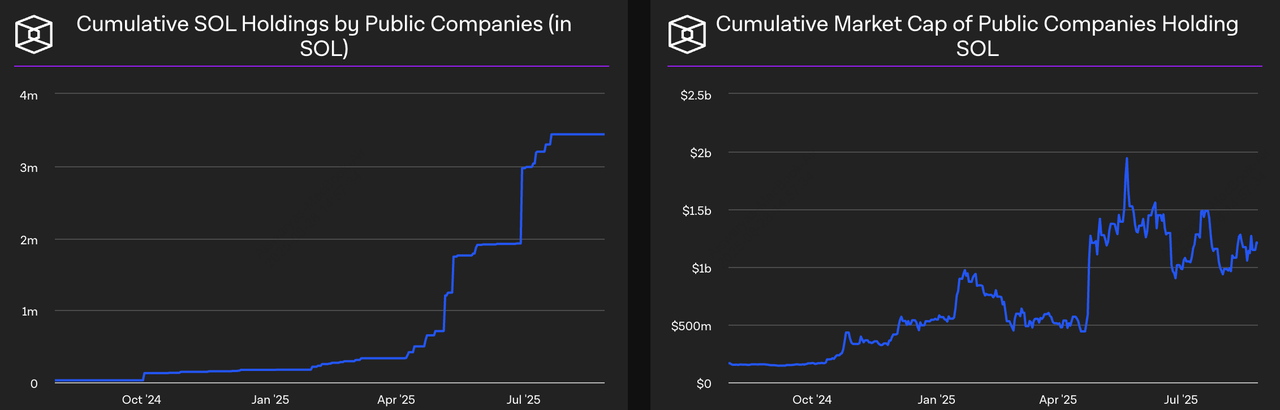

Publicly traded companies hold around 3.44 million SOL in their treasuries as of August 2025, representing more than $1.2 billion in combined market value. This marks a sharp acceleration in institutional adoption of the

Solana blockchain. What makes SOL attractive to corporate treasurers goes beyond price gains in the ongoing

bull market is its high throughput, low fees, and staking yields of roughly 6–8% offer both recurring on-chain income and the potential for long-term capital appreciation.

Market cap and SOL holdings of public companies with Solana treasuries | Source: TheBlock

The launch of the REX-Osprey

Solana Staking ETF in July 2025, which has already surpassed $160 million in assets under management, is further legitimizing SOL as a yield-generating institutional asset. Additionally, on Aug 22, 2025, VanEck filed the VanEck JitoSOL ETF, the first proposed U.S. spot Solana ETF backed 100% by a

liquid-staking token (JitoSOL). While the SEC is yet to approve this new offering, the S-1 confirms the fund would hold JitoSOL rather than native SOL, translating staking rewards to ETF investors.

Companies are not only

buying SOL but also staking it, often through their own validator infrastructure, to capture rewards and strengthen the network’s decentralization. This active approach stands in contrast to passive

Bitcoin holdings and positions Solana as one of the most dynamic assets in the growing corporate treasury landscape.

Discover the top public companies holding Solana (SOL) in 2025, why corporate treasuries are embracing SOL for

staking yields and blockchain utility, and the risks and future outlook for institutional adoption.

What Is a Solana Corporate Treasury and How Does It Work?

A Solana corporate treasury refers to a company holding SOL, the native token of the Solana blockchain, as part of its reserve assets. This is similar to how businesses might hold

BTC in a

Bitcoin treasury or

ETH in an

Ethereum treasury. The concept builds on the strategy made famous by

Strategy (former MicroStrategy), whose Bitcoin accumulation helped establish crypto as a legitimate corporate treasury asset.

Unlike traditional assets such as cash or government bonds, and even unlike passive BTC or ETH holdings, SOL can be actively put to work. Companies often stake their SOL to help validate transactions and secure the network. In return, they earn staking rewards that average 7 to 8 percent annually, paid in additional SOL. For example, a firm with 1 million SOL could earn approximately 70,000 to 80,000 SOL each year, depending on network conditions and validator performance.

Companies typically build their Solana treasuries using a mix of funding strategies:

• Equity raises to secure capital from investors

• Convertible notes that convert to shares later, minimizing upfront dilution

• Discounted locked-token deals, where SOL is purchased below market value with a holding requirement, creating built-in gains upon unlock

In addition to the companies listed below in this article, two large treasury initiatives are in motion:

• Pantera Capital is seeking to raise up to $1.25B to acquire and convert a Nasdaq-listed company into “Solana Co.”, a public treasury vehicle that accumulates SOL (initial $500M raise + $750M in warrants), per The Information and follow-on reporting.

• Galaxy Digital, Jump Crypto, and Multicoin Capital are working with Cantor Fitzgerald to raise about

$1 billion for a Solana-focused treasury firm. The plan reportedly involves acquiring a listed company, though the deal has not yet closed.

Through this approach, a Solana treasury becomes more than a crypto investment. It turns into a yield-generating, blockchain-native asset that strengthens a company's participation in the Solana ecosystem, following the evolution of corporate treasury strategies from Bitcoin to

Ethereum, and now to Solana.

Why Companies Are Adding SOL to Their Holdings?

Corporate treasuries are increasingly turning to Solana as a way to combine long-term asset growth with steady on-chain income, while gaining a foothold in one of the fastest-growing blockchain ecosystems.

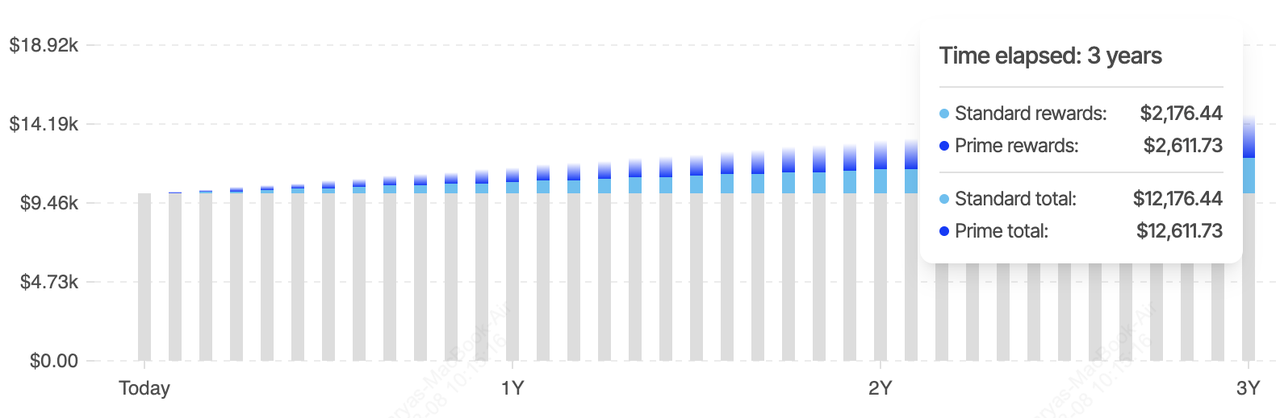

Solana staking rewards and APYs | Source: StakingRewards

1. High Staking Yields: One of the main attractions of Solana for corporate treasuries is its annual staking yield of around 7–8%. This is significantly higher than the yields from most savings accounts or U.S. Treasury bonds, which often fall below 5%. For example, a company holding 1 million SOL, valued at roughly $170 million in August 2025, could earn 70,000–80,000 SOL per year in rewards, worth about $12–14 million at current prices. These rewards are paid in SOL, giving firms the potential for both recurring income and capital appreciation if SOL’s price rises.

2. Operational Integration: Many companies aren’t just holding SOL; they’re actively participating in the network by running their own validator nodes. This allows them to directly process transactions, secure the blockchain, and capture validator commissions in addition to staking rewards. For instance, DeFi Development Corp and SOL Strategies both operate validators, ensuring they retain control over their staking operations while contributing to Solana’s decentralization and stability.

3. Strategic Differentiation: Adding SOL to a corporate balance sheet offers a clear point of differentiation compared to firms that only hold

Bitcoin or

Ethereum. While Bitcoin serves primarily as a store of value and Ethereum offers smart contract functionality with staking, Solana combines speed, scalability, and low fees with the ability to earn yield. This positions companies as early adopters of next-generation blockchain infrastructure, signaling innovation to shareholders, partners, and the market. It also aligns their finances with a rapidly growing ecosystem of

DeFi apps, NFTs, and

tokenized real-world assets being built on Solana.

What Are the Top Public Companies Holding Solana (SOL) in 2025?

A growing list of publicly traded companies is adopting Solana as a core treasury asset, combining the network’s high-speed infrastructure with attractive staking yields. While each firm’s approach varies, from aggressive accumulation to cautious, yield-focused holdings, they all share a belief in SOL’s potential as both a financial and strategic asset.

1. Upexi Inc. (NASDAQ: UPXI)

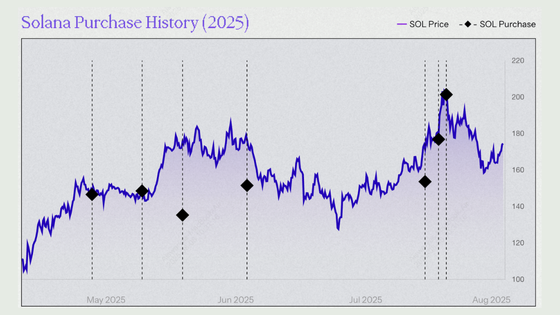

Upexi's Solana purchase history 2025 | Source: Upexi

• SOL Held: ~2,000,518 SOL as of Aug 4, 2025 (up ~172% MoM after >$200M raises via equity/convertible notes). Company says substantially all SOL is staked.

• Current Value: ≈ $427 million

Upexi has become the largest known corporate holder of SOL, growing its position from roughly 735,000 tokens at the end of June 2025 to over 2 million by early August, a 172% increase in just one month. The expansion was funded primarily through $200 million in equity raises and convertible notes, with a portion of tokens purchased at mid-teens discounts to market prices, creating built-in gains for shareholders.

Almost all of Upexi’s SOL is staked, generating an estimated $65,000 in daily rewards at around an 8% APY. The company has effectively mirrored

Michael Saylor’s Bitcoin treasury playbook, but with Solana’s faster settlement, lower transaction costs, and native yield, making it a case study in altcoin-driven corporate finance.

2. DeFi Development Corp. (NASDAQ: DFDV)

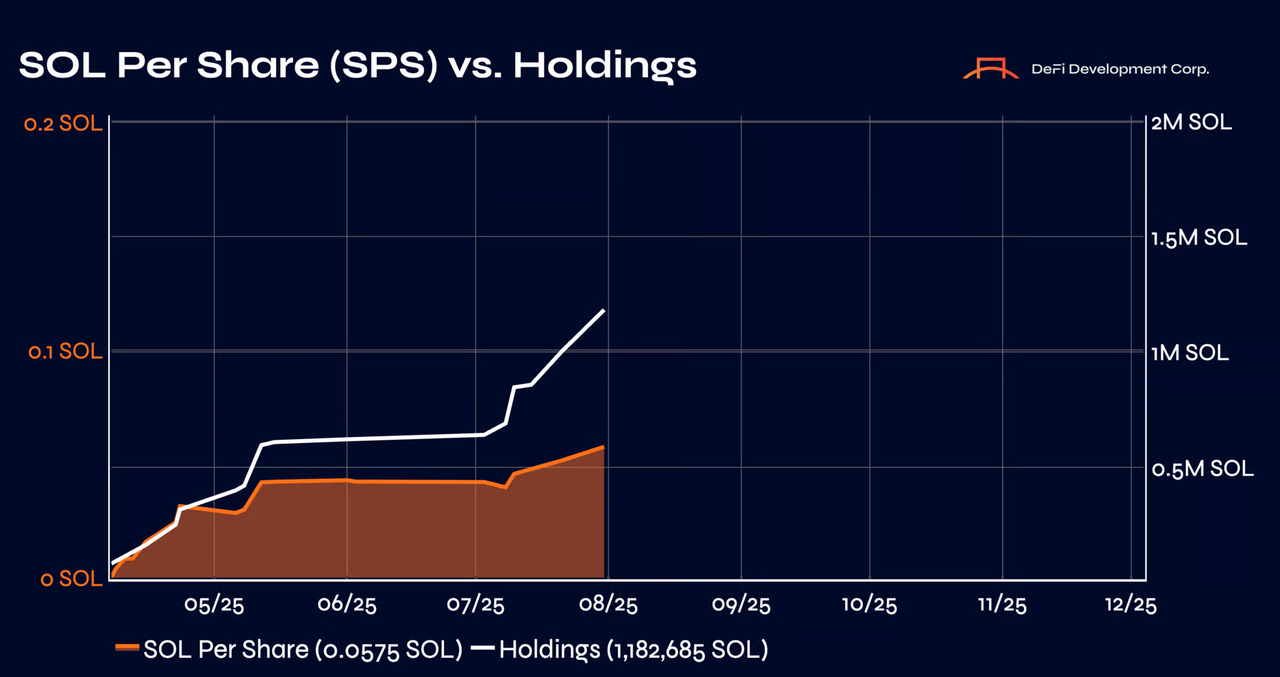

SOL per share (SPS) vs. Holdings | Source: DeFi Dev Corp.

• SOL Held: 1,293,562 SOL as of Aug 1, 2025; company later announced a $125M equity financing on Aug 25, 2025 to expand its Solana treasury.

• Current Value: ≈ $276 million (unrealized gain ~$37M)

DeFi Development Corp. (NASDAQ: DFDV), the first public company to center its treasury strategy entirely on Solana, has quickly grown into one of the largest corporate SOL holders. After pivoting from a real estate technology platform to digital assets in April 2025, the firm tapped a $5 billion equity line of credit to accelerate its accumulation. As of August 1, 2025, DFDV held 1,293,562 SOL, including staking rewards and on-chain earnings, up 9% month-over-month. Its most recent purchase added 110,466 SOL at an average of $166.61, worth about $18.4 million at the time.

To fund further expansion, DFDV announced a $125 million equity raise on August 25, 2025, which will be directed toward enlarging its Solana treasury. The company’s key metric, SOL per share (SPS), climbed to 0.0618 in August, a 7% increase from July, with a long-term goal of reaching 1.0 SPS by 2028, one SOL for every share outstanding. DFDV stakes its holdings across multiple validators, including its own infrastructure, and actively participates in the

Solana DeFi ecosystem to capture yields and compounding opportunities. This dual strategy of accumulation and ecosystem engagement highlights its commitment to long-term growth alongside Solana’s network expansion.

3. SOL Strategies Inc. (CSE: HODL)

• SOL Held: ~396,717 SOL as of Jul 31, 2025 (latest monthly update). The firm stakes a large portion and continues to raise capital via convertibles.

• Current Value: ≈ $85 million (unrealized gain ~$4M)

SOL Strategies Inc. has steadily expanded its Solana position since mid-2024, increasing its holdings to 420,707 SOL as of August 27, 2025. The company’s accumulation strategy has been primarily financed through convertible note offerings, enabling it to scale its SOL exposure without immediate equity dilution. At current market prices, its SOL treasury is valued at $101 million CAD, making it one of the largest dedicated SOL holders on the Canadian Securities Exchange.

Approximately 60% of its holdings are staked via institutional-grade validators, generating a blended annual yield in the 6%–8% range. This approach not only provides consistent on-chain income but also strengthens the network’s decentralization. By pairing long-term treasury growth with active validator operations, SOL Strategies positions itself as both a major investor and a core infrastructure contributor in the Solana ecosystem, aligning financial performance with the blockchain’s ongoing expansion.

4. Torrent Capital Ltd. (TSX-V: TORR)

Torrent Capital's Solana holdings | Source: Torrent Capital

• SOL Held: ~40,039 SOL (company disclosures through August). Strategic, yield-supported position with most tokens staked.

• Current Value: ≈ $8.5 million

Torrent Capital’s SOL position is smaller than other corporate holders, but its approach is deliberate. The firm began accumulating in early 2025, adding 13,657 SOL in March before building toward its current stake.

About 75% of Torrent’s SOL is staked, generating modest but consistent passive income. This yield-supported growth strategy aligns with Torrent’s broader focus on early-stage, high-growth investments that have asymmetric upside potential.

5. Bit Mining Ltd. (NYSE: BTCM)

• SOL Held: 27,191 SOL purchase disclosed Aug 11, 2025, with the launch of a self-operated Solana validator.

• Current Value: ≈ $5.8 million

Best known for its

Bitcoin mining operations, Bit Mining is now making an aggressive move into Solana. In August 2025, the company purchased 27,191 SOL for $4.9 million and launched a self-operated validator to begin staking immediately.

The acquisition is part of a larger plan to raise up to $300 million for SOL purchases and infrastructure expansion. This shift diversifies Bit Mining’s revenue streams, moving it beyond Bitcoin and into high-yield blockchain participation.

6. Accelerate (Planned)

Accelerate's financial projections | Source: Unchained Crypto

• Target Treasury: $1.5 billion

Accelerate is a newly formed Solana treasury company led by Joe McCann, founder and former CEO of hedge fund Asymmetric Financial. The firm plans to go public via a SPAC merger with Gores X Holding and raise up to $1.51 billion through a combination of private investment in public equity (PIPE), convertible debt, SPAC proceeds, and warrant sales. If successful, Accelerate would surpass Upexi to become the largest SOL-holding public company, with an estimated 7.32 million SOL, valued at over $1.36 billion at current prices, earmarked for purchase after fees and expenses.

The company’s pitch emphasizes offering investors exposure to SOL at a net asset value close to 1, potentially allowing them to capture significant upside if its stock price follows the trajectory of other crypto treasury companies. However, analysts have warned of risks such as post-PIPE sell-offs and market volatility. While questions remain about fundraising progress and leadership optics, given McCann’s recent closure of Asymmetric’s liquid fund, Accelerate’s ambitious plan signals the next stage in large-scale institutional accumulation of Solana, with a targeted launch timeline by the end of 2025.

7. Sharps Technology (NASDAQ: STSS) (Planned)

• Target Treasury: $400 million

Sharps Technology (NASDAQ: STSS), a medical device maker, is pivoting into digital assets with plans to raise over $400 million for a Solana-focused treasury strategy. The company has signed a letter of intent with the Solana Foundation to purchase $50 million worth of SOL at a 15% discount to the 30-day average price, giving it a strong entry point into the market.

To lead this shift, Sharps appointed Alice Zhang, co-founder of Jambo, as Chief Investment Officer, with James Zhang joining as a strategic adviser. The deal, structured as a private placement, is expected to close by late August 2025, subject to conditions, and would make Sharps one of the most significant new institutional participants in the Solana ecosystem.

8. iSpecimen Inc. (NASDAQ: ISPC) (Planned)

• Target Treasury: $200 million

iSpecimen, a biospecimen marketplace, announced plans to build a $200 million Solana-based corporate treasury in partnership with digital asset advisory firm BlockArrow Capital. The initiative will be supported by Coinbase Custody for insured, institutional-grade storage.

The strategy includes acquiring SOL for staking and potential future integration into decentralized research infrastructure. While still in the planning phase, the move signals how non-crypto-native companies are using blockchain assets to modernize operations and diversify their balance sheets.

What Are the Top Risks of a Solana Corporate Treasury?

Holding Solana in a corporate treasury can be highly rewarding, but it comes with significant risks that must be managed carefully.

1. Market & stock optics: SOL’s double-digit swings can whipsaw treasury NAVs, and equity/convertible financing used to buy SOL can amplify dilution and share-price volatility, such as Upexi’s rapid raises/accumulation and DFDV’s Aug 25 equity deal.

2. Product/regulatory uncertainty: The VanEck JitoSOL ETF has been filed (Form S-1 on Aug 22, 2025) but is not approved; LST-backed structures may face extended review or rulemaking, so institutional access via ETFs remains uncertain.

3. Concentration & market structure: Proposed mega-vehicles (e.g., Pantera’s ~$1.25 billion “Solana Co.” and Galaxy/Jump/Multicoin’s ~$1B plan) are not yet closed, but if executed could tighten free float and heighten stress-period volatility.

4. Legacy supply overhang: The FTX estate sold discounted locked SOL in 2024, but unlock schedules tied to those sales continue into 2025+ (largest cluster flagged for Mar 1, 2025), periodically adding tradable supply and headline risk. Treat %-of-supply claims skeptically and track administrator/court updates.

5. Operational/network: Solana has had no consensus halt since Feb 6, 2024 when a ~5-hour outage occurred, but high-usage spikes can still degrade performance; treasuries should diversify validators, use insured custody, and formalize staking/exit playbooks.

6. Flows risk (listed products): Early SSK (REX-Osprey) Solana staking ETF flows are choppy, e.g., outflows around Aug 21, inflows on Aug 27, and swings in daily flows can influence sentiment for SOL and SOL-exposed equities.

Future Outlook for Solana Treasuries and Corporate SOL Holders

Corporate adoption of Solana is moving from small balance-sheet buys to dedicated treasury vehicles that actively stake and run validators. Companies like Upexi and DeFi Development Corp. now hold hundreds of millions of dollars in SOL, while newcomers such as Sharps Technology are structuring discounted deals to accelerate entry. At the same time, institutional products are maturing: the REX-Osprey Solana Staking ETF (SSK) has gone live, VanEck’s JitoSOL ETF is awaiting approval, and multi-billion-dollar treasury plans from Pantera and Galaxy/Jump/Multicoin signal that formal rails for corporate SOL exposure are rapidly expanding. As more companies explore multichain treasury models, including SOL,

ETH, and occasionally

BNB, digital assets are likely to play a more strategic role in balance sheet management.

Looking forward, the trend remains upward but not without risks. Fundraising initiatives still need to close, ETF approvals face regulatory hurdles, and the FTX estate continues to pose liquidity overhang concerns. While Solana’s network reliability has improved since early 2024, stress-period performance remains on watch. Even so, Solana’s mix of yield generation, scalability, and growing institutional backing positions it as a leading contender to join Bitcoin and Ethereum in long-term corporate treasury strategies.

Related Reading